Tuesday, June 30, 2009

S&P/Case-Shiller: DC home prices up in April

For the Composite-20 average, seasonally-adjusted home prices fell 0.09%. Prices continued to fall in the four heavily-battered states of California, Florida, Nevada, and Arizona.

Inflation from March to April was 0.24%.

If Florida prices keep falling while DC prices start rising, I think I'm going to have to live where summer lasts all year long.

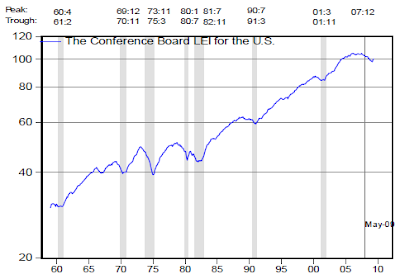

Leading Economic Index graph

Economist and blogger Rebecca Wilder notes more signs of recovery here and here.

Economist and blogger Rebecca Wilder notes more signs of recovery here and here.

Monday, June 29, 2009

Sunday, June 28, 2009

REDC runs wrong advertisement

I can't imagine many people in the DC area want to run out to a Northern California home auction. That looks like a half-hour's worth of advertising dollars wasted.

Update: REDC has been running the same Northern California ad on multiple channels, so either it's intentional (I can't imagine why) or someone really screwed up.

Thursday, June 25, 2009

In Support of Auditing the Federal Reserve

Ron Paul’s bill to audit the Federal Reserve (HR 1207) now has 242 co-sponsors, and the numbers keep growing! At the same time, HR 1207’s companion bill in the Senate, S 604, is beginning to attract its first co-sponsors,

Wednesday, June 24, 2009

Housing decline likely causing lasting structural unemployment

Many Americans are mired in a housing gridlock: They can't afford to sell their homes because property values have fallen, causing millions of people to owe more on their homes than they are worth. And, many can't move to take new jobs until they sell their homes. ...Megan comments:

Fewer Americans are moving now than in any year since 1962, when the population was 120 million smaller.

"The economy is playing havoc, since property values have dropped significantly in the last few years," Hicks said. "Many people simply cannot just pick up and move. They have a home they have to sell first.

One of the justly celebrated strengths of the United States economy is its labor mobility. By this account, at least, our housing market has basically destroyed that critical asset. A recession like this is the worst time to lose your labor mobility.

Tuesday, June 23, 2009

Harvard on housing

Harvard University released its annual State of the Nation’s Housing report today. Among its conclusions: “Despite some stabilization in homebuilding and home sales in the spring, real home prices continued to fall and foreclosures mount in most areas in the first quarter of the 2009.”If I remember correctly, the Harvard Joint Center for Housing Studies was one of the bubble-blowers. Here's what they wrote two years ago:

Adds Eric S. Belsky, executive director of the Joint Center for Housing Studies at Harvard: “The best that can be said of the market is that house price corrections and steep cuts in housing production are creating the conditions that will lead to an eventual recovery.”

Together with the enormous increase in household wealth over the past 20 years, healthy income growth will help propel residential spending to new heights.The household wealth argument is a circular argument, because household wealth is strongly determined by housing prices and stock prices. As Rebecca Wilder recently pointed out, household wealth hasn't been doing so well recently.

Monday, June 22, 2009

MBA lowers mortgage expectations

The Mortgage Bankers Association today significantly lowered its 2009 mortgage origination forecast to $2.03 trillion, a drop of $700 million below its March projection. The primary reason: higher interest rates. Interest rates climbed from 5.19 on March 25 to 5.76 on June 17, according to Bankrate.com.

Rising interest rates have put a serious damper on refinancing.

Sunday, June 21, 2009

Saturday, June 20, 2009

When will housing prices bottom?

Market bulls believe home prices could bottom in the second half of 2010, but the bears warn it could be 2013 before they finally trough. And once prices do reach a low, it could be years before they significantly rebound.

New blog comment policy

As far as I'm concerned, you have complete free speech on this blog, except when it comes to posting link spam. (Note, however, that David is less tolerant of foul language than I am.)

