Saturday, December 31, 2005

UPDATE: 1228 Walter St SE

Original Post

Will it sell at this price?

Unlikely. It needs to be reduced once again.

Comments are Encouraged!

P.S. I have some 'juicy' stories and pictures coming up soon. Stay tuned.

Friday, December 30, 2005

WashPost 'Existing-Home Sales Take Slight Slide in November'

Ironic. :-) Patience? How about lowering the price.

Thomas M. Stevens, president of the National Association of Realtors and a Vienna real estate broker, said he could sympathize. His own home, a 6,400-square-foot single-family house on two acres in Great Falls, priced at $1.45 million, has been up for sale since September. He said he would give Harrington the same advice he follows himself: When the market slows, sellers need to look at their properties with steely-eyed realism, cutting the price if other homes are selling for less. He also counsels patience.

Live from Chicago

I just arrived in Chicago on vacation. My family and a bunch of my friends live here.

According to the OFHEO 3Q 2005 Report the 5 year price appreciation for homes in the Chicago area was 47% and the one year rate stood at 9%.

Is Chicago a bubble market?

More investigation to follow. :-)

Thursday, December 29, 2005

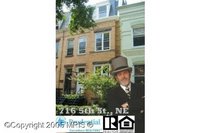

UPDATE: 716 5th Street NE

The price was lowered on this property to 925K from 975K.

Original post.

Craigslist Post

Will it sell at the new price of 925K?

Nope.

UPDATE: 1817 D Street SE

Maybe a Craigslist buyer will be fooled? NOPE.

The price NEEDS to be LOWERED.

Wednesday, December 28, 2005

US Mortgages Application at 3 Year Low

The number of mortgage applications filed last week fell to the lowest level in more than three years, more evidence the U.S. housing market is stumbling.

The Mortgage Bankers Association's index of applications to buy a home or refinance an existing mortgage declined 6.8 percent to 554.1 last week, from 594.6 a week earlier. The gauge is the lowest since 554.9 in the week ended June 7, 2002.

Higher mortgage rates are limiting both housing demand and the desire to refinance existing loans, a source of cash for consumers during the past few years. Home sales are forecast to decline in 2006 after a record this year, which economists said will provide less fuel for the economy.

Ouch. The mounting evidence is rapidly turning greed into fear. The Lereah's of this world are changing their tune. One more nail in the coffin.

Ameriquest Commercial

Two Points:

1) They use the term 'house' not home. Why? The word 'home' often has a deep personal attachment for owner. The term 'house' does not. It is 'Home Sweet. Home.'

2) One one gets a home equity loan they do NOT 'get money out of your house' but rather one borrows against their ownership in their home. The loan is guaranteed with the value of the house. Your home is not your ATM.

Oh and the corporate slogan is 'Proud Sponsor of The American Dream.'

Tuesday, December 27, 2005

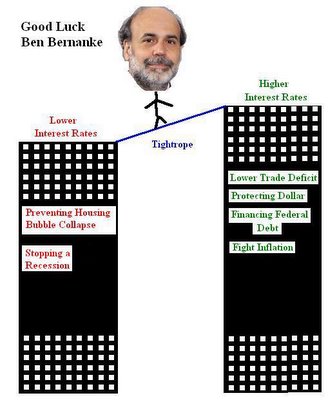

Good Luck Ben Bernanke

Calculated Risk: Top 5 Economic Stories

Monday, December 26, 2005

GDP vs. Housing Graph

Neat. :-) Its bubblicious.

Sunday, December 25, 2005

Saturday, December 24, 2005

Featured Bubble Sites

Housing.com Blog - I have met this blogger personally. Amicable fellow. Very solid blog.

The Housing Bubble Blog - Ben Jones' blog is the most visited. It rocks!

Another F*CKED Borrower - Relatively new blog that focuses on the lending side of the bubble. He is a mortgage broker who lives in Southern California. Wonderful perspective.

The Bursting Bubble Forums - Forums to discuss the housing bubble. Yipee!

Bubble Markets Inventory Tracking - Keeping the stats. Keep it up.

Marin Real Estate Bubble - Reporting from suburban San Francisco. Provocative.

Northern New Jersey Real Estate Bubble - Solid. Updated often. Suburban NYC.

There are other terrific bubble related sites out there. :-) The other great sites will be featured in the future.

Friday, December 23, 2005

Condos At Gallery Place

$599000 - Gallery Place Metro/China Town ( located in downtown, Washington, DC )

"Santa is brining a gorgeous 2 bedroom, 2 full bath condo to a deserving girl or boy for the low, low price of $599000. A steel for this area! Located on the eight floor, with views of 7th and H st from every window! city living at its best. Enjoy all of the surronding shops and DC`s best restaraunts. Oh by the way the metro is located outside the building. It cant get any better then this call Tom 301-512-8945 with any questions! Have a happy holiday Get in to this unit in early January! Special financing availble! 777 7th"

Craigslist Listing

Google Map

The google map link on the Craigslist site does not even work. The word steal is spelled 'steal.'

Is 599K a 'Low price' for a 2br 2ba condo, 1,100 sq ft? Sure it is a spanking new condo downtown, but it is 600K. The monthly costs ( 30 yr fixes, solid credit, tax deductions, property taxes, amd condo fees) are over $4,000 a month. Yikes. It is a condo. There is a huge amount of newly constructed condo and condo under construction occuring in the city of Washington, DC. Prices are already falling for condo units. A friend of mine owns a 1br condo in DC and is having a real tough time selling, despite having lowered the price twice.

Will it sell at 599K?

The price is inline with other newly constructed 2br 2ba condos in downtown DC for sale. However, there is a condo glut in DC. The inventory for condos is building. The seller better hope for a quick sale otherwise they won't get the 599K.

Thursday, December 22, 2005

Happy Holidays & Schedule

Happy Holidays!

For those who celebrate:

Christmas; Merry Christmas!

Chanukkah; Happy Channukkah!

Kwanzaa; Happy Kwanzaa!

For those who celebrate something entirely different happy other holiday to you.

Enjoy relax. Happy Holidays!

Housing Bubble Blogs Have Influence

StatCounter has a neat feature that tracks which ISPs ( Internet Service Providers) the reader came from. Most of them are the major internet providers like Verizon, Comcast, US West Internet Services which don't tell you much. However, some ISPs where visitors came are trackable to the organization level.

Among the ISPS that readers come from:

- Major Media ( Washington Post, NYTimes, CBS News)

- Federal Reserve Board ( maybe even Greenspan is reading? lol. Doubt it)

- Securities Exchange Commission

- World Bank, IMF Major Accounting Firms

- Internal Revenue Service

- US Dept Of Justice

- U.S. House Of Representative, U.S. Senate

- Real Estate Companies

- Mortgage Companies ( Premier Mortgage Funding. Priority One Lending Inc

- Fannie Mae

- Home Builders ( Pulte Home, another company even posted a link to this site on their intranet)

"enhanced skepticism that resolutely associates too evident optimism with probable foolishness" - John Glabraith, A Short History of Financial EuphoriaPrices in the bubble markets have NOT reached a "permanently high plateau."

Wednesday, December 21, 2005

Real Estate Blog Aggregator

PBS Nightly Business Report Interview with Fannie Mae Chief Economist

12/20/05: One On One With with Fannie Mae Chief Economist David Berson

SUSIE GHARIB: As you mentioned earlier, the housing market has logged another blowout month, with November housing starts up 5.3 percent, far beyond what Wall Street had expected. To find out why, Washington bureau chief Darren Gersh spoke with Fannie Mae chief economist David Berson. He began by asking Berson why this number caught analysts by surprise.

DAVID BERSON, CHIEF ECONOMIST, FANNIE MAE: I think that builders are responding to the very strong pace of home sales that we saw in October. Single-family sales were at a record pace in October. I think that`s the main part of the strength that we saw today with the housing starts numbers. It`s probably not sustainable, though.

