Tuesday, October 31, 2006

The 22 Million Bubblicious 'Donation'

Dallas-based Centex Homes, which had offered 8,000-resident Warrenton, Va., a cash donation of $22 million to approve its request to build 300 homes on a 500-acre property, has backed out of the deal.

Affordable housing supporters had called the donation a bribe, saying such projects drive home prices up and suburban sprawl farther into the country.

But the town was delighted and intended to use the money to pay off debt on a new aquatic center. "It was kind of a win-win for everybody," said George B. Fitch, Warrenton's mayor. "I assumed that they had done their homework, that they saw the downturn coming and still thought it was a viable project."

Centex Division President Robert K. Davis informed the town of its decision to abandon the project by letter, saying building these houses whose prices start at $850,000 was no longer economically feasible

Source: The Washington Post, Sandhya Somashekhar (10/31/2006)

Monday, October 30, 2006

Sunday, October 29, 2006

US Recession Coming Very Soon

The preliminary 3Q 2006 US GDP growth was a lousy 1.6% compared to a 2.6% for the 2Q. That is a very strong drop in the growth of the GDP. Nouriel Roubini, an economist with Roubini Global Economics, writes

The first leading indicators of economic activity for October -– the Philly, Richmond and Chicago Fed reports -– are all consistent with a further economic slowdown in Q4 relative to Q3. I thus keep my forecast that Q4 growth will be between 0% and 1% and that the economy will enter into an outright recession by Q1 of 2007 or, at the latest, Q2.Here are other factors that will contribute to the upcoming recession:

- Federal Debt & Deficit

- Continuing Housing Bust

- High Consumer Debt

- Large Trade Deficit

- Continued Offshoring

- Security Costs

For the past 4 years the US economic 'recovery' has been too dependent on a mountain of debt. It was simply unsustainablele. The housing boom of last year is now a bust. The convergence of the housing bust with other significant economic factors will almost certainly put the US into a recession by late 2006 or early 2007.

Friday, October 27, 2006

Bubble Sphere Roundup

A most excellent comparison post: Percentage of Reduced Listings Per Market @ Bubble Markets Inventory Tracking. The sellers are really competing against each other in some of the bubblicious markets.

Ryan Homes Offering to Pay Realtor Commissions ( Baltimore Metro Area Housing Blog )

HousingPanic and other housing bubble blogs were attacked in the mainstream media (MSM) "Blogs such as housingpanic.blogspot.com are helping to confuse buyers about everything from rumors to “bubble” theories." We housing bubble bloggers were ringing the alarm bells while people were busy engaging in bidding wars in summer of 2005. On May 25th 2005, I wrote "Behold the bubble is about to pop. The bubble will pop (price declines) within the next 12 months."

Tommorow morning's 3Q GDP prediction: 1.7%

Update: Actual 3Q GDP: 1.6%

Thursday, October 26, 2006

September New Home Sales

Sales of new one-family houses in September 2006 were at a seasonally adjusted annual rate of 1,075,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.3 percent (±15.6%)* above the revised August rate of 1,021,000, but is 14.2 percent (±12.2%) below the September 2005 estimate of 1,253,000.The national median sales price for a new home in September was 217,100 which represents a decline of 9.7% compare to September of 2005 when the price was 240,400. The average sales price for a new home September was 293,200 which represents a decline of 2.1% compare to September of 2005 when the price was 299,600. Of course, in real dollars the percentage price decline is even greater.

The median sales price of new houses sold in September 2006 was $217,100; the average sales price was $293,200. The seasonally adjusted estimate of new houses for sale at the end of September was 557,000. This represents a supply of 6.4 months at the current sales rat.

U.S. NEW-HOME SALES DOWN 14.2% YEAR-OVER-YEAR

These numbers are a huge challenge for the Real Estate Industrial Complex (REIC) many of whom are spouting the 'soft landing' after the largest housing boom in US history.

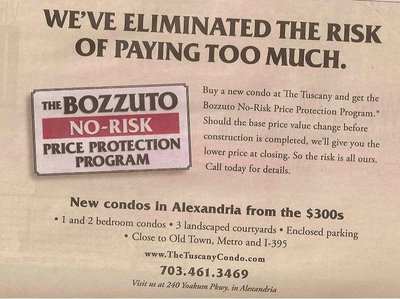

Unsuccessful Condo Projects in Alexandria, VA

The Tuscany Condos are being built on what used to be my apartment building's (200 Yoakum Parkway) tennis court. The Tuscany Condos were originally selling "from the $400s." By the time you posted your article on them, the price had already been reduced to "the $300's."

