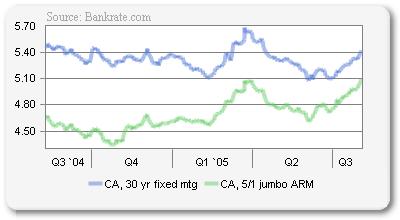

Notice how the difference in interest rates is narrowing. Hopefully, the allure of these Adjustable Rate mortgage Loans will wane.

Bubble Meter is a national housing bubble blog dedicated to tracking the continuing decline of the housing bubble throughout the USA. It is a long and slow decline. Housing prices were simply unsustainable. National housing bubble coverage. Please join in the discussion.

Higher rate is not necessary to burst the bubble. However, I do welcome more rate hikes.

ReplyDeleteI thought 5/1 ARM is passe. Everybody is using Option ARM now.

I agree 100% that 'Higher rate is not necessary to burst the bubble.'

ReplyDeleteHigher rates make a housing bubble pop more likely sooner.

I know this is a it off topic but none of the blogs have mention the reintroduction of the 30 year T-bill. While this wasn't a secret it does spell that the goverment want to finance its hugh war debt with the longer term. I truly beliveve that they ressurected this bond to drag the 10 year out of it's "conundrum" position. I also believe that this is a calculated effort to deflate the bubble and maybe encourage savings. I have read other blogs that state that savings by US citizens would only add to a "world Glut " of savings. I disagree.. China, Japan etc have excess $$$ because of our excess consumption for there cheap products...I think we our priming our economy for a correction that few can remember..ie 1980's type of recession.. 30 % percent of the population simply can't remember this type of economic downturn...

ReplyDeleteJohn