Wednesday, August 30, 2006

Two More Housing Bubble Sites

Bubble Pics -"housingbubblepicturesharing." View and upload the most bubblicious images. Please note this site is just getting started.

Bubble Meter is in Lockdown Mode

Blog Rules: In order to create a more perfect blog, these are the rules that will be followed. Additional rules may be added as necessary.

1) I shall be the final decision maker as to what comments are acceptable on this blog.

2) Any personal insults directed at me or commentators on this site will be deleted. Calling me or others 'stupid', 'moron', 'pathetic' is NOT allowed. Ad Hominem attacks are not allowed against me or commentators. [However, one can call a particular comment 'pathetic', 'moronic' etc if they give a reason.]

3) Any comment that is entirely unrelated to the post is highly likely to be deleted. [If the post is about foreclosures and you comment about conditions in the Chinese prison system].

4) Any comment which uses foul language such as 'f*ck', 'sh*t' or is obscene is highly likely to be deleted.

5) Commentators often ask for more evidence when I post. This is acceptable. Please bear in mind that I have a full time job and can't answer everyone's questions or requests. Attacks against me for not responding to a question or comment are prohibited.

6) Statements that clearly are false will be deleted. [China has less land mass then Singapore. Or everyone in China is wealthy.]

7) If there are any questions regarding blog rules please email me at bubblemeter@gmail.com.

Tuesday, August 29, 2006

Chicago Housing Market

Chicago-area sales of existing homes and condos fell 14.5 percent in July compared to the same month last year, but median prices rose 2.6 percent, according to the Illinois Association of Realtors.

Nevertheless, single-family home sales in the Chicago area fell by 18.6 percent in July compared to last year at this time.

Even with the Chicago-area single-family home sales falling, median prices rose 4.2 percent, to $285,000. (Daily Herald 8/24/06)

So what will happen with housing prices during the coming years?

Overall I do not think the Chicago metro area is a bubble market. The typical housing unit is unlikely to decline in price by 20% in real dollars during from its peak price within 3 years of peak price. However, condos especially in the city itself are likely to fall by over 20% in real dollars. Certain 'hot' neighborhoods that have experienced very strong price appreciation may fall more then 20% in real dollars over the course of 3 years. Chicago, is certainly not bubblicious like San Diego, nevertheless declining real dollar prices will be a reality for the Chicago metro area in the coming years.

Senate Square Condos in Washington, DC

View from Congress Street in Washington, DC of Senate Square condo development.

View from Congress Street in Washington, DC of Senate Square condo development.- Studios: 230K - 340K

- 1br: 340K - 500K

- 1br / den: 400K - 730K

- 2br: 470K - 980K

- 2br / den: 600K +

Monday, August 28, 2006

Personal Bubble Stories

A recent college graduate wants to buy a newly built 1br condo to live in an inner suburb of Washington, DC. He was thinking of buying one for about 280K. He was pleased that the price had come a bit from last summer's peak.

I asked him "How long do you plan to live there?"

He: "About 10 years"

Me: "10 years? Don't you want a family and children and all well before then? In 10 years you'll be 35."

He: "Ok maybe 5 years"

Me: "What do you think the 280K condo you are considering buying will be worth in 5 years?"

He: "500K"

Yikes! Talk about unrealistic expectations. I politely explained why that would not happen.

My mom's friend who is involved in specialty homebuilding in the North Shore area (northern Chicago suburbs along the lakefront) has been in the business for a few years. He told my mom that "nothing is selling."

Sunday, August 27, 2006

BubbleSphere Roundup

I have been slacking off recently on my blogging. Here are some blog posts of interest:

At The Housing Bubble Blog there is a great post where people Post Local Housing Market Observations Here. One commentator writes of the, " 'Zillow-gap' in Loudoun Co. — getting larger every month! Homes are being listed for 5-20% below the zillow value!" FYI: Loudoun county is an outer suburb of Washington, DC.

Southern California Real Estate Blog tell us why The Fed Cant Save Housing, even if it wanted to! He turns to history for evidence "Fed Funds rates dropped from 9 3/4 in Feb 89 to 3% in September 92, and California still had one of the worst housing-busts in recorded history in the US. A total drop of 6 3/4%! We currently stand at 5.25%. Not possible to even drop that much this time" Right on!

