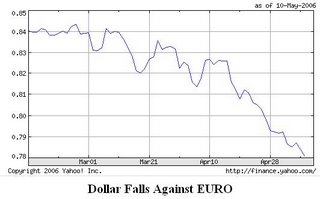

The dollar has been declining against a basket of foreign currencies over the past few months.

The dollar has been declining against a basket of foreign currencies over the past few months. How will a declining dollar affect the US housing market?

Bubble Meter is a national housing bubble blog dedicated to tracking the continuing decline of the housing bubble throughout the USA. It is a long and slow decline. Housing prices were simply unsustainable. National housing bubble coverage. Please join in the discussion.

OT - Ad for Mica condos in today's Post Express. Prices are now from the upper $200's. Wasn't it the low $300's just a couple of weeks ago? Also, "up to $20k towards closing costs" and "free plasma."

ReplyDeleteLooks like the $1,500 in gift cards just wasn't cutting it.

John, how much do you pay to rent in Clarendon?

ReplyDeletebryce

Weaker dollar means higher prices, for all asset classes, including homes.

ReplyDeleteWeaker dollar means the Chinese Central Bank will re-consider buying those US dollars. Fewer currency purchases from foreign banks mean serious trouble for the economy. Interest Rates will climb steadily for mortgages and non-housing loans. Liquidity will begin to dry up for investment and mortgages. Housing prices will take a further tumble.

ReplyDeleteIt's beautiful!!!!

I suspect that these folks don't read this blog:

ReplyDeletehttp://money.cnn.com/2006/03/22/pf/millionaire/turner/index.htm

I suspect that those folks didn't use an interest only loan consuming 40+% of their income to purchase their upgraded home...

ReplyDeleteMy $0.02.

So, do bubbleheads feel a twinge of jealousy or hatred when they see people like those at money.com; those who make sound financial decisions, have an admirable positive net worth, own a home and STILL seem to enjoy life? (and are young to boot)

ReplyDeleteCan't be many people like that in the world, can there? Nah. 'specially not in the DC area....

bryce

I'm done with this blog. All it focuses on now is the obsessive desire to see the real estate market crash and the misery that would cause to people. There are enough sour grapes here to open up a fruit store. Goodbye. Thanks, but no thanks, for all the desires for economic misery. I'll take my browser elsewhere for less biased and more informed housing opinions.

ReplyDeleteweak dollar has bernanke running for cover..of course that means he has to raise rates..of course that means the new home owners w/ ARMS as well as helocked ones will be rammed even more..

ReplyDeleteand that will reduce import bill..and that will reduce trade deficit..and that will bolster dollar..So recession---->cure excess ----->stabilize dollar. End Game.

Off topic, but I love people who announce to everyone they have "quit" reading the blog. As though it matters. There are millions of blogs out there, and you should read the ones you like.

ReplyDeleteSo read it. Don't read it. No one effing cares.

Although I enjoy engaging in Schandenfrued (sp?) as much at the next guy...I think some folks are going to get really burned including some friends. I had a friend who just walked away from a $5000 deposit on 1 bedroom condo. Good move that he cut his loses but the fact is I warned him. I must say though that being able to say "I told you so" doesn't feel as good as one might think.

ReplyDeleteWeaker dollar means higher prices for everything we import.

ReplyDeleteFrom Oil to Chinese goods. Will increase inflation.

Bernanke raising interests will most likely not help

stabilise the dollar. It will break the back of the US

economy though.

That combined with housing bubble busting, a weakening

economy. Could prompt foreign investors to pull back from

the stock market and other US/USD assets. That will

only accelerate the unwinding.

Bryce,

ReplyDeleteJealousy of a successful couple has more to do with the individual that's jealous. It's not an issue that rising or sinking home values will fix...

My $0.02.

Dumbass from above wrote:

ReplyDelete"So, do bubbleheads feel a twinge of jealousy or hatred when they see people like those at money.com; those who make sound financial decisions, have an admirable positive net worth, own a home and STILL seem to enjoy life? (and are young to boot)"

A pharmceuticals sales rep and a software engineer. Of course that charming young Republican, corporate couple is going to make boat loads of money. They should make enough money to donate funds for future Republican campaigns.

You know what's funny? You don't read Money magazine articles about struggling working class couples trying to save and invest their dollars. You can add public sector employees to the equation as well.

Money magazine chooses to ignore the fact that a significant portion of American families are struggling with housing costs, medical bills, education costs, and tons of taxes heaped on everything.

Are you saying there is nothing here that points to Envy?

ReplyDeleteDo you recall about a week ago when a bitter renter was trying to impress us with stories of eating lobster and creme brule on a regular basis? (yuck, and yuck.)

Someone invoked Schaudenfreud today in another thread on this site; saying they "enjoy it".

I submit that Envy/Schaudenfreud is an underlying motivation for many who are cheering for a national economic disaster. If you are here for strictly academic purposes (a perfectly reasonable expectation), I suggest transfering to another academic community - because the cheerleaders here have lost their objectivity.

It is one thing to recognize a problem or three with the economy (including over-inflated housing price increases) but it is quite another to lose one's objectivity and then devote emotional energy to hope of future suffering on the part of other people.

Full disclosure: I practice Schaudenfreud when it comes to people who's lives revolve around cars. Can't gain access to food or a salary without driving? HAHAHAHA! I love it. Gas prices climbing? I love that too. Living a sedentary life with high bloodpressure because you are trapped in your car? I LOVE IT SO MUCH THAT I INVEST IN HEALTHCARE COMPANIES. The obesity epidemic is an economic engine. (pun intended).

So, in a sense, I'm speaking from practical experience. :-)

bryce

MyTwoCents,

ReplyDeleteMy problem with Money.com articles is that they paint money with happiness. Affluence brings joy! Flipping properties for a quick profit is bliss!

Unbelieveable.

I'm happy that I am still renting in this bubblicious market!

"Money magazine chooses to ignore the fact that a significant portion of American families are struggling with housing costs"

ReplyDeleteYou are preaching to the choir, sonny. I'm a bonafide blue-collar working class rust-belt kinda guy. The first in my family to go to college, and I'm going to finish paying off my student loans this year. I paid for grad school *out of my own pocket by working while attending*. Imagine that.

