I know this is a blog about the housing bubble, but I'd like to take a moment to talk about government waste. In particular, I'd like to talk about Alaska's "Bridge to Nowhere." John McCain's new running mate, Alaska Governor Sarah Palin, is patting herself on the back for opposing the Bridge to Nowhere. Here are a few tidbits that Sarah Palin (and the mainstream media) isn't telling you about the bridge.

First, Governor Palin was for it before she was against it.

Second, she changed her position on the bridge when it became a national issue and when it became apparent that Alaska would have to pay part of the cost itself.

Third, even though Alaska got rid of the bridge, THEY KEPT THE FEDERAL MONEY! All they did was decide to spend your federal tax dollars on other stuff. They got rid of the symbol of wasteful earmark spending, but they kept the actual wasteful earmark spending.

I have a McCain bumper sticker on my car, but I'm debating whether or not I should keep it.

On a housing-related note, looking up Governor Palin's public financial disclosure form and cross-referencing it with Zillow.com reveals her Wasilla, Alaska home had a 2006 tax assessor's value of $526,800.

Other bloggers comment on Governor Palin:

Update: Apparently now on Intrade, you can bet on the odds of Sarah Palin being withdrawn as the Republican VP candidate. The odds of her withdrawal have dropped in half since her convention speech.

Saturday, August 30, 2008

Another Bank Failure!

Integrity Bank has become the tenth bank failure of the year:

Alpharetta, Georgia-based Integrity Bank has been closed by regulators and its assets have been transferred to Regions Financial Corp., Regions said in a prepared statement late Friday.

The Federal Deposit Insurance Corp. assumed some $900 million in total deposits from Integrity and has transferred them to Regions, Regions said, adding that, "the FDIC will retain most of Integrity Bank's loan portfolio for later disposition."

Integrity's closure is the 10th bank failure so far this year. The bank had $1.1 billion in total assets and $974 million in total deposits as of June 30, the FDIC said.

Friday, August 29, 2008

Housing Bubbles: America vs. Japan

The Economist compares Japan's real estate bubble with America's:

AS FALLING house prices and tightening credit squeeze America’s economy, some worry that the country may suffer a decade of stagnation, as Japan did after its bubble burst in the early 1990s. Japan’s property bubble was also fuelled by cheap money and financial liberalisation and—just as in America—most people assumed that property prices could not fall nationally. When they did, borrowers defaulted and banks cut their lending. The result was a decade with average growth of less than 1%.The worst is over in America. ;-)

Most dismiss the idea that America could suffer the same fate as Japan, but some of the differences are overstated. For example, some claim that Japan’s bubble was much bigger than America’s. Yet average house prices nationwide rose by 90% in America between 2000 and 2006, compared with a gain of 51% in Japan between 1985 and early 1991, when Japanese home prices peaked. ... Japanese home prices have since fallen by just over 40%. American prices are already down by 20%, and many economists reckon they could fall by another 10% or more.

What about commercial property? Again, average prices rose by less in Japan (80%) than in America (90%) over those same periods. Thus Japan’s property boom was, if anything, smaller than America’s. Japan also had a stockmarket bubble, which burst a year earlier than that in property. This hurt banks, because they counted part of their equity holdings in other firms as capital. But its impact on households was modest, because only 30% of the population held shares, compared with over half of Americans. ...

John Makin, at the American Enterprise Institute, a think-tank, argues that monetary and fiscal relief were necessary but not sufficient to revive Japan’s economy. The missing ingredient was a clean-up of the banking system, on which Japanese firms were more dependent than their American counterparts. ...

One advantage over Japan, says Mr Jerram, is that America is spreading the costs of its housing bust across other countries. ...

By learning from Japan’s mistakes, America can avoid a dismal decade. However ... experience in other countries shows that serious asset-price busts often lead to economic downturns lasting several years. Only a wild optimist would believe that the worst is over in America.

Thursday, August 28, 2008

More Banks in Danger of Failure

CNN Money reports that the FDIC's list of troubled banks is still growing and expected to keep growing in the future.

The number of troubled banks on the government's watch list grew dramatically last quarter.

The Federal Deposit Insurance Corp. reported Tuesday that the number of firms on its so-called problem bank list grew to 117 during the second quarter — its highest level since the middle of 2003. There were 90 banks on the problem list in the first quarter.

FDIC Chairman Sheila Bair expressed little surprise at the increase and warned that the number would grow.

"More banks will come on the list as credit problems worsen and assets of problem institutions will continue to rise," said Bair in a press conference.

The number of troubled institutions has moved steadily higher this year - nearly doubling from 61 at the same time a year ago - as banks across the country struggle to cope with the fallout in the housing market and rising loan losses.

Wednesday, August 27, 2008

New Home Sales Fall 35% YoY

From CNN Money:

The government offered more discouraging news about the housing sector on Tuesday, reporting that new home sales rose slightly in July only after revising the previous month's number sharply lower.

