Thursday, December 28, 2006

BubbleSphere Roundup

NAR's blog has NOT been updated since December 13th. Taking a break for the holidays or are they just too busy spinning the news?

Bubblicious Sign #13,424: 'Million-Dollar Condos, With a Soup Kitchen Below' (Washington Post). But, now you really can be one with the urban environment!

Florida Paradise Lost updates us on the meltdown in Florida.

November Existing Home Sales (Calculated Risk) Mr. Risk writes "As I've noted before, usually 6 to 8 months of inventory starts causing pricing problems and over 8 months a significant problem. With current inventory levels at 7.4 months of supply, inventories are now well into the danger zone and prices are falling in most regions. Nationwide prices were off 3.1% from November 2005." Lovely graphs here too!

Wednesday, December 27, 2006

This Blog is Not About Me, It Is About the Housing Bubble

Here are some choice comments left.

- what a loser. 27 years old and renting part of a townhouse? get a life. do you even have a girlfriend?

- Wow. Now it becomes clear why David has been so angry and bitter for the past 2 year

- I'm sorry you missed the boat on housing. I'm sorry you think that at your age you are entitled to a particular kind of house or living style. I'm sorry you have to share your home with a bunch of people in order to pay the rent. I'm sorry you've spent the past 2 years of your life fostering and nurturing bitterness and resentment.

In the article, I merely stated that a couple of years ago I started looking at buying a condo or a townhouse (where I would rent out a room). After studying the market in the Washington, DC area I came to the conclusion that there was a housing bubble. That is that real dollar prices had inflated to unsustainable levels and that real dollar prices would fall significantly in the Washington metro area.

One commentator wrote regarding my blog that "It's all about how unfair it is that some people have done very well in real estate and how come others have missed the train?" This blog is not here to complain about the fairness that some people have done extraordinary well in real estate during the boom years and others have not. The term 'fairness' appears zero times in my blog. In fact the term 'fair' ONLY appears six times in the whole blog and four of those times it used where I reference what others have said. In the two times I use the term fair it is not in anyway talking about the fairness of a housing bubble.

This blog is NOT about my personal decision to rent or buy, but rather it is a blog:

dedicated to the premise that there is a Housing Bubble in many locales in the USA. With a particular focus on the: When will it pop? Why will it pop? How will it pop? Where will it pop? Who is responsible for the bubble? Also the DC Metro Area bubble. Please join in the discussion.That is the purpose of the this blog. The housing industry has been cheerleading the speculative bubble that is the housing market. As we know from history, speculative episodes do NOT end well. They leave many people financially devastated. If the speculative episode is large enough it will lead an economy into a recession.

Tuesday, December 26, 2006

David Lereah Watch Mentioned in The Wall Street Journal

In today's Wall Street Journal in an article titled 'Renters Gloat Over Housing Slump,' my other blog, David Lereah Watch was mentioned and I was interviewed.

Mr. Lereah resorts to putting words in my mouth when he says, in reference to my blog, that "There are people who believe it's the end of the world" for housing. I have never claimed it is the end of the world for housing. I claimed that from peak the "Prices declines in the bubble markets are very likely to vary between 20% - 65 in real dollars."David Jackson, a 26-year-old information-technology specialist, has been railing against the housing industry for two years -- ever since he made a vain attempt to find an affordable town house or condo in Silver Spring, Md. Unable to understand why prices were so high, he began researching the real-estate market and, he says, "came to the conclusion that there was a massive housing bubble." So Mr. Jackson decided to remain a renter. He pays $645 a month for part of a townhouse.

Now that the housing market is slumping, "I feel vindicated," Mr. Jackson says. "But I'm not looking forward to the coming recession." He believes that the housing slowdown and the effects of "a mountain of debt" on consumers will pull the entire economy into a slump.

Mr. Jackson blames what he calls "the housing industrial complex" in general and Mr. Lereah, the Realtors' economist, in particular. Since last year, Mr. Jackson has maintained a blog (davidlereahwatch.blogspot.com) devoted entirely to vilifying Mr. Lereah.

The blog recently offered a $75 cash prize for an essay containing "the most scathing criticism" of Mr. Lereah. Sample submission: "Dr. Lereah is a lying snake with the ethics of a dope-dealing pimp."

Mr. Lereah says he doesn't object to the blog. "There are people who believe it's the end of the world" for housing, he says. "They blame me for being positive."

By putting words in my mouth, Mr. Lereah, attempts to make me out as a housing extremist. He uses a straw man (Fallacy Of Extension) argument. Mr. Lereah cannot be trusted because of his history of deception and wrong predictions.

Monday, December 25, 2006

Monitoring The Realtor Bubble

Leading the decline were states like:

State: # Lost % Change

Florida: 839 -.54%

New York: 206 -.32%

Illinois: 478 -.82%

Virginia: 1562 -4.12%

Nevada: 213 -1.04%

The number of Realtors has grown tremendously over the past 5 year. This corresponds precisely with the housing bubble years.

See: Is There a Realtor Bubble? (September 20th, 2006).

Wednesday, December 20, 2006

Realtors Association Concerned over Rising Rate of Defaults and Foreclosures

The foreclosure rate is rapidly increasing in much of the country as housing markets decline and toxic mortgages adjust. DataQuick reports:

Residential foreclosure activity in California surged to its highest level in more than four years last quarter, the result of slower home sales and flattening prices, a real estate information service reported. Lending institutions sent 26,705 default notices to homeowners in the state during the three-month period ending in September. That was up 28.3 percent from 20,812 for the prior quarter, and up 111.8 percent from 12,606 for 2005's third quarter, according to DataQuick Information Systems.

In response to the rapidly increasing default and foreclosure rate the NAR said in their press release that:

NAR President Pat Vredevoogd Combs urged consumers to make sure they understand the risks and rewards ofall types of mortgages before they make a decision on a loan. She also advised consumers to consult with a Realtor and to participate in mortgage education programs sponsored by Realtors before they buy ahome

We are committed to helping people buy -- and keep -- the home of their dreams, and an educated consumer really can make the best decision,"said Combs, of Grand Rapids, Mich., and vice president of ColdwellBanker-AJS- Schmidt. "Realtors(R) help Americans achieve the dream of homeownership. We work to ensure that homebuyers have access to the proper information so they can fulfill their homeownership goals.

These Realtors are partly to blame for the unacceptable foreclosure rate. A large percentage of Realtors have been promoting exotic (read toxic) mortgages as an affordable method to buy now (or forever be priced out (BS)). For example real estate agent Joe O'Hara was pushing toxic mortgages when he sold a property in Washington, DC.

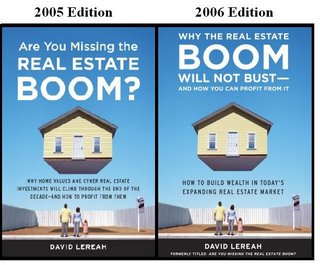

Or we have David 'Paid Shill' Lereah, NAR's cheif economist who promoted perpetual mortgage debt. He said during the peak of the housing bubble:

"If you paid your mortgage off, it means you probably did not manage your funds efficiently over the years," said David Lereah, chief economist of the National Association of Realtors and author of "Are You Missing the Real Estate Boom?" "It's as if you had 500,000 dollar bills stuffed in your mattress.The Realtors are partly responsible for the fiasco that is the rapidly rising and high mortgage default and foreclosure rate. Their behavior has been despicable as they cheered on homeownership at almost any cost. Wait, it will get worse going into 2007 as more toxic mortgages reset, housing sales and prices continue to decline and the economy takes a turn for the worse.

"He called it "very unsophisticated." (Los Angeles Times Aug 28th, 2005)

Tuesday, December 19, 2006

To Buy or Not To Buy That is The Question

The housing market has changed dramatically in the bubble markets over past year and a half. Back in the summer of 2005 bidding wars were common and inventory was very low in the bubble markets across the USA. Those days are a sweet memory to the legions of stuck flippers.

Today, a new reality faces both buyers and sellers. Its the Inventory Stupid! Inventory has increased dramatically in most bubble markets in the last year and a half. In Phoenix, inventory rose from 10,748 on 7/20/05 to 51,998 on 12/10/06 according ZipRealty and Bubble Markets Tracking Inventory. The inventory of houses for sale in Massachusetts has "now risen for 18 consecutive months" (Warren Group).At the same time the number of housing units sold has fallen dramatically in the bubble markets compare with a year ago. The number of housing units sold in Northern Virginia (Washington, DC suburbs) has fallen - 23.6% compared to November 2005.

Some real estate agents are claiming that is now a 'buyer's market' due to the increased inventory, lack of bidding wars and the small reductions in prices. Blanche Evans , Editor of Realty Times thinks it is a good time to buy. “You can get a better price on a better home that will pay off when the slump ends.”

On the front page of the National Association of Home Builders (NAHB) website they write 'It's a great time to buy.' and 'making today's economic environment the perfect one in which to buy a home.'

So is it a good time to buy in the bubble markets?

In many bubble markets, the peak price was reached late summer 2005. Real prices will continue to decline in the bubble markets for many more years. Prices declines in the bubble markets are very likely to vary between 20% - 65 in real dollars (inflation adjusted) from peak to bottom (it may take up to 8 years). Most of the real dollar price decline will occur in the first 3 years of the housing bust. Indeed, the huge price appreciation that occurred in the bubble markets over the past 5 years or so was a speculative episode.

Just as importantly, monthly rents are generally cheap compared to buying in the bubble markets. Buying in the bubble markets generally costs 1.25 to 2.5 times the cost of renting ( for a similar property; assuming 30yr fixed, solid credit, property taxes, and typical interest rate tax deduction). Each month hundreds if not thousands of dollars can be saved and invested if one chooses to rent as opposed to owning.

Buying now in a bubble market does not make financial sense. As the housing inventory continues to rise and prices decline there will be lots of buying opportunities in the future. Additionally, an economic recession in very likely to occur in the US within the next 7 months. If you earn a reasonable income it is an absolute fallacy that you need to "Buy now or be priced out forever." This is not a small temporary 3 months dip like Mr. Lereah suggested. In the bubble markets, this is a multiyear housing market bust. In the Bubble Markets, renting and waiting is fiscally prudent. Don't be fooled.

Friday, December 15, 2006

Bubble Sphere Roundup

Paper Money is a wonderful blog. What’s In a Word? in this case the word is 'substantial,' as the Federal Reserve board opined that there is a 'substantial cooling of the housing market.'

Median Sales Prices are down 8% in Sacramento and even more in some of the nearby counties. Sacramento Land(ing) posts that Double-Digit Price Declines for Placer & Yolo; Sacramento Down 8%.

And just to cheer you up during this holiday season. Nouriel Roubini posts: Economic downturn is still fully underway. He writes "The housing recession is not bottoming out (see collapsing housing starts and building permits); the housing recession has now led to a total stall of non-residential construction. The auto sector is in a recession; the manufacturing sector is in a recession; inventory adjustment is cutting Q4 growth; and now real investment by the corporate sector is sharply falling (see October durable goods)." A general US recession is most probably coming within 9 months.

Tuesday, December 12, 2006

Realtors' Ego Ride

More ego boosting from the Realtors which appeared on their blog. Here is the offending post:

The National Association of Realtors (NAR) has become a pathetic organization that is desperately manipulating the housing market. They spread misinformation to unsuspecting consumers through their 1.3 million members and through the mainstream media (MSM). Now, they are lobbying the US Congress to keep theicommissionse commisions.Realtor® is to Real Estate Agent as Mercedes® is to Car

Recently, some journalists reported results of a Harris poll in which real estate agents were perceived as one of the least prestigious occupations in a list of 23 professions. Too bad they didn't include Realtors'® on the list.

Realtors'® are distinct from real estate licensees. In addition to completing mandatory quadrennial Code of Ethics training, Realtors® also have access to educational opportunities and training in real estate specialties that are not available to other licensees. NAR's Public Awareness Campaign educates consumers about these and other distinctions, and after nine years, the campaign's effects are evident.

In the past three years alone, NAR research has shown that the number of consumers who say they would be more likely to use a Realtor' instead of a real estate agent who is not a member of NAR has risen by nearly 20 percent, to three out of every four consumers. Over the past six years, the percentage of consumers who believe that Realtors'® are more qualified to promote the sale of a home than real estate agents who are not Realtors' has risen dramatically, from 54 percent in 2000 to 73 percent in 2005.

