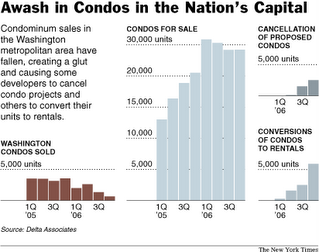

Since the middle of 2006, the frenzied condominium market here and in several other big cities like Las Vegas, Miami and Boston has collapsed. Once roaring sales have slowed to a trickle, sparse inventory has mushroomed into a glut and soaring prices have flattened out and started falling.This development, originally proposed as condos, in the DC area is now becoming apartments:

After six weeks of failing to lure more than a couple of dozen buyers, Mr. Franco and his partner, Jeff Blum, joined the builders of nearly 6,000 condominium units in the Washington metropolitan area who have decided in the last three months to recast their projects as rental apartment buildings.Below, we are told of a condo owner wanting to sell their unit but can only get somewhat less then the original 2004 purchasing price.

Take the owner trying to sell a spacious two-bedroom condo for $879,000 in the former Columbia Hospital for Women, which closed in 2002, in the Foggy Bottom neighborhood of Washington. In 2004, the investor was so confident that he would make a handsome resale profit that he told his agent, Thomas P. Murphy, he wanted to buy five condos. Mr. Murphy said he flatly told his client he would only assist him in purchasing one unit in any one building.Could he rent the condo? Yes, but that option is not appealing, either. Mr. Murphy estimates that the unit could rent for $4,000 a month, far short of the $6,800 a month the condo costs in mortgage interest, maintenance fees, insurance and taxes.

"They have a choice of how they want to lose it," Mr. Murphy said of investors and condo developers. "Drip by drip or in one slap."

The condo market in the DC area is undergoing serious decline as the number of sales has plummeted and prices have dropped. The average sales price for a condo unit in December 2006 compared to December 2005 [these are ones listed through the MLS and does not include many condos such as those sold directly by developers].

The condo market in the DC area is undergoing serious decline as the number of sales has plummeted and prices have dropped. The average sales price for a condo unit in December 2006 compared to December 2005 [these are ones listed through the MLS and does not include many condos such as those sold directly by developers].Montgomery County : -7.1%

Washington, DC: -7.9%

Fairfax County: -4.0%

Loudoun County: -4.4%

The condo market in the Washington, DC area will continue to decline due to the growing inventory and the lack of investors. Expect further price declines in the Washington, DC condo market in 2007.

wow. that graph is really telling. look at the quarterly units sold vs units for sale.

ReplyDeleteand the scale of the 'condos for sale' chart is skewed. Look how it jumps from 20k to 30k, while all of the other increments are only 5k.

It will be interesting to see how many condo owners end up taking their units off the market and renting them out. That looks like a tough environment for putting a condo on the market.

Does the category 'conversions of condos to rentals' include individual condo owers who choose to rent (as an investment or alternative to selling) or is it just the condo developers who rent out their units rather than selling? I'm guessing the latter.

The condos sold graph says it all. The market it done, put a fork in it.

ReplyDeleteBut hey, its all about information and facts. Information is power and the old rules of "I have the information (power) and you get none" are over.

2007 is developing in an interesting manner.

Maybe, just maybe, Fall of 2008 will indeed be the time to buy. :)

It amazes me how national this is in scope.

Neil

So, first time homebuyers (or those looking to downsize from a house and move closer in), isn't this an ideal time to buy a condo? I suspect many bubbleheads will say "but condo prices will go even lower". Yes, they might, but as someone who is fiscally conservative, if I were in the market for such a move, I just wouldn't risk the possibility that prices and/or interest rates could head in the other direction without warning. I am risk adverse. Provided the place fit my needs AND fit my budget, I wouldn't sit around waiting for that ever better deal. I guess that's why I wouldn't make a good flipper ... or BH ... I just don't like "playing the market" ... I also not coincidentally don't like gambling ... The most boring time I ever had was going with friends to Atlantic City ...

ReplyDeleteOnce again, the best news regarding DC Real Estate is in the NYTimes.

ReplyDeleteI'm not one of those people who thinks the media is biased. But the WaPo Real Estate Section rarely does articles like this ... with the exception of Kristin Downey.

It is going to be fun seeing how Lance spins this one...

ReplyDeleteLets see... this is actually bad for renters and good for the housing market because obviously less condos for sale means that those May 2007 bidding wars and price increases he predicted a couple days ago will come even faster!

Nevermind that these projects are turning into apartments because the builders recognize that the condo bubble has popped and they don't have a prayer of selling these units at anything like the prices of the last couple years.

As condo prices fall through the floor the whole market will get pulled down with them. Without a doubt condos represent the lowest end of the market and will see the biggest drops... but lets not forget that there are a significant number of "luxury" condos that have been selling well into the >$700k range over the last couple years, placing them in direct competition with single family homes.

I think a lot of people are going to be shocked this spring when they try to sell.

To think... all of those condos still under construction. Inventory is going to grow. Like it or not, housing is like any other comodity and thus prices are driven by inventory. :) (Credit to CR's blog)

ReplyDeleteI think a lot of people are going to be shocked this spring when they try to sell.

Yep. And it will repeat in 2008 too. Be patient. If you have a down payment, you're set. If you don't have one. SAVE!

Don't be a sheeple. Look at cost to rent, price to income (or mortgage payments as a % of gross income), sales inventory to monthly sales. If you aren't looking at the numbers, you're in the dark. Every chart that I see screams SELL! Every non-dimensionalized statistic that is out there says we're going into a recession (e.g., Mprime contraction). I thank CR, OCrenter, David, and others for getting information out.

I have to say, condos and the implode-o-meter have become the most entertaining aspect.

Over the last year, I have come to really respect many of the regular posters on this blog. Notably, those who privide good links to statistical information (this includes David).

In the markets with good information we see inventory going up at an astounding pace. I have no doubt DC's is too. I'm now tracking the DC inventory a la OCrenters most excellent blog. It amazes me that DC has more inventory than would be healthy for LA yet is comparably such a smaller city. Cest la vie.

http://www.ziprealty.com/buy_a_home/search/form/city.jsp?usage=dynamic&cKey=2931g35b&&metro=virginia

The spring will be interesting.

Neil

Anon 7:32 said:

ReplyDelete"but lets not forget that there are a significant number of "luxury" condos that have been selling well into the >$700k range over the last couple years, placing them in direct competition with single family homes."

So, you think price is what determines who is looking for what? Sorry, you're wrong here. Yes, some people who'd rather be in houses end up in condos because they can be bought for less, but when you get to $700,000, you're talking about people who buy in a condo because they want to live in a condo. (I.e., they want someone else worrying about most maintenance, the security of having neighbors in close proximity, more "fixed" maintenance costs, etc. ... These people aren't buying a condo as a "best second" for a house they can't afford ... 'cause they can. And by the way, the market in the District is doing exactly as I predicted last summer. Condos are down but house prices aren't budging much. I'm glad to have been vindicated. (Check the archives if you think I am making this up.) Originally, I had thought that this price drag would stay on for "12 - 18 months" ... now I think it will be briefer. And we've the speed of information to thank. I guess we could even thank David in part for bringing a bubble discussion to the table earlier than it would have otherwise occured ... and, as such, allowing it to be dismissed earlier on than it otherwise would have. I think the next couple of months are going to be interesting. BHs will soon start bickering between themselves whether it is time to buy yet.

"Lance said...

ReplyDeleteSo, first time homebuyers (or those looking to downsize from a house and move closer in), isn't this an ideal time to buy a condo?"

Yep, Lance I want to cancel my cell service, cable, ect and eat beans and rice for the next 15-20 yrs. Sign me up!

letsgetreal said:

ReplyDelete"Yep, Lance I want to cancel my cell service, cable, ect and eat beans and rice for the next 15-20 yrs. Sign me up!"

hmmm ... when I bought my first DC place, I basically did just as you are advocating. That's the kind of will and determination it takes to make it in a high cost of living place like DC. It sounds like you want your cake and to eat it too. A while back Va_Investor correctly pointed out that a lot of people who could be buying aren't 'cause they want it all. Well, good luck. Btw, have you ever considered living in a place like say Detroit? You could afford the house AND keep all your toys and restaurant meals!

lance, alan greenspan said that it was impossible to indentify a bubble while you are in one. (check it out yourself...this is a paraphrase). thus with a small bit of logical extension you are the only Bubble Head on this board since you refuse to admit that we are in one. the rest of us live in the real world.

ReplyDeletePeople at the office have been asking me why I am so happy today- can you spell Schadenfreude?

ReplyDeletePay no attention to Lance. He is the Greater Fool, and is desperate to negate that fact by posting his own spin on the market decline. Hope you love love love your place Lance, you are likely to be there for a long while.

ReplyDeleteDavid

ReplyDeleteUSA today has a tidbit on Tulsa...

But notice the graph... US home prices down 3.6%...

And its just the start.

http://www.usatoday.com/money/economy/housing/2007-01-15-close-tulsa_x.htm

Neil

Hello all,

ReplyDeleteI am curious to find out how the market is in Georgetown for single family homes. My sister owns a 3 bed/3bath rowhouse there and she is thinking of selling it this spring. She lives abroad and asked for my opinion. I stumbled upon this web site and thought perhaps some of you might know if prices have gone down or are still stable in Georgetown (compared to last year). Thanks,

Sue

"So, you think price is what determines who is looking for what? Sorry, you're wrong here. Yes, some people who'd rather be in houses end up in condos because they can be bought for less, but when you get to $700,000, you're talking about people who buy in a condo because they want to live in a condo. "

ReplyDeleteYou just agreed with me and I don't think you ever realize that...

Yes, people who buy a $700k condo prefer the condo, clearly. What you seem to have missed is that before these high end condos arrived on the market, relatively recently, that buyer would have purchased a house.

>$700k condos are a recent trend in this area and they ARE competing with houses.

"Originally, I had thought that this price drag would stay on for "12 - 18 months" ... now I think it will be briefer."

According to the article there were 24,200 condos on the market in the Washington DC area at the end of 2006.

In the fourth quarter of 2006 663 were sold.

Do the math, how many months of inventory is that?

If you think that kind of glut of inventory is going to work itself out in 12-18 months then I have a bridge to sell you.

Prices have just barely begun to drop, you are right about that at least.

"I define wealthy as greater then 200k in savings (not 401k) and making about 200k as a couple."

ReplyDeletelol

Lance, I'd bet that the most boring time your friends ever had was taking YOU to Atlantic City. Real investors will wait until prices begin to level or change direction - until then - only a fool is buying on the way down.

ReplyDeleteDavid-

ReplyDeleteWhy do so many of my posts get deleted here? I love you man.

I just want to have a friendly conversation with Va_Investor.

Please?

I seriously doubt that there are 30,000 condos for sale in DC, all to be filled by households making 200K a year and with 200K in the bank. That population is a very tiny portion of the entire DC area. Please check the recent ACS data at the Census website to confirm what I said.

ReplyDeleteThe traditional market for the vast majority of condos was singles or childless couples who were living in a city and wanted to save money on rent for a few years while they built equity for the first house. Then there was a very tiny portion of the market that was very wealthy and wanted super elegant condos like Lance is talking about.

I believe this traditional view of demand probably still holds true today.

The problem is, DC condos are so expensive that the singles and childless couples can save more money by renting apartments than by buying condos. And all these condos are priced at many multiples of median household income. The glut extends far out- there are many condo projects in close-in suburbs like Silver Spring and even further out ones like Bowie. I haven't seen any that are reasonably priced, though. But I haven't been looking closely.

This article was great. Maybe this is what newspapers should do. Since they can't slam their own housing markets for fear of losing advertisers, they could all do articles on each others' markets.

A Redskins fan

bakersfield bubble,

ReplyDeleteBlog Rules

"I am curious to find out how the market is in Georgetown for single family homes. My sister owns a 3 bed/3bath rowhouse there and she is thinking of selling it this spring. She lives abroad and asked for my opinion. I stumbled upon this web site and thought perhaps some of you might know if prices have gone down or are still stable in Georgetown (compared to last year). Thanks,"

ReplyDeletePrices in Georgetown have been stable, and may actually be slightly up from last year. The lowest end of the housing market is getting hit first, and it will get hit the hardest in the end. A SFH in Georgetown is going to be a relatively attractive property regardless of what the market does and it is not going to get hit nearly as hard as condos or far out suburban houses.

If she wants to sell for her own reasons then spring won't be a bad time to do it.

If she is interested in selling because she is worried there will be a huge price drop and she will lose money... I would advise her not to... with one important assumption. That is that she has a mortgage she can sustain indefinitely. Georgetown may lose some value, but it won’t be anything like what will happen to condos and she just isn't likely to come out that much ahead. If she plans to return to DC one day and buy again, she is likely better off simply keeping her current house.

Now, about that assumption from above… If she has a mortgage that will become unmanageable in the next several years and she needs to sell for that reason then obviously she should sell and it will probably be easier sooner rather than later. In that case she should try to make sure her house is ready to go on the market by early spring if possible, mid-late Feb. She should also honestly look at what houses in the immediate neighborhood have been selling for and price her house realistically. If she overprices her house it is likely to just sit and sit and sit.

-Leroy

Funny how bob keeps going back to the "median household income" no matter how many times he gets beaten up over using a meaningless statistic. Guess he doesn't have much else to go on.

ReplyDelete"This article was great. Maybe this is what newspapers should do. Since they can't slam their own housing markets for fear of losing advertisers, they could all do articles on each others' markets."

ReplyDeleteI wonder how many prospective buyers and sellers of condos in this area alone read that article?

I think when the NYT is running full length articles on a housing bubble in another city... the cat is officially out of the bag.

It is going to be an ugly ugly spring for condos... and once condo prices start to fall back to where they belong the lower end of the SFH market will get dragged down as well... and so on and so on.

Condos will get hit the worst, but no housing will get off easy. I wouldn't be surprised to see 25-35% real price drops in the SFH median prices from peak prices before this is done. (and no lance, done does not mean this spring... this will take a couple years)

va_investor said...

ReplyDelete“You wouldn't know a "normal Cycle" if it slapped you in the face.”

Va, you continue to call this a normal cycle, but you refuse to address that historically, for every run up in home prices, there has been an equal drop back to the mean. So are you, or are you not, calling for a reversion to the mean?

ditka driving said:

ReplyDelete"Real investors will wait until prices begin to level or change direction - until then - only a fool is buying on the way down."

Again, another BH who can't get his facts straight. We're not talking about INVESTORS, we're talking about people who have a housing decision to make. Do they buy and lock in their housing costs or do they wait for that ever illusive 50% drop in house prices.

"Do they buy and lock in their housing costs or do they wait for that ever illusive 50% drop in house prices. "

ReplyDeleteDo they buy and lock in their housing costs or do they wait for the imminent 15-20% drop in house prices?

My favorite part of the article:

ReplyDelete“They have a choice of how they want to lose it,” Mr. Murphy said of investors and condo developers. “Drip by drip or in one slap.”

K A P O W !!!

Thomas P. Murphy is a well-known condo agent in the Foggy Bottom, West End, Georgetown market and has been for eons.

Robert said:

"Va, you continue to call this a normal cycle, but you refuse to address that historically, for every run up in home prices, there has been an equal drop back to the mean. So are you, or are you not, calling for a reversion to the mean?"

