Alan Greenspan, Ben Bernanke, and the rest of the crew running economic policy somehow could not see the housing bubble as it grew to more than $8tn. It really should have been hard to miss. ...Dean Baker goes on echo my rants about the financially-unstable FHA.

As a result of this astounding incompetence, we are now living through the worst downturn since the Great Depression. Because Greenspan and Bernanke and the rest messed up, tens of millions of workers are unemployed. ...

Remarkably, the folks in charge seem to have learned zip. They still have no clue about the housing bubble. How else can anyone explain the Obama administration's latest proposal for helping out underwater homeowners?

If the point is to help homeowners then there are two incredibly simple questions that must be asked:

1. Are homeowners paying less under the plan than they would to rent the same place?

2. Are homeowners going to end up with equity in their home?

These are the key questions, because if we can't answer yes to at least one of them, then we are not helping homeowners. If we can't answer yes to at least one of these questions, then taxpayer dollars being put into the programme are helping banks, not homeowners.

Unfortunately, it seems no one in the Obama administration has yet been told about the housing bubble. There is no evidence that they ever considered these questions in designing the latest policy to "help" homeowners.

Wednesday, March 31, 2010

Dean Baker: Obama helping banks, not homeowners

Economist Dean Baker says the latest Obama plan to "help" homeowners will only help banks. I agree.

Tuesday, March 30, 2010

Was the global savings glut an effect of the bubbles, not a cause?

Ben Bernanke's explanation for why we had a housing bubble is that it was caused by a global savings glut, coming from China and the Middle East. Apparently, some economists are arguing that cause and effect go the other direction. That is, the stock and housing bubbles caused excessive American consumption, which in turn caused more saving in China and the Middle East.

Monday, March 29, 2010

Elizabeth Warren: Half of commercial RE mortgages to be underwater

Bad news for commercial real estate and the economy:

By the end of 2010, about half of all commercial real estate mortgages will be underwater, said Elizabeth Warren, chairperson of the TARP Congressional Oversight Panel, in a wide-ranging interview on Monday.I agree with this:

“They are [mostly] concentrated in the mid-sized banks,” Warren told CNBC. “We now have 2,988 banks—mostly midsized, that have these dangerous concentrations in commercial real estate lending."

As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

Speaking on troubled mortgage lenders, Warren said it’s time for the government to "pull the plug" on mortgage lenders Fannie Mae and Freddie Mac.I also think we should pull the plug on AIG and the FHA. AIG is a zombie. The FHA is just getting into deeper and deeper financial trouble, all in an effort to prop up home prices above their intrinsic value.

Saturday, March 27, 2010

Paul Krugman on financial reform

In a sentence, Paul Krugman echoes my fears on financial reform:

I’m all for passing reform. But I’m not that optimistic that it will work, even if it passes.

Friday, March 26, 2010

More government encouragement of irresponsible behavior

President Obama continues the traditional government policy of rewarding irresponsible behavior:

President Obama continues the traditional government policy of rewarding irresponsible behavior:The Obama administration on Friday will announce broad new initiatives to help troubled homeowners, potentially refinancing several million of them into fresh government-backed mortgages with lower payments. ...So, if you bought a house with a large down payment, you reduced your risk of ending up underwater, and reduced your chance of government help. If you bought your house with no money down, you easily ended up underwater, and therefore get government help.

The administration’s earlier efforts to stem foreclosures have largely been directed at borrowers who were experiencing financial hardship. But the biggest new initiative, which is also likely to be the most controversial, will involve the government, through the Federal Housing Administration, refinancing loans for borrowers who simply owe more than their houses are worth.

About 11 million households, or a fifth of those with mortgages, are in this position, known as being underwater. Some of these borrowers refinanced their houses during the boom and took cash out, leaving them vulnerable when prices declined. Others simply had the misfortune to buy at the peak.

If you didn't cash out your home equity during the bubble, you're less likely to be underwater, so you don't get help. If you did cash out your home equity during the bubble, and bought lots of cool stuff, then you do get government help.

