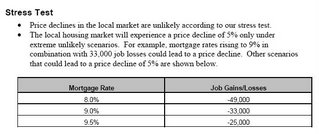

In their Sarasota - Bradenton report (pdf) the NAR claimed "price declines in the local market are unlikely according to our stress test." They also claimed that "the local housing market will experience a price decline of 5% only under extreme unlikely scenarios. For example mortgage rates rise to 9% in combination with 33,000 job losses could lead to a price decline."

Well mortgage rates are nowhere near 9% and also there has not been 33,000 job losses in the Sarasota -Bradenton metro area. Yet despite this "Prices remain the story in home sales, with Sarasota-Bradenton prices falling 18 percent in October, the second biggest drop in the state. The median sales price in the Sarasota-Bradenton market was $277,900 last month, compared with $340,700 during the same month in booming 2005. (Herald Tribune)."

On November 15, 2005 I criticized there reports saying that "The work of NAR on these housing reports is contradictory, deceitful and lousy. NAR should be ashamed of their research."

There anti-bubble reports have been proven wrong. The NAR's work needs to be debunked more by the mainstream media. The National Association of Realtors cannot be trusted.

As the whole idea of blogs is so new, it's doubtful that Lereah's calculations would have taken into account the drops in value incited by these "panic-inciting" blogs. He was quoted in a Post article this morning where he said:

ReplyDelete"The demographics of our growing population, historically low and declining mortgage interest rates, and healthy job creation mean the wherewithal is there to buy homes in most of the country, but many buyers remain on the sidelines,"

Like someone yelling FIRE! in a crowded theater, the blogs are sure to have an effect ... albeit a temporary one as people realize the predictions are based on falsehoods.

Economy Expands by 2.2 Percent in 3Q

WASHINGTON -- Business growth slowed to a 2.2 percent pace in the late summer, a much better performance than anticipated and an encouraging sign that the housing slump hasn't been too much of a drag on the economy.

www.washingtonpost.com/wp-dyn/content/article/2006/11/29/AR2006112900424.html

But I thought Sarasota and Bradenton was different? It's on the water and the rich Europeans, Baby Boomers, and Latin Americans would save the day. What happened???

ReplyDeleteAlthough I disagree with your editing. You do an excellent work! Keep it up!

ReplyDeleteCrispy&______

Lance,

ReplyDeleteI'm not sure which is more ridiculous: your assertion that "blogs are so new" that someone in 2005 wouldn't be aware of them or that blogs are to blame for the housing bubble.

Well lance, its a "good" thing you are here to set the record straight. You've been about as accurate in your predictions as Lereah has.

ReplyDeleteFirst the media is to blame for falling home prices and now it's the blogs? Give me a break!!

David - nice piece. Keep up the good work. I am not shocked at the magnitude of the Florida price declines, but I am surprised at their pace. This is happening faster than I anticipated.

Call me crazy, but I can foresee the day where you'll be able to buy nice, two bedroom ocean-front condos in Miami for under $100,000. The amount of overbuilding and speculating down there is stunning.

Oh, come on Lance. I've seen some assinine things said on this board but I think your comment about blogs is in the top 2.

ReplyDeleteYou are reaching SO far past every rational explanation that it defys logic.

It's a good thing Lance dosn't ahve to invoke emperical data for his analysis, otherwise, he'd have to shut up.

ReplyDeleteAnd the problems with the housing market in most areas are fundemental. Well renowned Economist like Robert Shiller (who recieved his PhD from MIT, a top 5 Economics research institutions, unlike Lereah who recieved his degree from American University..... is that even ranked in the top 100 for Economics?), have been predicting this correction for about a year, and they say its going to be big. Too bad, everyone listens to the Mail-in-degree Lereah instead of a real economist like Shiller.

As the whole idea of blogs is so new, it's doubtful that Lereah's calculations would have taken into account the drops in value incited by these "panic-inciting" blogs. He was quoted in a Post article this morning where he said:

ReplyDeleteLance, you just lost a lot of respect with me. Blogs don't matter Not in the big scheme of things. Don't blame the messanger.

What matters?

1. The shear number of people I know who cannot afford their current mortgage payments, much less the reset.

2. Employment and salary growth.

3. People's financial confidence.

4. The dirth of qualified new buyers. Think about that... in reality, most of the potential buyers are probably us bloggers or our friends!

5. Home prices. They're beyound what my coworkers can pay. So we wait... and transer employees to non-bubble areas. Cest la vie.

Do you realize how many people at my work own 3 or more homes? Dozens. They've finally decided to sell one of their properties... pretty soon it will be two. Then 3... All brag about how they've extracted equity down to 20% in each property.

We just saw 20% can disapear in 30 days!!! The knife is falling and fast. Oh, it will slow for the holidays... (I think.)

Like someone yelling FIRE! in a crowded theater, the blogs are sure to have an effect

If the theater is on FIRE, one has a responsibility to warn others. I've certainly warned my friends. For years.