Welcome to America. The good, the bad, the ugly, and the indifferent. Optimize your own life instead of whining about what woulda/shoulda/coulda happen if only "The Man" wouldn't keep you down all the time.

Oh, and tell your relatives to give their homes back to the working class Italians and Irish who owned them originally. M'kay?

bryce

my rent in Clarendon was $634/mo last year, the landlord upped it $100/mo this year but that increase is split between 3 people sharing a 4 bedroom/2 bath house in Lyon Village. Good stuff, beats throwing 3Xs that amount away in interest "renting" a mortgage for an asset that won't appreciate for another 7 years.

ReplyDeleteBryce - You post on this site regularly. You point out that a lot of folks here engage in schedenfreude..well duh!...are you just figuring this out. I think everyone has financial interest in how this plays out and no one is really objective. At least the agenda of folks on the blog is out in the open as opposed to the MSM.

ReplyDeleteinteresting about the rent increaes.

ReplyDeleterents seem to be going up.

Bryce thinks we should act like a submissive sheep while the country is falling apart around us.

ReplyDelete"Ba..aa..aaaa.aaaa.aaaa".

Your sheepherder (George W. Bush) is calling you Bryce. "Baaaa.aaaa.aaaa".

bacon,

ReplyDeleteyou're living the dream buddy! I bet you can't wait until you grow up and live like a self-actualized adult, can you?

Now go put one of your baseball hats on backwards and talk with your buddies about next year's basketball season.

bryce

DC Bubble,

ReplyDeleteRents are definitely going up! Why? Because people are scared of investing in condominiums and townhomes in this inflated asset market. More people are choosing renting for now. Supply & demand calls for the apartment management companies to jack up rents.

Also, electric utility rates are about to be de-regulated for Maryland. I live in a utilities-included apartment building and my rent up 8 percent. The PEPCO bills are being passed down to the tenants. Ouch!

Ha! I really am laughing out loud. I have a visceral dislike for George W.

ReplyDeleteI didn't vote for him. I honestly think that he is the worst president. ever. period.

But you go on beleiving that I'm a cookie-cutter yuppie republican if that makes you feel better about yourself.

now go tell your relatives to give their property back to the Native Americans who owned it originally. M'kay?

bryce.

"bacon said...

ReplyDeletemy rent in Clarendon was $634/mo last year, the landlord upped it $100/mo this year but that increase is split between 3 people sharing a 4 bedroom/2 bath house in Lyon Village. Good stuff, beats throwing 3Xs that amount away in interest "renting" a mortgage for an asset that won't appreciate for another 7 years.

"

LOLOL! Yeah, you live with 3 other people because you prefer not to own your own home. Ok, buddy! Maybe I'll move back in with my parents because I'm afraid of the bubble monster!

I live in a utilities paid building, and there is no way my rent was raised enough to cover utilities. My rent is up only 20 bucks this year. They are offering great deals to new tenants as well. The real cost of renting in my building is definitely down.

ReplyDeleteA Redskins fan

"I live in a utilities paid building, and there is no way my rent was raised enough to cover utilities. My rent is up only 20 bucks this year. They are offering great deals to new tenants as well. The real cost of renting in my building is definitely down."

ReplyDeleteIt will be WAY up next year.

Please folks. Don't do macroeconomic analysis about what other countries will do with their currency reserves using blanket statements.

ReplyDeleteSimple fact is that the only country driving the world economy right now is the United States. A hint of a recession will NOT automatically result in China and other Asian nations buying less dollars. They export to the US to drive their economies. Without US markets they are net importers. China cannot afford to allow the Yuan to rise against the dollar otherwise they lose that advantage and manufacturing will shift to Vietnam/Cambodia/The next dirt cheap country with worthless currency and cheaper labor. Shift the manufacturing to other countries and that reduces China's GDP growth. As a result, millions of rural peasants looking for city jobs start getting even more pissed about the economic disparity between them and the communist party elite.....

Stick to the local observations. Trying to figure out the timeline for real estate market decline is tough enough. Trying to figure out macroeconomic policies of other countries that have different objectives and mentality to your own? That is an exercise in folly.

"Stick to the local observations. Trying to figure out the timeline for real estate market decline is tough enough. Trying to figure out macroeconomic policies of other countries that have different objectives and mentality to your own? That is an exercise in folly. "

ReplyDeleteAnd if gives quite an indication of the minds at work on the bubble hypothesis. Everything on this blog should be taken with a major grain of salt.

$634 is a steal in DC. I'd take that in a second. Not because I can't afford more, but because I have no intention of staying in DC more than 4 years, and I hate to spend too much on a place to live.

ReplyDeleteBut rent is going up. My last landlord, upped the rent $100 because she said housing prices were increasing. I bailed on her and found a cheaper place to live. She also told me she had trouble renting the place out after I left, but she finally found a nice couple to take my place.

My take: until housing starts to depreciate, and until all these speculative condo owners start renting out their condos, rent in DC is going to continue to rise.

Redskins Fan,

ReplyDeleteWhere do you live?

"My take: until housing starts to depreciate, and until all these speculative condo owners start renting out their condos, rent in DC is going to continue to rise. "

ReplyDeleteYou mean unless. Those condo owners can, by in large, afford them. Contrary to myths perped on this site, yuppies make a lot of money and need places in the city to live. There will always be more than enough buyers for that sort of thing in DC.

In response to PTT:

ReplyDeleteThe United States is the world's consumer of last resort. Guess what? That ain't gonna last forever. If the American economy sinks into recession, China and India are in trouble. That means fewer Americans can buy their manufactured goods. American corporate revenue takes a hit and Chinese workers get laid off.

I think our negative account balance speaks for itself. We consume more than what we produce. It's that simple.

"Affluence brings joy!"

ReplyDeleteHealth brings joy, kiddo. If you don't beleive me, step in front of a moving bus today and then come back here to tell me all about how happy you are despite being hit by a moving bus.

Everything else, including money and a roof over your head, takes a back seat to health.

