Click on image for larger version.

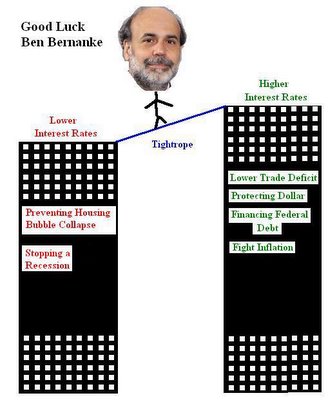

What should Chairman Bernanke do with short term interest rates? What will he do? Lower them? Raise them?

He really is walking a tightrope. Tough situation.

Bubble Meter is a national housing bubble blog dedicated to tracking the continuing decline of the housing bubble throughout the USA. It is a long and slow decline. Housing prices were simply unsustainable. National housing bubble coverage. Please join in the discussion.

I think Ben will raise short term interest rates to 4.5% then stop raising them. If I missed significant factors on either side then please let me know, as I will add them to the cartoon.

ReplyDeleteI like the "Flying Willenda" tightrope reference. You could also use the scylla and charybdis analogy too. He is stepping into a minefield because Greenspan has left him no more options. It is crash and burn time!

ReplyDeleteWhile AG and BB are high accomplished economists and have great insight to the complex equations that interest rates are part of, they both are subject to political influences - and that is probably the thing we need to worry about more than anything. They will be influenced left and right by politicians looking to protect their constituents housing values - they will bow to some pressure, and that's when the equations will no longer be of any use. The Feds will be pressured by politicians to minimize impact on housing values - even the cost of long term health of the economy. The politicians need to get re-elected next year - they don't care as much what kind of housing collapse they may cause a couple years down the road.

ReplyDelete