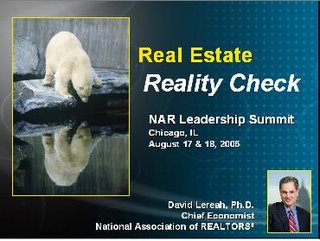

The National Association of Realtors just released some of David Lereah's 'Greatest' Hits. These are some of the most requested power point presentations by NAR Chief Economist David Lereah and others from the last 12 months. It is was quite a story. In a power point presentation from August's Realtors' Leadership conference in Chicago titled 'Reality Check' (ppt) David Lereah basically has many slides showing how housing prices have become divorced from reality.

Please note that the background for the 'Reality Check' power point shows multiple bubble. Below are some excellent some posts about this issue from my esteemed housing bubble blogger colleagues:

Lereah Mea Culpa? (Paper Money)

The End of the Myth (Paper Money)

Lereah Says "Hard Landing" (Marin Real Estate Bubble)

FLASH: I can't believe what I'm reading. NAR admits US housing disaster underway (Housing Panic)

In David Lereah's presentation he writes "Soft Landing," "Price expected to fall for remainder of year," "Price fall to be limited due to pent-up demand at lower prices," "home prices begin to soften," and that a "correction is necessary."

Thursday, August 24, 2006

New Home Sales for July

The figure was weaker than the average Wall Street estimate of a pace of 1.105 million units. The level of new home sales was down 21.6% from the pace a year earlier, when many analysts had warned about a property market bubble.More bad news for the 'soft landing' cheerleaders. The 'soft landing' theory is being put to rest. Soon the argument will merely be how hard will the landing be.

The average sales price fell to $230,000 from $233,800 in June. It has been falling since a peak of $257,000 in April [corrected] but is virtually unchanged from the level a year ago of $229,200. (RTE Business)

OFHEO Delays Report: What is Up?

Wednesday, August 23, 2006

David Lereah's 'Greatest' Hits

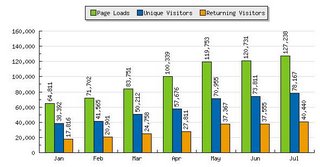

While reviewing David Lereah's power point presentations I found one titled 'Winding down to and Expansion' from October 2005 . Below is one of the images:

In October 2005, David Lereah chief economist of the National Association of Realtors, was busy calling the bubble believers 'chicken littles.' Many of the predictions espoused by the 'chicken littles' are fast becoming closer to reality. Inversely, David Lereah's predictions are becoming further and further divorced from reality. Mr. Lereah is an irresponsible cheerleading.

July Existing Home Sales Decline

Nationally, sales of existing homes in July plunged 4.1% from June 2006 to a seasonally adjusted annualized rate of 6.33 million, the lowest since January 2004, the National Association of Realtors said Tuesday. Sales in July are down 11.2% compared to July 2005.

The inventory of unsold homes rose 3.2%, compared to June 06, to a record 3.856 million, a 7.3- month supply at the July sales rate, the highest since April 1993. This represents a 39.9% spike in inventory compared to July 2005.

The median sales price has risen 0.9% in the past year to $230,000. It matches June for the weakest price growth in 11 years. Prices fell on a year-over-year basis in the West and the Northeast.

The median sales price has risen 0.9% in the past year to $230,000. It matches June for the weakest price growth in 11 years. Prices fell on a year-over-year basis in the West and the Northeast.David Lereah stated "Boom markets are cooling significantly." Cooling is an inappropriate euphemism. The housing market in the formerly boom markets are in an outright decline. The reality of a declining housing market is becoming ever more apparent each week.

Tuesday, August 22, 2006

Who Is To Blame?

- Greenspan & The Feds for short term interest rates that were too low for too long [corrected from before, my terminology before was faulty]

- Parts of the Housing Industrial Complex (David Lereah and other shills)

- Irresponsible Lenders for lending to people who really can't afford it. All those toxic mortgages.

- Fannie Mae & Freddie Mac

- Asian Central Banks & GSE for buying all these bundled loans

- Speculators & Flippers ( for being greedy and fueling this mania)

- Some HomeBuyers for buying beyond their means and being ill informed.

- Parts of the Media for not informing the public about this issue sooner (finally they are communicating this)

- Others ( yet to be determined, please discuss)

Monday, August 21, 2006

David Lereah Continues To Spout 'Soft Landing' BS

The media regulary turns to him for real estate quotes. He is very influential. David Lereah needs to be discredited by the mainstream media. Mr. Lereah tells half truths and manipulates facts and figures. He cannot be trusted as he is a paid shill. David Lereah is the new 'Baghdad Bob.'"With more sellers competing for the pool of buyers, the pressure on home prices has evaporated in most metro areas. After a full year of double-digit gains in the national median price, the timing is right for a cooling in the rate of growth -- we are presently experiencing a soft landing in the housing sector."

Sunday, August 20, 2006

Friday, August 18, 2006

Club Year Over Year Declines in Median Sales Price

Many jurisdication have already joined club year over year median sales price declines. Many more will join in the coming six months.

Which counties / states / places have thus far reported Year over Year (YoY) declines in median sales price?

Let me get started:

Place: Washington, DC proper

Housing Units Type: All Housing Units

Time Period: July 06 vs July 05

Percentage Change: -3.45%

From: $429,850

To: $415,000

Total Units Sold: - 21%

Source: MRIS

Please provide information in the above format if possible. If you don't have all the info that ok as well. Thanks.

Discredited: National Association of Realtors' Anti Bubble Reports

NAR's Housing Market Reports (10/15/05, Bubble Meter)

NAR Releases Local Anti-Bubble Research (10/02/05, Bubble Meter)

For metropolitan Sacramento, CA their anti bubble report (pdf) stated that

The local housing market will experience a price decline of 5% only under extreme unlikely scenarios. For example, mortgage rates rising to 7.8% in combination with 25,000 job losses could lead to a price decline.However, according to data from DataQuick:

The new survey shows that median sales prices for new and resale homes and condominiums in Sacramento County fell 5 percent below July 2005 levels.According to Freddie Mac interest rates on 30yr fixed averaged 6.52 . Jobs are still plentiful in Sacramento as it "showed strong growth in online want ads." [Monster.com] The 'extremely unlikely scenario' where mortgage rates hit 7.8% in conjunction with 25,000 job losses in Sacramento area has not yet happened. Yet, median prices have already declined 5% (YoY) in Sacramento county.

The National Association of Realtors' anti bubble reports will quickly become a laughing matter just like the book Dow 36,000. The National Association of Realtors is losing its credibility.

Thursday, August 17, 2006

BubbleSphere Roundup

July 2006 sales data in the San Francisco area is nicely graphed by Marinite. "The median price paid for a Bay Area home was $627,000 last month. That was down 2.6 percent from June's record $644,000, and up 3.5 percent from $606,000 for July a year ago."

Some interesting posts at Northern New Jersey Real Estate Bubble. :-)

Bubble Markets Inventory Tracking continues to track inventory in such places as Orange County, San Diego County, Phoenix Metro area and many others.

High Housing starts in Vancouver area. "The July number is the 2nd highest so far this year, and is 32% higher than July 05, and 48% higher than July 04"

DC Bubble Blog has been removed from the blogroll as there has not been a post since July 22nd.

Florida Paradise Lost has beed added to my blogroll. Solid blog!

Wednesday, August 16, 2006

Bubblicious Building in Chicago Area

New condo building under construction in Chicago area that will also house a Century 21 Realty Office on the first floor.

New condo building under construction in Chicago area that will also house a Century 21 Realty Office on the first floor.

DROdio Real Estate Inc. Uses Lies, Deception, and Scare Tactics

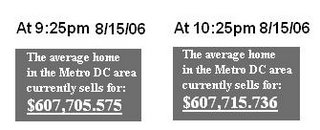

Lies, deception, and scare tactics are being used by some Realtors to sell houses. DROdio Real Estate Inc. is guilty of such practices. DROdio Real Estate Inc located in Northern Virginia (Washington, DC suburbs) has a website where there is a counter 'showing' (it has since been removed off of their front page) what the "average home in the Metro DC area currently sells for"

The counter continues to show rising prices. If you click on the price it takes you to a webpage where it states:

The counter continues to show rising prices. If you click on the price it takes you to a webpage where it states:That is the average estimated sale price of a home in the DC Metro / Northern Virginia area!

According to the Northern Virginia Association of Realtors (NVAR):

"Average sales prices continued to rise through December [2005] in Northern Virginia, despite a decrease in sales and sizeable increase in inventory. The average sales price [in Northern Virginia] rose to $552,621, a 16% increase over December 2004's average of $476,941."A 16% rise in home prices annually means a 1.3% rise monthly. This translates to a rise of $239.47 increase in value daily, or $9.97 per hour!