Robert, generally when you say points to va_investor that make too much sense, she ignores the comments, so don't expect one and be surprised if you get one.

va_investor said:

ReplyDelete"Over a year ago, I said condo's could drop up to 40%."

Is that a condo bubble? Sounds like what you are saying. If not, what is a bubble in your view?

While Lance often makes an amusing foil to toy with, he's actually done something useful on this thread: He's made a testable prediction. Lance says the DC bubble will be over and the recovery will be on by May 2007. Let's record this prediction and then see how well Lance does.

ReplyDeleteBut I thank David for saving people a lot of money. Those who listened to David will be able to lock in much lower housing costs when they eventually buy, unlike whatever poor sucker would have actually been listening to Lance.

Robert said:

ReplyDelete"Va, you continue to call this a normal cycle, but you refuse to address that historically, for every run up in home prices, there has been an equal drop back to the mean. So are you, or are you not, calling for a reversion to the mean?"

Robert, you are confusing cycles with trends. Cycles go up and down around a mean which trends up or down. Think of it as a bee flying around a clothes line where the clothes line is swinging upward or downward. The bee's path is the cycle and the clothes line is the trend of the mean. You keep presenting a case where the trend (i.e., the clothesline) went down after having gone up. Va_Investor is talking about cycles which aren't even shown on the graph you are presenting. So, know, she is not contradicting herself. Additionally, that graph you keep presenting is fundamentally flawed in that it only looks at trends in house prices completely ingoring the "housing value" or "rent" or which is inseparable from any analysis on return on investment. One other problem with the graph which I don't think has been brought up before is that using an inflation index over a long period of time (such as the 100 years plus here) is questionable at best since over time the basket of goods that determines that basket changes so much that one ends up comparing apples to oranges at one point. For example, as some BHs have pointed out, were we today using the same basket of goods to measure inflation as we did in the 80s (before the Clinton Administration changed the basket) we would probably be recognizing a lot more inflation than we are. I don't know all the details behind the change, but think it has to do with currently giving rents a lot of weight in the basket of goods equation. In any case, my reason for pointing this out is to point out that even if your graph had included rents/value of housing, the very measure by which it is adjusted for inflation over a 100+ year period is questionable.

And in the interests of equal time, I'll throw in a few factors that would augur for a shallower bubble than I expected:

ReplyDelete1. Rent growth has been strong in the DC area. This provides a rising floor for the size of the housing price drop. (Will this rent growth continue as people increasingly put condos out for rent? Vacancy rates in DC shot up during the 4th quarter 06, which could flatten rent growth.)

2. Homebuilder stock prices are well above their 52-week lows, indicating a lot of the bubble beliefs that got priced into homebuilder stocks have dissipated. Toll Brothers, which has a lot of DC exposure, is far closer to their 52-week high than their 52-week low.

3. The DC area may have a lot of interest-only financing, but doesn't have a lot of neg-am loans. I don't know what percent of DC's interet-only loans have teaser rates that would generate much payment reset shock that could generate short sales. I do know some realtor blogs in this area have discussed short sales more than they used to. But if the IO loans don't have major resets in the short run, that shouldn't be a big issue (but could augur for more downward pressure in the future, so the long-term stagnation scenario would then be more likely for DC).

Anyone know anything about the beauregard condos on U St? How are they fairing now? I thought about purchasing roughly a year ago. - Tom

ReplyDeleteva_investor said...

ReplyDeleteThe real bob,

You wouldn't know a "normal Cycle" if it slapped you in the face. And your memory is very short. I am quite sure I said to stay way from condo's and this was last month. Over a year ago, I said condo's could drop up to 40%. Try to get your facts staight.

"Bubblehead" my ass; just a realist.

I thought va_investor didn't post anymore. Now she just lurks. Sure sounds like she's pissed. She might just jump out of her wheelchair and whack you over the head with her cane.

Funny how bob keeps going back to the "median household income" no matter how many times he gets beaten up over using a meaningless statistic. Guess he doesn't have much else to go on.

ReplyDeleteDo you have a better measure of household wealth?

"Do you have a better measure of household wealth? "

ReplyDeleteThe point is that the statistic is totally irrelevant because:

1) corporations buy condominiums for their own use; and

2) a very large segment of dc does not participate in the economy at large and is not relevant to the real estate market

Bob has been made to look foolish because of these things, but continues to bring it up over and over again, most likely because he has little else to say.

Keith said:

ReplyDelete"Lance says the DC bubble will be over and the recovery will be on by May 2007. Let's record this prediction and then see how well Lance does."

Keith, first off, I've said there is no bubble in house/condo prices because by definition a bubble can't apply to something which isn't a piece of paper representing an interest in a commercial activity (eg. a stock or bond.) A stock or bond can "burst" to zero value (the definition of a bursting bubble) because the underlying commercial activity can cease to have ANY value. That can never be the case with a place where people live. When you buy a stock it could be backed by something no more tangible than someone's grand ideas (as where the Dot.Com stocks), but when you buy a house you buy something with tangible and indisputable value. And THAT can never go to zero value as would be required for it to go "burst" as a bubble does.

Secondly, if you follow any credible news anywhere, you will hear that the predictions are for the depths of the bottom side of the cycle to be over by the Spring. That doesn't mean completely over, but if by recovery you mean for example "declining inventories", then it is already over from what I have read on this blog. From my perspective, this is really obvious. I've witnessed up cycles and down cycles going back some 40+ years, and this is about as mild a down cycle as I've ever seen. Why? 'Cause unlike other times when we had recessions or gas crises or hyper-inflation helping the down cycles, this time we have a roaring and growing economy (and growing population) taming it instead. Over all it's no different than where we've been before ... just tamer. And if the experts tell me that the Spring is when we can expect to say this short-lived down-cycle is going to be over, then I am apt to believe them. So far they have been right on the money. The bursting bubble has yet to materialize ('cause it can't), so why would I be apt to believe the bubble-believers and their predictions of doom and gloom? Why do you?

Anonymous said...

ReplyDelete"Funny how bob keeps going back to the "median household income" no matter how many times he gets beaten up over using a meaningless statistic. Guess he doesn't have much else to go on.

Do you have a better measure of household wealth?"

The best measure of household wealth is one's power's of observation. Look at this area ... walk around it ... drive around it and witness the high number of new cars on the streets and highways, the malls brimming with shoppers, the restaurants overflowing with expensively dressed patrons, the tons of dollars given to charities and political causes, the number of people paying over $100/month for cable/satelitte television, the WallMarts and Home Depots full of shoppers, the new construction everywhere, the traffic jams filled with all these expensively-dressed people and their expensive cars, ... That's right, and all that is happening on LOW household wealth. Get real ... quit trusitng statistics and trust your senses more. Statistics are just someone else's interpretation of what's going on ... Do your own.

Anon 12:25,

ReplyDelete1) So corporations are now the savior of the condo market? I guess the Saudi Princes, GS-15s, and Lawyers weren't holding up their end of the deal.

2) If a large segment of the population is not participating in the RE market, then that implies that a fewer number of participants move the market. So increasing foreclosure rates, and declining sales numbers with much higher inventories will have that much more of an impact on the market.

My $0.02.

"The 10-year benchmark Treasury fell 6/32 to 98-27/32 with a yield ($TNX) of 4.787%, up from 4.752% at Tuesday's close. Prices and yields move in opposite directions."

ReplyDeleteLet's see that 30yr fixed rate rise, go baby go.

So Lance, if you have lived through so many cycles, how can you possibly believe that this one is over if absolutely none of them have played out this quickly? Don't be so quick to believe the hype about our "booming" economy and what the experts have to say - also, where is the population growth to absorb all the houses? You are betting on hope - maybe some here are betting on destruction, which is probably unlikely without something crazy happening, but my bet is that it lands somewhere in the middle of those two extremes, and that later on this year you will realize that you're wrong.

