The Tuscany Condos are being built on what used to be my apartment building's (200 Yoakum Parkway) tennis court. The Tuscany Condos were originally selling "from the $400s." By the time you posted your article on them, the price had already been reduced to "the $300's."

At the same time, my apartment building has been getting converted to condominiums. I had originally been offered a purchase price of $262,900 for my one bedroom apartment. (I turned it down.) More recently, one bedroom apartments like mine have been advertised "from the low $200's."

Because of my building's condo conversion, all of the tenants who didn't choose to buy have been told to move out. I am now one of the very few people still living in this very vacant building. (Finding parking is GREAT!) My eviction date is October 28th -- this coming Saturday.

Last week, I found a new (and bigger) apartment elsewhere and signed the lease. I have been worried about being able to move all my stuff out on time, so I called and asked for a 3-day extension so I could have the whole weekend to move.

A few days ago, signs were posted in my building saying the condo sales office had closed. I was shocked that they could have actually sold all the condos in this declining housing market.

Today, I got a call back on my answering machine regarding the 3-day extension, and I cannot believe what they told me. My building is "going to turn back to rentals. It is not going condo." I JUST SIGNED THE LEASE ON THE NEW PLACE! I HAVEN'T EVEN MOVED YET! I haven't had a chance to ask, but I'm willing to bet that they couldn't sell nearly enough condos.

Months ago, I had bookmarked my building's condo sales website, strandcondominium.com. I even visited the site just a few days ago. So now, with the notice that my building is not going condo, I decided to visit the site again to see what it said. Well, it's gone! It has vanished into the ether.

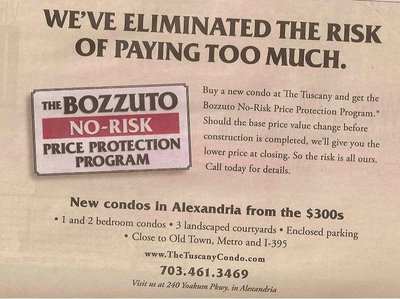

And this is where I get back to The Tuscany. ITS WEB SITE IS GONE, TOO! The building is only half built, and its sales web site is GONE! (You actually posted the wrong URL on your blog. It's TheTuscanyCondo.com, not TuscanyCondo.com. You can see that if you look at the photo you posted.)

I'd say that clinches it. The bubble has definitely burst....but I still have to move if I want to avoid an expensive lease break fee on my new apartment.

This raises a question: Will the DC area (and other housing bubble areas) spend years filled with abandoned, partially-built residences? Or will the home builders finish building places that they won't be able to sell?

ReplyDeleteFor now at least, construction is still being done on The Tuscany, even though they have discontinued condo sales.

Where I live in West Hartford, CT, a school is being converted to condoes, "starting in the 200's". The most expensive ones are supposed to be $600,000. This is in a blue-collar area bordering a commercial zone. I have noticed there has been no activity on the site for months, just a partially renovated shell. The website is unchanged, but it looks like 1990 all over again.

ReplyDeleteSome people never learn from history.

Yes try doing what dc condo watcher says. Sounds reasonable! I'm sure they want you to stay for another year.

ReplyDeletePia

http://www.glgi.net

Original Poster,

ReplyDeleteYou may have some legal protections because the apartment management originally "evicted" you and gave you no notice of their decision to decide to suddenly hold you to your lease.

I know nothing of Virginia law, but you may want to research this before you make any decisions.

Yep, condos are in for a bruising. One good example of how things have gone whacked...the Chaselton in Dupont. I recently got into it with the EYA-Urban person sending out promo emails. This is a conversion of what was cheapo student apartments. Unless they utterly gutted the baseboards, etc...I know of one 2 bedrooom unit which has alcohol, vomit, and cocaine residue in it (I knew the two girls who lived there). It has zero amenities...no balconies, gym, pool, roof deck, etc...

ReplyDeleteThey want $200K+ for studios, up to almost $500K for a 2 bedroom. You can get the same or lower prices in Penn Corridor with amenities.

Or look at 555 in Penn Corridor. The website lists the prices as monthly payments, based on zero down and a suicide loan combo (I/O Arms).

Condos have risen way out of whack based on tulip mania, flippers, and whack loans. Pain is coming soon.

anon, in discussing the Chastleton said:

ReplyDelete"They want $200K+ for studios, up to almost $500K for a 2 bedroom. You can get the same or lower prices in Penn Corridor with amenities."

The number one rule in valuing real estate is "location, location, location." There's no comparison between the 2 areas. Now, 10 years down the road, the Penn Corridor location (which is in realty the Mass Ave Corridor) might become a much safer place with more amenities and a residential mix that includes more than "just out of college" twenty-somethings buying their first place. At that point, it might hold a Candle to the "Dupont/U Street/Logan" location of the Chastleton, but we aren't there yet. The extra amenities are still needed to attract people who otherwise would rather buy in far safer places with much more to do right at their door steps. Of course, if location really means nothing to you, then why not just take your $200K and buy a 4 bedroom colonial in West Virginia instead?

http://www.555condo.com/comparison.htm

ReplyDeleteI hate it when anyone quotes a monthly payment as the price. I think the monthly rents of the "similar area apartments" are unrealistic, not to mention the fact that I don't need to have a $70K down payment.