Become a home owner and have this $9.97/hour work for you, instead of against you!

Every hour you wait is costing you $9.97 in equity!

The counter is a lie for multiple reasons. Here are some reasons:

Reason 1: On the front page of the website where the counter is located it says the counter reflects the "average home in the Metro DC area," but when you click on the link it take you to a webpage which references number for Northern Virginia. Northern Virginia and the 'Metro DC area' are not interchangable. [Update: The counter has been removed from the front page]

Reason 2: Their price counter is based on outdated statistics from December 2005 for Northern Virginia from the Northern Virginia Association of Realtors which takes their numbers from the MRIS. The price counter assumes evenly distributed price appreciation throughout the entire year which is fictitious. As of 9:25pm on 8/15/06 the price counter showed a average price of $607,705. If we check with the Northern Virginia Association of Realtors (NVAR), they show an "average sales price of $537,731 in July 2005. This represents a 3.94 percent decrease from July 2005's average of $559,790." According to the NVAR average sales prices are actually decreasing, not increasing. The price counter is thus going the wrong way. Currently, the counter shows an average price of 607,000 which is 13% above what the average sales price was in July 2006.

DROdio Real Estate Inc use lies, deception, and scare tactics to sell housing units. The price counter must be removed. Additionally, DROdio owes an apology for its despicable practices.

If you are so inclined to take on the lies, please contact them and tell them to remove their price counter. Call Us: 1-800-705-2782 or email from their contact page or go to their directory page.

Update: I just recieved this email from Daniel R. Odio. It was recieved less then an hour after my post:

My Response: I am glad you have indeed removed the price counter from your front page. It is still on other webpages as of 12:15am 8/16/06. The price counter must be removed from all webpages. You still owe a public apologize for keeping the price counter up for so long. You are obviously very aware of it being there because the company has a very savy website, including a blog. The fact that you were able to repond to my post within 30 minutes of it being posted speaks to the sophistication of your web operation. I demand a full apology and a commitment to represent reality when dealing with clients. If the price counter is not removed by 5:30pm on 8/17/06 EST, I will be using my contacts at the local media to report DROdio Real Estate Inc. and will also file a complaint with the Better Business Bureau.

David,

I agree with you in that the figures are outdated. I've removed them from our site.

I'm very sorry to see such a negative posting. You should just realize that we're a very hard working group of people trying our best to fairly represent clients and their interests. Using words like "lies, deception and scare tactics" to describe us is not at all a fair representation, and marginalizes the many, many satisfied customers we have, and the years of work I have put into building our company. I hope you reconsider your position.

Regards,

DROdio

Owner & Managing Broker, DROdio Real Estate, Inc.

Update 10:20am 8/16/06: DRODio Real Estate Inc has removed all the price counters from their website. They now have "We've removed our house clock while we recalibrate it for the changing market conditions. Look for it in the next few weeks!" Thank you for doing the right thing and removing it. Bubble Meter will continue to monitor your website.

Tuesday, August 15, 2006

NAR 2Q 2006 Existing Home Sales

In their press releasee the NAR started searching for evidence of a 'soft landing' in their data

The association'’s second-quarter metro area single-family home price report, covering changes in 151 metropolitan statistical areas,* shows 37 areas with double-digit annual increases and 26 metros experiencing generally minor price declines - many of the areas with declines are showing weakness in the local labor market.In real dollars the 3.7% nominal increase in represents basically flat median prices. Regionally, median sales prices of existing homes increased 3.6% in the Northeast, 4.1% in the South, 3.6% in the West and fell 2.0% in the Midwest.

The national median existing single-family home price was $227,500 in the second quarter, up 3.7 percent from a year earlier when the median price was $219,400.

The quarterly report on total state existing-home sales shows that the seasonally adjusted annual rate was 6.69 million units in the second quarter, down 7.0 percent from the record 7.19 million-unit level in the second quarter of 2005.

The number of sales was down in the 2Q 2006 compare to 2Q 2005:

- Northeast: -5.2

- South: -4.2

- West: -14.7

- Midwest: -4.7

Metro area condominium and cooperative prices, covering changes in 57 markets, show the national median existing condo price was $225,800 in the second quarter, down 0.3 percent from a year earlier. Fifteen metros showed double-digit annual gains in the median condo price, and 14 areas had declines.

