Friday, September 29, 2006

BubbleSphere Roundup

Keith says HP message to the REIC - kiss my blogger butt. For those who don't know REIC = is the Real Estate Industrial Complex.

Mortgage & Loan: Focused Like A Lazear @ Housing.com Blog.

The most informative Paper Money report that Home prices are being SLASHED! In Massachusetts. Perhaps a bit dramatic, but the blogger blogs "Ouch! You can chalk another mark up in the column of total housing collapse in Massachusetts."

Banks more exposed to residential real estate. Oh my!

Wednesday, September 27, 2006

To Buy or Not To Buy That is The Question

The housing market has changed dramatically in the bubble markets over the last year. Back in the summer of 2005 bidding wars were common and inventory was very low in the bubble markets across the USA. Those days are a sweet memory to the legions of stuck flippers.

Today, a new reality faces both buyers and sellers. Its the Inventory Stupid! Inventory has increased dramatically in most bubble markets in the past 12 months. In Phoenix, inventory rose from 10,748 on 7/20/05 to 54,441 on 9/23/06 according ZipRealty and Bubble Markets Tracking Inventory. The inventory of houses for sale in the San Fernando Valley (the Los Angeles area) has more than doubled since August 2005 (DataQuick).At the same time the number of housing units sold has fallen dramatically in the bubble markets compare with a year ago. The California Association of Realtors reported that housing sales decreased 30.1 percent in August 2006 compared to August 2005.

Some real estate agents are claiming that is now a 'buyer's market' due to the increased inventory, lack of bidding wars and the small reductions in prices. Blanche Evans , Editor of Realty Times thinks it is a good time to buy. “You can get a better price on a better home that will pay off when the slump ends.”

So is it a good time to buy in the bubble markets?

In many bubble markets, the peak price was reached late summer 2005. Real prices will continue to decline in the bubble markets for many more years. Prices declines in the bubble markets are very likely to vary between 20% - 65 in real dollars (inflation adjusted) from peak to bottom (it may take up to 8 years). Most of the real dollar price decline will occur in the first 3 years of the housing bust. Indeed, the huge price appreciation that occurred in the bubble markets over the past 5 years or so was a speculative episode.

Just as importantly, monthly rents are generally cheap compared to buying in the bubble markets. Buying in the bubble markets generally costs 1.25 to 2.5 times the cost of renting ( for a similar property; assuming 30yr fixed, solid credit, property taxes, and typical interest rate tax deduction). Each month hundreds if not thousands of dollars can be saved and invested if one chooses to rent as opposed to owning.

Buying now in a bubble market does not make financial sense. As housing inventory continues to rise and prices decline there will be lots of buying opportunities in the future. Additionally, an economic recession in very likely to occur in the US within the next 9 months. If you earn a reasonable income it is an absolute fallacy that you need to "Buy now or be priced out forever." This is not a small temporary 3 months dip like Mr. Lereah suggested. In the bubble markets, this is a multiyear housing market bust. In the Bubble Markets, renting and waiting is fiscally prudent. Don't be fooled.

What happens if I just walk away

In their subsequent post the desperate seller writes:

We made an extremely bad investment 4 years ago when we bought our condo. There are several foreclosed units in our community, making it impossible to sale. We're asking 30% less than we paid and can't even get buyers to look at our property. The neighborhood is going downhill fast. I have personally witnessed drug deals, gang activity and people fornicating in park cars outside our house.

We want out, right now we have good credit and are current on all bills. But I am willing to throw it away to get out.

As a last resort we are considering buying a new house while our credit is still good and waling away from the condo. Anyone have any thoughts? What would happen if we just cut our loses now and let the bank take it back.

I forgot to mention a few more key points that are leading us to explore this idea.Looks like they bought a newly built condo in a marginal neighborhood. Despite buying 4 years ago and listing it at a 30% less then they paid, they still are having trouble selling. This condo project must have been an absolute disaster. Yikes!

The property is in colorado, the builder walked away from the property 6 months ago with 3 buildings left to build. The builder ran out of money to pay his subs so the subs posted leins againt the entire community. It think that about sums it up

Thanks for your input

ARM Adjusting on Condo, owe more than it's worth

People are hurting. The housing bubble, which is a speculative episode, is causing hardship across the United States.

