Friday, June 30, 2006

Its Been Busy, Here are Some Links

The BubbleSphere welcomes Housing Doom Housing Blog. Doom is too strong a term to describe the housing market in the coming years. As I've said before, I am prophet of upcoming housing and economic gloom, but not doom.

BubbleTrack blog has a informative post regarding the Northeastern housing market.

Check out Calculated Risk's GDP: Q1 Personal Savings.

After yesterday's 1/4 point Fed announcement the dollar declined from about 1.2540 to the current price of 127.70 against the euro. I made over $200 yesterday betting on the euro. Sold to soon at 1.2646. Can't compain as I made money.

There will be posts over the July 4th weekend. Material is planned. Happy 4th! :-)

Thursday, June 29, 2006

Fed Raises Rates by 1/4

The FOMC mislead when it stated there is a 'gradual cooling of the housing market.' *Nice* euphemism. The FOMC can't really tell the truth at this time and use a term like 'significant decline' as its utterance would cause a housing panic!The Federal Open Market Committee decided today to raise its target for the federal funds rate by 25 basis points to 5-1/4 percent.

Recent indicators suggest that economic growth is moderating from its quite strong pace earlier this year, partly reflecting a gradual cooling of the housing market and the lagged effects of increases in interest rates and energy prices.

Readings on core inflation have been elevated in recent months. Ongoing productivity gains have held down the rise in unit labor costs, and inflation expectations remain contained. However, the high levels of resource utilization and of the prices of energy and other commodities have the potential to sustain inflation pressures.

Although the moderation in the growth of aggregate demand should help to limit inflation pressures over time, the Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information. In any event, the Committee will respond to changes in economic prospects as needed to support the attainment of its objectives.

FOMC Meeting, Announcement Expected Soon

"While a rate hike is a virtual certainty, the FOMC's statement will again be carefully analyzed for any clues as to where rates will go from here." (CNBC Money 6/29/06)

Looking foward to the announcement! :-)

Wednesday, June 28, 2006

Blanche Evans of Realty Times Sounds Desperate

The bubbleheads were ignored last year. It seems that what she is really upset about is the attack on real estate commissions.First, the blow below the belt.

On Tuesday, June 20, 2006, dozens of newspapers across the nation published the so-called report, "How The Real Estate Cartel Harms Consumers and How Consumers Can Protect Themselves," by the executive director of the Consumer Federation of America.

Then the uppercut, published the same day in the New York Times by a Brookings Institution senior fellow. "Commission Accomplished" is also a diatribe that criticizes the real estate industry and its commissions. Both reports are unabashed, unsubstantiated opinion pieces, and what's strange is that they both appeared on exactly the same day. Why?

Dozens of news services gleefully joined in the tarring and feathering of the real estate industry by reporting the CFA opinion piece as news when it should have been placed in the editorial section along with the Brookings Institution fellow's piece.

News organizations reported that the consumer group called the real estate industry a "cartel." Not one paper questioned why neither the CFA report or the Brookings Institute editorial had any quotes, facts, or anything other than the opinion of the authors. The real estate industry's side of the commission question was all but ignored by virtually every newspaper.

What we have is two venerable research institutions slamming real estate commissions on exactly the same day using the biggest name newspapers in the country.She claims it was a planned attack. Blance Evan then goes on to declare war on the media that published the CFA (pdf)

What really ought to happen here is two things:

- Every Realtor in America should jerk their housing ads to any newspaper that published the Brookings or the CFA "editorials." We should have a advertising holiday where not one agent puts an ad in the newspaper out of protest. Then, we can see if not having newspaper ads really hurt sales, which my guess is, it won't.

- Forward this story to every Realtor in America so they'll stop putting money in the enemy's war chest. Every dime you give to newspapers is a dime that will be used to put you out of business. Stop supporting any company that wants to put you out of business!

If money talks for donors, it should sure as hell talk for advertisers.

Wow! She is pretty desperate. The housing industrial complex is scared. Many in the housing industrial complex have made significant money during the unsustainable boom years. Now, as the housing market is declining many feel threatened and a few are lashing back. Watch out it will be a rough ride.

Blog Rules

1) I shall be the final decision maker as to what comments are acceptable on this blog.

2) Any personal insults directed at me or commentators on this site will be deleted. Calling me or others 'stupid', 'moron', 'pathetic' is NOT allowed. Ad Hominem attacks are not allowed against me or commentators. [However, one can call a particular comment 'pathetic', 'moronic' etc if they give a reason.]

3) Any comment that is entirely unrelated to the post is highly likely to be deleted. [If the post is about foreclosures and you comment about conditions in the Chinese prison system].

4) Any comment which uses foul language such as 'f*ck', 'sh*t' is highly likely to be deleted.

5) Commentators often ask for more evidence when I post. This is acceptable. Please bear in mind that I have a full time job and can't answer everyone's questions or requests. Attacks against me for not responding to a question or comment are prohibited.

6) I do indeed welcome opposing opinions on this blog as long as they follow the blog rules detailed in this post. [If someone would like to construct a well reasoned post on why there will be a soft landing or why the boom will start up again I will post it].

7) Statements that clearly are false will be deleted. [China has less land mass then Singapore. Or everyone in China is wealthy.]

8) If there are any questions regarding blog rules please email me at bubblemeter@gmail.com .

Federal Reserve Board Starts Two Day Meeting

Despite, the speculative talk of 50bps increase in short term interest rates, I am still predicting a 25bps increase at tommorow's announcement. That would bring rates to 5.25%.

What will happen at August's FOMC Meeting?

Tuesday, June 27, 2006

Condos in U Street Corridor in DC

The Flats at Union Row being constructed on the left (condos). On the right is a completed condo building.

The Flats at Union Row being constructed on the left (condos). On the right is a completed condo building.

NAR: May Existing Home Sales

Total existing-home sales– including single-family, townhomes, condominiums and co-ops – eased 1.2 percent to a seasonally adjusted annual rate of 6.67 million units in May from a pace of 6.75 million in April, and were 6.6 percent below the 7.14 million-unit level in MayThe National Association of Realtors used the term 'eases' to describe the month over month seasonally adjusted 1.2% drop in existing housing unit sales. Ok.

2005.

The national median existing-home price for all housing types was $230,000 in May, up 6.0 percent from May 2005 when the median was $217,000.

Single-family home sales slipped 1.5 percent to a seasonally adjusted annual rate of 5.82 million in May from 5.91 million in April, and were 6.6 percent below the 6.23 million-unit level in May 2005. The median existing single-family home price was $229,700 in May, up 6.4 percent from a year ago.

It's the Inventory Stupid! Nationally, inventory has increased by 41% from last May, and a full 5.5% from April 2006. In the bubble markets, the growth in inventory is a much greater percentage. Keep your eyes on that inventory!

Extremely Bubblicious in Phoenix Metro Area

1/2/06: 26,715

2/10/06: 34,608

4/20/06: 43,054

6/24/06: 50,440

Many in the bubblesphere have been watching as the number of active listings has exploded in the Phoenix area. The amount of inventory has nearly double since the beggining of the year.

The housing market in the Phoenix area is about to enter the meltdown mode as inventory continues to skyrocket. A t the very same time, the number of sales per months has fallen compared to last year at this time. The Dallas Morning News had this to report:

In the Valley, where used-home sales are down 34 percent from last year's record pace and below 2004's more normal pace, the slowing is likely to be more acute.Meanwhile, a large amount of new housing units continue to be built. Furthermore, the Phoenix economy is unusually dependent on the housing industry. It is a sad situation that the intense speculation of the past few years has inevitably brought the upcoming housing meltdown.

The median price of a used home in Pinal County fell to $211,500 in this year's first quarter. That's down from the $220,000 the typical existing home was selling for at the end of 2005.

Monday, June 26, 2006

May 2006 New Home Sales

In May 2006, the median sales price for new homes sold in the US was 235,300 which was down 4.3% from April 2006 when the median sales price 245,900. The average sales price also declined, falling 2.6% from 302,200 to 294,300 between Aprill and May 2006. Please note these are the preliminary numbers which are subject to revisions.

Sales of new one-family houses in May 2006 were at a seasonally adjusted annual rate of 1,234,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.6 percent (±13.1%)* above the revised April rate of 1,180,000, but is 5.9 percent (±10.8%)* below the May 2005 estimate of 1,311,000.

The median sales price of new houses sold in May 2006 was $235,300; the average sales price was $294,300. The seasonally adjusted estimate of new houses for sale at the end of May was 556,000. This represents a supply of 5.5 months at the current sales rate.

