What is a Housing Bubble Market? A bubble market is any housing market where there will be a real dollar price decline of at least 20% from peak price over the course of three years. This is for a typical property. In most of these bubble markets, real dollar price declines will continue for much more then 3 years. Most of these bubble markets saw prices double or more over the course of five short years.

Where are the Housing bubble Markets? The bubble markets are located mainly in the following states; MA, CT, RI, MA, NY, NJ, PA, MD, DC, NJ, VA, FL, NV, AZ, NM, CA, OR, HI, WA, CO. Here are some metro areas that are bubblicious.

- Boston, MA

- Hartford, CT

- Providence, RI

- New York City, NY

- Baltimore, MD

- Philadelphia, PA

- Washington, DC

- Virginia Beach - Norfolk, VA

- Miami, FL

- Cape Coral - Fort Myers, FL

- Naples, FL

- Orlando, FL

- Tampa Bay - St Petersburg, FL

- Sarasota-Bradenton-Venice, FL

- Daytona Beach, FL

- Jacksonville, FL

- Tallahasee, FL

- Boston, FL

- Seattle, WA

- Tacoma, WA

- Bend, OR

- Boise, ID

- Merced, CA

- Bakersfield, CA

- Redding, CA

- Fresno, CA

- Modetso, CA

- San Francisco, CA

- San Deigo. CA

- Sacramento, CA

- Los Angeles , CA

- Stockton, CA

- Flagstaff

- Phoenix, AZ

- Las Vegas, NV

- Carson City, NV

- Reno, NV

- Honolulu, HI

Exploding Inventory

Nationally, the inventory of existing homes for sale has increased by 39.1% year over year from 2,678,000 in June 2005 to 3,725,000 in June 2006 according to data published by the National association of Realtors. In the bubble markets, inventory has increased at an even faster pace then the national picture.

In San Diego County, housing inventory started off at 13,916 on January 1st 2006 and has risen by a full 67% and was 23,259

In Los Angelos County, housing inventory started off at 24,463 on January 2nd 2006 and has risen by a full 82% and was

In Sacramento Metro area, housing inventory started off at 9,513 on January 2nd 2006 and has risen by a full 80% and was

In the Phoenix metro area, inventory spiked from 10,748 on 7/20/05 to

In Northern Virginia, a part of the Washington DC metro area, the number of active listings was 4061 in June 2005, which increased by 197% to 12,096 in June 2006 (MRIS).

In the Orlando area, inventory had exploded from 13,533 on January 7th, 2006 to 25,665 on August 21st, 2006 (HousingTracker).

In most bubble markets inventory has more then doubled since last summer. In some metro areas like Phoenix inventory has more the quadrupled since last summer. The inventory is obviously the supply side of the equation.

Plunging Sales

Last year, in the bubble markets housing units were often selling in less then a week with sellers choosing from multiple offers. Now, the average number days on markets has increased dramatically in nearly all bubble markets compared to last summer.

Nationally, new home sales are down 21.6% compared to July 2005 (US Department of Commerce). Existing home sales are down 11.2% (National Association of Realtors).

In July 2005, in the Baltimore metro area the average days on market for housing units that sold was 35. This July, the number had increased to 55 representing an increase of 57% in the days on market. In Baltimore City the number of housing units sold in July 2006 fell 24% compared to July 2005 (MRIS).

"Existing home sales in July continued their year-long downward trend, plunging 44 percent in Palm Beach County and 39 percent in the Treasure Coast, year over year, the Florida Association of Realtors said Wednesday. Statewide, home sales fell 33 percent to 14,451 closings from 21,691 in July 2005, the association said"" (Palm Beach Post 8/23/06)

According to The Warren Group, in Massachusetts, sales of single family residences tumbled 26.9 compared to July 2005. Condo sales are down a similar 23.5% as compared to July 2005.

In Washington DC, the number of housing units sold in July 2006 fell 21% compared to July 2005 (MRIS).

Graph showing the number of home sales plunging in 2006 in Northern NJ.

Courtesy of Northern New Jersey Real Estate Bubble

In Sacramento, CA "Declining demand and buyer hesitancy pushed existing-home sales down 45 percent in Sacramento, Placer and El Dorado counties in July, compared to the same month last year (Sacramento Business Journal)".

The demand from flippers and specuvestors is drying up as the the word gets out that prices don't always go up in the bubble markets. The National Association of Realtors reported "The annual report, based on two surveys, shows that 27.7 percent of all homes purchased in 2005 were for investment and another 12.2 percent were vacation homes" As prices decline in the bubble markets there will be even less demand from the short term investors (flippers) who have been such a large part of the price runup. Plunging sales indicates a strong decrease in demand.

