Source.

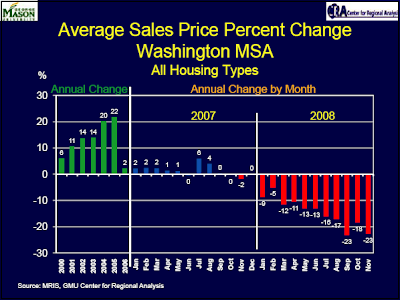

Source.Clarification: If you notice, on the left side of the slide it says "annual change" and covers seven years (2000-2006). The middle and right says "annual change by month" and covers 2007 and 2008. When I posted the slide, I actually didn't notice that the left side isn't monthly data. In retrospect, it is a confusing graph. Sorry.

I live in Europe now, but I know a thing or two about Arlington. All houses revert to the mean - Arlington will drop by 40%.

ReplyDeleteWhen they do, I will come home and Lance and I will shack up together.

PS. Arlington homeowners are holding out.

ReplyDeletePPS. I hate Lance.

Blood in the streets!!

ReplyDeleteAnyone who has ever been inside a "home" will spontaneously combust!

Cats and dogs will soon be sleeping together!

I have no clue what this slide is trying to communicate. What's the basis for its analysis? Are these changes YoY, MoM, what? MRIS doesn't publish data for the MSA so how were these numbers calculated?

ReplyDeleteDC is listed as the only bright metro spot for real estate in 2009, read more at

ReplyDeletehttp://realestate.yahoo.com/promo/housing-what-the-experts-see-ahead.html;

I'd like to wish you all a pleasant commute on this ice-slicked morning:

ReplyDelete"In his cultural analysis of the motor car in Germany, Wolfgang Sachs starts from the assumption that the automobile is more than a means of transportation and that its history cannot be understood merely as a triumphant march of technological innovation. Instead, Sachs examines the history of the automobile from the late 1880s until today for evidence on the nature of dreams and desires embedded in modern culture. Written in a lively style and illustrated by a wealth of cartoons, advertisements, newspaper stories, and propaganda, this book explores the nature of Germany's love affair with the automobile. A "history of our desires" for speed, wealth, violence, glamour, progress, and poweras refracted through images of the automobileit is at once fascinating and provocative. Sachs recounts the development of the automobile industry and the impact on German society of the marketing and promotion of the motor car. As cars became more affordable and more common after World War II, advertisers fanned the competition for status, refining their techniques as ownership became ever more widespread. Sachs concludes by demonstrating that the triumphal procession of private motorization has in fact become an intrusion. The grand dreams once attached to the automobile have aged. Sachs appeals for the cultivation of new dreams born of the futility of the old ones, dreams of "a society liberated from progress," in which location, distance, and speed are reconceived in more appropriately humane dimensions."

Keith said...

ReplyDelete"I have no clue what this slide is trying to communicate. What's the basis for its analysis? Are these changes YoY, MoM, what? MRIS doesn't publish data for the MSA so how were these numbers calculated?"

The first slide says "Dulles Area Association of Realtors", so I bet it's based on NAR's home price data.

If you notice, on the left side of the slide I posted, it says "annual change" and covers seven years. The middle and right says "annual change by month." I actually didn't notice that the left side isn't monthly data when I posted the slide. In retrospect, it is a confusing graph. Sorry.

http://www.theonion.com/content/news_briefs/housing_crisis_vindicates

ReplyDeleteOKLAHOMA CITY—In a year that saw a record number of mortgage defaults and home foreclosures, part-time landscaper Ben Foster, 34, was publicly vindicated in his bold decision, made back in the spring of 1996, to continue living with his parents. "It's like I've been telling my buddies for eight to 12 years now: 'Why get in over your head before you're ready?'" Foster said in praise of the no-risk, meals-included housing agreement he has maintained on and off since birth. "Sometimes it just makes more sense to be fiscally conservative, especially if you can move into the basement and set things up just how you like them." Leading financial analysts said Foster will likely remain secure in his current situation until skyrocketing medical costs force his aging parents to sell the house.

"en Foster, 34, was publicly vindicated in his bold decision, made back in the spring of 1996, to continue living with his parents."

ReplyDeleteLOL - this probably describes a good deal of the bubble sitters out there!

I think it's a great slide (and very clear).

ReplyDeleteAssuming a 4% increase for 2007, 25% decrease for 2008, and a 10% decrease for 2009 then the average annualized increase from start of 2000 (start of bubble) to end of 2009 is 6.2%. Professor Shiller stated that real estate should annually increase 3% above inflation.

ReplyDelete6

11

14

14

20

22

4

-25

-10

Annualized Average 2000-2010: 6.22%

Anonymous said...

ReplyDelete"Professor Shiller stated that real estate should annually increase 3% above inflation."

Where did he say that? His famous graph shows housing prices increasing at roughly the rate of inflation between 1890 and 2000, not 3% above inflation.

Good question James. I meant to say Professor Case stated that, read more below and there is a link provided. I imagine the DC area that the average annual appreciation is 6.5%. Perhaps this quote should be shared with other blogs like the Northern Virginia bubble blog.

ReplyDelete"Karl Case, an economics professor at Wellesley College whose name adorns the S&P Case-Shiller home-price indexes, has studied U.S. house prices going back to the 1890s. Over the long run, he says, home prices tend to increase on average at an inflation-adjusted rate of 2.5% to 3% a year, about the same as per capita income. He thinks that long-run pattern is likely to continue, despite the recent choppiness."

http://finance.yahoo.com/real-estate/article/106238/The-Future-for-Home-Prices

Condo developments with many units still available in DC.

ReplyDeleteDumont

Solea

Kenyon Square

Union Row

Renaissance Logan

Floridian

Moderno

Cityscape on Belmont

Lofts 11

Metropole

Citta50

Privado Condos

Yale Lofts

City Vista

Jenkins Row

Good luck!

"Condo developments with many units still available in DC."

ReplyDeleteOkay, show us the proof that condos are still available at this long list of condos. Are they all located in the DC area?

The Case-Shiller DC numbers encompass a lot of far-flung suburbs, not just DC proper. I am looking for DC-area income numbers, but I haven't found them yet. Since the DC home price index covers a huge swath of areas, from ultra-rich to ultra-poor and everything in between, my guess is that the trend (if not the absolute dollar figure) in median income is probably analagous to that of the entire country, which is flat in real terms.

ReplyDeleteNice long list of condos there.

ReplyDeleteNow, can we get a long list of single family homes (fee simple, non condo) that are sitting empty on the market? No?

Given the option to choose between condo and fee simple, I will always choose fee simple.

North Myrtle Beach Real Estate, I would reasonably expect the suburbs closer in such as Fairfax County and those within or just outside the beltway would be above the median. Exurbs like western Loudon County would be below the median. In DC, the location with respect to commuting to the jobs centers is the primary factor for pricing homes.

ReplyDeletePlug in a county or area in Wikipedia, and they often have Median household incomes, which is a good starting point.

ReplyDeleteGenerally speaking, Loudoun & Fairfax jockey for the highest median household income in the US. Places like DC, Arlington & Alexandria are far lower because they arent as homogenous. I.e. the burbs are filled with middle & upper middle class folk, whereas the urban areas have uber wealthy and poor people alike.

"Loudoun & Fairfax jockey for the highest median household income in the US. "

ReplyDeleteThe bulk of the high-paying jobs aren't in Loudoun or Fairfax.

People own things called "cars" and people operate these "cars" on "roads" and "highways" to get from their suburban homes to their high-paying jobs and back. They do this nearly every day. It is commonly referred to as "commuting", and everyone agrees that it "sucks", which is another reason the "core" has retained most of its gains.

"Driver 8 said...

ReplyDeleteIt is commonly referred to as "commuting", and everyone agrees that it "sucks", which is another reason the "core" has retained most of its gains."

I agree. However there is probably more to it. After all, commuting sucked well before the bubble started. Did traffic really get that much worse in the 2003-2008 period?

Washington-area traffic is projected to increase by 50% every 20 to 25 years.

ReplyDeleteThat 2003-2008 period is a full five years of sprawl- building. If you're familiar with the changes in Loudoun County over the past five years, you will know.

More than 10 years ago, the Post ran a story about the results of a (then) recent study which concluded a "24 hour rush hour" was inevitable in the Washington area.

Anyone who has ever tried to drive south from DC on I-95 after 3pm on an given weekday might agree about that inevitability.

Factor a little rain or snow (gasp!) into the picture, and we're talking about massive delays. Take this morning's "rush hour" (5am to 10am?). It was a mess.

Yep, that is why even the suburbs that are near a metro stop or not far from the job centers in Alexandria, Arlington/Rosyln, etc. will fare well. I've been looking to buy around the Kingstowne/Alexandria area and everything I've seen and heard that prices bottomed at early to mid-2004 levels.

ReplyDeleteDC is listed as the only bright metro spot for real estate in 2009, read more at

ReplyDeletehttp://realestate.yahoo.com/promo/housing-what-the-experts-see-ahead.html;

No, one real estate consultant based out of Irvine, CA states that Washington, DC will be the one bright spot in 2009. One person's opinion (and one tied to real estate at that) doesn't tell me that there's any consensus amongst experts.

Let's just deal with the big picture for a moment and burst one of the myths that people have thrown around: "DC is immune to a housing bubble because DC doesn't follow national trends."

First off, the national housing bubble itself is on a level that we've never seen before and has no real precedent, so any speculation based off conventional wisdom about how the real estate market operates are off the table. The simple fact is the Washington, DC metro area's rate of real estate appreciation matches all national trends in relation to this bubble. As such, why shouldn't it follow the national trend in depreciation?

In the early 2000s everyone was claiming that housing would only appreciate because housing never depreciates and if you didn't get in the market then, you'd never be able to own.

In 2004 and 2005 everyone was saying there was no bubble, housing prices would simply peak and plateau in the metro region. Well, the exurbs have cracked and we've now seen housing prices slashed in half where most of the gains in house prices in these areas have been erased. So the new consensus seems to be that the close-in suburbs and the city will be fine.

None of the claims being made are backed up with any hard data, just peoples' personal observations with no hard data to back it up.

just fwiw: I thought the graph's mingling of annual and monthly data brilliant!

ReplyDeleteGenerally speaking, DC will be better off than the rest of the Metro. A friend of mine bought his house in 1999 right across the street from the Potomac Avenue Metro station for $180K. He might not be able to sell it for $1 million today, but he could easily get 400 or 500K for it. The property in DC proper was depressed for a long time, but they still got carried away to some extent along with prices around the rest of the country.

ReplyDelete