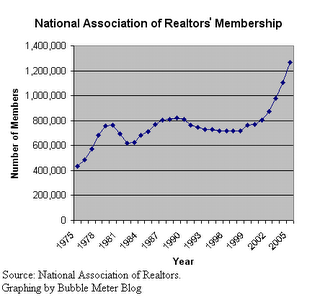

Millions of Americans overextended themselves during the housing boom years. Now, foreclosures are up from one year ago.

The foreclosure rate will continue rise as home prices decline, unemployment rises and the economy heads into a recession. It terrible to see so many naive first time home buyers being suckered into this speculative episode, some of whom will end up in foreclosure.

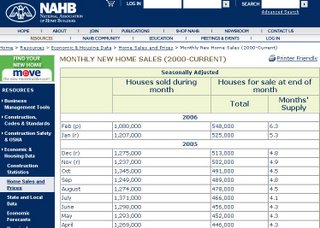

Foreclosures rose to 272,109 nationwide in the second quarter, marking a gain of 25 percent from the corresponding period in 2005, according to RealtyTrac, Irvine, Calif.

Rick Sharga, vice president of marketing at RealtyTrac, an online database of foreclosure properties, anticipates higher foreclosures during the remainder of the year and through 2007.

Sharga expects that rates on more than $2 trillion in adjustable-rate mortgages will jump during the next 18 months to two years, boosting monthly payments by upwards of 50 percent.

RealtyTrac CEO James Saccacio, however, says low unemployment and steady home-price appreciation have kept foreclosures reasonably low.Source: Milwaukee Journal Sentinel, Michele Derus (07/28/06)