Sales for July came in at a seasonally adjusted annual rate of 515,000, up 2.4% from 503,000 in the previous month, the Census Bureau reported. Last month, Census had put the June figure at 530,000.

The change marks the fourth of the past five reports that Census has slashed the previous month's number. The trend worries economists who say a hoped-for stabilization of the housing market remains elusive.

"It's concerning because the pattern of revisions from the Census Bureau has been systematically downward instead of random as you'd expect," said David Seiders, chief economist for the National Association of Home Builders. "Chances are we'll see some downward revision when they put out the August numbers." ...

Even though sales for the month unexpectedly rose month to month, sales fell 35.3% from July 2007, when new home sales were on an annual pace of 796,000.

The rise in new home sales is also deceptive because of seasonal adjustments. On a non-seasonally adjusted basis, the report showed only 43,000 new homes were sold in July, which marks the lowest level for that measure since December 1994. ...

The report is the latest sign of trouble in the overall housing market.

On Monday, the National Realtors Association reported existing home sales rose more than expected in July, but prices continued to fall and inventory increased to a record high. Earlier Tuesday, the S&P/Case-Shiller national home price index showed U.S. home prices fell a record 15.4% in the second quarter compared with last year.

And according to a new report from the Mortgage Asset Research Institute released Tuesday, the number of fraudulent loans issued during the first three months of 2008 skyrocketed 42% compared with the same period in 2007.

S&P/Case-Shiller Q2 2008 Home Price Indexes Fall Again

National house prices: -15.4% YoY

National house prices: -2.33% QoQ

Boston: -5.2% YoY

Boston: +1.23 MoM

Chicago: -9.5% YoY

Chicago: +2.00% MoM

Denver: -4.67% YoY

Denver: +1.48% MoM

Las Vegas: -28.6% YoY

Las Vegas: -1.57% MoM

Los Angeles: -25.3% YoY

Los Angeles: -1.44% MoM

Miami: -28.3% YoY

Miami: -1.72% MoM

New York Metro: -7.29% YoY

New York Metro: +1.60% MoM

Phoenix: -27.9% YoY

Phoenix: -2.63% MoM

San Diego: -24.2% YoY

San Diego: -1.49% MoM

San Francisco: -23.7 YoY

San Francisco: -1.76 MoM

Tampa: -20.1 YoY

Tampa: -1.15 MoM

Washington, DC: -15.7% YoY

Washington, DC: -0.93% MoM

National house prices: -2.33% QoQ

Boston: -5.2% YoY

Boston: +1.23 MoM

Chicago: -9.5% YoY

Chicago: +2.00% MoM

Denver: -4.67% YoY

Denver: +1.48% MoM

Las Vegas: -28.6% YoY

Las Vegas: -1.57% MoM

Los Angeles: -25.3% YoY

Los Angeles: -1.44% MoM

Miami: -28.3% YoY

Miami: -1.72% MoM

New York Metro: -7.29% YoY

New York Metro: +1.60% MoM

Phoenix: -27.9% YoY

Phoenix: -2.63% MoM

San Diego: -24.2% YoY

San Diego: -1.49% MoM

San Francisco: -23.7 YoY

San Francisco: -1.76 MoM

Tampa: -20.1 YoY

Tampa: -1.15 MoM

Washington, DC: -15.7% YoY

Washington, DC: -0.93% MoM

Tuesday, August 26, 2008

Yun Interview

Lawrence Yun, chief economist of the Realtors', being interviewed by Diana Olick (CNBC)

Monday, August 25, 2008

Homeowner-Oriented Magazines Going Under

The housing crisis has moved to the magazine rack.In addition, in early June the decade-old Discovery Home TV network was relaunched as Planet Green, an environmentally-oriented TV network.

For much of this decade, publishers could not move quickly enough to offer design and decorating advice to the mushrooming population of homeowners. Lately, though, the downturn in the real-estate market has cast doubt on reader and advertiser appetite for "shelter" publications that tell people how to spruce up their homes.

Now, grappling with the possibility that they overshot demand for home-related content, some publishers are scaling back their investments in these publications.

On Wednesday, Lagardère SCA's Hachette Filipacchi Media U.S, publisher of Elle, Woman's Day and Car and Driver, as well as several shelter and enthusiast titles, said it is pulling the plug on its struggling Home magazine. The closure of Home comes less than a year after the demise of Condé Nast Publications Inc.'s House & Garden magazine and Martha Stewart Living Omnimedia Inc.'s Blueprint. Jack Kliger, president and chief executive officer of HFM U.S., cited sharp declines in the "mid-market home sector" for the decision to close Home, which posted a 47% decline in ad pages in the second quarter, according to the Publishers Information Bureau.