That goes for emotional health, too, ihateyuppies. So will your folks ever join the ranks of distinguished ethnic groups like the Italians or the Irish - those who tended to work their way into the middle class en masse? Or is the "The Man" always gonna keep ya down?

bryce

Very true. Yuppies in DC make boat loads of money. The bulk of yuppies come from the legal profession in DC. Overpaid lawyers. Bleh.

ReplyDelete"Baaaaa.aaaaaaa" Bryce is saying something. What are you saying Bryce?

ReplyDelete"Baaaa.aaa.aaaa.aaaa, there's no housing bubble".

Oh.

"Baaaa.aaa.aaaa.aaaa, everything is great because we live in America where everyone can be rich"

Bryce, your sheep herder wants you back in your expensive, over-valued barn.

"Baaaa.aaaa.aaaa, you bubble heads are ruining my property value!"

another update on rents rising...

ReplyDeleteSheffield Court is now charging approx 1600/mo for 1BR, but they're one of the few true pet-friendly rentals so they have a nice emotionally-attached niche to exploit. that's up about 400/mo from when i last checked them out 2 years ago.

"Very true. Yuppies in DC make boat loads of money. The bulk of yuppies come from the legal profession in DC. Overpaid lawyers. Bleh. "

ReplyDeleteYep, and god bless us everyone. I'm 29 and I make enough for 2 overpaid lawyers. Hahahaha!!

My rent in 2001 was $863.

ReplyDeleteMy rent in 2006 is $1,193. An increase of 38 percent over five years. That's definitely more than the CPI. It's more than my salary increase in five years.

Still. Renting is better deal than buying a condo right now.

Very poorly stated and un-persuasive, ihateyuppies. You don't even appear to comprehend what I've written, yet it upsets you.

ReplyDeleteThat fact that you are upset by what I've written is a sign of your own shortcomings, not mine. Maybe someday you'll understand that, and you'll be a better person for it. :-)

bryce

Once again another blanket statement from a welfare liberal.

ReplyDeleteLet me see, in the last US recession, what happened to China's GDP growth? Was it growing? Yes. Why? Because Americans love their cheap goods from Walmart. Why were those goods cheap? Because the Chinese government propped up the US dollar with their billions in reserves in order to sustain growth.

Will it happen this time around? Who knows? I'd open an everbank currency account if I knew the dollar was going to plummet like a rock. Double my money with a couple clicks of the button.

Stick to just hating yuppies, your macroeconomic analysis is shoddy at best.

I know a lot of lawyers and only a few are lucky (or unlucky if you don't like putting in a lot of hours) enough to work for blue chip law firms that pay the big bucks. Those firms are pretty selective and I don't think they are driving condo prices. Easy credit and the expectation of future price increases is driving prices more than anything else IMHO.

ReplyDeleteI can't wait until the rents increase 60-80% in the next few yeas. All economic indicators show big, big rent increases. Nobody will be able to afford their rent anymore. All the bubbleheads will be homeless, cold, and hungry. Then the bankruptcies will start. Yea! I hope that the government will let them suffer, I don't want any of my tax dollars going to anyone who made bad financial decisions. I'm shivering in anticipation to see all of this suffering.

ReplyDeleteOh wait, I'm sorry, I forgot, nobody here takes joy in human suffering here.

"I know a lot of lawyers and only a few are lucky (or unlucky if you don't like putting in a lot of hours) enough to work for blue chip law firms that pay the big bucks. Those firms are pretty selective and I don't think they are driving condo prices. Easy credit and the expectation of future price increases is driving prices more than anything else IMHO."

ReplyDeleteBut, oddly enough virtually every lawyer I know makes what I make (or more, if they're senior). There are many many such lawyers in DC:

http://www.infirmation.com/shared/insider/payscale.tcl?state=DC

There have always been highly paid lawyers in DC. So that doesn't explain why housing has appreciated so much in the last 5 or 6 years. What has changed in DC in that time to cause the increase?

ReplyDeleteThe answer is low interest rates, loose mortgages and speculative buying. Can this continue?

Honestly, no one really knows. But having watched the Tech Bubble burst... I'm betting it doesn't last.

"There have always been highly paid lawyers in DC. So that doesn't explain why housing has appreciated so much in the last 5 or 6 years. What has changed in DC in that time to cause the increase? "

ReplyDeleteThe local economy has grown exponentially, and lawyers' salaries (particularly young lawyers like me who have a need for condos in the city) have grown substantially during that time.

"Honestly, no one really knows. But having watched the Tech Bubble burst... I'm betting it doesn't last. "

ReplyDeleteSame dopey reasoning that drives this whole site. "The NASDAQ collapsed, therefore housing prices will collapse." That's some analysis, boy!

Same dopey reasoning that drives this whole site. "The NASDAQ collapsed, therefore housing prices will collapse." That's some analysis, boy!

ReplyDeleteTrue.

But you're not convincing that it won't. I guess we'll see.

Whoever posted that money.cnn.com article obviously doesn't read their articles on a regular basis. Money.cnn.com is one of the sites that has been warning of a housing bubble in recent years. It is one of the best sites for financial news.

ReplyDeleteA falling dollar doesn't mean recession, it means inflation. When the dollar falls, American made goods become cheaper to foreigners, so they buy more of them. At the same time, foreign made goods become more expensive to Americans, so we buy less of them.

"There have always been highly paid lawyers in DC. So that doesn't explain why housing has appreciated so much in the last 5 or 6 years. What has changed in DC in that time to cause the increase? "

ReplyDeleteNice try Catalyst. But responder above is correct. Lawyers' salaries have doubled during this time, and there are tens of thousands of lawyers working in DC.

The legal market in DC is one of the biggest if not the biggest economic private sector engine in DC. I'm not suggesting that real estate appreciation is the direct result of the massive increases in lawyers' take home pay, but any serious analysis of the current real estate narket would have to consider the impact of the continual and substantial pay to the tens of thousands of lawyers working in DC. Dismissing this, as you did, is right in line with much of the *analysis* that is characteristic of this blog, i.e., focusing only on information that supports the desired bubble burst, and ignoring-or dimissing-all other information.

"The local economy has grown exponentially, and lawyers' salaries (particularly young lawyers like me who have a need for condos in the city) have grown substantially during that time."