Calculated Risk has an excellent post on this data. A commentator, called PrivateBanker, wrote this astute comment on Calculated Risk's post "Sales are up are because of skewed reporting numbers and the fact that home builders are offering everything imaginable in incentives to unload their inventories. Don't people see this as a major warning sign?!!!"

Sunday, June 25, 2006

David Lereah's 'New' Book

Hat Tip to Housing Panic Blog. "Hat-tip to Housing Panic'er Damon for the work"

It is past time that David Lereah is taken to task by the mainstream media for his shameless cheerleading

BubbleSphere Roundup

Now, a decent number of the remaining BubbleSphere blogs have not been updated in the past few weeks.

- The Boy in The Big Housing Bubble (June 1st)

- Out at The Peak (June 4th)

- Housing Bubble Casualty (May 24th)

- South Florida Real Estate Bubble (May 24th)

- Massachusetts Housing Market (June 3rd)

- New Mexico Real Estate (May 27th)

Friday, June 23, 2006

Interest Rates Continue to Rise

Concerns about inflation pushed the 30-year fixed mortgage rate to 6.71 percent this week from 6.63 percent last week, to what Freddie Mac says is the highest level seen since May 2002.I do not expect interest rates on 30 year fixed rates to go above 7.25% this year.

The 15-year fixed mortgage rate rose as well, climbing to 6.36 percent from 6.25 percent over the same time span. The one-year adjustable mortgage rate edged up to 5.75 percent from 5.66 percent; and the five-year hybrid ARM surged to 6.32 percent from 6.23 percent.

Thursday, June 22, 2006

The Bubblicious Fence

First we had the bubblicious wall, then the bubblicious bench and now there is the bubblicious fence. The bubblicious fence is located at 1117 10th Street NW in Washington, DC.

First we had the bubblicious wall, then the bubblicious bench and now there is the bubblicious fence. The bubblicious fence is located at 1117 10th Street NW in Washington, DC.As of 6/22/06 it the bubblicious fence has 29 lockboxes hanging on to it.

The condo building is called Quincy Courts. It has a total of 135 units. Original sales began on 3/15/05. Many flippers and specuvestors bought here. Located at the edge of downtown and right next to the Massachusetts Avenue corridor it certainly has many other condo units to compete with for buyers.

[Please feel free to copy the bubblicious fence image onto other sites as long as credit is given.]

I checked ZipRealty and found 31 units for sale at this address which is actually more then the number of lockboxes on the site.

The bubbleheads have a new mecca in the Washington, DC area.

Prices for units that are for sale on the MLS:

Prices for units that are for sale on the MLS:Data from ZipRealty

Studios (4 units): 259, 269, 286, 342

1br 1ba (10 units ): 359, 359, 425, 449, 449, 470, 474, 475, 479, 480

2br 1ba (3): 479, 535, 609

2br 2ba (13): 529, 579, 614, 619, 638, 638, 749, 829, 839, 850, 859, 979, 1095

2br 3ba (1): 833

Total units for sale in MLS: 31 (as of 6/22/06)

Wednesday, June 21, 2006

In Chicago 'Bloodbath' ended first condomania

Sara Benson acquired her first condominium in the city at the peak of the boom, back when speculators traded condos like stocks and the value of some units doubled in as little as a year. It turned out, she paid too much: $24,000.The article continues and compares the 1970's condo mania to today's market:That became clear when she sold the one-bedroom walkup in Buena Park for $13,000 four years later, after the Chicago condo market crashed. It was 1983, a good year for Michael Jackson, whose album "Thriller" was selling a million copies a week, but a bad year for the Chicago condo market, which was suffering from a glut of unsold units and soaring interest rates.

"It was a bloodbath," recalls Ms. Benson, a residential broker who was working as a property appraiser at the time. "So many developers got caught up in the excitement and frenzy of the market."

Back on January 2, 2006 I wrote "However, condos especially in the city itself are likely to fall by over 20% in real dollars within 3 years." The condo market in Chicago is bubblicious and prices are likely to fall by over 30% in real dollars from peak prices real dollar prices.More than a quarter-century after the city's first condo craze — or "condomania," as it was called at the time — Chicago is several years into another condo boom fueled by low interest rates, the growing appeal of city living and plenty of speculative activity. The skeptics see a bubble poised to burst, while market boosters say Chicago exhibits none of the speculative excesses of other markets, like South Florida, Las Vegas and Southern California.

Yet the early 1980s show that the Chicago condo market is not immune to a crash.

