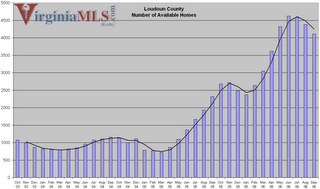

Housing Inventory For Loudoun County (part of Northern Virginia)

In Northern Virginia (Alexandria City, Arlington County, Fairfax City, Fairfax County, Falls Church City, Loudoun County, Manassas City, Manassas Park City, Prince William County) the active inventory has declined slightly during the past few months. On September 25th the inventory stood at 20,064 which is a 6% decline from July 1st, 2006, when active inventory was at 21,336. Source: VirginiaMLS.com

I saw a report that hinted at this last week. I linked to it in an earlier comment.

ReplyDeletethe report was done by an area realtor and, predictably, their advice was 'better buy while it is still a buyer's market!'

However, if you drilled-down a little deeper, it appeared to me that new listings were still outpacing sales over this period. It seems to me that the decrease in inventories can only then be explained by expired & unrenewed listings. (e.g. optimistic sellers who would rather keep their house than lower prices, thinking prices will turn around soon, etc.)

So it would be interesting to see on the same graph (and I'd be willing to do it if I had the data): sales, new inventory, existing inventory, and expired inventory

sc in dc

What's the current sales rate? Months of inventory matter more than total quantity.

ReplyDeleteAt this time of year, one expects the inventory to be about half the summer inventory (or less)... not at 200%+ of summer inventory...

I think a few hundred homes were pulled off the market for winter. Homes that will relist come spring.

Neil

I think this is to be expected. Folks are pulling inventory in order to relist next spring. I think the inventory will decrease slightly until next spring when inventory is going to explode due to people relisting plus fresh inventory from resetting ARMs. If it doesn't then I will believe we've hit bottom. The wild care is the ARMs - were folks able to refiance to fixed rates? We shall see. What do folks on this blog think - and more importantly what data are you basing your opinions?

ReplyDeleteNOVA Fence Sitter

I expect a dead-cat bounce early next year, so a decline in inventory toward the end of the year seems on target. The less-informed/less patient will buy in at this point. People will wipe their brows (whew!) and think that housing dodged a bullet.

ReplyDeleteThen the true declines will happen.

I also think the inventory decline is the "want-to-sells" letting listings expire (versus the "have-to-sells"). Next spring/summer will be nutty as the have-to-moves, the ARM resets, the retiring want-to-turned-have-tos all getting more adamant about selling.

Actually, the inventory has increased in each of the last three weeks. Still too soon to say whether this is a reversal or just an aberration. It's also possible that the buyers did all of their buying this summer and now the inventory is heading back up again.

ReplyDeleteFrom personal experience I agree with other posters that some pulled their listings from the market. This condon building I was interested I saw several units' listings were gone from the MLS a month ago only to resurface this past week.

ReplyDeleteIt’s anecdotal, but just the other day a Realtor active in Fairfax and Arlington mentioned to me that people were pulling their listings now in anticipation of a stronger spring market. Add to that the new construction that doesn’t show up in the MLS, and we have the makings for an “interesting” housing market next year.

ReplyDeletei've been tracking inventory in specific price ranges for houses and condos. the only inventory that's going down is condo inventory. the thing i'm noticing is that more and more stuff is showing up in the sub-$750,000 range. i'd say the total inventory stat is meaningless when the inventory in the "sweet spot" for buyers is expanding.

ReplyDeleteI have a question for the group:

ReplyDeleteIt is becoming increasingly clear that the Fed is most likely finished easing on rates for at least the next two quarters.

Let's pretend this is true and the Fed holds, won't this make the process less painful for those looking to reset their ARMs?

I checked earlier in the week and 30 years are at 5.8% (in the grand scheme of things this is still very low)

I'm not the most informed of real estate types, but it is clear that while prices have dropped the past two quarters, rates seem to be staying constant. So there might be some hope for even those that purchased with a crazy loan at an inflated price over the past 24 months assuming they can refinance at a decent rate.

As a disclaimer, I am not one of those people, but I am looking to make a purchase now.

interested party said:

ReplyDelete" So there might be some hope for even those that purchased with a crazy loan at an inflated price over the past 24 months assuming they can refinance at a decent rate."

Good observation! That is precisely what happened in the mid 80s when people bought with high owner-carries (balloon loans) or with even higher conventional bank loans. This time though interest rates have been low ... It's prices that are high .. So, it could play itself out otherwise ... But make no mistake that it will play itself out ... This is just the normal down side of the real estate business cycle. There'll be no armagedon!

Don't buy now - wait. Prices are reduced on about one third of the listings. They have much further to go.

ReplyDelete