I bought a condo in April of 2005 in San Diego with zero down, we got a 2 year ARM loan, so in April of next year it will adjust. We also have a heloc on the 2nd that started at 8%, but has gone up to over 10%. My neighbor is trying to sell for roughly the same price we bought ours and is having no luck. I enjoy the place, but really don't care if I lose it. I am married, but I am the only one on the loan. My credit was good, so it gave us a better rate to just have me on the loan. When our loan adjusts, I will still be able to pay the loan, but almost all of our income would be going to it. What happens if I just walk away. I don't even care that much if my credit is screwed up, because we can just go rent a place using my wifes credit. Will I owe the difference on the loan if I just walk away and have the bank sell it?

Tuesday, September 26, 2006

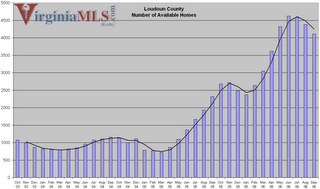

Housing Inventory in Northern Virginia Down Slightly in Past 3 Months

In Northern Virginia (Alexandria City, Arlington County, Fairfax City, Fairfax County, Falls Church City, Loudoun County, Manassas City, Manassas Park City, Prince William County) the active inventory has declined slightly during the past few months. On September 25th the inventory stood at 20,064 which is a 6% decline from July 1st, 2006, when active inventory was at 21,336. Source: VirginiaMLS.com

Monday, September 25, 2006

National Median Sales Price Falls Year over Year

Sales of previously owned homes in the U.S. fell in August to the lowest since early 2004, and prices fell from year-ago levels for the first time since 1995.

Purchases declined 0.5 percent last month to an annual rate of 6.3 million, from 6.33 million in July, the National Association of Realtors said today in Washington. Sales fell 12.6 percent compared with a year earlier.

The median sales price fell 1.7 percent to $225,000 from a year earlier, the first drop since April 1995, David Lereah, chief economist for the Realtors, said at a briefing. Federal Reserve policy makers, who last week held interest rates steady for a second month, expect housing will cool gradually to slow the economy and help curb inflation.The supply of homes for sale increased to 3.918 million, a 7.5 months supply that was the highest since April 1993, up from 7.3 months at the end of July. (Bloomberg)

David 'soft landing' Lereah, stated that "We've been anticipating a price correction and now it's here. The price drop has stopped the bleeding for housing sales. We think the housing market has now hit bottom.'' Think Again!

NAR: Sales Down, Prices Down, Inventory Up (Calculated Risk)

FLASH: Used home sales fall again, bogus price number shows first year-over-year price decline since 1995, Lereah predicts market has hit bottom (Housing Panic)

Friday, September 22, 2006

Mortgage Bankers Association Celebrates Exotic Mortgages

It is disgusting that the Mortgage Bankers Association is busy celebrating their toxic mortgages. They should be very alarmed by these ticking time bomb loans.

Fed Reserve is Trapped

Reasons To Raise Rates:

- Inflation Worries. As "readings on core inflation have been elevated, and the high levels of resource utilization and of the prices of energy and other commodities have the potential to sustain inflation pressures."

- Attract Inflow of Foreign Capitol.

- Recession Fears "The moderation in economic growth appears to be continuing"

- Don't want to cause a meltdown in the housing market. As there is already "a cooling of the housing market.

Thursday, September 21, 2006

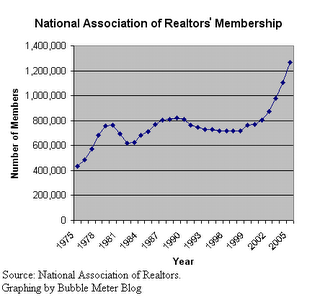

Is There a Realtor Bubble?

Members of the National Association of Realtors (NAR) are called Realtors. As of 8/31/2006 there were 1,354,468 Realtors. The above graph only shows full years, thus 2006 is not graphed. [I posted this post earlier this year]

The number of Realtors has grown tremendously over the past 5 year. This corresponds precisely with the housing bubble years. Is there a Realtor bubble?

Wednesday, September 20, 2006

FOMC Pauses Again

"The moderation in economic growth appears to be continuing, partly reflecting a cooling of the housing market."

"Readings on core inflation have been elevated, and the high levels of resource utilization and of the prices of energy and other commodities have the potential to sustain inflation pressures. However, inflation pressures seem likely to moderate over time, reflecting reduced impetus from energy prices, contained inflation expectations, and the cumulative effects of monetary policy actions and other factors restraining aggregate demand."

"Nonetheless, the Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information."

BubbleSphere News

The Northern New Jersey Real Estate Bubble has moved and changed names and is now called the New Jersey Real Estate Report. Congratulations on the upgrade!

