Monday, December 31, 2007

BubbleSphere Roundup

Keith at HousingPanic reports about a Realtor whose recently property is declining fast. This same Realtor wrote in May 2006 that "I see an awful lot written about the real estate "bubble" bursting, but I've yet to see evidence of this happening in Phoenix."

Everyone is buying 'a year from now.' (RECOMMENTS) from Neil the Got Popcorn guy?

The Foreclosures Dog (Real Estate Bloggers)

Happy New Year! :-)

Saturday, December 29, 2007

Lawrence Yun Watch mentioned in UK's Times

So irritating has NAR become that Yun now has his own hater blog (Lawrenceyunwatch.blogspot. com). The same people ran a blog blasting his predecessor, David Lereah.

To be fair to Yun, Lereah seems the more deserving target. Lereah is a classic booster who once advised people it was a great time to buy and to sell.

Agreed. Lereah is indeed a more deserving target then Yun. Yun has learned much from his mentor David 'the paid shill' Lereah.

Wednesday, December 26, 2007

Silver Spring Townhouse, 20% Less Then 2005 Price

Property Bought from Original Owner: 10/13/2005 $661,000

The previous owner kept on chasing the falling housing market without success.

Please note this property was bought originally from the developer for 279,915 on 06/21/2000. So in about 5 years the property went up 136% for a sale of 661,000 in late 2005. If it had appreciated by 6% a year (compounded) the price would be 375K in late 2005. If that theoretical 6% had continued for another two years it would be valued at 421K today.

It just sold for 565,000 on 11/27/07. Which is 14.5% less then the previous price paid in October 2005. In real dollars the current owner paid about 20% less then the 2005 price.

Prices are falling in the Washington area. This is a prime location across the street from the Silver Spring Metro station and inside the Washington Beltway.

Case Shiller Index Way Down; Washington, DC Area Down 7% YoY

Home prices fell 6.7 percent in October, compared with a year ago, according to the S&P/Case-Shiller 10-city home-price index, a record drop as housing markets continued to deteriorate.It was the largest drop in more than 16 years and marked the 10th consecutive month of price depreciation and 23 months of decelerating returns.

"This is just the beginning," said Peter Schiff, a Darien, Conn.-based investment adviser known for his bearish views of the housing market. "Pressure is there for much, much lower prices."Miami was hit with a 12.4 percent decline in the month, the most of any area. Tampa fell 11.8 percent and Detroit, 11.2 percent. Sun Belt cities have suffered deep losses with San Diego down 11.1 percent in the past year, Phoenix off 10.6 percent and Las Vegas 10.7 percent. In Los Angeles, a huge market, home prices have fallen 8.8 percent.

In the Washington, DC area the price index fell 7.0% compared with October 2006 . Prices continue to fall in the Washington, DC metropolitan area. In real dollars prices have fallen about 10% this past year. For more numbers go to Case Shiller S&P Index. The prices declines in the metro area are accelerating with the Case Shiller S&P Index showing October prices declines of over 1.1%. For comparison purposes in October 2006 prices fell .4%.

This housing bust is accelerating, spring will not stop further prices declines in the Washington, DC area. Be careful falling knives are dangerous.

Monday, December 24, 2007

Wednesday, December 19, 2007

Loudoun Couty, VA Huge Budget Shortfall In Part Due to Housing Bubble

"It's difficult to overstate the importance of real estate values on the county budget. In the budget adopted by supervisors last spring, taxes from real estate accounted for 72 percent of all county revenues, most of which is used to fund school projects and programs"

Tuesday, December 18, 2007

Bubble Sphere Roundup

Housing Construction Hits 16-Year Low (AP). This is not population adjusted. Yikes!

Treasury Secretary Henry Paulson wants to temporarily allow Fannie Mae and Freddie Mac to purchase so-called jumbo loans, which exceed $417,000. I'm against this idea. These two irresponsible relatives already have taken too much risk.

Remarks Prepared (pdf) for Pat V. Combs 2007 NAR President REALTORS® Conference & Expo General Session November 14, 2007 Las Vegas, NV. Here is snippet "The future is daunting, and there are no guarantees. While others in our industry may be scared of the future and the challenges that lie ahead, I know 1.3 million Realtors who are determined to succeed – no matter what. That’s all the inspiration I need in ANY market. " Yuck! Does success depend on assisting millions of Americans in commiting finacial suicide by buying more house then they could afford?

Friday, December 14, 2007

Washington - Baltimore , RE Sales Numbers. November 2007

The housing market in the Washington and Baltimore area has been declining in the Washington, DC for about 2 years. Thus the year over year comparisons only represent a portion of the declining housing market.

