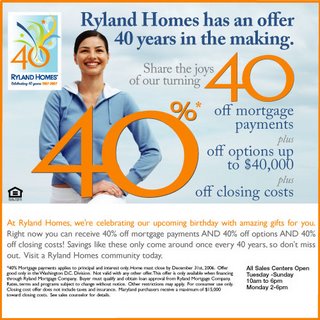

Ryland Homes 40% Off Sale going on in the DC Area.

Ryland Homes 40% Off Sale going on in the DC Area.The 40% off your mortgage is only for the first year. Thanks to commentator John Fountain who found this gem.

In celebration of our 40th Anniversary, we are passing on an anniversary gift that will save you thousands! Through September 30, you can receive 40% off options, closing costs, mortgage payments for a full year and more. See your local market for specific details*. Don’t miss the opportunity to purchase your dream home at a great savings during Ryland Homes’ 40th Anniversary sales event!The Ryland 40% off information can be found here. This is just the start of the incentives and price reductions that will be offered by the new homebuilders. They need to move their inventory as they take out large loans to finance most of their development.

Another sign market conditions are deteriorating rapidly.

ReplyDeleteThis one from Centex in Southern California

Affordability Days

I also got a flyer in the mail for "Centex Homes: Affordability Days Are Here".

ReplyDeletehttp://www.theacorn.com/news/2006/0831/real_estate/096.html

They are getting hand in hand with the toxic loan issuers to get their inventory moving. "A variety of special loan programs-from zero down to low interest rates-is available for a limited time only." "Act now before it's too late."

So, is Ryland using a gimmick or what?

ReplyDeleteThe fine print doesn't mention any term limitation on the payment discount (i.e., first year only) and doesn't say the payment discount needs to be repaid later.

So is this a real discount (which would be shockingly large) or is this deceptive advertising meant to lure in unsuspecting consumers?

Any realtors out there familiar with the terms of this offer?

Not always Richard, believe me.

ReplyDeleteYour comment makes you sound like a rookie, even if you are not.

Richard M. Johnston, Realtor said...

ReplyDelete"Lenders will always be coming out with special packages for buyers or those who need to refinance.

Richard"

Yes, and how terrible of them to offer financial products that when used responsibly can make the difference between someone getting into a house and building equity and and someone being stuck in an apartment throwing their money down the toilet! That is soooo bad of them! They should just assume that no one will ever have the will and determination to sacrifice and get into that house! They should just assume the worst about everyone! Who cares if it is one in one-hundred-thousand who will later default!?! Protecting that one in one-hundred thousand from themselves should mean that no one gets trusted to be responsible and make the payments for which they've been qualified and deemed capable of making. Bad lenders trying to help people own their own homes. Bad real estate agents for encouraging people to do likewise. Enablers, all of them!

Richard M. Johnston, Realtor said...

ReplyDelete"Lenders will always be coming out with special packages for buyers or those who need to refinance.

Richard"

Yes, and how terrible of them to offer financial products that when used responsibly can make the difference between someone getting into a house and building equity and and someone being stuck in an apartment throwing their money down the toilet! That is soooo bad of them! They should just assume that no one will ever have the will and determination to sacrifice and get into that house! They should just assume the worst about everyone! Who cares if it is one in one-hundred-thousand who will later default!?! Protecting that one in one-hundred thousand from themselves should mean that no one gets trusted to be responsible and make the payments for which they've been qualified and deemed capable of making. Bad lenders trying to help people own their own homes. Bad real estate agents for encouraging people to do likewise. Enablers, all of them!

40% definitely different in this part of the country!?!??!

ReplyDeleteWouldn't it be simpler to lower the price? Of course not; bad marketing. Better to make it look like RYL is doing you a favor -- buyers become understandably skittish if they think the next person in line is going to get the same unit for less money.

ReplyDeleteBTW, the fine print states that the offer is available only if Ryland Mortgage is the lender. Aside from the obvious questions, it should be noted that Pulte got in trouble in NV (deceptive trade practice) for conditioning incentives upon the buyer using Pulte's mortgage sub. I will assume that RYL's attorneys are smart enough to know that and drafted the program so as not to run afoul of the DISB. Still, I would beware of builders with unsold inventory bearing gifts.

