The number of foreclosures started in February rose to 243,000 from 217,000 in January. About 87,000 homes were repossessed by banks during February, a 28% jump from the 68,000 foreclosures completed in January. ...Again, month-over-month numbers tend to be highly volatile, but these numbers are a countercurrent to the rosy month-over-month spin we got a lot of last week. The S&P/Case-Shiller 20-City Home Price Index numbers that come out today should help provide a clearer view of the short-term housing trend.

February was the second straight month of sharply higher foreclosures; prior to January, the problem appeared to be easing.

Tuesday, March 31, 2009

Foreclosures rising again

The number of foreclosures increased in February, compared with January:

Labels:

housing bubble

Monday, March 30, 2009

DC-area house price changes in 2008, by the numbers

From The Washington Post:

No local jurisdiction except the District was spared from falling home prices, and some of the hardest hit Zip codes in the suburbs had declines of more than $100,000.Washington, DC:

Region-wide, the median sales price for single-family houses and townhouses fell 8 percent, to $382,500 from $417,000, in 2007, according to a Washington Post analysis of government sales records. The median price for condominiums also fell 8 percent, to $268,000 from $289,900.

— The District fared the best out of all the jurisdictions in the region, according to The Post's analysis. While sales volume slid 30 percent, to 2,239 homes from 3,212 in 2007, the median home price rose 8 percent, to $520,000, from $480,000.Northern Virginia:

The biggest price increase occurred in Georgetown's 20007 Zip code, one of the District's most expensive neighborhoods. There, the median home price shot up 18 percent, to $1,075,000 from $909,150, even as the number of sales decreased to 199 from 237. ...

Meanwhile, the Zip code with the biggest drop in median home price was 20011, which includes parts of Petworth and Columbia Heights. There home prices fell 10 percent, to $375,000 from $415,000, and homes sales dropped to 290 from 433. Data for the District and the other jurisdictions in this story exclude condos.

— Prince William County, plagued by foreclosures stemming from the subprime meltdown, had the region's steepest price decline. The county's median home price fell 23 percent, to $300,000, in 2008, down from $390,000 in 2007. Volume also plummeted, with 4,961 homes sold compared with 6,755. ...Maryland:

— In Loudoun County, demand picked up as prices fell. The median home price dropped 17 percent, to $410,000 from $492,000, and the number of homes sold jumped to 4,885 from 4,034. The falling prices are a legacy of Loudoun's ambitious growth during the boom years. ...

— In Fairfax County, the median home price fell 14 percent, to $445,000 from $520,000, and volume declined to 9,852 homes sold from 10,851. Several Zip codes had six-figure drops.

The median home price for a house in Herndon, Zip code 20170, for example, fell 34 percent, to $309,000 from $469,900, but home sales jumped to 499 from 317. ...

— In Alexandria, the median home price fell 5 percent, to $550,000 from $580,000, while the number of homes sold fell to 832 from 1,315. It remained the region's priciest jurisdiction. ...

— In Arlington, the median home price fell 7 percent, to $543,000 from $581,000, while the number of homes sold fell to 1,375 from 1,713.

In South Arlington's Zip code 22204, the county's least expensive area, prices fell 11 percent, to $385,150 from $435,000, while home sales also decreased to 288 from 310.

— Montgomery County experienced the steepest drop in home prices among the suburban Maryland jurisdictions, a sharp reversal for a county that had otherwise withstood some of the worst of the housing bust.

The median home price fell 11 percent, to $440,000 from $495,000, and sales volume plummeted to 7,195 from 8,598.

While prices declined in the majority of Zip codes, some of the steepest drops were in the northernmost areas.

Germantown, Zip code 20874, posted an 11 percent decline, falling to $314,990 from $353,750. Nearby Gaithersburg, Zip code 20877, posted a 20 percent decline, to $350,000 from $438,060. ...

— The housing market in Prince George's County continued to erode. The median home price fell 7-percent in the county, to $314,910 from $340,000, while sales volume fell to 3,831 from 7,993 in 2007. ...

Other Maryland jurisdictions also took a hit.

— In Anne Arundel County, the median price fell 5 percent, to $322,500 from $339,000. Home sales fell to 4,928 from 6,479.

— In Charles County, the median price fell 5 percent, to $309,990 from $325,000. There were 1,170 sales, down from 1,918.

— In Calvert County, the median price fell 5 percent, to $315,000 from $332,800. Sales fell to 500 from 782.

— In Frederick County, the median price fell 8 percent, to $300,000 from $324,900. Sales fell to 1,490 from 2,473.

— In Howard County, the median price fell 3 percent, to $391,903 from $402,500. Sales fell to 2,369 from 2,972.

— In St. Mary's County, the median price fell 7 percent, to $285,000 from $305,000. Sales fell to 899 from 1,080.

Sunday, March 29, 2009

Saturday, March 28, 2009

Rahm Emanuel's oversight of Freddie Mac

An interesting article about President Obama's chief of staff and his former high-salary, do-nothing job overseeing Freddie Mac:

An interesting article about President Obama's chief of staff and his former high-salary, do-nothing job overseeing Freddie Mac:Before its portfolio of bad loans helped trigger the current housing crisis, mortgage giant Freddie Mac was the focus of a major accounting scandal that led to a management shake-up, huge fines and scalding condemnation of passive directors by a top federal regulator.

One of those allegedly asleep-at-the-switch board members was Chicago's Rahm Emanuel—now chief of staff to President Barack Obama—who made at least $320,000 for a 14-month stint at Freddie Mac that required little effort. ...

On Emanuel's watch, the board was told by executives of a plan to use accounting tricks to mislead shareholders about outsize profits the government-chartered firm was then reaping from risky investments. The goal was to push earnings onto the books in future years, ensuring that Freddie Mac would appear profitable on paper for years to come and helping maximize annual bonuses for company brass.

Labels:

housing bubble

Friday, March 27, 2009

History suggests housing doesn't overshoot

Apparently, many bubbleheads (and economists who have recently discovered the bubble, e.g. Martin Feldstein) believe this housing bubble will overshoot on the way down. They base this belief on the incorrect assumption that the real estate market behaves like the stock market. It does not; housing reacts much more slowly and is usually resistant to decline.

For the bubbleheads, overshooting is a thing to be embraced. After all these years of being priced out of the housing market, they say, we will finally be able to buy houses for pennies on the dollar. For the economists, overshooting is a thing to be feared because it would prolong and deepen the recession.

I would love it if housing would overshoot. Who wouldn't want to buy a dollar's worth of house for 50¢? However, predictions should be based, not on hope or fear, but on historical data. Those who predict overshooting do not have history on their side.

The two most prominent examples of previous housing bubbles come from Japan and Los Angeles in the late 1980s and early 1990s. Here is Japan. Notice no overshooting:

Here is Los Angeles. Notice inflation-adjusted prices fell right back down to where they were in 1987, with no overshooting. Nominal prices never fell back to their 1987 level:

People who predict overshooting—especially the professional economists—have a responsibility to back up their predictions with actual historical data. Martin Feldstein, especially, has been using a baseless fear of overshooting as an excuse to justify propping up the bubble.

I challenge people who believe in overshooting to back up their belief with actual historical data. It is certainly possible that housing will overshoot—Las Vegas and Phoenix are looking like they will—but in most parts of this country, it is far from probable.

For the bubbleheads, overshooting is a thing to be embraced. After all these years of being priced out of the housing market, they say, we will finally be able to buy houses for pennies on the dollar. For the economists, overshooting is a thing to be feared because it would prolong and deepen the recession.