Northern Virginia (Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA (NVAR))

- Median Price: $425K

- Median Sales Price YoY: -7.6%

- Average Sales Price YoY: -1.8%

- Total Units Sold YoY: -28%

- Average Days on Market YoY: 16%

- Active Listings YoY: 10%

- Median Price: $260k

- Median Sales Price YoY: -3.8%

- Average Sales Price YoY: -.4%

- Total Units Sold YoY: -31%

- Average Days on Market YoY: 40%

- Active Listings YoY: 20%

- Median Price: $400k

- Median Sales Price YoY: -2.4%

- Average Sales Price YoY: 7.3%

- Total Units Sold YoY: -18%

- Average Days on Market YoY: -1.5%

- Active Listings YoY: 4%

- Median Price: $308K

- Median Sales Price YoY: -7.1%

- Average Sales Price YoY: -8.9%

- Total Units Sold YoY: -55%

- Average Days on Market YoY: 75%

- Active Listings YoY: 68%

Montgomery County, MD

- Median Price: $410K

- Median Sales Price YoY: -5.8%

- Average Sales Price YoY: .5%

- Total Units Sold YoY: -35%

- Average Days on Market YoY: 30%

- Active Listings YoY: 22%

Loudoun County, VA

- Median Price: $405K

- Median Sales Price YoY: -7.7%

- Average Sales Price YoY:-0.9%

- Total Units Sold YoY: -21%

- Average Days on Market YoY: -10%

- Active Listings YoY: 2%

- Median Price: $475K

- Median Sales Price YoY: -7&

- Average Sales Price YoY: 1.7%

- Total Units Sold YoY: -33%

- Average Days on Market YoY: 14%

- Active Listings YoY: -2%

- Median Price: $300K

- Median Sales Price YoY: -3.9%

- Average Sales Price YoY: -1.8%

- Total Units Sold YoY: - 39%

- Average Days on Market YoY: 59%

- Active Listings YoY: 18%

- Median Price: $420K

- Median Sales Price YoY: -9.2%

- Average Sales Price YoY: -4%

- Total Units Sold YoY: -27%

- Average Days on Market YoY: 15%

- Active Listings YoY: 14%

These numbers show a declining housing market in the Washington - Baltimore area compared to last year. For every jurisdiction listed, the number of housing sales fell in November compared to November 2006. In most the median sales price fell, while the mix of housing units sold did not change dramatically.

The Washington - Baltimore area is not recovering from the housing decline. Prices contine to fall. Far out suburbs and condos are experiencing larger price declines. In the metropolitan area a declining housing market is reality. This coming spring's real estate season will not be a recovery time in the DC - Baltimore area for real estate. Housing busts usually last many, many years. It is far from over.

Tuesday, December 11, 2007

Is It Time to Buy More?

Is it time to buy more? How is consumer spending holding up this Christmas season? Will people tap their remaining housing unit ATMs to buy more cr*p?

Is it time to buy more? How is consumer spending holding up this Christmas season? Will people tap their remaining housing unit ATMs to buy more cr*p?Daniel Gross Rips David Lereah To Pieces

But within the fraternity of financial and fiscal forecasters, the seers at the National Association of Realtors—longtime chief economist David Lereah and his successor Lawrence Yun—may be uniquely ill-equipped to deliver sobering forecasts. They work for a trade group whose mission is to buck up the spirits of real-estate brokers. And real-estate brokers—who live to sell, promote, and market—are constitutionally disinclined to hear anything but good news. Indeed, as I noted last summer, Lereah's penchant for putting out positive spin on dismal housing numbers inspired a blog and led critics to dub him the Baghdad Bob of real estate. Lereah has moved on. But Yun has picked up where he left off.

In addition to claiming that the sun is shining brilliantly even as rain pours down from the heavens in a mighty stream, Lereah and Yun have also hazarded optimistic, educated guesses about the future. In February 2005, Lereah published a book that is my candidate for Longest Title Ever: Are You Missing the Real Estate Boom?: The Boom Will Not Bust and Why Property Values Will Continue To Climb Through the End of the Decade—And How To Profit From Them. Naturally, the boom busted soon after publication, and property values began to descend.

Thanks for the mention of my other blog (David Lereah Watch). Daniel Gross is right on the money when he writes "David Lereah and his successor Lawrence Yun—may be uniquely ill-equipped to deliver sobering forecasts." It is refreshing to read people in the press call out these paid shills from the NAR.

Tuesday, December 04, 2007

Bubble Sphere Roundup

HousingTracker offers useful stats that track inventory and median asking prices in a bunch of metropolitan areas. Washington, DC shows year over year median aksing price declines of 14.6%. And an inventory increase of 27.3%.

The Northern Virginia Fallout Bubble Blog is showing dramatic price declines in the outer suburbs of Washington, DC. Prices have declined much more in the outer suburbs then in the inner suburbs or in DC proper.

Housing Panic reports on Jesse Jackson's march on Wall Street to protest the foreclosure crisis.

Thursday, November 29, 2007

Mr. Yun's September 2005 Prediction is Way Off

As we know prices have declined in the DC area since Yun's wrong prediction. According to the S&P Case Shiller Index, since September 2005 DC area prices have fallen 6.3%.

Do not trust Lawrence 'paid spinner' Yun. The general public and media need to be aware of his spins, predictions that have proven wrong, and his contradictory statements. Mr Yun is a paid shill who has lost his credibility.