DC_TOO,

ReplyDelete... hmm .. the equity I invested has already doubled to tripled based on what neighboring houses of similar size and shape have been selling for ... sorry, DC Too, but is is DC_YOU who has lost out on hundreds of thousands of dollars worth of equity by holding off ... The fact you think that equity appreciation occurs through paying down principal on a loan, shows how little you know. One doesn't "build equity" in that way ... That is merely paying down principal owed and thereby shifting earning producing assets into your home which is not an asset but an expense. Earned equity comes from when you sell your home and because of the passing of time you take out more than you put in ... in nominal dollars. But of course, like many bubbleheads, you are not looking to buy a home but rather an investment ... In the last 5 years you would have been a flipper ... except for one minor fact ... That you don't have enough wealth to both buy a home and make investments ... so, you choose to treat your home like an investment ... and will at some point end up homeless because of this irresponsible behavior. Oh wait, you already are, aren't you? Btw, did you read tonight's report in the Post about economists being VERY worried about inflation. Brace yourself for those big rent increases coming your way. You've made your bed (in someone else's house/building), now lie in it ... for as long as you can afford to hold on ...

Lance said...

ReplyDelete“Yes, and how terrible of them to offer financial products that when used responsibly can make the difference between someone getting into a house and building equity and and someone being stuck in an apartment throwing their money down the toilet! That is soooo bad of them! They should just assume that no one will ever have the will and determination to sacrifice and get into that house!”

Absolutely Lance! Let no one tell you that you can’t afford something, how rude! The will and determination to sacrifice is key! Hot dogs and ramen five nights a week! And if you get a little behind on the payments? No worries! The government is here to help you out!

Oh yea,I almost forgot........................

BUY NOW OR FOREVER BE PRICED OUT!

Same promo in Balto. As winter comes, these "deals" will get even better...there are so many $500K-$800K homes where I live, it's unreal. The actual salary you'd need to pay that mortgage, even with 20% down, is along the lines of $175K. Sure, some can afford it, but there are subdivisions and subdivisions of monster homes at those prices, and no buyers to sell to.

ReplyDeleteNikki said...

ReplyDelete"Same promo in Balto. As winter comes, these "deals" will get even better...there are so many $500K-$800K homes where I live, it's unreal. The actual salary you'd need to pay that mortgage, even with 20% down, is along the lines of $175K. Sure, some can afford it, but there are subdivisions and subdivisions of monster homes at those prices, and no buyers to sell to."

Nikki, you really should talk to a lending officer or a financial advisor ... or for that matter to anyone with the skills to do some numbers. I ran a quick pro-forma on your facts and assuming a $500,000 purchase with 20% down (i.e., $100,000), the payments for a 30 yr fix FULLY AMORTIZING loan are $2,528 per month. Assuming yearly taxes of $2,400 or $200/mo, your monthly housing costs (for qualifiying purposes is about $2,728 per month. Lenders determine your eligibility for a loan (and capability to repay) based on a ratio of these housing expenses to your gross monthly income. The better your credit rating, the higher the ratio they'll allow ... depending on the guildelines of the underwriter for the loan. On average, with excellent credit, you can go to 46% ... But, let's say your credit is just "so so", and you can't go over 40% ... That means you'd have to have a gross income of $6,820 per month or $81,840 per year to qualify for this loan. This isn't an I/O loan or an ARM, but a fully amortizing 30 year fixed rate at today's going rate. And it isn't asking that you make any out of the ordinary sacrifice. It is asking that you put $4 out of every $10 that you earn toward your mortgage and property taxes. Because of tax benefits you will get roughly $1.50 back on this, meaning you are putting roughly only $2.50 out of every $10 you earn into your living expenses. At that income level, you'll be paying something like $3.50 in taxes for every $10 you earn. Combined that makes $6 ... Leaving $4 of every $10 you earn to eat, play, and save. Why would anyone consider this unreasonable?

Do you not understand the point of my post? Using the lowest range of my example to attempt to disprove my point is auestionable--you would have had a bit more credibility had you picked something in the middle of that $300K range, not the bottom.