These people rate right up there with car salesmen.

DuPont area also happens to still be up considerably year over year. Yeah, I know, it's coming - blah, blah, blah.

ReplyDeleteOriginal Poster,

ReplyDeleteTrying calling your existing leasing office and see if they are willing to pay the lease breaking fees for your new lease. Would they rather pay the $2000-$3000 in lease break penalties to have you stay there another year, or loose a revenue generating customer for the next 12 months

I considered that, but I viewed this eviction as an opportunity to move to a bigger and better place. I never intended to live in my current apartment as long as I had. It's often better to embrace change, rather than stick with what is comfortable and familiar. The process of finding a new place and moving is stressful, but it's almost over.

Va_Investor said:

ReplyDelete"In a hot market they go up. But they really get crushed on the downside."

Yep, I agree with you on this. Condos are much more volatile. And as you said in an earlier post, I did indeed consider this when deciding to go forward with switching from a condo to a house during what was obviously the "height of the market". I didn't do it for "investment" reasons but rather thaT my end goal had always been a house and it made sense to me that at the height of a market a condo price would relatively be much higher than a house's ... thus reducing the chasm between the two and allowing me to more easily make the transition up despite the also relatively higher price of houses. I believe part of the reason condo prices are more volotile than house prices is that because of the condo fee (and limited and indirect authority over spend/repair decisions), condos have some elements of a rental/apartment in them. I haven't thought it through, but I'm sure the hybrid nature of the ownership plays a part in the price volotility.

* There's a crane sitting idle months by Montgomery Mall since the Canyon Ranch condo project got canceled.

ReplyDeleteThey're going to start up again as apartment rental towers.

* The Morgan (former condo) in North Bethesda is offering units as rental apartments now

* Received this report on The Chase at Bethesda from apartmentratings.com:

Something is wrong with the current condo conversion. One of the two buildings is not being shown to prospective purchasers. The project hasn't sold very well, which isn't a total shock when looking at the overall market. This is more bad news for the developer, Monument Realty, which already cancelled two other projects this year.

Moving is great, I've changed 9 places, 3 states and 2 countries in past 9 years - because it's always a great experience to live in a new place!

ReplyDeleteI wish I can move, too.

What I'm seeing up here in Massachusetts is lots and lots of "luxury" (but not really) condos going unsold. The builders/investors are bringing in renters so the buildings don't look so abandoned. Some good friends of mine have rented from the builder a huge 3BR + loft, 1 1/2 bath rowhouse-style condo in a good location for $1650/month. That's about 60% of what a monthly payment (including HOA) would be if they bought the place with a reasonable mortgage...

ReplyDeleteI think first-time buyers have been going for condos because they are just priced out of the SFH market. Some other friends, who can afford a ~275K mortgage, are finding that SFHs in that range are either in bad towns or need major maintenance, or both. But they are trying to stay away from condos because they want things a condo wouldn't give them -- no common walls with neighbors, no HOA, a garden, etc.

Yes, the Chase in Bethesda is in trouble. The sales office has confirmed that the North tower building (there were two buildings) will not be proceeding. There were about 110 units in this building. All purchasers who had contracts are being solicited to move to the other building (probably no incentives!). Sales were so poor in the building that the developer decided to cancel before settlements began. Monument Realty, which oversees the project, has already cancelled two other projects this year. Sales in Bethesda are non-existent. Many units in buildings such as the Christopher, Crescent Plaza, the Edgemoor and others are sitting on the market unsold. Even after some generous price reductions, nothing is moving. Prices have movement in the next few months. Sellers need to wake up and realize that buyers have the upper hand.

ReplyDeleteOf course Bozzuto is going to complete the construction of the property. They're going to offer the units as rentals. It's a pretty reasonable exit strategy, one that many condo developers will utilize. This will prevent a lot of the mania this post is so fond of predicting.

ReplyDeleteI was in my rental office in McLean asking for a new 1 year lease and there was a woman in there talking about the very exact thing. She was getting ready to move into a condo, had the cabinets that she selected installed already and was just informed that the condo was going back to rentals and that the website for the project was already gone.

ReplyDeleteI think she was just going to rent after that experience and not bother loking again until things shake out.

I was living in the exact building described above and received my returned deposit check with a letter asking me to contact the leasing office to stay in my "unit" that I had been going to buy. As soon as I saw the sales office closed, I contacted the developers and they told me the project was cancelled, so I found a new place and moved by October 30th. Question is, I now have to pick up a certified letter from the development company. Can they hold me to a 30 day notice and try to get me to pay the rent for November when they provided no notice to me of the cancellation and "offered" me the opportunity to remain and lease from them? Mind you, I lived through the entire "reconstruction" of the lobby, etc., removal of all security and amenity services.

ReplyDelete