ReplyDeleteHow many condos do you own? Most lawyers I know own at least too or three....if they're succesful that is.

"lawyers' salaries (particularly young lawyers like me who have a need for condos in the city) have grown substantially during that time."

ReplyDeleteThat's not true. The last time firms really raised salaries was during the dot.com era. I'm a lawyer, 5 years out. When I graduated in 2001, starting salaries were 125 (and had been since 2000). They were still 125 until just a year or two ago, and then only at the very top firms were they raised to 135. The bonuses were pretty good, for the most part, but salaries did not only NOT grow substantially, but barely. Just this year, some major law firms raised salaries, but in doing so stated that bonuses would be lower, and that they no longer wished to operate their bonus systems like investment banks. So, a first year at a place like Skadden now makes 145 - 20 K more than 5 years ago, less than a 5% raise per year, but with the bonus decreasing, effectively makes the same as they did last year. The overall payout for the associate is about the same. Stagnation is what best describes legal salaries since 2000. And salary stagnation is certainly no reason for lawyers to be contributing to 200% price appreciation anywhere.

Lawyers' salaries have doubled during this time, and there are tens of thousands of lawyers working in DC.

ReplyDeleteI simply don't believe that lawyer's salaries have doubled in the last six years.

And there has to be tens of thousands more lawyers working in DC to explain the higher appreciation rates.

But again. Who knows? Maybe you're right. No amount of arguing on this blog is going to change housing appreciation.

Only increased inventory and decreased demand can do that...

....oh wait... that's what's happening.

Post express article on tuesday quoted median salary for starting lawyer was $55K. I am thinking this was nationwide.

ReplyDeletePrivate sector average was $80K

Public sector jobs $41K

Very high-end starting out was $150K

For those in the public sector they could not even afford their law school debt...

PTT,

ReplyDeleteKeep believing that Kool Aid propaganda that comes out of the Bush White House and the American Enterprise Institute.

The American economy is more vulnerable than you think and Wal-Mart won't save China's behind. Wages for Chinese workers will inevitably climb. More and more Chinese are getting college degrees and professional jobs. Manufacturing will begin to shrink and move elsewhere regardless what the central bank does in China.

Since 2001, the number of registered lobbyists have doubled in Washington, DC. With a Republican Congress and a Republican White House, the corporate lobbying has reached new heights. Big business is showering tons of money on attorneys who do heavy lobbying on the Hill.

ReplyDeleteThe lobbying industry is one reason why lawyers salaries are so attractive in the DC area. The salaries and bonuses for the partners have far exceeded the income growth for associates slaving away with the grunt work.

Regarding the money magazine couple, they are doing what they should - saving money. It is a little sad that people like these are so rare that it gets published in a national magazine.

ReplyDeleteWe are their same age and have less in savings (just under $150K) but my household operated on one salary for three years out of the 7 we have been married (2 of which were while my husband attended B-school), so I feel that we have done okay, but not incredible. We are fully aware it is our own retirement we are funding. (And don't even mention college tution etc.)

Regarding the couple's home equity - they have equity because they did what was smart - they SOLD when prices were high and I comend them for it. It served them well. It does not make them financial geniuses - they simply took advantage of an existing trend. And it was a wise thing to do.

"That's not true. The last time firms really raised salaries was during the dot.com era. I'm a lawyer, 5 years out."

ReplyDeleteThe problem with your conclusion is that you're only looking back 5 years, and you're not considering what happened 5-7 years ago.

When I graduated from law school (7 years ago) most large firms were paying 60-80k year, and the bonuses were about 5-10k per year. During 1999-2001, the time you aren't considering, firms had "salary wars." During those few years, salaries at many local large firms when from 60-80k to 110-120k, and bonuses went up as well, to 20-30k. Now salaries start at 135k.

It's true that salaries have stagnated during last few years, but if you look at the salaries during the relevant time, the time of real estate property appreciation, you'll see that salaries have in fact doubled or nearly doubled, depending upon your particular firm's bonus policy.

Disclaimer: This is not any financial advice to anyone.

ReplyDeleteMost of you have no idea about what money or wealth is.

Martin Wolf, in a recent article wrote thus..

"Where prices have risen far faster than underlying incomes, only two possibilities exist.

Either prices have moved to a higher equilibrium level, in which case future purchasers will have to save more and consume less. That would itself have significant economic implications. Or they have reached an unsustainable level, in which case they will fall in real terms. That would have far more significant economic implications."

Now think about that. Think more about that. You think you can make your million flipping and live happily?

Money is just not pieces of paper, my friend. Money is a claim against production. When Dick and Tom haggle about $100 in a trillion dollar economy, the outcome does not affect anyone else - but when a lot of Dicks and Toms argue about thousands, adding upto half a trillion, the outcome is not going to affect everyone.

And those who are prepared for the outcome will fare better

House prices are going to fall in _real_ terms. Whether you lose or not is going to determined by what price you bought. In general, I would say beware if you are using your house as a your main income or only retirement saving.

Even if you are cashed out, unless you are super rich, there are no guarantees. Whats going to happen to the economy (via Toms and Dicks) is what will determine whether your cash/investment is worth something later.

Going forward, other investments are going to rise _against_ _housing_.

Rents simple cannot rise faster than income (cant get 30 yr loan to pay rent).

If indeed rents rise, people will cut other spending, which will bit back via less economic growth. You might ask - does not the landlord get the money and spend it? Maybe - but it wont have the same economic effect. (Or in other words - why does Bill Gates getting a billion and 10000 Mac workers getting $100 have different economic effects)

Rents will track income in real terms, if supply and demand keeps pace. If there is an oversupply, they WILL fall in real terms. If there is an undersupply, they WILL rise in real terms. The landlord's cost has nothing to do with it - other than as a corrective mecahnism. Landlords who run losses will go bankrupt and 2 things can happen - either someone else buys the rental at a lower price which makes the low rent profitable, or the house gets pulled down, thus reducing supply and raising market rates.

Rents are determined by the market.

Real wealth is not money, it is not gold. Real wealth is owning something that produces a positive cash flow. Real wealth is investing in yourself, to keep upto date in a fast changing world.

Everyone is going to learn a few hard lessons. Wolf will be proved right.