ReplyDeleteAlso, check out http://en.wikipedia.org/wiki/Economic_bubble

Prices need not decline to zero for there to be a bubble.

"I've said there is no bubble in house/condo prices because by definition a bubble can't apply to something which isn't a piece of paper representing an interest in a commercial activity (eg. a stock or bond.) A stock or bond can "burst" to zero value (the definition of a bursting bubble) because the underlying commercial activity can cease to have ANY value."

ReplyDeleteWow... you just get more clueless by the day don't you? Are you really trying to redefine the word "bubble" now?

LOL

From www.dictionary.com

Bubble:

"5. an inflated speculation, esp. if fraudulent: The real-estate bubble ruined many investors. "

Seriously lance... stick to providing tech support. You don't have a clue when it comes to financial advice.

Do you really think you are going to redefine the word "bubble?"

"I've witnessed up cycles and down cycles going back some 40+ years, and this is about as mild a down cycle as I've ever seen. "

ReplyDeleteWow... now your presence on this blog makes even more sense. Not only did you buy an overpriced house at the top of the bubble... you are also on the edge of retirement. I would be worried too if I was contemplating paying off a mortgage well into my 80's...

Even if we assume you were an unusually gifted kid when it came to investing.(something we already know is not the case) You couldn't HOPE to realistically "witness" real estate cycles before you were 16-18.

That puts you in your mid 50's at the earliest... unless you were "witnessing" real estate cycles while in elementary school...

Anon 1:18 said:

ReplyDelete"Also, check out http://en.wikipedia.org/wiki/Economic_bubble

Prices need not decline to zero for there to be a bubble."

They may not need to according to Wikipedia, BUT they would need to in order for them to mirror what happened with the stock market. Is it co-incidental that the generation that came of age with the bursting of the stock market bubble are the same generation establishing blogs to cry out "there's a housing bubble"? I may be wrong, but I think most of the bloggers out there (and their followers) are thinking what happened to the stock market and stock prices can happen to the real estate market and house prices. And in the stock market you had the general value of stocks (i.e., the indices) drop by a lot because you had a lot of Dot.com stocks get re-valued to $0 when people discovered that their underlying worth was $0. What I'm saying is that that can't happen with real estate. There will never be a case when someone finds out that the real estate they purchased has $0 worth and that they have been sold something valueless under the guize it was worth something. So, call it what you will, but if BHs really think what happened with stocks can happen with real estate, they are wrong. It is an impossibilty. All land/property is worth at least something. So, the extent to which prices can fall is limited. If a BH believes a bursting bubble means "1 -12%" decline like David stated the other day, then I say I don't disagree with them. I just wouldn't call such a small decline a bursting bubble. If a BH says "50% decline --- as a bubble a la "stock market bubble" meant, then I say you are deceiving yourselves.

The best measure of household wealth is one's power's of observation. Look at this area ... walk around it ... drive around it and witness the high number of new cars on the streets and highways, the malls brimming with shoppers, the restaurants overflowing with expensively dressed patrons, the tons of dollars given to charities and political causes, the number of people paying over $100/month for cable/satelitte television, the WallMarts and Home Depots full of shoppers, the new construction everywhere, the traffic jams filled with all these expensively-dressed people and their expensive cars, ... That's right, and all that is happening on LOW household wealth. Get real ... quit trusitng statistics and trust your senses more. Statistics are just someone else's interpretation of what's going on ... Do your own.

ReplyDeleteAll that means is that everyone is in debt up to their eyeballs. Did you not hear that the average savings rate is negative? Or is that some media conspiracy too?

Anon 1:31,

ReplyDeleteI was an "unusualy gifted kid" ... still am ... ;)

mid-40s ...

Yeap, all those expensive cars, expensive iPods, plasma TVs. People are just soooo darn wealthy. Yeah it's called the illusion of wealth, it's called DEBT. What's the savings rate in this country? -1.5 to -3.0%. Yes, yes I know it doesn't include 401(k). The bottom line with it though is that as a country we spend more than we take home each month. How many MEWs and HELOCs have people taken out on their homes in the past 3-5 years. What happens when the merry-go-round stops??

ReplyDeleteI have this real estate agent kept asking me if I want to submit an offer for a studio in south arlington and said I should hurry but it's listed on MLS and avoid competitions. I almost laughed since that condo has been listed twice after 3 price reduction in the last 7 months and still didn't sell. Why would I worry about competitions. I am not buying anything when I can rent an apartment twice the size of the condo she's selling for the same monthly expenses.

ReplyDeleteForeclosure rates up big in December

ReplyDeleteAmericans continue having difficulties paying their mortgage obligations, with December foreclosure rates above the 100,000 mark for the fifth straight month.

http://money.cnn.com/2007/01/16/real_estate/December_foreclosures_up_from_2005/index.htm?postversion=2007011706

Can somebody tell these 100,000 people that a house value can't burst? After all some experts have studied the real-estate market for more than forty years, and after careful analysis (looking up one's own ass), have come to the conclusion that buying real-estate is safe anytime, anywhere, anyhow.

"So corporations are now the savior of the condo market? I guess the Saudi Princes, GS-15s, and Lawyers weren't holding up their end of the deal."

ReplyDeleteNice response. i gues you have absolutely nothing serious to say.

"If a large segment of the population is not participating in the RE market, then that implies that a fewer number of participants move the market. So increasing foreclosure rates, and declining sales numbers with much higher inventories will have that much more of an impact on the market."

ReplyDeleteMan, you will say just about anything, huh? Your 2 cents is more like 1 cent.

"The Real Bob said...

ReplyDeleteanon 10:25, said

"a very large segment of dc does not participate in the economy at large"

you just made your self look foolish. Any person with a brain uses the median income stat. What planet are you from? Oh wait, now corporations drove up the housing price.

"

So, in other words, bob, you have absolutely no response. Game, set, match. I win.

"mid-40s ... "

ReplyDelete"I've witnessed up cycles and down cycles going back some 40+ years"

LOL...

Your credibility is NIL dude. It is nothing but sad that you would try to claim you were watching real estate markets while a toddler... and using that as "evidence" of your expertise.

And when the numbers don't support your warped world view? Well then ignore the numbers... salaries aren't what matter. Nope... clearly it is expensive clothes and nice cars... so long as there are lots of those in sight everything is peachy.

Look up "roaring 20's" sometime why don't you?

They may not need to according to Wikipedia, BUT they would need to in order for them to mirror what happened with the stock market.

ReplyDeletePlease point out one stock market index that went to 0. Individual stocks may go to 0. However nobody buys 1 stock. Most people buy a basket. We called it a Tech bubble in 2000, however NASDAQ did not go to 0.

Also you seem to have much belief in the value of land/house. Just because it is a physical asset as opposed to paper one means nothing. If you understood basic economics, a value of an asset is what people are willing to pay for it. Why is a house in some places in California/Florida 2-3 times more today than 5-7 years ago. Is it because somebody discovered Gold underneath? Or their wages doubled/tripled in this time period? This happened because of easy credit. People were willing to borrow money cheap and bet on the fact that house prices will keep appreciating. If house prices return to their values 5 years ago, even inflation adjusted, it would be no big surprise.

Lance said...

ReplyDelete“Robert, you are confusing cycles with trends. Cycles go up and down around a mean which trends up or down. Think of it as a bee flying around a clothes line where the clothes line is swinging upward or downward. The bee's path is the cycle and the clothes line is the trend of the mean…….”

Lance, I mean come on. You try to do a decent job of explaining a trend line, but your application is all wrong. Cycles indeed go up and down, as seen by the data. The prices must come down, back to the mean (even below), for this to be a “normal” cycle. If not, then this is not a normal cycle and the trend line would adjust, thus indicating an "abnormal" cycle. (google “trends” and “least squares”) So when you and/or Va tout a normal cycle, you're saying that prices will revert to the mean, or “trend” if you will (historically ~3% annually).

