Glenn Beck mocks the current and former chief economists at the National Association of Realtors, Lawrence Yun & David Lereah for the their history of bad predictions.

Thursday, July 31, 2008

Top Economic Issue: Home Prices or Gas Prices?

Which economic issue is this "nation of whiners" more concerned with, home prices or gas prices? Here are the GoogleFight results:

Of course, this says nothing of which direction people want prices to go. Homeowners probably want home prices to go up. Renters should want home prices to go down. Environmentalists should want gas prices to go up. SUV owners almost certainly want gas prices to go down.

To try to get the most accurate GoogleFight results, I first pitted several synonyms for each issue, then chose the most popular ones. Of "home prices," "housing prices" and "real estate prices," "home prices" was the most popular. Of "oil prices," "energy prices," "gas prices" and "gasoline prices," "gas prices" was the most popular.

Of course, this says nothing of which direction people want prices to go. Homeowners probably want home prices to go up. Renters should want home prices to go down. Environmentalists should want gas prices to go up. SUV owners almost certainly want gas prices to go down.

To try to get the most accurate GoogleFight results, I first pitted several synonyms for each issue, then chose the most popular ones. Of "home prices," "housing prices" and "real estate prices," "home prices" was the most popular. Of "oil prices," "energy prices," "gas prices" and "gasoline prices," "gas prices" was the most popular.

Wednesday, July 30, 2008

The State as Mortgage Lender

From the International Herald Tribune:

In a country that holds itself up as a citadel of free enterprise, Washington has morphed from being the lender of last resort into effectively the only resort for home loans for millions of Americans engaged in the largest transactions of their lives.Of course, Fannie Mae and Freddie Mac are technically private businesses now, but they are businesses that politicians are inclined to bail out. This implicit backing of the government acts as a subsidy for homeowners.

Before, the government's more modest mission was to make more loans available at lower rates. Now it is to make sure the loans that matter most to middle class Americans are made at all.

The new reality is scorned by libertarians and conservatives, who fear intrusions by the state in the market, and by populists and progressives, who rue a society in which education and housing increasingly rest upon the government's willingness to finance it.

"If you're a socialist, you should be happy," said Michael Lind, a fellow at the New America Foundation, a research institute in Washington. "But you should really wonder whether you want people's ability to pay for housing and college dependent on the motives of people in Washington."

Why is this happening? Much of the private money that once surged into the mortgage industry has fled in a panicked horde, leaving most of the responsibility for financing American homes to the government-sponsored Fannie and Freddie.

Two years ago, when commercial banks were still jostling for fatter slices of the housing market, the share of outstanding mortgages Fannie Mae and Freddie Mac owned and guaranteed dipped below 40 percent, according to an analysis of Federal Reserve data by Moody's Economy.com. By the first three months of this year, Fannie and Freddie were buying more than two-thirds of all new residential mortgages.

Tuesday, July 29, 2008

Case Shiller Index Way Down; Washington, DC Area Down 15.4%

Price continue to fall in the the bubble markets across the United States. The growing number of foreclosures, tighter lending standards, large inventory, weak home sales and rising mortgage rates are pushing prices down.

The Washington, DC area continued to experience price declines. According to the Case Shiller Housing Index prices declined 15.4% between May 2008 vs. May 2007 in the Washington, DC area. The monthly price decline was 1% for May.

The housing bust is not over.

The Washington, DC area continued to experience price declines. According to the Case Shiller Housing Index prices declined 15.4% between May 2008 vs. May 2007 in the Washington, DC area. The monthly price decline was 1% for May.

The housing bust is not over.

Monday, July 28, 2008

Flashback 2005: Neil Barsky Asks "What Housing Bubble?"

From July 28, 2005—exactly three years ago today. Neil Barsky, writing in the Wall Street Journal, insisted there was no housing bubble.

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.

Congratulations, Neil Barsky! I hereby award you the James K. Glassman and Kevin A. Hassett Award for being completely unable to recognize an asset bubble. Keep up the good work and perhaps you can become a senior fellow at the American Enterprise Institute, too.

If you want to be scared out of your wits these days, you basically have two choices: go watch Steven Spielberg's latest, or listen to the hysterical warnings of economists and journalists about the imminent popping of our so-called housing bubble. Robert Shiller, the ubiquitous Yale economist, says home prices could fall 50% from their peak. Taking things a step further, The Economist recently went so far as to call the global housing boom "the biggest bubble in history."

In a free country, it is fair game for the media and economists to scare homeowners with words of gloom and doom, however knee-jerk, consensual and misguided they may be. But housing is a serious business; for most of us, it is our most valuable asset. For generations of immigrants, home ownership has represented the realization of the American dream.

The reality is this: There is no housing bubble in this country. Our strong housing market is a function of myriad factors with real economic underpinnings: low interest rates, local job growth, the emotional attachment one has for one's home, one's view of one's future earning- power, and parental contributions, all have done their part to contribute to rising home prices. Over the past quarter-century, there has been an explosion of second-home purchases, a continued influx of immigrants, and a significant reduction in existing housing inventory through tear-downs. Not all of these trends are accurately reflected in the unending stream of data published daily. Home prices on average have risen at a 6% annual pace since 1999, and 13% over the past year.

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.Congratulations, Neil Barsky! I hereby award you the James K. Glassman and Kevin A. Hassett Award for being completely unable to recognize an asset bubble. Keep up the good work and perhaps you can become a senior fellow at the American Enterprise Institute, too.

Labels:

Flashback

Friday, July 25, 2008

Thursday, July 24, 2008

Wednesday, July 23, 2008

Short Sale in Silver Spring, MD: 30% Real Dollar Decline from 2006.

The number of short sales and foreclosures available for purchase is increasing in the Washington, DC area. Here is one short sale from the Kemp Mill neighborhood which is in Silver Spring a few miles outside of the beltway. It is located at 908 HYDE RD, Silver Spring, MD 20902.

The Maryland Property Search shows this 3 bedroom house was purchased in September 2006 for 459,000. Now almost two years later it is being sold as a short sale for 340,000. Which is a nominal reduction of 26% and a inflation adjusted decline of over 30%.

MLS #: MC6811928.

Prices continue to decline in the Washington, DC area as foreclosure activity increases, mortgage rates rise and the general economic situation declines. This housing bust is not over yet. Expect continued price declines over the coming years.

The Unnoticed Foreclosure Victims: Renters

MarketWatch reports that homeowners aren't the only people affected by foreclosures. If the foreclosed property is a rental, the renter can often be forced to move on little notice. For low-income renters, this can result in homelessness.

Jeremy Rosen, executive director of the National Policy and Advocacy Council on Homelessness, thinks the effect of foreclosures on low-income renters has been underreported.Any thoughts from readers?

"The foreclosure crisis is hitting two groups," Rosen said. "The owners of houses and buildings, and the renters that are occupying them."

The main issue for Rosen pertains to time: Renters can be forced to leave a foreclosed property at a faster pace than a homeowner, who typically gets earlier notice that a crisis is looming. If the renter has limited income, that compounds the problem.