Again,

ReplyDeleteI would love to see Money magazine featuring a working class couple saving money.

Oops...between the housing costs, taxes, and health care bills...there goes the take-home pay. So much for a feature article on REAL married couples struggling to save and invest this crazy economy.

It's easy to save money when you have a couple working two high-paying professions.

Spare me the yuppie worship.

Ok, so since 1999 law firm salaries may have doubled, but the crazy run-up in housing prices didn't start until 2003 (2002 at the earliest), by which time lawyers salaries were already stagnant. There is no reason then, based on lawyer's salaries at least, for the run up.

ReplyDelete"Ok, so since 1999 law firm salaries may have doubled, but the crazy run-up in housing prices didn't start until 2003 (2002 at the earliest), by which time lawyers salaries were already stagnant. There is no reason then, based on lawyer's salaries at least, for the run up. "

ReplyDeleteFirst, nobody said that lawyer salaries was *the* cause of real estate price appreciation. The point was that this salary increase could be a factor, and that all such factors should be considered as part of any serious analysis of what has happened to real estate prices (and also as to what will happen to real estate prices).

Second, DC real estate price appreciation began in about 1999. You can check the data on this here or many other places. Ihttp://localmarketmonitor.com/Sample/WashingtonPMSA.pdf In DC the price appreciation has been fairly even year over year since about 1999 to 2005, thus there wasn't any "crazy" price run up in 2003 much more than 2001 or 2004.

So what does this all mean? I suppose nothing to people who just dismiss this data because it does not support the presumption that real estate appreciation was nothing but speculation, and therefore there has to be a crash by 60%.

On the other hand, you could conclude that in about 1999 DC real estate began to appreciate, and during the same year, lawyers' salaries began to also increase significantly (more or less doubling since then). Again, nobody said that the lawyers were the cause of the big real estate price increase, but considering the number of lawyers here in DC, there may be a relationship.

Ihateyuppies:

ReplyDeleteIf you actually read Money magazine, you will find that they have had many articles like the one that you would love to see. They have focused on working class folks and how they scrimped and saved.

Perhaps you should actually read the magazine before commenting on the kinds of articles you'd love to see in it.

Similarly, Money has had an article in almost every issue for the past year looking into real estate prices and whether these prices can last.

Once again, these are the kinds of articles you say you'd love to see in Money. If you went out and read the magazine, you'd see that they have been doing these very kinds of articles for quite some time.

In other words, read before you rant.

It's pretty stupid to say that lawyers are the cause of the property runup. Are lawyers all across the country causign the price spikes as well?

ReplyDeleteHere's a better guess:

1. Low mortgage interest rates.

2. All sorts of new mortgage creations.

3. Tech bubble meltdown frightened people out of the stock market and into something more "secure" like real estate.

"On the other hand, you could conclude that in about 1999 DC real estate began to appreciate, and during the same year, lawyers' salaries began to also increase significantly (more or less doubling since then). Again, nobody said that the lawyers were the cause of the big real estate price increase, but considering the number of lawyers here in DC, there may be a relationship."

ReplyDeleteOk, now I want to know this - just how many lawyers are there in DC, making that money, and what is their percentage population wise? I just can't imagine that they have much of anything to do with home prices, especially if you assume that the younger lawyers spend a minimum of a year or two paying off their debt (most much longer),which even at a big firm does not leave much extra cash for purchasing a home.

The argument just seems akin to the "Wall St. money" argument people in NYC make.

There are a number of fundamental factors that drive the housng market prices in DC:

ReplyDelete- All the lawyers in DC make a bunch of money

- They are not making anymore land in DC (any land that is available is much too expensive to develop)

- All the government workers make a bunch of money too

- The Federal Government is there can never be an economic downturn

- Everyone loves the weather (wait that's FL nevermind)

Am I missing any factors?

"My problem with Money.com articles is that they paint money with happiness. Affluence brings joy! Flipping properties for a quick profit is bliss!"

ReplyDeleteAffluence doesn't bring joy, financial security does. Now, that could mean making a jillion dollars, or it could just mean living within your means. If a couple both got college degrees from state schools, paid off their student loans and held off having kids, does that make them yuppies, or just wise? Do you hate them then? If so, why?

Look, poverty is pretty terrible, don't get me wrong, but it's not like most people in the country don't have a way to get out of it.

When one talks about "what are the 25-year-old single mothers with 3 kids supposed to do?", well maybe they shouldn't have had 3 kids so young.

"Look, poverty is pretty terrible, don't get me wrong, but it's not like most people in the country don't have a way to get out of it."

ReplyDeleteDude, very few people can turn it around once they've entered into poverty. Some do but most don't. It takes money to make money. It takes money to go to college. It takes money to buy clothes for interviews. In addition, if you're in poverty chances are you were never put into a situation to develop the necessary social skills that most people from middle class families learn from their parents. Don't pretend that you don't owe the sucess you had to your parents and others in society that were gracious enough to give you a leg up.

KoolAid? Please. You spout nonsense like you are some economic genius but you are nothing but a babe in the woods wondering where is your mommy. You sound lost.

ReplyDeleteQuotes from the welfare liberal:

"If the American economy sinks into recession, China and India are in trouble. That means fewer Americans can buy their manufactured goods. American corporate revenue takes a hit and Chinese workers get laid off. "

"The American economy is more vulnerable than you think and Wal-Mart won't save China's behind. Wages for Chinese workers will inevitably climb. More and more Chinese are getting college degrees and professional jobs. Manufacturing will begin to shrink and move elsewhere regardless what the central bank does in China."

What is your point? If workers get laid off doesn't that mean wages get depressed so that it remains competitive? If there are more and more professionals doesn't that mean they have higher income and as a result generating domestic demand thereby insulating their economy from the US economy? So they won't be in trouble if the US goes into a recession? You wander around like a drunk hoping that eventually you'll make it to the bathroom. Are you sure you aren't drinking that spiked Koolaid?

I wonder if you are that same fool I met at a summer job many years ago. He kept telling me he was a financial advisor, but couldn't explain to me what area was his specialty. All he did was babble that he was a financial advisor while standing next to me in the assembly line. All you do is regurgitate crap and hope that one of the noodles in the vomit hits the mark and impresses your drunk buddy.