To be sure, conditions were different back then: Rates on the average 30-year fixed-rate mortgage hit 18% at one point, vs. a mild 6.5% today. Rates are rising again, but no one expects a reprise of the '80s.

In one respect, however, the market is riskier today. Most developers back then were converting apartments into condos, adding little to the overall supply of housing stock. Today, condo developers mostly are building new high-rises, adding more than 26,000 units, excluding conversions, to the downtown market since 2000, according to Chicago-based real estate consulting firm Appraisal Research Counselors. Another 8,600 units are on the drawing board for this year alone (Crain's, May 15).

Tuesday, June 20, 2006

Where are the Greater Fools?

Demand has fallen as there are significantly less greater fools showing up to buy properties this spring. Spring is the busiest season for real estate and typically when prices rise the most. The hope was that with the spring season a large amount of buyers will swoop in, raise demand, and significantly bid up prices.

Real estate 'guru' Blanche Evans wrote on January 23rd "What about housing? There's a lot of positive news that suggests that housing may have had its "rest." Spring might catapult housing into another record year." It didn't happen. Not enough greater fools showed up this spring.

Inventory continues to increase in the bubble markets as prices are either declining slightly or remaining flat. The false hope of the 'spring boom' is being shattered by the harsh reality of a declining housing market. This year, there has been a noticeable decline in the amount of greater fools buying in the bubble markets.

Danbury Station in Washington, DC

Danbury Station is offering "new townhomes in Washington DC. Just minutes from Bolling Airforce Base and I-295. Offers one car garages." Based Priced from the 300's.

"Danbury Station is conveniently located near Bolling Air Force Base and I-295 at the intersection of S. Capitol Street and Danbury Street in the Southwest quadrant of Washington, DC. Danbury will be part of the new redevelopment of the Bellevue neighborhood!! Brand new Centex Homes floorplans will be introduced to this community which will include three levels of finished space, a rear load garage, 2 Bedrooms and 1-2 Bathrooms."

It is a low income neighborhood that has a high crime rate. Will Centex Homes be able to sell all the new townhouses under construction at their target price?

Monday, June 19, 2006

AP: Foreclosures may jump as ARMs reset

AP Title: Foreclosures may jump as ARMs reset

My Proposed Title: Foreclosures

Here are some highlights from the article:

This year, more than $300 billion worth of hybrid ARMs will readjust for the first time. That number will jump to approximately $1 trillion in 2007, according to the MBA. Monthly payments will leap too, many beyond what homeowners can afford.The increase in the number and dollar amount of adjusting ARMs over the coming years will be a significant factor in driving housing prices down. Some of these properties will go into foreclosure, while ohers will be sold by the owners in attempt to escape foreclosure.

"ARMs are a ticking time bomb," said Brad Geisen, president and chief executive of property tracker Foreclosure.com. "Through 2006 and 2007, I'm pretty sure we'll see a high volume of foreclosures."

Last year, foreclosures hit a historical low nationwide at about 50,000. But that number has more than doubled since then, according to Foreclosure.com.

It is indeed sad to watch naive home buyers, who just wanted a house to live in, forced out due to adjusting mortgages. People should be more informed. It is after all, most likely, the biggest purchase of one's life. Yet, at the very same time, mortgage brokers have a responsibility to lend responsibly.

Bubble Sphere Roundup

Housing Panic has a terrific post about two real estate agents in the Phoenix area who are reporting very differently about local market conditions.

Marin Real Estate Bubble has a post titled 'Losing on Real Estate is "A Matter of Perspective" '

Updated graphs for Sacramento market.

Over at Urban Digs there is a solid post about, CPI, short term interest rates, FOMC etc.

Friday, June 16, 2006

Freddie Mac Can't Get Their Books Right

U.S. Assistant Treasury Secretary Emil Henry Thursday cited "new and troubling revelations that Freddie Mac's accounting and internal controls continue to be in disarray."In a speech in which he first centered on Fannie Mae's recent $400 million settlement to resolve accounting and other problems, Henry said of Freddie Mac that "they have recently reported that they can 'begin' the registration process" with the Securities and Exchange Commission only after releasing full year 2006 results.

Is it reasonable for Freddie Mac to begin this process over five years after announcing that they would register with the SEC?" the Treasury official asked.Just as troubling, he said, is Freddie Mac's recent announcement that it needs to limit the number of internal controls initiatives and defer "lower priority" internal control efforts.