This is not just a subsidy for irresponsible homeowners, it's also a subsidy for banks holding bad loans:

Many of these loans have been bundled together and sold to investors. Under the new program, the investors would have to swallow losses, but would probably be assured of getting more in the long run than if the borrowers went into foreclosure. The F.H.A. would insure the new loans against the risk of default. The borrower would once again have a reason to make payments instead of walking away from a property.Let's not also forget that the FHA is already on very shaky financial ground. Any FHA losses will come out of the pockets of the American taxpayer:

This much was clear, however: the plan, if successful, could put taxpayers at increased risk. If many additional borrowers move into F.H.A. loans, a renewed downturn in the housing market could send that government agency into the red.This plan is just a way of shifting the burden of loss off the backs of those who engaged in irresponsible behavior, and onto the backs of taxpayers. Of course, if the housing market kept going up forever, homeowners and banks would have pocketed all of the gains. Homeowners who made the smallest down payments would have gotten the highest return on equity. Heads they win, tails we lose.

Thursday, March 25, 2010

There's no "Mc" in this mansion

An 8,000 sqft. colonial-era colonial in Harwood, Maryland goes on the auction block.

Built in 1756, it sits on 52 acres of land. George Washington was a friend of a former owner and slept in the home. Apparently it failed to sell at $2.75 million and is now bank-owned.

From the auction press release:

Built in 1756, it sits on 52 acres of land. George Washington was a friend of a former owner and slept in the home. Apparently it failed to sell at $2.75 million and is now bank-owned.

From the auction press release:

Considered one of the finest Pre-Revolutionary War historic estates in the United States, Tulip Hill is a grand Georgian plantation house built around 1756 by the Quaker merchant-planter Samuel Galloway. Frequent visitors included George Washington and Robert E. Lee.More photos here. Here's a map.

"The magnificent home and grounds that encompass the Tulip Hill estate, combined with its extensive, storied history, makes this truly a one-of-a-kind property," Gestson stated.

The home has been beautifully preserved and restored on more than 52 acres that includes an expansive terraced garden, water frontage and a pier on the West River. Among the home's modern conveniences are central heat and air conditioning and a fully renovated kitchen.

The property was named for its grove of grand tulip poplar trees, many dating to the early 18th century. Located at the edge of a high plateau, with the land falling rapidly away on all three sides, the impressive approach to the house from the river by a tree lined lane exists today as it did more than 250 years ago.

Tulip Hill includes a two-level brick main house measuring 52 feet wide and 42 feet deep, and two 20-by-24-feet brick end wings. The approximately 8,000-square-foot mansion includes seven bedrooms, a large attic, full stone basement, and nine wood burning fireplaces.

"The upcoming auction of Tulip Hill represents a rare opportunity for the discerning buyer to own an estate with extreme aesthetic and historical significance," stated Laura Brady, Co-Founder and Vice President of Marketing for Concierge Auctions.

Located in Anne Arundel County near Annapolis, Harwood is approximately 30 miles from Washington, D.C. and about 35 miles from Baltimore. The county has several historic homes dating to the 1700s in addition to Tulip Hill.

The auction of the Tulip Hill estate at 4621 Muddy Creek Road in Harwood, Maryland will be held on Saturday, April 10 at 11am EDT. The properties are available for preview daily from 12pm to 3pm and by appointment. View Terms and Conditions of Sale for full details. For more information, visit www.TulipHillAuction.com or call 877-217-2001.

Wednesday, March 24, 2010

More Cash for Clunkers bashing

Ph.D. economist Rebecca Wilder echoes Calculated Risk and me in her contempt for last year's cash for clunkers program, calling it "the most economically atrocious piece of legislation in 2009."

Also, even in a fiscal mess, California is wasting taxpayer money.

Also, even in a fiscal mess, California is wasting taxpayer money.