"Obviously, this is a tough time for the shelter magazine category," said Andy Sareyan, president of Meredith Corp.'s Better Homes & Gardens, which he said was less vulnerable than competitors because of its broader focus on lifestyle. "When people do less buying and selling of homes and less remodeling, there is less need for the advertising categories that support the businesses to spend their money."

Spending on home additions and alterations declined 5% in 2006 and an estimated 11% in 2007, according to the National Association of Home Builders. This year, the number of home magazines is expected to decline for the first time in five years, after the number of titles increased by 57% between 2002 and 2007, according to the National Directory of Magazines.

Sunday, August 24, 2008

9th Bank Failure of the Year

ABC News reports that a Kansas bank is the 9th to fail so far this year.

Bank regulators closed Columbian Bank and Trust Company on Friday, the ninth U.S. bank to fail this year as the weakening economy and falling home prices take their toll on financial institutions. ...

Citizens Bank and Trust has agreed to assume the failed bank's insured deposits. Columbian Bank and Trust's branches will reopen on Monday as branches of Citizens Bank and Trust, which is based in Chillicothe, Missouri. ...

The failure is expected to cost the FDIC deposit insurance fund an estimated $60 million.

Saturday, August 23, 2008

We're Not in a Recession

While the economy may be weak, it turns out that we are still not in a recession.

Weak Economy Hurting Rental Real Estate

The housing bust had been pushing up rents as former homeowners became renters. Now, according to The Wall Street Journal, the weak economy is hurting the rental market.

For the past year, apartment buildings have been one of the few bright spots in the real-estate industry as people forced out of the home-buying market by foreclosures or the credit crunch have turned to renting.

But now the specter of job losses is beginning to spread the gloom into that sector as well. As would-be renters are doubling up in apartments or moving in with friends and families, rents and occupancy rates are beginning to fall in many cities.

"In many markets, our new prospects are beginning to resist the current and increasing levels of market rents we've enjoyed over the past quarter," David Neithercut, chief executive of Equity Residential, told investors during this month's earnings call. While the Chicago-based apartment owner, one of the largest in the U.S., reported an increase in funds from operations of 1.5% last quarter, it lowered its estimates for comparable-property revenue growth.

Friday, August 22, 2008

New Movie about the U.S. National Debt Opens Today

I.O.U.S.A., a new documentary about the U.S. national debt, opens in ten cities across the U.S. today. It is said to be An Inconvenient Truth for the U.S. economy. Here is the official movie trailer:

A review of the movie is here. There are also two associated books, Empire of Debt and the yet-to-be-released I.O.U.S.A.

Locally, in the DC Area it is playing at:

A review of the movie is here. There are also two associated books, Empire of Debt and the yet-to-be-released I.O.U.S.A.

Locally, in the DC Area it is playing at:

- REGAL ---- Fairfax Towne Center 10 ---- Fairfax, VA

- REGAL ---- Ballston Common 12 ---- Arlington, VA

Warren Buffett on Housing: "We had a very, very big bubble."

Warren Buffett, the world's richest man and world's greatest investor, did three hours of interviews on CNBC this morning. He covered a number of topics, including housing. A few nuggets from the CNBC summary that may be of interest to readers of this blog:

6:48 AM: Is Fannie Mae going under? Buffett says in a sense they already have because they wouldn't survive without government backing. "They priced risk wrong."A video of Buffett's comments on housing is here.

7:03 AM: Becky asks again about the economy and he repeats his view that the negative ripples will continue to spread for awhile. He sees no "early end" to the problems although they will end eventually.

7:10 AM: Asked about the oil market, Buffett says demand and supply for crude has changed significantly in the past five years. He thinks Boone Picken's energy plan is "on the right track" and warns that the world cannot keep increasing its demand for oil.

7:38 AM: [Becky] asks what grade he would give to the Federal Reserve. He says he admires anyone who takes on a very difficult job. He might not always agree with Fed Chairman Ben Bernanke but he admires that Bernanke is taking tough problems with no obvious answers.

7:40 AM: Buffett says there's a "reasonable chance" that Fannie and Freddie's equity will be wiped out. They keep existing because they're backed by the government, and the government should continue to support them, except for the equity portion. He notes that Berkshire had been a big holder of the GSEs before selling the entire stake around 2000 and 2001.

7:42 AM: Buffett says he has no bets against the U.S. dollar right now and no direct currency plays. He also notes that stocks are generally more attractive now than they were a year ago.

7:53 AM: Buffett: The Fed "has real problems on inflation." ... Wholesale prices will "have to" show up in consumer prices. Once inflation is "ignited" it gets difficult to bring it under control.

8:01 AM: Are there bargains in the stock market? Buffett says yes, there are companies that are better today than they were a year ago selling for lower prices. When he gets calls from someone who has just lost billion of dollars and wants to be replenished, he doesn't get that excited. He points out that when someone tries to sell something to you, like an investment, it probably isn't worth buying. The best ideas come from your own ideas and digging.