DARREN GERSH, NIGHTLY BUSINESS REPORT CORRESPONDENT: Your forecast is that the market has peaked. What does that mean, you just put out your forecast for 2006?

BERSON: That`s right. We think that home sales will fall in 2006. 2005 can be the fifth consecutive record year for home sales. We`ve never seen that before. But we think in 2006 we`ll have a modest fall-off, somewhere between five and 10 percent in home sales. That would still leave home sales in 2006 at the third highest level ever.

GERSH: Why the fall-out, because you`ve got interest rates basically unchanged. I mean you still see interest rates around 6 1/4. So why the fallout?

BERSON: We think rates will move up a little bit, but that`s not the main reason. We think that sales will fall in 2006, because one of the components of the strength that we`ve seen -- particularly in the last two years -- has been investors. Investors have come into the housing market in large quantities, perhaps record quantities. Investor demand is more volatile than other housing demand. So investors go in and out of markets more easily than other buyers of homes. They`ve been very big into markets and the housing markets in the last two years. We`re already starting to see some very early signs, we think, of investors starting to pull out of markets and that leads us to our view that housing demand will fall next year.

GERSH: But if investors as you say jump in and out of the housing market, why wouldn`t that seem to indicate that maybe the market will not just sort of gradually decline but crash like some people are saying?

BERSON: The main part of housing demand is not coming from investors. Housing demand comes fundamentally from job and income growth and demographics and not from investors. Now the investors have been the icing on the cake of the housing market in the last year. The icing is coming off, but the cake remains.

GERSH: we could have a good national housing market and see individual cities really crash.

BERSON: We will almost certainly see significant regional variation, as we almost always do. Cities that have had a very high investor share may be at more risk, if the investors do pull out, particularly those areas that have not had --

GERSH: Name names.

BERSON: Particularly areas that have not had strong job growth to help offset the investors. For example, everybody likes to look at Las Vegas, the poster child of investor buying. And indeed, Las Vegas has seen lots of investors but Las Vegas also has the strongest job growth in the country, also has very strong in migration people who move there and buy homes. So could Las Vegas see a signature slowdown? Yes, if investors pull out, but because people continue to move there, it`s probably not going to crash.

GERSH: What`s your outlook for prices?

BERSON: We think home price gains are going to slow meaningfully. They have been rising at double digit rates in the last couple years in part fueled by this boom in investors. So for 2004 and 2005, home price gains on average have been anywhere from 10 to 12 percent. That`s not sustainable. We think that a sustainable rate is somewhere around 4 percent. That`s about income growth. But we think for a year or two, we may see home price gains somewhat below that and that`s what we normally see. When we see a period where home price grains are well above normal, we then see a following period where home price gains, while still positive are less than normal. So in 2006, nationally, we`ll probably see home prices going up at about a 3 to 3.5 percent rate.

GERSH: What about the condo market? I hear a lot of people speculating that the condo market has turned even harder than the housing market.

BERSON: Well, the condo market we think has been the investment of choice for the housing investors and it makes sense. It`s a much easier investment. You don`t have to mow the lawn, for example, you simply have the unit. If investors have been more concentrated in condominiums than in single-family units, then we`re more likely to see a fall-off, a bigger fall-off in condominium sales in 2006 than single-family sales, if the investors do pull out. And that means that there`s likely to be more weakness in condo prices than single-family home prices next year as well.

GERSH: David Berson, chief economist for Fannie Mae, thanks a lot.

BERSON: Good to be here.

NAR Running Scared

"Banks have once again demonstrated their incredible ability to find ways to charge customers record fees. Banks that once touted warm, fuzzy customer relations now are brazenly charging nearly $3 to use an ATM and more than $26 for a bounced check. Imagine what they will do to the real estate customer if they are allowed to broker real estate. Banks will control the real estate transaction end-to-end, creating virtually unlimited opportunities for extra charges and add-ons", said NAR President Thomas M. Stevens of Vienna, Va.There is increasing competition for real estate transactions. Think For Sale By Owner (FSBO) and discount brokers. Oh and the bubble is bursting. The Realtors are running scared.

Tuesday, December 20, 2005

Fortune: Real Estate: Is the party over?

In the report lists expected price changes in the top 100 metro areas for 2006 and 2007. For example. Of the these 100 cities, they expect only 16 to have nominal price declines in 2006. Then in 2007, 38 metro areas are expected to have price declines.

In Bakersfield, they expect the median price which currently stands at $286,300 to fall by 0.80% in 2006 and 3.00% in 2007. That's laughable. Price declines will be much greater in Bakersfield, CA. Most of these predicted price declines are minimal (especially for 2006) . Bubble Meter is more bearish.

Monday, December 19, 2005

To Buy or Not To Buy, That Is The Question

Today, a new reality faces both buyers and sellers. Inventory has increased rapidly in the past 4 months in the bubble markets. In Phoenix, inventory rose from 10,748 on 7/20 to 27,684 on 12/17 according ZipRealty and Bubble Markets Tracking Inventory. Some real estate agents are even claiming that is it a buyer's market due to the increased inventory, lack of bidding wars and the small reductions in prices.

So is it a good time to buy in the bubble markets?

Real prices will continue to decline in the bubble markets for many more years. The bubble markets will experience price decline of at least 20% in real dollars [inflation adjusted] over the course of 3 years. In most bubble markets, the peak price was reached in June, July or August of 2005. Many bubble markets will experience real price declines much greater then 20%. Some may experience price declines of 60% in real dollars over the next 3 years. Of course some markets may keep on declining for more then 3 years.

Just as importantly, monthly rents are cheap compared to buying in the bubble markets. Buying in the bubble markets generally costs 1.25 to 2.5 times the cost of renting ( for a similiar property; assuming 30yr fixed, solid credit, property taxes, and typical interest rate tax deduction). Each month hundreds if not thousands of dollars can be saved and invested.

Buying in a bubble market does not make financial sense. As housing inventory continues to rise and prices decline there will be lots of buying opportunities in the future. This is not a seasonal dip. If you earn a reasonable income it is an absolute fallacy that you need to "Buy now or be priced out forever." Renting and waiting is fiscally prudent. Don't be fooled.

Sunday, December 18, 2005

Baltimore's Butcher's Hill Neighborhood

I was back in Baltimore today. In the Butcher's Hill and Upper Fell's Point neighborhoods there are so many rowhouses for sale. There really is a glut.

The image on the left shows two rowhouses for sale, one on each side of the street. The little alley houses that are nicely renovated ( hardwood floors, granite countertops etc.) are going between 170K - 220K.

Renovation in Butcher's Hill

Friday, December 16, 2005

Interview with Longtime Chicago Homeowner

Chicago man. Skokie, a northern suburb of Chicago in 1981.

Do you believe in the housing bubble?

Yes. Because over 1/3 of all homesales are for investment or as second homes.

Do you believe there is a bubble in Chicago?

No. But there is a bean ( the Bean is part of the Millennium Park, downtown).

Do you think home prices will continue to rise in the Chicago metro area by 8% a year over the next few years?

With the increased interest rates and less speculation prices will rise more slowly. In the Skokie area there has been many teardowns and rebuilding of the monster homes in the past few years.

What effects will the end of the housing bubble cause for the national economy?

Money will go back to the stock markets, especially foreign markets.

Would you consider extracting equity from your home?

Yes, as much as I would extract gold from my yard.

Thank you Mr. Homeowner for your time. Much appreciated.

DC Glut

Speculator Shenanigans in Baltimore

Baltimore is bubblicious. Check out the Craigslist Baltimore Real Estate Section.

How about this post:

$11900 - West Side Rehab opportunity ARV $70K

"Great Rehab in upcoming sandtown -This 3 bed/1 bath rowhome offers a medium to light rehab with duct work, furnace and hot water tank already in place. Estimated cost of repairs $5K. This unit can be rented for $850/month or sold after rehab at $75K"Really? If this is really such a fantastic money maker, why are you selling at this price?