Monday, March 22, 2010

Costs of renting vs. owning

The National Multi Housing Council (think of them as the anti-NAR) presents its argument for renting (from 1997):

Computing the total expense of homeownership is not easy. The costs vary from person to person, from city to city, and from time to time, because of both market conditions and tax treatment. A recent NMHC research paper (available upon request) offers one method of summarizing this diverse national experience. The study estimates how the housing costs — properly measured — of the typical home buyer in the mid-1980s would have compared with their costs had they rented identical housing.And they present several home-ownership "myths" (from 2004):

That research concludes that, when all the costs of owning and renting housing are considered, a majority of all families and individuals that bought a home in the mid-1980s would have saved money by renting comparable housing. Specifically, the study estimates that the average homebuyer in 1985 paid six percent more for housing during his residency in that house than if he had rented.

The costs of owning were particularly high for short-term owners, according to the study. Buyers who sold within four years of purchase on average paid 19 percent more as owners than they would have paid as renters. For these short-term owners, transactions costs averaged 23 percent of their total costs of owning.

These cost estimates make no allowance for the home-owners' time spent in the process of buying and selling, which typically far exceeds the time spent by renters in securing their housing and subsequently moving out.

Myth: I'll reduce my tax bill if I buy a house.Of course, this organization is probably as trustworthy as the National Association of Realtors, but we hear so much of the Realtors' spin that I thought I'd post the counter-argument.

Reality: A majority of homeowners reap no annual tax benefits from owning a house.

Myth: Paying rent is throwing away money.

Reality: For the first five years of ownership, you are simply giving away your money to a bank. Nearly one-third of all buyers move within five years before they start building any real equity.

Myth: My mortgage payment will be less than my rent.

Reality: Your mortgage payment is just the beginning. The "hidden costs" of ownership can add up to thousands of dollars a year.

Myth: As an owner, my housing costs will stay constant. I won't have to worry about rent increases.

Reality: Your mortgage may remain constant, but other costs, such as maintenance, insurance and property taxes can go up significantly every year. And if you have an adjustable-rate mortgage, your mortgage payment itself can increase.

Myth: Investing in a house is a safe investment.

Reality: Even in today’s healthy housing market, stocks and bonds often still offer a better return.

Friday, March 19, 2010

Greenspan still in denial

Alan Greenspan's slightly updated denial of the ability to prevent the housing bubble:

Alan Greenspan's slightly updated denial of the ability to prevent the housing bubble:The former Fed chairman also acknowledged that the central bank failed to grasp the magnitude of the housing bubble but argued, as he has before, that its policy of low interest rates was not to blame. He stood by his conviction that little could be done to identify a bubble before it burst, much less to pop it.Can't identify a bubble before it burst? Really? This blog was created before the peak of the housing bubble specifically because my cob-logger, David, had identified a housing bubble.

At the time I first created my housing graphs in May 2006, I had already been following the housing bubble for five years. When housing activity had peaked but prices were still rising rapidly, that was the last straw that finally pushed me to warn people publicly.

Robert Shiller published the second edition of Irrational Exuberance in February of 2005, before the housing bubble peaked, specifically warning about the housing bubble. Because research and writing take time, he must have noticed the housing bubble quite a while before his book was published.

The editors of The Economist, after warning of the housing bubble for years, made it a cover story right before the peak in housing activity, a year before the peak in housing prices, and 2-3 years before the Federal Reserve decided to take it seriously.

Finally, economist Dean Baker first noticed the housing bubble in autumn of 2002 and was warning people for years before the peak.

Update: Harvard economics professor Greg Mankiw gives his thoughts.

Wednesday, March 17, 2010

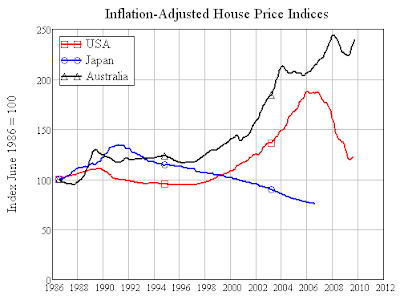

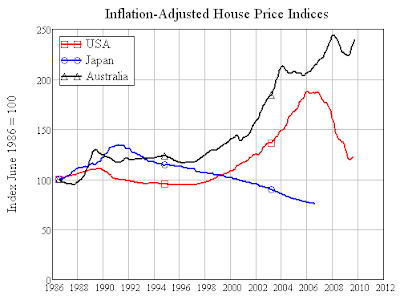

Australia's housing bubble

Compare Australia's housing bubble to America's:

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

Tuesday, March 16, 2010

Meredith Whitney: Housing market will double-dip

Financial analyst Meredith Whitney forecasts a second fall in the housing market:

Financial analyst Meredith Whitney forecasts a second fall in the housing market:The US housing market will face another retreat while mortgage-backed securities and Treasurys are likely to go through a "material" correction, Meredith Whitney, CEO of Meredith Whitney Advisory Group, told CNBC Tuesday.

"The housing market surely will double dip," Whitney told "Worldwide Exchange."

Government programs to support housing have been "murky" and when the modifications caused by them come to an end, a lot of supply may come to the market and that's when the real-estate market is likely to go down, she explained.

Senator Dodd's financial reform bill, in summary

Here's a brief summary of the financial reform bill proposed by Senator Dodd:

Here's a brief summary of the financial reform bill proposed by Senator Dodd:On the surface I don't think it's bad. I don't know much about the details.

- Consumers: A consumer-protection division would be created within the Federal Reserve, with the ability to write new rules governing the way companies offer financial products such as mortgages and credit cards. It would have authority over any bank with more than $10 billion of assets, and certain nonbank lenders.

- Banks: The Fed would oversee bank holding companies with more than $50 billion of assets. Regulators would have the discretion to force banks to reduce their risk or halt certain speculative trading practices.

- Failing companies: The government would be able to seize and break up large failing financial companies. Big companies would have to pay into a $50 billion fund to finance the dissolution of a failing firm.

- Systemic risk: A new council of regulators would be created to monitor broader risks to the economy. The council could strongly urge individual agencies to take specific actions to curb risk.

- Corporate governance: The Securities and Exchange Commission would have authority to write rules giving proxy access to shareholders who own a certain amount of stock. Shareholders would have a nonbinding vote on compensation packages for top executives.

- Hedge funds: Large funds would have to register with the government.

I really like the consumer protection part, because a lot of credit card and consumer lending has gotten completely out of control. Will the new regulation result in 20% down payments for houses again? I doubt it. Why would the new regulation result in 20% down payments when the government, via the FHA, is encouraging 3.5% down payments?

I think having a systemic risk regulator is a good idea. I am skeptical about its ability to prevent future financial crises, though. After all, didn't the Fed completely look the other way during the buildup of the housing bubble? When everybody's getting rich, nobody wants to step in and stop the party. I don't see how this changes that innate human tendency.

Labels:

Chris Dodd

Monday, March 15, 2010

New book: Ending government bailouts

Brief description:

Brief description:In Ending Government Bailouts as We Know Them, a team of expert contributors examine the dangers of continuing government bailouts and offer constructive alternatives designed to both resolve the current bailout problem and prevent future crises.The authors include former Fed Chairman Paul Volcker, current Kansas City Fed President Thomas Hoenig, former U.S. Treasury Secretaries George Shultz and Nicholas Brady, and Stanford University professors John B. Taylor, Darrell Duffie, and Joseph Grundfest, among others.

Author Michael Lewis on the financial crisis

For those who missed 60 Minutes last night:

Part 1

Part 2

Part 1

Part 2

Saturday, March 13, 2010

Flashback: Economic Forecasting FAIL!

From the back cover:

From the back cover:Dent identifies opportunities, explores trends, and makes concrete predictions. Among them are: A Dow that will reach at least 21,500 and possibly 35,000 by the year 2008.Far from being a "roaring" decade, the 2000s had the slowest rate of job growth since the Great Depression.

