David Lereah's presentation The Road to Recovery (ppt), slide number 1, at the Realtor's Annual Convention in New Orleans (Nardi Gras). It is ironic that there is a steep treacherous cliff on the edge of the road and clouds ahead.

David Lereah's presentation The Road to Recovery (ppt), slide number 1, at the Realtor's Annual Convention in New Orleans (Nardi Gras). It is ironic that there is a steep treacherous cliff on the edge of the road and clouds ahead.

Announcing that it is a 'Unique Housing Cycle,' Lereah blames the current declines on affordability problems, investor flight, psychology and a media scare.

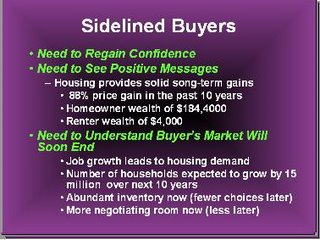

Sidelined Buyers: Lereah tells potential buyer that the 'Buyer's Market Will Soon End.' Lereah is once again using scare tactics to sell houses. Lereah is a disgrace. His real estate books have been discredited. Lereah, will go down in infamy as the housing bubble continues to pop. Lereah is the new Irving Fisher.

David Lererah mocks the 'Negative Media'.

'Buyers Are Missing Opportunities If They Postpone.' He asks "Can you afford NOT to lock in now?" given today's low interest rates. Does Lereah have no shame?

Lereah's last slide is a quote from Greenspan saying that "Most of the negatives in housing are probably behind us. The fourth quarter should be reasonably good, certainly better than the third quarter."

Lereah's last slide is a quote from Greenspan saying that "Most of the negatives in housing are probably behind us. The fourth quarter should be reasonably good, certainly better than the third quarter."

This might very well be one of the most unprofessional presentations I have ever seen.

ReplyDeleteI've got to start including some more silly graphics in my presentations. Did I miss the slide with the dancing baby?

jb

va)investor,

ReplyDelete"How in the world do Agents justify charging twice as much to sell a 600K house vs a 300k house? The simple answer is that they can't justify it"

You are correct!

"How about addressing the minimal licensing requirements and inherent conflicts of interest in the "profession"."

Agreed!

I'll post on these issues in the future.

"These are real issues. Lereah's opinions and predictions merely need to be seen for what they are, pure propaganda."

Agreed! This blog and others attack Lereah's propaganada which is important. I will also focus on the other issues you bring up. Thanks for contributing.

More downside factors:

ReplyDeleteWith the ongoing globalization of labor and supply markets, it's hard to conceive a scenario where US wages will be increasing. The relative weakness of the US dollar is also limiting investment.

Re: negative media - Now Mr. Lereah complains that negative media is artificially holding sales down with negativity, but if this is true, then surely they contributed to the unprecedented surge in prices with their previous euphoria. Did Mr. Lereah give proper credit to the media then or did he claim that price rises were due to fundamentals? (I for one do not remember him crediting the media.)

ReplyDeleteDavid (not Lereah), I appreciate your efforts at documenting Mr. Lereah and the accuracy of his statements.

Funny he didn't include Greenspan's later quote that the market had not hit bottom yet, or whatever it was he said. Somebody: look up the quote.

ReplyDeleteQuote: He didnt really present these slides did he?...He has spelling

ReplyDeleteerrors...

Well, the presentation is on the realtor.org website, typos and all - slide #40 is the one you pointed out.

VA Investor-

ReplyDeleteDid someone hi-jack your username? You actually said something I agree with. Hold on, let me catch my breath. WOW!!

crispy&cole

Lereah presents some reasonable assertions/facts in a misleading way:

ReplyDeleteHe says that this cycle is unique because:

Past declines...associated with job losses and high mortgage rates

Current declines happening with ...a good job market, with rates at near historic lows and good economic fundamentals

Current declines from...affordability problems, investor, flight, psychology, media scare.

Yet he suggests you should buy since rates are low, without addressing the fundamental issue he mentioned...affordability.

Since despite, low interest rates and a good economy, and a good job market, which are the best of all worlds, homes are unaffordable, thus they are overpriced. Getting a 2% mortgage on a $5 trillion house makes no sense if its unaffordable.