At the same time, my apartment building has been getting converted to condominiums. I had originally been offered a purchase price of $262,900 for my one bedroom apartment. (I turned it down.) More recently, one bedroom apartments like mine have been advertised "from the low $200's."

Because of my building's condo conversion, all of the tenants who didn't choose to buy have been told to move out. I am now one of the very few people still living in this very vacant building. (Finding parking is GREAT!) My eviction date is October 28th -- this coming Saturday.

Last week, I found a new (and bigger) apartment elsewhere and signed the lease. I have been worried about being able to move all my stuff out on time, so I called and asked for a 3-day extension so I could have the whole weekend to move.

A few days ago, signs were posted in my building saying the condo sales office had closed. I was shocked that they could have actually sold all the condos in this declining housing market.

Today, I got a call back on my answering machine regarding the 3-day extension, and I cannot believe what they told me. My building is "going to turn back to rentals. It is not going condo." I JUST SIGNED THE LEASE ON THE NEW PLACE! I HAVEN'T EVEN MOVED YET! I haven't had a chance to ask, but I'm willing to bet that they couldn't sell nearly enough condos.

Months ago, I had bookmarked my building's condo sales website, strandcondominium.com. I even visited the site just a few days ago. So now, with the notice that my building is not going condo, I decided to visit the site again to see what it said. Well, it's gone! It has vanished into the ether.

And this is where I get back to The Tuscany. ITS WEB SITE IS GONE, TOO! The building is only half built, and its sales web site is GONE! (You actually posted the wrong URL on your blog. It's TheTuscanyCondo.com, not TuscanyCondo.com. You can see that if you look at the photo you posted.)

I'd say that clinches it. The bubble has definitely burst....but I still have to move if I want to avoid an expensive lease break fee on my new apartment.

Wednesday, October 25, 2006

Existing Home Sales

U.S. home resales fell 1.9 percent in September and prices dropped from year-ago levels for a second month, the first back-to-back monthly declines since 1990.Nationally, the September median sales price is down 2.2% from a year ago. In real dollars that national is a decline of over 5%. The housing bubble has occured in many places throughout the US. These locales are enough to make national YoY price declines.

Existing home sales fell to an annual rate of 6.18 million rate, the lowest since January 2004, from 6.3 million in August, the National Association of Realtors said today in Washington.

Compared with a year earlier, sales were down 14.2 percent, the Realtors group said. Home resales have fallen every month since March.

The median sales price fell 2.2 percent to $220,000 from a year earlier. Prices in August had fallen for the first time in 11 years.

The number of homes for sale fell 2.4 percent from August to 3.75 million, remaining at a 7.3 months' supply.

"Existing condominium and cooperative housing sales fell 3.2 percent to a seasonally adjusted annual rate of 763,000 units in September from 788,000 in August, and were 16.0 percent less than the 908,000-unit pace in September 2005. The median existing condo price was $219,800 in September, which is 2.8 percent lower than a year ago (NAR)"

Another inane comment by Mr. Lereah. Consumers care far more about house prices stabilizing then 'home sales stabilizing.' Prices will continue to fall in the bubble markets over the coming years. Don't be fooled by David 'Paid Shill' Lereah."The worst is behind us as far as a market correction _ this is likely the trough for sales," said David Lereah, the Realtors' chief economist. "When consumers recognize that home sales are stabilizing, we'll see the buyers who've been on the sidelines get back into the market."

Tuesday, October 24, 2006

Letter To The Editor in WashingtonPost

Market CorrectionThank goodness for Kenneth R. Harney. Finally, someone has pointed out that this minor, much-needed adjustment in the local housing market is beneficial ["All Crashes Should Be So Good," Real Estate, Oct. 14].

All of this media brouhaha about a plummeting real estate market discourages the very people who most need the financial security that owning a home provides: first-time buyers.