Tuesday, September 19, 2006

NAR: Learn How to Stay Hot in a Cooling Market

In one of the articles linked in their section it is written: "Make sure the price is right. Become masterful at pricing right the first time. Don’t add to the problem of oversupply and increased absorption rates. Every time a home is priced to “expire,” you increase the number of FSBOs on the market. How? When a listing expires, it’s not uncommon for the owner to get mad at the whole real estate profession. They might just try selling on their own the next time around." Heaven forbid they sould not use a Realtor!

David Lereah Watch Mentioned In Salon

Chicken Little's revenge

The August new-housing-start numbers are out, and they're not good, dropping by more than analysts expected.

But the heck with the numbers. According to David Lereah, chief economist at the National Association of Realtors, this was all to be expected. "The housing boom ended more than a year ago, but sellers are having a tough time accepting that fact," said Lereah. "The result has been tumbling sales as buyers stay on the sidelines.”

The busy beavers commenting at the Housing Bubble blog, who have been grinding their teeth over Lereah's self-serving interpretations of real estate data for years, were quick to dig up a quote from exactly "a year ago."

"With a general background of growing population and favorable affordability conditions, home sales are staying at very healthy levels," said Lereah. "As a result, we'll continue to see above-normal home price appreciation for the foreseeable future."

Lereah is quoted in nearly every article that reports new-housing data, as if he were some kind of impartial source, instead of a spokesman for the real estate industry and the author of a book whose 2005 title was "Are You Missing the Real Estate Boom?: Why Home Values and Other Real Estate Investments Will Climb Through the End of the Decade -- and How to Profit From Them." But personally, I didn't think the above quote was all that damning. So I went looking for more and found the latest proof that on the Internet, there really is a blog devoted to everything an info junkie could possibly need. I give you David Lereah Watch.

There, we can find a picture of a Power Point slide from October 2005, in which Lereah called two of the biggest predictors of a housing bust, Yale's Robert "Irrational Exuberance" Schiller and Dean "Beat the Press" Baker, "Chicken Littles." We also learn that in February, the title of his book was changed to "Why the Real Estate Boom Will Not Bust -- and How You Can Profit From It."

We're looking forward to the 2007 title: "Busted! Why You Should Have Listened to Chicken Little, Instead of Me."

Lereah's Latest Musings

"The housing boom ended more than a year ago, but sellers are having a tough time accepting that fact, says David Lereah, chief economist at the National Association of Realtors. The result has been tumbling sales as buyers stay on the sidelines.”

“The expansion that began in November 1991, when mortgage rates fell into single digits, became a boom following the 9/11 terrorist attacks, when trillions of dollars left the stock market looking for a safe haven in real estate, Lereah said.”

Mr. Lereah talked about the current 'correction' that the housing market is experiencing.

Source: (Times Union 9/19/06) Hat Tip: Ben Jones' Blog for finding this gem. Back in October of 2005, in his infamous anti-bubble reports, Mr. Lereah said that prices will not experience a 5% price decline unless there are high interest rates and or large job losses. For metropolitan Sacramento, CA their anti bubble report (pdf) stated that:“This correction is different from any others because it wasn’t triggered by a recession, high financing costs or job losses. With unemployment below 5 percent, mortgage rates still below 7 percent and a growing economy, ‘all you need is a price correction, a price adjustment, to bring the market back,’ Lereah told the crowd.”

“The transition to lower prices is already under way nationwide, Lereah said, and will result in a more balanced market than the one that has been dominated by sellers. He said the Capital Region experienced ‘a moderate boom’ without the extreme price run-ups or overbuilding seen in parts of California and Florida. As a result, ‘you don’t need as much of a price correction,’ he said.”

“Lereah predicted prices will drop nationally over the next six months, and that each percentage point drop ‘will bring thousands and thousands of buyers back into the marketplace.’”

The local housing market will experience a price decline of 5% only under extreme unlikely scenarios. For example, mortgage rates rising to 7.8% in combination with 25,000 job losses could lead to a price decline.

Neither of those things happened in Sacramento and yet prices are down 5%. Now Mr. Lereah claims says that "This correction is different from any others because it wasn’t triggered by a recession, high financing costs or job losses." This 'correction' was primarily triggered by the excess that resulted from the speculative episode. The fundamentals become totally disconnected from reality.

Monday, September 18, 2006

Real Estate, Mortgage Employment Declines

"Employment in the real estate and mortgage industries peaked at 504,800 in February, according to the Bureau of Labor Statistics. In June employment was at 503,100, a noteworthy decline given that the sector gained jobs at a rapid pace for most of 2001 through 2005."

