Hat tip to Curt on The Housing Bubble Blog who found this gem. Here is what he wrote:

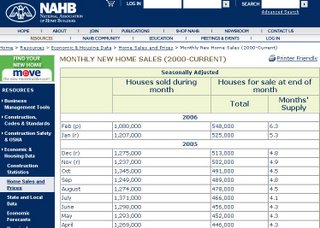

There are blog readers who come from the National Association of Home Builders. Care to respond?the National Assoc of Home Builders used to put ou a handy year by year summary of sales and months of inventory

http://www.nahb.org/generic.aspx?sectionID=131&genericContentID=341

But, as you can see, when the numbers started looking dismal, the data stopped flowing in Mar of 06. Wonder why?

silence is deafening

ReplyDeleteThe same thing happened with our local Association of Realtors. For a while there, they stopped posting the MRIS data.

ReplyDeleteAlso, I’ve noticed that ihomefinder.com has disabled the “search by minimum days on market” feature. What gives?

Lying Lereah is incapable of honesty. Just my opinion of course!!! We all hope that there are enough homeowners who have not tapped equity who will survive the downturn. And we hope foreign economies remain strong. That is because the US government and the NAR will not be able to overcome a slowing market with bs about the value of investing in real estate. The bond traders are just today betting on a slowing market. They know more than Lereah will ever know.

ReplyDeleteOn a positive note, growth of middle classes in China and Russia and India and elsewhere are positives for the world economy that hopefully will not need our middle class purchasing power to keep the world economy going.

In a word, if the world can prosper without the appreciation of David Lereah's condo then America's corporations will remain strong even though housing tanks.

Honestly, I find this hilarious.

ReplyDeleteGary Anderson said: "We all hope that there are enough homeowners who have not tapped equity who will survive the downturn."

ReplyDeleteNot true. Many who write on this blog are hoping for a complete collapse, massive foreclosure waves, and prolonged recession. Sick.

from cnn.com today: " Saudi prince's Aspen getaway has $135 million price tag"

ReplyDeleteit goes on to say:

"Bandar has been busy chairing his country's security council and spending too much time in Washington."

Rich foriegners spending time in DC? Naaahhh...

http://www.cnn.com/2006/US/07/12/bandar.home.ap/index.html

ReplyDeleteWell, I am not hoping for a serious recession, but there is an alarming article July 9 from Bob Casagrand, a Realtor who posted at realitytimes.com. Please read the following regarding San Diego, a place with perfect weather and an awesome lifestyle:

ReplyDelete"One of the major issues for our market is what does the future demand look like, and only time will tell. I did a rough check on July to date (July 9) to see where it stands, I debated about putting this in this writing because the numbers are SCARY and they will close somewhat by the end of the month. I decided to put it in so that we can see the mountain ahead to maintain some level of reasonable demand.

The first 9 days of July have 303 homes sold for an average price of $559,577 and an average size of 1781 sq ft; the first 9 days of July 2005 had sales of 933 and an average price of $629,168 and an average size of 1749 sq ft. Last July's 933 sales represented 25% of the month's sales, if that were to hold this year, well suffice it to say that would be a disaster. I think this July will stay in the 30% to 35% down from last year region and that would put July sales at about 2,700 homes sold, keeping us a path to about 30,000 home sold for the year, down about 30% from last year.

Junes' average price was $638,380 up 3% from last year. However, this increase is explained by the fact that the over $1 million sales represent 10% of June total sales where they were only 8.5% of last Junes' sales. When you break down the sales into price & sq ft segments you see a completely price flat market. However, there are neighborhoods already showing price declines of the 4% to 5% region and I expect to see this show up in the overall county statistics.

Markets can not sustain 30% declines in demand over a period of time and not have price erosion. Here is a trend to consider; sales in the fourth quarter of 2005 was down 10% from prior year, sales of the first quarter 2006 was down 20% from prior year and the second quarter of 2006 was down 30% from last year third quarter of 2006 ???, anybody's guess.