Its interesting that he notes that there was an unsustainable frenzy from 2004 to 2006 (bubble?), and wonders whether the current level of existing home sales is sustainable.

Where is the nice downtown condo that can be bought for $500,000 that is great space and not a boring box? And why are the condo people building more unaffordable ugly boxes downtown dc?

I'm looking at the slides and I'm not getting the same picture he is.

ReplyDeleteFirst, isn't this appropriate, look at Slide #66. Notice the difference between new home sales and new Housing starts?!? ROTFL. The inventory problem isn't done...

Slide #3: Sales are still at 6.25 million units yet previous healthy times were < 5.5 million units. So sales will slide a bit more.

Slide #10: I'm not concluding that's a stabilized Mortgage purchase graph.

Slide #11. Ok, the NAR doesn't want my extropolation of that chart... It screams that prices will be dropping faster than they rose... By about summer.

Slide #16: DC is one of the very hot to very cold metros Interesting, eh?

Gee... What doesn't slide 23 go back to the 1970's... Hmmm....

Side #24: God lord, some of those markets have so much risk for ARM's its... well, something we've talked about for a while. ;)

Slide #27: Wait a second, only 71% of 2006 (est) purchases are primary homes... Oh boy, the cool aid is still being consumed. That isn't much behind 2005...

Slide #41: Very informative.

Slide #49: Not much gain in 2006 for DC...

slide #53 should scare the bulls when they understand it...

Slide #56: Whisky Tango Foxtrot? Eveything I've read about declining prices says that sidelines buyers. I'd like to know their reasoning.

Slide #62: Core inflation is still high. Gee... Guess what that does to the Fed...

Housing is not at normal multiples to incomes or rents. Until it is... prices will drop.

But we're now in the "dead zone." Not much is going to happen until post super bowl. I saw no news that said "buy now or be priced out forever." I know people who will probably lose their homes because of unaffordable mortgages. I have coworkers with investment properties that are probably going to destroy their retirements. When its common that my barber, a cab driver, or other investment know-nothing warns me about staying out of real estate. Then I'll buy. Not for a bit though...

Neil

We all know Lereah is full of cr*p--so is Greenspan, apparently.

ReplyDeleteThis article appeared on Reuters today: " US heartland hit by house price declines-survey"

( http://today.reuters.com/news/ArticleInvesting.aspx?type=bondsNews&storyID=2006-11-20T212134Z_01_N20292005_RTRIDST_0_ECONOMY-HOUSING-SALES.XML )

This other one appeared on the NY Sun (NY's conservative newspaper, I must add) today: "Exactly what policy, Alan?"

( http://www.nysun.com/article/43879?access=470956)

There was another relevant article on the WSJ from a few days ago, but I don't have online access to it. Basically it said the Fed is proceeding with a lot of caution still, as core inflation is not under control; and that it seems to suggest that the ONLY TWO possible actions it will consider this Dec. 12 will be to leave interest rates alone, or to increase it slightly.

--SSH Anon

BTW - If you want an accurate state of the economy, check out the M3 figures. Of course it will be a bit difficult, as the Govt. stopped releasing them about a year ago, but you can find them if you dig.

ReplyDeleteM3 is the M2 money supply, plus large deposits and short term loans (primarilly Fed). You'll see that Bennie has been pumping short term money into the economy like mad, and we are now at the highest rate of short term loans from the Fed in decades. Benny's pumping liquidity like mad.

Sort of explains the persistent inflation issues.

This can't last for long. Wonder what will happen to asset values when the spigot is turned off?

"Song-term"? Lereah is an embicile.

ReplyDeleteJust a passing thought:

ReplyDeleteThe mechanic that owned the shop where I get my car repaired sold his shop this year...

and became a REALTOR!

Well Guys

ReplyDeleteI am a european friend...

the same bubble is still growing everywhere here in europe, with some differences from state to state.

Anyway... I believe the bubble is a loan bubble, not a housing bubble.

It is just "cheap money" pumped in the system by banks to earn some commission.

The more money is created from thin air and pumped, the more the currency will suffer afterwards.

Dollar is already collapsing. Euro will follow?

Maybe in five years thanks to Greenspan we will purchase petrol using yuan...