What a mess. :-(

Thursday, June 15, 2006

What's Next for The MLS?

If there i’s one consensus among almost everyone interviewed for this article, it'’s the need for the nearly 900 MLSs nationwide to consolidate further. Although more than 100 regional and statewide MLSs already exist, the 2006 MLS Technology Survey conducted by the Center for REALTOR® Technology found that 55 percent of REALTORs® surveyed would like to see more regional or statewide MLSs and 47 percent of the MLSs surveyed had discussed consolidation. The disagreement comes in the degree.Read it. What do you think?

Wednesday, June 14, 2006

Mr. Lereah is Backpedaling!

The housing standoff between buyers and sellers in South Florida will continue for another six months, and then prices in some areas will fall, a well-respected economist predicted Tuesday. In some cases prices may fall by 10 percent to 15 percent, said David Lereah, the National Association of Realtors’ chief economist.Adjust for inflation, and you have even larger real dollar price declines. Ain't looking so soft!

"Lereah pegged the end of the housing boom to August 2005." Sounds about right to me.

Quick Links

Northern Virginia Blog has terrific charts with the latest MRIS numbers showing housing market conditions in this bubblicious market.

Recent Housing 'Investors' Are Hurting

For example, back on August 19, 2005 a flipper from San Diego bought a lovely 2br, 2ba condo located in Arlington County, in Northern Virginia (DC Suburbs). The address is 880 N POLLARD ST # 1025. It was bought for $591,300 on 8/19/2005 by someone from San Diego, CA. It has 1040 sq. feet. In the Craigslist post it states "$485000 - OPEN SUNDAY 1-4: STEAL A Brand New 2 BD/2BA Ballston Condo."

Below information comes from ZipRealty (MLS # AR5530848) : Days on Market: 125

Price Reduced: 03/10/06 -- $520,000 to $515,000

Price Increased: 03/11/06 -- $515,000 to $520,000

Price Reduced: 04/21/06 -- $520,000 to $515,000

Price Reduced: 04/22/06 -- $515,000 to $505,000

Price Reduced: 05/06/06 -- $505,000 to $499,900

Price Reduced: 06/09/06 -- $499,900 to $485,000

Additionally, there are 8 other condo units available for sale in this building that are listed on the MLS. (There may be some not on the MLS).

It was bought for $591,300 and is now being sold for $485,000. If the flipper from San Diego recieves the full asking price they will have lost at least $106,300. Ouch! It was never even rented out as it is "Brand new! Never lived in! " Add in carrying cost losses which are in the tens of thousands of dollars and we have a huge financial loss for this unsuccessful flipper.

'Investors' are a large portion of the housing market especially in the bubble markets. As recent specuvestors and flippers in the bubble markets wake up to their continuing financial losses, many of them will try and sell. Inventory is already exploding, while demand is falling.

Tuesday, June 13, 2006

Harvard's 'The State of the Nation’s Housing' Study is Funded by The Housing Industrial Complex

The housing boom came under increasing pressure in 2005. With interest rates rising, builders in many states responded to slower sales and larger inventories by scaling back on production. Meanwhile, the surge in energy costs hit household budgets just as higher interest rates started to crimp the spending of homeowners with adjustable mortgages.Reporting on the study, Reuters adds " Major house-price declines seldom occur without "severe" overbuilding and major job losses, or a combination of "heavy" overbuilding and modest job losses, according to the study" The Housing Bubble Blog also reports about the housing study.

Nevertheless, the housing sector continues to benefit from solid job and household growth, recovering rental markets, and strong home price appreciation. As long as these positive forces remain in place, the current slowdown should be moderate.

Housing Panic rightly points out that Harvard's Joint Center for Housing Studies is in large part funded by the housing industrial complex:

It is a sad state of affairs. If the report had warned of a housing bubble would the Joint Center for Housing Studies still get as much funding from the housing industrial complex? Doubtful.

HP'er Panicearly did some easy digging, and yup, Harvard's Joint Center for Housing Studies, who issued the report? Bought and sold by every major member of the corrupt REIC. Harvard is their bitch, and the report is a big wet kiss to their donors. Don't worry, masses, there is no bubble, there is no meltdown underway. Support our sponsors - Beazer, Centex, Countrywide, the corrupt Fannie Mae, etc etc etc.