"In May of 2001, essentially when jobs started gaining, 290,800 people were employed in the two industries."

"Peter Morici, economist and professor at the University of Maryland’s Robert H. Smith School of Business, views the downsizing of employment as a good development."

“When things shake out it is going to be the better sales men and women that will stay,” he says. “They are the ones who have built a reputation over time.” Source: Reuters, Julie Haviv (09/17/06)

FOMC Meeting on September 20th

On Wednesday, September 20th the Federal Open Markets Commitee meets to set short term interest rates. I expect another pause.

Sunday, September 17, 2006

BubbleSphere Roundup

The Socket Site blog is doing a tremendous job keeping up with the San Francisco housing market.

Many solid graphs at the Matrix Blog. These graphs show how unsustainable the housing boom has been.

Percentage of Reduced Listings Per Market brought to you by Bubble Markets Inventory Tracking. Excellent Post!

Over at Patrick.net they debate the State of the Landing.

There is a dearth of comments at the Realtors' Blog. Why?

Friday, September 15, 2006

Thursday, September 14, 2006

NAR's Written Statement Before The Senate Banking Committee

NAR represents a wide variety of housing industry professionals committed to the development and preservation of the nationÂ’s housing stock and making it available to the widest range of potential homebuyers.How does cheerleading dramatic home prices increases help the 'widest range of potential homebuyers?' The NAR continues in its written staement:

After five years of outstanding growth and being the driving force of the U.S. economy, the housing market is undergoing a period of adjustment. I have experienced this first hand as my prior home has been on the market, in Northern Virginia, for over a year. Existing home sales in July fell 11.2 percent from a year ago. New home sales are down 22 percent from a year ago. The inventory of unsold homes on the market is at an all-time high of 3.9 million, which is a 40 percent rise from a year ago. Given the falling demand and increased supply, home prices have seen less than 1 percent appreciation from a year ago compared to the double-digit rate of appreciation in 2005.Ok. Does the NAR think there is a housing bubble?

Contrary to many reports, there is not a '“national housing bubble.'” All real estate is local. For example, the housing market in California is extremely different from Oklahoma. Home price-to-income ratio, home price-to-rent ratio, and more importantly, mortgage debt servicing cost-to-income ratio have greatly increased in some markets to worrisome levels. Markets in Florida, California, Arizona, Nevada, Virginia, and Maryland exhibit trends far above the local historical norm, thus it would not be surprising for these markets to experience a price adjustment. However, these states have solid job growth – Because of solid job growth, price declines are likely to be short-lived as new job holders provide demand and support for the housing market.The "solid job growth" that the NAR speaks is made only possible because of the housing bubble. As the housing market declines the 'solid job growth' will reverse course and there will be layoffs in the housing industry. NAR on a what sort of landing there will be:

NAR understands that the housing sector could not maintain a record setting pace indefinitely. A soft landing is certainly possible and under the right circumstances likely, but that soft landing is critically dependent upon policies that support a transition to a more normalized market and mitigate changes in local markets in the availability of mortgage financing and other essential elements to homeownershipThey conclude by saying "The NAR stands ready to work with Congress to continue to open the door to the American Dream of Homeownership." A lower price would certainly help.

Wednesday, September 13, 2006

Peak Bubble: A Time To Remember

He called it "very unsophisticated." (Los Angeles Times Aug 28th, 2005)

CNN: Foreclosures Spike in August

NEW YORK (CNNMoney.com) -- With real estate markets slowing and mortgage rates well above levels of recent years, times are getting tougher for homeowners - the number of homes entering into some stage of foreclosure is surging, according to a survey released Wednesday.Expect foreclosures to rise even more as the housing market continues to decline and the US economy heads into a recession in 2007.

In August, 115,292 properties entered into foreclosure, according to RealtyTrac, an online marketplace for foreclosure sales. That was 24 percent above the level in July and 53 percent higher than a year earlier.

It was the second highest monthly foreclosure total of the year; in February, 117,151 properties entered foreclosure.

Some of the bellwether real estate market states are among the leading foreclosure markets. Florida, had more than 16,533 properties in foreclosure in August. That led all states and was 50 percent higher than in July and 62 percent higher than in August 2005.

California foreclosures are increasing at an even faster annual rate, up 160 percent since last year to 12,506. And the formerly red-hot Nevada market recorded a spike of 24 percent compared with July and a whopping 255 percent increase from August 2005. (CNN)

Tuesday, September 12, 2006

Congressional Hearing on The Housing Bubble

WASHINGTON (Reuters) - U.S. lawmakers will question some leading government and industry economists about the perils of a possible 'housing bubble' in a Wednesday hearing.For the current predicament: Too Little, Too Late. Nevertheless, new regulations regarding the real estate and lending industry are certainly needed. Paper Money has launched a mini campaign so that the hearing is aired on C-SPAN. I fully support this effort.

