Here is a better graph than Saturday's,

straight from the St. Louis Fed, the U.S. unemployment rate since 1948. (A similar BLS graph is available

here.) Click on the graph to see it full size.

Again, worst recession since the Great Depression? Not! —At least not yet.

So the press is kicking and screaming, and scaring everyone by saying "worst since the Great Depression," yet look where we are today. I count four recessions with higher unemployment rates than the current one.

The press has to make its "worst since the Great Depression" claims based on economic forecasts, but economic forecasting is notoriously unreliable. Furthermore, actual economic forecasts expect the unemployment rate to reach 9%, which is still lower than the early 1980s recession. So, their "worst since the Great Depression" claims are not based on current data, nor on actual economic forecasts, but rather on fear mongering.

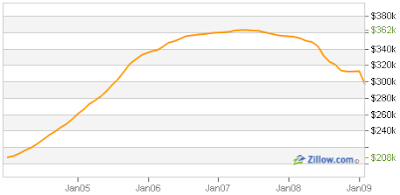

Now, based on

current valuations, I expect housing prices to continue falling for several more years. Since housing is the cause of our current recession, this may well turn out to be the longest recession since the Great Depression. And, yes, unemployment rates could exceed those of the early 1980s. However, the U.S. government is enacting an $800 billion stimulus package plus a bank bailout, in an attempt to weaken the link between falling housing prices and rising unemployment.