It is too good to be true. Healthy skepticism.

Thursday, December 15, 2005

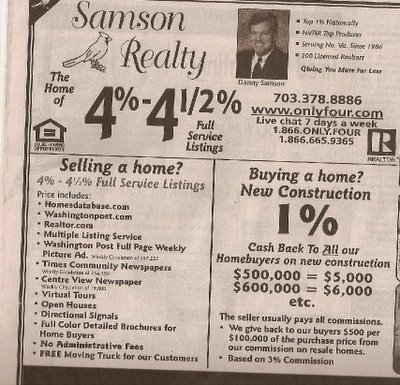

Clowns over at the California Association of Realtors

In an article in the San Diego Union-Tribune "Despite rising interest rates, a growing for-sale inventory and a slowing sales pace, the county's shortage of housing will prevent prices from dropping steeply, speakers asserted. 'It's Economics 101,' said Leslie Appleton-Young, chief economist for the California Association of Realtors. 'It's demand and supply.'

In an article in the San Diego Union-Tribune "Despite rising interest rates, a growing for-sale inventory and a slowing sales pace, the county's shortage of housing will prevent prices from dropping steeply, speakers asserted. 'It's Economics 101,' said Leslie Appleton-Young, chief economist for the California Association of Realtors. 'It's demand and supply.'Demand and Supply? It's Supply and Demand. These clowns at the California Association of Realtors should not be taken seriously.

Looks at the above slide from the California Association of Realtors' 2006 Economic Forecast.

What is odd?

Notice the question mark next to the word speculation. They can't even admit that speculation is driving rising home prices. They need to say its a 'mere' possibility.

Clowns!

Wednesday, December 14, 2005

DC Area Real Estate Databases

Search Real Property Sales Database

Search Real Property Assessment Database

Montgomery County, MD

Montgomery County SDAT Real Property Search By Property Sales

Maryland

Maryland Department of Assessments and Taxation

Note: If anyone has the urls for real estate databases for the DC suburbs in Virginia please post. Thanks.

Row House in eastern part of Capitol Hill

Offered at 699K

Offered at 699K"This is your opportunity to purchase in the Capitol Hill Area. This rare find includes 3 bedrooms, spacious updated kitchen, separate dining room, hardwood floors, walk-out basement, front and back porches, fenced level yard with rock garden, pond and more. Close to shopping, 2 subway stations, stadium ... This just may be the home for you. "

The seller bought this house on 10/21/1997. There is no sale price available.

MLS#: DC5428823

Google Map. Please note that the empty space on the Google imagery next to this property has been developed with solid rowhouses and lofts called Independence Court (image). It is near Lincoln Park. On the the very eastern edge of the Capitol Hill neighborhood.

This area is on somewhat gentrified. Although it is only a few block from the gentrification frontier.

Will it sell at 699K? Possibly. The price is a little high considering the growing inventory and the growing reluctance of home buyers due to bubble concerns.

Row House in Baltimore

$345,000 buys this "Newly Updated 3Bed 2 Full Bath In The Heart of Historic Federal Hill. New Carpet & Fresh Paint Throughout. Spacious Kitchen has a New Ceramic Tile Floor, New Countertop & New Stainless Steel Refrigerator & Range. Newly Refinished Wood Floors. Large 2nd Floor Bedroom W/ Amazing Brick FirePlace Could Also Be Used As a Den. Home"

Wikipedia Federal Hill, Baltimore

Craigslist Posting

Google Map Location

I'm partial to this neighborhood it has much charm. The architecture is superb.

Will it sell at 345K? Probably. It is 'reasonably' priced for this neighborhood.

Price will continue to fall in this neighborhood as the bubble continues to pop.

Cashtration

Here is one this year's winners:

Cashtration: The act of buying a house, which renders the subject financially impotent for an indefinite period of time.

Tuesday, December 13, 2005

Fed Raises .25 Once More

Despite elevated energy prices and hurricane-related disruptions, the expansion in economic activity appears solid. Core inflation has stayed relatively low in recent months and longer-term inflation expectations remain contained. Nevertheless, possible increases in resource utilization as well as elevated energy prices have the potential to add to inflation pressures.

The Committee judges that some further measured policy firming is likely to be needed to keep the risks to the attainment of both sustainable economic growth and price stability roughly in balance. In any event, the Committee will respond to changes in economic prospects as needed to foster these objectives. "

Full text here

MSN Virtual Earth

MSN Virtual Earth has just debutted in Beta version. Also known as Live Local. Jefferson Memorial

"Windows Live Local combines mapping and local search to put the answers to your search questions in a geographical context." Very useful for seeing oblique (angled images) aerial images of major metropolitan areas. Check out a bubblicious house. Or a bubblicious neighborhood. :-)

Check it out!

Washington Times: 'Limits on homes push up prices'

Escalating prices that have made houses unaffordable for many people in Washington are mostly the result of homeowners using political and regulatory means to block construction of new housing, economic studies show. ....

Certainly there have been restrictions on residential growth during the housing bubble period. However, during recent non bubble periods there restrictions were alive and well ( ex. mid 90's ). These residential restrictions are definitely a part of the equation in certain metro areas.

Look at places like Bakersfield, CA (123% in 5 years ) or Reno, NV ( 103% in 5 years ) where there has been little restrictions on residential building and an explosion in home construction in the past few years. These places have still experienced very strong price appreciation. Residential building restrictions are a small factor in the housing boom and certainly not the primary reason for skyrocketing home prices. The three main factors driving this housing boom are low interest rates, very lax lending standards, and speculation.

Sold: 1608 Noyes Drive

See Previous Post.

Monday, December 12, 2005

8300 Hartford Avenue

See my previouse posts:

Still Not Selling in Silver Spring November 30

Falling Leaves, Falling Prices II November 13

8300 Hartford Avenue, Silver Spring, MD October 9th

Lockbox Glut

The condo development 2020 Lofts which is located in Washington, DC at 2020 12th Street NW is infested by flippers.

A special thanks to one of my readers, DC Condo Watcher, who sent in this amazing picture of the lockboxes. Who wrote: "Just came back from a newer condo building on 2020 12th Street NW in DC. There were 18 lockboxes on two bars outside the building where real estate agents hang the lockboxes for condos on sale. There was no room left on the two bars so this particular condo that I was seeing actually had its lockbox directly on its door (to the actual condo unit inside the building). When walking down the hallway I noticed one more lockbox hanging off the door know of another unit. And that was walking down just one wing of this 12-14 story building. Therefore just extrapolating: 18 lockboxes outside, 2 on each floor of the 14 (28) = 46 units on sale in one building alone! This is much worse that I thought." There are 146 units in this building. Please note that not all these units are for sale. Lockboxes are also used to allow agents to show prospective renters units. Some of these units may be for rent.

The poster also visited one condo unit "2020 12th Street NW, the particular unit I saw was unit #T-10, a terrace level unit (which means it lies about 50% below grade - i.e., no sunlight). Just as astonishing is the number of units on sale at this building, is the astounding greed prevalent in the DC market.

The poster also visited one condo unit "2020 12th Street NW, the particular unit I saw was unit #T-10, a terrace level unit (which means it lies about 50% below grade - i.e., no sunlight). Just as astonishing is the number of units on sale at this building, is the astounding greed prevalent in the DC market."1BR, 1BA, terrace level (which means it's half below grade and you feel like you live in a basement - the windows are shorter than normal, and are located towards the upper part of the walls). It was 724 sq. ft., s a pretty decent size 1 br for DC.

It was never lived in, brand new, so the owner had change of circumstances or was an investor. everything in the condo was builder stock, so i am quite certain that the seller/owner did not spend any money to upgrade anything.

