The good surface news on the US economy just keeps on coming. Today the Commerce Department reports that second quarter real GDP growth was a robust 3.4% -- and if wasn't for the big, big drop in private inventory investment during 2005:II, the overall figure would have been even higher.General Glut is right. The unsustainable trends are similiar to a thunderstorm on the horizon that is coming your way. It may be sunny now, but just wait a few hours. Or in the case of the US economy it could be a few months or a couple of years till we enter into a recession.

First, residential investment continues on high burn. Not only did it grow 9.8% in the second quarter (following an equally hot 9.5% rate in 2005:I), but overall residential investment now contributes 6.0% of overal US GDP -- the highest quarterly tally since 1955. That it, the present US economy is the most dependent on housing construction in fifty years.

In sum, a lot of what makes this GDP report good are clearly unsustainable trends. But then, as a country our motto is clearly "Eat, drink, and be merry, for tomorrow we die."

Saturday, July 30, 2005

General Glut: GDP & Unsustainable Trends

Friday, July 29, 2005

Buying Is Not the Only Option

I am astounded by the housing costs in my area. I live in Northern California, and a home just four years ago would cost you about $120,000, now that same home is costing you upward of $350,000. This is a university town and many Bay area and Southern California parents are coming up here and buying houses for their Chico State university children. That in turn is raising the home prices here for the rest of us. A home right next door to my in-laws in a very nice neighborhood in Chico sold for $549,000. This house was bought for a Southern California developerÂ’s CHILDREN. In Chico you will be lucky to find a job that pays $10-plus an hour. Our local economy can't keep up with the booming house prices. There were 160 homes listed for sale two weeks ago in our paper and not one was for under $200,000. I would love to sell my house and make a huge profit, but then where would I move in California? Its really very sad and I am very lucky that we bought our house when we did or I would be living in Montana or Ohio.

Heather

Chico, Calif

There are other options. Renting. How about this 3br - 1ba Beautiful Oroville Home in Chico, CA for $1095 ?

Thursday, July 28, 2005

Google Fight: 'Housing Bubble' vs. 'Housing Boom'

The term 'housing bubble' had 986,000 hits on Google whereas 'housing boom' had 1,770,000 hits. I'll continue to monitor these numbers as the housing bubble pops.

Wednesday, July 27, 2005

Real Estate Kiosks

Tuesday, July 26, 2005

Monday, July 25, 2005

WashingtonPost: DC RE Market Cools

The market in the Washington, DC area is starting to stagnate. A reasonable argument can be made that DC prices may stagnate but it is not a bubble market because of the solid fundamentals. Here are some quotes from the Washington Post article:

Home sales tend to slow in the summer, but the number of houses for sale in the Washington area has climbed by 50 percent in recent months. The available inventory has risen to about 35,300 homes, up from an average of about 23,000 in

the past three years, according to Metropolitan Regional Information Systems Inc., which runs the local multiple-listing service.

Local real estate brokers say they are seeing signs of a change."The market has slowed for sure, especially at the high end," said Wes Foster, chairman of Long & Foster Real Estate Inc.

Foster said the market is returning to "normalcy" after a frenzied era of multiple contracts, bidding wars and desperate buyers waiving their right to property inspections or appraisals.

It's very healthy," he said. "It worried the pure hell out of me the numbers we were seeing. I remember Boston in 1982 to 1989, when [prices] went up 25 percent a year for six years, and then in one year [they] fell 87 percent. The ride up for everybody selling was wonderful but the ride down was awful. . . . It was very painful and I don't want to see that here."

Foster said the recent manic market has been fueled by what he called "crazy fools running around buying houses as investments," with "bad loans, interest-free loans."

They'll get hurt, and I think they should," as prices inevitably correct themselves, he said. A slowdown is needed because so many average people have been priced out of homes or compelled to pay high prices, he said.

Towards the end of the article:

In Falls Church, Josefina Villegas, 71, thought her house would sell in just a few days when she put it on the market in late June and that she would soon be winging her way, carefree, to visit her grandchildren in Florida.