A full 26 of 57 condo market tracked by NAR, experienced median sales price decreases or increases of less then 3%. In over half of the condo markets tracked by the NAR, the median sales price for condo units is decreasing in real dollars. In general, the condo market is more bubblicious then then the single family housing market.

‘'Pressure On Home Prices Has Evaporated'’: NAR (The Housing Bubble Blog)

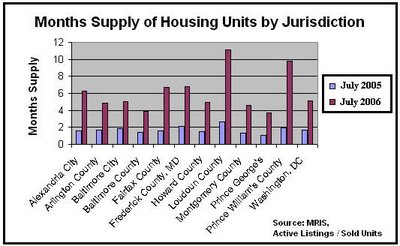

Months Supply of Housing Units by Jurisdiction: July 2006 vs July 2005

in selected jurisdictions in the Washington, DC metro area.

Back in Washington, DC

Well folks, I am back in the Washington, DC metro area tonight. It was a fun vacation. I saw lots of newly built condos. More importantly, was visiting family and relatives. [The image to the left was taken at O'Hare airport]

I'm back to my regular blogging schedule. Many posts planned for this week. :-)

Sunday, August 13, 2006

Thursday, August 10, 2006

Washington, DC Area July MRIS Numbers

Northern Virginia (Fairfax County, Fairfax City, Arlington County, Alexandria City, & Falls Church City, VA (NVAR))

- Median Sales Price YoY: - 4.71 %

- Average Sales Price YoY: - 3.94%

- Total Units Sold YoY: - 39.31 %

- Average Days on Market YoY: 262.5%

- Active Listings YoY: 146%

- Median Sales Price YoY: 5.89 %

- Average Sales Price YoY: 6.03 %

- Total Units Sold YoY: - 23.59 %

- Average Days on Market YoY: 57.14 %

- Active Listings YoY: 117%

Washington, DC (just the District of Columbia, no suburbs)

- Median Sales Price YoY: - 3.45 %

- Average Sales Price YoY: - 2.31 %

- Total Units Sold YoY: - 21.11 %

- Average Days on Market YoY: 82.14 %

- Active Listings YoY: 146%

Prince George's County, MD

- Median Sales Price YoY: 6.56 %

- Average Sales Price YoY: 7.15 %

- Total Units Sold YoY: - 23.50 %

- Average Days on Market YoY: 76.19 %

- Active Listings YoY: 162%

Montgomery County, MD

- Median Sales Price YoY: - 1.09 %

- Average Sales Price YoY: - 0.75 %

- Total Units Sold YoY: - 33.06 %

- Average Days on Market YoY: 157.89 %

- Active Listings YoY: 129%

Loudoun County, VA

- Median Sales Price YoY: - 2.54 %

- Average Sales Price YoY: - 2.96 %

- Total Units Sold YoY: - 46.07 %

- Average Days on Market YoY: 281.82 %

- Active Listings YoY: 129%

USATODAY: For Some Renting Makes More Sense

"Real estate is probably the best investment any young person can make," says Yadiris Ferreira, 29, who bought a condo last month in Pembroke Pines, Fla.

Still, her mortgage, including homeowner association fees, totals $1,800 a month — more than half the money she takes home as a high school math teacher. "It's crazy," Ferreira concedes.

But, she explains, "If I didn't buy something soon, it was going to get to the point that I couldn't afford anything."

There are still greater fools out there. :-( The scary thing is that she is a high school math teacher. If I were a principal of that school and she told me during the interview that she just bought a condo in a bubble market last month and proclaimed "If I didn't buy something soon, it was going to get to the point that I couldn't afford anything," she would not be hired. Yikes!

Wednesday, August 09, 2006

BubbleSphere Roundup

A hearty welcome to Florida Paradise Lost blog. The blogger out of Tampa writes "Will Florida ever become an affordable place to live again? Only time will tell, and you'll be able to read about the journey (to sanity, or maybe not) right here"

Housing Panic declares Dubai, United Arab Emirates to be the epicenter of the world housing bubble.