Each state has its own rules concerning tenants' legal rights. This means that some states say tenants have to vacate a foreclosed property within weeks and in some instances, even days. The lack of notice often doesn't give occupants enough time to find an affordable place to live, according to Rosen. For people on a tight budget, this can be devastating, Rosen said.

"There are moving expenses and first month's rent," Rosen said. "Sometimes people just don't have the money for it." ...

The doomsday scenario for low-income renters is homelessness and homeless advocacy groups believe it's a problem that will soon have to be dealt with.

"Foreclosures are driving rental prices up, supply is not keeping up with demand," said Greg White, a policy analyst for the National Low Income Housing Coalition. "You are going to start to see a flood into homeless shelters."

Labels:

Foreclosure

Tuesday, July 22, 2008

New England Real Estate Prices

Click on the images to see the full-sized graphs of housing prices in Boston, Massachusetts, Providence, Rhode Island, and Portland, Maine.

Source.

Source.

Source.

Source.

Labels:

Graphs

Monday, July 21, 2008

Dean Baker's View of the Housing Bubble

From a paper written in May by Dean Baker of the Center for Economic Policy Research:

The housing bubble in the United States grew up alongside the stock bubble in the mid-90s....

The stock wealth induced consumption boom also led people to buy bigger and/or better homes, since they sought to spend some of their new stock wealth on housing. This increase in demand had the effect of triggering a housing bubble because in the short-run the supply of housing is relatively fixed. Therefore an increase in demand leads first to an increase in price. As prices began to rise in the most affected areas, prices increases got incorporated into expectations. The expectation that prices would continue to rise led homebuyers to pay far more for homes than they would have otherwise, making the expectations self-fulfilling....

As the house prices grew further out of line with fundamentals, the financial industry adopted more sophisticated financial innovations to support its growth. A key part of the story was the growth of non-standard mortgages....

The bubble began to unravel after house prices peaked and began to turn down in the middle of 2006. This led to rapid rises in default rates, especially in the subprime market....

[The] financial meltdown also has important feedback effects on the housing market. On the supply side, the flood of foreclosures ensures that a large supply of housing will be placed for sale, since banks are generally anxious to sell properties on which they have foreclosed....On the demand side the growing stress in financial markets has helped to dampen demand, since banks are far more reluctant to make loans than had been the case two years ago....The continued flow of houses for sale, coupled with the sharp cutback in demand, is leading to rapid declines in house prices in many markets....

Through the run-up of both the stock bubble and the housing bubble, the Fed took the view that financial bubbles are natural events, like the weather, which cannot be prevented. In fact, financial bubbles can be contained and there is nothing more important that the Fed or any central banks can do than to ensure that they do not grow to such dangerous proportions.

Labels:

Dean Baker

Oil market outlook

Since I've touched on the topic of a possible oil bubble before, I'll point out that Paul Krugman says he expects oil prices to eventually decline.

Saturday, July 19, 2008

Robert Shiller on Bubble Thinking

Yale economist Robert Shiller, author of Irrational Exuberance, writes about the causes of the housing bubble in The Atlantic:

Shiller provides a rational view of the housing bubble:

Many culprits have been fingered for the housing crisis we’re in today: unscrupulous mortgage lenders, dishonest borrowers, underregulated financial institutions. And all of them played a role. But too little attention has been paid to the most fundamental cause, the same one that was at the root of the many booms and busts that Sakolski chronicled years ago: the contagious optimism, seemingly impervious to facts, that often takes hold when prices are rising. Bubbles are primarily social phenomena; until we understand and address the psychology that fuels them, they’re going to keep forming. And unless we apply that understanding to the bubble we’re trying to recover from, we risk calamity....There's a name for this collectivist thinking—Social Proof.

Speculative bubbles are fueled by the social contagion of boom thinking, encouraged by rising prices. Sooner or later, some factor boosts the transmission rate high enough above the removal rate for an optimistic view of the market to become widespread. Arguments that this boom is unlike past bubbles—I call them “new era” stories—become more prominent and seemingly credible. In the recent housing boom, such optimism was much in evidence. A survey that Karl Case and I conducted in 2005, for instance, found that on average, San Francisco home buyers expected housing prices to increase by 14 percent a year over the next 10 years. About a quarter of the respondents reported truly extravagant expectations—occasionally more than 50 percent a year....

Few people seem immune to boom thinking. The recent bubble grew so large partly because the very people responsible for the financial system’s oversight came to share the general public’s rosy expectations. They may not have believed as fervently in the boom, but they still accepted the idea that it would not end badly. Builders kept building, and ratings agencies did not temper their sunny assessments of mortgage securities until after the crisis had begun. In October 2006, Frank Nothaft, the chief economist at Freddie Mac, a major securitizer of home mortgages, told me that Freddie Mac had financially modeled the impact of a price decline of up to 13.4 percent. When I asked him about the possibility of a bigger drop, he replied that such a drop had never happened (at least not since the Great Depression)—and he seemed unable to imagine that it could.

Shiller provides a rational view of the housing bubble:

Since the 2006 peak, housing prices, adjusted for inflation, have fallen nearly 15 percent. Where they’ll go from here is uncertain; we are in uncharted territory. Between 1997 and 2006, real home prices in the United States rose 85 percent; this run-up was historically unprecedented. There was no rational basis for it: fundamental indicators such as the ratio of home prices to building costs, or to rents, or to personal income, also soared, suggesting unsustainable price levels. (The idea that the country is running out of residential space is no more true now than it was during the manias of the 18th and 19th centuries.)Comments?

Labels:

Robert Shiller

Friday, July 18, 2008

Flashback 2005: Ken Fisher Says He's Confident There's No Housing Bubble

Let me ask you, seriously, would you buy investment advice from this man?

Here's the advice Fisher Investments gave regarding the housing bubble in its Q3 2005 Stock Market Outlook. (Unfortunately, I can't link to it because I have it in hard copy. I saved it because of the ridiculous housing bubble prediction.) Summer of 2005, let me remind you, was the peak of housing bubble activity.

Here's the advice Fisher Investments gave regarding the housing bubble in its Q3 2005 Stock Market Outlook. (Unfortunately, I can't link to it because I have it in hard copy. I saved it because of the ridiculous housing bubble prediction.) Summer of 2005, let me remind you, was the peak of housing bubble activity.

Other advice from Ken Fisher in his Q3 2005 Stock Market Outlook: "The dollar rally should continue."

Here's the advice Fisher Investments gave regarding the housing bubble in its Q3 2005 Stock Market Outlook. (Unfortunately, I can't link to it because I have it in hard copy. I saved it because of the ridiculous housing bubble prediction.) Summer of 2005, let me remind you, was the peak of housing bubble activity.