Houses in her woodsy neighborhood had been selling in the $900,000s, so she priced hers at $925,000 and waited for the bids to come in. She waited some more -- no bids. She dropped the price to $899,00. Three weeks later, still no bids.

I think houses are going slower now," she said, as she worried about getting the lawn mowed once again to keep up its pristine market-ready appearance. "Send

me somebody to buy."

Deborah Davenport, 50, listed her single-family house in Fairfax County last week at $569,000. Her husband, an echocardiographer who does heart ultrasounds, was offered his "dream job" with pediatric cardiologists in Tucson. In the past week, her home has been visited by just one set of prospective purchasers.

We haven't gotten any nibbles, unlike a month ago, when people put their houses on the market, and poof, they'd be gone," she said. "I figured it had to slow, it had to stabilize; but I hope it hasn't completely stalled -- for our sake."

The Washington, DC market is stagnating. If the Washington, DC housing market which has strong fundamentals is stagnating, then certainly there will be stagnation in bubble markets which do not have strong fundamentals. Look for stagnation in bubble cities such as Miami, Orlando, Los Angelos, Merced, Bakersfield and Reno. The price stagnation in these bubble cities will be followed by price declines.

Sunday, July 24, 2005

The HomeBuilders

It has gotten even worse, when I was discussing the real estate bubble earlier this year the Dow Jones Homebuilding Index was trading at nearly 800, it has increased over 30% in just a few months and trades at 1,070 as I write!! It has doubled in the last year. This, of course, is not sustainable. (HoweStreet.com, Dave Skarica)

Now lets look at individual Homebuilder's stock:

Friday, July 22, 2005

Mortgage Rates Climbing

As this blog has argued before, rising mortgage rates are NOT a necessity for a bubble bursting. However, rising mortgage rates are a nice prick that will help pop the bubble.

Median Single Family House Price Map

The above map shows the Median Single Family House Price in selected housing markets. You can click on the map to see the full image.

Thursday, July 21, 2005

Bubble Markets Stagnating

- San Diego: The year over year price appreciation (June 04 to June 05) is now a measly 6.3%. Most of that gain probably occured in the first part of that period

- Boston:

- Las Vegas

- Others ( please provide info)

Wednesday, July 20, 2005

Learning Greenspeak

Learning Greenspeak. This was posted by an anonymous commentator on The Housing Bubble Blog

"Whether home prices on average for the nation as a whole are overvalued relative to underlying determinants is difficult to ascertain. Among other indicators, the significant rise in purchases of homes for investment since 2001 seems to have charged some regional markets with speculative fervor.

We certainly cannot rule out declines in home prices, especially in some local markets. If declines were to occur, they likely would be accompanied by some economic stress, though the macroeconomic implications need not be substantial."

The anonymous poster comments: " You must admire his language. We must all learn Greenspeak. " Later on in the comments section green eggs and spam said...

Greenspan always shellacs his language with carefully worded conditionals and disclaimers... and then softens and rosies it up so as not to be blamed for inciting any panic-based movement.

Therefore, when he goes on record with this kind of bearish warning, you can bet that he privately sees the situation as much more problematic.

Thanks for you outstanding input. Exactly. Well said.

Greenspan Being a Hypocrite

The increase in the prevalence of interest-only loans and the introduction of more-exotic forms of adjustable-rate mortgages are developments of particular concern. To be sure, these financing vehicles have their appropriate uses. But some households may be employing these instruments to purchase homes that would otherwise be unaffordable, and consequently their use could be adding to pressures in the housing market. Moreover, these contracts may leave some mortgagors vulnerable to adverse events. It is important that lenders fully appreciate the risk that some households may have trouble meeting monthly payments as interest rates and the macroeconomic climate change

Greenspan is a hypocrite on the issue of adjustable rate mortgages (ARMs). Due, to this and other policies he has enacted he should resign or be fired.

Greenspan: 'regional markets with speculative fervor'

"Whether home prices on average for the nation as a whole are overvalued relative to underlying determinants is difficult to ascertain. Among other indicators, the significant rise in purchases of homes for investment since 2001 seems to have charged some regional markets with speculative fervor.