Another issue that will impact price pressures is that about 30% of our listings are vacant and heaven help the Fed continue to raise interest rates. Help comes in the form of something that will increase demand or reduce inventory.

The folks at the NAHB are too busy not selling houses to update their website? How convenient.

ReplyDeleteMaybe the non-essential staff of the NAHB has been busy looking for other employment in anticipation of the coming housing bust.

"Maybe the non-essential staff of the NAHB has been busy looking for other employment in anticipation of the coming housing bust."

ReplyDeleteOr they had to layoff their webmaster due to lower revenues.

Or maybe they post here as bubbleheads to totally confuse everyone as to whether there is a bubble or not.

ReplyDelete"Or maybe they post here as bubbleheads to totally confuse everyone as to whether there is a bubble or not."

ReplyDeleteHmmmmm! So I will be confused whether there is a bubble or not. Well if I am not sure there really is a bubble then I should buy a house. Well there are alot of construction cranes in this area. Instead of a bursting bubble, we are are experiencing a housing boom. I better buy now or miss out!

Gary Anderson said: "Help comes in the form of something that will increase demand or reduce inventory."

ReplyDeleteFor those of us who are hoping that our country does not slide into a deep recession (or worse), we are forced to hope that a slow down in interest rate hikes, along with a gradual tightening of the rental market, along with a gradual slow down in new home starts, will help correct the current supply/demand imbalance. To hope, as many who post here do, for more rapid destabilization of the market, is to root for an American depression.

This another monthly table the NAHB has

ReplyDeletestill not updated with May numbers.

http://www.nahb.org/fileUpload_details.aspx?contentID=55761

"To hope, as many who post here do, for more rapid destabilization of the market, is to root for an American depression."

ReplyDeleteHey, that sounds familiar. Just after 9/11, people were running around saying it would be un-American to sell your stocks because it would lower prices. So I guess now its un-American if you are a net seller or not a net buyer of homes.

"Do you American duty and keep the housing bubble alive."

"Do you American duty and keep the housing bubble alive."

ReplyDeleteHmmmmmmmm. I can buy one of these condos as an American duty that will benefit the condo developer, or with all this extra money I have left over by renting I could buy American stocks; eat in American Pizza Parlors or Hamburger joints and buy airline tickets and tour America. So I would be better serving my country by renting.

Anonymous said: "To hope, as many who post here do, for more rapid destabilization of the market, is to root for an American depression."

ReplyDeleteI do not hope for a destabilization of the market. What I hope for is for the Fed to control inflation as it should. Yes, housing is an asset, but its price should be part of the Fed's decision process. If the Fed doesn't raise rates one more time (and I think that is all that is required) then the dollar will slide (a little). If the dollar weakens, forign investment will slow a little... That is not something we can afford. Like it or not our economy must, via good investment returns, attract forign capital.

The dollar losing its place in world economics would have far worse implications for our economy in 20 years than a 30% drop in home prices. I've seen regions survive 20% drops that hit 40% on certain streets. We can survive 30%.

Or is my group of friends the only group of hiring managers that cannot hire in a bubble city for the wages we're allowed? Ok, I accept it might be time for my industry to leave the US like so many others. We have no trouble hiring 20 something renters. Its those that want a home for their family we can no longer hire. In fact, due to the exodus of workers, we're giving up hiring and instead are shrinking via attrition down to the most profitable sectors. Only when we get down to the most profitable "core" will we be able to offer wages to attract new talent. Cest la vie.

But I also hear from *several* doctors who cannot hire staff for what medicaid reimburses as their staff wishes to own property. So either we have massive inflation to cover the salaries required or we have "job flight" to lower cost areas. Without doctors, retires will be forced to leave the area, etc.