HOLLY WORTHINGTONPresident

Greater Capitol Area Association of Realtors

Silver Spring

Monday, October 23, 2006

'Interesting' Says Mudd Regarding Borrowers Facing Foreclosure

Daniel Mudd, chief executive officer of Fannie Mae, told the conference that the payment shock accompanying many monthly mortgage bills would have a profound impact on the housing industry next year. He said that out of $9 trillion in mortgage debt outstanding, roughly $1 trillion will reset in 2007."Those resets are going to have some interesting and difficult-to-predict impacts on consumers," Mudd said.'Interesting'? Consumers are not guinea pigs for toxic mortgages. The Review Journal from Las Vegas reports that:

“In Nevada, 6,523 homes entered some phase of foreclosure in the third quarter, an increase of about 80 percent from 3,499 homes in the second quarter and roughly double the rate of foreclosure activity in the third quarter of 2005, said Tom Adams.”The lending companies have been grossly irresponsible in peddling these suicide loans to ill informed borrowers. There has already been an explosion in foreclosures, and the worse is yet to come. The pain of the toxic mortgages will become much more evident as we approach the summer of 2007.

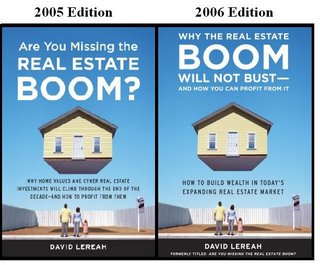

David Lereah's New Book

From the Publisher:

Book Description

When real estate booms nationally, there are hundreds of cities and regions that lag behind. Similarly, when the market slows or flattens, countless states and neighborhoods begin to boom. As Lereah makes clear, the most important factor in buying or selling a home is the local market conditions. Lereah shows readers how to:

- Evaluate the values of homes in one's own town or county

- Determine whether property values in your targeted neighborhood are on the rise

- Assess the market conditions in locations when buying a vacation or second home

- Learn how to identify markets that are overvalued or fully valued, and those that promise to appreciate more quickly in the future

- Understand the local economic developments that can affect oneÂ’s investment in the future

There are countless books offering advice on making money in real estate. This is the first one to explain why knowing the ins and outs of your local region is essential to deciding when, and where, to buy.

--------------------------

The boom did nbot continue. The housing market in the bubble markets are undergoing significant declines. His main predictions have been totally discrested. Mr. Lereah tells half truths and manipulates facts and figures. He cannot be trusted as he is a paid shill.

Sunday, October 22, 2006

Realtor Membership Growth Slowing

Year To Date Growth in Realtor Membership (End of January though End of September)

2006: 7.8

2005: 13.1

2004: 11.6

2004: 9.6

The percentage of growth is slowing down as we head in to the real estate decline. In economically depressed Michigan the number of Realtors has declined 3.72% from September 2005.

Thursday, October 19, 2006

Federal Reserve Is Trapped

Reasons Not to Lower Rates:

- Inflation Worries. As "readings on core inflation have been elevated, and the high levels of resource utilization and of the prices of energy and other commodities have the potential to sustain inflation pressures."

- Attract Inflow of Foreign Capitol. (Ensure the dollar does not tank)

- Recession Fears "The moderation in economic growth appears to be continuing"

- Don't want to cause a meltdown in the housing market. As the housing market activity is already "cooling considerably"

It is very likely that captain Bernanke will, once again, hold rates steady later this month. They are in a very tough position.

Wednesday, October 18, 2006

BubbleSphere Roundup

Historical Graph of Housing vs GDP. Nice. :-)

How Local Real Estate Agents Deceive the Public

Realtwhores?. Discussed @ Patrick.net.

New Construction Report @ Paper Dinero.

High Cancellation Rates for New Home in the DC Area

NVR Inc., the region's largest home builder, said yesterday that four out of 10 of its new-home sales in the Washington area were canceled last quarter, making it the latest builder to report that more buyers are backing out of deals.

Around the Washington market, cancellation rates have tripled in the past year, to 17 percent, according to researchers at Hanley Wood Market Intelligence. In August alone, that meant about 250 cancellations. In its most recent earnings report, builder Toll Brothers Inc. said cancellations in the quarter that ended in July had more than doubled, to 18 percent nationally, while numerous builders said in interviews that their cancellations locally had increased.

Some are abandoning their contracts even if they have significant deposits. "Buyers are abandoning five-figure deposits on their future homes because they cannot sell their existing homes or did not sell them for nearly as much as they had counted on."