Wednesday, November 28, 2007

Tuesday, November 27, 2007

Lance from September 2006

"The window of opportunity for those who have been sitting on the sidelines waiting to purchase is quickly slipping away, however I suspect most bubbleheads will miss it. I just hope they are on here a year from now explaining why they are still "waiting it out." The justifications will be interesting to hear." ( Comment at September 25, 2006 7:52 AM)

Case Shiller Index Way Down; Washington, DC Area Down 6.5% YoY

"S&P also reported that prices fell 1.7 percent from the previous quarter, the largest consecutive quarterly decline in the index's history. The S&P/Case-Schiller quarterly index tracks prices of existing single-family homes across the nation compared with a year earlier. "

"A separate index that covers 20 U.S. metropolitan areas dropped 4.9 percent in September from a year earlier. A 10-area index decreased 5.5 percent from the previous year."

MarketWatch adds "Home prices fell in September in all 20 major cities covered by the Case-Shiller price index, even in cities that had been holding up, Standard & Poor's reported.

In the Washington, DC area the price index fell 6.5% from September 2006 . Prices continue to fall in the Washington, DC metropolitan area. In real dollars prices this is almost 10%. For more numbers go to Case Shiller S&P Index.

Sunday, November 25, 2007

Greenspan's Recent Statements on Housing & Asset Bubble

“The markets are becoming aware that the decline in U.S. housing prices is not stopping. It is at an unprecedented pace compared to the last 50 years,” Greenspan told a financial audience in the Norwegian capital.

"He said the housing bubble had burst and the market was “a good deal away” from its selling climax — a point at which sellers ultimately lower their prices to match lower bids.

He said central banks should concentrate on alleviating the economic fallout from burst asset bubbles because they had few methods to prevent them and “lean against the wind.”“There doesn’t seem to me that there is very much evidence that we can do much about them,” said Greenspan, who oversaw Fed policy during the dot-com bubble and the start of the present housing bubble.

“Irrespective if we could identify them, we could not do much to defuse them,” he said of asset bubbles.

Greenspan could have pulled a Volcker (raise interest rates tremendously) which would pop the housing bubble. Not that I would support that. In retrospect, Mr. Greenspan allowed interest rates to be too low, for too long.Negative Sales in Las Vegas by Toll Brothers

In Las Vegas ,Toll Brothers is not reducing prices on its luxury housing units. It stubbornly clings on to very high prices:

These Toll Brother fools out in Las Vegas better get the widely circulated memo that deep price reductions in price are necessary to move new housing units.And despite total traffic through models of between 500 and 600 people weekly, Toll Bros., a luxury builder that also hasn't marketed any discounts, had zero net sales in the week ended Nov. 11 and a negative net-sales rate of two homes in the week ended Oct. 14.

That means the company, whose homes are priced from $345,975 to more than $1 million, had two more cancellations in Las Vegas that it had sales.

Toll officials declined to discuss local sales volume, noting that they release regional data only quarterly. Spokeswoman Kira McCarron said sales of new homes and standing inventory "are consistent with current marketing conditions." (Las Vegas Review - Journal 11/25/07)

Wednesday, November 21, 2007

Tuesday, November 20, 2007

Google Trends: "Foreclosure" in California

California Prices Fall Significantly Year Over Year

"Prices in the Los Angeles-Orange County metro area fell by 8.1% in September, sixth highest among the top 30 metro areas, the company reported. It was the eighth straight month that prices here have shown a year-over-year decline. The Inland Empire led the nation’s top 30 metro areas in price declines. Prices there fell 13.6% from September 2006.

"Seventeen states had price declines, LoanPerformance reported. Nevada had the nation’s second-highest price decline, with home prices falling 9.3%, followed by Florida (-8.2%) and Arizona (-7.4%). (Lasner on Real Estate Blog 11/19/07)"

Sunday, November 18, 2007

BubbleSphere Roundup

- Foreclosure Violence (Sacrameto Landing)

- 188 at The Mortgage Lender Impode-O-Meter

- Housing Crash News (Patrick.net)

- Second City Bubble

Tuesday, November 13, 2007

Realtor's Convention in Vegas

2007 Realtor Conference in Las Vegas Website

Yun Loses His Marbles in Vegas (Housing Doom)

Oh, Yun is blaming the media "The media, meanwhile, played up problems in the market, Yun said. "They have a natural bias of wanting to sensationalize all the news items."

"And, while many markets remained healthy, he said: 'The local media, many are just very lazy. They just copy the national stories and put them in their local papers.' "

Lawrence Yun InvterviewMonday, November 12, 2007

Washington - Baltimore , RE Sales Numbers. October 2007

The housing market in the Washington and Baltimore area has been declining in the Washington, DC for about 2 years. Thus the year over year comparisons only represent a portion of the declining housing market.