Here's the advice Fisher Investments gave regarding the housing bubble in its Q3 2005 Stock Market Outlook. (Unfortunately, I can't link to it because I have it in hard copy. I saved it because of the ridiculous housing bubble prediction.) Summer of 2005, let me remind you, was the peak of housing bubble activity."Bubble" Paranoia is Good NewsKen Fisher's reasoning here is flawed. I remember the late-1990s' stock market bubble quite well. There were lots of people warning about a bubble then, including—oops!—The Economist. Perhaps Forbes Magazine (which Ken Fisher writes for) wasn't warning about it, but many people in the press were. Did he forget Alan Greenspan's "Irrational Exuberance" speech? Bubbles occur, not due to a lack of warnings, but due to people disregarding the warnings in the quest for the quick buck.

The Economist's June 18 cover story "House Prices—After the Fall" sums up the international mood—a global real estate bubble is on the verge of bursting. This fear is bullish. Real bubbles are seldom referred to as bubbles in the press until after they've burst, so there's little need to worry now. If there isn't a bubble, that's good news for stocks, the health of the global consumer, and in turn, the global economy.

The technology stock bubble burst just a handful of years ago but investors have already forgotten its origins. Remember that it wasn't much called a bubble until after it burst. Bubbles tend to occur when fear is replaced by phrases like "new economy" and "it's different this time." A healthy dose of fear reduces risk for investors. It's the wall of worry bull markets like to climb. We don't have a specific forecast for home prices from here and don't claim to be real estate experts, but we're confident there's no bubble to worry about.

Other advice from Ken Fisher in his Q3 2005 Stock Market Outlook: "The dollar rally should continue."

Labels:

Flashback

Krugman on the Housing Bubble

From today's New York Times, Paul Krugman discusses his outlook for the economy, including housing:

According to the widely used Case-Shiller index, average U.S. home prices fell 17 percent over the past year. Yet we’re in the process of deflating a huge housing bubble, and housing prices probably still have a long way to fall.

Specifically, real home prices, that is, prices adjusted for inflation in the rest of the economy, went up more than 70 percent from 2000 to 2006. Since then they’ve come way down — but they’re still more than 30 percent above the 2000 level.

Should we expect prices to fall all the way back? Well, in the late 1980s, Los Angeles experienced a large localized housing bubble: real home prices rose about 50 percent before the bubble popped. Home prices then proceeded to fall by a quarter, which combined with ongoing inflation brought real housing prices right back to their prebubble level.

And here’s the thing: this process took more than five years — L.A. home prices didn’t bottom out until the mid-1990s. If the current housing slump runs on the same schedule, we won’t be seeing a recovery until 2011 or later.

Thursday, July 17, 2008

Home Prices Compared to Residential Investment

Notice in the graph below that the fall in home prices is experiencing a significant lag compared to residential investment. The residential investment line will give you a good sense of where home prices are going.

From the Federal Reserve Bank of San Francisco:

From the Federal Reserve Bank of San Francisco:

From the Federal Reserve Bank of San Francisco:

From the Federal Reserve Bank of San Francisco:Figure 3 shows that one can observe similar comovement between asset prices and investment in the U.S. housing market. From 2001 to 2006, house prices nearly doubled, rising much faster than the underlying fundamentals, as measured by rents or household income. An accommodative interest rate environment, combined with a proliferation of new mortgage products (loans with little or no down payment, minimal documentation of income, and payments for interest-only or less), helped fuel the run-up in house prices. At the time, Fed Chairman Greenspan (2005) offered the view that the financial services sector had been dramatically transformed by advances in information technology, thus enabling lenders "to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately." Feldstein (2007), citing a number of studies, argues that the rapid growth in subprime lending during these years was driven in part by "the widespread use of statistical risk assessment models by lenders."Any comments from readers?

The subprime lending boom was later followed by a sharp rise in delinquencies and foreclosures, the collapse of numerous mortgage lenders, massive write-downs in the value of securities backed by subprime mortgages, and record-setting levels of unsold new homes. In retrospect, enthusiasm for a "new era" in credit risk modeling appears to have been overdone. Persons (1930 pp. 118-119) describes the fallout from an earlier era of rapid credit expansion as follows: "It is highly probable that a considerable volume of sales recently made were based on credit ratings only justifiable on the theory that flush times were to continue indefinitely….When the process of expanding credit ceases and we return to a normal basis of spending each year...there must ensue a painful period of readjustment."

Labels:

Graphs

Wednesday, July 16, 2008

IndyMac investigated for fraud by FBI

CNN reports:

The FBI is investigating Indymac Bancorp for fraud, a source tells CNN.

The California-based bank was taken over by federal regulators last week. Indymac's collapse was the second-largest bank failure in U.S. history.

A source said the federal government is looking into whether the bank engaged in fraud when it made home loans to high-risk borrowers. The source said the investigation is focused primarily on the company, not individuals.

In a written statement, the FBI didn't specifically comment on Indymac but noted that it is investigating 21 corporations in the subprime lending market for possible mortgage fraud.

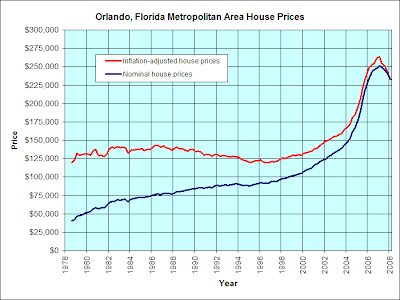

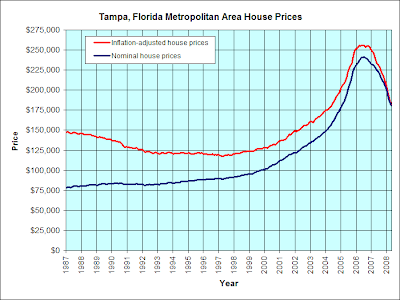

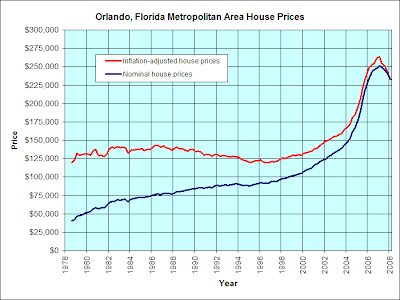

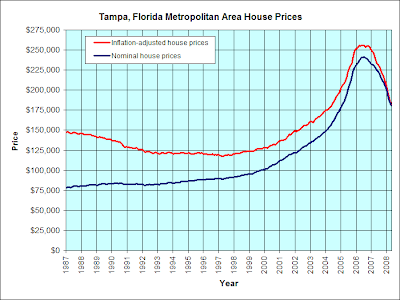

Florida Real Estate Prices

Click on the images to see the full-sized graphs of housing prices in Miami, Orlando, and Tampa, Florida.

Source.

Source.

Anybody here live in Florida?

Source.

Source.Anybody here live in Florida?

Labels:

Graphs

Tuesday, July 15, 2008

Treasury seeking a "backstop" for Fannie and Freddie, not an imminent bailout

CNN Money reports:

Treasury Secretary Henry Paulson was hammered by lawmakers on Tuesday over the Bush administration's plan to prop up mortgage finance giants Fannie Mae and Freddie Mac.Senator Christopher Dodd shows that he is again "Mr. Bailout".