Realtors' are real professionals who have the opportunity, experience, and privilege of helping people achieve the American dream of homeownership. What could be more prestigious than that?

NAR's New President: Pat Vredevoogd Combs

NAR's new president is Pat Vredevoogd Combs. Ms. Combs has a blog. She appears to be as much of a shill as David Lereah. On a recent blog posts she writes "The National Association of REALTORS continues to show just how influential the Voice for Real Estate has become – in communities across the United States and around the world. As the news media took special note of NAR’s Metro Home Price Report last week, we managed to send a clear message that the “soft landing” is both expected and sustainable and that 2006 will still be a great year for real estate."

It appears she is learning from David 'Paid Shill' Lereah. She can learn how to decieve, spin, maninpulate facts, and cheerlead the housing market.

Friday, December 08, 2006

National Association of Home Builders (NAHB)

National Association of Home Builders, National Housing Center located in Washington. Part of the Housing Industrial Complex.

National Association of Home Builders, National Housing Center located in Washington. Part of the Housing Industrial Complex. On the front page of their website they write 'It's a great time to buy.' and 'making today's economic environment the perfect one in which to buy a home.'

On the front page of their website they write 'It's a great time to buy.' and 'making today's economic environment the perfect one in which to buy a home.' For the home builders it is always a good time to buy. According to them has it ever been a mediocre time to buy?

Ha!

Saturday, December 02, 2006

BubbleSphere Roundup

Deceptive Realtors? I'm schocked, schocked I tell you. Southern Maryland Housing Bubble News reports on How To Screw Homebuyers And Doctor Statistics - A Re/Max Educational Series.

Calculated Risk tells about the Housing Optimists. "In spite of the steady stream of bad news for housing, there are a growing number of forecasters and stock analysts that are bullish on housing and housing stocks."

Nouriel Roubini explains his predictions for a US recession in early 2007.

Thursday, November 30, 2006

How Much Influence Do The Housing Bubble Bloggers Have?

As the whole idea of blogs is so new, it's doubtful that Lereah's calculations would have taken into account the drops in value incited by these "panic-inciting" blogs.Prices have dropped not because of some blogger 'incited' panic, but rather because in the bubble markets prices have become divorced from the fundamentals (price to rent ratio, income etc). It is flattering to think us housing bubble bloggers have that much power. Many of us housing bubble bloggers have received a bit of mainstream press.

Like someone yelling FIRE! in a crowded theater, the blogs are sure to have an effect ... Albeit a temporary one as people realize the predictions are based on falsehoods.

Yes, we are a having a small effect and we made the housing decline start just a bit sooner. But, the bubbliciousness was unsustainable and was inevitably going to burst due to its own absurdity.

Wednesday, November 29, 2006

NAR's Anti Bubble Predictions In Sarasota Bradenton Proven Wrong

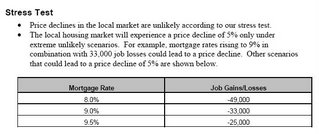

In their Sarasota - Bradenton report (pdf) the NAR claimed "price declines in the local market are unlikely according to our stress test." They also claimed that "the local housing market will experience a price decline of 5% only under extreme unlikely scenarios. For example mortgage rates rise to 9% in combination with 33,000 job losses could lead to a price decline."

Well mortgage rates are nowhere near 9% and also there has not been 33,000 job losses in the Sarasota -Bradenton metro area. Yet despite this "Prices remain the story in home sales, with Sarasota-Bradenton prices falling 18 percent in October, the second biggest drop in the state. The median sales price in the Sarasota-Bradenton market was $277,900 last month, compared with $340,700 during the same month in booming 2005. (Herald Tribune)."

On November 15, 2005 I criticized there reports saying that "The work of NAR on these housing reports is contradictory, deceitful and lousy. NAR should be ashamed of their research."

There anti-bubble reports have been proven wrong. The NAR's work needs to be debunked more by the mainstream media. The National Association of Realtors cannot be trusted.

Tuesday, November 28, 2006

Existing Homes: Sales Up, Median Sales Price Down 3.5% YoY, Inventories Up

"Sales are down 11.5% in the past year. Median sales prices fell a record 3.5% year-over-year, the third decline in a row. Inventories of unsold homes increased 1.9% to 3.854 million, representing a 7.4-month supply at the October sales rate. It's the largest months' supply since April 1993." (MarketWatch)

“Sales of condos dropped 4.8% to 778,000. Median sales prices are down 5.3% in the past year to $214,300. Condo sales are down 14.5% in the past year. The inventory of unsold condos rose to 9.1 months. ‘That’s a segment of the marketplace that’s experiencing some pain,’ Lereah said.”

No folks this is not the bottom and the housing market will continue to decline. Overall, this is NOT a rosy report.

Bernanke on Housing

Ben Bernanke spoke before the National Italian American Foundation, New York, New York about the US economic outlook:

"Housing has played a significant role in the recent slowing of overall activity, and developments in this sector are likely to have an important influence on economic growth going forward as well. As you know, the correction in the housing market that is now in train follows a boom during the first half of this decade. Between 2000 and late 2005, the pace of construction of single-family homes rose more than 40 percent, and sales of both new and existing homes increased by a similar amount. Nationally, home prices increased about 60 percent over that period--an average figure that masks considerable variation in the rate of price appreciation across cities and regions, as home prices rose exceptionally rapidly in some "hot" locations but only modestly in others."

"No real or financial asset can be counted upon to pay a higher risk-adjusted return than other assets year after year, and housing is no exception. Thus, a slowing in the pace of house-price appreciation was inevitable. Moreover, the sustained rise in prices, together with some increase in mortgage interest rates, sowed the seeds of the correction by making housing progressively less affordable. Declining affordability ultimately served to limit the demand for housing, leading to a deceleration in house prices and slowing home purchases."