Gary... Nice post. I read it a few days ago... scary. Half of the homes I've seen on the market have been empty... that isn't going to last much longer. A surplus of suply says the prices much be cut. Remember, houses aren't homes anymore but investments. Do recall investments have much harsher price swings with the economy than homes. And if 2nd homes drop in prices and not the homes where the jobs are... I know my retired parents will move. :) So somehow this will correct.

Like it or not we're due for one of those recessions that hits about every 15 years. Yawn. Its no big deal. We've all been through this before. I can survive for years without an income as I'm sure many bubbleheads could to.

But when this is done... we'll be the ones buying helping the economy start its climb back up.

Neil

"Hey, that sounds familiar. Just after 9/11, people were running around saying it would be un-American to sell your stocks because it would lower prices. So I guess now its un-American if you are a net seller or not a net buyer of homes."

ReplyDeleteYou're missing the point, and grossly perverting the meaning of a fairly simple sentence. The point of that sentence was not that anyone who rents is un-American. Neither was the point that it is un-American to sell a home. You can be a complete patriot and think that the housing market is overvalued and think that there is a bubble that is about to burst. Similarly, you can be a true American hero while thinking that certain markets are tremendously overvalued.

The point was that aggressively cheering (BURST, BURST, BURST!!!) for a complete collapse of the housing market, with full knowledge of the modern economy's dependence on that market, is essentially the same as rooting for a depression. Some of you people who post here are so unbelievably excited about the prospects of a total bubble burst that you forget that the housing sector (construction, etc) has contributed a significant amount to the economic growth we've seen in the last several years. With the economy on the brink of a recession, as David's post suggests, a total collapse in the housing market, with rising foreclosures, soaring interest rates, and the like, could well push us into steep and sustained negative economic growth.

If you think that's a good thing, fine. I didn't say that you were un-American to root for it. I just pointed out that you were, in fact, rooting for a deep and severe economic downturn by cheering on a violent collapse in the housing market. If you want to read more into that, be my guest. And by the way, if your coveted downturn does come, all that opportunity cost money that you've tucked away into stocks, bonds, mutual funds, and essentially all dollar-denominated assets will evaporate as quickly (if not more quickly) than the value of current owners' homes. Hope you've been diversifying your investment portfolio into assets that are hedged for the oncoming dollar collapse. Best of luck!

wvu_84 said...

ReplyDelete"Do you American duty and keep the housing bubble alive."

No one actually said this, by the way. John Fontain made it up. He fabricated a quote that did not exist to make his point seem more reasonable. Typical of his impoverished argumentation style.

Anon 11:36

ReplyDelete"No one actually said this, by the way. John Fontain made it up. He fabricated a quote that did not exist to make his point seem more reasonable."

So glad you cleared this up for me.

The US is headed for a depression no matter what. The longer the FED postpones it, the worse it will be. So, bring it on ASAP.

ReplyDeletewvu_84 said...

ReplyDelete"So glad you cleared this up for me."

No problem. It's obvious that you didn't realize that it wasn't an actual quote, because otherwise you, like John Fontain, would have been guilty of misleadingly treating it as such ("I can buy one of these condos as an American duty that will benefit the condo developer"). In other words, you're either just as misleading as John Fontain, or a bit slow, and I didn't want to insult you by comparing you to JF. Glad I could be of service.

Considering they send out press releases for New Home Sales, Housing Starts, and Builder Confidence, I would hardly call it hiding. At worst you can call it spinning.

ReplyDeletehttp://www.nahb.org/news_details.aspx?sectionID=148&newsID=2819

My problem is that the conservative politicians (and on certain issues we all are conservative and on certain issues not so conservative)are making the talk of a housing bubble a "liberal" issue. For Rush and his minions, the conservative base cannot believe there is a bubble, and that base cannot badmouth housing because that would be badmouthing Bush and the Republican party.