8:06 AM: Would Buffett buy additional shares in the financials he already owns like American Express and Wells Fargo if prices come down? Is he buying shares now? Buffett replies that he has indeed been buying shares in one of those two names lately, but won't say which one. He points out that both companies were both started by the same people.

8:17 AM: Buffett repeats his belief that a windfall profits tax on oil doesn't make any sense, despite the fact that his favored candidate, Barack Obama, has expressed support for such a tax. He notes that no one is calling for a tax on other commodities that have gone up in price like soybeans. The oil companies are an easy target.

8:38 AM: Buffett says it's possible there could be another financial firm imposion along the lines of Bear Stearns, but it would be "inappropriate" to comment on any specific companies right now because it could undermine confidence. He notes that while it is hard to find the sources, rumor-mongers should be punished.

8:44 AM: Buffett predicts housing market recovery will take some time, probably years. "A lot of blame to go around." The market won't really come back until you get to a normal inventory of unsold homes.

8:46 AM: Buffett: No interest right now in buying any homebuilder stocks. They still have plenty of problems.

Labels:

Warren Buffett

Thursday, August 21, 2008

Presidential Candidates Attack Each Other Over Their Houses

Obama's attack on McCain:

Mother Jones explains why McCain may be confused. Obama is confused as well. Someone needs to tell him that condos aren't houses.

McCain's attack on Obama:

Both ads were released earlier today.

Mother Jones explains why McCain may be confused. Obama is confused as well. Someone needs to tell him that condos aren't houses.

McCain's attack on Obama:

Both ads were released earlier today.

McCain unsure how many houses he owns

John McCain, when asked about how many houses he and his wife own, responded by saying he doesn't know.

"I think — I'll have my staff get to you," McCain told Politico in Las Cruces, N.M. "It's condominiums where — I'll have them get to you."

Lovely. When did they buy all these houses? Did John and his wife Cindy McCain dabble in real estate speculation during the bubble years? Are they in part responsible for the housing bubble?

Housing Bust Punishes Home Depot

From The Wall Street Journal:

Home Depot Inc. said its second-quarter net profit fell 24% as the world's largest home-improvement retailer by sales struggled to sell big-ticket items due to the slowing U.S. economy and housing market.

Wednesday, August 20, 2008

America's Most and Least Affordable Cities

CNNMoney cites a new National Association of Home Builders quarterly report:

Indianapolis led the the nation's major metro areas in home affordability for the 12th straight quarter. The median price of homes sold during the second quarter was $108,000, down from $122,000 last year. And 91.6% of the households there earning the median income of $65,100 could afford to buy a median priced home. That's up from 86.8% last year.Given the NAHB report above, this little tidbit from Wikipedia seems nuts:

New York was the least affordable major housing market in the country, according to the report. It was the first time that a major metropolitan area outside of California was the least affordable home market in the 17-year history of the report. Los Angeles was the least affordable housing market at this point last year.

"Prices went down a lot in both areas, but they fell a lot more in Los Angeles," said Ahluwalia. "Prices are declining very rapidly in California because of a large supply and low demand."

In New York, the median home price fell slightly year over year to $481,000 from $510,00. That led to an increase in affordability; 11.4% of households earning the median income of $63,000 could afford to buy a median priced home, up from 6.3% in the second quarter of 2007.

However, in 2008, Indiana ranked 12th nationally in total home foreclosures and Indianapolis led the state within this.WTF?

Monday, August 18, 2008

Investors Dump Fannie Mae and Freddie Mac Stock

From CNBC:

Investors dumped the stocks of Fannie Mae and Freddie Mac after Barron's reported the increasing likelihood of a U.S. Treasury bailout that would approach nationalization of the two housing finance titans.

The weekly financial newspaper said such a move could wipe out existing holders of the largest U.S. home funding companies' common stock.

Preferred shareholders and even holders of the two government-sponsored entities' $19 billion of subordinated debt would also suffer losses.

Shares of Fannie and Freddie, the two providers of home mortgage funding, fell more than 16 percent and some of their bonds sharply underperformed Treasuries.

Saturday, August 16, 2008

Cassandra

The New York Times profiles Professor Nouriel Roubini, who predicted our current economic difficulties.

Friday, August 15, 2008

One Quarter of Home Sales are Below Original Purchase Price

CNNMoney reports:

Also, if someone had bought a house in 2000, traded it for a new house in 2004, and is trying to sell that today, they would be counted as one of these poor folks who are upside-down on their homes. However, they would have made so much money during the 2000-2004 period that there would be little reason to feel sorry for them. They would be no worse off financially than if they had simply bought a house in 2000 and then held it until today. Except, in this latter case, they wouldn't be counted as upside-down.

