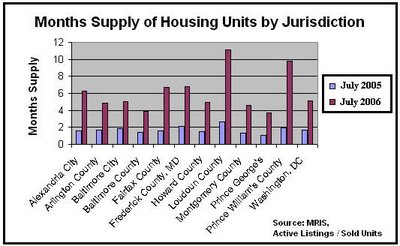

Months Supply of Housing Units by Jurisdiction: July 2006 vs July 2005

in selected jurisdictions in the Washington, DC metro area.

in selected jurisdictions in the Washington, DC metro area.

The months of inventory numbers are calculated from the MRIS. Months of inventory is calculated by taking the number of housing units available (active listings) and dividing that by the number of housing units sold during the past month. Generally, six months of inventory is considered a 'balanced' market between buyers and sellers. The months of supply during 2005 was really low. Now, in many jurisdictions across the Washington, DC area, the months of supply is returning to normal. Jurisdictions like Loudoun County, and Prince William's County face a glut of inventory

David,

ReplyDeleteFirst, welcome back!

Second, some of those numbers are scary, some are not. Interesting... Loudoun County is toast. If there at 10 months inventory in 2006 before we even acknowledge we're in a recession... ouch!

I find it interesting Washington DC has such high inventory.

Out of curiousity, do you know what the conversion rate is in the DC area from "pending sales" (what Realtors (tm) report) and closings?

In my area... ouch! Thornberg has split off of the Anderson School's report in order to remove the muzzle. I always thought he shot straight, but that his "official reports" seemed too sunny compared to his oral presentations... Now we know why.

http://www.latimes.com/business/la-fi-thornberg15aug15,1,4462297.story?coll=la-mininav-business&ctrack=1&cset=true

found on:

http://calculatedrisk.blogspot.com/

Neil

Gotta run! My realtor told me I better get my offer in on a Loudoun County property before they are all gone. He said they aren't making any more land and that immigrants are coming so fast that we're running out of homes or something like that...

ReplyDeleteWith that kind of inventory, we can all sit back for a long while and wait for prices to slam to the ground.

ReplyDelete"I find it interesting Washington DC has such high inventory."

ReplyDeleteThat's because all those ambassadors and Arnold & Porter lawyers are on the Cote d'Azur/Lago di Como/in East Hampton right now. Once they get back, that inventory will simply vanish. Lance: where will that leave a good, hard-working SES/GS-15?

Jerkstore

Folks, a dash of reality to go with the cheerleading:

ReplyDeleteThe July 2005 numbers were abnormal ; which, in some respects, is the very premise of this blog.

I have a question about this "months of inventory" statistic.

ReplyDeleteI'm a little suspicious of it, because I don't know how it's calculated.

How do they decide how many "months of inventory" are available?

What worries me is this. I don't know the numbers, so I am making these up. Say there were 1,000 sales a month in some jurisdiction in August 1992, and 5,000 homes for sale. So you say "five months of inventory."

Then say there are 2,000 sales in August 2006, and 10,000 homes for sale (perhaps because there is still flipper activity). Still "five months of inventory," but 5,000 more houses for sale than 14 years ago.

I don't know, but is something like that going on? I am asking, not theorizing, because I do not know.

A Redskins fan

"That's because all those ambassadors and Arnold & Porter lawyers are on the Cote d'Azur/Lago di Como/in East Hampton right now. Once they get back, that inventory will simply vanish. Lance: where will that leave a good, hard-working SES/GS-15?

ReplyDeleteJerkstore "

No, you're right. We all make $24,000/year like you, Jerkstore.

Go have another cigarette, jerkstore. In fact, have a whole carton of cigarettes today. What is your brand? May I buy you a dozen cartons of your brand of cigarettes? No, no need to thank me. I'll gladly provide you with all the cigs you can smoke.

ReplyDeleteI thought jerkstore's comment was hilarious! Why all of the anger? Is someone having trouble paying their suicide mortgage?

ReplyDeleteYeah, everybody who thinks Jerkstore's an idiot is on the verge of losing their home. it's not that he's repeated the same line 200 times.