Friday, March 12, 2010

Thursday, March 11, 2010

Dean Baker: Recession not caused by a financial crisis

Dean Baker, the earliest economist to publicly warn about a housing bubble, argues that the recession was directly caused by the decline of the housing bubble, not by the financial crisis:

Dean Baker, the earliest economist to publicly warn about a housing bubble, argues that the recession was directly caused by the decline of the housing bubble, not by the financial crisis:Politicians and the media continue to refer to the economic downturn as being the result of a financial crisis. This is wrong. We have 15 million people out of work because the housing bubble that drove the economy since the last recession finally burst. The financial crisis may have been good entertainment for those who like to see huge banks collapse, but it was a sidebar. The real story was the rise and demise of the housing bubble.So, while apparently 71% of Bubble Meter readers blame banks for the U.S. housing bubble (see polls in the sidebar), Dean Baker seems to argue that Spain disproves them.

Those who claim that the real problem was the financial system and its faulty regulation can be disproved with a single word: Spain.

Spain is noteworthy because it now has an unemployment rate of more than 19%, the highest rate in any of the wealthy countries. Spain did not have a financial crisis. In fact, its well-regulated financial system is often held up as model for the United States.

Spain did have a horrific housing bubble. ... When the housing wealth created by the bubble disappeared people naturally cut back their consumption. ...

This is why Spain's economy is in a severe slump right now. Note that just about all analysts agree, Spain's financial system was well regulated and it had none of the loony loans and outright corruption that pervades Wall Street and the US financial system. Yet, it is suffering from this economic downturn even more than the United States.

The moral of this story is that the problem is not first and foremost a financial crisis. ... The economy's real problem is simply the loss of demand created by collapse of the bubble. ...

We do need financial reform. We have an incredibly wasteful and reckless financial industry. But bad financial regulation by itself did not give us 10% unemployment, nor would good regulation have been sufficient to prevent it. Just ask the workers in Spain.

I still put most of the blame on human psychology. When asset prices are going up, people jump on the bandwagon, which pushes prices up even more. When the bubble finally bursts, people deny personal responsibility by making scapegoats out of people they resent (i.e. those who are "big", rich, powerful, or foreign).

Wednesday, March 10, 2010

Did the Washington DC metro area have a recession?

A question from the blog comments:

Second, the belief that a recession is defined as two quarters of negative economic growth is pure myth, not fact.

Third, in the question, "this area" could be defined in multiple ways. In the blog comments, people who live in DC-proper have long complained that the Washington-Arlington-Alexandria, DC-VA-MD-WV Metropolitan Statistical Area includes a small part of West Virginia. To them, any part of West Virginia is irrelevant. Meanwhile, someone who lives and works in Fairfax County, Virginia might care far more about the Fairfax County unemployment rate than the DC unemployment rate.

Anyway, here are unemployment rate graphs for differing definitions of "this area", depending on where you live.

Washington-Arlington-Alexandria, DC-VA-MD-WV Metropolitan Statistical Area unemployment rate:

District of Columbia unemployment rate:

District of Columbia unemployment rate:

State of Maryland unemployment rate:

State of Maryland unemployment rate:

Commonwealth of Virginia unemployment rate:

Commonwealth of Virginia unemployment rate:

So, were "we" in the DC area in a recession? Yep, any way you look at it.

So, were "we" in the DC area in a recession? Yep, any way you look at it.

Question, does anyone know if we officially went into a recession in this area "2 negative quarters of GRP"?? My suspicion is no, in which case, its inaccurate to say we are "emerging" from the recession when we never entered one in the first place.First of all, NBER, the official arbiter of recessions, only makes its judgments for the country as a whole. Therefore, if "we" are in the United States of America then "we" are/were in a recession.

Second, the belief that a recession is defined as two quarters of negative economic growth is pure myth, not fact.

Third, in the question, "this area" could be defined in multiple ways. In the blog comments, people who live in DC-proper have long complained that the Washington-Arlington-Alexandria, DC-VA-MD-WV Metropolitan Statistical Area includes a small part of West Virginia. To them, any part of West Virginia is irrelevant. Meanwhile, someone who lives and works in Fairfax County, Virginia might care far more about the Fairfax County unemployment rate than the DC unemployment rate.

Anyway, here are unemployment rate graphs for differing definitions of "this area", depending on where you live.

Washington-Arlington-Alexandria, DC-VA-MD-WV Metropolitan Statistical Area unemployment rate:

District of Columbia unemployment rate:

District of Columbia unemployment rate: State of Maryland unemployment rate:

State of Maryland unemployment rate: Commonwealth of Virginia unemployment rate:

Commonwealth of Virginia unemployment rate: So, were "we" in the DC area in a recession? Yep, any way you look at it.

So, were "we" in the DC area in a recession? Yep, any way you look at it.

Monday, March 08, 2010

Mort Zuckerman on housing

Real estate billionaire Mort Zuckerman describes the state of the housing market:

Real estate billionaire Mort Zuckerman describes the state of the housing market:America’s housing crisis has not gone away. If anything, it is getting more severe. Today, median single family house prices nationwide are down by slightly more than 30 per cent from their early 2006 peak. Fusion IQ, the research group, estimates that excess inventories will push prices down by a further 10 per cent. This is a critical issue because home equity was for years the largest asset on the balance sheet of the average American family.I believe Mr. Zuckerman gets some exaggerated statistics by using month-over-month numbers rather than year-over-year. Natural short-term volatility can easily make month-over-month numbers look far better or worse than the actual longer-term trend.

The sheer number of empty homes overhanging the residential property market points to lower prices. There are an estimated 7m homes empty today, and an estimated 7.7m houses and condominiums behind on their mortgage payments. This is tantamount to a shadow inventory. More than 4m of those are now delinquent and going through some form of foreclosure or related procedures that will put them on the market in the next year or two. Fannie Mae’s 90-day delinquency rate is now roughly 5.5 per cent, double that of a year ago.

Home sales are depressed, too, by competition from some 6m rental vacancies, or 11 per cent of total rental supply. Median asking rents have been declining by an estimated 3.5 per cent over the past year – and that is accelerating.

There is no cheer in the new residential numbers either. January’s new home sales plunged by more than 11 per cent month-on-month to an annual rate of 309,000 units, the weakest on record. It now takes a record 14.2 months to sell a finished house. In the boom years, it took about three.

Even worse, the median price for new homes sold was $203,500, almost a seven-year low, and that for existing single-family homes fell 3.5 per cent month over month to $163,600, a new eight-year low. Inventories rose to a 9.1 month supply, which on top of the shadow inventory of unsold houses and those in the foreclosure pipeline does not bode well for homebuilders or housing. Neither does the sharp decline in mortgage applications to the lowest levels since May 2007 and the rise on the 30-year mortgage rates to more than 5 per cent.

Roughly one in four mortgages today exceeds the house’s value – approximately 10.7m homes. American Corelogic, the research provider, estimates an average deficiency per home of $70,700 or an aggregate of about $800bn. An additional 2.3m homes had less than 5 per cent equity. The remaining equity for many other homeowners is at historic lows. With declining prices beginning to hit the middle to higher ends of the housing market, we are looking at another foreclosure wave.

Mr. Zuckerman goes on to basically argue that tax money should be used to bail out homeowners. I wholeheartedly disagree.

Friday, March 05, 2010

A housing bubble in China?

Apparently, China may have its own housing bubble:

Premier Wen Jiabao pledged further measures to curb speculation in China's housing market Friday, signaling that lending to the sector would be tightened as well as the imposition of targeted taxes and stricter enforcement of real estate laws.If the decline of America's housing bubble brought down the world economy, what might a decline of China's housing bubble do?

"We will rein in speculative housing purchases by intensifying the implementation of differentiated credit and tax policies," Wen said in his report to the annual National People's Congress in Beijing.

The government would work to improve management of land to prevent "prices from rising too fast" along with making "greater efforts" to tackle illegal land hoarding and property-price manipulation, he said.

The speech marked a step-up in Wen's rhetoric since he warned of rising property prices in December. ...

Indeed, many economists believe China's property market is inflating at a dangerously fast pace.

Prices of new homes in the urban Beijing and Shanghai areas gained by 68% and 66%, respectively, in November from a year earlier, while research by Standard Chartered in January said land prices nationwide more than doubled during 2009.