Members of the Senate Banking Committee drilled into Paulson on a day when the shares of Fannie and Freddie were once again pummeled by investors.

Paulson was asked about his request that Congress remove limits on how much money Treasury can lend to the troubled mortgage finance firms — was it just a "blank check" from taxpayers? He also faced questions about a second part of the plan — to allow Treasury to buy equities in the firm — and whether Fannie and Freddie are as safe as the companies, Treasury and regulators now claim.

"I fear we're sitting on a financial powder keg," said Sen. Richard Shelby, R-Ala., the committee's ranking Republican.

Paulson told the committee that the two firms have adequate capital to continue operating. He said that proposals he announced on Sunday — expanding the Treasury credit line for or buying equity in Fannie and Freddie — were "backstops" to assure the markets. ...

The rescue plan won some support, most notably from Sens. Christopher Dodd, D-Conn., and Charles Schumer, D-N.Y. But the amount of opposition and skepticism from other members of the committee, both Democrat and Republican, suggested that hopes voiced by Paulson and Dodd for action on the proposal within the next week may be a long shot.

One Republican, Sen. Jim Bunning, R-Ky, vowed to do everything in his power to defeat the proposal, which Schumer took as a threatened filibuster that could stall the proposal dead in its tracks.

The Bursting Housing Bubble is Causing Homeowners to Become Renters

From a paper by the Center for Economic Policy Research and the National Low Income Housing Coalition:

The bubble that developed in the U.S. housing market from the years 1996 to 2006 pushed prices in many markets far out of line with fundamental values. The correction that began in the middle of 2006 has helped to bring house prices back in line with their long-run trend growth path. Nonetheless, house prices in some of the most inflated markets are still hugely out of line with rents and income....

In bubble markets, renting is becoming an increasingly attractive refuge for homeowners saddled with a depreciating asset. Nationwide households evicted as a result of foreclosure are also likely to turn to rental markets for housing. Additionally, homeowners who are making a transition in their lives or households or individuals entering the housing market for the first time are even more likely to put off the decision to own in the current market....

With or without proactive policy, the transition from owner-occupied housing to rental housing is happening. There are a variety of factors that make it likely that the transition of the housing stock may not keep up in many areas. In these bubble markets, policy makers must not only be less committed to sustaining ownership and home values, but also must proactively facilitate the conversion to rental of vacant, foreclosed and delinquent units to limit the pressure on the rental market. Even in slack markets, it is necessary to limit the impact on the most vulnerable renters and more importantly to use the opportunity provided by the current market to relieve the pressure on these households by providing additional affordable housing through programs to purchase, renovate, and reuse foreclosed and vacant units to house those at risk of homelessness.

Labels:

Dean Baker

Will The FDIC Need to be Bailed Out?

Recently, the Federal Reserve came up with a list of 150 banks that were candidates for failure. From the IStockAnalyst:

One medium sized failed bank, IndyMac, needs between 7.5% and 15% of total FDIC funds dedicated to reimbursing customers of failed banks.

Given that there are 150 banks on the list and that this list is missing many potential bank failures as evidenced by the fact that IndyMac was not on this secret list, it is very likely that there are double or triple that amount of banks which are candidates for failure. The FDIC currently does not have sufficient funds to reimburse consumers for future bank failures.

The FDIC will either need a whole bunch of federal money to deal with bank failures or will need to dramatically raise the fees FDIC member banks (for FDIC privileges). By raising fees this puts extra strain on banks, many of whom have shaky financial underpinnings.

In the main, the financial leadership CANNOT be trusted. It is damn scary!

Also, of the $53 billion the FDIC has to reimburse consumers of failed banks, IndyMac is estimated to need between $4-8 billion, putting more pressure on existing banks

One medium sized failed bank, IndyMac, needs between 7.5% and 15% of total FDIC funds dedicated to reimbursing customers of failed banks.

Given that there are 150 banks on the list and that this list is missing many potential bank failures as evidenced by the fact that IndyMac was not on this secret list, it is very likely that there are double or triple that amount of banks which are candidates for failure. The FDIC currently does not have sufficient funds to reimburse consumers for future bank failures.

The FDIC will either need a whole bunch of federal money to deal with bank failures or will need to dramatically raise the fees FDIC member banks (for FDIC privileges). By raising fees this puts extra strain on banks, many of whom have shaky financial underpinnings.

In the main, the financial leadership CANNOT be trusted. It is damn scary!

Monday, July 14, 2008

Graph: Bank Failures Per Year

An interesting graph from Calculated Risk: bank failures per year.

It's interesting how the 1980s dwarfed even the Great Depression. And today? Barely a blip.

It's interesting how the 1980s dwarfed even the Great Depression. And today? Barely a blip.

It's interesting how the 1980s dwarfed even the Great Depression. And today? Barely a blip.

It's interesting how the 1980s dwarfed even the Great Depression. And today? Barely a blip.

Labels:

Graphs

Financial meltdown quote of the day

From the International Herald Tribune:

"The real outrage is that none of this had to happen," said William Fleckenstein, co-author of "Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve" and president of Fleckenstein Capital in Issaquah, Washington. "We did not have to ruin the financial system and ruin the financial lives of a huge chunk of the middle class in the United States.For the record, way back in the early part of this decade Bill Fleckenstein was the first person in the press I'm aware of who recognized the housing bubble for what it is. He writes a weekly article for MSN Money.

"It is crystal clear," he adds, "that the Fed not only made mistakes, they had the pompoms out, cheering for deregulation. Until people recognize why we are in this mess, I don't see how we get out of this thing."

Sunday, July 13, 2008

Fannie and Freddie Bailout in the Works. Shareholders to Get Screwed.

From The Times of London:

Also in the article:

May you live in interesting times. Comments from readers?

US TREASURY secretary Hank Paulson is working on plans to inject up to $15 billion (£7.5 billion) of capital into Fannie Mae and Freddie Mac to stem the crisis at America’s biggest mortgage firms.According to Yahoo! Finance, Fannie Mae and Freddie Mac combined are currently worth $15 billion. So, if the U.S. government injects another $15 billion, current shareholders will instantly lose huge stakes in the companies. However, that's the risk you take for owning stocks.

The two companies lost almost half their market value last week as rumours of a government bail-out swept the stock markets, hammering share prices around the world.

Together, the two stockholder-owned, government-sponsored companies own or guarantee almost half of America’s $12 trillion home-loan market and are vital to the functioning of the housing market.

The capital-injection plan is said to be high on a list of options being considered by regulators as a means of restoring confidence in the lenders. The move would protect the American housing market, but punish shareholders in both companies.

Under the terms of the proposed move, the US government would receive a new class of shares in exchange for the capital, which would be hugely dilutive to shareholders. ...

Paulson killed off speculation that the government would renationalise the two agencies, a move that would have pitched the US public accounts into a new state of crisis.

However, Paulson pledged to support the two companies “in their current form”. He is said to have been concerned about the prospect of a rescue plan benefiting shareholders. ...