Bernanke: Most in U.S. manage money well

U.S. households overall have been managing their personal finances well. On average, debt burdens appear to be at manageable levels, and delinquency rates on consumer loans and home mortgages have been lowReally? That is news to me. How about the Negative US Savings Rate? This is exactly the time where you would expect a high savings rate, as retirement is fast approaching for tens of millions of baby boomers .

In the very same speech Mr. Bernanke talks about the 'democratization of credit ' and goes on to say "Payday lending outlets, a source of credit that was almost non-existent a decade ago, now number more than 10,000." The explosion of payday lending outlets is NOT something to cheer. These payday lending outlets cater to low income people who are often living paycheck to paycheck.

In large part, American's personal finances are in a sorry state. Mr. Bernanke states "U.S. households overall have been managing their personal finances well." Mr. Bernanke is wrong here, and the doubts about his leadership have thus grown.

Monday, June 12, 2006

The Motley Fool Takes on NAR and David Lereah

Year over Year Median Sales Price Stagnates in Northern Virginia

The total number of housing units sold in May 2006 declined 32% compared to May 2005. Northern Virginia includes "Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA"

The total number of housing units sold in May 2006 declined 32% compared to May 2005. Northern Virginia includes "Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA"The number of active listings in Northern Virginia stood at 11554 in May 2006, which represents an increase of 240.3% from May 2005 when active listings were at 3395. The average days on market (DOM) for housing units that sold in May 2006 was 51 which was 240% more days then the 15 days in recorded in May 2005.

In Northern Virginia there is a declining number of sales, declining real dollar prices, and an exploding amount of housing inventory. There will be no soft landing in Northern Virginia or in other bubble markets.

Sunday, June 11, 2006

Bubble Sphere Roundup

Lots of great posts in the Bubble Sphere this week!

Southern California Bubble found this 'atrocious' real estate posting on Craigslist. Its bad enough they did not know how to spell, but they also put the ad in the 'Apartments for Rent' section of Craigslist. It should be in the 'Real Estate for Sale' section instead.' Its placement in that section violates Craigslist's rules.

Check out Calculated Risk's post about April's 63.4 billion dollar trade deficit.

Housing inventory is exploding in the Phoenix area. The Bubble Markets Inventory Tracking blog has an update on this most bubblicious place. Do I hear 50,000?

The Matrix blog has a noteworthy post about the difference in the rise of imputed rents vs. home prices and how that affects the Consumer Price Index (CPI).

Taking a look at the lighter side. Patch Tuesday has a bubblicious cartoon. :-) Housing Panic posts this YouTube music video about Greenspan, Bernanke, inflation and interest rates. Very, very funny!

Please stay tuned for a hard hitting post for tomorrow.

Watcha Gonna do Ben?

So what is the Federal Reserve Board going to do with interest rates over the coming months?

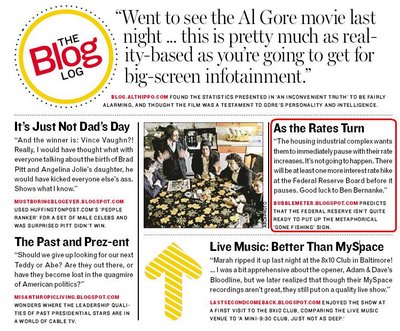

The housing industrial complex wants them to immediately pause with their rate increases. Its not going to happen. There will be at least one more interest rate hike at the Federal Reserve Board before it pauses. Good luck to Ben Bernanke. You have inherited a very tough job from Mr. Greenspan.

Friday, June 09, 2006

Rent vs Buying A Similar Property

The for rent rowhouse is located at 1203 I Street NE in Washington, DC. It rents at $1750 a month. "Newly Renovated 3BR, 1.5 BA Townhouse with updated baths, brand new appliances, new blinds, new hardwood floors, and carpet. Contains exposed brick interior, french doors, washer/dryer, Central AC/Heat, security system and off-street parking. Ready for immediate occupancy. Minutes from Union station metro, seconds to Metro-bus"

The for sale rowhouse is located at 1237 I ST NE in Washington, DC. It is available for sale at 525,000. 3br 3 ba. "Gorgeous victorian close to h st. And noma dev., union station. Great finishes thru-out - crown moldings, tray ceilings, gleaming hardwoods, gourmet kitchen, deck, fireplace, masterbath w/jacuzzi and so much more!!! Tenant occupied but will deliver vacant.,1,224 Sq. Ft" MLS#: DC6079106

These two 3br renovated rowhouses are located on the same block and their 2007 assessed values differ by less then 10,000.

Let us calculate the cost of buying. At 525,000 lets assume one has decent credit and takes out a loan for the full amount and pays an average rate 6.7% using a 30yr fixed mortgage. Your monthly mortgage payment would be $3387 according to bankrate. Minus mortgage tax deductions of perhaps $900 a month. Taxes will run about $200 a months and maintenance and insurance costs will add in another $450 a month.

- Total Ownership Costs: ~$3150

- Total Renting Costs: $1750

Thursday, June 08, 2006

Homebuilders' Stock vs.Nasdaq vs. S & P 500

This chart shows the performance of homebuilding stocks vs. The S&P 500, NASDAQ and the Down Jones U.S. Home Construction Index. The Dow Jones U.S. Home Construction Index charts the stock prices of home builders. Since stock prices generally reflect expected future earnings of a company based on all currently available data, the Home Construction Index gives a sense of what Wall Street expects the housing market to do in the future. Notice that homebuilding stocks even dwarf the late 1990's NASDAQ stock mania. [Thanks to James Parson who sent this information to me]

This chart shows the performance of homebuilding stocks vs. The S&P 500, NASDAQ and the Down Jones U.S. Home Construction Index. The Dow Jones U.S. Home Construction Index charts the stock prices of home builders. Since stock prices generally reflect expected future earnings of a company based on all currently available data, the Home Construction Index gives a sense of what Wall Street expects the housing market to do in the future. Notice that homebuilding stocks even dwarf the late 1990's NASDAQ stock mania. [Thanks to James Parson who sent this information to me]

Wednesday, June 07, 2006

Tuesday, June 06, 2006

NAR to Bernanke: Don't Raise Rates

The National Association of Realtors on Tuesday lowered its forecast for U.S. home sales in 2006 and called on the Federal Reserve to stop raising interest rates because parts of the housing market are "vulnerable."Mr. 'soft landing' Lereah is saying that some markets are 'vulnerable' to interest rates hikes. They are vulnerable with or without the interest rate hikes. Other things being equal, the interest rate hikes at the Federal Reserve make housing markets even more vulnerable to price declines.

"Experiencing a slowing from a hot market is a good thing because we need a solid housing sector to provide an underlying base to the economy, and slower appreciation will help to preserve long-term affordability," said David Lereah, the group's chief economist, "But this is a time for the Fed to pause on rate hikes because we have some interest-sensitive housing markets that have become vulnerable.," he said

According to the National Association of Realtors, even the bubble markets will only experience price declines if 'extremely unlikely scenarios' occur. In their anti bubble reports, we have a stress test for Miami:

The local housing market will experience a price decline of 5% only under extreme unlikely scenarios. For example, mortgage rates rising to 8.3% in combination with 60,000 job losses could lead to a price decline.The National Association of Realtors is now in the comical position of telling the Federal Reserve to not raise rates. I smell desperation. Mr. Lereah needs to remember that interest rates on mortgages are still historically low.

Crab Feast To Sell Condos in Silver Spring

Mica Condos has a new promotion in an attempt to sell their overpriced condos. :-)

Thank you for registering for MICA's all-you-can-eat hard-shell crabs. Live music poolside. Just come in through the lobby and check out MICA's beautiful models and amenities. Then, join the crab feast-plus, you'll have a chance to win a cool weekend getaway and other great prizes. Hot fun in the summertime!

Here are some previous posts regarding the Mica Condo development:

- Latest Promotion for Mica Condos (4/21)

- Mica Condos Update (4/3)

- Mica Condos in Silver Spring (3/21)

- Selling at Mica Condo in Downtown Silver Spring (3/7)

Last time I checked crabs live in the water with lots of bubbles. Oh the irony!

Housing Bubble Blogs Falling Like Flies

- Crash 2006

- OverPriced DC

- Overvalued

- Thereisnohousingbubble (former satire site)

- Housing.com Blog (domain is being sold)

Housing.com is being sold. Others may have been hacked. These were quality blogs. The losses of these five blogs in recent weeks is disappointing. Despite, these losses the bubblesphere is strong and will continue to spread the truth.