"The drop in home sales that began earlier this year has led homebuilders to curtail the rate of new construction. Indeed, single-family housing starts are down about 35 percent since their peak earlier this year. Obtaining a precise read on home prices is difficult: During a period of weak demand, potential sellers often choose to leave their homes on the market longer or even to remove them from the market, rather than accept price offers that are below their expectations. The timeliest data on house prices do not fully account for changes in the composition of home sales by location, size, and other characteristics. Moreover, the data do not capture hidden price cuts, as when builders try to stimulate sales through the use of "sweeteners" such as paying the customer's mortgage points or upgrading features of the house at no additional cost. Nevertheless, there can be little doubt that the rate of home-price appreciation has slowed significantly for the nation as whole. Some areas have continued to experience gains--albeit smaller ones than before--while other markets have seen outright price declines. "

"Notwithstanding the sharp reduction in starts of new single-family houses, inventories of both new and existing homes for sale have increased markedly this year. For example, according to the most recent data, homebuilders currently have about 550,000 new homes for sale, roughly half again the number that has been typical during the past decade. Moreover, the official statistics likely understate the full extent of the inventory buildup, as many homebuilders have reported a sharp increase this year in the number of buyers canceling signed contracts. A home for which the sales contract is cancelled becomes available for sale once again but is not included in the official data on the inventory of unsold new homes. To reduce this inventory overhang, builders are likely to continue to limit the number of new homes under construction."

"Although residential construction continues to sag, some indications suggest that the rate of home purchase may be stabilizing, perhaps in response to modest declines in mortgage interest rates over the past few months and lower prices in some markets. Sales of new homes ticked up in August and increased a bit further in September. The University of Michigan's survey of consumers shows an increase in the share of respondents who believe that now is a good time to buy a home, from 57 percent in September to 67 percent in November. Meanwhile, an index of applications for mortgages for home purchases has been trending up since July. Although these developments are encouraging, we should keep in mind that even if demand stabilizes in its current range, reducing the inventory of unsold homes to more normal levels will likely involve further adjustments in production. The slowing pace of residential construction is likely to be a drag on economic growth into next year. "

Sunday, November 26, 2006

Housing For Sale in Adams Morgan Neighborhood in DC

Adams Morgan is trendry gentrified neighborhood in Washington, DC. In the 2009 zipcode where this block is located as of October 2006 there were 392 units for sale. In December 2005, there were just 254 units available for sale. The number of days on the market for housing sold is up 258% compared with October 2005. The median sales price is flat year over year and the number of units sold is down 10%. Source: MRIS

Adams Morgan is trendry gentrified neighborhood in Washington, DC. In the 2009 zipcode where this block is located as of October 2006 there were 392 units for sale. In December 2005, there were just 254 units available for sale. The number of days on the market for housing sold is up 258% compared with October 2005. The median sales price is flat year over year and the number of units sold is down 10%. Source: MRIS

Friday, November 24, 2006

Wednesday, November 22, 2006

More Scare Tactics From the Despicable NAR

Pat Vredevoogd Combs, a Grand Rapids Realtor who became president of the Ntional Association of Realtors this month, said the current market transition -- what some call a slump -- is good news for buyers.In other words, 'BUY NOW' or else prices will rise and there will be less choice. Don't be fooled by the Housing Industrial Complex.

“‘This window of opportunity will continue into the new year, but inventories are starting to decline and sellers will be less willing to negotiate when conditions begin to balance in most areas around early spring,’ she said.”

Tuesday, November 21, 2006

David Lereah's Presentation At The Realtors Convention

David Lereah's presentation The Road to Recovery (ppt), slide number 1, at the Realtor's Annual Convention in New Orleans (Nardi Gras). It is ironic that there is a steep treacherous cliff on the edge of the road and clouds ahead.

David Lereah's presentation The Road to Recovery (ppt), slide number 1, at the Realtor's Annual Convention in New Orleans (Nardi Gras). It is ironic that there is a steep treacherous cliff on the edge of the road and clouds ahead.

Announcing that it is a 'Unique Housing Cycle,' Lereah blames the current declines on affordability problems, investor flight, psychology and a media scare.

Lereah's last slide is a quote from Greenspan saying that "Most of the negatives in housing are probably behind us. The fourth quarter should be reasonably good, certainly better than the third quarter."

Lereah's last slide is a quote from Greenspan saying that "Most of the negatives in housing are probably behind us. The fourth quarter should be reasonably good, certainly better than the third quarter."

Pulte Giving 25$ Amazon Gift Certificates Just for Visting

Show up, see the their bubblicious homes and get a 25$ Amazon gift certificate. Sweet!

Monday, November 20, 2006

Growth in Realtors Slowing Dramatically

At the end of 2000 the number of Realtors stood at 803,803, by the end of 2005 their ranks had swelled to 1,265,367. In five short year the Realtors had grown by 57.4%.

Now their membership growth is slowing. Their month over month (pdf) national growth was .48% from 1,364,196, to 1,370,758 which represented this smallest percentage growth rate for the month of October since 1999.

For the month of October, the number of Realtors declined in 10 states.

The tremendous growth rate of the Realtors is over. The NAR should expect outright declines in their membership.

Sunday, November 19, 2006

Realtors Do Much Harm, Then a Little Good in New Orleans

The goodness that the Realtors accomplished in New Orleans in no ways makes up for all the amount of harm many Realtors have caused during the housing bubble. By cheerleading the bubble and encouraging toxic mortgages many Realtors have done tremendous harm. The foreclosure rate has skyrocketed in many bubble markets due in part to these toxic mortgages. These toxic mortgages were promoted by Realtors and mortgage lenders to many naive homebuyers. The Realtors as a whole should be ashamed of the actions of many of their fellow Realtors and their pathetic leadership (ex. David Lereah) during this bubblicious period.

Wednesday, November 15, 2006

Bubble Sphere Roundup

Patrick.net Photoshop Extravaganza! Don't Miss It!

Do big cash bonuses sell homes? (NJ Report) There is even a downloadble spreadsheet with cash bonus offers from craigslist. Here is one example: "$20,000 BONUS to SELLING AGENT for full price offer!!!!! $10,000 towards the BUYER’S CLOSING Costs"

Pacific Beach Housing Bubble does a tremendous job writing abotu the local market. How about the deluded flipper who has this property.

Purchase price (03/04): $749,000

Asking price: $1,400,000

Expected appreciation: 87% in 20 months

Ya right will you be able to sell it for that price. Keep drinking the financial kool aide!

From Newsweek: David Leareah says "You'd have to go back to the Great Depression to find a housing period that is this unique." Thanks to one reader who found this gem.

Monday, November 13, 2006

The Realtors Attend Nardi Gras

To cheer up his grumpy Realtors, who pay Mr. Lereah's salary, he offered hope.

"We need a price decline, we were overbloated," particularly on the West Coast, David Lereah, chief economist for the National Association of Realtors, told attendees at his organization's annual meeting here on Friday.