We certainly cannot rule out declines in home prices, especially in some local markets. If declines were to occur, they likely would be accompanied by some economic stress, though the macroeconomic implications need not be substantial."

Greenspan's comments are certainly disappointing news to the housing bulls. The bubble is now on its last legs.

Kiplinger's Personal Finance: The 13 Riskiest Housing Markets

| |

| 1. | Boston, MA | 8. | Sacramento, CA |

| 2. | New York, NY | 9. | Providence, RI |

| 3. | Fort Lauderdale, FL | 10. | Minneapolis-St. Paul, MN |

| 4. | Washington DC | 11. | Denver, CO |

| 5. | Detroit, MI | 12. | Miami, FL |

| 6. | Los Angeles, CA | 13. | Tampa-St. Petersburg |

| 7. | San Francisco, CA |

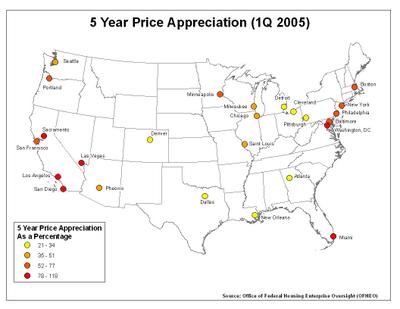

I beg to differ. Sure, most of these are risky markets but they are not the 13 riskiest. In Fresno, prices are up 111% in 5 years, Washington, DC is up 93%. Not only that but as the article itself admits "It's increases in federal spending, which support a strong job market." The strong job market is a big part of the huge price appreciation in Washington, DC. Fresno, CA is much riskier then Washington, DC. Where is Fresno on this list? Which markets do you think are the riskiest?

Monday, July 18, 2005

Growth of Subprime Loans

No documention (aka 'liar loans') and low documentation loans are also increasing as a percentage of all loans. This from HoweStreet.com :

The share of “jumbo” mortgages (mortgages for more than $359,650) issued without full documentation increased from 27% in 2001 to 51% in 2004.One of the major causes for the housing bubble is the ongoing credit bubble. If, and when the credit bubble pops the housing bubble will surely pop shortly thereafter. ( Even if the credit bubble does not pop, the housing bubble will still eventually pop ) The

Traffic Explodes on Housing Bubble Blogs

Sunday, July 17, 2005

NYTimes: A Hands-Off Policy on Mortgage Loans

"For two months now, federal banking regulators have signaled their discomfort about the explosive rise in risky mortgage loans."

First they issued new "guidance" to banks about home-equity loans, warning against letting homeowners borrow too much against their houses. Then they expressed worry about the surge in no-money-down mortgages, interest-only loans and "liar's loans" that require no proof of a borrower's income.

So has there been any changes?

It's as easy to get these loans now as it was two months ago," said Michael Menatian, president of Sanborn Mortgage, a mortgage broker in West Hartford, Conn. "If anything, people are offering them even more than before."

Why are the federal reserve board reluctant to do anything about the housing bubble?

The reason is that federal banking regulators, from the Federal Reserve to the Office of the Comptroller of the Currency, have been reluctant to back up their words with specific actions. For even as they urge caution, officials here are loath to stand in the way of new methods of extending credit.

"We don't want to stifle financial innovation," said Steve Fritts, associate director for risk management policy at the Federal Deposit Insurance Corporation. "We have the most vibrant housing and housing-finance market in the world, and there is a lot of innovation. Normally, we think that if consumers have a lot of choice, that's a good thing."

Also, Greenspan at least publicly denies there is a significant housing bubble. Just some 'froth' in certain markets. The article continues:

The main issue for regulators is whether banks and other lenders are properly managing their own risk, and the lenders are looking good.However, "consumers - and perhaps the broader economy - are taking on more risk. About 60 percent of mortgages last year had adjustable interest rates, many with artificially low teaser rates that expire after the first few years. If a mortgage rate jumps from 4 percent to 6 percent, just slightly above current levels, the monthly payment can jump by roughly 30 percent when the teaser rates come to an end."