“Additionally, that graph you keep presenting is fundamentally flawed in that it only looks at trends in house prices completely ingoring the "housing value" or "rent" or which is inseparable from any analysis on return on investment.”

First of all, I didn’t present the data. Second of all, I think it’s you who continues to point out that housing is not an investment. Furthermore, you continue to ignore things such as “rent”. Over the past few years, rental prices and salaries have been out of sync with housing prices. Tack on the toxic loans into the mix of your calculations and you might have an idea of what we're talking about.

“One other problem with the graph which I don't think has been brought up before is that using an inflation index over a long period of time (such as the 100 years plus here) is questionable at best since over time the basket of goods that determines that basket changes so much that one ends up comparing apples to oranges at one point…”

That’s why we have benchmarks Lance. How would you make the apples to apples comparison? Let’s go a step further. I’d like to see the data you’re basing your theories on. I would especially like to see your data on the history of home values. Post the links Lance.

Lance said...

ReplyDelete“Keith, first off, I've said there is no bubble in house/condo prices because by definition a bubble can't apply to something which isn't a piece of paper representing an interest in a commercial activity (eg. a stock or bond.)”

Then what is a HELOC?

Lance said

ReplyDeleteAnd in the stock market you had the general value of stocks (i.e., the indices) drop by a lot because you had a lot of Dot.com stocks get re-valued to $0 when people discovered that their underlying worth was $0. What I'm saying is that that can't happen with real estate. There will never be a case when someone finds out that the real estate they purchased has $0 worth and that they have been sold something valueless under the guize it was worth something . . .

So now we are justifying buying RE b/c it will always be worth something. Hmmm, did you pay attention in 1979-1980 w/ Silver and Gold. If you bought at the tail end of that massive bubble you're still hurting. Gold to reach inflation adjusted highs would have to hit upwards of $1600/oz and silver would need to hit around $100/oz. Sure silver and gold aren't worth 0 but ~13/oz and ~650/oz is a loooonnnnnngggg way from their respective highs. I'm sure all those investors who bought at the end sure feel cozy . . .well it won't ever be worth 0. . . . geeez investing for dumbies.

Lance . . .

ReplyDeleteI would seriously suggest a couple of books to you to help you understand markets, b/c it seems obvious that you don't understand them a whole lot---or what you do understand is from Jim Crammer (BOOO YAHH!!!!-gosh please someone SHUT HIM UP-crammer---investing for the lazyboy-i want it now generation).

One would be Technical Analysis of Financial Markets (pretty good basics of markets), Forecasting Financial Markets, and please for the love of pete pick up a Crowd behavior, mania book.

Bubbles DO NOT have to go to 0 and do not have to be only in stock/bonds. Commodity bubbles happen, look at the Florida Land Bubble circa 1920, the Tulip craze-hey a flower is worth something, we spend $20 all the time for significant others.

One of the main problem with many speculators, and I imagine this is/will happen with RE is they become emotionally attached to their investments. "Gosh, I just know it's a good investment, I know it will go up". Sure maybe it will recover in 20 years, but they put themselves through hades b/c they are too egotistical, too proud, too stubborn to do one very simple thing. Admit they were wrong and get the heck out of dodge.

ReplyDeleteHuman beings don't like to be wrong, we always want to be right--especially after we've taken a huge risk b/c we have a hard time admitting we got caught up in the moment and were stupid.

"Gosh, I just know it's a good investment, I know it will go up". Sure maybe it will recover in 20 years, but they put themselves through hades b/c they are too egotistical, too proud, too stubborn to do one very simple thing. Admit they were wrong and get the heck out of dodge.

ReplyDeleteHuman beings don't like to be wrong, we always want to be right--especially after we've taken a huge risk b/c we have a hard time admitting we got caught up in the moment and were stupid. "

You are talking about Lance aren't you?

If you weren't you might as well have been...

That is really what his presence on this blog is all about. He isn't honestly dumb enough not to understand what is happening... but it is too painful for him to admit he is wrong so instead he is just trying to spin and spin and spin.

I mean what can you say about someone who is reduced to trying to redefine the word "bubble" to try to "win" the argument? I mean who CARES what it is called?

The point is prices are dropping and will continue to do so for some time. Lance had the dumb luck to buy on the way up and is just too full of himself to admit that is what it was.

I suspect even as prices tank and his May 2007 recovery predictions are proven to be false, he will still be here... trying to invent new theories to explain how he isn't really wrong and blah blah blah...

This isn't about real estate for Lance. This isn't about anything but him trying to "win" an argument.

robert said...

ReplyDelete"Lance said...

“Keith, first off, I've said there is no bubble in house/condo prices because by definition a bubble can't apply to something which isn't a piece of paper representing an interest in a commercial activity (eg. a stock or bond.)”

Then what is a HELOC?"

Huh Robert ... HELOC stands for Home Equity Line of Credit. What commercial activity are you buying a piece of when you take out a HELOC? Haven't you ever heard the expression "You shouldn't ask a question you don't already know the answer to."?

Lance said...

ReplyDelete“Huh Robert ... HELOC stands for Home Equity Line of Credit. What commercial activity are you buying a piece of when you take out a HELOC? Haven't you ever heard the expression "You shouldn't ask a question you don't already know the answer to."?”

So, you’re saying that the lending of monies is not a commercial activity?

Robert,

ReplyDeleteIf you don't understand the difference between a stock which is a piece of paper representing a financial interest in a commercial activity and your loan papers for a HELOC which are evidence of a debt you owe, I really don't know how I can explain it to you. Perhaps one of your fellow bubbleheads can put it in terms you will understand.

John here...(too lazy to sign up)

ReplyDeleteLance:

“Keith, first off, I've said there is no bubble in house/condo prices because by definition a bubble can't apply to something which isn't a piece of paper representing an interest in a commercial activity (eg. a stock or bond.)”

Please google the the following "Dutch...tulip...mania". Read carefully. Note that Tulips are not a commercial activity, nor a piece of paper representing one.

Discuss.

The most comon and repetative bubbles are real estate bubbles. Heck, Babylon had real estate bubbles! Want other examples of non-paper bubbles? How about the railroad bubble before the long depression?

ReplyDeleteI've seen prices drop 40% in my neighborhood. I've seen it twice and its about to happen again. How do I know? Ferrari's. When too many Ferrari's are on the road, people are living beyound there means. Its been the way every bubble...

Real investors will wait until prices begin to level or change direction - until then - only a fool is buying on the way down.

The most successfull business person I know pointed out that you only expand a business on the way up.

This isn't about real estate for Lance. This isn't about anything but him trying to "win" an argument.

Very true. He likes to practice arguing. Bummer he didn't realize we want numbers. I think he only frequents this blog to practice lawyering skills. I haven't learned anything from him except that he'll constantly advocate buying.

Real estate is a well known cyclical market. If you don't know that already... you'll about to learn. Nothing determines your standard of living more than when in the cycle one buys real estate. Now is not the right time in the cycle. Anyone who has lived in New York or Southern California knows how brutal the cycles can be.

But some people can't open their eyes. Cest la vie. Ignore them, you won't ever learn from them.

Neil

"Lance said...

ReplyDelete“Keith, first off, I've said there is no bubble in house/condo prices because by definition a bubble can't apply to something which isn't a piece of paper(bank note/HELOC) representing an interest(return on the bank note/HELOC) in a commercial activity(Real estate) (eg. a stock or bond.)”

Lance,

ReplyDeleteHave you been drinking the Kool-Aid again.

David,

ReplyDeleteCR's blog noted the increase in housing starts... However, its not single family homes but rather multi-family units (condos/apartments). Is this true of DC too?