ReplyDeleteBut the truth of the matter is that Greenspan kept interest rates low too long, and that was coupled with supply side economics, which may work sometimes, but did not work as it was supposed to this time. The reason that it did not work this time is 1. the wealthy who got those rebates put the money into real estate, and not into stocks, 2. the result was a massive overbuilding of houses!!!

The Republicans are directly responsible for this overbuilding, and that is why they are deflecting criticism of their failed policy by criticising those of us who see the housing bubble for what it is and what it could be.

I am not saying that Democrats could have done better, but maybe they would have been more fiscally conservative, and would have not gone into Iraq which exacerbates the problem.

So then, for Rush and the rest, the failure of the housing sector will mean the failure of the Bush presidency, the way I am reading them. If THEY fear recession, then maybe we will have one.

If you'd like some actual, recent housing FACTS for NoVa feel free to see:

ReplyDeletehttp://www.nvar.com/market/marketstats/jun06/index.html

In short, prices up in Arlington for the most part and flat elsewhere YOY. Since we are not directly YOY on the height of, I'm not sure where these magical 20% price declines are...

Just another example of the Neo-con thought procees--if you don't publish it, it won't happen.

ReplyDeleteOh, come on anon, 30% declines are not going to happen overnight. A 10% decline by the end of the year would simply freak me out since 2007 is going to get worse.

ReplyDeleteneil,

ReplyDelete" In fact, due to the exodus of workers, we're giving up hiring and instead are shrinking via attrition down to the most profitable sectors. Only when we get down to the most profitable "core" will we be able to offer wages to attract new talent. Cest la vie. "

So it took a run up in real estate prices to tell you that you were holding on to inefficient and/or unprofitable segments of your business? hmmm, funny how "the market" can knock some common sense into entreched bureaucracies where everyone is just fat and comfortable.

That's fine but there is no evidence of ANY decline in most of these markets, let alone a 10% decline.

ReplyDeleteDisagree. Declines are evident, contracts are showing a 3-5% decline for 2006 at least. 10% would be the worst.

ReplyDeletePlease show me any evidence of a decline in Arlington, Alexandria or MoCo.

ReplyDelete"Please show me any evidence of a decline in Arlington, Alexandria or MoCo. "

ReplyDeleteAdd NW DC while you're at it.

*crickets*

Neil,

ReplyDeleteI had the same problem as a hiring manager. I could not get anyone to come into work (at the Pentagon or on the Hill) that didn't already live in the area. I was constrained by what the Feds would pay. I had some very good jobs, at competitive wages, but when everyone took a look at housing prices, commute times from places were they could buy, (DC was not even on the list due to the horrible public school system) I was just laughed at. When I ran the numbers in a company retention/recruitment tiger team I realized I needed to leave!

Bottom line: To get roughly the same net disposable income (after all taxes, mortgage, & insurance for the house) I would have to pay people double what I was offering. (You can get the same pay in Texas/Colorado/Atlanta etc for the same work). Thus no one wanted to come in and many were cashing out and leaving! The exedus in '05 was over 20% (we ran under 8% normally) and the #1 reason was to cash out the equity and move somewhere cheaper.

I had one friend who I thought was a shoe-in to come. He sent me two (almost identical houses) off Realtor.com. The one he bought in Colorado Springs cost him $400K - the one in DC was $1.1M. But we couldn't pay him to cover that nut. (And his commut is under 30 minutes compared to me estimate of 55-60 minutes fom the other house - longer via metro).

Lance - you keep profitable assests as long as there profitable and you can't get better returns elsewhere. I also didn't fire guys I was only making 4% even though my office average was 11%. These are people with families that are still making the company money.

David posted a craiglist entry a few weeks ago with a CA buyer of a condo in Arlington (near Ballston I believe) that was being offered at approximately an $85,000 discount to the purchase price. This was in excess of a 10% discount.

ReplyDeleteMy $0.02.

*chirp*

Look at the new houses in clarksburgh, they have reduced 40k on some units. also Germantown there are new town homes priced less than the existing town homes.