They have hedged their risks by bundling mortgages into securities that are then sold to investors around the world. And if interest rates go higher, they have shifted much of the risk onto consumers because a growing share of home buyers have taken on adjustable-rate mortgages. At the same time, they have built sturdier financial institutions through mergers and the breakdown of barriers to interstate banking.

The volume of subprime mortgages has soared from about $35 billion in 1994 to about $530 billion in 2004 - more than 20 percent of all new mortgages last year. That growth helped propel the homeownership rate to a record 69 percent in 2004. The foreclosure rate on subprime mortgages remains modest, only 3.5 percent in the first quarter of 2005, but that is nine times the rate for prime borrowers.

Finally, one bank regulator states "When I started out, the biggest complaints were about denial of credit. Today, none of our complaints are about denial of credit. They are all about what happened after the credit was given." Easy credit, is way too nice of a term for irresponsible credit.

Friday, July 15, 2005

The Blame Game

Here is my list:

- Greenspan & The Feds for the cheap money supply (low interest rates) for such a long time

- Parts of the Real Estate Industry for promoting the bubble and not inducing a does of reality

- Irresponsible Lenders for lending to people who really can't afford it.

- Fannie Mae & Freddie Mac for bundling up risky loans from

- Asian Central Banks & other for buying all these risky bundled loans

- Speculators & Flippers ( for being greedy and fueling this mania)

- Some HomeBuyers for buying beyond thier means and being ill informed.

- Parts of the Media for not informing the public about this issue sooner (finally they are commiunicating this)

- Others ( yet to be determined, please discuss)

Thursday, July 14, 2005

Freddie Mac Releases Reference Notes Securities

FREDDIE MAC PRICES NEW $3 BILLION TWO-YEAR AND $4 BILLION 10-YEAR REFERENCE NOTES® SECURITIES

What does this all mean? What insights can we draw from this information? Here is the key line " The issue, CUSIP number 3134A4VD3, was priced at 99.967 to yield 4.018%, or 21.0 basis points more than two-year U.S. Treasury Notes" Why is this? It is at least partially explained by the extra risk associated with these Reference Notes.McLean, VA – Freddie Mac (NYSE: FRE) announced today that it priced its new 4.00% $3 billion two-year USD Reference Notes® security due on August 17, 2007. The issue, CUSIP number 3134A4VD3, was priced at 99.967 to yield 4.018%, or 21.0 basis points more than two-year U.S. Treasury Notes.

Freddie Mac also announced that it priced its new 4.375% $4 billion 10-year USD Reference Notes security due on July 17, 2015. The issue, CUSIP number 3134A4VC5, was priced at 99.327 to yield 4.459%, or 33.5 basis points more than 10-year U.S. Treasury Notes. Both Reference Notes securities issues will settle on July 14, 2005.

Including today's new offerings, Freddie Mac has issued $26 billion of Reference Notes securities during 2005. Since the beginning of the year, approximately $23 billion of the company's Reference Notes securities have matured, leaving approximately $214 billion in Reference Notes and Reference Bonds® securities outstanding.

Note: I am no expert on the bond market, so if anyone else has more insights please post a comment

Wednesday, July 13, 2005

NAR: Record for Housing Sector Expected This Year

David Lereah, NAR's chief economist, said that in each month of 2005 the forecast has been looking stronger than in previous projections. The housing expansion is continuing as more Americans take advantage of favorable conditions to achieve the dream of homeownership, he said. Earlier this year, we expected 2005 home sales to be the second-highest on record, but monthly sales have been at or close to record levels. Although we should come off of sales peaks in the months ahead, mortgage interest rates have remained lower than expected, and job gains are providing additional stimulus, meaning unprecedented sales totals this year.

The most notable problem in the housing market is the shortage of homes available for sale, as well as some shortages of building materials, Lereah said. These shortages are proving to be a challenge for home buyers, builders and remodelers, and are continuing to put pressure on home prices.

He expects the national median existing-home price for all housing types to rise 9.4 percent this year to $202,600, with the typical new-home price increasing 5.8 percent to $233,900.