I would love it if housing would overshoot. Who wouldn't want to buy a dollar's worth of house for 50¢? However, predictions should be based, not on hope or fear, but on historical data. Those who predict overshooting do not have history on their side.

The two most prominent examples of previous housing bubbles come from Japan and Los Angeles in the late 1980s and early 1990s. Here is Japan. Notice no overshooting:

Here is Los Angeles. Notice inflation-adjusted prices fell right back down to where they were in 1987, with no overshooting. Nominal prices never fell back to their 1987 level:

People who predict overshooting—especially the professional economists—have a responsibility to back up their predictions with actual historical data. Martin Feldstein, especially, has been using a baseless fear of overshooting as an excuse to justify propping up the bubble.

I challenge people who believe in overshooting to back up their belief with actual historical data. It is certainly possible that housing will overshoot—Las Vegas and Phoenix are looking like they will—but in most parts of this country, it is far from probable.

Thursday, March 26, 2009

Lawrence Yun comments on the increase in home sales

On Monday, the mainstream media made a big deal about the fact that month-over-month existing home sales were up in February. The Dow Jones Industrial Average rallied almost 500 points on Monday, mostly because of Tim Geithner's already-expected financial stability plan, but also because of the increase in home sales.

Here is what NAR economist Lawrence Yun had to say about the increase in February existing home sales:

Here is what NAR economist Lawrence Yun had to say about the increase in February existing home sales:

The latest reading on home sales further confirms stabilizing trends. Existing home sales increased 2.9 percent in February to a 5.03 million unit pace from a 4.89 million unit pace in January. ...Sounds like a possible housing bottom, doesn't it? There's only one problem: the quote is a year old. That's right, exactly one year ago this week NAR reported that month-over-month home sales had increased in February, and an economic recovery was expected in the second half of the year. It's déjà vu all over again.

The economy is also anticipated to pick up momentum in the second half of the year, which will help lift consumer confidence.

In summary, today's rising sales data is encouraging in at least hinting that we are very close to the low point for home sales.

Roubini: Further 20% decline in home prices

NYU economist Nouriel Roubini predicts a 20% decline in home prices over the next year-and-a-half:

With “deflationary forces” lingering for as long as three years, Roubini said U.S. government bond yields were going to remain relatively low and that American house prices would fall as much as 20 percent more in the next 18 months. While the dollar will benefit as investors seek safe havens, it will ultimately decline as the U.S. trade deficit has to shrink, he said.

The need for governments to issue more public debt to fund stimulus and bank-rescue packages risked more downgrades to sovereign debt and the failure of more government auctions as happened in the U.K. yesterday, Roubini said.

Wednesday, March 25, 2009

Republican housing plan: Renters should subsidize homeowners

Apparently, today House Republicans are returning to their plan to fix the economy by having renters subsidize the mortgages of homeowners:

Don't like the housing bailouts? Let your congressmen know.

This plan demonstrates that, just like Democrats, Republicans do not believe in the free market. Why do politicians always want to meddle with the free market?House Republican leaders plan to unveil a housing package today that would increase the tax credits available for home buyers and would direct law enforcement to crack down on mortgage fraud.

Under the proposal, borrowers refinancing their mortgage would be eligible for $5,000 to help cover closing costs or to reduce their principal balance. The plan also revives a $15,000 home buyer tax credit proposal that Republicans pushed last year. This time, the proposal would require the borrower to have at least a 5 percent down payment. Both programs would expire in July 2010.

"We want to make sure responsible homeowners are able to purchase homes and stay in their homes," said House Minority Whip Eric Cantor (R-Va.), who will introduce the legislation. "If you can get a $15,000 tax credit, that is a tremendous incentive to get qualified buyers back into the game."

Brendan Daly, a spokesman for House Speaker Nancy Pelosi (D-Calif.), said he had not seen the proposal but that Democrats are committed to strengthening the housing market. "We have already seen a boost in home sales due to the $8,000 tax credit for first-time home buyers in the economic recovery package signed into law last month by President Obama," Daly said.

Don't like the housing bailouts? Let your congressmen know.

Labels:

housing bubble

Feldstein: 2009 economic recovery "too optimistic"

Harvard economist, former Council of Economic Advisers chairman, and former National Bureau of Economic Research president Martin Feldstein thinks the recession will not end this year:

Harvard economist, former Council of Economic Advisers chairman, and former National Bureau of Economic Research president Martin Feldstein thinks the recession will not end this year:The recession in the United States will stretch well into next year, probably raising the need for another fiscal stimulus package at least as large as the first one, prominent economist Martin Feldstein said on Tuesday.

Feldstein, a Harvard University professor who is a member of President Barack Obama's Economic Recovery Advisory Board, told Reuters that the stimulus would offset only a relatively small piece of the likely fall in spending, exports and construction.

"I'm afraid that the economy will continue to slide down well into next year," Feldstein, a former head of the National Bureau of Economic Research, said in an interview in Beijing where he was attending a conference.

"I don't know when it will end, but the forecasts that it'll end later this year I think are too optimistic," he said of the recession. ...

"The fiscal stimulus is just not large enough to offset the downward pressure that comes from reduced consumer spending. So unless somehow fixing the financial markets is enough to offset that, which I very much doubt, I think there will be a need for another fiscal stimulus package at some point," Feldstein said.

Labels:

housing bubble

Home prices up in January?

The Federal Housing Finance Agency (formerly OFHEO) reported yesterday that its index of home prices rose in January (month-over-month):

In conflict with FHFA's reported 1.7% rise in home prices in January (MoM), the National Association of Realtors's measure of home prices showed a 2.9% decline during the exact same period, followed by a further decline of 2.9% in February.

The reasons for the FHFA index's odd behavior is almost certainly due to the fact that it only measures houses with conforming loans. This means it doesn't cover houses with subprime mortgages, and—because of the conforming loan limit—it underweights the parts of the country where the housing bubble was biggest.

Sources: December home prices, January home prices, February home prices.

U.S. home prices rose 1.7% in January compared with December, the Federal Housing Finance Agency reported Tuesday. It was the first monthly increase in a year.The FHFA/OFHEO index has been a bit of an oddball. It was initially very slow to recognize the decline in home prices, then it fell much slower than other indexes, and now it shows a slight rise, when almost all competing indexes are showing declines. I have a lot of troubling believing that the mass of foreclosures, the banking crisis, and the recession are all the result of only a 9.6% decline in housing prices since April 2006, as the FHFA index would suggest.

Home prices are down 6.3% in the past year and are down 9.6% from the peak in April 2006, the agency said. In December, the year-over-year decline was 8.8%. ...

The "unexpected rise" in January was partially due to stronger sales in some markets, FHFA said. The FHFA index attempts to control for such changes in sales patterns, but the adjustment is not perfect, the agency said. The agency warned that its estimate was uncertain and subject to large revisions.

December's index, originally reported as a 0.1% increase, was revised down to a 0.2% decline. ...

The Case-Shiller index, a separate price index that has less geographic reach but better coverage of the bubble mortgages, shows a much larger price decline of 18.6% in 2008 and a drop of 27% from the peak. The Case-Shiller index for January will be released next Tuesday.

In conflict with FHFA's reported 1.7% rise in home prices in January (MoM), the National Association of Realtors's measure of home prices showed a 2.9% decline during the exact same period, followed by a further decline of 2.9% in February.

The reasons for the FHFA index's odd behavior is almost certainly due to the fact that it only measures houses with conforming loans. This means it doesn't cover houses with subprime mortgages, and—because of the conforming loan limit—it underweights the parts of the country where the housing bubble was biggest.

Sources: December home prices, January home prices, February home prices.