ReplyDeleteHaha may you don't consider these Mo County

One data point does not make a trend, my friends...

ReplyDeleteBut, again, if you want REAL data about prices in Arlington, check out this page:

http://www.arlingtonva.us/Departments/RealEstate/reassessments/scripts/saleslist.asp?Action=View&nbhd=230001&lrsn=61205&backRPC=18025418

It is a list of recent sales in Clarendon 1021, the most bubbelicous building in Virginia. The last 10-15 sales give an exact YOY sense of the market, and only two of them were below the purchase price--an average increase of 3-4%. Of course, the original buyers would still have lost money due to transaction costs, but it does show that, even in the worst (from a bubble perspective) building in Arlington, prices have not dropped.

More Arlington data...

ReplyDeleteSee this thread

http://bubblemeter.blogspot.com/2006/04/1413-n-monroe-st-arlington-va.html

where David poo-pahed the property.

Now see the sale record:

http://www.arlingtonva.us/Departments/RealEstate/reassessments/scripts/Inquiry.asp?Action=View&lrsn=25420

Hmm.

"Please show me any evidence of a decline in Arlington, Alexandria or MoCo. "

ReplyDeleteGo to www.homesdatabase.com and search all of arlington detached homes.

The fact that there are so many single family homes under 550k (40 homes) when there were hardly any at the beginning of the year is telling of the current market. Also, look at the inventories as a whole in Arlington. Approx 1250 available units now when there would typically be around 200 for the past couple years.

If you don't see signs of a turning market, then please tell us what you think that this indicates...

Net population in the area, month over month, is rising. Rising home inventories, month over month, are rising too?

ReplyDeleteTo me, this means pressure on the rental market, which means rising rents for the forseeable future.

No question inventory is up but it is up in all listing catagories--no one disproportionately more than any other, all in all.

ReplyDeleteThis is a highly desirable location right in the heart of Clarendon. Walking to bars, restaurants, night life, metro, and easy access to DC.

ReplyDeleteEven with all of this going for it, sales are flat to down. I would expect less desirable locations to begin faring even less well.

I agree, a few data points do not make a trend, but I choose to interpret the data as indicating a turn in the condo market.

NAR data shows prices have dropped QoQ for 2 quarters now, with 1Q06 numbers already lower than 2Q05 numbers for the greater Washington region. I would expect Arlington to perform better (as Lance states the market can get very local) but this information would not convince me that Arlington is a lock to go up, up, up.

My $0.02.

If you actually want to look at some numbers measuring over and undervaluation, try:

ReplyDeletehttp://www.globalinsight.com/gcpath/1Q2006report.pdf.

You will see that while DC is currently listed as overvalued (the estimate in this report is by about 38%), the Washington DC estimate includes suburban VA, MD, and WV for some reason. Only DC is like this among the cities analyzed by bubble reports like this. In any event, this hardly makes DC a major offender when compared to many places in California or Florida. And one is forced to wonder what the numbers would look like if you broke DC down into sub-cities, so instead of analyzing the entire metro area, you analyzed DC proper, Northern VA proper, Bethesda and Chevy Chase on their own, etc. Context matters here a lot.

I agree Arlington is not a lock to go "up up up"--I would expect, best case, to keep up with inflation for the next few years--but the posters here seem to be saying that the Arlington real estate market has collapsed, when the only objective indicators (local sales numbers) suggest otherwise.

ReplyDeleteThe data lags actual events. As explained before, when everyone wants to leave their stock position, they all sell, a crash occurs. When everyone wants to leave their real estate position, they all put their homes on the market.

ReplyDeletePrice declines take a long time to appear because first the homes have to sell. They might sit on the market for 8 months first. So the price decline or plateau can't be recorded until then. That is why inventory is more interesting than price delcines. ANY decline at this time (with six months inventory - the historical average) is a very bad sigh. Because it means that prices are coming down more rapidly than expected.