Monday, August 07, 2006

Observations From San Diego

One brochure that I picked up was for the Metrome condo development which implored:

Renting is so 6 months ago. [Give your landlord the boot] Renters become homeowners with no painful crack of the wallet. For about 1,508.46* a month you could be living it up in your own downtown digs. We're talking slate flooring and granite countertops...We all know condos won't sell unless they have the obligatory granite. It must be better then sliced bread. Here are the payment details for 1,508.46:

* Based on a purchase price of 425,700.00 . First mortgage loan amount of 340,550.00; 480 month term pay option loan with a minimum payment rate of 1.475%. Minimum monthly of 939.66. APR 5.884% with a lifetime cap of 10.05% Fully indexed interest rate will be based on the 12 Month Treasury Average plus a margin of 2.55%. Second mortgage based on 42,500.00 Line of Credit at 7.75%, interest only payment of 274.80, 7.98 APR%. Scenario reflects 10% down payment HOA fees of 294.00 per month included. Above monthly payment does not

include property taxes of approx. 443.44 per month. .....

Toxic mortgages for everyone! Anyway, its lovely weather here, which is tempting me to buy this very condo. I am sure a few years ago, before the housing bubble, San Diego's weather must have been miserable year round. I will be heading to LA soon and will have a report from there.

Sunday, August 06, 2006

Traveling To Bubblicious Southern California

Housing Example. Buying Vs. Renting in A Declining Market

After 12 months, the flipper is desperate as they can't make the mortgage payments due to an adjustable rate mortgage that just adjusted. Prices have fallen in that area about 7.5% in the past year. The flipper decides to sell the house at $416,250 or 7.5% less then what he was asking for a year ago. That would be a price reduction of $33,750.

At this point you suspect that prices will fall further but you just really want to buy the house for 416,250. [Plus you feel slightly bad for Mr. Flipper.]

How much did you save by rent and not buying for the year?

So we get 33,750 + $10800 (12 * 900 (savings on monthly housing costs - 4800 ( (12 & $400 (monthly principal payments) ) = $39,750 extra to buy for that year. Now divide this number by 52 (the number of weeks in a year) and it like saving $764 a week.

Friday, August 04, 2006

To Buy or Not To Buy That is The Question

Today, a new reality faces both buyers and sellers. Its the Inventory Stupid! Inventory has increased dramatically in most bubble markets in the past 12 months. In Phoenix, inventory rose from 10,748 on 7/20/05 to 51,557 on 7/20/06 according ZipRealty and Bubble Markets Tracking Inventory.

Some real estate agents are even claiming that is now a "buyer's market" due to the increased inventory, lack of bidding wars and the small reductions in prices. John Riggins of John Riggins Real Estate in Honolulu said:

"America is officially into a buyer's market, so (there is) no reason to sit on the sidelines and wait for a price drop," Riggins said. "Just like home builders are offering incentives, more and more sellers are offering incentives such as holding the note, paying down the interest rate or assisting with closing."So is it a good time to buy in the bubble markets?

Real prices will continue to decline in the bubble markets for many more years. The bubble markets will experience price declines of at least 20% in real dollars [inflation adjusted] over the course of 3 years [from the peak]. In many bubble markets, the peak price was reached late summer 2005. Most bubble markets will experience real price declines significantly greater then 20%. Some may experience real dollar price declines of 40% over the course of 3 years. Many markets may experience real dollar declining prices for more then 3 years.

Just as importantly, monthly rents are generally cheap compared to buying in the bubble markets. Buying in the bubble markets generally costs 1.25 to 2.5 times the cost of renting ( for a similar property; assuming 30yr fixed, solid credit, property taxes, and typical interest rate tax deduction). Each month hundreds if not thousands of dollars can be saved and invested if one chooses to rent as opposed to owning.

Buying now in a bubble market does not make financial sense. As housing inventory continues to rise and prices decline there will be lots of buying opportunities in the future. If you earn a reasonable income it is an absolute fallacy that you need to "Buy now or be priced out forever." In the Bubble Markets, renting and waiting is fiscally prudent. Don't be fooled.

Thursday, August 03, 2006

Dean Baker: The Coming Housing Crash

Right on. The economic 'recovery' coming out of the 2001 recession was built on an mountain of debt. So what happens next?This bubble sustained the economy through the 2001 recession and provided the basis for the recovery. The housing sector directly employs more than 6 million people in construction, mortgage issuance and real estate. The indirect effect of the bubble was even larger, as people took advantage of the rapidly growing value of their homes to borrow huge amounts of money. This borrowing binge supported rapid consumption growth in a period of weak wage and job growth. It also pushed the U.S. savings rate into negative territory for the first time since the beginning of the great depression.

