From the Publisher:

Book Description

When real estate booms nationally, there are hundreds of cities and regions that lag behind. Similarly, when the market slows or flattens, countless states and neighborhoods begin to boom. As Lereah makes clear, the most important factor in buying or selling a home is the local market conditions. Lereah shows readers how to:

- Evaluate the values of homes in one's own town or county

- Determine whether property values in your targeted neighborhood are on the rise

- Assess the market conditions in locations when buying a vacation or second home

- Learn how to identify markets that are overvalued or fully valued, and those that promise to appreciate more quickly in the future

- Understand the local economic developments that can affect oneÂ’s investment in the future

There are countless books offering advice on making money in real estate. This is the first one to explain why knowing the ins and outs of your local region is essential to deciding when, and where, to buy.

--------------------------

The boom did nbot continue. The housing market in the bubble markets are undergoing significant declines. His main predictions have been totally discrested. Mr. Lereah tells half truths and manipulates facts and figures. He cannot be trusted as he is a paid shill.

David - you tell half truths and manipulate facts and figures.

ReplyDeleteMr. Lereah tells half truths

ReplyDeleteThat's pretty generous of you. I would have put his truth level at more like 10%.

So, don't buy his book. Nothing like "beating a dead horse".

ReplyDeleteDead horse? This horse is still running around and neighing loud enough for all the villagers to hear. This is yet another new book from him. I say let the beatings continue - the only thing dead around here are the open houses.

I'd hardly say Lereah is telling half truths. His predictions have been far more on the money than the bubbleheads' predictions ... Yet I don't see bubbleheads claiming that they've been saying "half" (or even "quarter") truths.

ReplyDeleteThe world is black and white to bubbleheads ... And when they can't understand others' views being presented, they accuse them of "lying" rather than seeking to understand that in most cases there is no absolute "right" or absolute "wrong". Life is too complicated for such simplistic answers.

His predictions have been far more on the money

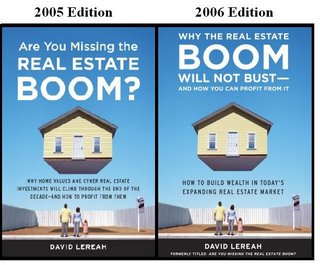

ReplyDeleteUh huh... you might want to scroll up the page a little and look at the title of his book from 2005. Here, I'll help you out:

Are You Missing the Real Estate Boom?: The Boom Will Not Bust and Why Property Values Will Continue to Climb Through the End of the Decade - And How to Profit From Them

I'm not sure what your definition of "on the money is", but that seems about as far off as possible.

Anon 7:11 said

ReplyDelete"Are You Missing the Real Estate Boom?: The Boom Will Not Bust and Why Property Values Will Continue to Climb Through the End of the Decade - And How to Profit From Them

I'm not sure what your definition of "on the money is", but that seems about as far off as possible. "

Year on year figures for my zip code are UP by 10% as of the last. Am I surprized? No ... Because I realize that there are no blanket yes's or no's for anything. The world isn't black and white ... That would make things too easy. When I read the comment about the boom not ending I don't read "each and every property will go up with no effort on your part ... just put your money in and you are guaranteed to see it grow" ... No, I instead read "do you due diligence and the fact that the fundamentals of economic and population growth are on your side, will ensure that if you make wise purchases, they will grow in value." And THAT is the bubblehead's failing. They are looking for EASY "gains" ... And they read in "easy" gains even into a book that is meant to help them help themselves ... And NOT give them a key to unearned wealth and prosperity. Lereah has been on the money. If you bought wisely in the past five years (and if you buy wisely in the next five years), you can be assured increasing value. The key is buying "wisely" ...

Lance said

ReplyDelete"that in most cases there is no absolute "right" or absolute "wrong". Life is too complicated for such simplistic answers. "

..dude that is scary thinking..it is this 19th century german nihilst/relativit philosophy that Lenin believed would destroy America..that I see more and more..especially from kids coming out of school...

"and history that will be made."

ReplyDeleteI'm sorry, so is it or isn't it "different this time"?

Va_Investor wrote: " People would be wise to read everything they can get their hands on if they are truly serious about RE. Use common sense and intellect to separate the wheat from the chaff. "

ReplyDeleteLereah's book is mainly chaff!

Lance,

ReplyDeleteWhat zipcode?

And THAT is the bubblehead's failing. They are looking for EASY "gains" ...

ReplyDeleteNice paper tiger there. If anything, bubbleheads want people to stop looking for easy gains so that the speculative element is flushed from the market. As a bubblehead, I just want home to live in, not for the "gains" - it is the prospect of price declines coupled with the relatively attractive alternative of renting which keep me from buying.

Jeez David, give it a rest. Is your advice then not to read anything or should people just let you decide what is worth reading?

ReplyDeleteI'm not David, but I must agree with him that reading Lereah's books would largely be a waste of time. Just take a look at the reviews at Amazon where it gets an average rating of 2 1/2 stars. Why would you invest your time in reading something which gets such horrible reviews? I'm not saying Amazon is the ultimate arbiter on book quality, but seriously, there are plenty of classic texts that would make a much better investment of anyone's time.

Joe and Mary Jane Sixpack don't purchase or read books. They aren't going to read Lereah, and they are unlikely to even know who he is.

ReplyDeleteBut thanks for looking out the great unwashed masses. (snicker)

Lots of reports out this week that Massachusetts is experiencing the "soft landing". Sales down (but still reasonable levels), inventory declining. SFH selling prices down 5-8%.

ReplyDeleteConsensus is that we are bottoming out, though the guessing is that everything will be flat for a while.

Job growth picking up strongly in MA also.

va_investor said...

ReplyDelete“RE: Anon 9:07

Lance, you might as well be talking to a wall. These guys don't WANT to get it. Rather whine and cry about prices.

Reminds me of a little kid running around covering their ears. “

But va_ we do get it:

-Lance said...

So, as one other poster aluded to, YES I do believe that for a prospective homeowner (or longterm investor) there IS no bad time to buy ... –

July 21, 2006 1:34 PM

There, enough said. No need to debate, argue or speculate:BUY! BUY! BUY!

I believe I said read everything you can get your hands on.

ReplyDeleteThat is obviously not possible. One must prioritize and I seriously doubt that you would run out of well regarded business and investment books in your lifetime before you have worked your way down to Lereah's.

And, no I don't rely on "average" people's assessment of a book's worth.

OK, how would you go about assessing the worth of the book I linked to at Amazon?

Someone is obsessed with Lance...

ReplyDeleteConsensus is that we are bottoming out, though the guessing is that everything will be flat for a while.

ReplyDeleteI don't think that's a consensus at all, it's just all the papers quoting the same Moody's article. Year over year price declines have been getting steeper every month for awhile now. Check out this graph. I wouldn't expect that to suddenly snap back to 0% appreciation.

They are not quoting Moody's there is are independent sources locally that are being quoted.

ReplyDeleteI was adamant things were going down from January 2005, but they kept going up and now have not dropped much.

Here in MA in the early 90's the most it went down was 7% a year. It doesn't feel like that at all right now.

They are not quoting Moody's there is are independent sources locally that are being quoted.

ReplyDeleteMaybe the articles citing the actual price declines aren't quoting Moody's, but all of the recent articles I've read which claim that MA has "bottomed out" were just repeating Moody's. Post links if you have have them to recent articles which say that MA has "bottomed out" without citing Moody's.

David said...

ReplyDelete"Lance,

What zipcode?"

20009

Sure. try this

ReplyDeletehttp://home.businesswire.com/portal/site/google/index.jsp?ndmViewId=news_view&newsId=20061023005792&newsLang=en

or this

http://business.bostonherald.com/realestateNews/view.bg?articleid=163689

or this (my town)

http://www.andovertownsman.com/news/20061019/FP_001.html

The Boston Globe does that the Moody quotes, but all tap into some other sources.

Anon said:

ReplyDelete"Nice paper tiger there. If anything, bubbleheads want people to stop looking for easy gains so that the speculative element is flushed from the market."

And by so wishing, you are wishing against your own best longterm interests as a prospective homebuyer. Even the flippers have their place in the overall scheme of things. Flippers provide liquidity to the market ... and while they get rewarded with higher than normal profits for doing so while prices are rising, it is also they who take the brunt of the loss when prices start falling. Anyone who bought for the longterm will be fine irrespective of what happens over the next year or two. The same cannot be said of a flipper who may have mortgaged their all for that expected short term gain ... and ended up instead with a short term loss. Someone mentioned socialism earlier. Getting rid of flippers in the erred belief that they are causing prices to rise higher than they otherwise would is akin to many of the failed policies that resulted from people looking at economic problems from a social (or rather "socialistic) viewpoint. Markets work fine on their own ... Mucking with them to make them better usually results in making them worse ... As would be the case if you got your wish and there were no flippers around. Take out the liquidity that the flippers provided during the last boom and you would have seriously lowered the number of new homes being built. And what do you think happens when there is less supply in a period of growing demand? ...Yes, prices would have risen even faster and higher than they did ... AND there still wouldn't have been enough homes to go around. There would have been less than there were with the added funds that the flippers brought to the market.

And by so wishing, you are wishing against your own best longterm interests as a prospective homebuyer.

ReplyDeleteI think you misunderstood me. I want the speculative element to be burned off now via natural market forces. I was in no way advocating that flippers be outlawed - freedom cannot exist if you are not free to do stupid things. I am very glad that they are leaving a glut of inventory in their wake for me to choose from, although I also would have been happy if the market had been rational the whole time.

Anon 12:42 said:

ReplyDelete"I am very glad that they are leaving a glut of inventory in their wake for me to choose from, although I also would have been happy if the market had been rational the whole time.

Yes, I guess I misunderstood you in regards to "outlawing" flippers. However, I'm not sure I agree tha the market would have been rational without them (as you seem to be implying ... Let me know if I misunderstod this.) I believe the market would have been "irrational" under any circumstances ... whatever "irrational" means in this case. By that I mean I think demand would have far outstripped demand (causing prices to skyrocket) even if there had been no flippers around to add fuel to the fire ... because I believe flippers only entered the market AFTER it became "irrational" and they saw an opportunity to make "irrational" profits ... in the same way they are now make "irrational" contributions to adding to the market supply etc.

However, I'm not sure I agree tha the market would have been rational without them (as you seem to be implying ... Let me know if I misunderstod this.)

ReplyDeleteI actually agree with you. I was only singling out flippers because you had mentioned them and I did not mean to imply that they were the only irrational or speculative element. Many buyers paid more than they normally would have because they believed stretching would be worth it because the appreciation of the last few years would continue forever. So while they may have bought without the singular intent of speculation, there was a speculative element to the prices that they paid.

LISTEN UP HERE!!!!!

ReplyDelete>>>>THE SOLITARY ITEM, THAT EVERYBODY IS MISSING...."IS"..

WHAT DOES IT COST TO BUILD A HOUSE<<<<<

|||| NOW ||| That lumber, and OSB [oriented strand board], has dropped more than 25%.....and many, many building contractors as scrathcing for work....

Crazy G. predicts, that in a short time, you will be able to build a house cheaper than buying existing stock, of builder inventory....

Keep in mind, a lot of these pricing pressures were cost related, due to demand for materials, and labor.....

NOW, that pricing is diminished, EVENTUALLY [short term], you'll be able to build at a better price????

fogcutter said:

ReplyDelete"Tell you what, I have a friend who is $3M in debt on DC area condos and is sweating blood right now. Since the bubbleheads have it all wrong, can I tell him that you are willing to buy him out at break even so he can quit worrying?"

Sometimes I think the only person on here who understands what I write is Va_Investor. Not 2 postings further up from your posting I am talking about how flippers must take the bad with the good. Yet, your post implies I've said that flippers won't be losing money. I've never said that. On the contrary, I've said that when someone goes in for a quick profit they have to be prepared for it to become a quick loss instead. By confusing my words, you are re-inforcing my belief that bubbleheads are really just wannabe flippers .... They are people who don't look at houses/condos as a place to live in ... but rather as a place to make money off of. For them their housing is an "investment" upon which they expect to make a monetary return. My focus throughout all my posts is from a homeowner's viewpoint (i.e., I am focusing on what a want-to-be-a-homeowner person should be taking into consideration.) From my perspective, a homeowner needs to look to minimize his longterm housing expense ... and not even give a second thought about how much he can "flip" his home for in the nearterm (or even in the medium term.) A homeowner doesn't flip their home .... They LIVE in it. Va_Investor has a slightly different focus on things in that she IS looking at houses as an investor ... albeit a longterm one. So she, like a homeowner, can look at the long term. But by and far, you the bubbleheads really have little in common with either Va_Investor or myself in that you are looking to make short term gains (or avoid short-term loses ... which is really just the other side of the same coin.) You can't seem to see things into longterm ... And that is your loss because in your attempt to make a quick buck (or conversely not have paper losses that you'll never really see) you are causing yourselves to (1) have higher overall housing costs in the longrun and (2) live life as second-class citizen renters. Your greed is causing you to shoot yourselves in the foot!

CAZY G, The cost of materials to construct a house is one of the least important factors in determining its price. The scarcity of the land on which it sits is the most important factor along with other constraints such as applicable zoning laws. That's why you can buy a $100,000 4 bedroom 2 car garage house on 2 acres in Alabama ... but pay something like $10,000,000 for that same house if it is sitting on 2 acres in the middle of Georgetown.

ReplyDeleteva_investor said:

ReplyDelete"joe hennessey,

No one on this board is Joe Sixpack. Your attitude reflects the worst of the Bubbleheads and shows why people are reluctant to provide any real help or valuable advice."

I was snickering at the bubbleheads.... They claim to be looking out for helpless, hapless homebuyers when in reality it is just another pointless argument they make from their vantage point of having their heads buried in the sand.

(I guess I should have been more specific initially)

Crazy G said: "Crazy G. predicts, that in a short time, you will be able to build a house cheaper than buying existing stock, of builder inventory...."

ReplyDeleteSounds great Crazy G! I want to build a new house on Reservoir Road in DC. Actully, anywhere in Georgetown will be fine. How do I get started?

joe hennessey,

ReplyDeleteIf the bubbleheads are A) wrong and B) not listened to by anybody anyway, then why do you care enough to spend your time commenting on this blog?

"If the bubbleheads are A) wrong and B) not listened to by anybody anyway, then why do you care enough to spend your time commenting on this blog?"

ReplyDeleteIt is *VERY* entertaining here!

Lance said...

ReplyDelete“CAZY G, The cost of materials to construct a house is one of the least important factors in determining its price. The scarcity of the land…”

Great, the “not making any more land” spiel.

Anywho Crazy G, the point you bring up is relevant, but more so to the small “independent” builders. Ones that put up a dozen or so houses a year, depending on how rural/suburban the location. Yea, their pockets might be deeper than yours, but not as deep as the builder who is putting in 100+ houses per subdivision. You could find the break even point for these guys, well, in the ball park anyway. Tax records/permits are easily had and for Maryland, you can find mortgage info online.

After “XXX” number of days on the market, and if the builder is exposed (6 or so houses still on the market), this makes for some leverage. You could probably find an argument that the builder could let go of one or two houses for “cost” and still bring in an ok profit.

Robert said:

ReplyDelete"You could probably find an argument that the builder could let go of one or two houses for “cost” and still bring in an ok profit."

So Robert, you believe that if one sells something for what it cost them to make it available for sale that they are still making an "ok profit"? You also earlier stated that you believed that because of inflation one would make a return on the money sitting in their pocket. And despite myself and others at various times explaining to you why you can make a good purchase under any market conditions, you continue to misconstrue what I have said by taking it out of context. Good luck finding something ... Especially at the 70% discount that you earlier said most properties should sell at. You're going to need it.

Yep, I have a job in Rockville and I'm going to buy a new house just north of Cumberland, MD because it is cheaper to buy a house up there.

ReplyDeleteNever mind the fact that I'll be spending five hours a day in my car (barring delays due to weather and collisions). Cost of goods sold is the ultimate factor in determining what house to buy, and where to buy it. Costs of both material and labor have fallen, so I'm building in Cumberland.

Perhaps I can get a job at a strip mall in Cumberland and reduce my commute by about 20 hours per week.

Location, Location, Location!

It is *VERY* entertaining here!

ReplyDeleteSo instead of "looking out the great unwashed masses" [sic], you choose to belittle and incite them. Thanks for clarifying, just in case anybody might have thought you were here for serious discussion.

Regarding the articles about Massachusetts "bottoming out"...

ReplyDeleteI see how you might read those quotes that way, but they are at least ambiguous on whether the price declines will be over soon. In the first link you posted, Timothy Warren from Banker & Tradesman said that the "softening" would continue into next year, so I could see you taking that as corroboration that prices are near bottom. However, it isn't unambiguous about whether we've bottomed out or not since it doesn't indicate how bad the additional declines will be.

In fact, here's another quote from somebody at Banker & Tradesman:

“We’re extrapolating numbers that we’ve extracted so far. That’s what the statistics are showing us. It’s accelerating rather than receding. We don’t expect it to end in the near future.”

See this article

I'm not predicting how prices will behave here, I'm just pointed out that there doesn't appear to be a consensus that Massachusetts has bottomed out.

"No one on this board is Joe Sixpack"

ReplyDeleteExactly, I am a pretty highly paid professional and potential first time buyer that cannot afford to buy a home. If I cannot afford to buy, there is absolutely no way in hell that Joe Sixpack can. This is the reason there are no sales, pleae get this through your thick heads already and lower the prices. And no, i do not want a BMW, pool or vacation and you do not deserve to make 100+K for buying a property 5 years ago.

