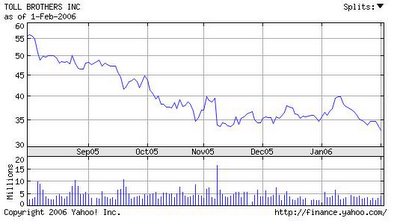

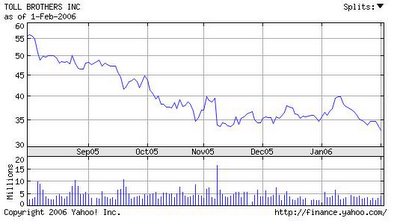

Toll Brother's stock continues to decline in price as the housing market declines. The homebuilder does most of its sales in the bubble markets.

Toll Brother's stock continues to decline in price as the housing market declines. The homebuilder does most of its sales in the bubble markets.

Subscribe to:

Post Comments (Atom)

Bubble Meter is a national housing bubble blog dedicated to tracking the continuing decline of the housing bubble throughout the USA. It is a long and slow decline. Housing prices were simply unsustainable. National housing bubble coverage. Please join in the discussion.

Toll Brother's stock continues to decline in price as the housing market declines. The homebuilder does most of its sales in the bubble markets.

Toll Brother's stock continues to decline in price as the housing market declines. The homebuilder does most of its sales in the bubble markets.

Be careful in leading anyone to believe that the homebuilder stocks are in any way a proxy for the real estate market, in particular, the existing homes market.

ReplyDeleteWhile I agree that it certainly reflects a changing public sentiment, I think you would be hard pressed to find any correlation between home prices and share prices... (yet).

Margins are still high as well as inventories and land positions. These guys can continue to be profitable long into a decline.

Grim

Northern NJ Real Estate Bubble

They can be profitable, but not as profitable...hence the decline...the same thing happened to them in the LAST bubble...

ReplyDeleteI wonder whether owning such a stock is a good hedge for non-homeowners like me who don't want to buy a home but are also uneasy about the idea that there's a bubble?

ReplyDeleteWhy you might want to hedge:

ReplyDeleteIf I think the market is basically efficient, I should want to hold a diversified portfolio of investments, including housing. This is difficult to do...if I buy a house, I'm way way "long" in housing. If I rent, I have no housing in my portfolio at all and I'm essentially way "short." Now, I might *want* to be short if I think I can out-guess the market, but experience has long shown that trying to time the market is a dangerous game that few can win. I'm sympathetic to the idea that there is a housing bubble, but I don't like having no housing at all in my portfolio, because you and I could be wrong and housing could perform better than expected. (By the way, I agree with Robert Shiller that this inability to take anything but a very long or short position in housing is a serious defect in the market that exposes people to excesive risk and exacerbates inequality.)

If you want a more concrete example of why I might want to hedge, I lost a *huge* amount of money by not owning any housing at all for the last 5 years.

ReplyDeleteWho typically buys Toll Brothers homes?

ReplyDeleteAge range: 35-50

Race: predominately white with more well-to-do Asian families joining the ranks.

Household Income: $125K-$500K

Profession: Corporate management, law, and medicine.

Political Affiliation: REPUBLICAN, RIGHT-WING GEORGE W. BUSH ASS KISSERS!

Yeah, I feel bad for Toll Brothers and their fucking home owner customers.

anon hedger,

ReplyDeleteIf you want to own homebuilders, at least buy some that are diversified in regions of the country and also in types of homes. Pulte and D.R. Horton come to mind.

anon 7:45,

You need help.