I'm pretty sure that the local real estate market is overpriced, but I'm also sure you aren't going to benefit from any price correction. You're too much the puffer fish, all air no substance.

Fritz,

ReplyDeleteMoney magazine is in the business of promoting participation in the capitalist system. Invest in housing. Invest in stocks. Invest in bonds. Unfortunately, only certain socio-economic groups can fully enjoy the benefits of investing.

Money is no different from other business/finance magazines.

BTW...the Money magazine "Best Places to Live" guide is the most useless study of regional living standards.

How much of Money magazine is dedicated to promoting capitalism versus non-editorial news coverage of business and finacial trends?

A reoccuring asserrtion by bubbleheads on this blog is that DC real estate appreciation cannot be explained by a rise in DC residents' income. Someone explained that lawyers working and living in DC have had huge salary increases. I always thought it was clear to everyone that there are a lot of lawyers here. But now people are saying, no, there aren't enough lawyers in DC to have any impact on the real estate market. What? So everybody knows there are a lot of lawyers living and working in DC, but this is forgotten when it doesn't fit your bubble model.

ReplyDeleteAt any rate, if you work and live in DC (which I presume those of you "experts" on DC real estate do), I am sure you know there are a lot of lawyers here. How many? I don't know for sure, but I read in a reputable publication that (don't have time to provide link) that 1/3 of white males who live in NW DC are lawyers. That's a large percentage of the potential home buyers here, and a group of buyers that could influence the market.

PTT,

ReplyDeleteFrankly, your posts about macroeconomics look very amateurish.

Pot...Kettle...Black.

Bye.

I dont own here I rent. So it makes complete sense for me to hope the realestate market tanks. That would be in my best interest. Am I a jerk for wanting the realestate to tank so I can buy a home. I am no more a jerk than the people who were rubbing it in everyones face about how much equity they have.

ReplyDeleteThe plain facts are this, if you stretched to buy a home, you have noone to blame but yourself. If the market crashes, you deserve to take a hit because you treated a property as an investment instead of a home. Anyone who could afford to buy a home at recent prices without stretching wont have any problems weathering a 50% decline in home values, cause they have a large enough salary to compensate for their actions.

It just wouldnt make sense for me to root for home prices to increase, just as it wouldnt make since for a homeowner to root for home prices to decrease. Neither sides are "jerks", or should have their "children molested", as one genious quote I read put it. What a idiot.

Full disclosure, BSME University of Wisconsin, MSE Johns Hopkins, gg-14 federal employee, no debt. I cant afford to comfortably buy a home anywhere within 40 miles of dc. I say afford, which is 3X my income cause anymore than that is not affording, its stretching. If prices dont come down I will just leave, like many others I work with said they would do. One other note, our agency is having trouble feeling engineering positions due to the high cost of living. People are turning down 14/10 offers to come here. FYI.

I went to Detroit on a business trip. During a lunch I asked one of my Detroit associates about real estate. He said real estate in Detroit had increased a lot because everyone in Detroit is in the auto industry and has large salaries. Sound familiar? Every town has its own myth to why prices have increased. Today's myth seems to be lawyers in DC drive housing prices. Tomorrow we will be back to not making anymore land or federal government workers. All these explanations are tired and don't address the root cause, which is lending standards and credit availability.

ReplyDeleteAnonymous Engineer,

ReplyDeleteWell stated.

btw...Can you find other federal engineering/technical jobs that suit your experience and knowledge outside of the Washington, DC region? For some people, their jobs are so specialized that it's tough to find new employment opportunities outside of the federal government.

With regard to the possiblity of tens of thousands more lawyers in recent years, that is exactly what happened. The number of registered lobbyists (lawyers) has increased from around 10,000 to over 30,000 in the last 5 or 6 years. All these lawyers have assistant lawyers who are not registered as lobbyists, but noneless relatively highly paid. While not all are necessarily based in DC the majority are.

ReplyDelete(my source for this info has been all of the articles about Tom Delay and his K Street Project)

Skytrekker, I believe in a third way when it comes to economics. You can't have complete Communism but you can't have unbridled capitalism either.

ReplyDeleteAnon at 12:02,

ReplyDeleteThat's a good post. I know there will be a correction in real estate prices. And I'd like you to afford a home you like too. I'm a homeowner, bought five years ago, and consequently have a lot of equity. Of course I don't want my home value to decrease, but over the long run I don't think it matters that much, so I'm not too worried.

This is off topic, but what amazes me is that so many people on this blog say things like "I want to buy a home, not an investment." Obviously this is an attempt to distinguish themselves from the flippers they vilify. But it’s total BS. The truth is that everybody wants to buy a house that is also a good investment. That's why many of the people on this blog have decided not to buy, because it doesn't make economic sense (in other words it’s not a good investment).

So please stop the double standards and the moral superiority, don't condemn flippers just because they purchased property as an “investment," and then attempt to cast yourself as superior to flippers because you want to buy a "home" rather than an investment. The truth is that everybody wants to buy property that’s a good investment.

Anon 12:21,

ReplyDeleteThere is a distinct difference between some on who is buying a home to make money or someone who is buying a home to live in.

You are correct in stating that,

"The truth is that everybody wants to buy property that’s a good investment."

However, my intention is not to make a killing, just to not lose alot of money and have more personal freedom than apartment living affords.

Ihate yuppies,

There are many federal jobs around the country that I kind transfer to, but I unfortunately started dating someone here! But, we both have talked about leaving the area if things stay out of whack as they are now.

The funny thing is that federal wages are only a few thousand dollars less in other areas. I thought the cola would be huge here, it is not.

Anon at 12:21 p.m.

ReplyDeleteIt pains me to agree with you. Even bubbleheads like myself want a decent return on my property some day.

"Today's myth seems to be lawyers in DC drive housing prices. Tomorrow we will be back to not making anymore land or federal government workers. All these explanations are tired and don't address the root cause, which is lending standards and credit availability."

ReplyDeleteThanks for sharing your undoubtedly accurate assesement of the problem. Certainly your myths are more accurate than any of the others.