Good lord, that must be good Kool-aid. We've never had such a surplus of housing. Cest la vie. Did you also see CR's predictions of construction employment? Darn good work on his part. Basically in March the work force reductions start in force, a brutal April and May just won't be pretty either.

The ball is rolling. The avalance has started. Quite bluntly, there is nothing we can do but get out of the way. Its a slow avalance. The town below won't know about it for a rather long time. But for those that recognize the strange fog on the mountain... they know its time to run for the opposite hills.

Its sad its come to this. I really wish Americans were a bit more disciplined with their spending... but they aren't. Its closing time and the scar faced bouncer wants to know why each table's check hasn't been paid. I hope that you, like myself, are out the door paid in full with cash left over.

The others?

Got popcorn?

Neil

For your consideration:

ReplyDeleteUS housing bust getting worse, warns Goldman

By Ambrose Evans-Pritchard

Last Updated: 1:16am GMT 16/01/2007

The US Federal Reserve will need to slash interest rates three times this year as the housing slump goes from bad to worse and the American consumer begins to buckle, Goldman Sachs has warned.

Federal Reserve Board chairman Ben Benanke

"Americans have shown a complete lack of self-control. The personal savings rate is at its lowest point ever, and has actually been negative since April 2005.

"We believe that housing will soon become the proverbial 'straw that breaks the camel's back'," said David Kostin, the investment bank's US strategist.

But of course Lance knows better...

Robert,

ReplyDeleteAgain, grasping the difference between a financial instrument that allows you to own equity in a commercial endevour and a financial instrument that provides proof of your indebtedness, seems way over your head. You're better off being a renter. Buying and then being a homeowner is far too complex for you. You're far better off just spending the extra money to rent your whole life. People will look out for you that way.

Robert, you are confusing cycles with trends. Cycles go up and down around a mean which trends up or down. Think of it as a bee flying around a clothes line where the clothes line is swinging upward or downward. The bee's path is the cycle and the clothes line is the trend of the mean…

ReplyDeleteLet's talk about the birds and the bees.

BTW, I saw a hot blonde today in LA sporting fake boobs, driving a BMW.

The real estate market must be moving up! Hallelujah!

For your consideration...First the Goldman article...Now a post from Richard Russel;

ReplyDelete"I just received the latest "Real Estate Timing Letter" by Robert Campbell (858-481-3236). This is a unique and excellent technical-fundamental report by a real estate expert -- Robert was one of the first to call the top of the real estate boom.

Campbell believes we're still at the beginning of a long bear market in real estate. Here are a few of his reasons --

"Real estate downturns typically last 4 to 6 years after housing prices peak out."

"A huge wave of ARMSs are scheduled to be re-priced in 2007, causing a significant rise in mortgage payments and an acceleration in foreclosures."

"A credit crunch is looming on the horizon, which make mortgage financing harder to get. If you contract the availability of credit, the housing bubble deflates.

"After rising by a spectacular 200% during the boom, history almost assures us that the resultant fall in housing will be equally spectacular during the bust."

So there you have it!

Lance, I know Richard Russel is a nobody, only your sources (which you accumulated during your 40 year observations) have any importance.

Lance - Selling houses not going well for you still, I see. Instead of working, you're still spending a lot of time here on this blog, fighting upstream against a growing public consensus of a failing RE market (see builder's cancellation rates that past two quarters for a bit of something commonly called "proof").

ReplyDeleteMy deepest, heartfelt sympathy for the next few years of decling home prices and reduced profit margins. Maybe you should try spending a week in Las Vegas? Perhaps the odds of you turning a profit this year are better at a sports book -- or maybe try the nickel slots.

I propose a new RE metric -- the Lance-o-meter. The more time Lance 'the desperate real estate agent' spends posting his faith-based/fact-less economic musings, the better things might become for buyers; conversely, the less time he spends here, the hotter the market is becoming for sellers.

So, judging by the amount of time Lance is posting now, definitely a good time to sit things out. Best put our money in short-term treasuries or CDs and see a minimal gain, rather than loss our shirts by drinking Lance's "buy it now, since prices are sinking" kool-aid.

Even when somebody (me) takes pity on Lance and shows some support, Lance ruins it with his incoherent ranting.

ReplyDeleteThe self-contradictions are my favorite:

1. Lance starts out pro-saving:

In reply to - "Yep, Lance I want to cancel my cell service, cable, ect and eat beans and rice for the next 15-20 yrs. Sign me up!"

Lance replies: "hmmm ... when I bought my first DC place, I basically did just as you are advocating. That's the kind of will and determination it takes to make it in a high cost of living place like DC."

2. But then Lance flip-flops and becomes pro-spending:

Lance: "drive around it and witness the high number of new cars on the streets and highways, the malls brimming with shoppers, the restaurants overflowing with expensively dressed patrons, the tons of dollars given to charities and political causes, the number of people paying over $100/month for cable/satelitte television, the WallMarts and Home Depots full of shoppers, the new construction everywhere, the traffic jams filled with all these expensively-dressed people and their expensive cars."

It's totally priceless.

And then Lance really displays his utter inability to learn by repeating his canard that an asset bubble implies that the underlying asset has zero value. Once again, everybody corrects Lance and points out the obvious: that assets with real underlying value can still see a bubble. In fact, most bubbles occur when the underlying assets have some value.

And Lance does all this to avoid facing the fact that he actually made a testable prediction - that everybody's going to be fighting over those houses come May 07. But Lance can't wriggle out of this one: He's forecast rising prices come May. Let's all be ready to remind him come June.:)

Interesting article, but a lot of hysterical people on this site. Could the bottom fall out of the market? Of course--I lived in Tokyo where the prices in the center fell 70% from the 80s to the 90s. Probably won't happen here, b/c it looks like builders and developers are putting the brakes on pretty quick. But it seems a lot of people on this board forget that you need a buyer and a seller to make a transaction--if their needs don't meet, no sale. There's no use getting all emotional over it--I can either get what i want out of a deal or I can't. No one knows what will happen in the market and if they did, or if it was as obvious as the "bubble is going to pop" or "you can't lose with RE" you hear sometimes, you can bet it's already priced in. If you still can't or don't want to buy (sell), then don't, but live with your decision and stop all the handwringing.

ReplyDelete37 yr old renter with no regrets.

Lance said:" Again, grasping the difference between a financial instrument that allows you to own equity in a commercial endevour and a financial instrument that provides proof of your indebtedness, seems way over your head..."

ReplyDeletePlease , Lance, don't talk about what you don't understand. It's over YOUR HEAD buddy...

Lance said...

ReplyDelete“Robert,

Again, grasping the difference between a financial instrument (a bank note/HELOC) that allows (the lender) you to own (shares)equity in (real estate.)a commercial endevour and a financial instrument that provides proof of your indebtedness, seems way over your head.”

Lance, can you not grasp that a mortgage is a financial instrument that allows lenders to……never mind Lance…..

So now, a home is “proof of your indebtedness” not an “expense”. I think that’s something we BH’s have said all along.

""We believe that housing will soon become the proverbial 'straw that breaks the camel's back'," said David Kostin, the investment bank's US strategist.

ReplyDeleteBut of course Lance knows better... "

Of COURSE Lance knows better!

Don't you know that he has been watching the RE market since he was in a diaper? Don't you know that he has actually bought a house and is thus suddenly an expert on economics even though his day job is computer maintenance?

Senior Investment bankers, Federal Reserve board members, home building company CEOs, none of them have half of Lance's experience.

They need to get him on the phone so he can explain to them that:

1. There is no reason to worry about a bubble in RE, because such a thing can not happen. It is simply impossible because that isn't what the word "bubble" means in Lance's world.

