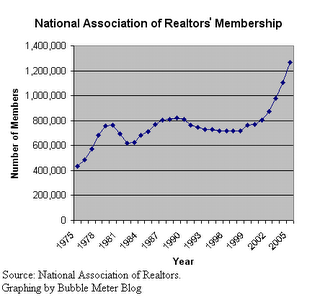

Members of the National Association of Realtors (NAR) are called Realtors. As of 8/31/2006 there were 1,354,468 Realtors. The above graph only shows full years, thus 2006 is not graphed. [I posted this post earlier this year]

The number of Realtors has grown tremendously over the past 5 year. This corresponds precisely with the housing bubble years. Is there a Realtor bubble?

Perhaps this might be why:

ReplyDeleteHarder to become a hair stylist

grim

Grim said:

ReplyDelete"Harder to become a hair stylist".

It looks like someone forgot that real estate agents are sales people ... pure and simple. If you're going to them expecting financial advice, you have far greater problems than even a financial advisor can solve.

Unfortunately someone has to be left holding the bag.

ReplyDeleteI just hope that we don't crash and flood the market with labor quickly since we don't have large amounts of decent jobs. I am also curious as to the loss of buying power that graph represents if it falls to a normal level.

Even so it is all very depressing and if things do become a serious mess I hope we can pull together instead of fight each other for survival. Between the fed and the rich globalizing labor we could be in for a rough ride politically and economically.

There was a recent article in Business Week about the bubble of health care workers in the United States.

ReplyDeleteThe difference between real estate and the health care industry is that one is running on fumes while the other is raping the American public out of their savings accounts.

Oh hell...what's the difference.

In order to gauge the severity of the looming recession*, it would be useful to know how many of those realtors are full-time, and how many are doing it for some supplemental income. Does anyone have any idea of the proportions?

ReplyDelete* Housing bubbles aside, I think we really need to start worrying about -- and getting vocal about -- administration intentions toward Iran. It is looking more and more likely that they're planning a reckless adventure that will make our Iraqi debacle look wise. I know all the arguments for why they won't launch military operations against Tehran -- insufficient troops, severe economic consequences, and so forth. But I see little evidence that this government pays much attention to external reality.

-- sglover

I believe 6:42 AM misunderstood Grim's point: i.e., that there are essentially no barriers to entry to becoming a RE salesman -- hence, the dramatic effect on "employment" numbers.

ReplyDeletelance opined: "It looks like someone forgot that real estate agents are sales people ... pure and simple. If you're going to them expecting financial advice, you have far greater problems than even a financial advisor can solve. "

ReplyDeleteHaving been to many an open-house around DC in the last nine months, I can't tell you how many Realtors(R) have eagerly told me about how an ARM or interest only loan can solve my problems of not being able to afford a house. If they're not financial advisors then they shouldn't be pushing financial advice!

Here is a quote from the Wall Street Journal last year:

ReplyDelete"To be sure, evidence abounds of a manic, overheated market in many places. A recent letter to the Wall Street Journal proudly proclaimed that '1.2 million Americans are Realtors,' which according to Labor Department data means they now outnumber doctors , police officers, bartenders, and even lawyers."

'Nuff said.

Well it looks like there may be some chart 'support' between 600,000 and 800,000..

ReplyDeleteThe bubble is about to pop on using the word "bubble". Oil, housing, bubble articles, internet stocks, gold, all commodities. But, we have always had an oversupply of realtors. (I'm a realtor)

ReplyDelete==========================

I am not looking for the housing market to suddenly turn back up on a dime. Too much inventory to work through. Some of that inventory will drop off as sellers cancel their listings (or they expire) as they were unable to sell at prices that are no longer available. These are the ones who didn't have to sell, didn't have to move, didn't have a bad mortgage to refinance, but were willing to sell at inflated prices and didn't pull it off.

Looks like previous dips in realtors coincide with dips in housing. Hmmmmm!

ReplyDeleteI walked into the bathroom at law school and there was a picture of two easy-on-the-eyes females promoting their staunch real estate broker practice.

ReplyDeleteHum...if you need to put an ad in the law school john, there might be a realtor bubble.

This chart depicts the magnitude of the bursting bubble we are up against.

ReplyDeleteIt is getting worse and worse. Toxic shock.