More homeowners than ever are selling at a loss, propelling the real estate market deeper into crisis.I am surprised that this is coming from Zillow, because I have been having trouble finding homes on Zillow.com where the Zestimate graph shows a significant reversal of the housing bubble. I mostly look in the Washington, DC suburbs and I usually see a huge increase in prices, followed by only a small decline. (Prince William County, VA is a notable exception.) Most homeowners should still be sitting on huge gains, not losses.

In the 12 months that ended June 30, nearly 25% of all homes sold nationwide fetched less than sellers originally paid, according to real estate Web site Zillow.com.

While the nation's double-digit decline in home prices has been well documented, the new report underscores the economic force of those price declines. Homeowners are walking away with much less in their pocket when they sell. And that affects more than the real estate market.

"It's stunning what's happening out there," said Stan Humphries, Zillow's vice president of data and analytics, who looked at statistics that date back to 1996. "The numbers are the worst we've seen and it's not just the magnitude of the problem but the scope - so many markets are affected." ...

Nationwide, nearly a third of all homeowners who bought since 2003 owe more on their homes than the homes are worth. And those that, like Bell, put little or none of their own money into the home purchases, are more likely to try to sell short or simply abandon their homes.

"They hand over their keys and walk away from the homes," says Danielle Babb, a real estate investor, instructor at the University of California Irvine and author of "Finding Foreclosures."

That adds to foreclosure rates. Zillow reported that nearly 15% of U.S. existing home sales during the last 12 months involved foreclosed homes.

That trend will almost surely continue. ...

A plethora of sellers taking losses can have a chilling effect on people's lives, says Dean Baker, co-director of the Center for Economic and Policy Research in Washington.

People don't want to sell at a loss, so they put off their plans, whether it's a move for a better job opportunity elsewhere or trading up to a larger home.

"That will delay the [market correction]," said Baker. "It takes time for people to recognize that [these losses] are real."

A quick turnaround is not likely. More than $200 billion in adjustable rate mortgages are scheduled to reset during the second half of 2008, according to the National Association of Realtors, and loans of all types defaulting at high rates. There is also about 11 months of inventory at the current rate of sales.

"With $3.9 million unsold homes on the market, prices will have to come down even more before the market stabilizes," said Zillow's Humphries.

Also, if someone had bought a house in 2000, traded it for a new house in 2004, and is trying to sell that today, they would be counted as one of these poor folks who are upside-down on their homes. However, they would have made so much money during the 2000-2004 period that there would be little reason to feel sorry for them. They would be no worse off financially than if they had simply bought a house in 2000 and then held it until today. Except, in this latter case, they wouldn't be counted as upside-down.

Thursday, August 14, 2008

Bubble Sphere Roundup

- U.S. Home Sales Fall to 10-Year Low as Prices Tumble (Bloomberg)

- U.S. Foreclosures Rise 55%, Bank Seizures Reach High (Bloomberg)

- Consumer prices rise at double the expected rate (AP)

Despite all this an much more some are saying the bottom is here or near. No, the bottom is not here or near. Prices are still heading down and the housing markets in most areas remains anemic.

Oh and check this amazing post trashing the Realtors': Affirming the credibility of Baghdad Bob and Crew.

Banks Taking Bigger Losses on Foreclosures

From The Wall Street Journal:

Stuck with a growing glut of foreclosed houses, banks and investors are shedding them at increasingly steep losses, potentially adding to the banking industry's red ink this year.

Banks are selling foreclosed homes in some cases for less than half the price they fetched two or three years ago. The cuts are coming as the U.S. banking sector, slogging through its worst crisis in decades, bites the bullet out of fear that prices will keep falling. ...

The steep losses on sales of foreclosed homes are painful for banks and investors in the short run but should help clear the backlog. That would allow for an eventual recovery of the housing market and clean up the banks' balance sheets. ...

Banks and investors have grown more leery of the rising costs of holding onto vacant homes. Along with such expenses as insurance, lawn care and maintenance, banks are being hit with higher costs for complying with local regulations applying to vacant homes. ...

The pain may get worse before it starts to ease. A recent report from Barclays Capital estimates that there are 721,000 bank-owned homes nationwide, up from 112,000 two years ago. Barclays expects the total to rise 60% more before peaking in late 2009.

Financial institutions are acquiring homes through foreclosure much faster than they can sell them. Fannie Mae, a government-sponsored mortgage investor, disclosed last week that it acquired 44,071 homes through foreclosure during this year's first half but sold only 23,627, leaving a balance of 54,173 as of June 30.

Fannie said it is opening field offices in California and Florida to try to speed sales of such homes and is evaluating offers from unidentified parties interested in "bulk" purchases. ...

Local governments are adding to the pressure on banks to sell foreclosed homes faster. Providence, R.I., recently imposed a property-tax surcharge on vacant properties to discourage banks and others from leaving them empty for long periods. Many cities now require banks to register the vacant homes they own and pay registration fees ranging from about $50 to $1,000.

OMG!