ReplyDeletechriso finds jerkstore's comments to be insightful, useful, and non-confrontational.

ReplyDeleteThus, chriso's & jerk's comments stand, while anon's comment about how jerk keeps repeating himself and how not everyone is attached to a suicide mortgage, is deleted.

FIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeletedavid is editing the discussion to his liking.

ReplyDeletewe know his preferred outcome is "Gloom, not Doom".

So unless you have something gloomy (not doomy) to say, don't say anything at all.

FIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteDavid's preferred outcome is "gloom not doom".

ReplyDeleteHe will edit the blog to support his outcome.

So unless you have something gloomy to say, don't say anything at all.

FIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteHmmm...

ReplyDeleteLooks like we're exiting Denial and going into Fear.

Folks, fundamentals are going to show "Joe Sixpack" its time to stand on the sidelines... So if disrupting David's interesting blog is your only interest, prepare to be cut.

I can't wait to see the posts when we're in Desperation, Panic, and Capitulation.

Anyone who doesn't believe homes will return to fundamental based values is in for a rude awakening. We could do a Japanese 10+ year decline... I bet with all of the suicide mortgages we'll clear out the inventory *very* quickly.

Or for those who think prices will keep increasing in the "u-haul index"

$1,265 for a 26' truck from DC to Nashville, its only $475 the other way...

The u-haul statistic is very accurate for showing job directionality. Its saying jobs are *leaving* DC!

Neil

FIGHT CENSORSHIP

ReplyDeleteFIGHT CENSORSHIP

ReplyDeleteAnon 6:39 & gambling econ.,

ReplyDeleteAny idea what the historic inventory level is for Loudoun County, Va? Granted it was low in July '05, but 11 months seems like a lot. And that figure doesn't include the new construction that's not listed.

"Such anger. Decaf's the one in the orange pot."

ReplyDeleteTHAT was funny.

"

ReplyDelete$1,265 for a 26' truck from DC to Nashville, its only $475 the other way..."

Interesting.

Is she moving to DC, or are you moving to Nashville?

This is probably a waste of time, but David is not a government official & this blog is not a publicly-owned forum, i.e. he cannot be guilty of censorship. For those who disagree with his editing, I'm sure youi knwo the cost to start your own blog is a fairly reasonable...$0.00.

ReplyDelete"Any idea what the historic inventory level is for Loudoun County, Va? Granted it was low in July '05, but 11 months seems like a lot. And that figure doesn't include the new construction that's not listed."

ReplyDeleteIt varies by market, but 6 mos. seems rational. A place like Loudoun is exceptional because of its rampant growth over a number of years. Loudoun is an "exurb" of the DC market and is not entirely representative of "close in" DC.

Eastern Loudoun is going to see a significant decline in value (on the order of 20% down from today's prices), and I suspect that Eastern Loudoun will become more of a lower-income, working class area. (see what is happening in Sterling for a leading indicator)

I am completely guessing here, but from what I have seen in Montgomery County, a lot of the inventory even in some of these exurbs (Prince William and Loudoun and Frederick MD) may be townhouses and condos.

ReplyDeleteIMO, there is almost no lower limit, other than zero, for how low these types of properties could go. A plastic condo 50 miles of heavy traffic from the city center... what is the point?

Just my opinion, but if you're selling something like that, you better be selling it very cheap.

A Redskins fan

Holy GLUTSVILLE!

ReplyDeleteHow will the Highly ethical NAR repsond to this?

Simply reporting back to you the theory you espoused, Lance. "Rah rah rah AMBASSADORS rah rah rah EMBASSIES rah rah rah WILMER CUTLER ASSOCIATES MAKING $400,000/year rah rah rah GS-15s WITH NO KIDS rah rah rah INSTALLED BASE OF HIGH PAYING JOBS rah rah rah." I guess it sounds a little stale now that you're not saying it and the worm has turned, eh?

ReplyDeleteJerkstore

To a Redskin Fan,

ReplyDeleteYou ask a very good question about the month’s inventory statistic. When one “gets under the hood” of this metric, they will find very interesting things.

