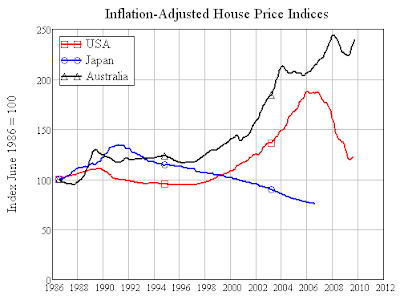

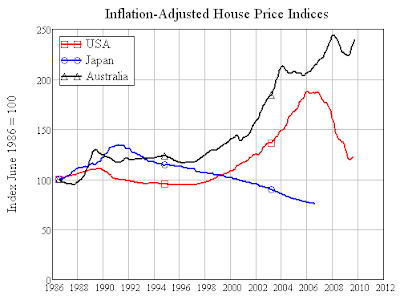

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

Subscribe to:

Post Comments (Atom)

Bubble Meter is a national housing bubble blog dedicated to tracking the continuing decline of the housing bubble throughout the USA. It is a long and slow decline. Housing prices were simply unsustainable. National housing bubble coverage. Please join in the discussion.

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

One may wonder why their bubble keeps growing. Apparently, the Australian government has been actively promoting the bubble at taxpayer expense.

Well, they're not making any more land. Real shortage of land in Austrailia, you know.

ReplyDeleteWynn Bloch has always dutifully paid her bills and socked away money for retirement. But in December she defaulted on the mortgage on her Palm Desert home, even though she could afford the payments.

ReplyDeleteBloch paid $385,000 for the two-bedroom in 2006, when prices were still surging. Comparable homes are now selling in the low-$200,000s. At 66, the retired psychologist doubted she'd see her investment rebound in her lifetime. Plus, she said she was duped into an expensive loan.

The way she sees it, big banks that helped fuel the mess all got bailouts while small fry like her are left holding the bag. No more.

Housing starts don't respond to price increases in Australia the way they do in the U.S. (due to restrictive local rules on land development). See chapter 6, and page 129 in particular in a Australian Inquiry Report here (pdf)

ReplyDeleteSo the Aussies are short on housing in general, and rents are rising along with house prices.

NIce way for comparison. Thanks for sharing informative graphs and statistics.

ReplyDeleteArticle on where the nation's millionaires live.

ReplyDeleteOf the top 50 states, DC comes in at #10, VA at #5 and MD at #2. However due to MD's millionaire's tax, look for more of them to cross the boundary into DC or VA

http://finance.yahoo.com/real-estate/article/109083/the-richest-states-in-america

This recession is over. The stock market is headed up, and so is housing. The dollar will be heading, up, too. Yes, it's all completely manipulated, but it's not as if we have any say in it anyway. So why worry about it? If the central bankers want your soul, they will take it when they want to, and you will give it to them. Why worry about the details? Enjoy your life. Being a zombie isn't so bad. Consume, consume, consume and buy green eco friendly stuff that makes you feel good inside. Remember to listen to the TV commercial music that sounds like baby-comfort happy music, because it will make you feel better.

ReplyDelete"Article on where the nation's millionaires live."

ReplyDeleteThe author obviously hasnt read "the millionaire next door."

Most millionaires drive old american cars, which they bought used, buy their clothes at walmart and live out in the middle of nowhere next to cow pastures etc. Millionaires are millionaires because they save their money.

What that article is talking about is people who make a big paycheck and live day to day, but are one paycheck from being evicted and thrown on the street. As attractive as that lifestyle sounds, no thanks.

James, when are you going to update your graphs? Reference:

ReplyDeletehttp://mysite.verizon.net/vzeqrguz/housingbubble/

Anonymous said...

ReplyDelete"James, when are you going to update your graphs?"

Thanks for the reminder. I'm trying to update them on a quarterly basis, but I hadn't noticed they are all due for an update.

Just so everyone gets a more global perspective on house prices compared to median income, the most ABSURD real estate bubble in the world (perhaps in the Universe) is in India, and is closely followed by China. In most Indian and Chinese metros, median home prices are over 200 times (yes two hundred times) the median income. Over 90% of the population has no chance whatsoever of buying a home. Prices in India have gone up a THOUSAND times in the past 30 years. Now compare that to the USA. Even in the so called bubble areas in the USA, home prices have gone up only 5 times in the past 30 years. In most of the country, home prices have only doubled or tripled in the last 30 years. And the median price to median income multiple in the USA is less than 3 in most of the country, and well below 10 in the so called bubble areas. And yet, we scream ourselves hoarse about homes being unaffordable. Just compare to places like India and China. And no, population density is not a factor. Japan has similar density too, but housing has been in a slump there for 20 years.

ReplyDelete