ReplyDeleteAnd where does a $500K house only have $2400 in taxes? And if your gross monthly take home is $6,500, the net is much, much less and you're paying $2500 of that towards a mortgage alone? That's over 1/3 of takehome for principal alone. Maybe you should talk to a lender or advisor, because that would not be a smart loan. Thanks for proving my point.

Thanks, I'd rather not contribute almost half of my income to a mortgage payment--maybe that's why my credit reating would be so good, becuse I don't listen to BSer's like you who cannot see the forest for the trees. 40% of gross is very different than 40% of net, tax deduction or none.

ReplyDeleteOne final comment, if my other two ever show up. Running a mortgage calculator on bankrate.com, with a monthly gross of $6500, a 6.5% fixed 30 yr and a downpayment of $100K, taxes of $5K/yr (1% of $500K house, not unreasonable), and insurance of $1K leaves you an affordable mortgage payment of $1820 and an affordable home amount of $387,943.69. And that's with no other debt or monthly expenses. But I'm not sure why I'm arguing about this with a person who, with a straight face, claims that an annual income of $80K affords a half a million dollar home, or over 6x's annual income. If this blog had an ignore feature, it sure would be nice..

ReplyDeleteLance said...

ReplyDelete“... hmm .. the equity I invested has already doubled to tripled based on what neighboring houses of similar size and shape have been selling for ... sorry, DC Too, but is is DC_YOU who has lost out on hundreds of thousands of dollars worth of equity by holding off ...”

Your equity? Tell us Lance, today, right now, what can you do with that “equity”? That’s right, nothing, except to say you have it. The only possible way to tap into that “equity” is to sell, and then, the only equity you’ll see is what the buyer will allow you to have.

Boy VA investor, you sure do like to make assumptions. I graduated college when this bubble started, actually into the bubble, so I've not been on the sidelines "all these years"--I was too late to even get in the game. But you've pegged me. I'm a complete idiot who has no idea what comps or FMV are or how an IO loan can be at a fixed rate.

ReplyDeleteI've come to the conclusion that by contributing nothing but denial and silly assumptions and platitudes to the conversation here, VAI and Lance are trying to drive traffic away from the blog by frustrating cogent posters with their permabull mentality and refusal to accept reality.

ReplyDeleteI guess they figure if they deny enough and try to convince the rest of us that any time, any place at any price is a fab time to buy a home, maybe we'll all go away and the bubble won't pop. Posting that over 6x's income to buy a home is not a "sacrifice" and is reasonable is simply ridiculous, as is the assertion that all "bubbleheads" will constantly find a reason not to buy.

Repeatedly spewing blanket generalities backed only by an obviously biased opinion and seizing on every comment to attribute as a blanket argument of all "bubbleheads" is an indicator of how little can be contributed from the housing buill side now, and most of their comments reflect this.

Rarely is there dialogue from them involving actual housing data, it's more like personal attacks and baltantly false calculations, as Lance posted as a reply to me earlier.

I hope this isn't a double post.

ReplyDeleteIf any readers are actually considering buying a home, I suggest using the calculators at fanniemae.com. At least you will be able to get an idea as to what is considered "affordable" for conforming loans. Please note that the expense ratios given in the example at 10:01 AM fall outside conventional loan guidelines.

OH NO, not the ignore list!

ReplyDeleteLook out Nikki, next it will be the comfy chair.

Warmredblanket said: Priorities like retirement, college savings, and values (as in choosing not to keep up with the Jones' or feeling the need to own, own, own, consume, consume, consume).

ReplyDeleteWell said. Homes should not exceed 28% for established buyers, 36% for 1st time buyers (who are young enough to reasonably expect rapid wage increases).

People simply are not saving for retirement expecting homes to keep shooting up. At today's prices, we're looking at guaranteed $100k+ losses.

Homes must be prices relative to wages. That is the #1 criteria to non-dimensionally normalize the price. Yes, there are other factors, but with prices so out of line with wages... yikes!

And the markets are getting spooked because inflation is most likely going to *force* the fed to raise rates.