2. There are various vague new methods of magically determining a prospective borrower's ability and willingness to repay a loan. Even with the proliferation of no-doc loans and wide reports of mortgage fraud... everything is fine. These borrowers are comparable to nation states with unquestionable credit.

3. There is a "new paradigm" where economic laws no longer apply.

4. Oh yeah, and as everyone here has already mentioned... despite the fact that he has been studying RE for 40+ years of his 40+ year life... he has concluded that this is a "normal downturn" and no cause for concern, only unlike a normal downturn this won't last several years... instead it will last a few months and the bidding wars will return in May 2007 as herds of "bitter renters" try to rush into the market.

5. Last but not least... it is always a good time to buy. It was a good time to buy when he bought in 2005 with an IO loan within sight of the top of the bubble. (true) It was true in Spring 06 even as inventory was shooting through the roof. It was true is summer 06 as real price declines began... and it true now as well, even as price declines continue to accellerate and there is no sign of them slowing.

I propose a new blog for lance and for all of you who spend your entire lives coming up with ways to zing lance. lancemeter.blogspot.com

ReplyDeletego there and leave the rest of us alone.

Anon

ReplyDeleteYep, some of the housing bulls are pretty hysterical.

I agree, you either (as a buyer) get what you want out of a deal.. or you don't deal.

But it has become obvious there will be a correction. I know of too many corporate moves, too many people who invested in RE, and we've looked at the statistics.

The era of the US savings rate being at -3% is over. Its time to pay the piper. If you don't like our discussions... de-bookmark this blog. That's what blogs are for!

Neil

Anon 8:41,

ReplyDeleteThank you for your rational and non-hysterical post.

I stumbled upon this blog last summer via a link from a blog where I had posted occasionally for a month or two. That blog, Inside the DC Bubble, was a fair and balanced blog frequented by people who believed there was a bubble, people who didn't believe there was a bubble, and those who didn't really know yet whether there was or there wasn't one. The blogger there made sure that no personal attacks occurred and basically kept it a rational and bias-free blog. It was informative because of the diversity of opinions. As I said, I happened to post here because the blogger there had referenced a post from this blog. I posted a rational and balanced post here as I was accustomed to ... And was immediately personally attacked and "accused" of having an interest in stating that there was no bubble. I was a realtor or some other member of the hated REIC (Real Estate Industrial Compex)! Or I was a GF (greater fool). One poster here even started using my name to post idiot comments. To David's credit, he took care of that poster and did stop some of the more blatant personal attacks. However, overall David and this blog hold a biased position ... that a blog DOES exist. This is even shamelessly stated in the masthead! This makes this blog from the get-go prejudiced against those who don't believe there is a bubble and against their attempts at arguing why a bubble in real estate is just plain impossible. This is a blog for those kindred spirits who want re-enforcement of their ideas ... ideas which are not supported by either the mainstream media, respected real estate experts, respected universities and economists or basically any other "trusted" sources that rational people go to. The people here want "preaching to the choir" ... and when someone not toeing the line expresses their opinion, they personally attack them for not agreeing with the bubbleheads' handpicked statistics. Statistics whose interpretations are widely discredited but which the Bubbleheads put all their hopes in. The BHs don't care that the experts don't view these statistics in the same way ... THEY know better and only those "experts" and statistics that offer them hope of gaining at others' expense are acceptable ideas. All others for them are just impediments to their ultimate dream ... i.e., to get something for nothing. With that in mind, I understand why my pleas for rational ideas and trust in respected experts' opinions vs. the defacto pronouncements of self-appointed prophets, are met with ridicule. The fact that I shove the truth in their faces is obviously not appreciated. With that in mind, I am here on in going to content myself with just looking on to the goings on here. And yes, I think it will be interesting to watch what happens in the spring as the reversal which has already begun gains strength. Of course, I know already that the doomsday date will just get pushed out again. I was reading through some of the archives and the date of judgment has already been missed more than several times. And it will be missed many more times. The real question will be "when will the bubbleheads give up on their foolish nonesense and just learn to deal with what is rather than with what they wish was. It's alright to dream ... but not when it gets in the way of reality. Bye.

Va_Investor ... Keep up the good fight ... and good luck with all your endevours.

The current trend is condo projects converting to apartment complexes They

ReplyDeletestart off strong selling as many as 70% of their units in the first 3 months, and then sales stopped cold turkey. Some are lucky if they get one sale a month. So they use a provision in the contract that allows them to cancel their 200+ contracts and sell it off as an apartment complex.

In the olden days, new constructions were a great deal since they would price them $50k UNDER the current market and then the market would go up $50k, for an easy $100k profit. If builders want to sell a year or two ahead of the grand opening, they better go back to super discounts.

More on why NOT to buy, from a Realtor at: Blog.FranklyRealty.com

Thanks

Frank

I really think the folks here do not really understand real estate. The DC apartment vacany rate is extremely low, and can easily absorb condominium developments being converted into apartment projects. Thus the #s in the inventory pipeline will not materialize. As for "flippers" who bought condos as investments, they were essentially gambling so who cares what happens to them? My guess is most will rather rent out their units for a year or two, taking a huge loss each month, and then try to sell again in the future.

ReplyDeleteThe market has had its initial correction, rates are still very low and the local economy is still very strong. I would expect many buyers to buy in 2007 although with prices remaining flat. I do not see any drastic change in local prices.

ditka driving? wrote...

ReplyDelete"Real investors will wait until prices begin to level or change direction - until then - only a fool is buying on the way down."

Don't confuse investors with speculators. Real investors estimate their expected rate of return from an investment and compare it to other available alternatives.

From where we stand today, I wouldn't worry about investing in real estate in much of middle America, but along the coasts it's a money loser. Stocks today are a far better long-run investment than bubble-market real estate.

lance said...

ReplyDeleteI've said there is no bubble in house/condo prices because by definition a bubble can't apply to something which isn't a piece of paper representing an interest in a commercial activity (eg. a stock or bond.) A stock or bond can "burst" to zero value (the definition of a bursting bubble) because the underlying commercial activity can cease to have ANY value. That can never be the case with a place where people live.

Lance is using his own made-up definitions. One of the most famous bubbles in history was the tulip bubble in the 17th century. That's right, a bubble for tulips--a type of flower. Japan experienced a real estate bubble in the late 1980's.

A bubble exists when an asset class--any asset class--is overvalued. Prices don't need to go to zero, they just need to result in a negative (or exceedingly low) future rate of return. For example, Coca-Cola is a very profitable company, but if you had bought the stock in 1999 you'd still be underwater, because you would have overpaid for it. Same with Microsoft and Dell. No fall to zero is needed.

Dictionary.com defines "bubble" as:

5. an inflated speculation, esp. if fraudulent: The real-estate bubble ruined many investors.

Investopedia defines "bubble" as:

1. An economic cycle characterized by rapid expansion followed by a contraction.

The American Heritage New Dictionary of Cultural Literacy has the most complete definition:

A period of wild speculation in which the price of a commodity or stock or an entire market is inflated far beyond its real value. Bubbles are said to “burst” when a general awareness of the folly emerges and the price drops.

Lance, I strongly recommend reading A Random Walk Down Wall Street by Princeton University professor Burton G. Malkiel. It's a classic investment book and it covers the history of financial bubbles. In the meantime, you are arguing based on ignorance.

Lance,

ReplyDeleteAre you really leaving? You are welcome to post here even if I often disagree with you.

David

There are about 20 real estate lockboxes in front of the Colombia. It is a great building in terms of location, exterior design,and quality of work. The resales are still overpriced though. Since this building may have some appeal for the lobbyist, congressional types, it will probably suffer less than others I predict.

ReplyDeleteWow... Lance's "last" post is nothing but a long rambling ad hominem attack and strawman argument...

ReplyDeleteThat is appropriate.