Housingheads like to say that bubbleheads are wrong because home prices haven't declined yet. But, did anyone, even bubbleheads, expect to wake up and find that houses were worth 50% less overnight? No.

This will take some time (as in 2-3 years) to unwind. With that in mind, it is still happening pretty darn fast.

I don't understand that post. Why would anyone be buying real estate now if it is so apparent that in 3 years it will be worth 30% less? And with 3% price appreciation YOY, how is it "happening pretty darn fast."

ReplyDeleteI honestly don't understand the arguments you are making. If the bubble has popped, prices should be dropping. They are not. Therefore, either the bubble has not popped or there is no bubble.

And, in any event, there is a two month lag between contract and settlement at most. So the June prices were contracted for in April. Still don't see where your argument is going...

ReplyDeletePersonally, I don't think condos will keep up with inflation over the next few years. I believe at best prices will stay flat.

ReplyDeleteWorst case, they'll fall back in line to historical trends. Though I define historical trends as 98-01 trend line + 5%/year appreciation + 20% asset appreciation due to banking competition.

I've done some rough math for a few examples and in those cases, this would require prices to fall 40-45%. Though each year the market stagnates, that 40% number declines. So a 10-15% drop over 2-3 years (not yearly) would hit the price floor I defined.

I don't think that's overly pessimistic or doomsday-ish. Nor do I think very many people will be incredibly hurt if this happens. Mostly, people will just have to stop bragging about paper profits and move on to another cocktail party conversation topic.

My $0.02.

"Please show me any evidence of a decline in Arlington, Alexandria or MoCo. "

ReplyDeleteNo problem. Seriously, how can anyone say there hasn't been a 10% price decline in Arlington?! I have been looking in Fairlington and for single family homes in North Arlington for 2 years. We decided we could buy this spring, but when we saw how fast prices were dropping, we decided to rent again for 2 years and buy then.

Examples of a price decline: Clarendon models (that's a two bdr townhouse in Fairlington) went for $485K-$500K last spring/summer. Now they are going for $439K to maybe $460K. THAT IS A PRICE DECLINE.

Want an example of a price decline for SFH in North Arlington? MLS ID AR6076876 was originally listed for $650K. It's a pretty nice all brick 3bdr, 2 bath in a good school district. It had to reduce to $584,999 before it finally went under contract. The sale is not final yet, but I guarantee they didn't get $585K. Last spring this would have sold in a day for over list price.

Prices are declining, I think 10% so far and I wouldn't be surprised if by next spring it's 20%. The peak was last summer and anyone who can't see that is lying to themselves or stupid.

Excellent. Someone who wants to argue with data. What is the address of the Fairlington places? Please post a link to the Arlington sales records

ReplyDeletehttp://www.arlingtonva.us/Departments/RealEstate/reassessments/scripts/DREADefault.asp?lnsLinkID=1116

showing places that have had price declines.

Further, here is a link to sales in that neighborhood (Dominion Hills):

http://www.arlingtonva.us/Departments/RealEstate/reassessments/scripts/saleslist.asp?Action=View&nbhd=504028&lrsn=17992&backRPC=12024011

Sale prices are simply NOT down over last year. Take a look one by one, I don't know how you could say otherwise. Now, I'm sure the seller in teh one you are referring to thought he could get 10% over what he could have gotten last year, and found out he is in a flat--but not down--market, but nothing else.

Anon 2:49,

ReplyDeleteTake this example:

An asset has a value of 100 in Q105:

Q105 = 100

Q205 = 112.8

Q305 = 116.0

Q405 = 113.7

Q106 = 111.0

This shows a year over year gain of 11%.

Normalize for Q205 though and you see the following:

Q205 = 100

Q305 = 102.8

Q405 = 100.9

Q106 = 98.4

Q206 = 95.7 (assumes Q206=Q106 prices)

So even though reports of 3% YOY growth still look great, you're going to be comparing to higher starting points as the YOY starting point moves through the peak of the market last summer.