Some in Wall Street believe a rescue plan may be announced ahead of tomorrow’s US market opening to calm nerves and support the debt auction.

Also in the article:

Citigroup is expected to reveal further writedowns of at least $8 billion with its second-quarter results, and Merrill Lynch is forecast to reveal writedowns of some $4 billion.In other news this weekend, IndyMac Bank, a former unit of Countrywide Financial—and unrelated to Freddie Mac and Bernie Mac—was seized by the FDIC on Friday.

Both banks are expected to post sizeable losses for the second quarter, and reveal plans to sell off billions of pounds worth of assets.

May you live in interesting times. Comments from readers?

Saturday, July 12, 2008

Oil Bubble?

As politicians blame rising oil prices on speculators, it's worth reviewing the counterargument made by Princeton University economist Paul Krugman. Krugman says today's high oil prices are based on actual supply and demand, not financial speculation. Krugman correctly recognized both the late-1990s' stock market bubble and the housing bubble, so the fact that he argues that there is no oil bubble is ominous.

Any thoughts from readers?

Are speculators mainly, or even largely, responsible for high oil prices? And if they aren’t, why have so many commentators insisted, year after year, that there’s an oil bubble?For anyone interested in the whole oil speculation issue, Economist's View has been covering it.

Now, speculators do sometimes push commodity prices far above the level justified by fundamentals. But when that happens, there are telltale signs that just aren’t there in today’s oil market.

Imagine what would happen if the oil market were humming along, with supply and demand balanced at a price of $25 a barrel, and a bunch of speculators came in and drove the price up to $100.

Even if this were purely a financial play on the part of the speculators, it would have major consequences in the material world. Faced with higher prices, drivers would cut back on their driving; homeowners would turn down their thermostats; owners of marginal oil wells would put them back into production.

As a result, the initial balance between supply and demand would be broken, replaced with a situation in which supply exceeded demand. This excess supply would, in turn, drive prices back down again — unless someone were willing to buy up the excess and take it off the market.

The only way speculation can have a persistent effect on oil prices, then, is if it leads to physical hoarding — an increase in private inventories of black gunk. This actually happened in the late 1970s, when the effects of disrupted Iranian supply were amplified by widespread panic stockpiling.

But it hasn’t happened this time: all through the period of the alleged bubble, inventories have remained at more or less normal levels. This tells us that the rise in oil prices isn’t the result of runaway speculation; it’s the result of fundamental factors, mainly the growing difficulty of finding oil and the rapid growth of emerging economies like China. The rise in oil prices these past few years had to happen to keep demand growth from exceeding supply growth.

Saying that high-priced oil isn’t a bubble doesn’t mean that oil prices will never decline. I wouldn’t be shocked if a pullback in demand, driven by delayed effects of high prices, sends the price of crude back below $100 for a while. But it does mean that speculators aren’t at the heart of the story.

Any thoughts from readers?

Labels:

Oil

The Decline of a Subprime Mortgage Hedge Fund

The International Herald Tribune writes about the downfall of the Horizon Strategy hedge fund, run by John Devaney, which invested heavily in mortgages.

On Wednesday Devaney, who made and then lost a fortune trading mortgage investments, finally called it quits. He shut his hedge fund, and told his investors that all their money was gone too. ...Happy 38th birthday, Mr. Devaney!

It is a stunning downfall for Devaney, whose brash bets in the markets — and equally brash public pronouncements on the perils and promises of subprime mortgages — made him something of a Wall Street celebrity.

For Devaney, things finally unraveled in late June, just before his 38th birthday. Deutsche Bank called in margin loans, demanding that he pay back $90 million by the next day. When he could not pay, the bank seized his fund's assets on June 26 to auction them, he said. Deutsche Bank declined to comment.

Devaney's Horizon Strategy fund, founded near the height of the mortgage bubble, is just the latest hedge fund to fall victim to the credit squeeze. ...

Many of the hedge funds that have run into trouble lately bought the same sort of mortgage investments that have cost Wall Street banks so dearly. But because hedge funds are private firms, their losses are not generally visible to the public. ...

He said he had personally lost more than $150 million.

Friday, July 11, 2008

Investors Run from Fannie Mae and Freddie Mac

A few numbers:

- United States GDP: $13.8 trillion (2007 est.)

- United States annual tax revenues: $2.6 trillion

- United States national debt: $9.5 trillion

- Assets held or backed by Fannie and Freddie: $5 trillion

The anxiety over Fannie Mae and Freddie Mac, crucial to a recovery of the battered housing market and the economy as a whole, reached fever pitch on Friday as shares plunged on speculation of a looming bailout.Source.

Immediately after the markets opened, shares of Fannie and Freddie fell more than 47% from their already battered closing price the day before. They soon rebounded later in the morning but Fannie shares were still down 22% and Freddie shares were off 20% in midday trading. ...

Even before the latest report on a possible rescue plan, speculation about the future of the firms this week sparked a run by investors away from their shares. That in turn raised questions about how difficult and expensive it will be for them to raise needed capital in the future, which fed into the stock plunge in a vicious cycle.

Government Preparing for Possible Fannie Mae or Freddie Mac Collapse

CNBC reports:

Alarmed by the growing financial stress at the nation’s two largest mortgage finance companies, senior Bush administration officials are considering a plan to have the government take over one or both of the companies and place them in a conservatorship if their problems worsen, people briefed about the plan said on Thursday.For anyone who invests in government bond funds or money market funds, let me point out that quite often "federal" bond funds invest in U.S. Treasury bonds as well as bonds of government sponsored entities (GSEs) like Fannie Mae and Freddie Mac. By contrast, "treasury" bond funds only invest in U.S. Treasury bonds, not GSE bonds. Check your prospectus.

The companies, Fannie Mae and Freddie Mac, have been hit hard by the mortgage foreclosure crisis. Their shares are plummeting and their borrowing costs are rising as investors worry that the companies will suffer losses far larger than the $11 billion they have already lost in recent months. Now, as housing prices decline further and foreclosures grow, the markets are worried that Fannie and Freddie themselves may default on their debt.

Under a conservatorship, the shares of Fannie and Freddie would be worth little or nothing, and any losses on mortgages they own or guarantee — which could be staggering — would be paid by taxpayers. ...

Officials have also been concerned that the difficulties of the two companies, if not fixed, could damage economies worldwide. ...

Under a 1992 law, Fannie or Freddie could be put into conservatorship if their top regulator found that either one is “critically undercapitalized.” A conservator would have sweeping powers to overhaul them, but would not have the authority to close them. ...

The companies are by far the biggest providers of financing for domestic home loans. If they are unable to borrow, they will not be able to buy mortgages from commercial lenders. In turn, that would make it more expensive and difficult, if not impossible, for home buyers to obtain credit, freezing the United States housing market. ...

Together the two companies touch more than half of the nation’s $12 trillion in mortgages by either owning them or backing them. ...

In recent weeks, the companies have spiraled downward, undermined by declining confidence in their future and shaken by sharp declines in their assets as the housing markets have continued to slide and foreclosures have risen. In the last week alone, Freddie has lost 45 percent of its value, and Fannie is off 30 percent.