So what effect will the housing bubble have on the genereal economy. So is a recession is coming?But, it was inevitable that the bubble would eventually collapse. The record run-up in housing prices led to record rates of housing construction. With population growth slowing, the country was building homes far more rapidly than the market could absorb them. At some point, excess supply will put downward pressure on prices.

The weakening of the housing market was further assisted by an entirely predictable rise in mortgage interest rates. The Federal Reserve Board deliberately pursued a low interest policy to help the economy recover from the stock crash, pushing interest rates to their lowest level in 50 years. With inflation picking up steam due to the oil price spike, higher import prices, weaker productivity growth, and a stronger labor market, interest rates are rising back to more normal levels.

The decline in housing prices will sharply limit the extent to which people can borrow against their home to support their consumption. This will cause savings to rebound from their current negative rates to more normal levels—at 6 to 8 percent of disposable income—but will be associated with a sharp falloff in consumption.

Together these effects virtually guarantee a recession, and probably a rather severe recession. Even worse, there is no easy route to recovery from a recession that results from a collapse of a housing bubble, just as there was no easy route to recover from the stock crash induced recession of 2001. Greenspan used the housing bubble to recover from that crash, because he saw no other mechanism. Unless Bernanke can find some other bubble to inflate, the recovery may be a long slow process. It took Japan almost 15 years to recover from the crash of its stock and housing bubbles.

The crash and post-crash world will not be pretty. Millions of people will lose their jobs and their homes. Unfortunately, the economists who led us down this path are not likely to be among the ones who suffer severe consequences.

There is growing chorus of economists and armchair pundits predicting a coming recession. A significant recession is coming in the next 12 months.

Wednesday, August 02, 2006

Mortgage Activity Down To May 2002 Levels

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending July 28. The Market Composite Index, a measure of mortgage loan application volume, was 527.6, a decrease of 1.2 percent on a seasonally adjusted basis from 533.8 one week earlier. This is the lowest that the index has been since May 2002. On an unadjusted basis, the Index decreased 1.4 percent compared with the previous week but was down 29.0 percent compared with the same week one year earlier.Calculated Risk has a superb post with great graphs. Obviously, this is more evidence of the significant declines occuring in the housing market.

The refinance share of mortgage activity increased to 37.0 percent of total applications from 35.6 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 27.8 percent of total applications from 28.6 percent the previous week. The ARM share is at its lowest since March 2004.

BubbleSphere Roundup

- DC Housing News is no longer in existence.

- The Boy in the Big Housing Boy Bubble has not been updated since June 29th. :-(

- Out At The Peak has not been updated since July 8th.

Shortly, both DC Housing News and The Boy in the Big Housing Boy Bubble will be removed from my blogroll. :-( Out At The Peak is on the watchlist.

Ok. Now the good news. :-) Here are some recent solid additions to the BubbleSphere:

Stay strong! Oh BubbleSphere! We will continue shining light on this speculative episode. Collectively, the bubblesphere is a powerful source of information that is being read by tens of thousands of people each and every day.

Tuesday, August 01, 2006

Daily Reckoning: ARMS and Interest Rates

The Daily Reckoning is a an excellent read. Currently, they are very bearish.

"I sing of ARMs and the Man..."

-

Virgil's Aeneid

We don't really have that much more to sing about ARMs, dear readers, but we just couldn't resist the headline.

Still, now that we think about it, our cautionary tale is likely to end just as bloodily as any epic poem we've read. Imagine what would happen if mortgages were adjusted upwards to rates anywhere near 10% - or any where near where they were 25 years ago?

That is why the Bernanke Fed cannot really fight inflation or stagflation the way Paul Volcker once did. Too many homeowners wouldn't be able to afford it. ARMS were meant to give marginal borrowers flexibility. Instead, they have locked both the borrowers and the Fed itselfinto...well, leg-irons. The borrowers have no margin. Most cannot affordeven the slightest boost in their payments. And with such boosts now automatic, the Fed can only react to inflation threats by prevaricating.

According to David Rosenberg at Merrill, discretionary items are now rising at a 5% annual rate - far beyond Ben Bernanke's target. But what can he do?

ARMs were supposed to be a way to realize the American dream of homeownership. But, like much else in American life, that dream too has been hollowed out.

Hurricane Season Heats Up in Bubblicious Florida

Topical Storm Chris threatens bubblicious southern Florida. Lets hope that this one does not strengthen and become a hurricane.

Hurricane Season is Here (June 1, 2006)