Stagnating & Falling Prices

During the boom years 2001 - 2005, prices for many housing units increased by double digit annual rates. In Washington, DC the median sales price for all housing units increased by 17.45% from July 2004 to July 2005. Then from July 2005 to July 2006 the median sales price has actually fallen by 3.45%.

For July 2006, in most bubble markets, median sales prices increase are less then 8% and in a significant number of bubble markets median sales prices have declined from last year.

In Massachusetts, the median sales price for condos is down 4.2% as compared to July 2005. The median single family residence is down 6.1% compared to July 2005 (Warren Group).

Now in many bubble markets prices are falling as inventory swells and demand declines.

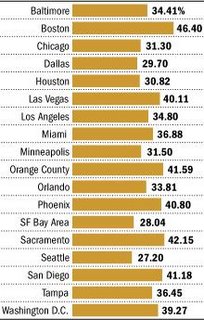

WSJ Chart showing the percentage of reduced price listing on local MLS.

The plummeting demand coupled with the swelling inventory has placed downward pressure on prices. Prices will continue to fall in the bubble markets.

Conclusion

The housing market in the bubble markets will continue to decline of the coming years. As the 2006 buying season comes to a close, inventory continues to pile up in many bubble markets. Sales are down significantly in the bubble markets compared to last year. Additionally, an economic recession in the US is coming within the next 9 months. Real dollar prices declines in the bubble markets are very likely to vary between 20% - 65 in real dollars (inflation adjusted) from peak to bottom (it may take up to 8 years). Most of the real dollar price decline will occur in the first 3 years of the housing bust. Indeed the huge price appreciation that occurred in the bubble markets over the past 5 years or so was a speculative episode. As John Kenneth Galbraith wrote "And thus the rule, supported by the experience of centuries: the speculative episode always ends not with a whimper but with a bang.

RMJ-

ReplyDeleteI want to ask a serious question. Are you encouraging any buyers you may have to bargain hard and make very low offers as starting points? What you say is correct--no more muliple offer bidding wars, etc. because there is double, sometime triple the available inventory now. With supply now so gluttenous when it once was tight, is it your opinion that prices must fall to allow all this excess inventory to be absorbed? If sales are not happening at current price levels, are you stressing to your sellers that a lower price is whats key to moving most middle-of-the-road homes?

Thanks!

BTW-David, excellent piece!

"However, a 20% real dolar decline over 3 years after 100%++ run up in the preceding 3 years is the defintion of a "whimper"."

ReplyDeleteThe vast majority of bubble markets will have larger real dollar price declines over the course of 3 years. Plus real dollar prices are likely to continue falling for 8 years.

Richard M. Johnston, Realtor said...

ReplyDelete"Nobody can predict the future of the housing market."

Were you telling that to your fellow Realtors when they were saying RE only goes up? or to David Lereah who said the boom will continue to the end of the decade? Or crtitizing the 'buy now or forever be priced out' nonsense?

Please do tell.

i_will_not_cooperate said:

ReplyDelete"If you can find a decent home, for a price that you can afford then by all means buy. In this current market, it's just not going to happen, especially for the first time home buyers."

You're not giving yourself enough credit. Of course you can. It may not be your ideal place, but it rarely is for a first time buyer. However, it will be the place that 5 - 10 years from now will provide you the equity to get a lot closer to that ideal home by "moving up." Also, don't shy away from creative financing techniques. They exist to help someone specifically in your circumstances. Houses back in the early 80s were substantially LESS affordable because of interest rates approaching 20%. (Look at page 27 of Shiller's report to see how only 80% of people earing a median income could afford a median-priced house back then vs. something approaching 120% of people today.) People used financing means such as seller-financing with baloon payments due in 10 years. Just like today, people could have said "and what will I do in 10 years when the note is due?!" ... Well, things sorted themselves out then ... Just like they will now. The trick is to get into something you can afford today by buying something less valuable today (e.g., in a transistional neighborhood) and using whatever financing will get you in there. As the years go back and your salary doubles triples quadruples --- and your starter home builds equity --- you'll be able to go out and move up closer toward your dream home. Just note that there'll always be something nicer out there, but you need to start somewhere. And there really never is a bad time to buy, just people who don't know how to buy ... and find it easier to blame everything around them than to look inside themselves and realize the problem ... and the solution ... starts at home.

"Life does not wait for home prices to fall further or rates to rise."

ReplyDeleteOn the other hand, life definitely will wait for those who are upside-down on their mortgage. Better have a nice down payment handy.

i_will_not_cooperate said:

ReplyDelete"Tell that to all the people that have lost their entire life savings to exotic loans,...please!"

The only people who will have lost their entire life savings to exotic loans are the same people who would have lost their entire life savings to conventional loans. It's always a lot easier to blame "the system" than to blame oneself. People who are going on exotic trips and buying $50,000 cars AND have an ARM will be in trouble. But they would have been in trouble even if they didn't have the ARM. Are you following?

