Montgomery County, Maryland:

Prince Georges County, Maryland:

Prince Georges County, Maryland: Anne Arundel County, Maryland:

Anne Arundel County, Maryland: Howard County, Maryland:

Howard County, Maryland: Frederick County, Maryland:

Frederick County, Maryland: Charles County, Maryland:

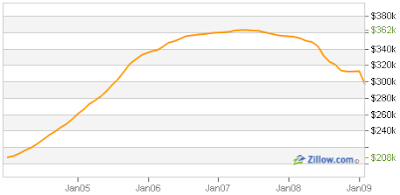

Charles County, Maryland: Note that most of these counties were stagnant for two or three years before beginning to decline in 2008.

Note that most of these counties were stagnant for two or three years before beginning to decline in 2008.Source: Zillow.

Update: By request, Calvert County, Maryland:

So these areas are back to 2005 prices so far. However the prices at 2005 were already twice the prices of 2001 prices.

ReplyDeleteNo way a run down 700 square foot home built in 1945 in a trashy part of Rockville is worth $350K.

These charts show a promising start though!

spin spin spin?

"Note that most of these counties were stagnant for two or three years before beginning to decline in 2008."

ReplyDeleteYeah - it looks like The catastrophe in all of NOVA is finally pulling down MD.

No one said the prices are going to stop declining..look at that slope.

ReplyDeleteIs anyone delusional enough to think we're going to see a singular rebound point?

I know of one person who probably does.

"Is anyone delusional enough to think we're going to see a singular rebound point?

ReplyDeleteI know of one person who probably does."

Nah - nowhere in MD is in the immunozone...

Yeah don't confuse MD with U street.

ReplyDeletespin spin spin?

Buh buy inventory...

ReplyDeletehttp://www.recharts.com/nova/nova.html

Nice to know you...

That look good =)

ReplyDeleteCan you do a chart for Calvert County?

ReplyDelete"Buh buy inventory..."

ReplyDeleteHAHAHA until the banks start dumping the BILLIONS of REO that have.

p.s. Do you have charts like that for MD? I mean the graphs for this thread arent really talking about NoVa anyway.

spin spin spin?

"HAHAHA until the banks start dumping the BILLIONS of REO that have.

ReplyDeletep.s. Do you have charts like that for MD? I mean the graphs for this thread arent really talking about NoVa anyway."

Unfortunately no - but per MRIS they are near their all time peaks in MD (another reason they have more pain to go thru).

Also, NVAR put out a year end report that appears to show the Phantom REO Inventory by area

http://www.nvar.com/MarketStatistics/tabid/224/Default.aspx

Resolution on the graph sucks but it looks like:

PWC - 6300 units

Fairfax - 5200 units

Loudoun - 1900 units

Arl & Alex - 500 units combined

Hidden inventory looks to be 3X stated in PWC - close to the amount stated in Lou & Fairfax, and far below stated in Arl & Alex. Once again, it looks like immunozones will be best.

I know in Maryland I'm seeing a lot of homes taken off the market, but not selling. I think the sellers are thinking that they'll bring them back online later. If this is true and is a general trend, comparing past years inventory to this years inventory won't work so well. We'll see what lower mortgage rates, likely a $15,000 credit to buyers and banks moving their REOs does to inventory in a couple months. This all comes down to affordability and so many people seem to lose sight of this fact. Homes are too expensive as compared to salary. People losing their jobs doesn't help.

ReplyDelete"Zmonet said...

ReplyDeleteI know in Maryland I'm seeing a lot of homes taken off the market, but not selling. I think the sellers are thinking that they'll bring them back online later. If this is true and is a general trend, comparing past years inventory to this years inventory won't work so well. "

Actually thats exactly what we saw here in va in 07 & 08 so expect to see the same thing in MD this year.

Incidentally, what you describe "refusing to list & holding out" seems to be a sign of a correction. Every time in the past, more and more people hold out for better days - the only ones who list are those that really need to.

It is possible the shadow inventory could come out in force and swamp the markets. Yet in PWC the market that has the most hidden inventory of all, the stated inventory is falling like a stone. My guess is, the banks will continue to do what theve been doing for the last 9 months - continue to dole out the REO inventory sparingly, making sure they dont flood the market - hoping to gain some firming in prices.

Bottom line - look for the same thing in your inventory growth there. In every past correction, inventory peaked and never returned to that peak. I dont expect it to be "different this time"...

I don't think the issue is whether inventory peaked. I could really care less about inventory peaking. What I care about is housing prices and those, regardless of inventory (within reason), will continue to come down. Book it.

ReplyDelete"I don't think the issue is whether inventory peaked. I could really care less about inventory peaking."

ReplyDeleteYou shoudnt worry. Our inventory (VA side) has been down for years, yet prices are down with no end in sight. Still, inventory is down and highly unlikely to return.

"You shoudnt worry. Our inventory (VA side) has been down for years, yet prices are down with no end in sight."

ReplyDeleteWell this is due to the endless stream of REO that isnt listed in the inventory numbers. They will keep coming in for years to come unless they are unloaded all at once.