The chart depicts about an 11 month’s supply of existing home inventory (EHI) for Loudon County. How this figure is arrived at is uncertain as the methodology is not footnoted on the chart (as an aside, data depicted in charts should be transparent and easily replicable by readers).

By my calculations, there is an 8.9 month’s supply of EHI in Loudon County. Here is how the 8.9 month’s figure is calculated based on data from MRIS: active listings in July are 4,747; the average monthly sales or absorption for the last 12 months are 536; dividing the active listings of 4,747 by the average absorption of 536 means that it would take 8.9 months to work off the unsold EHI. The denominator for this ratio is paramount and can lead to widely different results. I think averaging monthly sales for the last 12 months is the appropriate way to measure absorption as it eliminates any seasonality. When sales are declining on a yoy basis, the month’s inventory ratio is probably understated and the converse would be true when sales are increasing due to the averaging.

For Loudon County, the 12-month trailing average for monthly sales of 536 in July is down from its peak level in May 2005 when the trailing 12-month average was 744. In May 2005, the month’s supply of EHI in Loudon County was 1.7 months. Hence, the month’s supply of EHI has increased more than four-fold (1.7 to 8.9) in Loudon County over the last 14 months. Needless to say, there is an inventory overhang in Loudon County and the 2.5 percent decline in median prices in July yoy is just a precursor of larger declines in the near future. As a side note, the annual sales activity in Loudon County in 2005 approximated nearly 10 percent of the housing stock in the county. The turnover ratio was probably higher as the stock figure of housing units comes from Census and they do not break SF homes from multifamily. This turnover of the existing stock provides a great measure of the fervor or bubble activity in this market as I think nationally only about 5 percent of SF homes are sold in any one year.

The national figure for month’s inventory published by the NAR is even more difficult to understand. There is no way to replicate the NAR figures. The NAR takes the current month's sales of existing homes and then seasonally adjusts and annualizes to arrive at the denominator. They do not disclose any of the seasonal adjustment factors. However, where the NAR gets sales and inventory figures from is even harder to understand, which should be easy since they control the listing services. Apparently, the sales figure is a combination of sales through listing services and NAR’s estimate of sales outside listing services (FSBO). Reportedly, the NAR did some benchmarking to Census data to arrive at FSBO or sales outside the listing services.

The work of the NAR is questionable and their reports are taken as gospel in the marketplace. For example, the Florida Association of Realtors reports total SF home sales of approximately 249 thousand units in 2005 http://media.living.net/statistics/2005/2005%20yr%20end%20chart.pdf; however, the NAR reports a sales figure in Florida that is 48 percent higher. It is very difficult to believe that many sales of existing homes occur outside the listing services. I learned of this sales calculation method directly from the NAR. However, they do not disclose this methodology nor do they provide details of the adjustments to Census data.

After learning about the sales figure, I sent a question over to NAR asking about the inventory figures – where do they come from?? This is critically important for the numerator of the month’s inventory figure. NAR has never provided any explanation of where the inventory figures come from. It appears that the sales figure is overstated, which would push down the month’s inventory ratio. If anyone has any insight on how NAR does the calculations, please post.

The approach using the listing service data only for Loudon County makes sense. The majority of sales still occur through the listing service. There is no need to make some statistical adjustments for FSBO or other non-listing sales to arrive at the month’s inventory figure. Most certainly, this would be the case nationally as the activity within listing services is a good proxy for the entire market.

By the way, there are problems with the month’s inventory figure for unsold new homes as well which understate that metric, but that is another message.

"$1,265 for a 26' truck from DC to Nashville, its only $475 the other way..."

ReplyDeleteMost non-U-haul-ian studies indicate that job growth in DC will be strong for the foreseeable future. That doesn't mean that people aren't moving away from DC metro.

If job growth is indeed strong, yet DC metro is experiencing a decline in population*, what does it mean for the local economy? It means rapidly rising salaries and fringe benefits to incent workers to move to the DC metro area.

That would be a good thing for those of us who live here. :-)

(* US Census released new figures a couple of weeks ago that show population in the city of Washington is growing)

"A plastic condo 50 miles of heavy traffic from the city center... what is the point?"