Wait, is everybody here color blind, real estate analysis is only black and white, there's no possibility of a combination of a number of various factors driving the real estate market? Apparently not. Its only credit and lenders. Well at least the banks can take the blame instead of the lawyers (finally!).

Perhaps somebody tell David the blog can take a holiday, Anon 12:11 has solved all of the bubble mystery.

"There is a distinct difference between some on who is buying a home to make money or someone who is buying a home to live in"

ReplyDeleteI find this distinction to be an artificial construct, created by by bubbleheads, and utilized to further their agenda.

"I find this distinction to be an artificial construct, created by by bubbleheads, and utilized to further their agenda."

ReplyDeleteWhat is the bubblehead agenda? Just so I know...I must have missed the memo.

Flippers and landlords buy a home as an "investment". They don't buy it to live in. They buy it for someone else to live in.

ReplyDeleteHowever, I strongly suspect that the cap rates are too low in the DC area to make much money as a landlord. That's why so many apartment buildings are being converted to condos. That leaves just the flippers, most of whom probably don't even know what a cap rate is.

Re agenda, read a few posts, it should become apparent. But I'll try to summarize it for you:

ReplyDelete1. Renters deserve respect.

2. The real estate market will crash (this is not open to debate).

3. Anyone who questions no. 2 is a flipper, bagholder, or someother variation of a homeowner.

4. Bubbleheads do not question other bubbleheads' assertions re real estate market. For example, if a Bubblehead states that condo prices will drop at least 80%, only flippers or bagholders will be critical of such assertion.

5. Although all renters deserve respect for their choice to rent (see no. 1) renters may opt to buy real estate, but only in the future after the market crashes (see no. 2).

6. In the event a bubblehead owns real estate, or intends to purchase real estate, said bubblehead is to be distinguished from the flippers and other scum referenced in no. 3 because bubbleheads buy real estate as homes not investments.

7. Bubbleheads have superior analysis skills, thus they correctly predicted the real estate market crash before anyone else.

8. Bubbleheads may not discuss their failure to buy property during 1999-2001(and thus proft from the real estate run-up) because this failure would tarnish their self-described analysis and prediction skills described above.

9. Bubbleheads may take enjoyment in other peoples' suffering. Foreclosures, bankruptcies, ruined credit, and other suffering is accepted in the bubblehead society as certain people (see no. 3) getting what they deserve.

I may update as further details of agenda become known

Everyone wants to get rich quick.

ReplyDeleteIf that were possible, everyone would be rich.

When "the next new thing" rolls around, really lucky people are already there and make lots of $$$$$. Really, really, really, smart people were likely also there and make lots of $$$$$.

Normal smart people, see the developing pattern and get in quickly. They make a lot, but not lots, of $$$.

When everyone else starts paying attention, they want to make $$$$$ too. So they give it a go until $$$ declines to $$, goes down to $, and finally is no more...

This has happened in the past, is happening now, and will happen again.

My blog related opinion now:

I think we're on the turning point (the single $) in real estate because I observe people all around me, in the office, at the bar, in the airport, at a cocktail party, all discussing their latest strategy in housing. These are people who likely 3 years ago knew nothing about the industry, and today, still have full time jobs doing something else. They're far from dedicated to a job in the RE industry, they're novices all trying to cash in.

What concerns me are the every day people caught up in the frenzy. There are plenty of people who do only want to buy a house for the long haul. Will they pay too much? Will lenders convince them they are fine? That they can refinance for lower in 2 years with 40% appreciation? 20% YOY growth is just not sustainable...

My $0.02.

To all the bubbleheads who hate money.cnn.com and all the house-prices-can't-fall types who love it, today's headline article is "If you're a speculator ... get out now". The picture next to the headline is of a house inside a bubble.

ReplyDeleteFound this interesting post on another blog:

ReplyDelete"For all the property owners on this blog who are lucky enough to purchase your properties years earlier (good for you), just want to ask you 2 simple questions:

1. Can you afford to purchase your house, at its current value?

2. Would you repurchase your house, at its current value?

If "no" for either, how can you expect the housing price to keep at present level?

I'm so tired of the cliche name of "bitter (mean) renter", or the same-old assumption of being chicken 3 years ago not buying when price was low. Were the property price at the same level as three years ago with moderate appreciation (about 5-6% per year), I would buy in a heart beat.

Homeowners, assume yourself just finish your college study and find a decent job, or just get married, or simply want to upsize because of growth in family size now, and suddenly face with such out of basic property prices, would you buy? So because some people were born 3 years later, or got married 3 years later, or had child 3 years later than you, they got punished for unreasonbale property prices? Isn't that what you are indicating? Speaking of mean spirit, isn't homeowners' wish of sustaining current property price sort of mean spirit also?"

Guess it at least means:

1. Not all Bubbleheads are Chicken Little 3 years ago as assumed by HousingHeads.

2. HousingHeads also take enjoyment in other peoples' suffering.

This kind of debate can go on and on, and only time will tell.

great posts today...

ReplyDeletewhat i've gleaned is that for prices to drop we need:

1) tightened lending standards

2) a killer virus that only attacks lobbyist-lawyers

and the only immutable truth is BH and HH get along like jews and muslims in the middle east.

coincidentally, the above 2 factors will stop moral decay in America and cure rickets in Hungary.

I am glad to see ihateyuppies hijacking the housing bubble blog into a discussion of the ills of capitalism. Of course, the irony is that the housing market will, in fact, fall, if free markets are allowed to operate unfettered and will only be propped up with governemnt support. I believe this leaves some of you with some good ol' cognitive dissonence.

ReplyDeleteDaivd, I love your blog and agree with the bubble, but you do yourself no service by having most of the action take place on the comment threads like this. I have sent a couple of people here to check it out and their uniform reaction has been, intersting posts but the commentors are verging on sociopathy.

I agree with anonymous 1:37PM. The free market is self-correcting. Also, there is a lot of stupid stuff being said on both sides in this comment thread, but that is no reason to stifle free speech.

ReplyDeleteBy the way, while we're all busy discussing whether house prices will fall, has anyone noticed the stock market today?

>"There is a distinct difference between some on who is buying a home to make money or someone who is buying a home to live in"

ReplyDelete>

>I find this distinction to be an artificial construct, created by by bubbleheads, and utilized to further their agenda.

