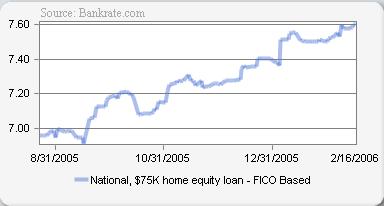

The 'great' American home ATM is becoming less well stocked and is becoming more costly to operate . How will this effect consumer spending which accounts for 70% of the US economy?

The 'great' American home ATM is becoming less well stocked and is becoming more costly to operate . How will this effect consumer spending which accounts for 70% of the US economy?

Subscribe to:

Post Comments (Atom)

Bubble Meter is a national housing bubble blog dedicated to tracking the continuing decline of the housing bubble throughout the USA. It is a long and slow decline. Housing prices were simply unsustainable. National housing bubble coverage. Please join in the discussion.

A few things..

ReplyDeleteAmericans are addicted to debt. If someone thinks nothing of double digit rates on credit cards, even at 8% a home equity is "cheap". It's going to take much more than increasing rates to shut down the Housing ATM.

Include the HELOC for the same terms as well.. The HELOC has seen a significant change in rates over the same time period. I believe it's just as representative of the housing ATM, maybe even more so.

It might help to increase the horizon as well.. Rates on these types of loans have been steadily increasing since 2004. Unfortunately, the bankrate data for these mortgages only goes back to mid-2004. It would have been nice to graph the data back to at least 2000.

grim

grim,

ReplyDeleteGreat points. :-)

The Re-Fi Craze is reaching a downturn. This will have tremendous implications for the US economy. No more ATM money for the kitchen remodeling, exotic vacations, or the Mercedes.

ReplyDeleteDavid, you might want to check out the article in the NY Times today "Farewell, Condo Cash Outs". It specifically covers a couple buildings, including Clarendon 1021. I bet you've already got it though.

ReplyDeleteAmericans have not yet been held accountable for their massive debt. WHen they are, when the creditors say hey, pay me now, then watch out.

ReplyDeleteMarinite

Marin Real Estate Bubble

arioch,

ReplyDeleteVery funny. :-)

anon,

I saw the article. Thanks for posting.