ReplyDeleteTo burn more fossil fuels and to wear out your vehicle faster, thus ensuring continued profits for Exxon and attempt to save the US auto industry(?)

Anon 8:42-

ReplyDeleteThanks, that's very interesting.

I have a feeling something like the following is going on (though I can't say for sure):

"A month's supply" of housing is now possibly much higher than in the past. So when someone says "there are 5-6 months supply in Hazzard County, which is about the historical average," it could be a VERY misleading statement.

If someone is using the activity of the last few years, with all the flipping and housing mania as an indicator of what a month's supply should be, then "a month of supply" now might be a LOT more than in the past. I don't know.

The implication, if what I fear is true, is that there is even more inventory than the presentation indicates.

A Redskins fan

chriso finds jerkstore's comments to be insightful, useful, and non-confrontational.

ReplyDeleteNo, I said they were "hilarious." Did you read your mortgage documents in a similarly careful fashion, Mr./Ms. Anonymous?

Kind of frightening, actually, how such thin-skinned people have taken on such financial burdens. Good thing DC has restrictive gun laws. :)

If job growth is indeed strong, yet DC metro is experiencing a decline in population*, what does it mean for the local economy? It means rapidly rising salaries and fringe benefits to incent workers to move to the DC metro area.

ReplyDeleteWow, do you do that kind of spin for a living? :)

Seriously, if there is a housing-inspired recession, the DC area would obviously be one of the better places to be, since the government never goes out of business. But that still doesn't support a housing market so fundamentally out of whack.

Neil said-

ReplyDeleteOr for those who think prices will keep increasing in the "u-haul index"

$1,265 for a 26' truck from DC to Nashville, its only $475 the other way...

The u-haul statistic is very accurate for showing job directionality. Its saying jobs are *leaving* DC!

What's this is saying is that the kind of people who use U-Haul are leaving DC --- To make room for the high paid people who use real movers. Typical Bubblehead inability to interpret the facts and stats ...

OK folks...I've been running some numbers and would like the feedback of the group. If you buy a typical starter townhouse in NOVA for $380K - with 5% down and 6.25% fixed mortage works out to be $2200 a month. Throw in a 250% condo fee and taxes you are up another $500/month. That's $2700 a month. However, you have a tax deduction (assuming a 25% marginal tax rate) of $612/month. That brings your adjusted monthly payment to $2100. If similar homes rent for $1800 per month. There is a $300 per month premimum to buy. The question is if one is expecting rents to rise that premium isn't really all that much or am I crazy. Appreciate the input from the group.

ReplyDeleteNOVA Fence Sitter

Anonymous said...

ReplyDelete"OK folks...I've been running some numbers and would like the feedback of the group. If you buy a typical starter townhouse in NOVA for $380K - with 5% down and 6.25% fixed mortage works out to be $2200 a month. Throw in a 250% condo fee and taxes you are up another $500/month. That's $2700 a month. However, you have a tax deduction (assuming a 25% marginal tax rate) of $612/month. That brings your adjusted monthly payment to $2100. If similar homes rent for $1800 per month. There is a $300 per month premimum to buy. The question is if one is expecting rents to rise that premium isn't really all that much or am I crazy. Appreciate the input from the group.

NOVA Fence Sitter"

You forgot two additional deductions that reduce that $300 premium for owning vs. renting. In addition to the write off for the mortgage interest in your Fed tax return, you get a similar write off for your state tax return. That is whatever your highest tax rate is in Va. (8%)? Similarly you get to write off the property tax you pay and you get to do this again on both the fed and state tax returns. Your buying premium is a lot less than $300/mo ... and it may actually even be cheaper to buy than to rent. Bubbleheads don't know math, so don't depend on their giving you any good advice where money is concerned.

Anon 9:59

ReplyDeleteThanks for the feedback. You're right I wasn't thinking about state taxes and that does make a difference...probably another $200 bucks or so.

NOVA Fence Sitter

I have no idea whether the numbers you quote are reliable. ($250 sounds a little low for a condo fee, but I don't know).