>

There is a distinction. You are wrong.

Housing is a consumption good. And in fact, housing returns, in real terms have been pretty low for all history, except for manias.

People who do not buy now are not making an investment decision - they just think that the service the house provides - housing - is not worth the price.

Cost of housing = carrying costs/yr - amortized(sale price - purchase price)yr

See the last part i.e. (sale price - purchase price)/yr. The amortized increase or decrease in housing cost?

You think that's an investment factor.

But in reality it is a cost factor for those who look at housing as an expense - that is those who need to live in their house.

There are those who dont want to live in their house (and also for some who live in their house), or who think they'll make money off the house. They just think that the cost of housing will be negative, that they'll get money living in a house or buying and keeping/renting the house

To do that, you'll have to have

--negative carrying costs ie. rent > expenses

--profit on sale (until you sell, there's none of it)

The first is way most landlords make most of the money. And since carrying costs are based on interest ( a % on purchase price) and rent, buying at the right price and market value of rent is key.

The second is hard, in real terms, and is mostly driven by purchasing low. Temporary aberrations can cause the second to generate money too. But mostly that just means that someone else got screwed. And these aberrations will extract their cost. You might have a lot of "money" for a short time, but the economic hemorrage will bite you. Money does not have meaning outside of the claims on production it can make.

Houses dont generate wealth. Its that simple. Otherwise all we have to do is buy a house, live in it, and sell it every 2 years. Or to make more money, buy more houses. [In fact we as a country are going to realize this idiocy soon - instead of investing in R&D or production, which generate wealth down the line, we have invested in houses]

What asset manias do is tranfer wealth between people. (ala Ponzi)

And the people who got in and got out first take money from those who did last.

And given the economic cost of the mania, unless you are a very, very big fish, even if you got in and got out first, you would not make anything. It can make you feel wealthy temporarily - just temporarily.

Really, you guys need to get educated. You need to _understand_ the word "wealth"

TANSTAAFL

Anon 1:37 p.m.

ReplyDeleteLast time I checked, we have freedom of expression in this country. The commentators will go off on tangents. Some commentators have zany ideas about real estate or the economy in general. So what? If you want hard-core analysis of real estate economics, go read an academic journal.

Furthermore, the fact that I cannot afford a decent place to live in the Washington, DC metro area, is an emotional issue. I am tired of housing heads denying that there is a fundamental problem with the real estate market.

"Daivd, I love your blog and agree with the bubble, but you do yourself no service by having most of the action take place on the comment threads like this."

ReplyDeleteThanks for the compliments. The amount of comments have exploded on this blog.

Still trying to figure out what to do regarding comments.

"I have sent a couple of people here to check it out and their uniform reaction has been, intersting posts but the commentors are verging on sociopathy."

A few of the commentators are 'verging on sociopathy." Agrees

The bubblehead agenda above is absolutely PRICELESS!!

ReplyDeleteIt really does sum up a lot of the childish commentating on this site.

ihateyuppies said

ReplyDelete"[t]he fact that I cannot afford a decent place to live in the Washington, DC metro area, is an emotional issue. I am tired of housing heads denying that there is a fundamental problem with the real estate market."

Methinks the poster doth protest too much. If you actually believed in your arguments, why would it be an emotional issue? Instead, you should be thankful that you rent, and await the correction with the certainty of the true believe. That you get so worked up over it makes it appear as if, instead, you are worried that the train has left the station without you on it, at best, or are a deranged lunatic, at worst.

epictetus is so wrong for so many reasons, I could never get to all of them. I will point out that the U.S. is not on the gold standard, so foreigners can't go to the U.S. Treasury and say "give me gold in exchange for my dollars." Besides, even if we were on the gold standard, they'd be going to the wrong building. Our currency is printed by the Federal Reserve Bank, not the Treasury Department.

ReplyDeleteRegarding the real estate market, everybody knows that to invest wisely you need to "buy low and sell high". So I ask everyone, are housing prices today low or high?

>If you actually believed in your arguments, why would it be an emotional issue? Instead, you should be thankful that you rent, and await the correction with the certainty of the true believe. That you get so worked up over it makes it appear as if, instead, you are worried that the train has left the station without you on it, at best, or are a deranged lunatic, at worst.

ReplyDeleteThats right. Most of the myths about owing are just that - myths.

Rent a place for your needs. Renting is not throwing away money. Not at current house prices. Let the landlord pay your housing costs. After all if houses are really worth these prices, and rents are not in line with owning costs, making the landlord pay the difference is a good deal.

Really, in this market the landlord is paying you. That's what my landlord is doing for me. I'm happy :-). I'll renew the lease for yet another year - maybe I'll let home tack 3% this year, last year I only agreed for 2%. Its a competitive market.

And I can buy cash down - but I dont see why.

Oh boy here we go. The housing bubble is the fault of the Fed, and the Rothschilds....bubblemeter.blogspot.com, meet Mr. Shark.

ReplyDeleteEpictetus, I'm not going to read all that!

ReplyDelete"

ReplyDeleteOk, now I want to know this - just how many lawyers are there in DC, making that money, and what is their percentage population wise? I just can't imagine that they have much of anything to do with home prices, especially if you assume that the younger lawyers spend a minimum of a year or two paying off their debt (most much longer),which even at a big firm does not leave much extra cash for purchasing a home."

My loan payments are $1400/month. I take home $3300 every two weeks (not counting 401k contributions). I am typical.

"I cant afford to comfortably buy a home anywhere within 40 miles of dc."

ReplyDeletepwn3d

>I'd be astonished to learn that you aren't a eunich.

ReplyDeleteSorry, my friend. I am not going to enagage with you on that here. I dont feel that its any of your business. You can talk all you want about that .. please do to your heart's content. (Although david may not like it.)

If you feel like a winner if you conclude that I'm an eunuch ... go ahead, be my guest. ;

You see, none of your words can hurt me, neither can my words hurt you.

Whatever you did to yourself is what will hurt you.

Winners are people who learnt from their past losses.

Perhaps, your irritation is because your math does not work out? Dissing me is not going to change the principles of arithmetic, you know.

Good luck. :-)