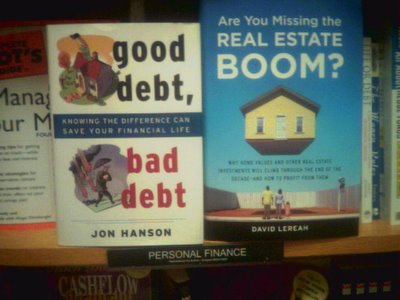

At a local Border's bookstore I came across these two titles. On the right is David Lereah's "Are You Missing the Real Estate Boom?" and on the left Jon Hanson's "good debt, bad debt."

The very small words on the front cover Lereah's book are "Why home values and other real estate investments will climb through the end of the decade - and how to profit from them." Lereah, the chief economist for the National Association Realtors is a major bubble cheerleader. Now, with bubble evidence mounting, his latest talking points are that there will be a soft landing in the bubble markets.

Note: David Lereah should read the book on the left.

Amen, Skytrekker. I don't know what a "soft landing" looks like either.

ReplyDeleteDavid: I had a chance encounter with a gentleman in my neighborhood, Capitol Hill (DC), the other day. He told me he was a realtor - I asked if things were slowing down a bit. Wide-eyed, he said, "Oh yes, it has. Things just ran up so high that all the people who can afford to buy have already bought," he said. Then he added, incredulously "...there's no one left to buy..."

That, in my view, is the absolute, classic, textbook end of any speculative mania.

What an education I'm getting....

As famous economist John Kenneth Galbraith writes in his book "A Short History of Financial Euphoria":

ReplyDelete"Those who had been riding the upward wave decide now is the time to get out. Those who thought the increase would be forever find their illusion destoyed abruptly, and they, also, respond to the newly revelaed reality by selling or trying to sell. And thus the rule, supported by the experience of centuries: the speculative episode always ends not with a whimper but with a bang."

I wouldn't say there is no record of a soft landing. Japan had a big run up in the late 80s and never had a vicious depression. Now granted, its economy was in the doldrums for twelve+ years, but there wasn't the kind of collapse that we saw in East Asia in 97 or in the US in 29. The average Japanese was able to continue with his life with somewhat more modest and realistic expectations.

ReplyDeleteI'm not saying that will happen here, but I'm just saying that there is some precedent.

Point well taken. I guess the issue is, what does "soft landing" really mean.

ReplyDeleteJapan got nailed pretty bad - real estate, for example, fell almost 90% on Tokyo during that time frame. There was no wide-spread unemployment, so I guess you can say the average Japanese hasn't suffered too much.

I would not describe what happened to Japan's RE market as a "soft landing".

ReplyDeleteTo me, and from what I have been able to infer from the comments of those economists in the spotlight, a "soft landing" means something along the lines that RE prices will stabilize at the current levels for the indefinite future or decline at most 5% and then stabilize at that new level for the indefinite future. In other words, "soft landing" is a term that is being used to comfort those people who own RE, who care about the price of their RE, and at the worst are willing to wait to sell as opposed to selling in the short term at a loss. The term "soft landing" is also being used by these economists to prevent panic selling which would surely kill the RE industry.

Well, if I were a politician and I inherited this mess, and I couldn't just tell the truth and let the economy take the hit, then this is what I would do.

ReplyDeleteI would talk about how prices are going to stabilize or fall mildly in a "soft landing." Then I would do everything in my power to make sure that happens *in nominal terms*. So a cruddy house may still cost $500,000 in a borderline DC neighborhood in ten years, but a Big Mac will cost ten bucks.

I think the politics of inflation are based on fooling people that way.

Good debt/bad debt. What a joke.

ReplyDeleteGood debt is a self-liquidating debt. Meaning, the cash flow from the asset purchased produces enough to pay for the debt and the interest.

Homes can be self-liquidating if home prices/payments are equal to or less than the cost of renting because you're working with opportunity cost. There is no surefire way to classify the asset as "good debt" material; it all depends on the circumstances.

So, "Soft Landing" is really sort of the same thing as a "permanently high plateau?"

ReplyDeleteThen I don't buy it. Not for a minute...

There is 'Soft Landing; for the real estate market which generally = stagnant or minimal nominal price declines.

ReplyDeleteand 'Soft Landing; for the economy which generally means = that there will be no recession, perhaps an economic slowdown but no recession,