In addition, favorable weather boosted housing construction early in the quarter. Later in the quarter, however, the pace of consumer spending moderated, and housing starts retraced their earlier run-up.

...

Ongoing increases in home prices and additional gains in the stock market, however, further boosted household wealth during the first quarter. Measures of consumer confidence remained consistent with moderate increases in consumer spending.

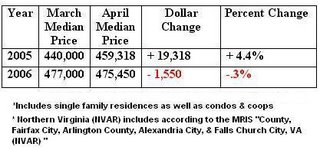

The underlying pace of residential activity seemed to moderate in the first quarter. After unseasonably warm weather allowed a high level of single-family housing starts in January and February, starts fell in March to their lowest level in a year. New permit issuance for single-family homes also fell in March, continuing its downward trend. Multifamily starts recovered a bit in March from their low rate in February but remained well within their historical range. Home sales also declined, on net, in recent months. Although sales of existing single-family homes edged up in February and March, the level of sales for the first quarter as a whole was notably below the record high in the second quarter of last year. Sales of new homes also moved up in March, but their average in the first quarter was down substantially from the peak in the third quarter of last year. House price appreciation appeared to have slowed from the elevated rates seen over the past summer. Growth in the average sales price of existing homes in March, versus a year earlier, decelerated sharply, and the average price for new homes in March fell compared to a year earlier. In addition, other indicators, such as months' supply of both new and existing homes for sale and the index of pending home sales, supported the view that housing markets had cooled in recent months.

.....

In the household sector, consumer credit continued to rise slowly, and the growth of household mortgage debt was thought, based on limited data, to have moderated somewhat in the first quarter against a backdrop of higher mortgage interest rates and some signs of a deceleration in house prices.

....

That cooling was especially noticeable for high-end homes and for houses in markets that previously had experienced the steepest appreciation. Data on home sales, permits, and starts on the whole likewise suggested that activity was gradually diminishing. Some reports indicated that speculative building of homes had dropped off considerably, but inventories of unsold homes still seemed to be expanding. Although fresh comprehensive data were not available, home prices on average appeared still to be rising, but at a slower pace than over the past few years. Going forward, growth in consumption spending was likely to be supported by gains in employment and personal income. But slower appreciation of home prices and the effects of the increases in energy prices and interest rates that had already occurred would likely act to restrain consumption spending somewhat. Certain features of recently popular nontraditional mortgage products had the potential to cause financial difficulties for some households and erode mortgage loan performance for some lenders. Nonetheless, the household sector seemed likely to remain in sound financial condition overall. On balance, consumption spending was viewed as most likely to expand at a moderate pace in coming quarters.

On future rate increase then FOMC had this to say:

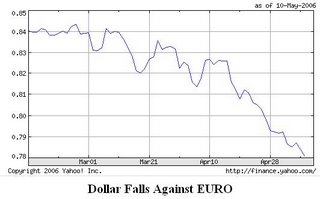

Although the Committee discussed policy approaches ranging from leaving the stance of policy unchanged at this meeting to increasing the federal funds rate 50 basis points, all members believed that an additional 25 basis point firming of policy was appropriate today to keep inflation from rising and promote sustainable economic expansion. Recent price developments argued for another firming step at today's meeting. Core inflation recently had been a bit higher than had been expected, and several members remarked that core inflation was now around the upper end of what they viewed as an acceptable range. Moreover, a number of factors were augmenting the upside risks to inflation: the surge in energy and commodity prices, some recent weakness in the foreign exchange value of the dollar, and the possibility that the apparent increase in inflation expectations could, if it persisted, impart momentum to inflation. In addition, the economy appeared to be operating at a relatively high level of resource utilization and had been growing quite strongly, and whether economic growth would moderate to a sustainable pace was not yet clear. At the same time, members also saw downside risks to economic activity. For example, the cumulative effect of past monetary policy actions and the recent rise in longer-term interest rates on housing activity and prices could turn out to be larger than expected. Still, it seemed most likely that, with modest further policy action, including a 25 basis point firming today, growth in activity would moderate gradually over coming quarters, pressures on resources would remain limited, and core inflation would stay close to levels experienced over the past year.More analysis to come later. Chat Away!

Given the risks to growth and inflation, Committee members were uncertain about how much, if any, further tightening would be needed after today's action. In view of the risk that the outlook for inflation could worsen, the Committee decided to repeat the indication in the policy statement released after the March meeting that some further policy firming could be required. However, the Committee agreed to emphasize that "the extent and timing of any such firming will depend importantly on the evolution of the economic outlook as implied by incoming information." Members debated the appropriate characterization of inflation expectations in the statement. Low and stable inflation expectations were key to the attainment of the Committee's dual objectives of price stability and maximum sustainable economic growth. However, the apparent pickup in longer-term expectations, while worrisome, was relatively small. They remained within the range seen over the past couple of years, and the increase could well reverse before long. Accordingly, it appeared appropriate to characterize inflation expectations again as "contained."