"In 2007, it will be a flat year, maybe 1 percent [sales] drop, and that's it," Lereah said. "After 2007, we'll be back to expansion again."

Lereah forecast that 2006 sales will end up about 9 percent lower than in 2005, a record year. He anticipates sales of 6.47 million units, declining to 6.43 million next year. Prices nationwide will be down by about 2 percent, year over year, and will inch up by 1.5 percent in 2007, he said.

New-home sales will decline this year by 16.8 percent, to 1.07 million units, and will sink 8.7 percent further next year, to 975,000, he said.

Lereah said inventory is stabilizing, citing his trade group's data on pending sales--homes that have gone under contract.

"It appears that inventory has peaked," said Lereah, who now estimates a 7.3 month supply of available homes nationwide.

"We were hovering near four to five months' [supply of homes for sale] during the boom, and in some areas, such as Orange County, Calif., we were measuring it in weeks, not months."

But Lereah said the national picture is positive. "I'm optimistic for 74 percent of the country," where local markets are, at worst, flat. The other 26 percent are in for some rough times."

Struggling the most would be California, South Florida, Arizona, Nevada, and metro Washington, D.C., he said, where sellers need to lower their prices.

Mr. Lereah, the discredited chief

Sunday, November 12, 2006

October 2006 MRIS Numbers

These numbers include all housing units, including single family residences (townhouses, houses), condos and co-ops.

Northern Virginia (Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA (NVAR))

- Median Price: $458K

- Median Sales Price YoY: -6.36%

- Average Sales Price YoY: -4.70%

- Total Units Sold YoY: -21%

- Average Days on Market YoY: 144%

- Active Listings YoY: 52%

- Median Price: $265K

- Median Sales Price YoY: 1.92%

- Average Sales Price YoY: 3.15%

- Total Units Sold YoY: -22%

- Average Days on Market YoY: 79%

- Active Listings YoY: 64%

- Median Price: $375k

- Median Sales Price YoY: -11.76%

- Average Sales Price YoY: -10.26%

- Total Units Sold YoY: -30%

- Average Days on Market YoY: 103%

- Active Listings YoY: 48%

- Median Price: $335K

- Median Sales Price YoY: 6.65%

- Average Sales Price YoY: 7.90%

- Total Units Sold YoY: -24%

- Average Days on Market YoY: 97%

- Active Listings YoY: 95%

Montgomery County, MD

- Median Price: $432K

- Median Sales Price YoY: .70%

- Average Sales Price YoY: 1.91%

- Total Units Sold YoY: -26%

- Average Days on Market YoY: 147%

- Active Listings YoY: 56.3%

Loudoun County, VA

- Median Price: $428K

- Median Sales Price YoY: -10.84%

- Average Sales Price YoY:-10.09%

- Total Units Sold YoY: -29%

- Average Days on Market YoY: 152%

- Active Listings YoY: 30.9%

Loudoun County's peak median price of for all housing units sold was a bubblicious 506,100 reached in August of 2005. Now, in October 2006 it has fallen by 78,150 dollars or 15.4%. In real dollars this would be a decline of 18 or 19%. [A small part of this huge price decline are seasonal factors at work where prices in the non prime real estate months are reduced compared to the buying season (spring through late summer)]. In the metropolitan DC area a declining housing market is reality.

Friday, November 10, 2006

Foreclosures Increasing

"While September's foreclosure activity only saw a 10 percent decrease compared to the record breaking month of August, the 51 percent hike from a year ago is alarming. Both September's figures, as well as the third quarter's, showed that the foreclosure rate was one new property for every 1,222 U.S. households."

"The top five states to represent 66 percent of the foreclosure activity were Florida, California, Michigan, Texas, and Colorado."

"Florida's foreclosure rate was four times the national average with one new foreclosure filing for every 254 households. Foreclosures in the Sunshine State totaled 28,000, accounting for 27 percent of the overall nationwide foreclosure activity."

"On the opposite side of the country, California, which ranked second, had 17,000 properties enter into some state of forelcosure, with a new foreclosure rate of 1 filing for every 712 households. Compared to the previous month, the state saw a 37 percent increase and a 44 percent increase from the previous quarter."

"Nearly 9,000 foreclosures were reported entering the foreclosure process in Texas, or 1 foreclosure for every 920 households. Colorado had a total of 7,00 foreclosure filings, or 1 foreclosure for every 266 households."

"Tom Adams, president and CEO of Bargain Network, it's not a surprise that the western states top the charts due to the "predominance of negative amortization loans" where borrowers pay interest-only, without gaining any equity."

Tuesday, November 07, 2006

Monday, November 06, 2006

Friday, November 03, 2006

Realtors Launch Major Ad Campaign

"Look for NAR's advertisement during the weekends of November 3-5 and 10-12 in six leading U.S. newspapers: New York Times, Wall Street Journal, Washington Post, Chicago Tribune, USA Today, and Los Angeles Times.

The ad encourages consumers to ignore the negative media coverage on the current housing market and reminds them that the time is right to buy now, for several reasons:

The ad encourages consumers to ignore the negative media coverage on the current housing market and reminds them that the time is right to buy now, for several reasons:

- Interest rates are low

- A good inventory of homes is available

- Prices have stabilized and are starting to rise

- The future of the housing market and the economy is positive

- Housing is a great investment, with average home valuations increasing 88 percent in the last 10 years

NAR is publicizing this message to the press through news release, media outreach, and selected television interviews.

In January 2007, NAR will take this message to the airwaves with television and radio commercials."

The National Association of Realtors is interested in thier membership and is not there to give prudent advice to potential homebuyers. Don't be fooled by their soft landing talk! In the bubble markets this will be a hard landing!Update: Check out this spoof of the Realtors' Ad and also Big Picture's Excellent Analysis of the Ad.

Thursday, November 02, 2006

Bubble Sphere Roundup

More and more toxic mortgages are resetting. Responsible are those uninformed and/or greedy borrowers abetted and encouraged by irresponsible mortgage brokers. To track this growing mess there is Bubble Markets Inventory Tracking.

Lots of links to Bubblicious Articles @ Southern Maryland Housing Bubble News!

3Q GDP Report (Paper Money)

Sex Sells Condos (Housing.com Blog)

A large congratulations for the NJ RE Report receives major publicity in the Star Ledger. Helping to spread the truth about the housing market!