Northern Virginia (Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA (NVAR))

- Median Price: $435K

- Median Sales Price YoY: -5.2%

- Average Sales Price YoY: -7%

- Total Units Sold YoY: -25%

- Average Days on Market YoY: 7%

- Active Listings YoY: 0%

- Median Price: $265k

- Median Sales Price YoY: 0%

- Average Sales Price YoY: 2.8%

- Total Units Sold YoY: -32%

- Average Days on Market YoY: 47%

- Active Listings YoY: 17%

- Median Price: $393k

- Median Sales Price YoY: 4.7%

- Average Sales Price YoY: 5.6%

- Total Units Sold YoY: -2.5%

- Average Days on Market YoY: -4.6%

- Active Listings YoY: 0%

- Median Price: $302K

- Median Sales Price YoY: -10%

- Average Sales Price YoY: -9%

- Total Units Sold YoY: -55%

- Average Days on Market YoY: 82%

- Active Listings YoY: 59%

Montgomery County, MD

- Median Price: $415K

- Median Sales Price YoY: -4%

- Average Sales Price YoY: 2.1%

- Total Units Sold YoY: -36%

- Average Days on Market YoY: 27%

- Active Listings YoY: 15%

Loudoun County, VA

- Median Price: $414K

- Median Sales Price YoY: -3.2%

- Average Sales Price YoY:-1.3%

- Total Units Sold YoY: -18%

- Average Days on Market YoY: 5%

- Active Listings YoY: -1%

- Median Price: $487K

- Median Sales Price YoY: 4.7%

- Average Sales Price YoY: 7%

- Total Units Sold YoY: -12%

- Average Days on Market YoY: 52%

- Active Listings YoY: -13%

- Median Price: $287K

- Median Sales Price YoY: -13%

- Average Sales Price YoY: -9%

- Total Units Sold YoY: - 34%

- Average Days on Market YoY: 40%

- Active Listings YoY: 15%

- Median Price: $425K

- Median Sales Price YoY: -7.6%

- Average Sales Price YoY:-2.9%

- Total Units Sold YoY: -26%

- Average Days on Market YoY: 12%

- Active Listings YoY: 4%

These numbers show a declining housing market in the Washington - Baltimore area compared to last year. For every jurisdiction listed, the number of housing sales fell in October compared to October 2006.

The Washington - Baltimore area is not recovering from the housing decline. Far out suburbs and condos are especially vulnerable to large price declines. In the metropolitan area a declining housing market is reality.

Tuesday, November 06, 2007

Lawrence Yun Promoted to Chief Economist

The National Association of Realtors® today named Lawrence Yun chief economist and senior vice president of research. Yun has served at NAR since 2000, most recently as vice president and senior economist.

“Lawrence is a talented economist and an outstanding forecaster who has contributed greatly to NAR’s growth and prestige as the leading advocate for the housing industry,” said Dale Stinton, NAR executive vice president and chief executive officer. “We are proud to have a man of Lawrence’s integrity and honor.

“He is a no-nonsense and level-headed analyst of the housing market who calls the data as he sees it, and has guided NAR with skill as chief spokesman for the past several months in a competitive real estate market. We have great faith and trust that Lawrence’s tenure will be a stellar one that will enhance NAR’s reputation as the most reliable and credible source of real estate research.”

Mr. Yun is not an 'outstanding forecaster;' his forecasts have been way off the mark. In September 2005 he predicted "The chance of a housing price decline in the DC area is close to zero, in my view. I anticipate that prices in DC will outpace the national average price growth. DC prices will rise at close to a 7 to 10 % rate of appreciation. " As we know priced have declined in the DC area since Yun's wrong prediction.

Bubble Sphere Roundup

- Foreclosure wave sweeps America (BBC News)

- New Low for Dollar Against Euro (AP News) Seems to be happening a lot lately?

- FLASH FLASH FLASH: Markets fear banks have $1 trillion in toxic debt (HousingPanic)

- Long and Foster Getting Desperate? (Baltimore Housing Bubble)

Monday, November 05, 2007

How Low Can They Go?

This months edition of Fortune Magazine (November 12, 2007) had a great article on housing called How Low Can They Go? by Shawn Tully (no online link available yet). It combined extensive analysis of 54 metro housing markets with the combined work of Moody's Economy.com, Fortune Analysts, PPR, & NAR. The basis of the article was to provide a snapshot of what the future of housing will look like in 5 years from June 2007. They determined a correction value (sometimes positive) by comparing present day price to rent ratios with the average of the past 15 years. Based on the data from the article I created a correction calculator and analysis for all 54 metro areas. For more background on the article check out this post on it until the actual article become public on Fortune's Website or you can just go buy the current edition of the magazine. I've attached the file and also here is a link for a hosted file. I'm sure this will be of some use to you.

Best Regards and Happy Blogging,

Kevin

Baltimore Housing Bubble

Friday, November 02, 2007

Back to Comment Moderation

1) I shall be the final decision maker as to what comments are acceptable on this blog.

2) Any personal insults directed at me or commentators on this site will be deleted. Calling me or others 'stupid', 'moron', 'pathetic' is NOT allowed. Ad Hominem attacks are not allowed against me or commentators. [However, one can call a particular comment 'pathetic', 'moronic' etc if they give a reason.]