In one quarters time we will see declines YOY. That's pretty rapid to me.

By the way, those example numbers are normalized numbers from NAR most recent quarterly report of actual home values in the Washington region. They're not made up (at least by me)...

My $0.02

Source: http://www.realtor.org/Research.nsf/Pages/MetroPrice

Also, you are just factually wrong on Fairlington. You said:

ReplyDeleteExamples of a price decline: Clarendon models (that's a two bdr townhouse in Fairlington) went for $485K-$500K last spring/summer. Now they are going for $439K to maybe $460K. THAT IS A PRICE DECLINE.

If you look at the FACTS

:

http://www.arlingtonva.us/Departments/RealEstate/reassessments/scripts/saleslist.asp?Action=View&nbhd=283017&lrsn=46656&backRPC=29004249

you will see that only 3 places in Fairlington have ever sold above $500K, all since last October, and only 3 have ever sold above 480 and only 3 have ever sold above 490, all spread through the last 2 years. Try again.

Fairlington is in South Arlington zip code 22206. Look up anything in the 3000 block of South Utah Street. Last year as I stated in my previous post, units were going for $485K to $500K. This year they are not. Sellers are lucky to get $460K. The price variations are due to the fact that some have redone the kitchens and bathrooms and some have not, but each model is exactly alike at 1500 square feet. Everyone in the neighborhood from home owners to real estate agents agree there is a price decline. IT IS FACT. So, please, stop lying to people and saying the market is "flat." Prices declined in this neighborhood b4 in the 90s. I know someone who bought her place (a clarendon model) in 1995 for $158K. The guy who sold it to her bought in 1989 for $175K. That's right, his property decreased in value in 6 years. It does happen and it will happen again over the next few years. Even in Arlington, even with job growth.

ReplyDeleteOy. Don't argue with me about Fairlington, I've lived there for 4 years. TONS of properties have gone for over $480K. When you "view sales in this neighborhood" on the RE assessment website, it only shows the sales for that condo association. Fairlington has SEVEN associations, so if you only looked in one neighborhood, you're not getting the whole picture. TRUST ME, I AM NOT FACTUALLY WRONG!!!!!

ReplyDeleteTry this fairlington link if you don't believe me:

ReplyDeletehttp://www.co.arlington.va.us/Departments/RealEstate/reassessments/scripts/saleslist.asp?Action=View&nbhd=283042&lrsn=49310&backRPC=30015049

AND, "look at the facts!!"

WTF, look at the bigger picture.

ReplyDeletewww.mris.com

The DC bubble is collapsing inward. Outlying areas have 6-9 month inventory and flat to sagging median prices. As the dominos begin to fall, the closer in areas will follow the trend. Inventory will swell and prices will fall.

As a friend told me back in 2004: Real Estate is just supply and demand.

I love it. Bubbleheads, when asked to prove that housing prices have dropped in specific cities, point to 2 houses that have had their asking price come down.

ReplyDeleteYou'd have more credibility if you just admitted you were wrong.

bitterrenter said...

ReplyDelete“WTF, look at the bigger picture.

www.mris.com

The DC bubble is collapsing inward. Outlying areas have 6-9 month inventory and flat to sagging median prices. As the dominos begin to fall, the closer in areas will follow the trend. Inventory will swell and prices will fall.

As a friend told me back in 2004: Real Estate is just supply and demand.”