Lawmakers wanted the session "because we've heard a great deal about the possibility of a housing bubble for several years now," said Sen. Wayne Allard, a Republican from Colorado.

The hearing, "The Housing Bubble and its Implications for the Economy," will be held in an open session of the Senate Banking Committee at 10 a.m.. (Reuters)

David Lereah Watch Makes Chicago Tribune Article

Lereah and his fellow housing industry economists don't come out unscathed. Critics say they generated unfounded optimism that the housing market would soar perpetually.I had a 25 minute interview with the reporter for this story. She ended up quoting something that was already published on the David Lereah Blog. The housing industrial complex need to be challenged. David Lereah and the National Association of Realtors have been engaging in digraceful behaviour.

"In October 2005 Lereah was busy calling the bubble believers `Chicken Littles,'" goes one post in a blog dedicated to criticizing the economist, davidlereahwatch.blogspot.com. "Many of the predictions espoused by the `Chicken Littles' are fast becoming closer to reality. ... David Lereah has lost credibility because of his irresponsible cheerleading."

Vancouver Condo Market

I run a blog with a satirical / humorous slant on our local market at Hello from Vancouver BC, the most expensive city in Canada! I run a blog with a satirical / humorous slant on our local market at Vancouver Condo Info. My real name is not ‘the pope’ but it’s a pseudonym that will work fine for our purposes here. David asked for a summary on what’s happening in our market, so here it is:

With the 2010 winter Olympics coming to Vancouver we’re all giddy about the limitless heights that our real estate prices can rise to. We’re particularly fond of our condos – prices are approaching double of what they were just four years ago in some areas. By my estimates a 450 sq ft. ‘garden level’ condo on a major road will be worth 3 Million dollars by 2010. Real estate is making us richer, and it’s a good thing since average family incomes in Vancouver actually dropped from 2000 – 2004 according to statcan and immigration has been flat. Clearly real estate here is a better investment than employment, so we’re all jumping into the debt-pool with lots of faith that ‘foreign investors’ will fish us out later.

When we see signs of a slowdown in the US, it just proves to us what a good investment Vancouver is. The local media is filled with warm and fuzzy quotes from realtors about how ‘it’s a great time to buy - things are different this time’ and reasons that ‘it can’t happen here’. We did see a minor dip in sales this last July –they were 28% lower than the previous July, but we also had the highest housing starts ever this July – everywhere you look there are new condo towers going up.

There was one negative report recently from PriceWaterhouseCoopers that warned of too much inventory in the condo market, but we’ve pretty much ignored that – we like to focus on the positive. And hey, what’s the worst that could happen? If we end up with two condos for every resident than we double our space from 450 to 900 sq feet and we’re already used to dining on Kraft Dinner to afford our housing cost. The futures so bright I’ve got to wear blinders!

-T.Pope . My real name is not ‘the pope’ but it’s a pseudonym that will work fine for our purposes here. David asked for a summary on what’s happening in our market, so here it is:

With the 2010 winter Olympics coming to Vancouver we’re all giddy about the limitless heights that our real estate prices can rise to. We’re particularly fond of our condos – prices are approaching double of what they were just four years ago in some areas. By my estimates a 450 sq ft. ‘garden level’ condo on a major road will be worth 3 Million dollars by 2010. Real estate is making us richer, and it’s a good thing since average family incomes in Vancouver actually dropped from 2000 – 2004 according to statcan and immigration has been flat. Clearly real estate here is a better investment than employment, so we’re all jumping into the debt-pool with lots of faith that ‘foreign investors’ will fish us out later.

When we see signs of a slowdown in the US, it just proves to us what a good investment Vancouver is. The local media is filled with warm and fuzzy quotes from realtors about how ‘it’s a great time to buy - things are different this time’ and reasons that ‘it can’t happen here’. We did see a minor dip in sales this last July –they were 28% lower than the previous July, but we also had the highest housing starts ever this July – everywhere you look there are new condo towers going up.

There was one negative report recently from PriceWaterhouseCoopers that warned of too much inventory in the condo market, but we’ve pretty much ignored that – we like to focus on the positive. And hey, what’s the worst that could happen? If we end up with two condos for every resident than we double our space from 450 to 900 sq feet and we’re already used to dining on Kraft Dinner to afford our housing cost. The futures so bright I’ve got to wear blinders!