Look at the numbers Lance, look at the fraction of income people are spending on their mortgages. They simply cannot take it anymore. In my area, its 55% on average. That is unsustainable. Thus prices must drop. DC too... Typically, homes prices are sticky as people only spend about 25% of their income, on average, on their mortgage. Its been shown in the past that the fraction above that isn't so sticky... So unless salaries rise and quickly... Home prices must drop for the good of the economy. Need I mention how people also don't have the savings to ride out any "bumbs" on the way down?

To think... credit has yet to tighten by any meaningfull amount. When it does, and it will, then we'll really be talking declines in home prices.

John Fontain said...

Well lance, its a "good" thing you are here to set the record straight. You've been about as accurate in your predictions as Lereah has.

ROTFL!

This bubble should never have been allowed to happen. But it has. So its time to pay the piper. :(

As to growth, I keep reading about 4Q 2006 estimates declining. Most to ZERO growth for the quarter . The recession we've been predicting is about to start. When? Maybe next month, maybe in 3 months; but its not far off. :(

Neil

John Fontain said:

ReplyDelete"First the media is to blame for falling home prices and now it's the blogs? Give me a break!!"

John, are you denying David and his blog their rightful position as part of the media? ... Where do you think the idea of a bubble first started? I don't think it was the mainstream media. Yeah, they're running with it now that the idea has surfaced out there in the population ... But the idea of a bubble, and the causes behind it came from the blogs originally (at least I think that's what I've heard David say here.) If that is the case, then the mainstream media has just repeated and amplified ideas from the blogs. And, of course, given them credibilty. I say it is undeserved credibility and I am sure you say otherwise. Only time will tell which it is ... But in the meantime I think we can agree that buyers are sitting it out now in large part owing to the bubble theory argument developed by bloggers like David. I think we should give David his due here.

mad tiger said: "At least the power to wipeout billions of dollars of home equity with a single post has not gone to David's head."

ReplyDeleteAnd in Sarasota, Florida nonetheless. A very high percentage of Sarasota's population must be reading David's DC-centric blog to have this big of an effect. Who'd of thunk it!

Here's the most comical aspect of Lance's comments. He blames the blogs for brining prices down but couldn't we just as well blame the NAR, Press and Main Stream Media for creating a market with unrealistic expectations that prices would continue to increase 20% each and every year?

ReplyDeleteYou can't have it one way and not the other.

It's as one of the posts said ---

It's the fundamentals. Yes markets can got up too much and even down too much with emotion but in the long run fundamentals that determine pricing. You need income, personal income, to pay for a house and in the end that is what drives prices.

Oh yes and did anyone notice that the govt. just revised personal income growth from 7.7% increase to a 0.7% increase! Can't have much increase in the value of a house when the average personal income goes up by less than one percent.

Well done David - keep up the good work!

ReplyDeleteGood job David.

ReplyDeleteBut in the meantime I think we can agree that buyers are sitting it out now in large part owing to the bubble theory argument developed by bloggers like David. I think we should give David his due here.

ReplyDeleteAs much as I like David's blog... I'm sorry, he hasn't singlehandedly brought down DC prices. Its affordability.

Lance, let's talk traditional ratios. Any one you like:

Price to income:

Price to rent

Mortgage payment to monthly income.

The last one is so out of whack it shows why the previous patterns won't be repeated... we have no cushion this time. :(

All are so out of whack with history its insane. Until they get in balance, all we're seeing is an investment mania deflating. That it. ugly? Cest la vie.

Neil

David deserves credit for running a great blog and helping to spread the truth about the housing bubble. But he isn't responsible for the correction in home prices.

ReplyDeletePrices are falling because they fundamentally should fall, not because people started writing and reading bubble blogs.

As an ardent bubblehead, I've spread the word about David's blog and thehousingbubbleblog.com to many of my friend, co-workers, and relatives. Hardly a one realized home prices might be in a bubble, let alone that these blogs exist. I'd venture to guess that if you did a survey of 1,000 random people in Sarasota, in DC, or anywhere, that the percentage of respondents who had seen or heard of a housing bubble blog would be miniscule (I'd venture a guess of less than 2%). If that were true, then it would be simply foolish to blame the blogs for the crash that is just starting.

Hopefully, that percentage will rise dramatically over the next couple of years, but its absurd to say blogs are responsible for the correction.

Fine, bloggers have played a role, but thats because some of us, like in Seattle, got sick of watching aholes ruining it for the rest of us. OK some people got in early, and they've seen increases over 10-30 years. Fine. But when some jackwad doubles the price of his 250k home to 500k in three years, thats when I say a hefty bite me.

ReplyDeleteNo sympathy, none whatsoever. Blame the blogs, its easier than blaming the sucker in the mirror, and America is all about the rich finding new suckers wherever they can. You gotta watch your money in this society, absolutely. Most investing is not a sure thing, its gambling, and if you lose, then tough toenails. Unfortunately, it looks like whole economy may lose. Oh well, the next generation will learn some great lessons that the boomers never did.

John Fontain said...

ReplyDelete"David deserves credit for running a great blog and helping to spread the truth about the housing bubble. But he isn't responsible for the correction in home prices."