"It's hard to escape the conclusion that at some point our extraordinary housing boom...cannot continue indefinitely into the future." —Alan Greenspan, November 2002

In other Greenspan news:

He thinks the housing bottom is right around the corner. (Housing bulls might as well start quoting Annie, because the housing bottom is always a day away.)

Greenspan also says that instead of bailing out Fannie Mae and Freddie Mac shareholders, any government bailout should wipe out shareholders, break the companies into 5-10 smaller companies, and then sell them back into the stock market. I agree with Greenspan on this point. The enormous size of these two companies creates a serious systemic risk to the U.S. economy.

In other Greenspan news:

He thinks the housing bottom is right around the corner. (Housing bulls might as well start quoting Annie, because the housing bottom is always a day away.)

Greenspan also says that instead of bailing out Fannie Mae and Freddie Mac shareholders, any government bailout should wipe out shareholders, break the companies into 5-10 smaller companies, and then sell them back into the stock market. I agree with Greenspan on this point. The enormous size of these two companies creates a serious systemic risk to the U.S. economy.

Tuesday, August 12, 2008

Former Treasury Secretary on Housing Outlook

Former U.S. Treasury Secretary Larry Summers on housing:

Several sources of evidence suggest that house prices will fall for some time to come, perhaps by 10 per cent or more. Big further declines would be necessary to restore their traditional level relative to rents, incomes or the price of other goods. There are growing signs that rates of default and foreclosure will rise considerably even well outside the subprime sector.

Monday, August 11, 2008

Déjà Vu All Over Again

From The Economist:

“The Fed may have been convinced to cut rates too fast and too far.”Not again! Didn't this already happen five years ago?

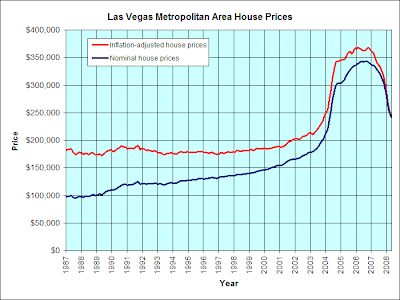

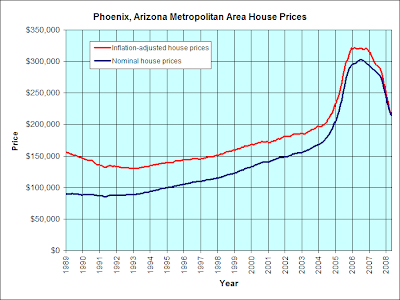

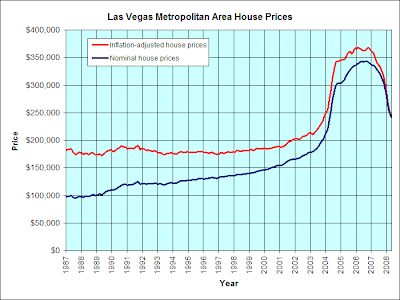

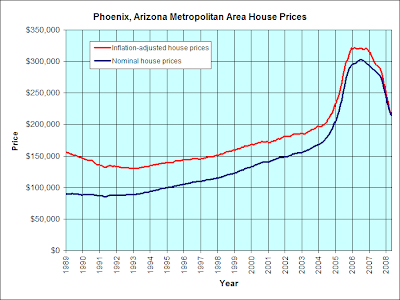

American Southwest Real Estate Prices

Click on the images to see the full-sized graphs of housing prices in Las Vegas, Nevada and Phoenix, Arizona.

Source.

Source.

Do any readers live in the American Southwest?

Source.

Source.Do any readers live in the American Southwest?

Labels:

Graphs

Sunday, August 10, 2008

Housing Pain Continues to Spread Overseas

The International Herald Tribune reports that global sales of commercial real estate is falling:

World sales of major commercial properties fell 49 percent to $306 billion (160 billion pounds) in the first six months of 2008 from the same period last year, as sales in developed countries were hit hard by the credit crisis and slowing economies, a report released on Friday said.And Britain is experiencing a declining housing market and a weakening economy:

In recent weeks, Britons have come to an uncomfortable realization: After 17 years of uninterrupted growth, their economy is moving closer to recession and may well already be in one. Home prices are dropping, sapping consumer confidence, and even though repossessions, bankruptcies and unemployment are still at relative lows, they have started to creep up during the last three months.

Just Thursday, figures released by HBOS, the largest mortgage lender in Britain, showed the housing market slump was gathering pace. The average price of a property fell 8.8 percent in the 12 months through July, the biggest drop since the company started to track prices in 1983.

But the Bank of England is caught in a bind. It is unable to lower interest rates to keep the economy growing because, at the same time, inflation looms. It left lending rates unchanged at its meeting on Thursday.

As a result, many economists are predicting that the situation will sharply deteriorate over the next six months, leaving Britain to face a longer, more painful downturn than the United States.