Bank of America CEO Discusses Countrywide Financial

From the Los Angeles Times, Bank of America CEO Ken Lewis discusses the merger with Countrywide Financial and his outlook for the housing market:

I also expect that the decline will take much longer than just until the first quarter of 2009. However, I expect that the rate of decline is currently at its peak and price declines will gradually slow in the future.

As for the Countrywide Financial purchase, I believe that in the long run it will help Bank of America become the dominate player in the U.S. mortgage market.

Often cast as having epitomized the lax lending standards that buried millions of Americans in unaffordable loans, Countrywide, the nation's largest mortgage lender, was on the ropes when Bank of America agreed to buy it six months ago. ...I think Bank of America is overly-optimistic regarding future housing prices. Personally I expect that, on a national level, real housing prices will fall about 30%, which means nominal prices would fall less. I expect bubble markets like California, Florida, and the DC metro area will fall much more.

On a weeklong California trip that included a Town Hall Los Angeles luncheon address Wednesday, Lewis acknowledged that loan losses at Countrywide were at the high end of estimates that Bank of America projected in January.

But he said Bank of America paid so little for the lender that once the books on the deal were closed, the Countrywide operation would immediately show a profit — with the potential for huge growth in income when the mortgage industry recovers. ...

"Given our view of things, we do not expect to cut [our] dividend nor do we expect to have to raise capital," he said, even though many other financial firms have taken both of those steps.

But he added that Wall Street clearly didn't believe him on those issues, given how far Bank of America's stock has fallen in recent months. It fell $1.48 to $22.06 on Wednesday, and is down 46% year to date.

As for the housing market, Lewis said Bank of America's latest forecast called for a further 15% decline in home prices nationwide, with the decline going into at least the first quarter of next year.

In the case of California, Florida and other markets that had the biggest booms, a further 20% decline is more realistic, he said.

I also expect that the decline will take much longer than just until the first quarter of 2009. However, I expect that the rate of decline is currently at its peak and price declines will gradually slow in the future.

As for the Countrywide Financial purchase, I believe that in the long run it will help Bank of America become the dominate player in the U.S. mortgage market.

Thursday, July 10, 2008

Bank Of America Credit Card Cancelled Due their Purchase of Countrywide

On a personal note: Two days ago I cancelled my Bank of America credit card due to their purchase of Countrywide. I told them that I was ceasing all financial realtionships with them due to their purchase of Countrywide.

Bank of America cannot be trusted.

Bank of America cannot be trusted.

Wikipedia Article Needed for Lawrence Yun

There is a need for a Wikipedia article on Lawrence Yun (chief economist for the National Association of Realtors). But, there is a solid article about Yun's predecessor David Lereah. Volunteers are needed to create a Wikipedia entry on Lawrence Yun

For more information about Mr. Yun please see the Lawrence Yun Watch.

Northern California Real Estate Prices

Click on the images to see the full-sized graphs of housing prices in San Francisco and Sacramento, California.

Source.

Source.

Do we have any readers from Northern California who can provide feedback?

Source.

Source.Do we have any readers from Northern California who can provide feedback?

Labels:

California,

Graphs

Wednesday, July 09, 2008

Dean Baker's Recommendations to Congress Regarding the Housing Bailout

From the introduction of congressional testimony in April by economist Dean Baker of the Center for Economic Policy Research.

The current situation in the housing market is potentially the largest economic crisis in the post-World War II era both for the country as a whole, and the millions of homeowners facing the loss of their home. By its actions, Congress can help to either ameliorate some of its worst effects, or exacerbate the problems. For this reason, it is crucial that it consider carefully the implications of any legislation.

The Hope for Homeowners Act of 2008 is an ambitious effort to address the crisis created by the collapse of the housing bubble, and the epidemic of predatory subprime mortgages over the years 2003-2007. In assessing the merits of this proposal, it is important to realize that there are large differences in the state of the housing market across the nation. Policies that may be appropriate for some parts of the country may not be appropriate for other parts of the country.

In my comments, I argue that the mortgage guarantee program that is at the center of the Hope Act may be useful for parts of the country where housing prices are not abnormally high, but that this program is not well-suited for areas that still have bubble-inflated house prices.

Specifically, the program in bubble-inflated areas:

1) Will lead to situations in which homeowners spend far more on housing than renters would pay for comparable units;

2) Will lead to situations in which homeowners are unlikely to accumulate any equity at the point when they leave their home;

3) Will fail to stabilize prices.

I also argue the effort to stabilize prices in bubble-inflated areas is counter-productive. Insofar as it succeeds, it makes homeownership less affordable for young people and families moving into the area. I also briefly describe an alternative "own-to-rent" proposal that would guarantee moderate-income homeowners facing foreclosure the right to remain in their home as long-term tenants paying the fair market rent.

Labels:

Dean Baker

Tuesday, July 08, 2008

Bubble Sphere Roundup

Thank you James for all your excellent posts. :-)

Large mortgage companies: Fannie, Freddie and IndyMac all in trouble. So reports Housing Doom.

The Real Estate Bloggers informs that Trump Tower Declares Chapter 11 Bankruptcy.

Mortgage Lender Implode stands at 266. Yikes!

The housing bust is not over. The bottom callers who are saying a turnaround is around the corner are wrong. The housing market in the US will continue to decline in most areas for a while. With job losses mounting, gas prices rising and foreclosures swelling how can this be the bottom?

Large mortgage companies: Fannie, Freddie and IndyMac all in trouble. So reports Housing Doom.

The Real Estate Bloggers informs that Trump Tower Declares Chapter 11 Bankruptcy.

Mortgage Lender Implode stands at 266. Yikes!

The housing bust is not over. The bottom callers who are saying a turnaround is around the corner are wrong. The housing market in the US will continue to decline in most areas for a while. With job losses mounting, gas prices rising and foreclosures swelling how can this be the bottom?

Flashback 2005: Carl Steidtmann Called the Housing Bubble a Myth

From July 8, 2005—exactly three years ago today. Carl Steidtmann, chief economist at Deloitte Research, called the housing bubble a myth. Here are his wise words:

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.

Congratulations, Carl Steidtmann! I hereby award you the James K. Glassman and Kevin A. Hassett Award for being completely unable to recognize an asset bubble. Keep up the good work and perhaps you can become a senior fellow at the American Enterprise Institute, too.

Everywhere you turn these days the buzz is about soaring real estate prices. If you are lucky enough to be a homeowner in one of the hot markets like South Florida or New York City, owning real estate is almost as good as winning the lottery. The increase in household wealth is seen by many analysts, who can’t stand the thought that someone somewhere might be doing well in this economy, as a sign of some future catastrophe to come. All the hype about a housing bubble is an excellent illustration of Benjamin Disraeli’s lament that there were 'liars, damned liars and statisticians.' While many of the housing price indexes that are published by both government and industry trade groups show prices spiraling higher, you really need to be a statistician to understand what they are saying.

