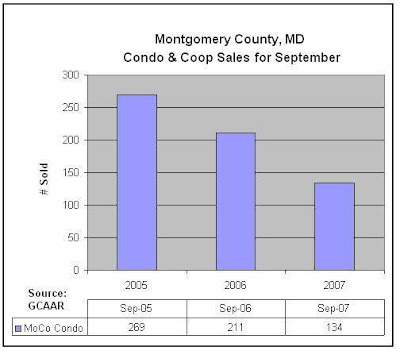

The number of housing units sold in the DC area in September 2007, has dropped precipitously from September of last year. The number of sold single family houses fell 42.2% from September 2006 and 67% from September 2005 in Montgomery County, MD. In DC, the percentage decline was basically the same, at 42.1%. The months supply of single family houses in Montgomery County, MD for September 2007 has now reached over 10 months. There were 4520 active listings and only 423 single family houses sold.

It will be interesting to see if, or how, the MRIS Statistics (which are to be released today) jibe with these numbers.

ReplyDeletethis is butt ugly...

ReplyDeleteMRIS stats are out today, and DC got killed.

ReplyDeleteAs we all know, the suggestion in the MRIS numbers that the Baltimore City/County median price has remained unchanged y-o-y is pure hogwash: MRIS doesn't factor in incentives.

ReplyDeleteLooks like lance picked a good time to run off and hide.

ReplyDeleteNow that the credit bubble has popped the RE market won't be far behind. Even areas inside the beltway are now showing massive drops in sales.

These graphs are beautiful. Correction is in the eye of the beholder.

ReplyDelete-dcandout

Another Anon said:

ReplyDelete"Even areas inside the beltway are now showing massive drops in sales."

Does the term "bubble" refer to sales volume or sales price?

Incidentally, I don't think anyone (other than BHs) are surprised that sales volume is down considerably when compared to a period when sales volume was extrordinary. To read anything ominous into the reduction in sales levels is like saying in January that retail is going down the tubes because sales volume is so much lower than in December.

"Does the term "bubble" refer to sales volume or sales price?"

ReplyDeleteIt refers to both. There was a housing price and housing unit sales bubble in many parts of the US.

Lance,

ReplyDeleteThese are year over year numbers. Don't try to compare different months when they are the same month. Sales are at half of what the sales were in the bubble. A 50% drop in sales rate isn't a small change!. Guess what, there is still room on the downside.

There is a reason Case-Shiller is down 7.2% in DC! In other words, yes the median is going up because the $2.5M place is selling for $2.3M and the cheaper places sit. The median has become a worthless statistic due to the low end of the market freezing up. I'm seeing high end places sell, but for quite a bit less than a year ago comparable.

Volume always leads price.

These graphs are incredible.

That 6% to 13% drop in prices for the next six months might be looking optimistic.

Got popcorn?

Neil

Volume = Demand

ReplyDeleteInventory = Supply

Supply and Demand determine Price.

Sales volume, inventory, and price do not occupy their own little independent vacuums.

The charts are yr/yr to avoid seasonality issues, unlike comparing January retail sales to December.

mad_tiger

Somewhat off-topic, but someone in the auction thread was asking about the results on 3576 Ellery Circle, Falls Church.

ReplyDeleteIt looks like the sellers rejected the high bid of $425k (for perspective, it looks like the property last sold for $991.5k.) They're accepting offers at the hudson and marshall site.

Scratch the $991.5k figure, the last sales price appears to have been $700k.

ReplyDeleteYes, Lance.

ReplyDeleteA 30-40% drop in sales volume is GREAT news for the MD-DC market. There's never been a better time to buy.

John

"

ReplyDeleteA 30-40% drop in sales volume is GREAT news for the MD-DC market. There's never been a better time to buy."

tomorrow is a better time to buy. And will be for the foreseeable future.

DC median is down 17.58% YOY for September. Ouch.

ReplyDeletehttp://www.mris.com/reports/stats/route.cfm

"DC median is down 17.58% YOY for September. Ouch."

ReplyDeleteThese median numbers are pretty much worthless right now and will remain so for a long time to come.(years possibly)

When a market is experiencing the sort of major disruptions that this one is you can't trust median price statistics unless you are willing to seriously dig into the data and get a good grasp of what is really taking place.

Last month (Aug) Arlington county showed an 18.57% increase in median price over Aug 2006.

This month DC is showing a 17.58% drop in median price.

Neither of these numbers is accurately reflecting what is taking place in the market right now.

A different mix of homes is selling and that is what is skewing the median numbers more than anything.

What is worse is that these numbers are going to take a long time to work out of the system.

Next year this time when we do a year over year comparison of Aug or Sept 2008 to Aug or Sept 2007 we will be comparing to this year's inflated (or deflated) numbers...

mad tiger said:

ReplyDelete"The charts are yr/yr to avoid seasonality issues, unlike comparing January retail sales to December."