The option ARM's are coming home to roost. 80% of option ARM holders only made the minimum payment. Look at the bond markets... Talk to your friends in banking; what I'm hearing from my friends in banking is that the mortgage side of the house is about to be downsized hard due to the potential losses from the loans.

Next year home purchases are going to require large down payments... think about how much that will slow the purchasing.

Lance, great you've made lots on your "investment" in our house. I simply know too many high income couples who are going to lose their hose to believe that this mania can continue.

Homes have traded hands 3 to 4 times while under construction... Everyone does realize the last time that happened was Florida 1925. Does everyone remember Florida 1926?

I have no problem with builders offering incentives that still allow them a profit. That's normal in most marketing businesses. My issue is with home affordability; its not there.

We're not looking for excuses not to buy. This is like the Nasdaq at 5000 when people were arguing 4000 is "fair value." Nope.

I'm involved in moving too many people out of bubble markets to believe home prices can stay where they are. (I confirmed, we're pulling people out of DC.) I have too many people every week show up into my office demanding to be relocated or they'll jump ship; they mean it.

When investment markets start falling, speculators panic. There are just too many speculators in housing right now. Cleaning them out is going to be ugly...

Neil

va_investor said...

ReplyDelete“You miss the point Robert. Just like a 401k or a stock portfolio, "equity" is for retirement.”

I think I got the point Lance was making:

Lance said...

-….sorry, DC Too, but is is DC_YOU who has lost out on hundreds of thousands of dollars worth of equity by holding off ...-

After constantly belching:

Lance said...

-….I do believe that for a prospective homeowner (or longterm investor) there

IS…. no bad time to buy-

Lance said...

-In brief, if you are looking to buy a home, the thought of resale value shouldn't even cross your mind…..-

It seems he too is pointing to his “equity” and flaunts it as a great investment. An investment that currently is loosing value.

“The house will be paid for.”

It will? What type of guarantee does he have? It may be paid for, but worth less than when he bought it.

“What can you, Robert, do today - right now- with your 401? (assuming you have one).”

If need be, cash out. Not recommended, but I could have cash in hand before Lance has his first open house, much less a buyer.

“At least Lance knows that his house will be paid for at retirement. Can you say that your alternate "plan" will pay for your housing in retirement?”

Lances buy no matter what plan? No thanks, I’ll stick to my buy a decent house at a decent price plan and not use my house as my retirement vehicle.

“And, btw, most homeowners have a 401 in addition to their house and other investments.”

And a lot of homeowners will visit:

http://www.dhcd.state.md.us/Website/programs/cdammp/Lifeline.html

for their handout.

rebar said...

ReplyDelete“VA Investor and Lance might make assumptions, but you're just plain wrong. While both have said that real estate is always a good investment in the long run, they have both repeatedly stated, over and over, that whatever house is in question has to be at the right price.

Nowhere has either one ever said or even implied, that you ought walk up to the first house you find and buy it at whatever price.”

Well let’s see what Lance has to say about home buying:

Lance said...

“…… that there is never a bad time to buy if it is a home you are buying….”

“….I do believe that for a prospective homeowner (or longterm investor) there

IS…. no bad time to buy”

“In brief, if you are looking to buy a home, the thought of resale value shouldn't even cross your mind…..”

“And would I have like a big house with at least 3 bedrooms? Sure, but I settled for a small one with 2 bedrooms and a basement rental that helps me meet the mortgage payment.”

“The numbers you are watching (inventory, foreclosures, ARM restets)are fine and dandy if you are a flipper and looking to make short term gains. They mean little if you are a long term invester such as Va_Investor and absolutely nothing if you are a homeowner ... or wannabe homeowner as some of the bubbleheads are.”

va_investor said...

ReplyDeleterobert,

“….If you were to "csah-out" your 401, there would be significant penalties.”

Agreed, that’s why I said “not recommended”.

“Lance can either tap a HELOC,”

Oh, I see, debt IS wealth!

“Or if an emergency, sell his house quickly at a discount. Since he has a good amount of equity, chances are slim he will lose cash dollars. You, on the other hand will lose actual cash on a 401.”

Lance sell at a discount? How about a loss! My “devalued” 401 is worth more than the $$ Lance would need to bring to the table to sell.