When you strip away all of the white noise around a housing bubble, what you find is a robust market for housing that is undergoing several profound changes all of which manifest themselves in higher home price indexes, none of which adds up to a housing price bubble....

Everywhere the Boomers have gone, economic, political and social disruption has followed, and housing is no different. When the boomers were born, maternity wards were overwhelmed. When they went to school, there was a boom in school building that was not enough to keep a lot of public schools from going to a double session day. When the Boomers hit puberty we had a sexual revolution. At college age, they took to the streets in protest on a global level. Upon entering the workforce they produced record unemployment. When they first started buying houses in the late-1970s, housing prices soared. Even as we look ahead to their retirement, they will create a crisis in both private and public pensions. It should not be surprising that they are roiling the housing market.

As the children of the Boomers leave home, the housing needs of the Boomers are changing. They are moving back into the inner city to places like Harlem and at the same time buying second homes at record numbers. Both changes in housing demand are producing an upward movement in home price indexes. But do these changes really represent an increase in home prices that can be described as a bubble?

...The psychology of market participants in a bubble is also different from normal times. As a bubble reaches its peak the market participants are in search of the greater fool. Buyers buy only in the expectation that there is a greater fool out there who will pay a higher price. Eventually the greater fool is found and the price falls. As the market searches for the greater fool, the rising price brings out extra and sometimes unexpected sources of supply. It is this combination of increased supply and narrowing demand that results in the breaking of a market bubble and a fairly rapid descent in price. While there is some anecdotal evidence of market speculation, most participants are buying houses because they still represent a very good long term value....

Financial bubbles come to a crashing end when the sky high prices lure a wave of supply onto the market that crushes demand. Were housing a bubble, the high price of existing housing should be fostering a boom in home building. While new housing starts have risen steadily over the past couple of years, when adjusted for population, new home building is no where near the heights of building activity set back in the 1970s....

And finally, as interest rates have come down, the affordability of home ownership has gone up. Asset prices are high, but the actual cash flow cost of housing is near record lows due to low interest rates. The share of an average American household income going to finance a new median priced house today is lower then it was at any time in the past two decades. Interest rates are going to have to rise more than a little to increase the cash flow cost of housing back to the levels seen in previous decades....

And finally, as interest rates have come down, the affordability of home ownership has gone up. Asset prices are high, but the actual cash flow cost of housing is near record lows due to low interest rates. The share of an average American household income going to finance a new median priced house today is lower then it was at any time in the past two decades. Interest rates are going to have to rise more than a little to increase the cash flow cost of housing back to the levels seen in previous decades.

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.

The summer of 2005—when he wrote the words above—was actually the peak of the housing bubble.Congratulations, Carl Steidtmann! I hereby award you the James K. Glassman and Kevin A. Hassett Award for being completely unable to recognize an asset bubble. Keep up the good work and perhaps you can become a senior fellow at the American Enterprise Institute, too.

Labels:

Flashback

Monday, July 07, 2008

Housing Bailout Again Under Consideration This Week

As the U.S. Senate returns from its week-long Independence Day recess, the housing bailout bill is again in focus. The House of Representatives has already passed their version of the bill.

The housing rescue is designed to help hundreds of thousands of homeowners buckling under subprime mortgage payments avoid foreclosure and get new, cheaper loans. This could be the last major compromise to be signed by Bush this year.I ask that everyone email their senators again asking them to oppose the bailout.

It has drawn broad support in the Senate, where test-votes show it has enough backing to override a veto. A procedural vote was expected Monday, and the measure is expected to pass the Senate as early as week's end.

First, though, lawmakers have to break a logjam over Republican Sen. John Ensign's bid to add $8 billion worth of renewable energy tax breaks. Then leaders have to resolve disputes among Democrats and with the White House about important details.

The measure includes a plan for the Federal Housing Administration to insure up to $300 billion in new, more affordable fixed-rate loans for borrowers otherwise considered too financially strapped to qualify. The proposal also would overhaul the FHA and tighten rules for government-sponsored mortgage companies Fannie Mae and Freddie Mac.

"I think we can get us a bill," Bush said recently. "But it's going to require less politics and more focus on keeping our minds on who we need to help, and that's the homeowner."

Democrats are divided on how high to place limits on the loans FHA can insure and those two companies can buy. The House proposed a roughly $730,000 cap and the Senate embraced a $625,000 ceiling.

Leaders are tussling with the White House over including at least $3.9 billion in grants for buying, fixing up and reselling foreclosed properties. This is an idea that Democrats say is critical to battling blight and Bush calls a government bailout for lenders who helped cause the housing crisis.

Sunday, July 06, 2008

A New Realtor Sales Pitch

Here is an actual Realtor sales pitch for buying U.S. real estate.

FOREIGN INVESTORSI'd love to hear what our readers think of this. There's never a bad time to buy, right?

Now is the time to purchase real estate in the United States. Take advantage of our weak dollar and our sub-prime mortgage catastrophe. Invest in the Capital of the United States, Washington DC. Contact me today, and I will send you a pictured email of any type of property that you are intrested in, Residential, Commerical, Multi-Unit Apartment Buildings.

Saturday, July 05, 2008

A Graph of Gas Prices Since 1919

Remember those really, really high gas prices of the late 1970s and early 1980s? Well, we're past that and still climbing. From the U.S. Energy Information Administration:

To quote Stein's Law, "If something cannot go on forever, it will stop." Of course, when it will stop is the big question.

To quote Stein's Law, "If something cannot go on forever, it will stop." Of course, when it will stop is the big question.

The really interesting thing in the graph is that until 1998, the long-term trend for real gas prices was down.

To quote Stein's Law, "If something cannot go on forever, it will stop." Of course, when it will stop is the big question.

To quote Stein's Law, "If something cannot go on forever, it will stop." Of course, when it will stop is the big question.The really interesting thing in the graph is that until 1998, the long-term trend for real gas prices was down.

Labels:

Energy Prices,

Graphs,

Oil

Friday, July 04, 2008

Money Magazine Home Price Forecasts

Money magazine forecasts home prices over the next year.

The housing implosion is nowhere near over. In 75 of the 100 top U.S. cities, prices are expected to fall in the next 12 months according to Fiserv Lending Solutions....Many markets won't hit bottom till late 2009 or even 2010.

Thursday, July 03, 2008

How Congress Should Address the Foreclosure Crisis

A paper by the Center for Economic Policy Research and the National Low Income Housing Coalition provides recommendations for how Congress address the foreclosure crisis. (Sorry about the length.)

This paper compares ownership and rental costs in twenty major metropolitan areas. It shows that in many areas, ownership and rental costs are more or less in balance. This means that it might be practical and desirable to craft policies for these cities that are focused on keeping homeowners in their homes as owners.

However, the paper also shows that in many cities homeownership costs are greatly out of line with rental costs. These are cities, mostly on the two coasts, that have seen an extraordinary run-up in house sale prices over the last decade that have not been matched by any comparable increase in rents. In these markets, homeownership costs could easily be double, and even close to triple, the cost of renting comparable units. Paying these inflated ownership costs will take away money that might otherwise be used to pay for health care, child care or other necessary expenses. Similarly, a government that intervenes at these prices will have less money for other needs.