Oh yes, parking was included, but it conveys with the condo (as opposed to a deeded spot) - so the original $269K price came with parking as well. The building is definitely in an already gentrified area - it's just north of U street, so not as nice as your Dupont circle or Logan circle location, but still pretty good"

This unit was purchased in 9/2005 for $269K, and now the seller wants $395K. That approximates to a $126K profit (minus selling fees of 6%). I am certain that the owner did not put any money in the unit because it's brand new and advertised as "never lived in". I can tell that everything there was "stock". To see the Listing

Speculators have infested the condos at 2020 Lofts. Now, realizing that the market is changing, many of the speculators are now trying to sell. The peak prices were in in July 2005. The glut of condo inventory is already bringing prices down in the Washington, DC area. As the bubble continues to pop, condos prices are more vulnerable to large percentage price decreases then single family houses.

Sunday, December 11, 2005

1817 D Street SE

The rowhouse located at 1817 D Street SE is being offered at 599K.

"Very nicely done! SemiDetached Federal Porchfront, 3 Bdrms, 2 full baths, kitchen to dream for, granite counters, stainless steel appliances, hardwood floors, finished basement, Parking. DEEP SIDE YARD. Renovated masterfully by a fabulous contractor of quality and style"

The MLS number is DC5419847. For pictures of the gorgeous interior go to Prudential Carruthers Realtors and type in the MLS number.

The area is really the gentrification frontier. It is about 3 blocks from the Stadium-Armory Metro station.

The owners bought the place 04/25/2005 for 366K. They spent a huge amount on renovating it. Perhaps 75K - 125K. They are trying to sell it for 599k. Huge potential profit in a small time.

Will it sell at this price?

NOPE.

1228 Walter St SE

1228 Walter Street SE is available for sale at 549K. It is in Washington, DC proper.

Map of location.

Here is the Craigslist posting

To see more pictures go this site.

It is located in a nice gentrified area east of Capitol Hill. Although, it is relatively near the gentrification frontier.

Aerial view of Walter St SE. Image taken from MSN Virtual Earth.

The property was bought on 1/29/2001 for 235K. Renovation was most probably done.

The real estate agent, Joe, was a friendly fellow. He was internet savy as he had built a website to market his properties. The house is very narrow at about 11.5 feet wide. I was in the house touring and chatting to Joe for about 20 minutes. No one came in to look. The house has been on the market for 20 day now. Apparently, 45 days is now the average for a similiarly priced house in this neighborhood.

One of the handouts was a sheet showing the 'monthly cost.' There were three examples 5%, 10%, 20% were the down payments. On all of three payment examples an 5/1 ARM /IO was taken out.

Will is sell at 549K price? It is a pretty cute house located in a reasonably well gentrified area. However, 549K is high for such a small house in this neighborhood. The asking price needs to be reduced.

Saturday, December 10, 2005

Another House in Trinidad in Washington, DC

Trinidad is a high crime area. There has been a very very minimal amount of gentrification.

The house was bought for $350,000 on 8/26/2005 which was just over 3 months ago. It was bought presumably by a speculator who is trying to flip it. Although it looks like the speculator put some work into it ( unless the previous owner put money into) he is still try to sell it for the same price he paid for it 3 months ago.

The current owner most probably bought it thinking that the housing boom would continue for awhile. Now, realizing the boom is over he is now trying to bail without too much of a loss.

Will it sell at this price? Nope.

Friday, December 09, 2005

Reader's Choice

Post your requests in the comments section.

Rowhouse in Tinidad for Sale

Offered at 307K, this 3br 1ba rowhouse located in the Trinidad neighborhood in Washington, DC is still sitting on the market after a minor price reduction from 312K. The house "Needs updating and TLC." For those who do not know Trinidad is a high crime area. There has been a very very minimal amount of gentrification.

When the price of this rowhouse was 312K someone on craigslist wrotes "Just a brief request--the non-stop, multiple times a day posts for the tenement building in Trinidad have become beyond annoying and need to stop. Obviously the property is not generating any interest at the low low price of 312K, so either cut the price or pull it off the market. You are not doing the seller any favors by repetitively spamming the property day after day. " LOL! Now it is priced for 307K.

Will it sell for 307K?

Probably Not. The price needs to be reduced further.

Henson Ridge Development in Washington, DC

Like many other areas, there is a lack of affordable housing ( especially to buy) in the Washington, DC area. The picture on the left shows a small part of Henson Ridge development area. The DC Housing Authority (DCHA) worked with private developers to develop this huge property. The area is located in the Southeast quadrant here. Alsoall those apartment buildings around Stanton Road, 15th Place, Bruce and Robinson Street were knocked down and will be a part of the developement area.

Thursday, December 08, 2005

Washington, DC Metro Area Housing Report

The huge price appreciation has been the result of a multiple factors; historically low interest rates ( IO / ARMs, negative armortization ) , loose lending standards, strong job growth, tax law changes, people being burned in the stock market, and of course speculation.

Many of the factors fueling the housing boom are coming to an end. Interest rates are rising, lending standards are slowly increasing, job growth in the DC area will continue albeit at a slower pace, and the speculation is ending. The speculators are bailing.

The peak in Washington, DC was probably in August of 2005; the boom period is over. The housing market started stagnating a few months ago and is now experiencing very small price declines. Inventory has rapidly increased throughout the metropolitan area.

According to this article by Reuters "After hitting a high in May, the number of contracts in Washington D.C. and its surrounding Virginia areas of Prince William, Loudoun, Fairfax and Arlington counties have fallen by about half, according to the Greater Capital Area Association of Realtors. Meanwhile, inventory of houses for sale has doubled and in some cases tripled, and homes are staying on the market 30 percent longer."

The high price properties are sitting longer. "Anything over $500,000, especially in the suburbs, is just sitting." said Gay Ruth Horney, of Long & Foster Real Estate Inc. in Maryland's Montgomery County, where inventory rose 5 percent and homes stayed on the market 7 percent longer than in September 2004. "Would-be landlords have discovered that they are not able to achieve rents high enough to cover their mortgages. she said." Seasonally adjusted monthly home sales have fallen.

Due to the rapidly increasing inventory and the changing buyer mentality sellers have been forced to either reduce prices or wait longer for a sale. The market is seeing an increasing amount of "price reduced," "huge price reduction," "price reduced to sell," "25,000 reduction," "price reduced. Must sell," "way below market value", and "just reduced"The housing market continues to weaken in the DC area. Inventory is surging. The boom is clearly over.

So what happens next? Over the next 3 years housing prices are likely to fall in the Washington area by 20 - 25% in real dollars ( inflation adjusted ). The Washington, DC metro area is thus a bubble market.

Wednesday, December 07, 2005

Tuesday, December 06, 2005

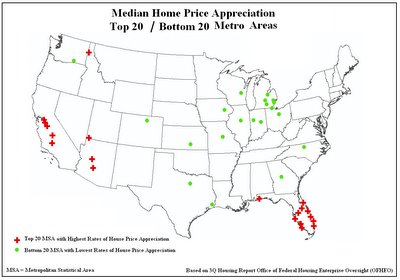

Highest and Lowest Home Price Apprecaition

Monday, December 05, 2005

OFHEO Tracking Page

Sunday, December 04, 2005

Trip to Central New Jersey

There is a bubble here in New Jersey.

New Jersey Bubble

Northern New Jersey Real Estate Bubble

The house across the street from my friend's has been sitting on the market for about 3 months. See below picture.

My hosts, who have been home owners, here in East Brunswick concur about the bubble. It snowed 3 inches last night. :-)

I'll be back in Maryland later tonight.

