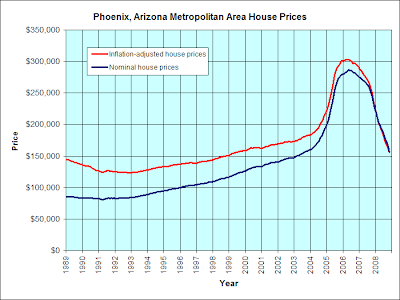

According to the S&P/Case-Shiller Home Price Indices, Las Vegas and Phoenix home prices are all the way back down to pre-bubble levels:

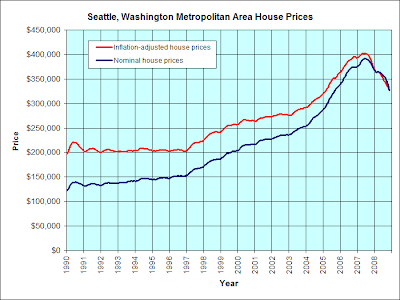

Meanwhile, New York and Seattle home prices still have a very long way to fall:

As for the Washington, D.C. area, it is falling at a slightly slower rate than the national average, and is only down about half way.

Welllll, I'm not so sure. Seattle and NY haven't seen nearly the amount of housing built as Phoenix and LV. As the laws of supply and demand reassert themselves all that excess supply could drive prices in Phoenix and LV well below pre-bubble prices. It's perfectly possible that they are all 30%-50% through the correction, just that some are going to fall much further than others. Even if we're looking further back than they did, we don't want to make the same mistake that the bubbleheads did of only looking in the rearview mirror.--Jim A.

ReplyDeleteI would also like to add that frequently at the end of a bubble like this, there is a bit of an overcorrection. Once prices really bottom and settle down, then prices drift back up to the mean.

ReplyDeleteThe last datapoint in the DC data is Nov 2008. Just watching my Redfin RSS feeds I can say almost certainly there's been more decline than what the graph is showing (because it's outdated).

ReplyDeleteCase-Shiller indices. Pleh.

ReplyDeleteEveryone knows that they act as a sword when a scalpel is what is needed to profit from all this.

Looking at DC, I would say the outer burbs are nearing a bottom, but many close in desirable areas have barely budged.

ReplyDeleteCome on Baltimore, go down! There are buyers waiting for when price sanity returns. High prices are the exact reason people stopped buying, not the lack of easy credit the NAR, homebuilders, and resellers are screaming about. I can't believe how expensive things are here, and I'm seeing a lot of houses just go off the market after a while as sellers try to put off the pain.

ReplyDeleteso back in the 90s, vegas inflation adjusted homes were about 170,000,...and with the typical 20% down and 8% mortgage rate back then, a buyers mortgage payment was about $1000/mo.

ReplyDeletetodays price looks about 185,000. and with 20% down 5% rate today, your monthly payment would be about $800/mo

looks cheaper to me. but then again maybe lower rates dont matter and we should call the fed and tell them their $1.2 trillion agency MBS buying program is a waste of time.

Anon:

ReplyDeleteIn the 90's, card dealers made $35/hr.

Today?

Glad you asked:

$32/hr.

Glad to see your inflated dollars at work!

We're going to see housing prices overshoot downward.

ReplyDeleteThere is no way in hell a curve like that is simply going to stop and make a U-turn in a month or two.

My personal opinion is that the bottom will be lower than the pre-bubble values. But that's just an opinion - does anyone have some evidence that supports or contradicts this?

ReplyDeleteJust eyeballing the charts it looks like we are back to the long term trend line in many of these markets.

ReplyDeleteYou meant to say that housing in the Tri-State area as a whole has a long way to fall, not NYC, right?

ReplyDeleteNYC has been expensive for as long as I remember. You might be able to get a condo in Harlem for $750,000 now that the market's down.

"looks cheaper to me. but then again maybe lower rates dont matter and we should call the fed and tell them their $1.2 trillion agency MBS buying program is a waste of time."

ReplyDeleteThey DONT matter. Cause when the rates go back up, what happens to your home value?

Answer? It goes down the toilet. So when you are ready to upgrade 7 years down the road, like the average buy is expected to do, you cant.

I really dont plan on living in a run down $300K home in cracktown for 40 years. So yeah, the rate doesnt really matter to me.

Derek said...

ReplyDelete"The last datapoint in the DC data is Nov 2008. Just watching my Redfin RSS feeds I can say almost certainly there's been more decline than what the graph is showing (because it's outdated)."

The graph is fully up-to-date as far as S&P/Case-Shiller published data is concerned. All data has a lag between when it is collected and when it is published.

The most recent release of the S&P/Case-Shiller index is for "December". However, all Case-Shiller monthly releases are really 3-month trailing averages. So, the "December" data really covers the 3rd quarter (October, November, and December). In order to get the Case-Shiller data to properly sync up with the CPI and Realtor home price numbers, which are not trailing averages, I recently decided to shift the Case-Shiller index back a month. I did this because a 3-month trailing average is more likely to properly represent the value of housing during the middle month of the 3-month period, than the final month of that period. Furthermore, the lines on the graph for the Oct-Nov-Dec trailing average end at the exact same point that they would if I was drawing a graph of quarterly numbers.

Allen said...

ReplyDelete"You meant to say that housing in the Tri-State area as a whole has a long way to fall, not NYC, right?"

New York City metro area. All these graphs are metro area graphs. It says that right on the graphs.

I'm not willing to say "tri-state" area because I don't know how that will be interpreted. Albany and Buffalo are part of New York State, but they are not covered by the graph.

ANON 6:05

ReplyDeleteyou are correct in the simple mortgage math and if rates were to go higher instantly.

but the fed is controlling mortgage rates in the secondary market now, and they will have to do this for quite a while.

you think they are going to just BAM!, let rates jump back up after they spend considerable effort to stabilize housing prices and the economy only to let home prices plummet again and potentially send the economy back into a tailspin? i doubt it very much

the fed will be controlling affordability, via mortgage rates, of homes for a while. what i mean by that is, as inflation and the economy grow in the coming years, they will be able to adjust mortgage rates higher towards true market levels such that affordability of homes stays in an acceptable range. so for example, if inflation increases over the next seven years, they will be able to slowly raise rates such that the effective mortgage payment (affordability) is still acceptable. 7 years from now a lot can happen, hyper inflation is one such possible scenario many folks are concerned about with all this money we are printing.

Allen said...

ReplyDeleteNYC has been expensive for as long as I remember.

NYC will certainly fall. However it still will be expensive when this is over -- much to the chagrin of many bubble sitters wondering why they cant afford a sweet pad on the upper west side.

"7 years from now a lot can happen, hyper inflation is one such possible scenario many folks are concerned about with all this money we are printing."

ReplyDeleteYeah but one thing is for CERTAIN. Prices will continue to decline. So other factors such as rates going up, staying the same, inflation are all guessing, the only constant is if you buy a home, its value will continue to drop.

Every rise and every fall in real-estate starts with a trend change. Some of the Phoenix submarkets have actually seen consecutive months of price appreciation. Looks like a trend change to me. Check out

ReplyDeletehttp://www.metrohousingreports.com