Lance said...

ReplyDelete“Also, don't shy away from creative financing techniques. They exist to help someone”

Yes! Snap up those exotic loans! And if you can’t keep up with payments, no worries, the state will help you out!

http://www.dhcd.state.md.us/Website/programs/cdammp/Lifeline.html

originaldcer said:

ReplyDelete"Apparently, people living on Danbury Street, people living in Deanwood, people living on Alabama Avenue...they all have decided that they should price their homes the same way people in other areas are."

OriginalDCer, you've overlooked that which you yourself have pointed out. That they have decided to price their homes the same as homes in nicer neighborhoods. Now, who do you think really sets the prices on homes? Certainly not they, the sellers, alone. Go in there and offer them what the home is really worth which you can easily ascertain by checking tax records and seeing what similar houses in the same neighborhood are selling for. This gets back to the discussion with Neil last week ... where I mentioned that the 10% - 15% in price reduction he was referring to meant nothing in terms of what places were selling for ... Since those price reductions were on asking prices ... i.e., they were on prices that had never been getting obtained anyways. Also, note that when you find in the tax records that homes in those neighborhoods have been selling for a lot less than the asking prices, don't walk away without the realization that others have been seeing the same homes you thought were too expensive and realizing that they weren't "too expensive", just "overpriced" .... and making their offers on these homes accordingly.

va_investor,

ReplyDelete"Those "exotic" loans have been around since at least the early 80's. Even had neg. am. loans back then. Real Estate did not collapse."

In some areas RE did have significant price declines. Secondly, the percentage of exotic loans was MUCH lower.

fogcutter said:

ReplyDelete"No, IO loans are like options and other derivatives. Fine in the hands of pros but as we will see, deadly when miused."

you are 100% right ... i.e., I agree with you ... but what I believe is that the folks who misuse these instruments are the same folks who would find a way to mess up whatever was out there ... in another universe without these tools allowing them to make purchases they otherwise couldn't afford, they would still manage to get themselves in the same position by overreaching in another way ... perhaps they'd overcharge the credit cards, perhaps they'd sell that land in Florida that mom and dad left them for pennies on the dollar of what it is really worth, perhaps they'd just overcommit in a number of other ways. i.e., you'd still have these folks out there getting themselves in trouble ... but that is not your problem ... your problem is figuring out how YOU are going to buy ... and if you can RESPONSIBLY make use of these instruments, then go for it ...

data miner, you are so so right ... And it is so so scary ... With attitudes like this, it's no wonder you have people out there who think they should only buy if there are 100% guarantees that they'll always be able to make their mortgage payments. And that, is the beginning of the end ... for these people.

ReplyDeleteJust wanted to draw you attention to a recent survey conduced by Bankrate.com where it ranked the 50 states based on mortgage closing costs. Here is a link to the article and the table.

ReplyDeletehttp://www.bankrate.com/brm/news/mortgages/ccrank2006a1.asp

http://www.bankrate.com/brm/news/mortgages/ccmain2006a1.asp?caret=2

I was shocked to see that DC ranked 46, with one of the lowest average closing costs in the country. Last year's survey had D.C. ranked at 17. I specualte that this dramatic drop has a lot to do with the fact that margins are getting much tighter for the mortgage industry as the housing market begins its downward cyvle.

whitetower said:

ReplyDelete"Right! Which is why there is a price bubble: the number of buyers was artificially inflated because the Federal Reserve dropped interest rates too low."

I think you are giving the Federal Reserve too much credit for low interest rates. Mortgage rates are even lower in Europe (3% is the current mortgage rate.) Do you really think our federal reserve is responsible for that too? No, we have a very fundamental change occuring in regards to how business around the world is occuring. The low costs of telecommunications and freedom of trade have created a situation where previously way-too-underutilized millions of people ... such as those in China and India ... can now participate in what has become a global economy ... And the magnitude of wealth being created out of previously idle hands has created a pletora of stored wealth for the wealthy that can be lent out at lower and lower interest rates. The doomesday scenario the bubbleheads like to forecast isn't anywhere in the cards ... Just the opposite.

Please STOP! you are like a 2 year old! how can we have rational discussions here when there is a 2 yr old around making mahem!

ReplyDeletecreativemind said...

ReplyDelete“VA, this site does allow for a full discussion of economic factors that could cause the "domino" effect of cascading defaults. however, i seriously question your statement that most people have six month of cash reserves. the savings rate in this country is negative!”

Hear, hear!

Add to that the need for government help for those with exotic loans, the increased inventory, and trillions off dollars of ARMs resetting. Every data point is pointing to a housing bust.

In the spirit of full discussion, please housingheads, post data indicating that RE will sustain current prices and/or will continue to climb in the near term.