Tuesday, October 31, 2006

The 22 Million Bubblicious 'Donation'

Dallas-based Centex Homes, which had offered 8,000-resident Warrenton, Va., a cash donation of $22 million to approve its request to build 300 homes on a 500-acre property, has backed out of the deal.

Affordable housing supporters had called the donation a bribe, saying such projects drive home prices up and suburban sprawl farther into the country.

But the town was delighted and intended to use the money to pay off debt on a new aquatic center. "It was kind of a win-win for everybody," said George B. Fitch, Warrenton's mayor. "I assumed that they had done their homework, that they saw the downturn coming and still thought it was a viable project."

Centex Division President Robert K. Davis informed the town of its decision to abandon the project by letter, saying building these houses whose prices start at $850,000 was no longer economically feasible

Source: The Washington Post, Sandhya Somashekhar (10/31/2006)

Monday, October 30, 2006

Sunday, October 29, 2006

US Recession Coming Very Soon

The preliminary 3Q 2006 US GDP growth was a lousy 1.6% compared to a 2.6% for the 2Q. That is a very strong drop in the growth of the GDP. Nouriel Roubini, an economist with Roubini Global Economics, writes

The first leading indicators of economic activity for October -– the Philly, Richmond and Chicago Fed reports -– are all consistent with a further economic slowdown in Q4 relative to Q3. I thus keep my forecast that Q4 growth will be between 0% and 1% and that the economy will enter into an outright recession by Q1 of 2007 or, at the latest, Q2.Here are other factors that will contribute to the upcoming recession:

- Federal Debt & Deficit

- Continuing Housing Bust

- High Consumer Debt

- Large Trade Deficit

- Continued Offshoring

- Security Costs

For the past 4 years the US economic 'recovery' has been too dependent on a mountain of debt. It was simply unsustainablele. The housing boom of last year is now a bust. The convergence of the housing bust with other significant economic factors will almost certainly put the US into a recession by late 2006 or early 2007.

Friday, October 27, 2006

Bubble Sphere Roundup

A most excellent comparison post: Percentage of Reduced Listings Per Market @ Bubble Markets Inventory Tracking. The sellers are really competing against each other in some of the bubblicious markets.

Ryan Homes Offering to Pay Realtor Commissions ( Baltimore Metro Area Housing Blog )

HousingPanic and other housing bubble blogs were attacked in the mainstream media (MSM) "Blogs such as housingpanic.blogspot.com are helping to confuse buyers about everything from rumors to “bubble” theories." We housing bubble bloggers were ringing the alarm bells while people were busy engaging in bidding wars in summer of 2005. On May 25th 2005, I wrote "Behold the bubble is about to pop. The bubble will pop (price declines) within the next 12 months."

Tommorow morning's 3Q GDP prediction: 1.7%

Update: Actual 3Q GDP: 1.6%

Thursday, October 26, 2006

September New Home Sales

Sales of new one-family houses in September 2006 were at a seasonally adjusted annual rate of 1,075,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.3 percent (±15.6%)* above the revised August rate of 1,021,000, but is 14.2 percent (±12.2%) below the September 2005 estimate of 1,253,000.The national median sales price for a new home in September was 217,100 which represents a decline of 9.7% compare to September of 2005 when the price was 240,400. The average sales price for a new home September was 293,200 which represents a decline of 2.1% compare to September of 2005 when the price was 299,600. Of course, in real dollars the percentage price decline is even greater.

The median sales price of new houses sold in September 2006 was $217,100; the average sales price was $293,200. The seasonally adjusted estimate of new houses for sale at the end of September was 557,000. This represents a supply of 6.4 months at the current sales rat.

U.S. NEW-HOME SALES DOWN 14.2% YEAR-OVER-YEAR

These numbers are a huge challenge for the Real Estate Industrial Complex (REIC) many of whom are spouting the 'soft landing' after the largest housing boom in US history.

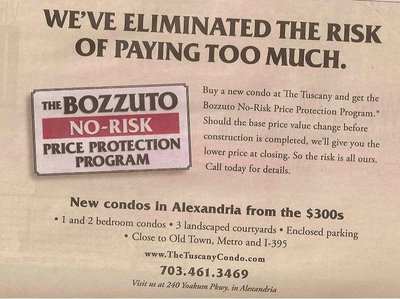

Unsuccessful Condo Projects in Alexandria, VA

The Tuscany Condos are being built on what used to be my apartment building's (200 Yoakum Parkway) tennis court. The Tuscany Condos were originally selling "from the $400s." By the time you posted your article on them, the price had already been reduced to "the $300's."

At the same time, my apartment building has been getting converted to condominiums. I had originally been offered a purchase price of $262,900 for my one bedroom apartment. (I turned it down.) More recently, one bedroom apartments like mine have been advertised "from the low $200's."

Because of my building's condo conversion, all of the tenants who didn't choose to buy have been told to move out. I am now one of the very few people still living in this very vacant building. (Finding parking is GREAT!) My eviction date is October 28th -- this coming Saturday.

Last week, I found a new (and bigger) apartment elsewhere and signed the lease. I have been worried about being able to move all my stuff out on time, so I called and asked for a 3-day extension so I could have the whole weekend to move.

A few days ago, signs were posted in my building saying the condo sales office had closed. I was shocked that they could have actually sold all the condos in this declining housing market.

Today, I got a call back on my answering machine regarding the 3-day extension, and I cannot believe what they told me. My building is "going to turn back to rentals. It is not going condo." I JUST SIGNED THE LEASE ON THE NEW PLACE! I HAVEN'T EVEN MOVED YET! I haven't had a chance to ask, but I'm willing to bet that they couldn't sell nearly enough condos.

Months ago, I had bookmarked my building's condo sales website, strandcondominium.com. I even visited the site just a few days ago. So now, with the notice that my building is not going condo, I decided to visit the site again to see what it said. Well, it's gone! It has vanished into the ether.

And this is where I get back to The Tuscany. ITS WEB SITE IS GONE, TOO! The building is only half built, and its sales web site is GONE! (You actually posted the wrong URL on your blog. It's TheTuscanyCondo.com, not TuscanyCondo.com. You can see that if you look at the photo you posted.)