For those who choose a consistent username, but don't log in:

As far as I'm concerned, you will usually have free speech on this blog, but if you are nasty toward others, post link spam, or I suspect you are engaging in sockpuppetry, I may delete your comment.

For those who insist on posting as "Anonymous":

If you want to hold other commenters accountable for their previous statements on this blog, then at least have the courage to choose a consistent and unique username for yourself (other than "Anonymous") so you can be held accountable as well. If you make snide remarks towards others, your comment may be deleted. If your comment is offensive or disagreeable in general, your comment may be deleted. If you attempt to hold others accountable for their previous statements while you cowardly hide behind the username "Anonymous", your comment will definitely be deleted.

In short, the five seconds you save by not using a unique and consistent username will substantially increase the odds that your comment will be deleted.

Friday, June 19, 2009

Using Google Maps Street View to Visualize a Block or a Neighborhood

Google Maps Street View is a solid tool for quickly acquiring a visual perspective of a block or a neighborhood. Street View is a great service.

Where Housing Will Be in 2012

"Prices? While they're likely to keep falling a while longer under the weight of foreclosures, the market is definitely closer to the bottom than the top."

In most bubble markets, a bottom in terms of prices is not here yet as prices will continue to fall over the coming months and into 2010. After that I expect a long period of very low price growth. Current buyers would be foolish to expect a quick jump and return to 2005 & 2006 prices.

California's coastal immunozones no longer immune

Values have fallen even along the coastal submarkets that were once seen as mostly immune from the collapse in home prices elsewhere. Now, while signs of a recovery mount in some of the most distressed inland markets, declining values along the coast are just beginning to lead to short sales and foreclosures in mid-to-upper end housing markets.

Thursday, June 18, 2009

Flashback 2002: "Alan Greenspan needs to create a housing bubble"

The basic point is that the recession of 2001 wasn't a typical postwar slump, brought on when an inflation-fighting Fed raises interest rates and easily ended by a snapback in housing and consumer spending when the Fed brings rates back down again. This was a prewar-style recession, a morning after brought on by irrational exuberance. To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.Paul Krugman, May 25, 2005:

Judging by Mr. Greenspan's remarkably cheerful recent testimony, he still thinks he can pull that off.

In July 2001, Paul McCulley, an economist at Pimco, the giant bond fund, predicted that the Federal Reserve would simply replace one bubble with another. ''There is room,'' he wrote, ''for the Fed to create a bubble in housing prices, if necessary, to sustain American hedonism. And I think the Fed has the will to do so, even though political correctness would demand that Mr. Greenspan deny any such thing.''OK, Paul Krugman is citing Paul McCulley of PIMCO, but still... I just don't know what to think about this right now. Thoughts from readers?

As Mr. McCulley predicted, interest rate cuts led to soaring home prices, which led in turn not just to a construction boom but to high consumer spending, because homeowners used mortgage refinancing to go deeper into debt. All of this created jobs to make up for those lost when the stock bubble burst.

Now the question is what can replace the housing bubble.

Nobody thought the economy could rely forever on home buying and refinancing. But the hope was that by the time the housing boom petered out, it would no longer be needed.

But although the housing boom has lasted longer than anyone could have imagined, the economy would still be in big trouble if it came to an end. That is, if the hectic pace of home construction were to cool, and consumers were to stop borrowing against their houses, the economy would slow down sharply. If housing prices actually started falling, we'd be looking at a very nasty scene, in which both construction and consumer spending would plunge, pushing the economy right back into recession.

That's why it's so ominous to see signs that America's housing market, like the stock market at the end of the last decade, is approaching the final, feverish stages of a speculative bubble.

Update: Paul Krugman defends himself here. Arnold Kling does a better job of defending him here:

Krugman was mainly expressing pessimism. He was not cheerfully advocating a housing bubble, but instead he was glumly saying that the only way he could see to get out of the recession would be for such a bubble to occur. ... In the event, we had a housing bubble and we got out of the recession. To me, this raises the question of whether a distorted recovery is better than an undistorted recession.