ReplyDeleteHowever, you are missing maintenance and insurance from your homeowning costs.

Additionally, you need to consider appreciation or (IMHO more likely) depreciation. If that TH sold for $180,000 five years ago, and would sell for $280,000 five years from now, then it will have gained $100,000 in ten years, not a bad rate of appreciation.

However, you have paid $380,000 for it, plus say $20,000 in closing costs, so you are now $120,000 in the hole. Dividing that by 60 months, that's an additional cost of $2,000 per month.

That's the kind of calculation I personally would do. But maybe I am wrong to do that; you need to make your own decision.

A Redskins fan

Lance and Nova both make some mistakes. It's pretty funny that Lance claims that bubbleheads don't know math, when he's the one making mistakes.

ReplyDeleteFirst, if you're going to look at the tax benefit of your home, you have to compare your total itemized deductions under homeownership to your current standard deduction, and calculate the marginal gain. It's the difference between the standard deductions and your total itemized deuctions as a homeowner that determine your marginal tax benefit of buying, not the total deductions as a homeowner you can take.

The standard deduction for a married couple is $10,000. That's a bit over $800 a month. That seriously changes the math for Fence Sitter and for Lance.

Oops, make it $200 a month. My bad. That makes it quite a bit closer.

ReplyDeleteKeith,

ReplyDeleteGood point on the standard deduction. To account for that in my calculation I would have to add an additional $800 a month - that does make a difference.

Redskins Fan,

I agree with you on appreciation/deapprecation and maintenance. However, I was thinking I would be there for a while (5 years plus) and deapprecation/appreciation would average out. I knew maintenance should have been included - not sure what a good assumption is for that...maybe a hundred dollars per month.

NOVA Fence Sitter

Keith,

ReplyDeleteKeep me out of this. Address whoever it was that contributed. I am not contributing other than to point out that your last assertion is incorrect as we have discussed many times ... including the time the tax attorney pointed out how wrong you are. As you should know, Itemized deductions = your standard deductions + real estate-related and other non-standare deductions. I.e., you get the WHOLE benefit of your itemizations that are owing to real estate such as mortgage interest and property tax etc. Your statement is incorrect because you are assuming that the average person has nothing else to itemize other than their real estate-related expenses. Is this really that difficult for you to understand?

Keith,

ReplyDeleteI see the $200 ($800x 25%). Still a good point.

NOVA Fence Sitter

Maintenance and insurance costs can be fairly significant.

ReplyDeleteBut if that townhome rents for $1800 and sells for $380K, it isn't that crazy.

Not like around my area where you can rent something for $1700 but hedonic equivalents go for $500K plus a really heavy-duty condo fee.

Lance, Keith,

ReplyDeleteDon't worry. I will check with my tax guy before making any decisions. I don't make final decisions from information posted on blogs.

NOVA Fence Sitter

Actually, they don't go for that anymore.:)

ReplyDeleteKeith,

ReplyDeleteI've been tracking the neighborhood and prices have come down from the $430K price point. They are starting to get into my strike range.

NOVA Fence Sitter

FIGHT CENSORSHIP

ReplyDeleteFirst, I think David's post was informative and unbiased.

ReplyDeleteSecond, Bubbleheads do themselves a diservice by mis-interpreting the data. A few months ago, as inventory was begining to rise, someone noted that if inventory is "low" it has to pass through "normal" to get to "high". That's a good point, but some of the Bubbleheads can't wait, so they perform inaccurate analyses to support their position not realizing they are doing themselves more harm than good.

An analogy to global warming would being someone pointing out that it's hot today - 85 degrees , so that means there's global warming, ignoring that the historic average temperature for today is 86 degrees.

Anon 8:42's analysis is very good. I'll add that I'm pretty sure that MRIS generate its Months Supply number by taking the 'active listings' and dividing it by the month's sales. I'm also somewhat sure that the 'active listings' is a snapshot of the listings on the last day of the month. Unfortunately, I can't confirm this but the math does check out.

Is she moving to DC, or are you moving to Nashville?

ReplyDeleteNeither, its a sign of job directionality. It wouldn't do any good to compare Los Angeles to DC... they both have outward job migration. Although, if you want an extreme situation, look at Florida. A state built on being a low cost place to have a business or retire cannot transition to a "high end" destination in 3 years. 20 years? Sure! 3 or 4? Nyet.

Fence sittter: If the math is close (excluding down payment, assuming you get a fixed rate mortgage), it might be ok to buy. With that I can agree with the "housing bulls." However, in my area, the after tax difference is 2X. Why would I pay $5k to $6k/month to buy a place I can rent for $1,800 a month? But that isn't DC...

Neil

NOVA Fence Sitter,

ReplyDeleteIf you get a fee-simple townhouse, rather than a condo townhouse, your monthly HOA fee (if any) would be less than the condo fee. Of course that maintenance figure would go up.

There are plenty of townhouses in NoVa. In a "soft" or "bursting" or "slightly deflating" market, you have the luxury of time (unless interest rates go through the roof overnight). Start going to open houses, if you haven't already, and get familiar with what's out there.

Not that anyone knows for sure, but if you're figuring on owning for a minimum of 5 years, I'd bet you'd be fairly safe as far as depreciation goes.

Not to add to the confusion but keep in mind you will not get a 6.25% fixed rate mortgage with a five percent downpayment. you will pay mortgage insurance until you have 20% equity. this is not cheap or tax deductible.

ReplyDeleteeveryone also assumes 25% or higher tax bracket when doing this calculation. tax bracket is based upon Adjusted Gross Income, or the amount left after all deductions are taken out. Married couple AGI of $61,300 or more will be in 25% bracket this year.

make sure you add up all income and subract all these deductions before calculating tax benefit.

Median familly income in NOVA is around 85K. This family is in 15% bracket. Recalculate tax. Add mortgage insureance. Recalculate. Recalculate.

I don't know where the $1800/month rental figure came from, but in Fairfax the only THs that rent for that much are luxury units and/or in the most desireable areas. $1300-1400/month for a TH is quite doable without living in the sticks or having to speak Spanish to converse with the neighbors.

ReplyDeleterecalculate. recalculate. recalcualte.

ReplyDeleteNova Fence Sitter,

ReplyDeleteDon't forget to take the principal payment into consideration. On a $361,000 6.25% 30yr loan the principal will be about $350/month. By year five it will have risen to about $450/month.

Just for grins, to those that think the huge run up in prices in the last few years signals a bubble, ask David to show you the appreciation for the last ten years, or even fifteen in the metro area...

ReplyDeleteThe run up was the return to 'the fundamentally based value' Neil was referring to. For more than a decade before DC saw almost no appreciation. Home prices have now caught up. Inventory levels represent a balanced market, and bubble bloggers search day and night for the one guy out of a hundred transactions that lost money to tell you the sky is falling.

thanks for your time

Chicken Little

chriso said:

ReplyDelete"Kind of frightening, actually, how such thin-skinned people have taken on such financial burdens. Good thing DC has restrictive gun laws. :)"

This is called projecting in psychological parlance. Chriso wants to beleive that everyone but Doom/Gloom cheerleaders are in financial dire straights.

To come to a blog for anonymous conversations and to project your own insecurities onto others (anonymously) as Chriso as done is just sad.

See if you can go for two hours without making assumptions about strangers on the internet and projecting your own insecurities onto others. Think you can do that?

Sigmund (<--I'm not anonymous, see?)

"Neither, its a sign of job directionality. "

ReplyDeleteYeah, its gonna be bad when the presidency changes hands in less than two years. All those outgoing political appointees, and no one will come to take their place. What will the United States do? I guess it will be time to give up antiquated notions like "The Executive Branch" and "The Legislative Branch". We'll just close them down and save the money on Fed taxes for Joe Sixpack in Franklin TN.

Fence Sitter,

ReplyDeleteRremember that you actually have to come up with the pre-tax-deduction amount of the mortgage payment every month; you don't realize the deduction until tax time. (Yes, I know it seems obvious, but it's easy to overlook cash flow during an analysis of total cost.)