3) Any comment that is entirely unrelated to the post is highly likely to be deleted. [If the post is about foreclosures and you comment about conditions in the Chinese prison system].

4) Any comment which uses foul language such as 'f*ck', 'sh*t' or is obscene is highly likely to be deleted.

5) Commentators often ask for more evidence when I post. This is acceptable. Please bear in mind that I have a full time job and can't answer everyone's questions or requests. Attacks against me for not responding to a question or comment are prohibited.

6) Statements that clearly are false will be deleted, unless it is clearly sarcastic. [China has less land mass then Singapore. Or everyone in China is wealthy.]

7) Publishing personal information about about me or commentators on this blog is not allowed

8) If there are any questions regarding blog rules please email me at bubblemeter@gmail.com.

Thursday, November 01, 2007

Mica Lowers Price This Weekend

Tuesday, October 30, 2007

Quoted in Reuters Article Where I Criticize Lereah

While many economists underestimated the depth of the nation's current housing slump, Lereah critics single him out for maintaining such a high-profile and upbeat appraisal for so long.Its grand to be quoted and have influence. It is disheartening, that while Lereah was at the National Association of Realtors, those who disagreed with his opinion generally had much less media exposure."His words harmed ordinary buyers who heard him and thought that the market was bottoming out. He knew better and that is the problem," said David Jackson, a 27-year-old computer programmer who balked at buying a home in 2005 because of ballooning prices in the Washington, D.C., area and came to see Lereah as an emblem of the runaway market. He skewers Lereah on his blog, David Lereah Watch.

Monday, October 29, 2007

Wednesday, October 24, 2007

Lawrence Yun is Wrong Abou Rising Prices; Puts Spin Machine into Overdrive

- National: Months supply of housing increased from 9.6 in August 07 to 10.5 this month

- National: Months supply of housing increased from 7.3 in September 06 to 10.5

- National: Inventory was up .4% this month compare to last and up 16.3% over last September

- National: September 07 Seasonally Adjusted Sales Numbers vs last month -8%

- National: September 07 Seasonally Adjusted Sales Numbers vs last year -19.1%

- National: September 07 Not Seasonally Adjusted Sales Numbers vs last month -28.9%

- National: September 07 Not Seasonally Adjusted Sales Numbers vs last year -22.7%

They quickly turned their spin machine into overdrive. Lawrence Yun blamed 'temporary' problems in the mortgage market and assured us these mortgage 'problems' were already improving.

Lawrence Yun, NAR senior economist, said the decline is understandable. “Mortgage problems were peaking back in August when many of the September closings were being negotiated, and that slowed sales notably in higher priced areas that rely more on jumbo loans,” he said. “The good news is that mortgage availability has markedly improved in recent weeks with interest rates on jumbo loans falling, and more people are applying for safer and conforming FHA mortgage products. Some of the cancelled transactions will move forward as buyers apply for other loans.”

Mr. Yun went on to say that prices were really rising in many area.

Mr. Yun is wrong. The evidence shows that overall prices are not rising in both the Northeast and the condo market. Look at the Case Schiller Index as well as date from the Massachusetts Association of Realtors. Prices are also falling in much of where the population in the Midwest lives such as Chicago, Detroit, Minneapolis and Milwaukee

“Because there were fewer transactions at the upper end of the market, there is a downward distortion reflected in a lower national median home price. Home prices continue to trend up in the Northeast and in the condo sector. In other areas not dependent on jumbo loans, such as much of the Midwest, prices are rising.”

Remember for September 2006, the NAR reported "Total existing-home sales -- including single-family, townhomes, condominiums and co-ops -- dipped 1.9 percent to a seasonally adjusted annual rate1 of 6.18 million" David Lereah the NAR's cheif economist, and Yun's boss at the time said "this is a lagging indicator and the worst is behind us as far as a market correction -- this is likely the trough for sales." Since then the seasonally adjusted rate is down 19% to 5.04 million. Some trough? The NAR's spokespeople cannot be trusted as they are paid shills who give propagandist predictions. They are super spinners.

Tuesday, October 23, 2007

Senate Sqaure Condos are Now Available for Rent

Senate Sqaure (Bubble Meter, August 2006)

52 Months Supply of Housing in Palm Beach County

September 2007: 52 Months Supply of Housing in Palm Beach County (suburban Miami). Or 4 year and a 1/3 year supply of housing units. (as a reader pointed out). ~52 = (25882 / 472) Yikes! Graph from Illustrated Properties

September 2007: 52 Months Supply of Housing in Palm Beach County (suburban Miami). Or 4 year and a 1/3 year supply of housing units. (as a reader pointed out). ~52 = (25882 / 472) Yikes! Graph from Illustrated PropertiesSunday, October 21, 2007

Thursday, October 18, 2007

Criminality At Countywide

Countrywide is the largest mortgage company in the country and Mozilo, its founder, is generally credited or blamed for the company's evolution from a mostly conventional lender into one where subprime products dominated.