Wednesday, June 17, 2009

We Bought a Townhouse

The reasons for purchasing:

* Low interest rates 4.625%, no points (30YR Fixed)

* Rent is expensive in the area and will continue to rise

* It was the neighborhood we wanted

* It was the housing type we wanted

* Prices are unlikely to fall much more in our new neighborhood.

Our purchase price is about 20% lower from its peak price (nominally). Will prices in our neighborhood fall further? Most probably, I expect most parts of the Washington area to fall another 5 - 10% nominally. Despite this we decided to buy and do not regret our decision.

Housing starts up 17% month-over-month, but...

First of all, the biggest part of the gain was in multi-family, up 61.7 percent month to month, but that’s after falling 49 percent in April. Patrick Newport, an economist at HIS Global Insight, says the multi-family market is still in a “deep slump,” despite the monthly jump. ...She then enumerates the headwinds still facing the housing market:

As for single family, ... 50 percent of sales in May were on spec. ... So why all the spec now? Because builders are trying to jam all these homes into buyers’ pockets before the expiration of the $8000 first time home buyer tax credit. It turns into a pumpkin November 30th.

The government and industry programs to ease foreclosures are not showing big successes. A lot of Alt-A borrowers are in big trouble and many won’t qualify for any of the bailout programs. With interest rates in the mid 5’s, refinancing isn’t going to do much of anything for many borrowers. There is no sign of abatement in delinquencies, and while investors are in there, using old-fashioned cash to eat up inventories of distressed properties, there are plenty more foreclosures in the pipeline just waiting to hit the market.

Monday, June 15, 2009

U.S. home prices not so overvalued anymore?

Click on the graph to see a full-sized version:

According to this graph, the national price/rent ratio is 10.7% higher than in Q1 2007. I haven't built a graph for the D.C. area yet, but running the numbers shows that the D.C. area price/rent ratio is 21.6% higher than in January 1998. (D.C. area rental data only goes back to December 1997.) Even worse, New York City area price/rent ratios are 38.2% higher than during January 1997. Of the twenty metro areas that the S&P/Case-Shiller Home Price Index tracks, New York and Washington are the slowest decliners. This is why I believe New York and Washington will bottom later than the country as a whole.

In the past I have argued that home prices don't overshoot, but the trajectory of the graph above suggests that in time I may be proved wrong. The current trajectory seems to suggest we are in for massive overshooting. You have to buy foreclosed homes or short sales to get the bargains, though.

Saturday, June 13, 2009

Recession not hurting D.C. metro area

At least there's one place in America that's wearing like Teflon through the recession: Washington, D.C. Most corners of the economy may be struggling, but in the nation's capital it's boom times, baby.

According to new data, the area's unemployment rate dropped to 5.6% in April from 5.9% in March. This is the second consecutive month of improvement for Washingtonians, and it's leagues from the national unemployment rate, which hit 9.4% in May.

With unemployment for all government workers about half the private sector's rate, the Beltway has been spared the tightening elsewhere. ...

As [Senator Mark] Warner put it to the Washington Business Journal, "It helps to be where the money is."

Friday, June 12, 2009

Senator again pushing for $15,000 tax credit to buy a home

He's at it again:

He's at it again:Sen. Johnny Isakson has reintroduced a bill that would give home buyers a tax credit worth 10% of the purchase price of a home up to $15,000. The Georgia Republican unsuccessfully tried to get the credit inserted into the $787 billion stimulus package that went into law in February. Congress instead opted for extending and boosting an existing credit, worth up to $8,000, for first-time buyers. That credit is set to expire Dec. 1.Again, these types of tax credits are inherently unfair. They effectively force other people to pay part of the cost of someone's home. This is an example of how Republicans lie when they say they believe in small government and the free market. The truth is they don't. This plan will add $35+ billion to the national debt in an effort to stop a much-needed housing correction.

The proposed credit wouldn’t have income restrictions, unlike the current one, which phases out for individuals making more than $75,000 and couples making more than $150,000.