"So instead of "looking out the great unwashed masses" [sic], you choose to belittle and incite them. Thanks for clarifying, just in case anybody might have thought you were here for serious discussion."

ReplyDeleteI see that I have my first fan! Thanks for going out of your way to attempt to psycho-analyze me :-)

Let's see.... David belittles Lereah and that is acceptable (really, it is), but I belittle the folks who expect others to beleive that Lereah has some profound ethical duty to Joe Sixpack's well-being; And I'm a criminal as a result.

If somone wants to do something stupid with their money and/or their credit rating, they are *FREE* to do so.

Oh, by the way. Get over yourself.

IHateYuppies is Joe Sixpack. If you haven't been here long enough to know what I'm referring to, then hold your tongue.

ReplyDeleteWhat a bag of hot air.....Keep up the pressure on this shill.

ReplyDeleteLance said...

ReplyDelete“So Robert, you believe that if one sells something for what it cost them to make it available for sale that they are still making an "ok profit"?

No, I said that he might find and argument for it. I’m not going to make the argument but for example, if a builder has six homes on the market and lets one go at cost and sells the other five at, hell, I don’t know 20%-60% over cost he’s made a profit.

“You also earlier stated that you believed that because of inflation one would make a return on the money sitting in their pocket.”

Uh, no. I said I’m getting 4.5% on the money in my pocket (i.e. the ATM card in my pocket Lance).

“And despite myself and others at various times explaining to you why you can make a good purchase under any market conditions, you continue to misconstrue what I have said by taking it out of context. Good luck finding something ... Especially at the 70% discount that you earlier said most properties should sell at. You're going to need it. “

No Lance, I think it’s just you with the “never a bad time to buy” plan:

Lance said...

“that is correct, there is never a bad time to buy”

July 28, 2006 3:14 PM

And 70%? Please Lance, I have yet to speculate/post on the percentage drop in the market. VA_investor seems to think this is a normal cycle, if so, that would be a reversion to the mean. Hell, I might go with that.

Anon 8:59 said:

ReplyDelete"I am a pretty highly paid professional and potential first time buyer that cannot afford to buy a home."

Impossible. ANY "highly paid professional" can afford to buy. You just might not be able to afford to buy what you think you deserve to be able to buy. The answer to your problem lies within you. Don't depend on the world to change to solve your problem. It won't.

Joe Hennessey, I didn't call you a criminal, just a joker.

ReplyDeleteOh, the guy who calls himself "A Redskins Fan" is Joe Sixpack as well.

ReplyDeleteWhee! I'm under someone's skin after just a few comments. I make valid points, and I get called names in return.

ReplyDeleteLooks like someone is unhappy with his/her housing arrangements....

yep ... welcome Joe!

ReplyDeleteHas an over/under pool started yet on when Lance and VA Investor disappear from the board?

ReplyDeleteI actually enjoy their well written posts and it's obvious they put a lot of thought/time into them. It's a contrarian point of view but it adds value to the board.

I'm curious, though, how much longer they can keep this up? The bottom is falling out and it's clear.

Of course, numbers can always be played with to support your point of view in RE.

If someone truly thought all the members of a message board were out of their minds and spewing nonsense, there's no WAY they'd spend as much time on here posting as they do.

Whee! I'm under someone's skin after just a few comments. I make valid points, and I get called names in return.

ReplyDeleteLooks like someone is unhappy with his/her housing arrangements....

Joe Hennessey, I didn't call you a criminal, just a joker.

ReplyDeleteYep, I have a job in Rockville and I'm going to buy a new house just north of Cumberland, MD because it is cheaper to buy a house up there.

ReplyDeleteNever mind the fact that I'll be spending five hours a day in my car (barring delays due to weather and collisions). Cost of goods sold is the ultimate factor in determining what house to buy, and where to buy it. Costs of both material and labor have fallen, so I'm building in Cumberland.

Perhaps I can get a job at a strip mall in Cumberland and reduce my commute by about 20 hours per week.

Location, Location, Location!

4:51 PM

ReplyDeleteYou do not appear to understand the psychology involved:

http://brandspankin.com/?p=58

fogcutter,

ReplyDeletePlease... your friend just happened to fall into the hands of some really irresponsible loan officers? What about some personal responsibility or did he eat too many twinkies?

They are not quoting Moody's there is are independent sources locally that are being quoted.

ReplyDeleteMaybe the articles citing the actual price declines aren't quoting Moody's, but all of the recent articles I've read which claim that MA has "bottomed out" were just repeating Moody's. Post links if you have have them to recent articles which say that MA has "bottomed out" without citing Moody's.