Friday, December 02, 2005

Los Angeles Epicenter of Housing Bubble

Los Angeles is the least-affordable housing market in the nation, and is joined by 17 other California cities in the top 20 least-affordable places, according to the latest Housing Opportunity Index numbers released today by the National Association of Home Builders. The index, which is compiled by NAHB and Wells Fargo, is the percentage of homes purchased in the third quarter of this year that were affordable to those earning the median income. ( The Boy in The Big Housing Bubble )

The speculative episode has reached insanity. The National Home Builders Association reports that "in the nation's least affordable major housing market of Los Angeles-Long Beach-Glendale, Calif., a mere 2.4 percent of all homes sold were affordable to those earning the median income of $54,500 when the median sales price was $495,000." This assumes a down payment of 20%, solid credit, and an interest rate of 5.9% on a 30 year fixed. Affordability is at the very heart of the bubble.

It is unsustainable. The speculative episode is ending. :-)

Where The Readers are From

Galbraith on Speculative Episodes

- John Kenneth Galbraith, A Short History of Financial Euphoria

Thursday, December 01, 2005

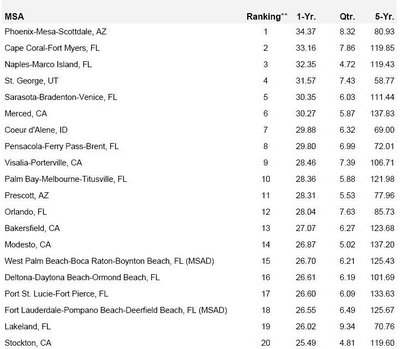

Selected Price Appreciation Chart

Top 20 Metro Areas for 1 YR Appreciation

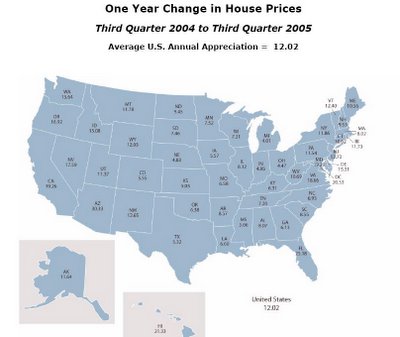

OFHEO: HOUSE PRICE APPRECIATION SLOWS FROM RECORD-SETTING

WASHINGTON, D.C. – Average U.S. home prices increased 12.02 percent year over year from the third quarter of 2004 through the third quarter of 2005. This represents a two percentage point decline from the previous four-quarter appreciation rate of approximately 14 percent. Appreciation for the most recent quarter was 2.86 percent. The figures were released today by OFHEO Acting Director Stephen A. Blumenthal, as part of the House Price Index (HPI), a quarterly report analyzing housing price appreciation trends.

“Appreciation rates in the third quarter were extremely strong, although some deceleration can be seen in a number of the faster-appreciating markets,” said OFHEO Chief Economist Patrick Lawler. “Price momentum in the Pacific and New England states, in particular, has pulled back.”

More to come later. Stay Tuned. :-)

Also: 2Q OFHEO Report

Still Not Selling in SIlver Spring

Which will sell first?

I am betting that there will be another price reduction.

See Earlier Post

Google Map

Wednesday, November 30, 2005

PBS Interview with David Lereah

GWEN IFILL: For months, economists and homeowners have been on the hunt for any sign that the nation's robust housing boom may be going bust. This has week has brought mixed news.

The Commerce Department reported today sales of new homes rose a record 13 percent in October, but yesterday, the National Association of Realtors reported sales of previously owned homes fell by nearly 3 percent in the same period. What to make of all of this? For help, we turn to David Lereah, the chief economist for the National Association of Realtors.

For help?. Lereah is biased. Where is the counter argument? We need a debate. Get Ben Jones' on NewsHour.

GWEN IFILL: Was there ever such a thing as a housing bubble?

DAVID LEREAH: I don't like to use the word "bubble" because bubbles burst.

GWEN IFILL: Exactly.

DAVID LEREAH: Balloons don't burst. You can put air in a balloon and it can expand or you can deflate a balloon, where air comes out. So if you're looking at different metro markets around this country that got real hot over the last four years, I like to use the imagery of balloons because they're getting hot. You're putting more air into those balloons. The prices are going up. But now air can come out of the balloon rather than the balloon popping.

GWEN IFILL: So we're hearing a hissing sound rather than a pop.

DAVID LEREAH: I think that's probably the best analogy to use right now.

Ifill says "Exactly." How about some tough questions? Or are you just going to agree with Lererah?

GWEN IFILL: If you're an average home buyer for whom owning a home is your major investment you'll make in your own life, you look at these numbers and you're trying to decide should I be selling now, should I be buying now or should I just stay out of it, what?

DAVID LEREAH: Well, if I'm not a homeowner and I'm thinking of purchasing a home, I would always purchase the home. Be a real estate owner; own property and you'll benefit from equity gains and wealth gains over the years. Have a long-term horizon.

If I'm looking to sell right now, you know, it's still a seller's market but it's starting to transition to a buyer's market so it's a good time to sell if you want to right now.

If I'm a buyer I'm still looking at historically low mortgage rates; even though mortgage rates have risen somewhat, they're still hovering around 6.25 percent. That's historically low. That's low-cost financing. I would take advantage of that.

Lereah says "Well, if I'm not a homeowner and I'm thinking of purchasing a home, I would always purchase the home." Bad idea. Of course he is from the Realtors Association and 'cannot' say that in the bubble markets he would consider holding off purchasing a home.

2006 mortgage conforming limit rises to $417,000

"Conforming mortgages are home loans that conform to standards set by Fannie Mae and Freddie Mac, the mortgage giants that keep money flowing by buying home loans from lenders and selling them as investments. The conforming limit marks the maximum loan size that Fannie. ( Bankrate.com)"

Certainly, the housingheads will be cheering this decision.

Tuesday, November 29, 2005

It's the Inventory Stupid!

Not convinced that the bubble is about to burst?

Calculated Risk posted this:

"The 496,000 units of inventory is the all time record for new houses for sale. On a months of supply basis, inventory is at a reasonable level.

This is a very strong report. The pronouncements of the demise of the housing market now appear premature."

It's the inventory stupid! Look at the inventory flooding the market in the bubble markets.

Note: Calculated Risk is certainly not stupid. Calculated Risk has many valuable insights and I am a dedicated reader of his blog. The phrase is priceless in this case.

New Home Sales Shoot Up?

Sales of new homes soared at a record pace in October in what could be a last hurrah for the booming housing market. The Commerce Department said that sales of new single-family homes shot up by 13 percent last month, the biggest one-month gain in more than 12 years."So what does this mean? Experts are 'confounded.'

"The increase confounded analysts who had been predicting that new home sales would decline by 1.8 percent. The rise in new home sales was accompanied by an increase in prices, with the median price increasing by 1.6 percent from September to $231,300 in October. ( Yahoo)

One poster on The Housing Bubble Blog wrote "You, know I'm not totally convinced that this boom has completely run its course."

Another poster [ pchander100 ] wrote "I am very suspicious of the new home sales numbers. In California, new home builders are offering incentives to sell homes, while the inventory is piling-up. Yet today's numbers show a 49 percent increase. These numbers are rigged."

Ben Jones' had this to say "Keep in mind the incentives the HB's have been offering, like the Sacramento story yesterdayrevealed. Thesee guys have a lot of margin in their pricing so they can hold a fire sale."

There is a large degree of error to these commerce reports "This is 13.0 percent ( ±17.7%)* above the revised September rate of 1,260,000 and is 9.0 percent (±18.2%)* above the October 2004 estimate of 1,306,000." The "A 2.5 percent (±3.2%) above appears in the text, this indicates the range (-0.7 to +5.7 percent) in which the actual percent change is likely to have occurred. All ranges given for percent changes are 90 percent confidence intervals and account only for sampling variability ( Commerce Department Report )"

Read little into this report. The 13 percentage increase likely reflects a large degree of error combined with increased incentives from homebuilders ( who have been 'taking away' sales from existing homes ).