I'd say that clinches it. The bubble has definitely burst....but I still have to move if I want to avoid an expensive lease break fee on my new apartment.

Wednesday, October 25, 2006

Existing Home Sales

U.S. home resales fell 1.9 percent in September and prices dropped from year-ago levels for a second month, the first back-to-back monthly declines since 1990.Nationally, the September median sales price is down 2.2% from a year ago. In real dollars that national is a decline of over 5%. The housing bubble has occured in many places throughout the US. These locales are enough to make national YoY price declines.

Existing home sales fell to an annual rate of 6.18 million rate, the lowest since January 2004, from 6.3 million in August, the National Association of Realtors said today in Washington.

Compared with a year earlier, sales were down 14.2 percent, the Realtors group said. Home resales have fallen every month since March.

The median sales price fell 2.2 percent to $220,000 from a year earlier. Prices in August had fallen for the first time in 11 years.

The number of homes for sale fell 2.4 percent from August to 3.75 million, remaining at a 7.3 months' supply.

"Existing condominium and cooperative housing sales fell 3.2 percent to a seasonally adjusted annual rate of 763,000 units in September from 788,000 in August, and were 16.0 percent less than the 908,000-unit pace in September 2005. The median existing condo price was $219,800 in September, which is 2.8 percent lower than a year ago (NAR)"

Another inane comment by Mr. Lereah. Consumers care far more about house prices stabilizing then 'home sales stabilizing.' Prices will continue to fall in the bubble markets over the coming years. Don't be fooled by David 'Paid Shill' Lereah."The worst is behind us as far as a market correction _ this is likely the trough for sales," said David Lereah, the Realtors' chief economist. "When consumers recognize that home sales are stabilizing, we'll see the buyers who've been on the sidelines get back into the market."

Tuesday, October 24, 2006

Letter To The Editor in WashingtonPost

Market CorrectionThank goodness for Kenneth R. Harney. Finally, someone has pointed out that this minor, much-needed adjustment in the local housing market is beneficial ["All Crashes Should Be So Good," Real Estate, Oct. 14].

All of this media brouhaha about a plummeting real estate market discourages the very people who most need the financial security that owning a home provides: first-time buyers.

HOLLY WORTHINGTONPresident

Greater Capitol Area Association of Realtors

Silver Spring

Monday, October 23, 2006

'Interesting' Says Mudd Regarding Borrowers Facing Foreclosure

Daniel Mudd, chief executive officer of Fannie Mae, told the conference that the payment shock accompanying many monthly mortgage bills would have a profound impact on the housing industry next year. He said that out of $9 trillion in mortgage debt outstanding, roughly $1 trillion will reset in 2007."Those resets are going to have some interesting and difficult-to-predict impacts on consumers," Mudd said.'Interesting'? Consumers are not guinea pigs for toxic mortgages. The Review Journal from Las Vegas reports that:

“In Nevada, 6,523 homes entered some phase of foreclosure in the third quarter, an increase of about 80 percent from 3,499 homes in the second quarter and roughly double the rate of foreclosure activity in the third quarter of 2005, said Tom Adams.”The lending companies have been grossly irresponsible in peddling these suicide loans to ill informed borrowers. There has already been an explosion in foreclosures, and the worse is yet to come. The pain of the toxic mortgages will become much more evident as we approach the summer of 2007.

David Lereah's New Book

From the Publisher:

Book Description

When real estate booms nationally, there are hundreds of cities and regions that lag behind. Similarly, when the market slows or flattens, countless states and neighborhoods begin to boom. As Lereah makes clear, the most important factor in buying or selling a home is the local market conditions. Lereah shows readers how to:

- Evaluate the values of homes in one's own town or county

- Determine whether property values in your targeted neighborhood are on the rise

- Assess the market conditions in locations when buying a vacation or second home

- Learn how to identify markets that are overvalued or fully valued, and those that promise to appreciate more quickly in the future

- Understand the local economic developments that can affect oneÂ’s investment in the future

There are countless books offering advice on making money in real estate. This is the first one to explain why knowing the ins and outs of your local region is essential to deciding when, and where, to buy.

--------------------------

The boom did nbot continue. The housing market in the bubble markets are undergoing significant declines. His main predictions have been totally discrested. Mr. Lereah tells half truths and manipulates facts and figures. He cannot be trusted as he is a paid shill.

Sunday, October 22, 2006

Realtor Membership Growth Slowing

Year To Date Growth in Realtor Membership (End of January though End of September)

2006: 7.8

2005: 13.1

2004: 11.6

2004: 9.6

The percentage of growth is slowing down as we head in to the real estate decline. In economically depressed Michigan the number of Realtors has declined 3.72% from September 2005.

Thursday, October 19, 2006

Federal Reserve Is Trapped

Reasons Not to Lower Rates:

- Inflation Worries. As "readings on core inflation have been elevated, and the high levels of resource utilization and of the prices of energy and other commodities have the potential to sustain inflation pressures."

- Attract Inflow of Foreign Capitol. (Ensure the dollar does not tank)

- Recession Fears "The moderation in economic growth appears to be continuing"

- Don't want to cause a meltdown in the housing market. As the housing market activity is already "cooling considerably"

It is very likely that captain Bernanke will, once again, hold rates steady later this month. They are in a very tough position.

Wednesday, October 18, 2006

BubbleSphere Roundup

Historical Graph of Housing vs GDP. Nice. :-)

How Local Real Estate Agents Deceive the Public

Realtwhores?. Discussed @ Patrick.net.

New Construction Report @ Paper Dinero.

High Cancellation Rates for New Home in the DC Area

NVR Inc., the region's largest home builder, said yesterday that four out of 10 of its new-home sales in the Washington area were canceled last quarter, making it the latest builder to report that more buyers are backing out of deals.

Around the Washington market, cancellation rates have tripled in the past year, to 17 percent, according to researchers at Hanley Wood Market Intelligence. In August alone, that meant about 250 cancellations. In its most recent earnings report, builder Toll Brothers Inc. said cancellations in the quarter that ended in July had more than doubled, to 18 percent nationally, while numerous builders said in interviews that their cancellations locally had increased.

Some are abandoning their contracts even if they have significant deposits. "Buyers are abandoning five-figure deposits on their future homes because they cannot sell their existing homes or did not sell them for nearly as much as they had counted on."