"Just for grins, to those that think the huge run up in prices in the last few years signals a bubble, ask David to show you the appreciation for the last ten years, or even fifteen in the metro area..."

ReplyDeleteThat is to compensate for the runup in the 80's

May very well be true David, what caused that run up? Cheap money was not to blame. (double digit interest rates if I recall) Did the bubble burst afterward? Can you find stats back that far, I have been looking, but not found them yet.

ReplyDeleteBTW, the search day and night comment may not apply to you, so I will apologize if it does not, I really just discovered your blog, but some of the others...

Anonymous said...

ReplyDeleteFence Sitter,

"Rremember that you actually have to come up with the pre-tax-deduction amount of the mortgage payment every month; you don't realize the deduction until tax time. (Yes, I know it seems obvious, but it's easy to overlook cash flow during an analysis of total cost.)"

Anonymous, The deduction can be "claimed" at any time by using a W-4 form to decrease the amount of withholdings from your paycheck. (There's a spreadsheet on back of the form that helps you estimate how much to decrease the withholding based on your mortgage and other deductions.) Cash flow problem solved. Next, good reason not to buy?

"Rremember that you actually have to come up with the pre-tax-deduction amount of the mortgage payment every month; you don't realize the deduction until tax tim"

ReplyDeleteThis isn't an accurate statement. You certainly can go to your employer's HR department and increase your tax exemptions (thereby increasing your monthly take-home pay). It is called a "Form W-4".

I'm single with no depenants, own a home, and claim 5 tax exemptions on my W-4.

Chris G,

ReplyDeleteHere's a source for price increases in NOVA from 1975-2005:

http://www.nvar.com/market/history.lasso

Whether it's make up for slack 90's or a fresh run-up is still up for debate. Either way, it looks like a cycle that preparing to move significantly sideways if not down based on past cycles.

Below shows the year/average price/and YOY % increase.

1976 : $62373 : 106.2%

1977 : $66722 : 107%

1978 : $71639 : 107.4%

1979 : $79838 : 111.4%

1980 : $90744 : 113.7%

1981 : $100050 : 110.3%

1982 : $103631 : 103.6%

1983 : $105388 : 101.7%

1984 : $108049 : 102.5%

1985 : $113120 : 104.7%

1986 : $121922 : 107.8%

1987 : $142163 : 116.6%

1988 : $162850 : 114.6%

1989 : $174975 : 107.4%

1990 : $174616 : 99.8%

1991 : $204886 : 117.3%

1992 : $202534 : 98.9%

1993 : $209381 : 103.4%

1994 : $210557 : 100.6%

1995 : $211098 : 100.3%

1996 : $214102 : 101.4%

1997 : $220932 : 103.2%

1998 : $229151 : 103.7%

1999 : $238496 : 104.1%

2000 : $252374 : 105.8%

2001 : $285159 : 113%

2002 : $319293 : 112%

2003 : $364684 : 114.2%

2004 : $441253 : 121%

2005 : $538144 : 122%

My $0.02.

This is called projecting in psychological parlance. Chriso wants to beleive that everyone but Doom/Gloom cheerleaders are in financial dire straights.

ReplyDeleteActually, it's called "making a joke." You should try it sometime.

I assume nothing about anybody who posts on the Internet, unless I happen to know them personally. Interesting that your own post assumes what my beliefs are. I happen to think that one can have fun engaging in witty repartee in the blog world, but responses such as yours are definite mood killers.

But let me clear the record for the humor-challenged out there. No, I do not believe that all housing heads are financially upside down, nor would I accuse any particular such individual of being in said condition. Hopefully, folks who are really upside down and struggling to pay their suicide mortgage are busy figuring out a way to get out of their predicament, rather than posting on a bubble blog.

To come to a blog for anonymous conversations and to project your own insecurities onto others (anonymously) as Chriso as done is just sad.

Well, sparky, I've given you my real first name and the real first letter of my real last name. In previously comments I've let slip the real neighborhood that I really live in. And that's probably more than I should have revealed, since who knows how many upside-down, desperate housingheads could be roaming the streets of my neighborhood like something out of "Dawn of the Dead."