Great Story On Another F*cked Borrower

Monday, November 28, 2005

US External Debt and The Bubble

More fundamentally, even if foreign investors give the United States an unlimited length of rope by continuing to finance ever-greater buildups in US external liabilities, there is a problem of long-term burden for the US economy as it becomes increasingly indebted abroad. To the extent that the borrowing is primarily directed not towards financing investment but rather toward financing high levels of private consumption and government dissaving, the accumulation of foreign debt amounts to mortgaging the country's economic future. Eventually, there will be a price to pay in the form of a major terms of trade loss as the external debt is serviced. This will reduce the real standard of living of US citizens - many of them of the next generation- from levels otherwise attained as real consumption is eroded through higher import prices. Injudicious, and perhaps inequitable, deferral of the adjustment burden into distant future is a fundamental reason to address the external deficit even if a sharp break in confidence and a hard landing are considered unlikely.The housing bubble is a significant contributing factor in the ever growing amount of US external liabilities. Mortgage debt is being bought by foreigners. Furthermore, the housing bubble has allowed a huge amount of home equity extraction, which has fueled strong consumer spending. A significant portion of this consumer spending is being spent on imported products. All this increases US external liabilities.

Unsustainable.

Jim Kunstler's Post

Ads on Housing Bubble Blogs

One reader critical of The Housing Bubble Blog set up this blog. On it the reader writes:

This blog is dedicated to the memory of Ben Jones, the "freelance writer" who posts thehousingubble2.com which is sponsored by the real estate biz. Or, more accurately, the memory of what is left of Mr. Jones's credibility. We posted to Ben's blog and he quickly deleted our simple and respectful question: "What's with all the links to real estate agents, lenders and other bubble heads?" So, Ben, we're giving you another chance. What's up?1) Has Ben Jones' Blog lost it's credibility'?

2) Should housing bubble blogs accept Google Ads, if some of them the ads are from companies that are housing cheerleaders?

I want input from my readers on there two important questions.

Sunday, November 27, 2005

Black Friday. Sales Surveys are Mixed

The data from ShopperTrak shows Black Friday sales down 0.9 percent from 2004. That is significant. Why? An increase in sales would be expected because of inflation and a growing population. According to poster Betamax:

It's interesting to read how the retail shills are now downplaying the importance of Black Friday as a predictive indicator, though obviously they'd be saying the opposite if sales were up.

As expected the retail interests played down the decline in sales ""While Black Friday is important to retailers, it's not always the best indicator for consumer shopping patterns during the remainder of the holiday season, which should allow the retail industry to continue feeling optimistic," said Michael Niemira, chief economist and director of research for the International Council of Shopping Center ( CNN Money 11/26 ),"

However, Visa said consumers charged up their credit and debit cards on Black Friday as total U.S. spending on Visa branded cards jumped 14 percent to $3.9 billion [from last year's Black Friday]. Does this mainly reflect a increase in sales or a change from other payment methods to Visa? [ Great more credit card debt. ]

The National Federation of Retailers reported that "The ceremonial kickoff to the holiday season began with a great deal of fanfare as 145 million shoppers flooded stores and the Internet hunting for popular electronics, clothing, and books. An NRF survey conducted by BIGresearch found that the average shopper spent $302.81 this weekend, bringing total weekend spending to $27.8 billion, an incredible 21.9 percent increase over last year'’s $22.8 billion."

"More than 60 million shoppers headed to the stores on Black Friday, an increase of 7.9 percent over last year. Another 52.8 million shopped on Saturday, a rise of 13.3 percent over 2004. The number of shoppers out today is expected to be close to last year, with about 22 million people shopping. NRF Press Release"

ShopperTrek says Friday sales were down 0.9 percent. The National Federation of Retailers said sales The NYTimes had this to report "Visa found that shoppers spent 24 percent more on electronics this Black Friday - a category ShopperTrak largely overlooks - while purchases at specialty retailers inside the nation's malls rose 16 percent. Consumers, Mr. Cohen said, "are clearly in the spending mood."

So how will the Christmas Season be for Retailers?

So far it is looking decent. Time will tell.

See my earlier posts.

Black Christmas [ where spending growth is less then inflation ]

Black Christmas II

* This post has been updated due to more information being available*

Saturday, November 26, 2005

Bubble Market Defined

A bubble market is any area where residential real estate prices will decline more then 20% in real dollars [inflation adjusted] over the course of 3 years. In most bubble markets, the peak price was reached in June, July or August of 2005.

Many bubble markets will experience real price declines much greater then 20%. Some may experience price declines of 60% in real dollars over the next 3 years. Of course some markets may keep on declining for more then 3 years.

Friday, November 25, 2005

Black Friday: Consumerism Unleashed

Today is Black Friday. According to Wikipedia "Black Friday, the day after Thanksgiving in the United States, is historically one of the busiest retail shopping days of the year. Many consider it the "official" beginning to the holiday season. ... Most retailers will open very early. "

The above picture shows crazed shoppers fighting in a Walmart story in Orlando, Fl [ a bubble city] . CNN has this story. Minimum credit card payments are about to rise.

Will this be a solid holiday retail season for retailers? Will consumers refinance again to fuel one more materialistic binge? Will fears of a housing bubble, high home heating costs and new bankruptcy laws curtail spending? Will consumers continue to spend more then they earn? How much debt will be raked up on those credit cards?

Thursday, November 24, 2005

Happy Thanksgiving

DC: 7441 8th Street, NW

Will it sell in a resonable amount of time at this price? Probably not.

Bubble Basics

- Interest rates are rising

- ARMs are adjusting

- Property taxes are rising

- High winter heating costs are coming

- Housing inventory is building

- New bankruptcy laws have been implemented

- Increased minimium credit card payment are coming soon.

- Housing bubble awareness is increasing

Wednesday, November 23, 2005

Quote of The Day

Tuesday, November 22, 2005

Cold Weather, Cooling Prices In Boston

But on Beacon Hill, the median price fell by 10.4 percent, to $394,500, as total units sold plunged by 9.2 percent in the quarter, data shows.

In the South End, the median price of condos fell by 14 percent, to $472,500, with unit sales off by 37.8 percent compared to a year ago.

“The prices are coming down,” said Virginia Saillant, a Realtor at Atlantic Properties in the South End. She expressed confidence the market will bounce back, once inventories are sold off.

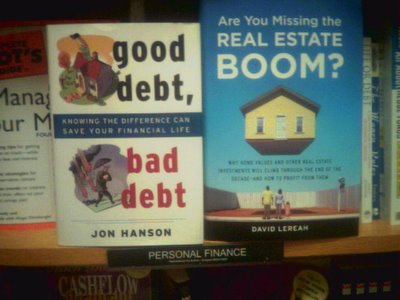

Two Books

At a local Border's bookstore I came across these two titles. On the right is David Lereah's "Are You Missing the Real Estate Boom?" and on the left Jon Hanson's "good debt, bad debt."

The very small words on the front cover Lereah's book are "Why home values and other real estate investments will climb through the end of the decade - and how to profit from them." Lereah, the chief economist for the National Association Realtors is a major bubble cheerleader. Now, with bubble evidence mounting, his latest talking points are that there will be a soft landing in the bubble markets.

Note: David Lereah should read the book on the left.

Monday, November 21, 2005

Chill Hits Housing

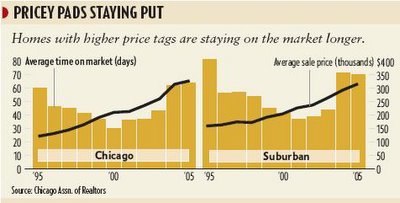

In a cooling residential real estate market, it's chillier at the upper end.

In a cooling residential real estate market, it's chillier at the upper end.After watching home values soar the last few years, sellers continue to slap hefty price tags on their homes. Yet buyers, wary of overpaying at the top of the market, are balking at the high prices. The result: Houses priced above $1 million are taking longer to sell.