-T.Pope

Monday, September 11, 2006

Sunday, September 10, 2006

A Million Page Views

Thank you to all the visitors who read this blog. :-)

A double thank you to all the commentators who comment on my postings. The citizen reporters who email me bubblicious tips are especially thanked. Keep it coming. :-)

A real special thanks to my fellow bubble bloggers. You are truly an amazing group of people.

Blogging will continue as the housing market continues to decline. So much more is left to report, discuss and digest in the coming years.

Washington / Baltimore Area August 2006 Numbers

Northern Virginia (Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA (NVAR))

- Median Sales Price YoY: - 8.06%

- Average Sales Price YoY: -3.44%

- Total Units Sold YoY: - 34.8 %

- Average Days on Market YoY: 219%

- Active Listings YoY: 126%

- Median Sales Price YoY: 4.96%

- Average Sales Price YoY: 4.54%

- Total Units Sold YoY: - 25.41%

- Average Days on Market YoY: 65%

- Active Listings YoY: 103%

Washington, DC (just the District of Columbia, no suburbs)

- Median Sales Price YoY: - 8.70%

- Average Sales Price YoY: -5.20%

- Total Units Sold YoY: - 34.39%

- Average Days on Market YoY: 103%

- Active Listings YoY: 139%

Prince George's County, MD

- Median Sales Price YoY: 8.73 %

- Average Sales Price YoY: 6.94%

- Total Units Sold YoY: - 19.72%

- Average Days on Market YoY: 86%

- Active Listings YoY: 142%

Montgomery County, MD

- Median Sales Price YoY: 2.51%

- Average Sales Price YoY: 1.52%

- Total Units Sold YoY: - 26.60 %

- Average Days on Market YoY: 159%

- Active Listings YoY: 121%

Loudoun County, VA

- Median Sales Price YoY: - 3.87%

- Average Sales Price YoY: - 14.22%

- Total Units Sold YoY: - 47.36%

- Average Days on Market YoY: 232%

- Active Listings YoY: 95%

Friday, September 08, 2006

More Deception From David Lereah

“The boom is cooling now,” said David Lereah, the chief economist for the association, who added that falling home sales have been “a bit worse than we had anticipated.”As chief economist of the National Association of Realtors (NAR), David Lereah, is responsible for the economic forecasts. Back on October 28th, 2005 the NAR forecasted that:

The group said that it now expected sales to fall further than it has said in the past — about 7.5 percent this year compared with an earlier projection of a 5 percent decline.

So on October 28th, 2005 the David Lereah and the NAR forecasted that there would be a decline of 3.5% in existing home sales for 2006 compared to 2005. Now, Mr. Lereah is forecasting a decline of 7.5% for 2006.Existing-home sales are projected to decline 3.5 percent in 2006 to 6.86 million. New-home sales, seen to grow by 8.0 percent to 1.30 million in 2005, are expected to fall 4.5 percent to 1.24 million next year. The figures for 2006 would be the second highest year for each sector.

The September 2006 forecast is more then double the decline of the October 2005 forecast. Despite the large adjustment from his October 2005 forecast, David Lereah says that the decline is "a bit worse than we had anticipated." This is deceptive. Due to his cheerleading and continuing deceptions Mr. Lereah cannot be trusted.

Delinquency Rate Soars on Home Equity Loans

"According to Moody's, delinquent loans now represent nearly 7 percent of the total existing pool of home equity loans."

"This is the 11th consecutive month that the home equity delinquency growth rate has risen," Moody's Ben Garber said.

"The really bad news is that the more people who can’t pay their mortgages or home equity loans, the more likely it is that home prices will fall as they rush to sell the properties and get out of a bad situation."

Thursday, September 07, 2006

BubbleSphere Roundup

Out at the Peak reports how the California Association of Realtors change the rules of affordability. "These numbers were not acceptable to California Association of Realtors (C.A.R.), so they redefined the Housing Affordability Index." I'm glad they are being exposed for their tactics.

In many bubble markets, housing units are sitting on the market. Realtors are unhappy as sales are down. Solution: New realtor talking point: Lower the price or it ain't gonna sell. Instead of cheerleading rising prices, maybe the realtors will be cheerleading declining prices.