“Which situation is better? Anyone can lose a job or get sick etc. Renters are MORE vulnerable because they have no equity to tap.”

I have cash on hand from the sell of my home and other liquid investments plus the cash I’m saving in renting. No need to go into debt (HELOC) to settle a debt.

Often 6 or 12 months earnings is plenty to get people through rough times. Heloc's are often used (or, just opened) as a form of financial security or insurance; so that one won't have to touch retirement accounts.

Excellent! More HELOCs please!

http://www.realtor.org/RMODaily.nsf/pages/News2006090704

“In brief, if you are looking to buy a home, the thought of resale value shouldn't even cross your mind…..”

ReplyDeleteFunny... that's the first thing my circa 1990 home buying guide talked about. It noted that any potential home buyer had to think like a home *seller* before purchasing and that looking toward resale should be the buyers #1 goal during the purchase process.

I'm saving that quote, its precious.

Neil

va_investor said...

ReplyDeleterobert,

“Lance will not have a "loss" of actual cash as you would, presumably, in your 401.

Lance rolled alot of equity from his condo into his "below market" purchase of his house. I am quite confident that your gains (cash on cash) in your 401 are pale in comparison to Lance's leveraged gains.”

Lance “presumably” rolled alot of equity from his condo. (It works both ways)

He has not sold it yet has he? Only then will we/he know. I am quite confident that Lance won’t see much, if any, gains if he sells in the next few years, so there, we’re even.

“In addition, selling one's home is a tax favored (tax-free in most cases) event. Cashing in a 401 is severely penalized and regular stock account sales have tax consequences.”

Tax favored, yes. But alas, where would our good friend Lance live? He would not become a bitter renter would he?

“Tapping home equity is akin to borrowing from yourself and is also tax-favored.”

Is it tapping home equity, or tapping debt? If I borrow from “myself”, do I have to pay “myself” back?

Neil said...

ReplyDelete“I'm saving that quote, its precious.”

Lance made me post it on my fridge, priceless.

Robert said:

ReplyDelete"Lance sell at a discount? How about a loss! My “devalued” 401 is worth more than the $$ Lance would need to bring to the table to sell."

If it weren't so sad, Robert's tendency to create his own alternate universe based on his own construed facts and assumptions would be laughable. Look at how he makes a judgement in this quote based on numbers he doesn't know ... The strangeness of it all is really amazing. He creates a "fact", states it over and and over until he thinks everyone believes it, and then draws "conclusions" from these self-construed facts in his alternate universe.

Robert asked:

ReplyDelete"Tax favored, yes. But alas, where would our good friend Lance live? He would not become a bitter renter would he?"

With the cash that I'd walk away with after all was said and done, I'd buy a nice, average, $400K - $500K 2 bedroom house out in the burbs ... for all cash ...

Actually, I wouldn't be stupid enough to pay all cash for a house while I am in the workforece and have income to shelter. I WANT those tax deductions!

Va_Investor said:

ReplyDelete"You and robert are taking Lance's comments out of context. Is this your intent?"

I have pointed this out to David on several occasions. If David weren't censoring at all, I would have no problem with this constant manipulation of my words and even misattribution of quotes to me (and you) that no one other than the bubbleheads have ever made on this post (such as "prices always go up!"). However, as David does indeed censor, Neil and Robert's misquotes and out of context references should likewise be prohibited.

robert said...

ReplyDelete"Neil said...

“I'm saving that quote, its precious.”

Lance made me post it on my fridge, priceless."

Robert, it's not your fridge. Your landlord bought it and it's theirs ... !

Robert asked:

ReplyDelete"Is it tapping home equity, or tapping debt? If I borrow from “myself”, do I have to pay “myself” back?"

Only if you want to. But I don't expect you to understand what that means. You have your mind set up as to how things "must be" and anything that conflicts with your known "facts" just gets dismissed .. Or perhaps just goes in one ear and out the other without even full recognition.

So Lance, DC market drops 8% and you want to recant some comments. Man, the claws come out too. You got that basement apartment on craigslist yet? Maybe once you get that rented out that’ll ease some frustration.

ReplyDelete