Lance, I am glad you have realized that you really can't make a case to support your "it is always a good time to buy" theory. It would have been nice if you had been enough of a man to simply admit you were wrong rather than running off, but it is obvious what is happening here.

We are still going to have a little party in May 2007 to celebrate the return of the bidding wars you have predicted.

Leave, Lance. Go back to school -- study the basic principles of mathematics, debate, and logic; study Economics 101 (and 102); and study the history of speculative markets. And please don't return and waste our time with your faith-based, grammatically-challenged rantings until you do.

ReplyDeleteThank you.

David - the problem is that you don't disagree good-naturedly. If a post is critical of you, you don't allow it to appear. That's why your readership has collapsed. All it is now is lance and a bunch of people who hate lance.

ReplyDeleteLance said...

ReplyDelete“This is a blog for those kindred spirits who want re-enforcement of their ideas ... ideas which are not supported by either the mainstream media, respected real estate experts, respected universities and economists or basically any other "trusted" sources that rational people go to……... Statistics whose interpretations are widely discredited but which the Bubbleheads put all their hopes in. The BHs don't care that the experts don't view these statistics in the same way ...”

Such consternation Lance, you poor thing. However, this is just another example of your non sequitur ranting. Anyone that’s kept track of this blog will attest that you’ve been given ample opportunity to provide information/data for your “never a bad time to buy” concept, but you continue to ignore the numbers. I would love to see the numbers you have for inventory, DOM, average/median prices, foreclosures, ARM re-sets, I/O loans, or any other pertinent market indicators.

But alas:

Lance said...

robert said:

"Please, enlighten us with any data that shows trends of sales increase, an inventory decrease, a reduction in foreclosures, and/or a reduction in the number of ARM’s resetting."

“again, for whatever reason Robert, I have learned that won't cannot see the forest for the trees ... even if it jumped out and bit you in the face. you keep looking for validation of your position in numbers that I and others have gone round and round with you explaining why they mean NOTHING ... absolutely NOTHING ...”

July 21, 2006 9:09 AM

Lance said...

“My point has always simply been "there is never a bad time to buy" ...” July 26, 2006 3:07 PM

And just further up, Lance is defending his position that there can be no real estate bubble…well, he sure thinks one can be had in sunny California:

Lance said...

“from everything I know about California and the west (including having lived there), I suspect there is a large bubble there. everybody is from somewhere else and trying to make a quick buck ...”

So, we’ve gone from no bubble to:

Not in NoVa

Not in DC

Not in DC proper

Not in my zip code

And back to “no such thing as a real estate bubble”

Thanks for the laughs Lance.

va_investor said...

ReplyDelete“Lance,

This blog is an echo chamber and I too have no interest in further contributing.”

Not you too Va!

va_investor said...

“Robert,

I never claimed that we were not in for a corretion. I have consistently stated that real estate is cyclical. I believe a 90's style correction is in store.”

September 04, 2006 5:09 PM

You have yet “contribute”, much less describe “a 90's style correction” or what a “normal cycle” looks like.

So, back to the topic at hand:

ReplyDelete“NYTimes: Buyers Scarce, Many Condos Are for Rent”

Will this surely drop rental prices?

Locally, I’ve seen a rise in rentals on the market. Anyone noticing the same? Where do you find data on rental inventory?

David,

ReplyDeleteThank you for your nice words. You almost make me want to say I will post again if for no reason other than to oblige you. Perhaps we can meet up for a drink one night? I honestly hold nothing against you and completely understand where you are coming from having been there myself at your age. Now, your "enablers" are a different story.

Va_Investor, yes, you too I will miss. Perhaps the 3 of us could meet for a drink? Only David has our emails to make this happen. Though you did once slip and posted something that allowed me to gain your real name ... or that of your husband ... Your house looks very nice in Google ariels ... So many swimming pools in the area! and so relatively cheap compared to what it costs us to live in DC! All I'll say is "subcontinent" ... correct? Though, oddly enough I have never been able to think of you as a woman for some reason ... Hopefully David will organize a get together ...

Lance, Guess this means goodbye. Don't let the exit button hit you in the @@@.

ReplyDelete"

ReplyDeleteSo, back to the topic at hand:

“NYTimes: Buyers Scarce, Many Condos Are for Rent”

Will this surely drop rental prices?

Locally, I’ve seen a rise in rentals on the market. Anyone noticing the same? Where do you find data on rental inventory? "

Rental inventory is not close to the place where some condos coming on the market can stop the hyperinflation.

I have been reading this blog for several months and have never posted till now. While I am not a bubble or housing head I have found the dialog to be quite interesting. I think both Lance and Va are a big part of that. So while I do not agree with them all the time I think their perspective will be missed. It was not all that long ago on this very blog that David was the victim of numerous personal attacks. So I think it is time that everyone grows up and stops all the stupid personal #$%@. I would also ask that both Lance and Va continue posting because there are many people who may or may not agree with them but enjoy reading their comment and hearing more that one perspective.

ReplyDeleteDTBG

http://www.baltimoresun.com/business/bal-te.bz.vacanthomes21jan21,0,2387143.story?coll=bal-business-headlines

ReplyDeleteHouses for sale stand vacant

Slowdown leaves half of homes on market unoccupied

BY LORRAINE MIRABELLA

SUN REPORTER

ORIGINALLY PUBLISHED JANUARY 21, 2007

-The number of vacant homes for sale nationally jumped more than 30 percent in the third quarter from a year earlier, to 1.9 million homes, the latest data available from the U.S. Census Bureau show. That's about half of all single-family homes on the market, said Michael Carliner, vice president of economics for the National Association of Home Builders.

More than a third of those - 825,000 - are in the southern region of the United States, which includes Maryland.-

Lance,

ReplyDeleteI don't care if you post or not. If you do again, please use paragraphs!!

Lance,

ReplyDeleteI've not seen much in the way of ad hominem attacks -- it's mostly people ridiculing your arguments.

(much the same as you ridicule theirs.) If you really want to "take your ball and go home", go ahead, but I don't

think you can honestly say everyone here is being mean to you.

Just sayin'.

robert said...

ReplyDeleteSo, back to the topic at hand:

“NYTimes: Buyers Scarce, Many Condos Are for Rent”

Will this surely drop rental prices?

Locally, I’ve seen a rise in rentals on the market. Anyone noticing the same? Where do you find data on rental inventory?"

Rents are dropping here in Kali with all the speculators flops being rented out. I saw a rental spike here about six month ago, it's gone now and prices are back to the norm. Other states will follow as the bubble is deflated in other areas. Good thing I took a lease during the storm.

Lance said, "Condos are down but house prices aren't budging much." Huh? Check this site: http://www.gcaar.com/statistics/default.htm.

ReplyDeleteIn DC, median single family house prices are down 12% since the Summer 2005 peak. 12% seems fairly significant, doesn't it Lance? Let's face it, the bottom line is that prices are 'supposed' to move up for a reason. These reasons include people making more money, people becoming wealthier in the stock market, supply shortages, and lots of other economic reasons. In the DC area, and many other urban centers, NONE of these reasons have happened. From 2000-2005 people's income did not double, people's stock market wealth did not double, etc. But real estate prices doubled. This tells you it was nothing but speculation. Now the market is adjusting for that speculation. This is really simple economics, I do not even know why there is a debate over this. When the general public figures this out, real estate is going to tank more than any of you ever have imagined. And with the condo over-supply now becoming a full-on glut, condo prices are going to tank even more steeply. I envision house prices dropping another 20%, and condo prices dropping another 30 to 50%. Look at the numbers, DC sells about 3400 condos a year on average. We have a 8 to 10 year supply of condos on the market, and growing! You tell me, how far will condo prices have to drop to absord that kind of inventory. Again, this is very simple economics to figure out. There is nothing that will prop up real state prices, prices are doomed for at least the next five years, to fall and then remained flat for a long time.