The legislation already has co-sponsors from both parties, including Senate Banking Committee Chair Christopher Dodd, a Connecticut Democrat. In February, congressional budget estimates figured that the $8,000 credit for first-time buyers would cost between $2 and $3 billion, while the $15,000 credit would cost an additional $35.5 billion. ...

Before serving in the Senate, Sen. Isakson spent more than 30 years in the real-estate industry.

On the other hand, if you're thinking of buying now in order to get the current $8,000 tax credit, perhaps you should wait for a better deal.

Wednesday, June 10, 2009

Bond yields predict economic recovery

When the Treasury yield curve is steep (long-term rates much higher than short-term rates), it suggests a strong economy going forward. When the Treasury yield curve is inverted (long-term rates lower than short-term rates), it suggests a recession ahead.

In late 2006 and early 2007, the yield curve became inverted. At the time, many pundits suggested that because of unique conditions, it may be a false positive. These pundits turned out to be very wrong. Now when pundits suggest that because of unique conditions, the currently steep yield curve may be a false positive, I am not inclined to believe them.

Don't argue with the yield curve.

Why home prices change so slowly

HOME prices in the United States have been falling for nearly three years, and the decline may well continue for some time. ...

Such long, steady housing price declines seem to defy both common sense and the traditional laws of economics, which assume that people act rationally and that markets are efficient. Why would a sensible person watch the value of his home fall for years, only to sell for a big loss? Why not sell early in the cycle? If people acted as the efficient-market theory says they should, prices would come down right away, not gradually over years, and these cycles would be much shorter. ...

Several factors can explain the snail-like behavior of the real estate market. An important one is that sales of existing homes are mainly by people who are planning to buy other homes. So even if sellers think that home prices are in decline, most have no reason to hurry because they are not really leaving the market. ...

Furthermore, few homeowners consider exiting the housing market for purely speculative reasons. ... In fact, most decisions to exit the market in favor of renting are not market-timing moves. Instead, they reflect the growing pressures of economic necessity. This may involve foreclosure or just difficulty paying bills, or gradual changes in opinion about how to live in an economic downturn.

This dynamic helps to explain why, at a time of high unemployment, declines in home prices may be long-lasting and predictable. ...

Even if there is a quick end to the recession, the housing market’s poor performance may linger. After the last home price boom, which ended about the time of the 1990-91 recession, home prices did not start moving upward, even incrementally, until 1997.

Tuesday, June 09, 2009

BubbleSpehere Roundup

Shiller on more home price declines (The Mess That Greenspan Made)

Eight Step Program to Improve Fed's Image (Mish's Global Economic Analysis)

IAS Sees ‘Normalization’ in House Prices (Housing Wire)

Tim Geithner can't sell his house for more than it's worth

U.S. Treasury Secretary Tim Geithner can't sell his house:

U.S. Treasury Secretary Tim Geithner can't sell his house:Real estate agents say Geithner recently rented out his Westchester County home after it didn't sell — even though he reduced the price to less than he paid.Here is his house on Zillow. The guy lives in a bubble (pun intended); Zillow says it's worth $200,000 less than his asking price.

Geithner put the five-bedroom Tudor near Larchmont on the market for $1.635 million in February.

Agents Scott Stiefvater of Stiefvater Real Estate and Debbie Meiliken of Keller Williams Realty say the house was rented for $7,500 a month on May 21, a few weeks after the asking price was dropped to $1.575 million.

Let's do a little math. He's renting it out for $7,500/month, which is $90,000/year. Divide $1,575,000 by $90,000 and we get a price-to-rent ratio of 17.5. That might seem equivalent to a typical stock market P/E ratio, but it's not a price-to-earnings ratio. It's a price-to-sales ratio.