Monday, June 05, 2006

Ben Bernanke Speech

In addition, the Committee must continue to resist any tendency for increases in energy and commodity prices to become permanently embedded in core inflation. The best way to prevent increases in energy and commodity prices from leading to persistently higher rates of inflation is by anchoring the publicÂ’s long-term inflation expectations.Ben Bernanke concludes with the following:

Our economy has reaped ample rewards in recent years from the achievement and maintenance of price stability. Although challenges confront us, as they always do, I am confident that we will be able to preserve those hard-won benefits while promoting sustainable economic growth.At the FOMC June meeting, Mr. Bernanke will raise rates again. I continue to expect a .25% increase.

June FOMC Meeting

- It needs to tame inflation (especially asset inflation)

- Defend a sliding dollar (its at ~1.2950 now)

- Making sure money keeps flowing to fund US debt

NAR Blog has NOT been Updated Recently

Have they given up?

What's up Mr. Lereah?

Having a little trouble keeping up with the housing bubble bloggers?

Sunday, June 04, 2006

Q & A Time

Certainly not. I strongly believe in the value of homeownership if and when the time is right. Homeownership, generally has many benefits such as forced savings (if you don't have a interest only or negative amortization loan), and increased stability in communities. While homeownership is certainly part of the 'American Dream;' In bubble markets it can easily become an American Nightmare. Buying today, in the bubble markets at near peak is financial folly. Be warned!

Given the last quarters' annualized 5.3% GDP growth, how can you continue to predict that a recession is coming soon?

Recent GDP growth has been largely built on an 'empire of debt.' The debt is being created in the form of US Treasury Bonds, mortgage back securities and credit card debt. In May, job growth was just 75,000 which is well below the 150,000 new jobs required per month just to keep up with a growing labor force population. "Outstanding household debt doubled to more then 10 trillion between 1992 and 2004, even adjusted for inflation (Empire of Debt, p 293)". Simply put, there are too many things that are unsustainable in the US economy. As the housing market continues to decline, it will push the US economy over the tipping point and solidly towards a recession. In 2007, the US economy is very likely to be in the midst of a recession.

Who is you least favorite housing 'expert'?

David 'Soft Landing' Lereah who is the chief economist for the National Association of Realtors. Mr.

Some have called you a prophet of doom. Are you?

No. I am not a prophet of doom. I am merely a prophet of upcoming economic gloom. A prophet of doom might say we are headed for a depression. My prediction is for a recession, not a depression. Thus gloom, not doom.

Bubble Sphere Roundup

Over at Urban Digs has a post comparing new listings between April to May in a collection of selected neighborhoods in New York City. There is also a solid graph. "Well on first glance I can't help but notice the surge in new listings in the $501K-$750K price group in May versus April; which is about a 51% increase month to month. In fact, every price group under $1M has experienced an increase in new listings with the exception of the little guys under $250K which stayed the same! The higher end listings data is erratic with a jump in the $3.001M+ price group but a notable decline in the $2.001M-$2.5M price group." Check out Urban Digs.

There is a fantastic discussion over at The Housing Bubble Blog as to which market is Ground Zero for the Housing Bubble . I'm leaning towards Phoenix. Although, most of Florida is NOT far behind.

The Southern Maryland Housing Bubble News is busy investigating and reporting on the apparent fraud going on involving supposed 'non profits' and real estate.

The Washington Post has an article that looks at how 'Condo Fees Are Escalating at a Shocking Pace.' Another reason to rent in the DC area.

Thursday, June 01, 2006

OFHEO 1Q Housing Data is Out

Calculated Risk has this post about the report.

Hurricane Season is Here

Unfortunately, the 2006 Atlantic Hurricane Season has officially begun. The pain and suffering that hurricanes cause is tragic. I hope that this hurricane season will be very mild.

Unfortunately, the 2006 Atlantic Hurricane Season has officially begun. The pain and suffering that hurricanes cause is tragic. I hope that this hurricane season will be very mild.Skyrocketing, Hurricane insurance premiums are already financially squeezing many homeowners in the hurricane zone.

The skyrocketing rates and the hassle of dealing with the effects of living in a hurricane zone are putting a damper on housing prices. As we move towards the heart of hurricane season prices in hurricanes zones are especially vulnerable to price declines.

How many flippers and specuvestors will be buying in the sunshine state (FL) during the coming months given the following:

- Rents don't come anywhere near to covering carrying costs

- Housing prices are declining

- Inventory is exploding

- Hurricanes are brewing

In bubblicious Florida, and in other bubble markets located in hurricane prone zones, the 2006 hurricane season, is very likely to further housing price declines that are already a reality.