"On the sellers' end, they're still thinking that the market is up, up, up," says Patti Navilio, a Chicago broker. "When you reach a peak, everybody's got too high expectations."

While Chicago-area residential brokerages expect to close the books next month on a record sales year, they're already seeing signs of a slowdown, especially at the high end. Mortgage rates are rising, and talk of a housing bubble has given some buyers pause.

The real estate market tends to slow down in the late fall, but it's slower than usual for this time of year, says Maureen Mohling, manager of Coldwell Banker's Winnetka office. The number of buyer appointments in the office declined 10% in October from the same month last year.

Price-cutting has become more common. In May, Michael Welborn put his six-bedroom house in Wilmette on the market for $2.7 million. He paid about $1.8 million for the property in 2000 and spent close to $500,000 remodeling it.

"Nothing happened," he says. So he dropped the price to $2.5 million, and showings have picked up — but still no takers."Ordinarily, a house like this in a location like this would come and go in a month and a half," says Sue Hertzberg, the Coldwell Banker broker selling the property. "It's just an indicator of the market."

Sales of less expensive homes are holding up better. Single-family suburban home sales rose 2% in the third quarter over the prior-year period, according to the Chicago Assn. of Realtors. Houses sat on the market for an average of 70 days, vs. 71 in the year-ago period and 44 in third-quarter 2003.

Sales of single-family homes in the city fell 4% in the third quarter, and the average market time rose to 64 days from 62. In October, sales of all residential property types in the city were flat.

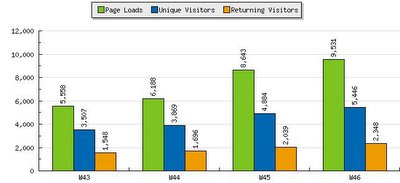

Web Traffic Increasing on Bubble Meter Blog

Sunday, November 20, 2005

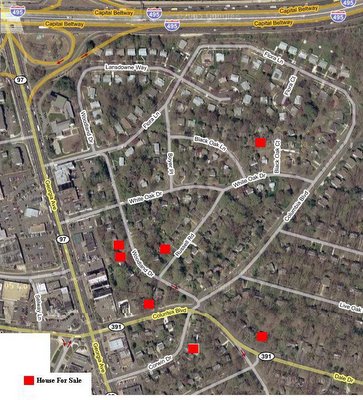

Homes for Sale in a Silver Spring Neighborhood

Here is a map of houses available for sale in a neighborhood in Silver Spring, MD. Silver Spring is a suburb of Washington, DC. This neighborhood is literally just in the beltway. The beltway ( I-495 ) is visible on the map. It is an area of single family homes. The zipcode is 20910. Inventory is way up from 4 months ago. The competition is fierce. May the best priced house sell.

Washington, DC: 313 17TH ST SE

A rowhouse located at 313 17th Street SE is being offered for sale at 399K. The rowhouse is located in an area that has just started to gentrify. It was bought on 12/09/2004 for $199,440 . Some remodeling was performed. Will is sell for 400K in a reasonable amount of time? Not sure. It is 'cheap' compared to other rowhouses in solidly gentrified neighborhoods in DC. However, this area is just starting to gentrify. Plus, the outside facade does not look like a house that gentrifiers would typically buy. The gentrifiers would generally want to remodel the outside.

Saturday, November 19, 2005

Cheerleading Quote of the Week

Always? What if your income is 40K, you have no down payment, and some sub prime lender offers you a loan for 350K and you are buying in a bubble mecca. Oh, by the way there are other ways to put "a roof over your family’s head," its called RENTING.

People who are waiting for prices to fall will miss it, and interest rates are just going to go up. But putting a roof over your family’s head is always the best investment you can possibly make.

The New American 'Hissing Housing Bubble'

William H. Gross is chief investment officer at Pacific Investment Management Co. (PIMCO), the world's largest bond-fund manager, with $513 billion in assets. In an interview published in the October 26 Business Week, Gross observed: "Housing is the asset that has kept this economy going. The second-mortgage loans and the like. The homeowner taking advantage of capital gains and withdrawing equity — that’s what has kept consumption going. If housing stops, equity withdrawal ceases" -- and the consumer economy grinds to a halt.Article from The New American.

Indications are rife that the housing market has cooled off and started to contract. Nick Godt, market analyst for The Street, noted on October 27 that the “average price of a new home … fell to $285,700 in September, from $287,500 in August.... Amid slowing sales, the supply of new homes on the market has risen sharply and is now up 20% year on year.” “No wonder price gains are slowing,” comments Ian Shepherdson, chief U.S. economist at High Frequency Economics. “Builders have over built and have to cut inventory.”For several years, analysts have warned that the housing and mortgage markets constitute a speculative “bubble” that will be pricked when interest rates begin to climb. Between June 2004 and this November, the Fed has consistently increased interest rates to the “point where real housing prices have peaked over the past 35 years,” Gross points out. “Make no mistake about it,” he warns, “the froth in the U.S. housing market is about to lose its effervescence; the bubble is about to become less bubbly.”

Tom Barrack, generally considered one of the world’s most savvy real estate investors, is more blunt about the housing bubble. “There’s too much money chasing too few good deals, with too much debt and too few brains,” he told Fortune magazine. “That’s why I’m getting out.” Along with the impact of higher interest rates, Barrack cites a steep increase in the price of building materials and labor, with construction costs spiking 30 percent in the past nine months. “It’s the busted deals caused by construction costs that will cause a [downturn] in the market,” he concludes

Friday, November 18, 2005

8406 Hartford Avenue Silver Spring, MD

The house was originally listed for 679K; then reduced to 649K, then 629K, and now 599K. See my blog post about 8406 Hartford Avenue.

The price has been reduced once more to 579K. That is 4 reductions totally 100K or 14%. Why? The housing bubble is popping in the DC area. Also, just down the street is 8300 Hartford Avenue. ( MLS MC5402312 ) which is available for 579K ( it had been reduced from 599K. Which one sells first? and for what price?

Urban Institute Report: 'Housing in the Nation's Capitol'

New Mortgage Related Blog

I'll be watching this blog. Keep up the solid reporting.This bwr had a car payment of almost $800 a month...and only made about $28,000 last year. Wanted to buy a 400k home...but would look at a condo "if they had too". Somehow I don't think that spending 34% of ones gross income on a car payment is the best thing to do...but what do I know. That USED to be the rule when buying a house. Oh how times have changed. There is no way I was going to help this guy get a loan...but I'm sure somebody out there will "state" his income so that he will "qualify". This bwr has all the makings of AFB...but maybe they will be lucky...let's hope so.

Inventory Rising in Washington,DC

We Need a Protest at NAR

We need a citizen's protest at the National Association of Realtors in Washington, DC. They need to be called to task for their lousy, deceitful, cheerleading propaganda. See my post on NAR's anti bubble housing reports .

Thursday, November 17, 2005

Wednesday, November 16, 2005

Sacramento Housing Market

There are some great statistics and graphs over at Lyon Real Estate for the Saramento area housing market. Check it out.

Thanks to poster Happy Renter for finding this information. :-)

NAR's Housing Market Reports

This project is incredibly labor intensive. My staff is working overtime to provide you with the necessary information (reports) to respond to the irresponsible bubble accusations made by your local media and local academics. Please be patient and you can expect to begin receiving the first batch of these reports just after Labor day.