Friday, August 08, 2008

Discredited: Alan Greenspan

"I suspect that we are coming to the end of this downtrend" -Alan Greenspan, proving that he knows nothing about economics, October 2006

Taken from HousingPanic

Taken from HousingPanic

Join the Anti-Bailout Facebook Groups

I'd like to invite everyone to join the Stop the Housing Bailout and the Renters Against Government Bailouts groups on Facebook. If anyone knows of similar Facebook groups, please list them in the comments.

The Democracy in America Blog Bashes Martin Feldstein

In response to Martin Feldstein's criticism of the tax rebate checks, which I posted yesterday, the Democracy in America blog rips Feldstein a new one:

A short-term economic stimulus works by encouraging people to go out and spend money when the economy is weak. Therefore, you want to give money to people who will go out and spend it, rather than save it. It is well-known that the poor spend a larger percentage of their income than the middle class and wealthy. Giving money to the poor and unemployed is thus a much more effective economic stimulus than giving out money to everyone. This is not an issue of fairness or helping those in need. Instead, it is simply about what is economically effective as a short-term stimulus.

While encouraging people to spend money is a good short-term economic stimulus, encouraging people to save is better for long-term economic growth. It's a trade-off. Ideally, consumers should be encouraged to spend money when the economy is weak and save money when the economy is strong. Their natural inclination, however, is to do the opposite. This causes the boom-bust economic cycle.

MARTIN FELDSTEIN wrote back in December of 2007 that a fiscal stimulus was needed, and that a good way to design said stimulus was in the form of uniform tax rebates. For once, Congress did just what an economist wanted it to do, introducing a tax rebate stimulus plan that sent cheques to millions of households in the second quarter of this year. Naturally Mr Feldstein is appreciative, no?To make things worse, when Feldstein testified before Congress advocating a tax rebate, he spoke out against policies which are known to be effective economic stimuli—namely more food stamps and unemployment benefits.

No. In today's Wall Street Journal, Mr Feldstein writes that of course the stimulus didn't work, and what's more, any old fool should have known it wouldn't. I believe this is what is known as a flip-flop.

A short-term economic stimulus works by encouraging people to go out and spend money when the economy is weak. Therefore, you want to give money to people who will go out and spend it, rather than save it. It is well-known that the poor spend a larger percentage of their income than the middle class and wealthy. Giving money to the poor and unemployed is thus a much more effective economic stimulus than giving out money to everyone. This is not an issue of fairness or helping those in need. Instead, it is simply about what is economically effective as a short-term stimulus.

While encouraging people to spend money is a good short-term economic stimulus, encouraging people to save is better for long-term economic growth. It's a trade-off. Ideally, consumers should be encouraged to spend money when the economy is weak and save money when the economy is strong. Their natural inclination, however, is to do the opposite. This causes the boom-bust economic cycle.

Thursday, August 07, 2008

Dumb Politicians and Gas Prices

From Paul Krugman:

What passes for policy discussion in the world’s greatest nation:House Republicans issued the boldest claim yet in their three-day energy protest, insinuating on Tuesday morning that their demonstration [speeches to an empty chamber demanding more offshore drilling] may in fact have already begun to lower gas prices.In other news, Republicans credited their speeches for the fact that the sun rose today.

“The market is responding to the fact that we are here talking,” said Republican Rep. John Shadegg.

Bubble Sphere Roundup

Housing Panic blasts Freddie Mac CEO Richard Syron for not proactively responding to developing risks. Oh. Freddie Mac just reported 821 million in losses for the second quarter.

Map of Prime Foreclosures at REComments.

Forbes: Central Valley's Incredible Shrinking Home Equity

Map of Prime Foreclosures at REComments.

Forbes: Central Valley's Incredible Shrinking Home Equity

The Tax Rebate Checks Were a Failure

I was opposed to the tax rebate checks as an economic stimulus, because economic history had shown that they failed the two other times they had been used (once under W in 2001 and once under either Nixon or Ford—I can't remember which). Now it appears that the data is in. Harvard economist Martin Feldstein says the tax rebates were a failure:

Recent government statistics show that only between 10% and 20% of the rebate dollars were spent. The rebates added nearly $80 billion to the permanent national debt but less than $20 billion to consumer spending. This experience confirms earlier studies showing that one-time tax rebates are not a cost-effective way to increase economic activity.Politicians really should stop trying to "fix" economic problems and let the free market correct itself.

Freddie Mac CEO: "The housing market is far from stabilizing"

Freddie Mac's CEO predicts an 18-20% housing decline, peak to trough. From CNBC:

U.S. house prices will fall by as much as 20 percent nationally and the current mortgage finance crisis is about half-way through, the chief of major mortgage financier Freddie Mac said Wednesday.