At issue is the sale by Mozilo of some 130 million of his company's stock in the first six months of 2007. It seems that there is a rather large loophole... ahem, provision, in the rules against insider trading that allows an insider to set up what is called a 10b51 trading plan. Such a plan, once established, allows the insider to proceed with transactions such as buying, selling, or exercising options even if he or she subsequently comes into possession of information that might impact stock prices which is not available to the public

There are other shady companies and characters out which need to be investigated.

The SEC is apparently investigating a dozen or so companies, including Countrywide, in connection with the subprime mess but, according to The Wall Street Journal article it is taking a special if informal look at Mozilo.Fraud was a significant contributing factor in the explosion in prices for housing units. How large is yet to be determined? There is no question that many of the loans that had no documentation (aka liar loans) were fraudulent. Additionally, the subprime industry was infested with shady doings, being that many of its borrowers were encouraged to borrower more then they could reasonably afford.

Hopefully, the SEC and other investigating authorities will take a very tough look at Countrywide and other players in the mortgage mania.

Tuesday, October 16, 2007

September Home Sales in Southern California Plunge

SAN FRANCISCO (Reuters) - Sales of houses and condominiums in the most populous Southern California counties fell 29.9 percent from the previous month and 48.5 percent from a year earlier, DataQuick Information Systems said on Tuesday.

The report covers the counties of Los Angeles, Orange, San Diego, Riverside, San Bernardino and Ventura and showed a total of 12,455 new and existing homes and condos sold in September, the lowest since the company began recording the data in 1988. (Reuters 10/16/07)

Monday, October 15, 2007

Best of The Bubble Sphere

8503 2nd Ave in Silver Spring, MD just reduced agains to 589K. See Previous Post

RTC2? Banks in desperate $80 billion scramble to avoid "mark to market" meltdown. Just delaying the inevitable (Housing Panic)

Thursday, October 11, 2007

Hudson & Marhsall Real Estate Auction Video

From recent Hudson & Marhsall Real Estate Auction (October 2007)

Wednesday, October 10, 2007

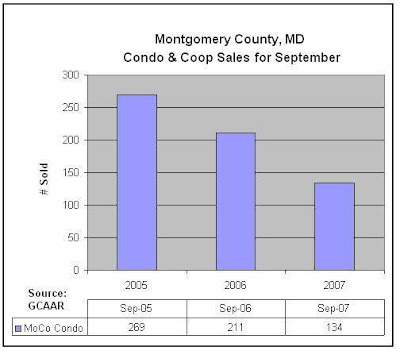

DC Area Housing Unit Sales for September Show Huge Yearly Decline

The number of housing units sold in the DC area in September 2007, has dropped precipitously from September of last year. The number of sold single family houses fell 42.2% from September 2006 and 67% from September 2005 in Montgomery County, MD. In DC, the percentage decline was basically the same, at 42.1%. The months supply of single family houses in Montgomery County, MD for September 2007 has now reached over 10 months. There were 4520 active listings and only 423 single family houses sold.

Tuesday, October 09, 2007

Bubble Sphere Roundup

Car Dealer Tactics on the New-Home Lot (Washington Post)

A Bank Bet on Condos, but Buyers Want Out (NYTimes)

Las Vegas Housing Market Outlook Grim (Las Vegas Channel 8)

Monday, October 08, 2007

Large Price Declines Expected in Fall and Winter

Real dollar prices will likely decline between 6% and 13% over the course of the next 6 months in most bubble markets.

Large Inventory

Inventory is significantly higher in most bubble markets then last time this year. According to Housing Tracker as of 10/01/2007:

- Miami: 24.3%

- San Diego: 3.6%

- Washington, DC: 9.1%

- San Francisco: 21.3%

- Baltimore: 21%

- Orange County: 10.9%

- Portland: 32.2%

Sales Declining

According to the National Association of Realtors the September 2007 Existing Home Sales Pending Index broke the previous low of 89.8 in September 2001. September 2001, was that month of a major terrorist attack (9/11). Home sales have fallen tremendously from the peak of the housing bubble.

According to insides information via Housing Doom, who is busy reporting the shocking numbers that sales are declining precipitously in Phoenix.

As of this morning we had 3,176 sales for September. Obviously, there will be no official closings on the weekend but there may be a few more that trickle in because a few agents entered the 29-30th as COE. This will leave Phoenix with a 18 month supply of homes (57,441 active). In addition, September has seen one of the largest monthly drops in value on a cost/sf basis.

It believe the rush to close deals in August sucked a lot of sales from September.

In the Seattle area, "sales are lagging. Offers were accepted last month on 1,541 King County houses — a 32 percent drop from the numbers in September 2006 (Seattle Times, Oct 6, 2007)"

Lending Standard Tightened Up

Lending standards have tightened up significantly in the last 3 months. Richard Syron, chief executive of Freddie Mac said "the credit squeeze had left some parts of the housing market "literally frozen", which was a "substantial depressive to the overall economy" (MSNBC Sept 28, 2007).