There is no real estate bubble ! or so declares Patrick. "I now agree with the housing bulls. There is no housing bubble. The bubble is no longer 'is', it is now 'was'. Yes, I think it's time to officially declare that there is no longer a housing bubble in USA. There was one, whose size, implications and aftermath are the only remaining questions. "

An Absolutely Amazing post is NAR's Forecast - Going Down, Down, Down in a Burning Ring of Fire. In it Frank from Florida Paradise Lost Blog lays a smackdown on the National Assocation of Realtors (NAR). The post shows how the NAR's original forecast for 2006 existing home sales was way off. The National Association of Realtors cannot and should not be trusted.

Wednesday, September 06, 2006

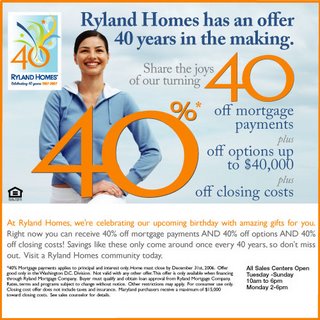

Ryland Homes' 40% Off Sale

Ryland Homes 40% Off Sale going on in the DC Area.

Ryland Homes 40% Off Sale going on in the DC Area.In celebration of our 40th Anniversary, we are passing on an anniversary gift that will save you thousands! Through September 30, you can receive 40% off options, closing costs, mortgage payments for a full year and more. See your local market for specific details*. Don’t miss the opportunity to purchase your dream home at a great savings during Ryland Homes’ 40th Anniversary sales event!The Ryland 40% off information can be found here. This is just the start of the incentives and price reductions that will be offered by the new homebuilders. They need to move their inventory as they take out large loans to finance most of their development.

Tuesday, September 05, 2006

OFHEO: House Price Appreciation Slows, OFHEO House Price Index Shows Largest Deceleration

U.S. home prices continued to rise in the second quarter of this year but the rate of increase fell sharply. Home prices were 10.06 percent higher in the second quarter of 2006 than they were one year earlier. Appreciation for the most recent quarter was 1.17 percent, or an annualized rate of 4.68 percent. The quarterly rate reflects a sharp decline of more than one percentage point from the previous quarter and is the lowest rate of appreciation since the fourth quarter of 1999. The decline in the quarterly rate over the past year is the sharpest since the beginning of OFHEO’s House Price Index (HPI) in 1975. The figures were released today by OFHEO Director James B. Lockhart, as part of the HPI, a quarterly report analyzing housing price appreciation trends.

“These data are a strong indication that the housing market is cooling in a very significant way,” said Lockhart. “Indeed, the deceleration appears in almost every region of the country.

This report is a lagging indicator. Please post your own findings in the comments section.

Monday, September 04, 2006

Market Conditions in the Bubble Markets

What is a Housing Bubble Market? A bubble market is any housing market where there will be a real dollar price decline of at least 20% from peak price over the course of three years. This is for a typical property. In most of these bubble markets, real dollar price declines will continue for much more then 3 years. Most of these bubble markets saw prices double or more over the course of five short years.

Where are the Housing bubble Markets? The bubble markets are located mainly in the following states; MA, CT, RI, MA, NY, NJ, PA, MD, DC, NJ, VA, FL, NV, AZ, NM, CA, OR, HI, WA, CO. Here are some metro areas that are bubblicious.

- Boston, MA

- Hartford, CT

- Providence, RI

- New York City, NY

- Baltimore, MD

- Philadelphia, PA

- Washington, DC

- Virginia Beach - Norfolk, VA

- Miami, FL

- Cape Coral - Fort Myers, FL

- Naples, FL

- Orlando, FL

- Tampa Bay - St Petersburg, FL

- Sarasota-Bradenton-Venice, FL

- Daytona Beach, FL

- Jacksonville, FL

- Tallahasee, FL

- Boston, FL

- Seattle, WA

- Tacoma, WA

- Bend, OR

- Boise, ID

- Merced, CA

- Bakersfield, CA

- Redding, CA

- Fresno, CA

- Modetso, CA

- San Francisco, CA

- San Deigo. CA

- Sacramento, CA

- Los Angeles , CA

- Stockton, CA

- Flagstaff

- Phoenix, AZ

- Las Vegas, NV

- Carson City, NV

- Reno, NV

- Honolulu, HI

Exploding Inventory

Nationally, the inventory of existing homes for sale has increased by 39.1% year over year from 2,678,000 in June 2005 to 3,725,000 in June 2006 according to data published by the National association of Realtors. In the bubble markets, inventory has increased at an even faster pace then the national picture.