Furthermore, because prices are now falling rapidly in many of these markets, homeowners are unlikely to accumulate equity. In fact, it is likely that many homeowners will end up selling their homes for less than their outstanding mortgage, even if new mortgages are issued with substantial write-downs from the original mortgage. In these bubble markets, government efforts to support homeownership are likely to do little to help homeowners and could leave taxpayers with a substantial bill in cases where homeowners leave their houses with negative equity.

The paper notes that in these markets, a policy of ensuring suitable rental options is likely to be more helpful to many current homeowners. This policy can encourage the rapid conversion of vacant and abandoned units to rental properties, as well as policies that facilitate the conversion of ownership units to rental units for the same households.

In addition, the paper also notes that many of the properties facing foreclosure are already rental properties. In these cases, foreclosures often result in the displacement of the current tenants. Congress should recognize this problem and consider policies that provide greater security to tenants in such situations....

The analysis shows that for several cities with bubble inflated house prices such as Los Angeles, Boston, and Washington the cost of homeownership is likely to be two or even three times as high as the cost of renting a comparable unit. Furthermore, since house prices are likely to continue declining towards long-term trend levels, homeowners in these markets are unlikely to ever accumulate equity in their homes.

In these markets, encouraging people to remain as homeowners, even with substantial write-downs from their original mortgage terms, is likely to lead to situations in which they pay far more of their income in housing costs than necessary. The result could be that these families forego health care insurance for their kids or quality child care, since they will be forced to continue to make extra sacrifices to remain homeowners, with considerably less likelihood of a long term financial benefit relative to renting.

By contrast, in markets where house prices do not appear to be inflated, such as Atlanta, Cleveland, and Detroit, there is not a serious imbalance between the cost of renting and the cost of owning. In these markets, it is reasonable to implement policies that attempt to keep people in their houses as homeowners and stabilize house prices.

Labels:

Dean Baker

Wednesday, July 02, 2008

More News on Countrywide Financial

From yesterday's Wall Street Journal:

The Florida attorney general on Monday filed a civil lawsuit against Countrywide Financial Corp. and its chief executive, Angelo Mozilo, alleging the company engaged in deceptive and unfair trade practices.From the Associated Press, via CNN:

The lawsuit, filed in state court in Broward County by Florida Attorney General Bill McCollum, alleges that Countrywide put borrowers into mortgages they couldn't afford or loans with rates and penalties that were misleading. It seeks civil penalties and damages.

Florida's action follows similar lawsuits filed last week by attorneys general in California and Illinois. Mr. McCollum said that his state has had a continuing investigation of Countrywide and "we thought it was important for us to do this right now."

Bank of America Corp. completed its purchase of Countrywide Financial Corp. Tuesday, making the Charlotte, N.C.-based bank the nation's leading mortgage originator and servicer.Is it really a good idea to control 20-25% of the nation's home-loan market during this housing bust?

The Federal Reserve and Countrywide's shareholders cleared the way for the acquisition last month. As of Tuesday's close, Bank of America controls between 20% and 25% of the country's home-loan market.

U.S. Senate Candidate Mark Warner Opposes Affordable Homes

A new campaign email from former Virginia governor and current U.S. Senate candidate Mark Warner (D) suggests he believes the government has a responsibility to prop up overvalued home prices. Higher prices, of course, mean lower affordability for new home buyers.

A new campaign email from former Virginia governor and current U.S. Senate candidate Mark Warner (D) suggests he believes the government has a responsibility to prop up overvalued home prices. Higher prices, of course, mean lower affordability for new home buyers.Here is the relevant section of the Mark Warner campaign email that I just received in my inbox:

Lately, it seems like the U.S. Senate is where good legislation goes to accumulate dust on a shelf. Legislators left Washington on Friday for the July 4th recess. They did so after failing to pass a bipartisan bill aimed at preventing the steepest decline in housing prices in a generation.Obviously, Mark Warner believes the abnormally high housing prices of the past few years were normal. They were not.

Unlike most politicians, Mark Warner has a business background so he has no excuse for not understanding the inverse relationship between price and affordability.

Of course, I got the email one day after putting a Mark Warner bumper sticker on my car. Lereah!

Tuesday, July 01, 2008

Angelo Mozilo Leaves Countrywide Today

Bank of America's acquisition of Countrywide Financial is expected to take place today, which means Angelo Mozilo is retiring. From the Wall Street Journal:

If you'd like to wish Angelo Mozilo a fond farewell, you may do so in the comments.

Angelo Mozilo, slated to step down as chief executive of Countrywide Financial Corp. on Tuesday, is departing with a devalued reputation partly because he stayed too long and at times ran the publicly traded mortgage lender as if it were his own company.I think this acquisition will hurt Bank of America over the next few years, but if you look out five years or more, Bank of America may dominate America's mortgage industry.

Bank of America Corp. plans to complete its acquisition of Countrywide on Tuesday, and the 69-year-old Mr. Mozilo will retire. Bank of America will become the nation's biggest home-mortgage lender, using Countrywide's loan-processing technology and nationwide presence—but not its brand, which is scheduled to vanish after a transition period.

Until about a year ago, Mr. Mozilo was little known outside his industry. In the mortgage world, he was considered a visionary. He helped found Countrywide in 1969 and built it into the nation's biggest and most efficient mortgage lender. Then came an abrupt fall as defaults surged and investors lost confidence.

Countrywide's reaction to the crisis was to push for more market share in the first half of 2007, aiming to benefit from the collapse of rivals. That backfired when Countrywide could no longer find buyers for many of the loans it had originated, leaving the company stuck with billions of dollars of high-risk mortgages. Former executives say Countrywide, which still accounts for about one in every seven home loans made in the U.S., was so focused on increasing volume that it neglected quality control.

Mr. Mozilo made things worse for himself by postponing his retirement and by making frequent, heavy sales of Countrywide stock. He offered discounts on loans to friends so frequently that FOA—for Friends of Angelo—became a familiar loan type among employees.

If you'd like to wish Angelo Mozilo a fond farewell, you may do so in the comments.

Worst Recession Since World War II?

From Fortune Magazine:

Eli Broad, the billionaire investor and KB Home (KBH) founder, says we’re in the worst recession since World War II, and that a housing market recovery is years away. In an interview with Bloomberg, Broad also said that the banking industry may need to raise even more money to protect against bad loans — a grim prediction for an industry that has already posted about $400 billion in accounting losses.

Southern California Real Estate Prices

Click on the images to see the full-sized graphs of housing prices in Los Angeles, Riverside-San Bernardino, and San Diego, California.

Source.

Source.

Do we have any readers from Southern California who can give us their thoughts?

Source.

Source.Do we have any readers from Southern California who can give us their thoughts?

Labels:

California,

Graphs

Subscribe to:

Posts (Atom)