According to real estate "guru" John T. Reed:

The average operating-expense ratio of a residential rental property is 45% plus or minus about 2%. That is, the operating expenses—taxes, management, utilities, insurance, etc.—will consume about 45% of the gross income. That percentage applies all over the U.S. for all types of residential property...Therefore, we can estimate the annual net income of Tim Geithner's house by multiplying the annual revenues by (1.0 – 0.45):

$90,000 x (1.0 – 0.45) = $90,000 x 0.55 = $49,500Then divide his asking price by the annual net income to get the P/E ratio:

$1,575,000 ÷ $49,500 = 31.8Alternatively, we could divide the annual net income by the asking price to get the earnings yield (cap rate):

$49,500 ÷ $1,575,000 = 3.14%So, the Treasury Secretary of the United States thinks his own house is worth 31.8 times the annual profits it can generate. He's willing to accept an earnings yield of only 3.14%. That's a horrible rate of return! Compare the 3.14% earnings yield with the 5%+ cost of a fixed rate mortgage.

This guy is an economist? Hey, Tim, take the hint: You need to drop the price!

An alternative look at monthly job losses

The graph below shows the job gain/loss estimates from the ADP National Employment Report. Note that although an individual month's numbers can be quite different between Automatic Data Processing and the U.S. Department of Labor, the overall trend has been roughly the same.

The numbers are in thousands. As before, this graph shows new job losses per month, not cumulative job losses:

Monday, June 08, 2009

Recession expected to end by Q4 2009

Job losses slowing

This graph shows new job losses per month, not cumulative job losses:

Even when job gains per month rise above zero, the unemployment rate is likely to keep increasing, because it takes about 100,000-125,000 new jobs per month just to keep up with population growth.

Even when job gains per month rise above zero, the unemployment rate is likely to keep increasing, because it takes about 100,000-125,000 new jobs per month just to keep up with population growth.

Sunday, June 07, 2009

Saturday, June 06, 2009

More blogs

Real Estate Calculator estimates the post-bubble value of your home.

Also, you may want to join the Facebook group called Let real estate prices fall!

Friday, June 05, 2009

Foreclosure modification plans still failing

A continuing steep drop in home prices combined with rising unemployment is powering a new wave of foreclosures. Unfortunately, there’s little evidence, so far, that the Obama administration’s anti-foreclosure plan will be able to stop it.Over the past year or two, the government has come up with several plans to stop the wave of foreclosures. But, for the most part, these plans have done what government plans do best: Fail.

The plan offers up to $75 billion in incentives to lenders to reduce loan payments for troubled borrowers. Since it went into effect in March, some 100,000 homeowners have been offered a modification, according to the Treasury Department, though a tally is not yet available on how many offers have been accepted.

That’s a slow start given the administration’s goal of preventing up to four million foreclosures.

Thursday, June 04, 2009

Jim Cramer says what?

I disagree:

You would expect price declines to slow before they stop. It seems that Jim Cramer is confused by the difference between housing sales and housing prices.

You would expect price declines to slow before they stop. It seems that Jim Cramer is confused by the difference between housing sales and housing prices.

Wednesday, June 03, 2009

Mortgage rates spiked last week

At the time I'm writing this, mortgage rates are 5.32%, up from the high fours a few weeks ago.Mortgage Rates - It Could be as Bad as You Can Imagine

With respect to yesterday’s in the mortgage market — yes, it is as bad as you can imagine. No call can be made on the near-term, however, until we see where this settles out over the next week of so. If rates do stay in the mid 5%’s, the mortgage and housing market will encounter a sizable stumble. The following is not speculation. This is what happens when rates surge up in a short period of time — I lived this nightmare many times.

Yesterday, the mortgage market was so volatile that banks and mortgage bankers across the nation issued multiple midday price changes for the worse, leading many to ultimately shut down the ability to lock loans around 1pm PST. This is not uncommon over the past five months, but not that common either. Lenders that maintained the ability to lock loans had rates UP as much as 75bps in a single day. Jumbo GSE money — $417k - $729,750 — has been blown out completely with some lender’s at 8%. I have seen it all in the mortgage world — well, I thought I had.

A good friend in the center of all of the mortgage capital markets turmoil said to me yesterday “feels like they [the Fed] have lost the battle…pretty obvious from the start but kind of scary to live through it … today felt like LTCM with respect to liquidity.”