The NAR did not allocate the necessary resources to properly write local housing reports. Instead, they presumably used a shoddy computer program to do a 'program and paste' job to 'write' these very similar reports. Some of the holes found in their research include:

- The conclusion for every market is the same. In the executive summary the reports conclude "With home prices rising strongly in most parts of the country, there has been widespread media coverage on the possibility of a housing market bust. A thorough analysis of the

metro market, as detailed below, reveals that there is very little danger of this." ( Thanks Felix who posted over at Calculated Risk)

- Even markets that are regarded as the most over-priced and are already experiencing contraction, such as Boston and San Diego, say "A thorough analysis of the Boston-Cambridge-Quincy metro market, as detailed below, reveals that there is very little danger of this." ( Thanks to poster Felix who posted over at Calculated Risk)

- So shameless is their cut-and-paste work that the data sometimes contradicts the text! For example, the Philadelphia analysis says "jobs are being created and ... suggest potential for further price gains.". However, the Philly numbers - right above this comment - contradict this statement and shows negative 3 year job growth (-0.2%, compared to 7.2% for the top 20 metros) and negative net migration of -4,800 over the past three years! The job situation is called "unfavorable". ( Thanks to poster Felix who posted over at Calculated Risk)

- One thing I noticed in looking at the anti-bubble report is that the price-income ratio seemed extremely low. Well, if you look at the table footnotes, the definition of income is "per capita income multiplied by the average number of people per home"!!! Logically, this means that a family with 4 kids is able to afford more house than a DINKY couple. Laughable at best.. ( Thanks to poster John Laws Ghost )

- In each market the NAR puts the housing market under a 'stress test.' In the Philadelphia market "The local housing market will experience a price decline of 5% only under extreme unlikely scenarios. For example, mortgage rates rising to 12.5% in combination with 114,000 job losses could lead to a price decline." If mortgage rates really hit 12.5%, and 114,000 jobs were lost a much greater decline would occur. What is NAR's formula for these stress tests?

Tuesday, November 15, 2005

NAR: 3Q Median Sales Prices

Here is a list of those metropolitan areas where the price median sales price fell in the 3rd quarter 2005 compared to the 2Q 2005:

- Albuquerque, NM

- Charleston, WV

- Colorado Springs, CO

- Decatuar, IL

- Dallas-FtWorth, TX

- Edison, NJ

- Green Bay, WI

- Kankakee, IL

- Memphis, TN

- Minneapolis-Saint Paul, MN

- Rockford, IL

- Sarasota-Bradenton-Venice, FL

- Southbend, IN

- Souix Falls, SD

- San Francisco-Oakland-Fremont, CA

- Pittsfield, MA

The 4th Quarter, NAR reports will show many more housing markets experiencing price declines. Despite NAR's anti housing bubble propaganda the bubble will pop.

NAR: Market-by-Market Home Price Analysis Reports

Much more to come on NAR's anti housing bubble reports. I have started to go through these reports. The housing bubble bloggers and readers must go through these misleading reports and point out the truth. The truth will prevail. Let freedom ring.

Note: Check out Detroit's report. LOL!

NAR: Anti Bubble Q&A

Housing Bubble Prospects Q&A

What is a housing bubble?

As broadly interpreted, a housing bubble refers to an unsustainable gain in home prices. The premise is that a price bubble is at risk of “popping,” resulting in a loss of equity.

Has there ever been a national housing price bubble?

No, not since good recordkeeping began in 1968. There was a national decline in the 1930s during the Great Depression; however, home prices were not a prime concern in that era. The greatest issues were essentials such as food, clothing, employment and shelter of any kind. Declining home prices were a natural result of a general economic collapse caused by the stock market crash in 1929.

What is the “normal” rate of home price growth over time?

Since 1968, the national median existing-home price has increased an average of 6.4 percent per year. However, that includes a period of high inflation. A better frame of reference is in relation to the overall rate of inflation. Home prices typically have increased 1.5 percentage points faster than the rate of inflation, as measured by the Consumer Price Index.

What are the biggest factors that drive home prices?

In simple terms, it gets down to supply and demand. The inventory of homes available for sale has been historically low since 2001, which is why home prices have been rising at above normal rates.In a balanced market between home buyers and sellers, there typically is a six-month supply of homes on the market. Over the last four years, the supply has hovered around 4.5 months. By contrast, in the recessionary period of 1990-1991, there was in excess of a 9-month supply.

What conditions are necessary for home prices to soften or decline?

Generally, two conditions are necessary for price softness in a given area: an oversupply of homes available for sale, and adverse economic conditions – generally a weak local job market. Sometimes these conditions occur against a backdrop of overall economic weakness, recession or high interest rates.

Where and when have home prices declined in the past? What were the general market conditions?

Most metropolitan areas, especially in the Midwest and South, have not experienced price declines in the era of modern recordkeeping. In the period from the mid-1980s though the early 1990s, many metros in the Northeast and on the West coast saw localized declines. Typically, this occurred in large population centers with very little capacity for growth. When housing shortages developed during a period of high demand, prices grew at sharp double-digit rates – often over 20 percent per year – for several consecutive years.After local economic conditions declined in those areas, home sales stalled and the inventory of unsold homes rose, which eventually led to price softness or decline.

How long have home prices declined in the past?

Although there are exceptions to any general finding, most metro areas that experienced price declines were relatively short lived (several years). Most homeowners who went through such downturns -- but stayed in their home for a normal period of homeownership -- still netted healthy gains when they sold. People view homeownership as a long-term investment as opposed to the kind of quick-in, quick out investment that Wall Street is fond of. Unlike stocks, homeowners don’t panic sell simply because a home down the street sold for less. Home prices tend to be sticky on the downside -- usually a single digit decline in any given year following a sustained period of double digit gains. Very few people buy at the top of a market and then sell in a short timeframe. After several years, home prices level and return to normal appreciation patterns.

Should we be concerned that home prices are rising faster than family income?

No. There are three components to housing affordability: home prices, income, and financing costs – the latter are historically low. During the last four-and-a-half years of record home sales, there has been a shortage of homes available for sale. As a result, home prices during this period have risen faster than family income. However, in much of the 1980s and 1990s, the reverse was true – incomes rose faster than home prices.On a national basis, according to the Housing Affordability Index published by the National Association of Realtors, a median income family who purchases a median-priced existing home is spending a little over 20 percent of gross income for the mortgage principal and interest payment. In the early 1990s, a typical mortgage payment was in the low 20s as a percent of income, and in the early 1980s it was as high as 36 percent. Overall housing affordability remains favorable in historic terms.

What are the prospects of a housing bubble?

There is virtually no risk of a national housing price bubble, based on the fundamental demand for housing and predictable economic factors. It is possible for local bubbles to surface under the right circumstances, but that also is unlikely in the current environment. There are tight supplies of homes available for sale in most of the country, and labor markets have been improving. In other words, the two conditions necessary for price softness do not exist in most of the country.The strong underlying demand for homes results from the simple fact that the population is growing faster than the supply of homes. In addition, it is highly unlikely that the cost of construction will decline. In fact, construction material shortages are expected to continue and the cost of building and development is trending up. Baby boomers remain in their peak earning years. Echo boomers – the children of the baby boom generation – are just entering the period of life in which people typically buy their first home. The echo boom is the second largest generation in U.S. history. Considering the median age of a first-time buyer is 32, echo-boomers will be a big factor over the next decade. In addition, immigration has been strong for many years. Census data shows that immigrants eventually achieve homeownership rates higher than do native born Americans – this also will be a strong factor in housing demand in the future. Also, minority ownership rates have been trending up. All this means the demand for housing is historically high and is one of the reasons 2005 will be the fifth consecutive year of record home sales. Even in an economic downturn, the demand remains.

If conditions become unfavorable, home buying may be postponed, but a general price decline remains highly unlikely.What is likely to happen with home prices?

The forecast is for mortgage interest rates to rise slowly over the next year, which will have a minor breaking effect on home sales. The good news is that will help inventory levels to recover and allow the market to come into a closer balance between buyers and sellers.In other words, a general slowing in the rate of price growth can be expected, but in many areas inventory shortages will persist and home prices are likely to continue to rise above historic norms.