As BHs have pointed out, real estate cycles are much longer than the cycles for most other items. Change the subject to seasonality if you like, but the inescapable truth is that the volume of annual real estate sales in the first half of the decade was far higher than the "average" annual volume in most years over the long run. It was easily triple what it was in any single year in the 90s. Dropping by less than half does not bring it back to even where it was prior to the boom ... So, what's the news here? That the boom has ended and we're returning to normal times? We all already know that ... As a matter of fact, we've known that for number of years. Everyone knows a boom cannot last forever.

"t was easily triple what it was in any single year in the 90s. Dropping by less than half does not bring it back to even where it was prior to the boom "

ReplyDeleteActually lance, if you go over to the Greater Northern Virginia Housing Bubble Fallout blog they have numbers up from as far back as 1997 and 1998.

In almost all cases the most recent numbers are below what was being seen in the 1997/1999 time frame.

Wow lance... do you ever do any research before opening your mouth?

ReplyDeleteGood to see Bubblemeter back at it!

ReplyDeleteI have compiled a list of things that would, could, and will not sink the markets:

http://economicdisconnect.blogspot.com/2007/10/what-would-could-and-will-not-sink.html

Lance's quote: on October 10, 2007 2:45 PM

ReplyDelete"So, what's the news here? That the boom has ended and we're returning to normal times? We all already know that ... As a matter of fact, we've known that for number of years."

Who precisely is this "we" you refer to Lance?

Lance's prior quotes:

From October 29, 2006 3:25 PM

"We're seeing a bubble-head induced slowdown ... but it won't last ... as your observation of all the construction in Arlington attests too."

From October 30, 2006 4:21 PM

"Of course SHE is smart enough to know you're not going to see a "crash" in prices ... just an adjustment as has been occuring."

From October 26, 2006 8:03 PM

"The "dip/correction" we're seeing now has happened inifinite times from time immemorial. There's nothing new out there under the sun. It's not different this time. Except for maybe that with the roaring economy we have going, this dip/correction will certainly be a lot briefer than the previous ones."

And the creme de la creme post from Lance....

From October 10, 2006 5:49 PM

There are no fundamental reasons out there for house values to decrease. The economy is continuing to go strong, the population is continuing to swell, and people are continuing to get raises. Could/should house prices stop rising as quickly as they have? Of course! Does it make sense for prices to go down in light of all the fundamental reasons I outlined contiuing to push demand up? No ... Only one thing can possibly be causing prices to decline ... and that is fear. Minus the fear factor, prices would simply just stabilize ... which is what they WILL do once people realize that the gloom and doom armagedon being spread around by bubbleheads is baseless. So, are bubbleheads responsible for stopping the rapid rise in prices? Of course NOT. Are they responsible for introducing fear into the equation? Read your various posts and THEN try to deny that your agenda isn't one relying strictly on fear fabrication and mongering."

An old saying, but a true one nonetheless....

"Be careful of the words you say

Keep them short and sweet

You never know upon which day

The words you will have to eat."

Bon appetit

Not only is lance completely wrong about the bubble, he is a liar on top of that.

ReplyDeleteLets not forget how many times he has made up "facts" out of thin air. The example from this very thread where he claims current sales are above historic levels is a good one but here is a better example:

Lance said (on March 25, 2007 at 10:19 PM)...

"Robert ... open your damn eyes! I looked at a couple open houses today in the District. Prices are up by a high degree. Houses that last year were going for $1.0 to $1.2 million are now just under $2.0 million ... That is a HUGE increase ... in only a 12 month period. And we aren't talking about McMansions ... just your average rowhouses in nice areas. And no, I'm not saying these homes are for everyone ... just that the "leading indicator" properties are going through the roof in price ... imagine what that means for "median" home prices. The Bubblehead theory is dead ... without question. And those that listened to David and waited are now screwed."

That is right folks, "average rowhouses" in the district going from $1 million to $2 million in the last 12 months...

He claims he has VISITED these houses...

Yet he can't produce a single example of one of these "average rowhouses" that he visited...

Lance's basic problem is that he actually believes he is smart enough to BS people but in reality all he gets is laughed at.

-RC

(Rabid Chihuawawa)

Anti, thanks for finding the quotes. Of course, what you fail to realize is that everything I said is happening exactly as I said. And oh, thanks for conveniently ommitting the quotes where I explained that properties out in the far out exburbs or in transitional neighborhoods would drop by some 15%-20% in real value. Like I said, everything is happening as I predicted. Thanks for making the effort to find the quotes that prove this.

ReplyDelete"...real estate cycles are much longer than the cycles for most other items. Change the subject to seasonality if you like..."

ReplyDeleteHuh? Seasonality masks the true real estate cycle. The whole point of stripping out seasonality is to get an unbiased picture of where we are in the cycle. The graphs David posted show very clearly that we are on the downside of this cycle.

mad_tiger

"everything I said is happening exactly as I said."