ARMs are Adjusting / Foreclosures Are Rising

Nearly a quarter of a million foreclosure filings were reported in August, up 115% from a year ago and up 36% from July. Each home in foreclosure can have multiple filings as it moves from default status to bank repossession...."The jump in foreclosure filings this month might be the beginning of the next wave of increased foreclosure activity, as a large number of subprime adjustable-rate loans are beginning to reset," said James Saccacio, chief executive for RealtyTrac. (Marketwatch September 18th)

Growing Negative Phsycology

In general, Joe Six Pack (aka JOE6PAK, J6P), the ordinary person, have woken up to the reality that most bubble markets are undergoing price declines.

Seasonal Changes

Usually, prices fall a few percentage points in the fall and winter months as it is off peak season. This year due to the declining housing market the seasonal influences should have a greater downward pull on home prices.

Conclusion

With the coming of fall and winter, large inventory, slow sales, tightened lending standards coupled with increased negative buyer and seller sentiments will lead to large price declines over the next 6 months. Real dollar prices will likely decline between 6% and 13% over the course of the next 6 months in most bubble markets. Like this year's spring, spring 2008 will not stop or reverse declining housing markets.

Wednesday, October 03, 2007

Hudson & Marhsall Real Estate Auction

Careful! Better deals can be had in the future. Prices will continue to fall in the Washington, DC metro area in the coming years. We are not at the bottom!

Monday, October 01, 2007

Best of The Bubble Sphere

The Daily 2¢ - BOOYA! (Paper Economy)

Will Countrywide Toxic Mortgage's Angelo Mozilo go to jail? (Housing Panic)

Dr. Housing Bubble has an Excellent Blog. He also has a new website located at www.doctorhousingbubble.com/. His Real Homes of Genius series is superb and funny. :-)

Mortgage Implode-o-Meter is at 161. Really, there is absolutely nothing to see here. [Sarcasm off]

NAR on "Temporary" Housing Problems (Big Picture)

Wednesday, September 26, 2007

Tuesday, September 25, 2007

NAR Spins Data Once Again

National Association of Realtors: The rebound is always just around the corner! Spin! Spin! Spin! [ It's always a good time to buy!]

National Association of Realtors: The rebound is always just around the corner! Spin! Spin! Spin! [ It's always a good time to buy!]Case Shiller Index Way Down; Washington, DC Down Big Time

"Values dropped 3.9 percent in the 12 months through July, steeper than the 3.4 percent decrease in June, according to the S&P/Case-Shiller home-price index. The index declined in January for the first time since the group started the measure in 2001, and has receded every month since then.

Stricter lending standards and reduced demand are prolonging the housing slump, now entering its third year. Prices may continue to fall as homes stay on the market longer, economists said. Diminished housing wealth may spur households to pare spending, hurting economic growth.

The housing slump ``doesn't seem like it will go away any time soon,'' said Michael Gregory, a senior economist at BMO Capital Markets in Toronto, who forecast the index to drop 4.1 percent. ``As far as consumers go, this is another sort of pall over'' their ability to borrow against the value of their homes, he said. (Bloomberg 9/25/07)

The Washington, DC area continued to experience price declines. According to the Case Shiller Index the year over year July 2007 price change was -7.2%. With the the monthly price declines accelerating from earlier this year. The housing market is not 'bottoming out!'

See Also: Home Prices Post Biggest Drop in 16 Years (Calculated Risk)

Monday, September 24, 2007

David Lereah Says "They Were Wrong Too!"

“Even the people that were talking about booms busting, my goodness they were talking about it in 2001 and 2002,” said David Lereah, the former chief economist with the National Association of Realtors. “And they were wrong for four years and they only became right at the end of 2004.” He and his former employer had been criticized for the optimistic forecasts they made during the boom. (NYTimes. September 23rd)Sure, some of the bears predicted the boom would end much sooner then it did. But, it is also true that many of the bears correctly pointed out that in 2002 some housing markets were already in a a bubble. Just because the bubble continued to grow, does not negate the reality that certain housing markets were already bubblicious.

Sunday, September 23, 2007

Question For Ben Bernanke

Friday, September 21, 2007

Alan 'Froth' Greespan: "We Had a Bubble in Housing"

----------------------------------Excerpt------------------------------------

JIM LEHRER: But you don't feel any responsibility for keeping interest rates low?

JIM LEHRER: Because interest rates were down, it was easier to buy a house?

ALAN GREENSPAN: Absolutely.

JIM LEHRER: And the market boomed.

ALAN GREENSPAN: And the market boomed.

JIM LEHRER: It boomed too much?

ALAN GREENSPAN: Well, yes, I think it did boom too much.