"Previously, we said house prices would fall at least 15 percent nationally, peak to trough. Today's challenging economic environment suggests that the housing market is far from stabilizing," Richard Syron, the chairman and CEO of Freddie Mac, told investors in a conference call held to discuss the company's earnings.

"As a result, we now believe that national home prices will fall 18 to 20 percent peak to trough. ... The long and short of it is that we now think that we are half-way through the overall peak-to-trough decline."

Wednesday, August 06, 2008

Bigger Wave of Mortgage Defaults Coming

The International Herald Tribune reports that "a second, far larger wave of U.S. mortgage defaults is building."

The first wave of Americans to default on their home mortgages appears to be cresting, but a second, far larger one is building with alarming speed.

After two years of upward spiraling defaults, the problems with mortgages made to people with weak, or subprime, credit are showing the first, tentative signs of leveling off.

But with the U.S. economy struggling, homeowners with better credit are now falling behind on their payments in growing numbers. The percentage of mortgages in arrears in the category of loans one rung above subprime, so-called alternative-A, or alt-A, mortgages, quadrupled to 12 percent in April from a year earlier. Delinquencies among prime loans, which account for most of the $12 trillion market, doubled to 2.7 percent in that time.

While it is difficult to draw precise parallels among various segments of the mortgage market, the arc of the crisis in subprime loans suggests that the problems in the broader market may not peak for another year or two, analysts said.

Defaults are likely to accelerate because many homeowners' monthly payments are rising rapidly. The higher bills come as home prices continue to decline and banks are tightening their lending standards, making it harder for people to refinance loans or sell their homes. Of particular concern are alt-A loans, many of which were made to people with good credit scores without proof of their income or assets. ...

Delinquencies on mortgages tend to peak three to five years after loans are made, said Mark Fleming, the chief economist at First American CoreLogic, a research firm. Not surprisingly, subprime loans from 2005 appear closer to the end than those made in 2007, for which default rates continue to rise steeply. ...

The resetting of rates on adjustable mortgages, which was a big fear of many analysts in 2006 and 2007, has become less problematic because the short-term interest rates that many of those loans are tied to have fallen significantly as the Federal Reserve has lowered U.S. rates.

Tuesday, August 05, 2008

Robert Shiller Interview: The Subprime Solution

Professor Shiller says the government should bail out homeowners. I generally disagree with him. Instead, I agree with Dean Baker's view that in bubble markets, trying to keep troubled homeowners paying their mortgages is actually harmful for them.

The video is about 20 minutes long. EconLog has a review of Shiller's new book here.

Monday, August 04, 2008

Sunday, August 03, 2008

William Poole: Tackle Inflation Soon

Via Economists View:

When William Poole warned in 2003 that Fannie Mae and Freddie Mac lacked the capital to weather a financial storm, his advice went unheeded. Five years later, the outspoken former president of the Federal Reserve Bank of St. Louis is far too polite to say “I told you so,” but he does have a message for the Fed: Wait too long to tackle inflation, and you’ll face an even worse recession in the years to come.

Friday, August 01, 2008

Don't Go Swimming Where the Water's Green

The Los Angeles Times describes how the decline of the housing bubble is affecting the upscale town of Temecula, California. The swimming pools of abandoned McMansions are becoming breeding grounds for disease. Neighbors of abandoned homes sometimes use green spray paint on dead grass to make it look alive.

The Los Angeles Times describes how the decline of the housing bubble is affecting the upscale town of Temecula, California. The swimming pools of abandoned McMansions are becoming breeding grounds for disease. Neighbors of abandoned homes sometimes use green spray paint on dead grass to make it look alive.Atop onion fields and grazing pastures, they've built a parade of 4,000- and 5,000-square-foot houses—palaces, many of them, with turrets and faux backyard grottoes, with six-car garages and children's playrooms larger than the average Manhattan apartment....Yum. Any comments from readers?

Today, said Rich Johnston, Temecula's deputy director of building and safety and code enforcement, as many as 15% of Temecula's 22,500 single-family homes are bank-owned or in some stage of foreclosure....

Reports of "green pools" -- swimming pools at abandoned homes, green with algae -- were up 45% in the first three months of 2008 compared to the previous year, officials said. Those pools "are almost guaranteed to breed mosquitoes," said Kelly Kersten, a county environmental health technician. He said West Nile virus is a concern....

At a home off Loma Linda Road, Kersten used an electric screwdriver to open the gate of an abandoned house. The backyard was enormous -- and apocalyptic looking, with weeds growing unfettered and a rusting swing set swaying in the breeze.

The pool was bright green, with a dead bird and other debris floating in the middle. Kersten dipped a cup in the muck, then peered into his sample. "Oh, yeah," he said. He retrieved pesticide from his truck, then began spraying it into the pool.

"Watch," he said. "The pool is going to start to percolate." In seconds, the water churned with thousands of larvae and pupae, each trying to escape the poison.

Subscribe to:

Posts (Atom)