Labels:

housing bubble

Tuesday, March 24, 2009

Tonight on PBS: The national debt

Tonight PBS is airing a Frontline episode about the national debt called "Ten Trillion and Counting." In the DC area, it airs on WETA at 10:00 PM. In the Baltimore area, it airs on WMPT at 9:00 PM. Bubble Meter readers in other parts of the country should check their local listings. For those who miss it tonight, you will be able to watch it online.

According to the National Debt Clock, the U.S. national debt is actually $11 trillion. That's roughly $36,087 for every man, woman, and child in the United States, or $97,515 for every American household.

According to the National Debt Clock, the U.S. national debt is actually $11 trillion. That's roughly $36,087 for every man, woman, and child in the United States, or $97,515 for every American household.

Labels:

housing bubble

BubbleSpehere Roundup

- The Big Takeover (Rolling Stone Magazine ) - How Wall Street fleeced Main Street and then grabbed even more power.

- Q4 Mortgage Equity Extraction Strongly Negative (Calculated Risk)

- Existing home sales up - don't get too excited (The Mess That Greenspan Made)

Labels:

housing bubble

NAR: Home prices fall 15.5%; sales down 4.6% YoY

According to the National Association of Realtors, the February median home price fell 15.5% year-over-year to $165,400.

BusinessWeek gives its take on the sales data:

The National Association of Realtors said that existing home sales rose last month to a seasonally adjusted annual rate of 4.72 million million units, up 5.1% from a rate of 4.49 million in January. February sales were down nearly 5% from year ago levels. ...NAR's press release very happily boasts about the 5% jump in month-over-month sales, but conveniently doesn't disclose the month-over-month decline in prices. By tracking down last month's press release, I can tell you that median prices were down 2.9% month-over-month. As I've said before: drop prices, sell houses.

The report said first-time buyers made up half of all purchases in February, and that sales of distressed properties accounted for about 45% of all transactions.

Sales were unexpectedly strong in the West, with activity increasing more than 30% over last year.

"February wasn't too shabby for the existing-home market," said Mike Larson, real estate analyst at Weiss Research. "The catch? The increase in sales activity is coming at the expense of pricing."

The national median existing-home price was $165,400 in February, down 15.5% from last year, when the median price was $195,800.

BusinessWeek gives its take on the sales data:

The monthly increase might be little more than statistical noise. It might be that the slightly warmer-than-usual February brought out some more buyers, said Patrick Newport, U.S. Economist for HIS Global Insight. But the formula used to adjust data for seasonal buying patterns tends to exaggerate monthly irregularities, he said.Wondering what a $165,000 house looks like? Here are a few examples.

Labels:

housing bubble

Monday, March 23, 2009

Where are we at?

Are housing markets bottoming on a national basis?

No. Prices are still falling as indicated by the recent release of the December Case-Shiller Price Index. Despite the new 8,000 home purchasing tax credit and the incredibly low mortgage rates housing prices will continue to fall as there is still a huge overhang in vacant housing units in combination with major job losses. In most markets nominal prices will not bottom until at least early 2010.

Do you support the federal 8,000 home purchasing tax credit?

No. The United States already spends too large a share of GDP on housing. The tax credit will temporarily increase this amount. In addition this adds more debt to the deteriorating federal balance sheet.

No. Prices are still falling as indicated by the recent release of the December Case-Shiller Price Index. Despite the new 8,000 home purchasing tax credit and the incredibly low mortgage rates housing prices will continue to fall as there is still a huge overhang in vacant housing units in combination with major job losses. In most markets nominal prices will not bottom until at least early 2010.

What about locally in the Washington, DC area?

In the Washington, DC metro area the majority of the nominal price declines have already occurred. Most areas will see small further price declines ( 5 - 10%). Nominal prices are likely to bottom in late 2009 or early 2010.

In the Washington, DC metro area the majority of the nominal price declines have already occurred. Most areas will see small further price declines ( 5 - 10%). Nominal prices are likely to bottom in late 2009 or early 2010.

No. The United States already spends too large a share of GDP on housing. The tax credit will temporarily increase this amount. In addition this adds more debt to the deteriorating federal balance sheet.

Labels:

housing bubble

Sunday, March 22, 2009

Vacant homes graph

From the Congressional Budget Office:

From the Congressional Budget Office:Most analysts believe that the correction in house prices is far from complete; for example, according to the February Blue Chip consensus (which is the average of about 50 forecasts by private-sector economists), the 20-city version of the S&P Case-Shiller index will fall a further 14 percent in 2009.

Housing starts in January plunged to 477,000 (at a seasonally adjusted annual rate), an all-time low since the U.S. Census Bureau started tabulating them in 1959. Although they rebounded somewhat, to 583,000 in February, that number contrasts with the more than 2 million starts at the height of the boom in 2005. Even though the construction of new homes has been at an extremely low rate for more than a year, no progress has been made toward reducing the excess supply of vacant units. ...

After rising for much of last year, mortgage rates—both for conforming loans and for larger, or jumbo, loans—fell late last year, and they have remained low thus far in 2009. Lower mortgage rates have spurred applications for refinancing; nevertheless, the number of applications for loans to finance purchases of homes has fallen this year.

Labels:

housing bubble

Saturday, March 21, 2009

Karl Case on the housing market outlook

The co-developer of the S&P/Case-Shiller Home Price Index gives his thoughts on the housing market outlook:

For the record, he was a bit over-optimistic a year ago.The U.S. housing market slump is nowhere near over and home prices will probably keep falling well into next year, one of the property market's best-known economists said.

Karl Case, the co-developer of a widely watched gauge of the housing industry, told Reuters that the hard-hit U.S. housing market has gone from being the primary source of the U.S. economic recession to one of its biggest casualties.

"Never say never, but it is looking increasingly probable that we will not see a housing market bottom until next year," said Case, an economics professor at Wellesley College in Massachusetts.

"If the housing market was independent of the economy, we would be getting closer to a bottom, but that is not the case and we have a horrible economy," he said in an interview late on Tuesday. ...

Case, whose research has focused on real estate markets and prices for over 20 years, said he did not anticipate the extent of home price depreciation that has transpired since the peak in the second quarter of 2006.

"I did not think it was probable that we would have a home price decline of this magnitude," he said.

Friday, March 20, 2009

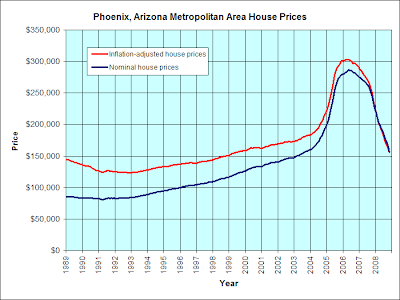

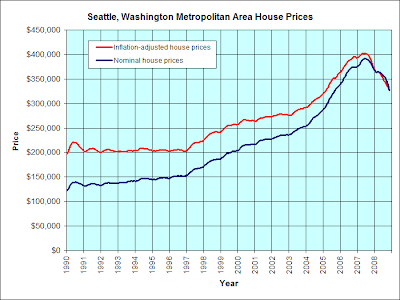

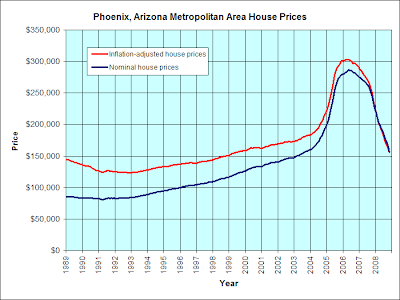

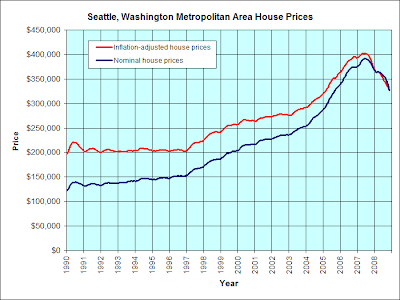

Home price declines: Las Vegas and Phoenix close to the bottom; New York and Seattle still near the top

By my estimates, the decline in U.S. home prices is about two-thirds of the way down to pre-bubble levels (adjusted for inflation). However, there is a lot of variation in different parts of the U.S.