Thursday, March 04, 2010

Rebound beginning in apartment complex construction

Real estate investment trusts are betting on an eventual economic recovery by starting construction on more apartment complexes:

This year, real-estate investment trusts, or REITs, are expected to start close to $1 billion in new multifamily projects, according to real-estate research firm Green Street Advisors. While that still is less than average, it is a significant increase over the $100 million of development starts in 2009.

Analysts caution that the increase in construction doesn't mean there has been an improvement in the business. Apartment vacancy is at a record and unemployment, essential to the sector's health, remains elevated.

But operators are betting that limited new supply, combined with an improving economy, will lead to ideal market conditions nationwide starting in 2011 or 2012. From then until 2015, "apartment REITs may generate the best property net operating income growth that they've seen in a very long time, maybe ever," said Haendel St. Juste, a REIT analyst with Keefe, Bruyette & Woods Inc.

To be sure, there are risks. Given the multiyear construction window, companies have to start now to be ready in time. If the economy weakens further and recovery is delayed, landlords may be forced to keep rents low or offer free rent to get leases signed.

"There's an element of risk," said Andrew McCulloch, an analyst with Green Street. "But if you were to go back a year, the outlook is much more clear today. Their confidence level in that eventual recovery is much higher."

Owners said the rent declines appear to have bottomed out in some areas and concessions are moderating.

Wednesday, March 03, 2010

Warren Buffett on the housing market

Warren Buffett discusses the prospects for the residential real estate industry in his newly-released letter to Berkshire Hathaway shareholders:

In 2009, [housing] starts were 554,000, by far the lowest number in the 50 years for which we have data. Paradoxically, this is good news.

People thought it was good news a few years back when housing starts – the supply side of the picture – were running about two million annually. But household formations – the demand side – only amounted to about 1.2 million. After a few years of such imbalances, the country unsurprisingly ended up with far too many houses.

There were three ways to cure this overhang: (1) blow up a lot of houses, a tactic similar to the destruction of autos that occurred with the “cash-for-clunkers” program; (2) speed up household formations by, say, encouraging teenagers to cohabitate, a program not likely to suffer from a lack of volunteers or; (3) reduce new housing starts to a number far below the rate of household formations.

Our country has wisely selected the third option, which means that within a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious. Prices will remain far below “bubble” levels, of course, but for every seller (or lender) hurt by this there will be a buyer who benefits. Indeed, many families that couldn’t afford to buy an appropriate home a few years ago now find it well within their means because the bubble burst.

Tuesday, March 02, 2010

Why Fannie and Freddie should be euthanized

Keeping Fannie Mae and Freddie Mac operational is consuming hundreds of billions of taxpayer dollars:

Friday night, note the timing, Fannie Mae said they will need another $15 billion in cash from the government (that's you and me, the taxpayers). That brings the Fannie and Freddie total to $126.9 billion thus far, but with more to come, according to both companies.Will Fannie Mae and Freddie Mac be shut down, as they should be? No, because politicians want to use other people's money (i.e. yours) to prop up the housing market.

The Congressional Budget Office estimates Fannie & Freddie cost us a total of $389 billion by 2019. That includes all the subsidies they are providing in an effort to keep mortgage rates low, and support the housing market.

And people are mad about Citi and Bank of America getting $45 billion (which they have paid back by the way)?

But Fannie and Freddie money is just going to money heaven.

Monday, March 01, 2010

Home prices predicted to fall this summer

Fiserv and Moody's expect home prices to fall this summer:

Despite signs that the real estate market might be lurching forward, prices are expected to fall further this year and next.Most predictions fall wide of the mark, so I don't place much faith in them. However, it's still interesting to hear what independent analysts expect.

The average home price in the United States will fall by about 6% by September 2011, according to a joint report between Fiserv and Moody's Economy.com. And that's after plunging more than 27% in the past three years.

Most of the projected home price decline will occur during the usually slow summer months of 2010. After that, prices should begin to stabilize, according to Fiserv, and stay almost flat through fall of 2011.

The main reason for continued decline, according to Mark Zandi, economist and co-founder of Economy.com, is foreclosures — the same thing that's plagued markets for the past three years.

Subscribe to:

Posts (Atom)