In San Diego County, housing inventory started off at 13,916 on January 1st 2006 and has risen by a full 67% and was 23,259

In Los Angelos County, housing inventory started off at 24,463 on January 2nd 2006 and has risen by a full 82% and was

In Sacramento Metro area, housing inventory started off at 9,513 on January 2nd 2006 and has risen by a full 80% and was

In the Phoenix metro area, inventory spiked from 10,748 on 7/20/05 to

In Northern Virginia, a part of the Washington DC metro area, the number of active listings was 4061 in June 2005, which increased by 197% to 12,096 in June 2006 (MRIS).

In the Orlando area, inventory had exploded from 13,533 on January 7th, 2006 to 25,665 on August 21st, 2006 (HousingTracker).

In most bubble markets inventory has more then doubled since last summer. In some metro areas like Phoenix inventory has more the quadrupled since last summer. The inventory is obviously the supply side of the equation.

Plunging Sales

Last year, in the bubble markets housing units were often selling in less then a week with sellers choosing from multiple offers. Now, the average number days on markets has increased dramatically in nearly all bubble markets compared to last summer.

Nationally, new home sales are down 21.6% compared to July 2005 (US Department of Commerce). Existing home sales are down 11.2% (National Association of Realtors).

In July 2005, in the Baltimore metro area the average days on market for housing units that sold was 35. This July, the number had increased to 55 representing an increase of 57% in the days on market. In Baltimore City the number of housing units sold in July 2006 fell 24% compared to July 2005 (MRIS).

"Existing home sales in July continued their year-long downward trend, plunging 44 percent in Palm Beach County and 39 percent in the Treasure Coast, year over year, the Florida Association of Realtors said Wednesday. Statewide, home sales fell 33 percent to 14,451 closings from 21,691 in July 2005, the association said"" (Palm Beach Post 8/23/06)

According to The Warren Group, in Massachusetts, sales of single family residences tumbled 26.9 compared to July 2005. Condo sales are down a similar 23.5% as compared to July 2005.

In Washington DC, the number of housing units sold in July 2006 fell 21% compared to July 2005 (MRIS).

Graph showing the number of home sales plunging in 2006 in Northern NJ.

Courtesy of Northern New Jersey Real Estate Bubble

In Sacramento, CA "Declining demand and buyer hesitancy pushed existing-home sales down 45 percent in Sacramento, Placer and El Dorado counties in July, compared to the same month last year (Sacramento Business Journal)".

The demand from flippers and specuvestors is drying up as the the word gets out that prices don't always go up in the bubble markets. The National Association of Realtors reported "The annual report, based on two surveys, shows that 27.7 percent of all homes purchased in 2005 were for investment and another 12.2 percent were vacation homes" As prices decline in the bubble markets there will be even less demand from the short term investors (flippers) who have been such a large part of the price runup. Plunging sales indicates a strong decrease in demand.

Stagnating & Falling Prices

During the boom years 2001 - 2005, prices for many housing units increased by double digit annual rates. In Washington, DC the median sales price for all housing units increased by 17.45% from July 2004 to July 2005. Then from July 2005 to July 2006 the median sales price has actually fallen by 3.45%.

For July 2006, in most bubble markets, median sales prices increase are less then 8% and in a significant number of bubble markets median sales prices have declined from last year.

In Massachusetts, the median sales price for condos is down 4.2% as compared to July 2005. The median single family residence is down 6.1% compared to July 2005 (Warren Group).

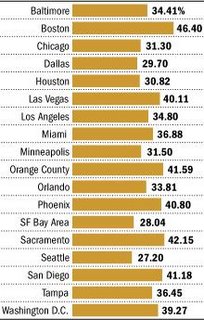

Now in many bubble markets prices are falling as inventory swells and demand declines.

WSJ Chart showing the percentage of reduced price listing on local MLS.

Sunday, September 03, 2006

Home For Sale in Fairfax , VA

Address: 2902 MAPLE LN, Fairfax, VA 22031

MLS#: FX6165529

This 4br, 3 full bathroom house built in 1978 is available for sale at 680,000. It is fresh on the market, just 11 days, and still it has had one price reduction from 699,000 to 680,000. It is located in a fairly nice upper middle class area in Northern Virginia (Washington, DC suburbs).

Commuter's dream! Customized and updated sfh---on .43 landscaped acre w/ pond & waterfall!--between vienna and dunn loring metros, minutes to rts 50, 66 and 29, and restaurants and shopping! Highlights: granite kitchen counters & island; hardwood on all main level; marble flooring in 3 baths; custom light fixtures & recessed lighting; no hoa! Welcome home!It was last sold on 12/20/04 for 580,000. Fairfax County has assessed its current 2006 value at 600K. Will it sell at 680K?