According to the S&P/Case-Shiller Home Price Indices, Las Vegas and Phoenix home prices are all the way back down to pre-bubble levels:

Meanwhile, New York and Seattle home prices still have a very long way to fall:

As for the Washington, D.C. area, it is falling at a slightly slower rate than the national average, and is only down about half way.

According to the S&P/Case-Shiller Home Price Indices, Las Vegas and Phoenix home prices are all the way back down to pre-bubble levels:

Meanwhile, New York and Seattle home prices still have a very long way to fall:

As for the Washington, D.C. area, it is falling at a slightly slower rate than the national average, and is only down about half way.

Thursday, March 19, 2009

Alan Greenspan's conflicting arguments to avoid responsibility

An eye-opening exposure of the faulty logic Alan Greenspan uses to defend himself:

I'm speechless.ALAN GREENSPAN’s defence of the Federal Reserve in the formation of the housing bubble restates a familiar argument—it raised short-term interest rates but long-term interest rates did not follow, and housing is most sensitive to long-term rates. His proof includes the fact that long-term rates were low worldwide, and that many countries had bigger housing bubbles than America. The housing bubble’s source must therefore be global.

I agree with this analysis but I don’t agree that it exonerates the Fed. In the earlier part of this decade Mr Greenspan asserted on a number of occasions that while America might have local housing bubbles, there was no national housing bubble. Yet he now asserts there was a global housing bubble. It has always puzzled me how he could go from seeing local bubbles to a global bubble without at some point diagnosing a national bubble. By failing to diagnose a national housing bubble until it was already well inflated, the Fed under Mr Greenspan escaped the obligation to do anything about it.

Labels:

housing bubble

Wednesday, March 18, 2009

Housing starts down 47.3% YoY; Permits down 44.2%

Initial construction of U.S. homes unexpectedly surged in February, after falling for eight months, according to a government report released Tuesday.CNBC's Diana Olick explains why February's month-over-month housing starts data constitutes a false dawn:

Housing starts rose to a seasonally adjusted annual rate of 583,000 last month, up 22% from a revised 477,000 in January, according to the Commerce Department. It was the first time housing starts increased since June, when they rose 11%. ...

Applications for building permits, considered a reliable sign of future construction activity, rose 3% to a seasonally adjusted annual rate of 547,000 last month. Economists were expecting permits to fall to 500,000.

While the surge in new construction was a welcome sign for the nation's battered housing market, analysts warned that the increase could be short lived.

"With new home sales still falling and the months' supply at a record, there is no reason for homebuilding to rise," wrote Ian Sheperdson, chief U.S. economist at High Frequency Economics in a research note. "This is a temporary rebound, not a recovery."

A surprising housing starts number sent the markets churning and the analysts buzzing, and when it all shook out the takeaway was less than promising. Housing starts bumped up 22% in February from the month before, but broken down, you see that single family starts rose just 1% while multi-family shot up 82%.Be wary of any abrupt single-month change in housing stats that diverges from the medium-term trend. We've been down this road before. Single-month improvements don't last when real home prices are still high by historical standards.

How could all this be?

Nishu Sood of Deutsche Bank:

I chalk it up to how low the number had fallen (making the subsequent jump look bigger in percentage terms). Multifamily starts had truly fallen off a cliff in 2H08, so the natural volatility in the series is amplied in percentage terms. Even after this month's jump we are still well below the averages of 2007 and 1H08.

And then of course there was the weather factor: a very cold and wet December and January were followed by a much milder February, so all those homes that didn’t get started in Dec/Jan, hit the dirt in Feb. If you look regionally, the starts were strongest in the Northeast, again where the weather was unseasonably mild in February.

More important to look at is the permits number. Single family permits rose 11 percent nationwide...

So why are permits up? Well, says building analyst Ivy Zelman, "This is supply. It is not indicative of demand." She notes that builders, and the banks funding them, have money in the ground already, in finished lots. "You have to put a house on it. Vertical construction continues even though demand is not strong." If you don’t put a house on it, the land is a total loss. If you put a small, cheap house on it, maybe you can recoup at least the cost.

But the permits number is not good news to J.P. Morgan analyst Michael Rehaut:

We believe a rise in new home inventory would only exacerbate the current downturn. Moreover, we believe these elevated inventory levels will continue given our outlook for weak demand to continue well into 2009, driven by rising unemployment, low consumer confidence, still tight credit conditions, and rising delinquency and foreclosure rates. Accordingly, we reiterate our negative sector stance on both the builders and the building products.

The year-over-year numbers tell a much different story than what's in the headlines. In February, building permits were down 44.2% year-over-year, and housing starts were down 47.3% year-over-year. Not so rosy, huh?

Labels:

housing bubble

Tuesday, March 17, 2009

Study: Real estate brokers are almost worthless

From BusinessWeek's Hot Property blog:

Fascinating study by Stanford University economists B. Douglas Bernheim and Jonathan Meer called “How Much Value Do Real Estate Brokers Add? A Case Study.” Bottom line: They don’t add a whole lot. “We find no evidence that the use of a broker leads to higher average selling prices, or that it significantly alters average initial asking prices. However, those who use brokers sell their houses more quickly,” the authors write.

The study was based on data pertaining to sales of faculty and staff homes on the Stanford campus over a 26-year period. “For the median home in our sample, a 6 percent sales commission totals $34,000, a steep price to pay for the value rendered,” the authors write.

The study closely resembles one in 2007 that covered brokers vs. FSBOs in Madison, Wis., another college town.

Monday, March 16, 2009

Bernanke's recovery prediction: Journalists report old news

Apparently more journalists watch 60 Minutes than watch Congressional testimony.

Apparently more journalists watch 60 Minutes than watch Congressional testimony.Today, the mainstream and financial media has been making a big deal about the fact that Federal Reserve Chairman Ben Bernanke predicts an economic recovery in 2010. Why is this such a big deal today? It's not like this is something Bernanke hasn't said before. The press might as well report that Jupiter is a planet. That would be equally groundbreaking.

For those who put stock in Bernanke's predictions, keep in mind that a year ago he was predicting a housing recovery in the second half of 2008. He also made housing recovery predictions several times before that as well. How'd that work out?

Also lost in the headlines is that Bernanke's prediction has a very major caveat. He only predicts a recovery in 2010 if the federal government's attempts to stabilize the financial system are successful. That's a pretty big caveat!

Prince William County home prices, who to believe?

As an anonymous commenter pointed out on Friday, according to MRIS, inflation-adjusted home prices in Prince William County, Virginia are all the way back down to pre-bubble levels. Zillow.com completely disagrees, suggesting that Prince William County prices are still 80% above their inflation-adjusted pre-bubble levels. (Inflation calculator here.) That's a pretty big disagreement! Who should we believe? Unfortunately, all home prices measures are flawed. Some are more flawed than others, though. Personally, I hope MRIS is more right, but I'm not so sure.

Let's take a brief look at some of the pros and cons of each index. (If I leave anything out, please mention it in the comments.)

Let's take a brief look at some of the pros and cons of each index. (If I leave anything out, please mention it in the comments.)

