Check out the

Live Housing Economics Chat on WashingtonPost.com. You can submit questions. It started at 12pm EST 4/5/06.

My question got answered :-) :

Silver Spring, Md.: Check out this image of 47 lockboxes attached to a bench at the Halstead at Dunn Loring. This is a new condo building with 220 units. This place is infested with speculators and flippers trying to sell. http://bubblemeter.blogspot.com/2006/03/bubblicious-bench-flippers.html

Don't you think that prices for condos in the DC area will fall significantly given all the speculators trying to sell?

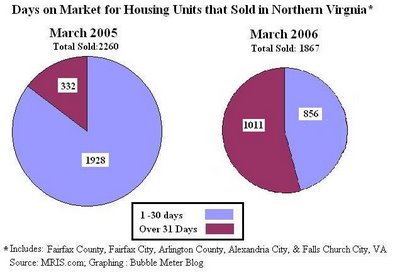

Neil Irwin: This is a pretty remarkable photo. It is a rather vivid illustration of just how much the market has shifted from a year or two ago, when you read of people lining up by the hundreds for chances to buy.

There is clearly immense supply of condos out there now. Whether this means condo prices will actually decline depends primarily on whether individual owners and developers drop their prices to a market-clearing price, or hold out indefinitely waiting for buyers. I have a colleague who bought a well-located D.C. condo in 1988, I believe, and sold it in 1998 for $10,000 less than she paid. Many buyers in recent years have done so without understanding that there can be long down or flat cycles in real estate, in addition to periods of extraordinary appreciation.

Here are some interesting questions asked by others:

Washington, D.C.: We are in our mid 20's and looking to buy our first home. We realize that we could only afford a condo and want to stay in the city. We have been approved for far more than we can afford can actually afford monthly with a rate at 6.75% and 0 points. I am noticing a huge glut in condos and fear the condo market in D.C. will bottom out sometime soon. Are we at risk for buying an expensive 1 bedroom condo in the city to only lose money on it 4 years from now?

Neil Irwin: Are you at risk? Yes. Buying real estate for a four year time horizon, especially in the particularly volatile condo market, is by definition taking a significant financial risk, particularly given the leverage involved in making the purchase. That doesn't mean you shouldn't buy, it means you should only buy if you are prepared to take that risk, and will not be financially devestated if the condo market remains soft (or gets softer).

-----------------------------

Suitland, Md.: Your last response implies that 'over the next couple of years' the region will see further housing price softness. Would you explain why you hold that view?

Neil Irwin: That's not necessarily my view. My view is that there is real risk that the region will see furhter housing price softness, based on the way previous real estate cycles have played out. There's a reason they call it a cyclical industry.

I'd turn the question around though: What examples can you find from the past of real estate prices doubling or tripling in a seven year period, then having a slump of a few months and then immediately resuming a meteoric rise? If there are historical precedents for that, I'd love to hear about them. I'm not aware of any.

-----------------------------

Arlington, Va.: but DC is "different".

they aren't making anymore land.

the population is growing.

babyboomers retiring and buying second homes.

real estate always goes up.

so sayeth NAR chief economist David Lareah, has anyone noticed that economists and weathermen are the only jobs where you can make completely assinine predictions and still keep your job?

Neil Irwin: Another thought from a reader . . .

---------------------------

RE: Richmond: A lot of young professionals share housing with several others their age and find a way to save money on small saleries. You might suggest this to your son. This is what i did when I first arrived, and saved enough for 20% down on a condo (it also helps to save in other areas - like not going to happy hour every night).

Neil Irwin: More advice for Richmond

---------------------------

Arlington (Waverly Hills), Va.: I've been noticing that the doom and glommers are out in full force now that the housing market is starting to slow. I'd love to see an article in the Post that tracks some of the more prominent economic forecasts. Some economists / prognosticators continually predict a recession year after year. Then when one finally ocurrs, they say take credit for predicting it. What they don't take credit for is missing wildly on their forecast in the previous 10 years.

Neil Irwin: You're right that there are perma-bears out there in the economic analysis game. But I would argue that the same exists on the other side of the optimism/pessimism scale. There are a ton of analysts out there who have a rosy view of the future at all times. I most value the economists who are genuinely unpredictable and offer fresh analysis, and don't get locked into one prism through which to view the economy.

---------------------------

That is a small selected group of the most interesting questions asked during the

live chat session. The bubbleheads won this chat session. :-) Good job to my fellow bubbleheads in the metro DC area.

On Craigslist this 1br / den 1ba condo unit is available for sale:

On Craigslist this 1br / den 1ba condo unit is available for sale: