Source.

Source.Anybody here live in Florida?

Bubble Meter is a national housing bubble blog dedicated to tracking the continuing decline of the housing bubble throughout the USA. It is a long and slow decline. Housing prices were simply unsustainable. National housing bubble coverage. Please join in the discussion.

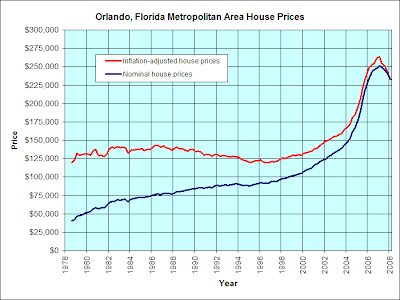

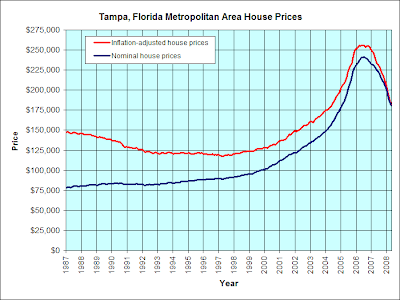

I dont live in Florida, but I was surprised to see that Orlando's fall has (yet) to become anything like that of Miami or Tampa. I just assumed the whole state was on fire by now.

ReplyDeleteActually, the difference between Orlando and the others is not due to the market, it's due to the data source. The S&P/Case-Shiller index is the data source for Miami and Tampa, while the OFHEO index is the data source for Orlando.

ReplyDeleteThe OFHEO index has been showing much smaller housing declines than other data sources. Most economists consider the S&P/Case-Shiller index to be the most accurate housing index. However, S&P does not produce an index for Orlando.

I think many markets around the country are going to see housing prices fall to 2003 levels. This has already happened in some places, like Las Vegas. Many parts of Florida are seeing prices we haven't seen since early 2004. There's just too much downward momentum in some neighborhoods -- particularly those with lots of foreclosures -- for prices to stop falling just yet. I think prices will level off in a few months, but there's still some pain to be felt in neighborhoods with a high number of bank-owned properties.

ReplyDelete