The big advantage of MRIS is that, unlike Zillow, it is a measure of actual sales. By comparison, Zillow is measuring its own appraisals. If those appraisals are wrong, then Zillow's index is wrong. If you look at enough properties in Zillow, it becomes quite apparent that a sizeable minority of its Zestimates are screwy, making huge price changes in short periods of time. Furthermore, many homeowners edit their home information on Zillow to inflate the size of their home, often listing the lot size as the home size.

However, Zillow's use of appraisals also gives it an advantage over MRIS. Specifically, Zillow is closer to being a constant-quality index than MRIS. A significant amount of the drop in MRIS's measured prices may come from the fact that far more smaller homes have been going into foreclosure than bigger homes. That means more smaller homes are selling, which suggests that some (much?) of the price decline on the MRIS graph is due to the changing mix of homes for sale. MRIS may be overestimating the decline in overall housing value in Prince William County (and the entire D.C. area).

A second strike against Zillow comes from the fact that its Zestimates today are based on comparisons with houses that have sold in the recent past. This probably makes Zillow a trailing indicator, while MRIS is probably much more up-to-date.

In the end, I'd say that MRIS probably overestimates the decline, while Zillow probably underestimates it. Zillow's measured decline in home prices is simply not enough to be compatible with the S&P/Case-Shiller Index. I'm not ready to claim that Prince William County's home prices are back to inflation-adjusted pre-bubble levels, but I hope they are. Prince William County should reach pre-bubble levels before other Washington, D.C. metro area jurisdictions, though.

Thoughts?

Let's take a brief look at some of the pros and cons of each index. (If I leave anything out, please mention it in the comments.)

Let's take a brief look at some of the pros and cons of each index. (If I leave anything out, please mention it in the comments.)The big advantage of MRIS is that, unlike Zillow, it is a measure of actual sales. By comparison, Zillow is measuring its own appraisals. If those appraisals are wrong, then Zillow's index is wrong. If you look at enough properties in Zillow, it becomes quite apparent that a sizeable minority of its Zestimates are screwy, making huge price changes in short periods of time. Furthermore, many homeowners edit their home information on Zillow to inflate the size of their home, often listing the lot size as the home size.

However, Zillow's use of appraisals also gives it an advantage over MRIS. Specifically, Zillow is closer to being a constant-quality index than MRIS. A significant amount of the drop in MRIS's measured prices may come from the fact that far more smaller homes have been going into foreclosure than bigger homes. That means more smaller homes are selling, which suggests that some (much?) of the price decline on the MRIS graph is due to the changing mix of homes for sale. MRIS may be overestimating the decline in overall housing value in Prince William County (and the entire D.C. area).

A second strike against Zillow comes from the fact that its Zestimates today are based on comparisons with houses that have sold in the recent past. This probably makes Zillow a trailing indicator, while MRIS is probably much more up-to-date.

In the end, I'd say that MRIS probably overestimates the decline, while Zillow probably underestimates it. Zillow's measured decline in home prices is simply not enough to be compatible with the S&P/Case-Shiller Index. I'm not ready to claim that Prince William County's home prices are back to inflation-adjusted pre-bubble levels, but I hope they are. Prince William County should reach pre-bubble levels before other Washington, D.C. metro area jurisdictions, though.

Thoughts?

Sunday, March 15, 2009

Friday, March 13, 2009

Bank of America CEO on housing

Bank of America CEO Ken Lewis made some interesting comments on housing yesterday. From MarketWatch.com:

"Housing is the single most important factor," Lewis said. "Housing may be bottoming. We're looking for house prices to stabilize. So the first sign of an improving economy would be that housing is stabilizing.I love the logic being used. I'm sorry, but I pay close attention to housing data. There is no sign of a bottom occurring in 2009 (except in Arizona and Nevada). This is just another example of wishful thinking among people who want there to be a bottom in housing. Financial professionals have been predicting a bottom since 2005, yet they keep being wrong.

Senate Democrats seeking support for mortgage cramdown legislation

From today's Washington Post:

Key Democratic lawmakers are courting support from the financial services industry, including credit unions, for legislation that would allow bankruptcy judges to modify mortgages.

The provision passed the House last week but has not been scheduled for a Senate vote. The Senate had been expected to take up the bill as soon as this week, but it now could be delayed a few weeks, perhaps until after Easter, some congressional aides said.

Many Republicans continue to oppose the measure. Even though it once appeared the legislation was likely to pass, "I really believe the momentum has slowed," said Sen. Bob Corker (R-Tenn.), a member of the Senate Banking Committee, which has jurisdiction over the legislation.

Under the measure, bankruptcy judges could reduce the principal on a homeowner's mortgage as well as cut the interest rate and extend the terms — provisions known as cramdowns.

Thursday, March 12, 2009

Foreclosures up in February

It appears those announced foreclosure moratoriums didn't help much:

The foreclosure picture suddenly darkened again in February.

More than 74,000 homes were lost to bank repossessions during the month, up from 67,000 in January, according to a regular monthly report from RealtyTrac, the online marketer of foreclosed properties. Nearly 1.2 million have been lost since the foreclosure crisis hit in August 2007.

The number of foreclosure filings rose 6% during the month after falling 10% in January. Worse, filings leaped nearly 30% compared with February 2008. And the results confounded expectations: A downtrend had been expected due to the numerous foreclosure moratoriums in effect during the month.

"We were very surprised," said RealtyTrac spokesman Rick Sharga. "The moratorium were led by big players like Fannie and Freddie and all the major banks. It was supposed to cover the whole waterfront. The fact that foreclosures still went up was a shock."

A particularly troubling aspect of the report was that, for many borrowers, once they go into default, they never get out despite moratorium efforts. That's borne out by comparing bank repossessions — homes actually lost by borrowers — with total foreclosure filings: Nationally, repossessions increased 11% for the month, almost double the 6% rise for filings.

The same holds true for year-over-year figures: February filings jumped 30% compared with last year but repossessions rang up a 60% gain.

The reason so many people lose their homes once they are in default is partially attributed to the severe home price drops recorded in many of the worst-hit areas. When borrowers are severely underwater, owing more than their homes are worth, it removes an incentive to keep up with mortgage payments. Some simply walk away.

Wednesday, March 11, 2009

A parable about debt

Why should someone underwater repay the loan?

Four weeks ago, I bought a grill on my credit card. It was not the best grill Home Depot had—indeed, because I am cheap, and also have never longed to rotisserie in my very own back yard, it was the cheapest grill they had in stock, except for tiny tabletop camping models.A person who doesn't pay his debts is a person without honor.

It's a nice grill. But I've since realized that our landlords have an old, broken grill that we might have been able to repair with enough duct tape, saving me almost $200. Meanwhile, I've discovered that I can't sell the grill for a profit, because Home Depot seems to have a large number of very similar grills in stock which they are willing to offer to buyers for a mere $200. For that matter, I can't even sell it for the value of the loan with which I financed it. The equity in my grill has dropped by about 50%. Given all that, I don't see why I should be required to pay back the credit card company. After all, they knew when they loaned me the money that I might not pay it back, and I suspect they also knew that I might not like my grill as much as I expected to. Hell, the dirty bastards may well have known that I was going to end up underwater on my grill loan. I don't see why I have any obligation to repay them.

This seems to me to be approximately the logic behind the people saying that folks who took out stupid loans don't have any sort of moral obligation whatsoever to make good their debts. The loan company didn't have your best interest at heart, the logic goes, so why should you take care of them at any cost to yourself?

Well, imagine you're the one I borrowed the grill money from. I doubt almost anyone reading this would be plunged into bankruptcy by the loss of $200. So why should I pay it, when you knew just as well as I did that the grill would depreciate and I might be better off without it?