The consequences of 5.5% rates are enormous. Because of capacity issues and the long time line to actually fund a loan in this market, very few borrowers ever got the 4.25% to 4.75% perceived to be the prevailing rate range for everyone.

This raises a significant issue for bubbleheads: Prices are likely to keep falling for at least the rest of this year, but mortgage rates are likely to increase when the economy recovers. Rising mortgage rates will likely push real prices down further, but not enough to prevent monthly payments from rising significantly. The Fed's monetary policy also risks (but doesn't guarantee) significant inflation as the economy recovers.

Tuesday, June 02, 2009

Why homeowners default on their mortgages

Why do borrowers default? Many have assumed it’s because mortgage payments are too high. But a new paper from the Federal Reserve Bank of Atlanta argues that unaffordable loans—with high mortgage payments relative to income from the time they’re originated—are “unlikely to be the main reason that borrowers decide to default.” Instead, unemployment and future home price declines are likely to play a bigger role. (The paper looks at loans that are unaffordable from the time they’re originated, and not at loans that may start with low “teaser” rates before jumping higher.)

The Fed paper estimates that a 1-percentage-point increase in the unemployment rate boosts the chance of a 90-day delinquency by 10%-20%, and a 10-percentage point fall in house prices raises the probability of a default by more than half. A 10-percentage-point jump in the debt-to-income ratio, meanwhile, increases the chance of a 90-day delinquency by 7%-11%.

Q1 foreclosure starts reached a new high

Despite all the hand-wringing and attempts to contain the foreclosure plague, the problem still spread during the first three months of 2009, as the number of foreclosure actions started hit a record high, according to a quarterly report.

The National Delinquency Survey released Thursday by the Mortgage Bankers Association (MBA), reported the largest quarter-over-quarter increase in foreclosure starts since it began keeping records in 1972. Lenders initiated foreclosures on 1.37% of all first mortgages during the quarter, a 27% increase from the 1.08% rate during the last three months of 2008 and a 36% rise from the first quarter of 2008. All told, more than 616,000 mortgages were hit with foreclosure actions.

Delinquencies, the stage in which borrowers have fallen behind on payments but have not yet received foreclosure notices, also hit record highs, with the seasonally adjusted rate at 9.12% of all loans, up from 7.88% last quarter.

Monday, June 01, 2009

The current recession in context

I have occasionally compared the current recession to the early 1980s recession (1981-1982), arguing that the early 1980s recession was worse. The graph above makes the current one look worse. However, the graph above seems to be a peak-to-trough measurement. The early 1980s recession was the fourth in a series of recessions in which the unemployment rate didn't fully recover before the next recession hit, resulting in a peak unemployment rate that was significantly higher than the current unemployment rate. (And before the conspiracy theorists out there claim we can't compare the current unemployment numbers to those of previous decades, you're wrong.)

I have occasionally compared the current recession to the early 1980s recession (1981-1982), arguing that the early 1980s recession was worse. The graph above makes the current one look worse. However, the graph above seems to be a peak-to-trough measurement. The early 1980s recession was the fourth in a series of recessions in which the unemployment rate didn't fully recover before the next recession hit, resulting in a peak unemployment rate that was significantly higher than the current unemployment rate. (And before the conspiracy theorists out there claim we can't compare the current unemployment numbers to those of previous decades, you're wrong.)That said, it seems very likely that the current recession will be the longest since the Great Depression. Even though it looks like the current recession may be on its last legs, the unemployment rate may very likely reach the second highest level since 1948, and could possibly go higher than that of 1982. In the latter case, it would unambiguously be the worst recession since the Great Depression —But it would be a far cry from what our grandparents and great-grandparents experienced during the 1930s.

Note: I notice that Cornell University (my parents' alma mater, BTW) law professor William Jacobson linked to a previous unemployment post of mine. I agree with his thoughts, so I encourage you to read his post.

Note: I notice that Cornell University (my parents' alma mater, BTW) law professor William Jacobson linked to a previous unemployment post of mine. I agree with his thoughts, so I encourage you to read his post.