Have a nice day, Sigmund.

"Have a nice day, Sigmund."

ReplyDeleteThanks for proving my point.

Sigmund

"but responses such as yours are definite mood killers."

ReplyDeleteLOL! Sigmund made him sad!

Thanks for proving my point.

ReplyDeleteWhich point was that: (1) I'm projecting, (2) I want to believe that housingheads are all upside-down? I'm not quite sure how wishing you a nice day (even if somewhat sarcastically) proves either point, but then perhaps you're referring to a point that you have not yet made.

LOL! Sigmund made him sad!

Perhaps I should amend my comments. Your online persona of a humorless crank provides a certain "Dean Martin straight-man" backdrop for my attempts at wit and levity but ultimately is insufficient, since it does not provide an adequate reply allowing for further responsive wit and levity.

On the other hand, you have elicited a couple of responses from me, so you've got that going for you.

"wishing you a nice day (even if somewhat sarcastically)"

ReplyDeleteIt is clear that you are emotionally involved here. If you want to believe that I'm incapable of humor based on the few lines of text that I've written: Go right ahead.

In doing so, you validate my premise.

Sigmund

It is clear that you are emotionally involved here. If you want to believe that I'm incapable of humor based on the few lines of text that I've written: Go right ahead.

ReplyDeleteNah, I just occasionally enjoy engaging in a little bit of online tomfoolery. I'm interested in the bubble, to be sure, but when I post I prefer to be a bit snarky, so as to liven things up a bit. I have no doubt that you are capable of humor, but your deadpan replies to humorous postings do not demonstrate it.

In doing so, you validate my premise.

Which is that if you repeat something enough times, it becomes true? Try to separate out the serious from the sarcastic in my postings, ok?

Even if you believe that DC area homes were undervalued in the 90s relative to fundamentals, when have median DC area homes EVER been 5-10 times median area income?

ReplyDeleteMedian income is a fundamental. Rental rates are fundamental. DC area house prices are way out of whack with both those fundamentals, IMO.

Also, the government does cut jobs sometimes. In the 90s, as budget balancing got serious, there were government RIFs. DC and P.G. County had horrific homicide rates. (P.G. County still does). The Federal government is not some magic teat that always squirts sweet milk.

A Redskins fan

"Also, the government does cut jobs sometimes. In the 90s, as budget balancing got serious, there were government RIFs. DC and P.G. County had horrific homicide rates. (P.G. County still does). The Federal government is not some magic teat that always squirts sweet milk."

ReplyDeleteOver 60% of the current federal workforce, including the SES, is eligible to retire right now. There will be a mass exodus of baby boomers.

Factor in the fact that every federal administration, regardless of party affiliation, *increases* the size of the federal government year over year; and we're looking at an enormous quantity of jobs in the federal sector in the coming years. I've experienced belt-tightening recently within DoD, and I can tell you that the DoD workforce is growing, even if they are cutting back on their supply of paper clips.

Lance said: " As you should know, Itemized deductions = your standard deductions + real estate-related and other non-standare deductions. I.e., you get the WHOLE benefit of your itemizations that are owing to real estate such as mortgage interest and property tax etc..."

ReplyDeleteIRS sais: "Form 1040 allows taxpayers to compare their standard deduction with the total of their itemized deductions and to choose the method that results in the greater reduction to their AGI."

http://www.irs.gov/app/vita/content/0108a/0108_02_080.html

Lance is wrong again...

Anon 6:52-

ReplyDeleteYou can't have it both ways. If all those baby boomer Federal employees retire, then that will also have a very negative effect on DC area housing. IMHO, and I could be wrong, not all of those potential retirees will be replaced.

Anyway, where do you get your stat that over 60% of the Federal workforce is eligible to retire right now? I'm not saying it's wrong; I'd just like to know where it comes from.

Finally, there is no "belt-tightening" going on right now. The last ten years have been an era of expanded Federal spending. But the early/mid-90s were not. That may be a better period to look for to see what could happen.

A Redskins fan