Greenspan says the housing bubble's not his fault

Alan Greenspan has an article in The Wall Street Journal today, saying he didn't create the housing bubble or the financial crisis. (Let's not forget he used to deny the very existence of a housing bubble.)

Alan Greenspan has an article in The Wall Street Journal today, saying he didn't create the housing bubble or the financial crisis. (Let's not forget he used to deny the very existence of a housing bubble.)While I agree that the Fed didn't initially cause the housing bubble, I disagree that the Fed was powerless to do anything about it. For example, an inverted yield curve (short-term rates higher than long-term rates) would have stopped it real quick. What bank is going to issue mortgages at 5% if they can get a 6% return on short-term government bonds? The Fed chairman also can use the bully pulpit. Greenspan should have clearly and forcefully said that people buying homes at current prices would lose significant amounts of money.

To be fair, Greenspan was far from alone in believing his actions were the correct ones. The Fed's policies earlier in this decade were not the failings of a single man, but a general failure of the economics profession.

Labels:

housing bubble

Tuesday, March 10, 2009

What caused the housing bubble?

Nobel laureate Paul Krugman mostly agrees with Ben Bernanke: It was caused by a global savings glut.

Paul Krugman, March 1, 2009:

Paul Krugman, March 1, 2009:

How did this global debt crisis happen? Why is it so widespread? The answer, I’d suggest, can be found in a speech Ben Bernanke, the Federal Reserve chairman, gave four years ago. ...Ben Bernanke, March 10, 2005:

In the mid-1990s, he pointed out, the emerging economies of Asia had been major importers of capital, borrowing abroad to finance their development. But after the Asian financial crisis of 1997-98 (which seemed like a big deal at the time but looks trivial compared with what’s happening now), these countries began protecting themselves by amassing huge war chests of foreign assets, in effect exporting capital to the rest of the world.

The result was a world awash in cheap money, looking for somewhere to go.

Most of that money went to the United States — hence our giant trade deficit, because a trade deficit is the flip side of capital inflows. But as Mr. Bernanke correctly pointed out, money surged into other nations as well. ...

For a while, the inrush of capital created the illusion of wealth in these countries, just as it did for American homeowners: asset prices were rising, currencies were strong, and everything looked fine. But bubbles always burst sooner or later, and yesterday’s miracle economies have become today’s basket cases, nations whose assets have evaporated but whose debts remain all too real. ...

If you want to know where the global crisis came from, then, think of it this way: we’re looking at the revenge of the glut.

During the past few years, the key asset-price effects of the global saving glut appear to have occurred in the market for residential investment, as low mortgage rates have supported record levels of home construction and strong gains in housing prices.

Hooverville in California

Labels:

housing bubble

Monday, March 09, 2009

WoW gold Chinese comment link spam

Bubble Meter has been getting a lot of comment link spam coming from China recently, promoting World of Warcraft gold (whatever that is). This comment link spam appears on over 150,000 Blogger blog posts, and yet the folks at Google (the owner of Blogger) seem to be oblivious.

Bubble Meter has been getting a lot of comment link spam coming from China recently, promoting World of Warcraft gold (whatever that is). This comment link spam appears on over 150,000 Blogger blog posts, and yet the folks at Google (the owner of Blogger) seem to be oblivious.Since being given administrator rights by David recently, I have been diligently deleting comment link spam, even on very old blog posts. I subscribe to Bubble Meter's comments in Google Reader, so I see the link spam and delete it within a few hours of it being posted. I can also find and delete older comment link spam by Googling for site:bubblemeter.blogspot.com "wow gold".

Deleting the link spam is kind of fun, but as I've been deleting it, the spammers have been more determined to post it. I've been trying to think of a way to defend against the spam without interrupting the ability of legitimate readers to carry on a conversation on the blog. I considered turning on comment moderation, but that would make it difficult for commenters to carry on a flowing conversation (or argument). I considered requiring commenters to have user accounts, but that would discourage casual readers from commenting. The spammers have Blogger accounts anyway, so that wouldn't work. (Unfortunately, Blogger allows people to flag blogs as hosting link spam, but it doesn't allow people to flag actual blogger user accounts as being spammers, so I have no way of bringing the spammers to Google's attention.)

It occurred to me that almost all legitimate comments appear on new blog posts, not old ones. Comments slow to a trickle on blog posts that are more than a day or two old. Meanwhile, link spammers don't really care how new or old a blog post is. Therefore, I have decided to turn on comment moderation only for blog posts that are older than three days old. This should allow legitimate readers to carry on a free-flowing conversation, while seriously impinging on the ability of spammers to abuse Bubble Meter.

Since the spammers live halfway around the world, they post the link spam when you and I are sleeping (usually around 1:00-2:00 am ET). So, another option I've considered to deter them is to turn off comments at night, and turn them back on in the morning.

Labels:

housing bubble

Dean Baker's new book on the housing bubble

Dean Baker was one of the few professional economists who recognized the housing bubble before its peak. Click the image to visit its page on Amazon.com.

From the product description:

From the product description:

The Huffington Post has a new interview with Dean Baker here.

From the product description:

From the product description:Dean Baker argues not only that competent economists should have recognized the developing housing bubble, but also that policy makers and the media cheerfully neglected those economists who did predict danger.The really sad thing is that not only did policy makers and the media ignore those who predicted danger, but they largely continue to ignore those who predicted danger.

The Huffington Post has a new interview with Dean Baker here.

Labels:

housing bubble

Thought of the day

I could afford Buckingham Palace if the government would just lower my principal, reduce my interest rate, and reschedule my missed payments.

Labels:

housing bubble

Warren Buffett on CNBC this morning

Warren Buffett is on CNBC this morning from 6-9 AM.

A few nuggets from the beginning of the interview:

A few nuggets from the beginning of the interview:

- Buffett admits he believed that home prices could never fall.

- He said Barrack Obama (whom he supported for president) should focus all effort on the current "economic Pearl Harbor," rather than trying to push through a lot of unrelated, controversial legislation.

- He said America's upcoming inflation could be worse than the inflation of the 1970s, depending on how policymakers respond to it.

- He said the U.S. economy almost collapsed in September.

- There are 1.5 million too many houses in the U.S. right now, but population growth will take care of that over time. A big difference between America's housing decline and Japan's is that America has population growth and Japan didn't.

- Once we get past the current crisis, it's a great time to be in banking because the yield spread between a bank's borrowing costs and it's lending rates is huge. Banks will make a lot of money on the new lending they are doing.

- Buffett favors mark-to-market accounting, because he's seen what happens when CEOs get to choose their own numbers. However, mark-to-market accounting has been "gasoline on the fire" during the current crisis. He'd love to buy the banks' toxic assets at their current mark-to-market prices.

- He favors secret ballots for unionization, and opposes the Democrats' plans for card check, which is part of the Employee Free Choice Act currently before Congress. He thinks card check is a mistake.

Labels:

housing bubble

Sunday, March 08, 2009

BubbleSphere Roundup

- Frankly Realty discusses auctions and bankruptcies in swanky Great Falls, VA.

- Predicting the Future of a Housing Crisis (Big Picture from NYTimes)

- S&P/Case-Shiller® December Home-Price Index (Northern Virginia Housing Bubble Fallout)

- National Association of Realtors is against the proposal to limit the interest tax deduction on home loans where the buyers have a household income of 250,000 or more. Surprise Surprise! The measure makes sense as the government already spends too much money subsidizing housing (especially for the wealthy).