Tuesday, October 17, 2006

Opinion about Real Estate professionalism

Anthony Marguleas, broker and owner of high-end realty firm Amalfi Estates in Los Angeles, thinks the industry shouldn't be spitting out low-producing agents. Instead, it should be harder to become one.Marguleas researched the number of hours it takes to become a licensed real estate agent, which varies by state. In California, he says, getting a license calls for a 45-hour class. Nationwide, the requirements range from a low of 24 hours in Massachusetts to a high of 120 hours in Ohio, according to ARELLO. He says it takes 9,000 hours to become a doctor and 1,600 hours to become a cosmetologist.

"To dye someone's hair it takes 20 times more studying than to help someone sell the largest investment of their life," he says.

"Real estate agents typically get ranked right around used-car salesmen. The bar is so low to get a real estate license," says Marguleas, who operates in a high-end market in Pacific Palisades, Calif., and has been in the real estate business for 15 years. "I would love to make it as hard as it is to become a doctor or lawyer to raise the professionalism. So many people who do this are part-time and not very knowledgeable about what they're doing. It's why consumers have such a poor image of real estate agents."

How can real estate agents as a group garner more public respect when they are lead by discredited shills like David Lereah? (that was a rhetorical question) Also, I don't agree that it should be as hard to become a real estate agent as it is to become a doctor or lawyer.

Monday, October 16, 2006

Wednesday, October 11, 2006

New September MRIS Numbers

Northern Virginia (Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA (NVAR))

- Median Price: $445K

- Median Sales Price YoY: -7.29%

- Average Sales Price YoY: -5.71%

- Total Units Sold YoY: -34%

- Average Days on Market YoY: 192%

- Active Listings YoY: 67%

- Median Price: $268k

- Median Sales Price YoY: 3.08%

- Average Sales Price YoY: 1.69%

- Total Units Sold YoY: -30%

- Average Days on Market YoY: 63%

- Active Listings YoY: 81%

- Median Price: $455k

- Median Sales Price YoY: 8.59%

- Average Sales Price YoY: 10.76%

- Total Units Sold YoY: -15%

- Average Days on Market YoY: 94%

- Active Listings YoY: 74%

Prince George's County, MD

- Median Price: $330K

- Median Sales Price YoY: 6.45%

- Average Sales Price YoY: 6.47%

- Total Units Sold YoY: -28%

- Average Days on Market YoY: 88%

- Active Listings YoY: 113%

Montgomery County, MD

- Median Price: $435K

- Median Sales Price YoY: 1.4%

- Average Sales Price YoY: 1.52%

- Total Units Sold YoY: -29%

- Average Days on Market YoY: 148%

- Active Listings YoY: 77%

Loudoun County, VA

- Median Price: $440K

- Median Sales Price YoY: -9.28%

- Average Sales Price YoY:-4.79%

- Total Units Sold YoY: -41%

- Average Days on Market YoY: 230%

- Active Listings YoY: 50%

Tuesday, October 10, 2006

Florida Leads Nation in Foreclosures

We know Florida is bubblicious. Now, it is the leader in foreclosure activity.

Yikes! Expect the foreclosure rate in Florida to rise further. Florida's homeowners are especially vulnerable to foreclosure because of high hurricane insurance rates. The Real Estate Industrial Complex bears a large degree of responsibility for this debacle.Florida is leading the nation in foreclosure activity, according to a report by Bargain Network.

The report said that Florida has approximately 28,000 properties in some form of foreclosure, accounting for 27 percent of the nation's total. With one new foreclosure filing for every 254 households, the state's foreclosure rate was more than four times the national average.

BubbleSphere Roundup

Housing Prediction: Starts, Completions, Sales (Calculated Risk)

Greenspan: Worst may be over for Housing (Calculated Risk)

Support Your Local Bubble Blogger! (Housing Doom)

Breaking News- Kara Homes Bankrupt (BubbleTrack)

Commercial Real Estate: The Next Domino? (Sacramento Land(ing))

If you are addicted to the housing bubble news there is now a Bubble News Network (BNN) which features video news. Excellent!

Next FOMC Meeting ends October 25th. Stay tuned! [Another Pause.]

Pictures from Bubblicious Baltimore

The charming 300 block of South Madiera Street in the Butchers Hill neighborhood. There are 5 rowhouses for sale on this block.

Rundown houses in Baltimore. Incidentally, there was an onsite public auction for a rowhouse about two blocks from here.

Monday, October 09, 2006

The Bubblicious Pole

in Northern Virginia (Suburban Washington, DC)

From the low 300's [Thanks to the citizen reporter who found this]

Friday, October 06, 2006

David Lereah Respond's To Moody's Bubblicious Report

David Lereah, chief economist for the National Association of Realtors, disagrees with the severity of the price downturn in the report.Is Mr. Lereah saying that if people's retirement did not depend on the housing market then he would use the term 'crash' like Moody's did? If the housing market was indeed based on fundamentals, in the bubble markets using the term 'crash' would not become a 'self-fulfilling prophecy.'

"It's possible we could go under zero, if you include prices of new homes" along with sales data for existing homes, he said. "For existing homes, I'm still predicting that prices will be above [last year] by 2 percent."

Nonetheless, Lereah agreed that broad price declines in some regions are unavoidable.

"I don't think I would use the word `crash,'" he said. "When you use a word like that, it's almost a self-fulfilling prophecy in the housing market. These are people's homes. Their retirement is depending on it."

Mr. Lereah, you were one of the housing cheerleaders who encouraged people down this dangerous path. You even wrote two books promoting the housing boom. As Ben Jones wrote "Maybe the NAR should have been urging caution the past few years instead of cheering prices higher."

Thursday, October 05, 2006

Wednesday, October 04, 2006

Tuesday, October 03, 2006

NAR Releases Market-by-Market Home Price Analysis Reports

"Get insight into the fundamentals and direction of housing markets in 119 of the nation's largest metropolitan regions. Each of the 11-page downloadable market reports evaluates a number of factors affecting home prices:"

- The health of the local job market

- The prevalence of "non-traditional" home financing options

- Debt-to-income ratios

- Net migration patterns

"These reports reflect data available through August 2006."

I have not yet reviewed these reports. More to come. Reader comments on these reports is highly encouraged. Hopefully they will be better then the discredited anti-bubble reports.

Errors & Omissions Insurance

Errors & Omissions Insurance