This blog is now under comment moderation.

ReplyDeleteOn the subject of exotic loans in general, and the comment that I/Os and neg ams existed in the 80s in particular, some history may be helpful.

ReplyDeleteI/Os did exist in the 80s but were a nonfactor in the residential purchase money and refi market. They were made available to wealthy individuals by the private banking departments of banks and brokers. In fact, the first one I ever saw was circa 1999 from Merrill Lynch's mortgage subsidiary. You know the rest. Interesting to note that the last time I/Os were a measurable part of the mortgage landscape was in the 1920s. Some track record.

Yes, neg ams were around in the 80s. Dime Savings Bank was a pioneer in marketing them, and wrote a ton in the northeast. When the market tanked in 1989, a large percentage ended in foreclosure & Dime ended up being sued/investigated out of existence. In fact, it was the perception of the time that neg ams constituted predatory lending, and they pretty much disappeared until the current run-up, when they wre combined with variable I/Os into the "option ARM" or, as BW puts it, the toxic mortgage.

You can disagree as to how the current market will unwind (or not); there is no question the amount of option ARMs are a problem. I will leave you with a link to an article by K. Harney, one of the biggest shills for the RE industry on the subject.

http://realtytimes.com/rtcpages/20060227_equity.htm

or: http://tinyurl.com/ljryn

va_investor said...

ReplyDelete“I think we have had this discussion here before, but the "savings" figures do not include growth in home equity”

And why would it? One would have to sell to see that “savings”. No buyer, no savings.

lex said:

ReplyDelete"I/Os did exist in the 80s but were a nonfactor in the residential purchase money and refi market. They were made available to wealthy individuals by the private banking departments of banks and brokers. In fact, the first one I ever saw was circa 1999 from Merrill Lynch's mortgage subsidiary. You know the rest. Interesting to note that the last time I/Os were a measurable part of the mortgage landscape was in the 1920s. Some track record."

Interest only loans were extremely common in the 80s. However, it wasn't the banks but rather the sellers making them. Because interest rates had sky-rocketed, sellers would induce buyers by providing interest-only 10 year balloon loans for a good part of that being financed. At the time, existing (bank) loans were usually assumable (unlike now where they are called in when the house is sold), so buyers would assume a low interest existing loan and the sellers would finance the remainder ... minus the downpayment. This allowed buyers to weather the high-interest "storm". Yes, like the ARMs of today, there was risk involved. What would have happened if interest rates had not dropped within 10 yrs? Well, hopefully the sellers (i.e., I/O loan holders) would have been smart enough to refinance so that they wouldn't have to foreclose. Of course, that never became a consideration as interest rates went down.

robert said...

ReplyDelete"va_investor said...

“I think we have had this discussion here before, but the "savings" figures do not include growth in home equity”

And why would it? One would have to sell to see that “savings”. No buyer, no savings."

Robert, a renter having invested his/her savings in equities or a bank certificate would also have to sell to see that savings. So, what was your point?

Lance said...

ReplyDelete“Robert, a renter having invested his/her savings in equities or a bank certificate would also have to sell to see that savings. So, what was your point?”

Sure Lance, cashing in CD’s or cashing out a savings account is just like trying to selling a house.

Va_investor said:

ReplyDeleteThose "exotic" loans have been around since at least the early 80's. Even had neg. am. loans back then.

Va... you know as well as I do that these loans have never been used to the degree they are today.

In this bubble market, homes are investments.

In the past, I would know about 1 in 200 being in financial trouble with their house. Today? Its more like 1 in 10.

This hasn't even begun to start. If not, why were so many new homes listed yesterday and today in my area? The selling season is over! Inventory should be declining rapidly... and yet its at record levels. Its funny, on some streets they are now hanging multiple signs from the same post due to the huge quantity of homes for sale.

A friend/coworker of mine went house hunting last weekend (his wife really wants to buy, she's a realtor). After the 10th homeowner or realtor *ran* out of the garage offering to cut the asking price by 20%... even she is too scared to buy. Yes, they had over 10 sellers offer to cut their asking price by 20% in one day of touring open houses!

The home sales rate needs to drop another 20% to be down at its historical norm and yet people are panicing at today's relatively high transaction rate. (This is Oceanside, California.)

The fortune 500 company I work for has gone from quietly relocating employees to lower cost areas to a mad scramble to move people. We aren't the only ones doing this... Between us and our competitors we're pulling a few hundred jobs from DC in the next few months. Why? The employees want *out* from overpriced real estate they are not comfortable paying for. They wish to live where homes are 28% to 36% of their gross, no more. So we're moving people (its cheaper than replacing them). No layoffs... no news...

Think about that... The 1st rule of economics is "follow the money." The money isn't into bubble markets right now...

Neil