Labels:

housing bubble

Flashback 2005: Bernanke on housing and consumer debt

Here are two nuggets from Ben Bernanke's congressional testimony before Joint Economic Committee at the peak of the housing bubble. The first one comes from testimony he gave exactly four years ago today:

Here are two nuggets from Ben Bernanke's congressional testimony before Joint Economic Committee at the peak of the housing bubble. The first one comes from testimony he gave exactly four years ago today:March 8, 2005:

Some observers have expressed concern about rising levels of household debt, and we at the Federal Reserve follow these developments closely. However, concerns about debt growth should be allayed by the fact that household assets (particularly housing wealth) have risen even more quickly than household liabilities. Indeed, the ratio of household net worth to household income has been rising smartly and currently stands at 5.4, well above its long-run average of about 4.8. With real disposable income having risen over the past few quarters, most consumers are in good financial shape—a positive indication for household spending. One caveat for the future is that the recent rapid escalation in house prices—11 percent in 2004, according to the repeat-transactions index constructed by the Office of Federal Housing Enterprise Oversight—is unlikely to continue. A plausible scenario is that house prices will either move sideways or rise more slowly during the next few years, eventually bringing the rate of return on housing in line with the relatively low prospective rates of return that we currently observe on virtually all assets, both real and financial. If the increases in house prices begin to moderate as expected, the resulting slowdown in household wealth accumulation should lead ultimately to somewhat slower growth in consumer spending.October 20, 2005:

House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals, including robust growth in jobs and incomes, low mortgage rates, steady rates of household formation, and factors that limit the expansion of housing supply in some areas. House prices are unlikely to continue rising at current rates. However, as reflected in many private-sector forecasts such as the Blue Chip forecast mentioned earlier, a moderate cooling in the housing market, should one occur, would not be inconsistent with the economy continuing to grow at or near its potential next year.The Washington Post has a blast from the past here.

Dow 36,000 is still coming

Old bubble deniers never die. They just make new excuses.

The really sad thing is even after being proven ridiculously wrong, these guys can still find gainful employment at right-wing think tanks.

The really sad thing is even after being proven ridiculously wrong, these guys can still find gainful employment at right-wing think tanks.

Labels:

housing bubble

Saturday, March 07, 2009

Housing bailout bumper stickers

Cool bumper sticker. I just don't like the organization it finances.

Update: Here's a color version of a similar sticker. It doesn't appear to finance the same organization. The wording is also different.

I think I'd confuse people if I put it next to the Obama sticker already on my car.

I think I'd confuse people if I put it next to the Obama sticker already on my car.

Update: Here's a color version of a similar sticker. It doesn't appear to finance the same organization. The wording is also different.

I think I'd confuse people if I put it next to the Obama sticker already on my car.

I think I'd confuse people if I put it next to the Obama sticker already on my car.

Labels:

housing bubble

Fed President Lockhart on the housing market

Federal Reserve Bank of Atlanta President Dennis P. Lockhart's comments on the state of the housing market, presented before the Greater Miami Chamber of Commerce:

As you know, residential real estate was the catalyst of problems in credit markets. Problems in housing contributed to economic weakness, but now the slowing economy is feeding back into the continued housing slowdown. South Florida has been among the hardest-hit residential markets, so let me spend a few moments discussing housing.

At the current pace of sales, the nation's supply of new homes is more than 13 months—the highest on record. Sales of new single-family homes fell 10 percent in January, and existing homes fell more than 5 percent.

Home prices here in Miami—after a steep run-up during the housing boom—have fallen 41 percent from a peak in December 2006. Nationally, house prices in 20 major MSAs have fallen almost 27 percent since their peak in the second quarter of 2006, according to the S&P/Case-Shiller index.

Other measures show smaller declines nationally. There's no doubt, though, that declining house prices have been a major driver of mortgage delinquencies, defaults, and foreclosures. What's happening is a profound revaluation of mortgage portfolios as well as securities in the global secondary market for mortgage-backed securities.

Efforts to prevent foreclosures appear to have had only modest success so far. There are many reasons this might be the case, but among them is the obstacle posed by securitization agreements to loan modifications. To date, payment-reducing modifications have been the exception rather than the rule. As a result, redefault rates have been high, and new foreclosures continue to add downward pressure on housing prices.

I should also comment on the weakening multifamily residential real estate picture. No two rental markets are exactly alike. But to generalize, those markets trending the worst probably share one or more characteristics. They had excessive condo construction or condo conversion activity. Such markets are seeing unsold units return as rentals. They had very high home price appreciation in the years 2004—07 with large amounts of speculative house construction activity. Today, in several markets, houses compete with apartments as rentals. And they have been experiencing high and rising foreclosure rates.

Labels:

housing bubble

Friday, March 06, 2009

Who caused the housing mess? It depends on how you vote.

A conservative's view of the housing bubble and financial crisis:

The Great Depression and the current recession were both caused by asset bubbles, yet modern macroeconomic textbooks largely ignore discussing bubbles. The economics profession knows little more about bubbles than it did on the day Irving Fisher uttered the words "permanent plateau". (The modern equivalent of "permanent plateau" is "new equilibrium".)

This recession is a failure of the economics profession.

There is very little doubt that the underlying cause of the current credit crisis was a housing bubble. But the collapse of the bubble would not have led to a worldwide recession and credit crisis if almost 40% of all U.S. mortgages—25 million loans—were not of the low quality known as subprime or Alt-A.And a liberal view:

These loans were made to borrowers with blemished credit, or involved low or no down payments, negative amortization and limited documentation of income. The loans' unprecedentedly high rates of default are what is driving down housing prices and weakening the financial system.

The low interest rates of the early 2000s may explain the growth of the housing bubble, but they don't explain the poor quality of these mortgages. For that we have to look to the government's distortion of the mortgage finance system through the Community Reinvestment Act and the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. ...

Long-term pressure from [Barney] Frank and his colleagues to expand home ownership connects government housing policies to both the housing bubble and the poor quality of the mortgages on which it is based. In 1992, Congress gave a new affordable housing "mission" to Fannie and Freddie, and authorized the Department of Housing and Urban Development to define its scope through regulations.

Shortly thereafter, Fannie Mae, under Chairman Jim Johnson, made its first "trillion-dollar commitment" to increase financing for affordable housing. What this meant for the quality of the mortgages that Fannie—and later Freddie—would buy has not become clear until now.

On a parallel track was the Community Reinvestment Act. New CRA regulations in 1995 required banks to demonstrate that they were making mortgage loans to underserved communities, which inevitably included borrowers whose credit standing did not qualify them for a conventional mortgage loan.

From his earliest days in office, Bush paired his belief that Americans do best when they own their own homes with his conviction that markets do best when left alone. Bush pushed hard to expand home ownership, especially among minority groups, an initiative that dovetailed with both his ambition to expand Republican appeal and the business interests of some of his biggest donors. But his housing policies and hands-off approach to regulation encouraged lax lending standards.This financial crisis is not the fault of politicians. It is the fault of economists, specifically the many economists who ignored the housing bubble, insisted there was no housing bubble, or insisted it was not the Fed's problem.

The Great Depression and the current recession were both caused by asset bubbles, yet modern macroeconomic textbooks largely ignore discussing bubbles. The economics profession knows little more about bubbles than it did on the day Irving Fisher uttered the words "permanent plateau". (The modern equivalent of "permanent plateau" is "new equilibrium".)

This recession is a failure of the economics profession.

20% of mortgages are underwater

The number of underwater mortgages keeps growing:

Because home prices continue to drop across most of the country, the mortgage debt on about 20% of all U.S. single-family homes exceeded the estimated current value of those properties as of Dec. 31, says First American CoreLogic, a real estate information firm based in Santa Ana, Calif. That’s a situation often known as being “underwater” or “upside down.” That proportion will rise to 25% of single-family homes if prices fall another 5%, the firm said.Click on the image to see the full-size version:

The problem is most acute in Nevada, where the percentage is 55%, followed by Michigan (40%), Arizona (32%), Florida (30%) and California (30%). Stripping out those five hard-hit states, the national percentage is about 14%. In New York State, the tally is just 4.7%.

Labels:

housing bubble

The glass half full

Calculated Risk is a stock market optimist:

The good news is the market can lose 5% per day and never hit zero!

Labels:

housing bubble

Thursday, March 05, 2009

William Poole says stop the bailouts

The former president of the Federal Reserve Bank of St. Louis says government should stop the bailouts:

THE fundamental causes of this recession, unique in the experience of the United States, were mortgage defaults and the consequent insolvency of major financial firms. These insolvencies, and especially fear of them, damaged normal credit mechanisms.

The self-correcting nature of markets will ultimately prevail. We should not underestimate the power of monetary policy; with the sharp increase in the nation’s money stock starting in September, monetary policy is now extraordinarily expansionary. I believe, though without great confidence, that the recession will end in the second half of this year.

Federal policy is damaging the economy’s prospects. It fails to provide the needed tax incentives for investment in factories and equipment, incentives that were central to efforts to revive the economy during the Kennedy-Johnson era and under Ronald Reagan. ...

Heavy-handed federal intervention into the management of companies from banks to auto makers will also delay recovery. And misguided efforts to help distressed homeowners by permitting courts to rewrite the terms of mortgages will cause banks to limit mortgage lending, which will prevent housing from contributing to the recovery.

The unrelenting anger across the country over bailouts of corporations and households that made unwise and even irresponsible financial decisions is influencing federal policy. Punitive measures, like forcing companies receiving federal dollars to cancel employee events, will increase uncertainty over where the government will strike next in its effort to deflect public outrage. Instead of more bailouts, we need a clear and consistent path to fundamental reform of our financial system.

Wednesday, March 04, 2009

10 reasons to oppose the housing bailout

The top ten reasons to oppose President Obama's $275 billion housing bailout:

- The Bailout Encourages Bad Behavior

- It Rewards the Wrong People

- It Will Further Nationalize our Housing Market

- It is a Futile Effort to Re-inflate the Housing Bubble, which Failed Miserably in Japan

- The Bailout Keeps People in Homes They Cannot Afford

- The Bailout Steals Billions from Hard Working Americans

- Policy Like this Caused the Crisis

- We Cannot Afford it

- It Distorts the Market Economy

- The Plan Creates Uncertainty in the Marketplace

Labels:

Bailout,

housing bubble

Megan McArdle on the owner/renter divide

Blogger and Washington, D.C. resident Megan McArdle writes about the owner/renter divide regarding the Obama foreclosure plan:

It occurs to me that while there is a big conservative/liberal split on the Obama foreclosure plan, there may be a bigger divide between renters and owners. I think that most of the people supporting the mortgage plan really do feel like falling home prices is an obvious catastrophe. I also think that most of them own homes. Because, of course, if prices stay high, where is the money coming from to support them? Well, from people like me, who do not currently have a home to sell, but would like to acquire one in the not-terribly distant future. Keeping people and banks from selling at a loss requires that I buy a house which is overpriced. With the exception of Detroit, all 10 cities broken out by the Case/Shiller house price index show that as of December, home prices were still at least 15% higher than they were in January 2000; their 20-city composite index was still up over 50%.

One of the things that I think is badly understood is that the government cannot do much to prevent house prices from falling. Foreclosures are not the cause of price declines; they are a symptom of them. The underlying event is too many houses, and too little demand for them. Propping up existing mortgages does absolutely nothing about the mismatch between supply and demand.

Labels:

housing bubble

Tuesday, March 03, 2009

Cramdown legislation faces opposition

Obama's proposed "cramdown" legislation is facing opposition among moderate Democrats in Congress:

This legislation will likely lead to higher mortgage rates in the future. A mortgage interest rate is composed of two components: the risk-free rate and the risk premium. The risk-free rate is basically just the rate of return on Treasury bills. The risk premium is an additional rate of return to compensate the lender for the risk of issuing the mortgage. The risk premium currently covers two significant risks: interest rate risk, the risk that interest rates will increase in the future, and default risk, the risk that the borrower won't repay the loan. This cramdown legislation will let banks know that in the future they will also need to account for a third risk: legal/legislative risk, the risk that politicians will change the law to modify existing contracts. This added risk will mean a higher risk premium, and thus higher mortgage rates.

President Obama's cramdown legislation is an example of irresponsible existing homeowners getting a bailout at the expense of future homeowners.

Update: The problem is not the specific cramdowns that Obama is proposing, nor cramdowns in the past. The risk is the precedent that is being set by having politicians coming in and modifying existing contracts. Banks now have to worry more that any of the terms of a mortgage that they issue may be changed, at the whims of politicians, in favor of the borrower.

President Obama is in danger of losing the biggest stick in his foreclosure prevention arsenal.This legislation will allow judges to basically say, "I'm sorry you owe $400,000 on a house that today is only worth $200,000. Presto! Now you only owe $200,000." Of course, someone has to take the loss. It will be the banks, and they will pass much of the loss on to future borrowers (i.e. current renters).

The administration's plan to stem the housing crisis depends on Congress amending the bankruptcy laws to allow judges to modify mortgages, in particular by reducing principal to make monthly payments more affordable.

The so-called cramdown provision could put pressure on loan servicers to modify mortgages before borrowers file for bankruptcy.

A major critique of the voluntary modification programs is that servicers aren't doing enough to help struggling borrowers. But servicers will likely be more aggressive in working with homeowners if they know that the borrowers can turn to judges for relief. ...

But congressional Democrats, who first introduced a bill broadening judges' power two years ago, are running into trouble gathering the support needed to pass the legislation. The House postponed a vote on the measure until early this week after a group of centrist Democrats voiced concerns. And its future in the Senate remains in doubt with many powerful Republicans strongly opposed to the legislation.

This legislation will likely lead to higher mortgage rates in the future. A mortgage interest rate is composed of two components: the risk-free rate and the risk premium. The risk-free rate is basically just the rate of return on Treasury bills. The risk premium is an additional rate of return to compensate the lender for the risk of issuing the mortgage. The risk premium currently covers two significant risks: interest rate risk, the risk that interest rates will increase in the future, and default risk, the risk that the borrower won't repay the loan. This cramdown legislation will let banks know that in the future they will also need to account for a third risk: legal/legislative risk, the risk that politicians will change the law to modify existing contracts. This added risk will mean a higher risk premium, and thus higher mortgage rates.

President Obama's cramdown legislation is an example of irresponsible existing homeowners getting a bailout at the expense of future homeowners.

Update: The problem is not the specific cramdowns that Obama is proposing, nor cramdowns in the past. The risk is the precedent that is being set by having politicians coming in and modifying existing contracts. Banks now have to worry more that any of the terms of a mortgage that they issue may be changed, at the whims of politicians, in favor of the borrower.

More REO auctions

As you've probably seen on TV, Real Estate Disposition Corporation (REDC) is having another auction of bank-owned homes in the Washington, D.C. area. The homes are available for inspection this weekend. They are mostly in the outer suburbs. The auction itself will be held on March 12, 14, & 15. You can request a brochure here.

For readers from places other than the D.C. metro area, the full calendar of auctions throughout the U.S. is here.

Update: It appears that REDC auctions are a scam.

For readers from places other than the D.C. metro area, the full calendar of auctions throughout the U.S. is here.

Update: It appears that REDC auctions are a scam.

Monday, March 02, 2009

Sunday, March 01, 2009

Subscribe to:

Comments (Atom)