Clarification ... I never said David was responsible for the fall in prices. What I said was that when Lereah used his models to determine how much prices would fall, those models probably didn't take into account the larger number of people waiting it out on the sidelines due to the media's proliferation of a bubble theory ... which started in the blogs (David's as well as other.) So what I DID say was that by creating the idea of a bubble which ultimately got picked up by the main stream media, the fall in prices became more abrupt and more deep than otherwise would have occured had the blogs not come up with a bubble theory. I.e., minus the idea of a bubble as invented by blogs, prices would have acted more in line with what Lereah predicted using models which are based on factors as they existed in past cycles. The blogs have introduced a new factor ... "news" from new sources. In the past news would have come from NAR, established economists, etc. Now it can come from someone establishing a blog and proclaiming there is a bubble. Crowds react to news ... like they do to the shout of "fire!" The question is "Is there really a fire?" ... Not "Will crowds react to the shouts of "fire!"? David (in combination with other bloggers) has in his small way influenced where prices are now.

John Fontaine said:

ReplyDelete"I'd venture to guess that if you did a survey of 1,000 random people in Sarasota, in DC, or anywhere, that the percentage of respondents who had seen or heard of a housing bubble blog would be miniscule (I'd venture a guess of less than 2%)."

It doesn't matter whether individuals know about the existence of blogs or not. The idea of a bubble originated with the blogs (or at least got spread by the blogs) and ended up in the mainstream media because of the blogs. Individuals know what they've read and heard in the mainstream media. Any drop in prices is of course going to be more profound then they would have otherwise been when you have front page articles saying "prices are going down". Just like price rises were faster on the way up when the like of NRA was implying "buy now or forever be priced out". And just like I always said that prices had to stop climbing so fast, I also believe they won't go down much (if any) in the midterm(i.e., prices 3 - 5 years from now will be no lower than they were at their height) and in the longterm (i.e., 5+ years) they'll be rising again at normal rates of appreciation.

I, too, would blame the blogs. Afterall, when I began looking to purchase a home last year and found prices and people nuttier than squirrel turds and questioning my sanity, I soon came across sites like David's, Kieth's and Ben's. Upon further reflection, I determined that my instincts, and the blogosphere, was right.

ReplyDeleteSince then, I have personally introduced at least 4 other well-paid co-workers to the blogs. Upon their introduction, each has indicated that they will not buy at least until late 2007-2008.

Somebody, please, grab that shovel away from Lance!

ReplyDeleteLance, can you possibly just observe in silence for a while?

Lance said:

ReplyDeleteI always said that prices had to stop climbing so fast, I also believe they won't go down much (if any) in the midterm(i.e., prices 3 - 5 years from now will be no lower than they were at their height) and in the longterm (i.e., 5+ years) they'll be rising again at normal rates of appreciation.

After home value drops 60% to 70% normal appreciation will be seen

Y-O-Y, which like you say will take five years.

Well, Lance, if blogs have been the cause of prices falling, why don't you just start a rational blog of your own (I know, it is hard for you to understand that concept, but we will give you the benefit of the doubt) similar to that of Ben Jones and start causing the prices of homes going up again? But you should have some valid data to base your arguments on and not your typical Realtor propaganda and self-beliefs and hot air.

ReplyDeleteYou should have no problem now in 2007 an beyond, since now blogs are well-established and they are not new anymore. After all, they caused the downfall in the first place after all, so I guess Mas and Pas and Joe Shmoes have abandoned TVs and are just hooked on blogs ...

anon 527 said:

ReplyDelete"After home value drops 60% to 70% normal appreciation will be seen

Y-O-Y, which like you say will take five years."

It's Christmas ... and anything can happen! ;)

Btw, Robert ... what do you think of anony's prediction?

This discussion is fascinating because we are debating the role media plays in either creating trends or amplifying them.

ReplyDeleteI think in reality both arguments have some truth: fundamentals eventually will prevail, but we all thought they would prevail sooner (I thought, for example, the bubble would start to deflate late 2004 or early 2005, but it took another year).

The bubble prevailed so long in part because of the role of the mainstream media, which parroted NAR data without ever trying to actually analyze or question anything (just as they parroted the WMD nonsense).

But now that fundamentals have started to move and market declines, the media (which includes blogs) definitely fans the flames.

The real interesting story is that people are realizing the mainstream media abandoned its role as watchdog sometime in the past decade, so now we turn to blogs and other populist sources if we want to read something other than the official party line.

Lance said...

ReplyDelete“Btw, Robert ... what do you think of anony's prediction? “

I don’t think prices will fall as drastically as you and anon predict.

Lance, where do you think we are in this normal cycle?

http://www.bubblepic.com/displayimage.php?album=9&pos=4

Lance said:

ReplyDelete"But in the meantime I think we can agree that buyers are sitting it out now in large part owing to the bubble theory argument developed by bloggers like David."

I disagree completely, sales are down only because speculators have exited the market, and first time buyers can no longer afford to buy.

The market will stabilize when buyers making the median income can afford a median priced home.

This can occur quickly thru price drops, or slowly thru income gains and inflation.