Tuesday, October 17, 2006

Opinion about Real Estate professionalism

Anthony Marguleas, broker and owner of high-end realty firm Amalfi Estates in Los Angeles, thinks the industry shouldn't be spitting out low-producing agents. Instead, it should be harder to become one.Marguleas researched the number of hours it takes to become a licensed real estate agent, which varies by state. In California, he says, getting a license calls for a 45-hour class. Nationwide, the requirements range from a low of 24 hours in Massachusetts to a high of 120 hours in Ohio, according to ARELLO. He says it takes 9,000 hours to become a doctor and 1,600 hours to become a cosmetologist.

"To dye someone's hair it takes 20 times more studying than to help someone sell the largest investment of their life," he says.

"Real estate agents typically get ranked right around used-car salesmen. The bar is so low to get a real estate license," says Marguleas, who operates in a high-end market in Pacific Palisades, Calif., and has been in the real estate business for 15 years. "I would love to make it as hard as it is to become a doctor or lawyer to raise the professionalism. So many people who do this are part-time and not very knowledgeable about what they're doing. It's why consumers have such a poor image of real estate agents."

How can real estate agents as a group garner more public respect when they are lead by discredited shills like David Lereah? (that was a rhetorical question) Also, I don't agree that it should be as hard to become a real estate agent as it is to become a doctor or lawyer.

Monday, October 16, 2006

Wednesday, October 11, 2006

New September MRIS Numbers

Northern Virginia (Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA (NVAR))

- Median Price: $445K

- Median Sales Price YoY: -7.29%

- Average Sales Price YoY: -5.71%

- Total Units Sold YoY: -34%

- Average Days on Market YoY: 192%

- Active Listings YoY: 67%

- Median Price: $268k

- Median Sales Price YoY: 3.08%

- Average Sales Price YoY: 1.69%

- Total Units Sold YoY: -30%

- Average Days on Market YoY: 63%

- Active Listings YoY: 81%

- Median Price: $455k

- Median Sales Price YoY: 8.59%

- Average Sales Price YoY: 10.76%

- Total Units Sold YoY: -15%

- Average Days on Market YoY: 94%

- Active Listings YoY: 74%

Prince George's County, MD

- Median Price: $330K

- Median Sales Price YoY: 6.45%

- Average Sales Price YoY: 6.47%

- Total Units Sold YoY: -28%

- Average Days on Market YoY: 88%

- Active Listings YoY: 113%

Montgomery County, MD

- Median Price: $435K

- Median Sales Price YoY: 1.4%

- Average Sales Price YoY: 1.52%

- Total Units Sold YoY: -29%

- Average Days on Market YoY: 148%

- Active Listings YoY: 77%

Loudoun County, VA

- Median Price: $440K

- Median Sales Price YoY: -9.28%

- Average Sales Price YoY:-4.79%

- Total Units Sold YoY: -41%

- Average Days on Market YoY: 230%

- Active Listings YoY: 50%

Tuesday, October 10, 2006

Florida Leads Nation in Foreclosures

We know Florida is bubblicious. Now, it is the leader in foreclosure activity.

Yikes! Expect the foreclosure rate in Florida to rise further. Florida's homeowners are especially vulnerable to foreclosure because of high hurricane insurance rates. The Real Estate Industrial Complex bears a large degree of responsibility for this debacle.Florida is leading the nation in foreclosure activity, according to a report by Bargain Network.

The report said that Florida has approximately 28,000 properties in some form of foreclosure, accounting for 27 percent of the nation's total. With one new foreclosure filing for every 254 households, the state's foreclosure rate was more than four times the national average.

BubbleSphere Roundup

Housing Prediction: Starts, Completions, Sales (Calculated Risk)

Greenspan: Worst may be over for Housing (Calculated Risk)

Support Your Local Bubble Blogger! (Housing Doom)

Breaking News- Kara Homes Bankrupt (BubbleTrack)

Commercial Real Estate: The Next Domino? (Sacramento Land(ing))

If you are addicted to the housing bubble news there is now a Bubble News Network (BNN) which features video news. Excellent!

Next FOMC Meeting ends October 25th. Stay tuned! [Another Pause.]

Pictures from Bubblicious Baltimore

The charming 300 block of South Madiera Street in the Butchers Hill neighborhood. There are 5 rowhouses for sale on this block.