ALAN GREENSPAN: Well, let me tell you. We had no choice. I mean, we're the vaunted Federal Reserve, but this global force was suppressing us. We actually tried in 2004 to get mortgage interest rates up and to put some sort of clamp on the extent of the housing boom, and we failed, because usually when we move short-term interest rates up, which is what the Federal Reserve does, long-term rates go with it. It didn't this time. We tried the same thing in 2005... JIM LEHRER: Didn't happen? ALAN GREENSPAN: Didn't happen. Had we done it back in 2002, there's no doubt in my mind nothing would have happened. And as a consequence, we and, in fact, every other central bank could not confront this issue. And what I'm increasingly beginning to conclude is, when you get bubbles like this, there is no way of diffusing them until the speculative fever breaks on its own. We tried numbers of things, and other people tried numbers of things.

Tuesday, September 18, 2007

US Dollar Is Eroding Value

If Bernanke cuts rates, we’re likely to see oil at $125 per barrel by next spring.Inflation is soaring. The government statistics are thoroughly bogus. Gold, oil and the euro don’t lie. According to economist Martin Feldstein, “The falling dollar and rising food prices caused market-based consumer prices to rise by 4.6% in the most recent quarter.” (WSJ)

Bernanke Cuts by 1/2

Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time. (Federal Reserve)

Monday, September 17, 2007

Best of The Bubble Sphere

Northern Run Bank Runs Returns (Calculated Risk)

Special Thread About Tommorow's FOMC Meeting (Housing Panic)

Precipitous Drop in Marin Sales; Tightening Lending Standards Just Starting to Bite (Marin Real Estate Blog)

Chasing The Market Down

Please note this property was bought originally from the developer for 279,915 on 06/21/2000.

So in about 5 years the property went up 136% for a sale of 661,000 in late 2005. If it had appreciated by 6% a year (compounded) the price would be 375K in 200 late 2005. If that theoretical 6% had continued for another two it would be valued at 421K today. However, the price it is being offered at is 619,000 or 47% more then the 421K value if the value had increased 6% a year for the next 7 years from its original year 2000 price.

Friday, September 07, 2007

Lawrence Yun Spins Pending Home Sales

The National Association of Realtors said its seasonally adjusted index of pending home sales for July fell 16.1 percent from a year ago and 12.2 percent from the prior month.

Lawrence Yun, the Realtors trade group's senior economist, called the problems "temporary," and related to jumbo home loans above $417,000 ..(AP Business 9/5/07)"

The depression was also temporary. The housing market in many parts of the US is undergoing large price declines, falling construction starts and lousy sales. The housing market is not ready to 'bottom out' or 'stabilize.' There will be many more years of this housing bust. Mr. "Spinner in chief' Yun is a paid shill who cannot be trusted.

David Lereah has admitted he was wrong. Can't You?

Friday, August 31, 2007

Bush to unveil first steps on mortgage crisis

He plans to announce a variety of measures in the Rose Garden on Friday morning that are designed to help struggling homeowners with subprime mortgages avoid foreclosure and will declare that lending practices need to be tightened, according to administration aides.

Bush will make clear, as he has in the past, that he does not plan to support a bailout for struggling mortgage lenders. But a senior administration official said aides are studying the possibility of “a broader federal role” in regulating mortgage brokers and originators." ( Politico 8/31/07)

Thursday, August 30, 2007

Significant Price Declines In the Washington Metro Area

An example of the price declines over the past two years:

4610 HUMMINGBIRD WAY #97

FAIRFAX, VA 22033

List Price: $424,000

Prior Sale: $486,838 07/01/2005

Listing Date: 08/20/07 -12.9%

Courtesy of: Nova Fallout Blog

According to the the S&P/Case-Shiller Home Price Index the metropolitan Washington area experienced a 7% price decline from June 2006 through June 2007 level.

According to the Housing Tracker website the median price for listings in the Washington, DC area has fallen 11.1% from August 2006.

The pullback in the U.S. residential real-estate market is showing no signs of slowing down," said Robert Shiller, chief economist at MacroMarkets LLC, which computes the price index for S&P. (MarketWatch 8/28/07) The Washington, DC area will continue to see real dollar price declines for the remainder of 2007 and throughout 2008.

Glut of Condos in Miami

Wednesday, August 29, 2007

David Lereah Admits He Was Wrong

It is heartening to know that Mr. Lereah now admits that he was wrong. Notice how even though he admits his mistake, he is still busy pointing out that some of the bubbleheads (aka realists) were also wrong.Perhaps the most prominent housing booster was David Lereah, the chief economist at the National Association of Realtors until April. In 2005, he published a book titled, “Are You Missing the Real Estate Boom?” In 2006, it was updated and rereleased as “Why the Real Estate Boom Will Not Bust.” This year, Mr. Lereah published a new book, “All Real Estate Is Local.”

In an interview, Mr. Lereah, now an executive at Move Inc., which operates a real estate Web site, acknowledged he had gotten it wrong, saying he did not fully realize how loose lending standards had become and how quickly they would tighten up again this summer. But he argued that many of his critics have also been proved wrong, because they were bearish as early as 2002.

“The bears were bears way too early, and the bulls were bulls too late,” he said. “You need to know when you are straying from fundamentals. It’s hard, when you are in the middle of the storm, to know.”

Bubble Meter on Mica

Bubble Meter on Mica