NAR is a major assocaition which promotes the bubble mentality. David Lereah, NAR's chief economist is a major cheerleader for home price appreciation. He will be proven wrong just like Jim Cramer during the dot com bubble.

Monday, July 11, 2005

A Black Christmas

The nation’s store owners, gleefully watching their cash registers whir, are keeping one eye focused on complaints that the housing market is in the midst of a price bubble. Because the real estate market is magically creating trillions of dollars in home equity, borrowing against the old homestead has become a near-obsession.

“But the buying binge could hit the skids when and if housing begins to weaken.” Look no further than Australia for the answer to that. “Australians have all but stopped using their home loans to go shopping. Mortgage equity withdrawal - when people take money out of their home loans to spend - has fallen to almost zero since last year.”

Furthermore, this is noteworthy information reported by a MSNBC Article:

In addition, when the rise value of homes is translated into consumer spending fairly quickly through a well-known "wealth effect." For every dollar of increased value, homeowners spend about 5.5 cents that they otherwise would not have spent, according to one recent study. That translates to $1,100 in spending on a home that rises in value by $20,000.

"You don’t have to have prices fall for the wealth effect to have a bite," said Tornberg, of UCLA. "If houses stop appreciating, then that consumer spending goes away. The very process of prices going flat is sufficient to have a real impact."

There are growing signs that the bubble will be in bursting mode this fall. Given this, consumer spending may fall for this year's Christmas season. It could be the worst Christmas shopping season in many years. A Black Christmas is a real possibility.

More Galbraith: Financial History Time Frame

..for built into the speculative episode is the euphoria, the mass escape from reality, that excludes any serious contemplation of the true nature of what is taking place.

Contributing to and supporting this euphoria are two further factors little noted in our time or in past times. The first is the extreme brevity of the financial memory. In consequence, financial disaster is quickly forgotten.

People quickly forget the financial past. Or maybe they are just uninformed We here in the housing reality community are here to remind people of this speculative episode.

Sunday, July 10, 2005

The Housing Bubble Blog is Down

This is the weirdest thing yet. It looks like they swithed urls or

something. Hold onto your hats guys, hopefully they will get this fixed soon.

Why is this happening to Ben's Blog? Is it because someone has been hacking it? Or perhaps it is due to the huge amount of postings / comments it is much more likely to have technical problems? Or some other reason?

Whatever the reason, I hope Ben's superb blog is up and running normally very shortly. You rock Ben!

Home Sales Take a Mild Dip

Watch for the Pending Home Sales Index too continue to fall as we move deeper into the stagnation period in many places. In many housing markets, the stagnation period will likely turn into a declining price period around this October.

The Pending Home Sales Index, the leading indicator for the housing market, slipped from near-record levels but remains historically high, according to the National Association of Realtors®.

The Pending Home Sales Index,* based on data collected for May, stands at 124.9, which is 2.0 percent below April but 3.7 percent above May 2004. April’s downwardly revised reading of 127.5 was second only to a record of 128.1 in October 2004.

The index is based on pending sales of existing homes, including single-family and condos; a sale is pending when the contract has been signed but the transaction has not closed. Pending home sales typically close within one or two months of signing.

Friday, July 08, 2005

The Value of Housing Skeptics

"enhanced skepticism that resolutely associates too evident optimism with probable

foolishness"

We skeptics are a valuable tool in stopping this bubble from getting any larger. The larger the bubble the larger the bust. Ben Jones and his Housing Bubble Blog are indeed positive restraints on rampant speculation. Thank you.

London Bombings

Wednesday, July 06, 2005

Secondary Bubble Markets

Tuesday, July 05, 2005

No Soft Landing

Those who had been riding the upward wave decide now is the time to get out. Those who thought the increase would be forever find their illusion destoyed abruptly, and they, also, respond to the newly revelaed reality by selling or trying to sell. And thus the rule, supported by the experience of centuries: the speculative episode always ends not with a whimper but with a bang.A soft landing will NOT happen. There will be a bang. A hard landing scenario is inevitable.