Rundown houses in Baltimore. Incidentally, there was an onsite public auction for a rowhouse about two blocks from here.

Monday, October 09, 2006

The Bubblicious Pole

in Northern Virginia (Suburban Washington, DC)

From the low 300's [Thanks to the citizen reporter who found this]

Friday, October 06, 2006

David Lereah Respond's To Moody's Bubblicious Report

David Lereah, chief economist for the National Association of Realtors, disagrees with the severity of the price downturn in the report.Is Mr. Lereah saying that if people's retirement did not depend on the housing market then he would use the term 'crash' like Moody's did? If the housing market was indeed based on fundamentals, in the bubble markets using the term 'crash' would not become a 'self-fulfilling prophecy.'

"It's possible we could go under zero, if you include prices of new homes" along with sales data for existing homes, he said. "For existing homes, I'm still predicting that prices will be above [last year] by 2 percent."

Nonetheless, Lereah agreed that broad price declines in some regions are unavoidable.

"I don't think I would use the word `crash,'" he said. "When you use a word like that, it's almost a self-fulfilling prophecy in the housing market. These are people's homes. Their retirement is depending on it."

Mr. Lereah, you were one of the housing cheerleaders who encouraged people down this dangerous path. You even wrote two books promoting the housing boom. As Ben Jones wrote "Maybe the NAR should have been urging caution the past few years instead of cheering prices higher."

Thursday, October 05, 2006

Wednesday, October 04, 2006

Tuesday, October 03, 2006

NAR Releases Market-by-Market Home Price Analysis Reports

"Get insight into the fundamentals and direction of housing markets in 119 of the nation's largest metropolitan regions. Each of the 11-page downloadable market reports evaluates a number of factors affecting home prices:"

- The health of the local job market

- The prevalence of "non-traditional" home financing options

- Debt-to-income ratios

- Net migration patterns

"These reports reflect data available through August 2006."

I have not yet reviewed these reports. More to come. Reader comments on these reports is highly encouraged. Hopefully they will be better then the discredited anti-bubble reports.

NYSUN: 'For Real Estate Brokers, Business ‘Has Dropped Dead'"

Veteran real estate broker Deanne Esses, who plies her trade as a senior vice president at one of the city's biggest firms, Bellmarc Realty, said eight people in her Upper East Side office on Madison Avenue are leaving their jobs for alternative careers. Those eight represent 20% of the office's sales staff of 40.Now read about the newbie real estate agent who quickly went from almost 200K a year to flipping sandwiches in Queens. Wow!

That's only the beginning. Ms. Esses said she thinks more New York City brokers will be leaving the scene. "Business here is just not quiet; it has dropped dead over the past few weeks," she said. "At the same time, there's a flood of inventory on the market. We run open houses, we run advertisements, but nothing works. There are no buyers, and without buyers, there are no sales."

Now as the market continues to decline there will be many more people leaving the housing industry for other prospects. The bubble was unsustainable and the wreckage will leave the US economy in a state of recession in 2007.Early in 2004, Mark Clemente left his uncle's dry-cleaning plant in Detroit to go east and, hopefully, make his fortune in real estate. Shortly thereafter, he became a broker at E&G Realty, a small firm in Newark, N.J., where he earned a respectable $195,000 in his first year.

But it has been downhill ever since. The housing slump and fierce brokerage competition led to the demise of E&G. Mr. Clemente's income collapsed, and over the past six months he has held a number of part-time jobs, including one making sandwiches at a Queens delicatessen that paid him $100 a week. "I'm going home; my real estate career is over," he said the other day.

Sunday, October 01, 2006

Housing Cheerleader Ad in Washington Post

"There is no such thing as a real estate bubble, it's called growth." - Creig Northrop

"There is no such thing as a real estate bubble, it's called growth." - Creig NorthropThe full ad can be seen here (pdf). Hattip to the reader who dound the link to the ad.

What Type of Landing?

Boom Continues- Soft Landing (0 to 20% real dollar price decline (peak price to bottom))

- Hard Landing (20 to 40% real dollar price decline (peak price to bottom))

- Crash Landing (40% + real dollar price decline (peak price to bottom))

Errors & Omissions Insurance

Errors & Omissions Insurance