ReplyDeleteGood to know, now... why don't you post us a couple rowhouses in the district that have gone from 1 million to 2 million in the last 12 months?

Shouldn't be hard right? They are just "average rowhouses."

Remarkable, Lance is proved wrong by his own quotes yet he uses them as vindication to support his beliefs.

ReplyDeleteOne need only re-read the quote from October 10, 2006 5:49 PM

and ask "What really caused the housing market to decline, prices and loans thet got all out of wack, junk loans that were sliced & diced and mixed in with AAA securities and hurt the credit market, or a group of bloggers who were looked upon as the fringe element that brought down the "house" of cards that is the housing market?

Per Lance's own words it was the latter, not the former.

The bubbleheads are the fault of the housing slump.

The bubbleheads caused the mess in the bond market,

spread fear amongst house buyers, shouted down the NAR who ran multi-million dollar ads on TV, radio and newspapers.

Oh yes, it was the bubbleheads who caused it all per the mighty Lance.

Remarkable, simply remarkable.

Lance said...

ReplyDeleteDoes the term "bubble" refer to sales volume or sales price?

That's actually a really good question, since not everyone agrees on the same definition. It usually refers to high asset prices due to high demand. When high prices are due to low supply (think plasma TVs seven years ago), it is not usually considered a bubble. Changing volume is a sign of either changing demand or changing supply.

In addition, "bubble" tends to refer to price increases that are unsustainable, unlike ordinary inflation that builds on itself. For example, stocks normally go up at about the same rate as corporate profits. That does not make a stock market bubble. A stock market bubble occurs when stocks increase in price significantly faster than corporate profits. For real estate, prices should increase at roughly the same rate as rents. When prices increase significantly faster than rents, you probably have a bubble. This holds true even though most homeowners live in their own homes, because they are trading homeownership for renting. They are essentially renting to themselves.

There is also a question of whether the word "bubble" refers only to rising asset prices, or whether is also refers to the decline afterward. I use the term to refer to the aftermath as well, because prices are still overvalued during the decline. That is, bubbles inflate but they also deflate as well.

The American Heritage Dictionary defines bubble as, "A speculative scheme that comes to nothing."

By the way, there seems to be another James on here. The James who posted above is not me. I'm the guy with the housing graphs.

Regarding David's blog post about housing unit sales:

ReplyDeleteThe decline in sales volume suggests that the demand for home purchases is decreasing. The continued rising inventories we've been seeing suggest that the supply of homes for sale is increasing. (In the short term, the supply of ALL homes is essentially fixed.) Since the equilibrium price is determined by supply and demand, when both supply increases and demand decreases, the equilibrium price drops pretty fast.

Now, the equilibrium price is just a theoretical price. The market price is the price homes are actually selling at. Market prices for homes are sticky to the downside, which means they tend to fall slower than the equilibrium price. According to economic theory, the market price moves toward the equilibrium price. The fact that equilibrium prices continue to fall suggests that real estate is going to see continued downward pressure on market prices for the foreseeable future.

Anti Lance,

ReplyDeleteYou have just discovered AMERICA! Lance is whatever he wants to be on the day he wants to be it. He is the ultimate simpleton.

Thanks for your research. It is a good think you do not have to put up with VA INVESTOR. (another real gem on an intellect).

VA Investor finally ran off a few months ago. It really raised the level of discussion here not to have to put up with two morons trying to slap each other on the butt the whole time.

ReplyDeleteJames (10:04):

ReplyDeleteCorrect. Demand is now diminishing in the close-in areas, most likely because lending standards tightened up so rapidly. Prices will take a while to adjust to equilibrium, since, as you recognize, sellers who are not compelled to sell are reluctant to lower prices, regardless of the level of demand. [Those interested in this concept should read the NYT article several weeks ago about loss aversion].

We're already seeing the bloodbath in the outlying DC exurbs. Foreclosures and fire sales have hit sufficient critical mass such that prices of all units are plummeting. Likewise, the degree and timing of price decreases in DC and close-in areas will depend upon the relative number of desperate sellers in those areas who can't hold out and must capitulate to lower demand and sell at reduced prices.

Lower sales without lower prices is not the sign of a healthy market; it's the sign of a stare down between buyers and sellers.

Yeah, and just as soon as demand in DC is similar to demand in the outlying suburbs, then the market's behavior should be similar. Uhh ...

ReplyDeleteWhat a great thread. Lance, I agree with you. Where are the price drops?? Yeah, everyone, sales are down - but WHERE ARE THE PRICE DROPS?

ReplyDeletePrice Drops????

ReplyDeleteCheck out these recent sales. Especially the most recent:

Addr, 2007 Assess, Sold, Amount

2500 SANFORD, $534K, Jun, $569K

2712 SYCAMORE, $523K, Jun, $705K

3104 HOLLY, $802K, Aug, $880K

2819 RUSSELL, $1,008K, Oct, $1,393K

It seems that we are going to see more price drops this year. Inventory seems to be going up daily.

ReplyDelete