Check out the National Association of Realtors

Questions & Answers page regarding the housing bubble. It attempts to dispute the housing bubble theory. It is a great read:

Housing Bubble Prospects Q&AWhat is a housing bubble?As broadly interpreted, a housing bubble refers to an unsustainable gain in home prices. The premise is that a price bubble is at risk of “popping,” resulting in a loss of equity.

Has there ever been a national housing price bubble?No, not since good recordkeeping began in 1968. There was a national decline in the 1930s during the Great Depression; however, home prices were not a prime concern in that era. The greatest issues were essentials such as food, clothing, employment and shelter of any kind. Declining home prices were a natural result of a general economic collapse caused by the stock market crash in 1929.

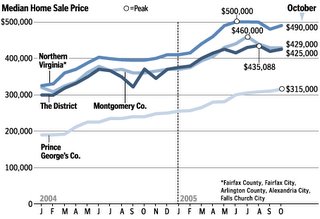

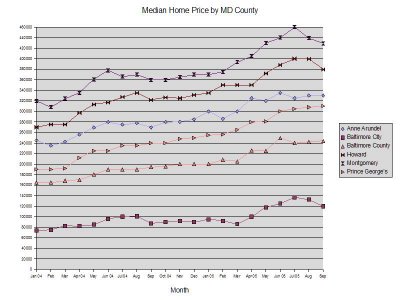

What is the “normal” rate of home price growth over time?Since 1968, the national median existing-home price has increased an average of 6.4 percent per year. However, that includes a period of high inflation. A better frame of reference is in relation to the overall rate of inflation. Home prices typically have increased 1.5 percentage points faster than the rate of inflation, as measured by the Consumer Price Index.

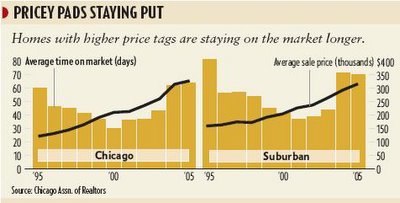

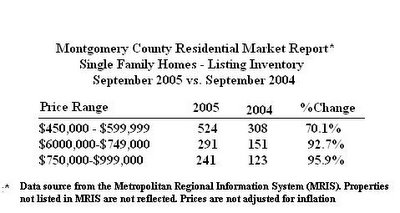

What are the biggest factors that drive home prices?In simple terms, it gets down to supply and demand. The inventory of homes available for sale has been historically low since 2001, which is why home prices have been rising at above normal rates.In a balanced market between home buyers and sellers, there typically is a six-month supply of homes on the market. Over the last four years, the supply has hovered around 4.5 months. By contrast, in the recessionary period of 1990-1991, there was in excess of a 9-month supply.

What conditions are necessary for home prices to soften or decline?Generally, two conditions are necessary for price softness in a given area: an oversupply of homes available for sale, and adverse economic conditions – generally a weak local job market. Sometimes these conditions occur against a backdrop of overall economic weakness, recession or high interest rates.

Where and when have home prices declined in the past? What were the general market conditions?Most metropolitan areas, especially in the Midwest and South, have not experienced price declines in the era of modern recordkeeping. In the period from the mid-1980s though the early 1990s, many metros in the Northeast and on the West coast saw localized declines. Typically, this occurred in large population centers with very little capacity for growth. When housing shortages developed during a period of high demand, prices grew at sharp double-digit rates – often over 20 percent per year – for several consecutive years.After local economic conditions declined in those areas, home sales stalled and the inventory of unsold homes rose, which eventually led to price softness or decline.

How long have home prices declined in the past?Although there are exceptions to any general finding, most metro areas that experienced price declines were relatively short lived (several years). Most homeowners who went through such downturns -- but stayed in their home for a normal period of homeownership -- still netted healthy gains when they sold. People view homeownership as a long-term investment as opposed to the kind of quick-in, quick out investment that Wall Street is fond of. Unlike stocks, homeowners don’t panic sell simply because a home down the street sold for less. Home prices tend to be sticky on the downside -- usually a single digit decline in any given year following a sustained period of double digit gains. Very few people buy at the top of a market and then sell in a short timeframe. After several years, home prices level and return to normal appreciation patterns.

Should we be concerned that home prices are rising faster than family income?No. There are three components to housing affordability: home prices, income, and financing costs – the latter are historically low. During the last four-and-a-half years of record home sales, there has been a shortage of homes available for sale. As a result, home prices during this period have risen faster than family income. However, in much of the 1980s and 1990s, the reverse was true – incomes rose faster than home prices.On a national basis, according to the Housing Affordability Index published by the National Association of Realtors, a median income family who purchases a median-priced existing home is spending a little over 20 percent of gross income for the mortgage principal and interest payment. In the early 1990s, a typical mortgage payment was in the low 20s as a percent of income, and in the early 1980s it was as high as 36 percent. Overall housing affordability remains favorable in historic terms.

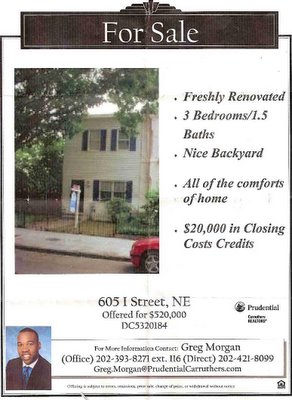

What are the prospects of a housing bubble?There is virtually no risk of a national housing price bubble, based on the fundamental demand for housing and predictable economic factors. It is possible for local bubbles to surface under the right circumstances, but that also is unlikely in the current environment. There are tight supplies of homes available for sale in most of the country, and labor markets have been improving. In other words, the two conditions necessary for price softness do not exist in most of the country.The strong underlying demand for homes results from the simple fact that the population is growing faster than the supply of homes. In addition, it is highly unlikely that the cost of construction will decline. In fact, construction material shortages are expected to continue and the cost of building and development is trending up. Baby boomers remain in their peak earning years. Echo boomers – the children of the baby boom generation – are just entering the period of life in which people typically buy their first home. The echo boom is the second largest generation in U.S. history. Considering the median age of a first-time buyer is 32, echo-boomers will be a big factor over the next decade. In addition, immigration has been strong for many years. Census data shows that immigrants eventually achieve homeownership rates higher than do native born Americans – this also will be a strong factor in housing demand in the future. Also, minority ownership rates have been trending up. All this means the demand for housing is historically high and is one of the reasons 2005 will be the fifth consecutive year of record home sales. Even in an economic downturn, the demand remains.

If conditions become unfavorable, home buying may be postponed, but a general price decline remains highly unlikely.What is likely to happen with home prices?The forecast is for mortgage interest rates to rise slowly over the next year, which will have a minor breaking effect on home sales. The good news is that will help inventory levels to recover and allow the market to come into a closer balance between buyers and sellers.In other words, a general slowing in the rate of price growth can be expected, but in many areas inventory shortages will persist and home prices are likely to continue to rise above historic norms.