Please, don’t ask these guys to look at the numbers, it just confuses them. They’ll give you some rant about “not on my state” then in a few months it’s “not on my city”, few more months “not in my neighborhood” then finally “not on my block”.

http://biz.yahoo.com/prnews/060419/law012.html?.v=53

Buffpilot,

ReplyDeleteI can't argue with what you have to say. I will add though that this isn't necessarily a bad thing that is happening. Private companies know they have to pay what it takes to bring in qualified employees to do the work and make their bids to the government for that work based on what they are paying. In this way, real costs are accounted for and dealt with. Regrettably, as a DoD/Civil Service person, you were fethered by government rules and practices that weren't market driven but rather just plain reactive. By that I mean, salaries get raised via official means such as what the COLA (based on inflation measures) says and NOT based on actual needs. (The COLA only accounts for a "basket of goods" tied inflation and not what it really takes to attract qualified employees.) In the end, the government must comply with market forces (by either paying more for these folks or, more likely, moving these folks to lower cost areas where in today's seamless on-line environment they can do the same job.) Unfortunately, it just takes longer because you don't have the same market signals that private industry benefits from. Now, is that a bad thing that people can do their jobs from locations other than Washington? Not at all. Were we to tell this to the people of 100 years ago they would marvel of such progress ... of not having to live in an air-conditioner-less Washington in order to have their federal employment! The other side of the coin is that the exodus of the folks who CAN do their job in places other than Washington leaves open more space for those who MUST be here such as lobbyists, lawyers, diplomats, IT, etc. Were it not for this natural release valve, prices would be even higher here than they are.

Anonymous said...

ReplyDelete"I love it. Bubbleheads, when asked to prove that housing prices have dropped in specific cities, point to 2 houses that have had their asking price come down."

After about 60 seconds of searching I found:

DC6095743

DC6094653

DC6082890

DC6062256

Do you need more? Take 5 minutes and look for yourself.

"You'd have more credibility if you just admitted you were wrong."??

And if you’re looking at Arlington specifically:

ReplyDeleteAR6097144

AR6044018

AR6053088

AR6047223

AR6055232

AR6077131

AR6085651

If you had told housingheads last year that inventories would be 3 times higher (more in some areas in northern va) in the summer of '06, then they would have the same banter as they do about the lower prices to come. To the housingheads on this site, are you supprised at the run up in inventories, or does this play perfectly into your soft landing scenario? WHat if they double from here - is this ok for the soft landing scenario?

ReplyDeleteRobert, it sounds like you didn't understand the question. We're looking for evidence that the average sale price has declined in Alexandria, NW DC, Arlington, Montgomery Cty, etc. Finding examples of houses that have lowered their asking price is not evidence of that. Please please please find evidence or admit that you're wrong.

ReplyDelete"To the housingheads on this site, are you supprised at the run up in inventories, or does this play perfectly into your soft landing scenario?"

ReplyDeleteThe fact that inventory has begun to decline does.

"The fact that inventory has begun to decline does. "

ReplyDeleteWhere are you speaking about?

I love it. Finally, I don't have the time to look up all the numbers and post them, so I am glad some others have! I get sick of the same old argument....

ReplyDelete"bubblehead= prices have dropped here is the data"

"househead=your data is wrong. your stupid. admit your wrong"

"bubblehead=no really, look at the data, right here.. it shows price declines"

"househead=you should die for wishing that housing declines, admit your wrong"

Listen folks, the argument is over, the data is there. Christ, you can see it just by going for a drive. Neighborhoods all over are littered with for sale signs. Housing prices have dropped. What we should start discussing is when they will stop, what areas are subject to the biggest declines, and does anyone think idiot california speculators will come in and drive it up again?

Bob

ps. please lance I beg you, dont blame bush anymore!

Read em and weep, bubbleheads:

ReplyDeletehttp://www.gcaar.com/statistics/2006/dcsf0606.pdf

Inventory began to trend down in DC in June.

Now it's your turn to make excuses.

Bob, I guess proof is beneath you? Sorry, Bob and the bubblefucks - we win, you lose.

ReplyDeletethanks anon 6:14pm, you have proved my point exactly.

ReplyDeleteBob

No, Bob, you have to provide some proof, or else you lose the argument.

ReplyDeleteproof? are you kidding me? Have you read any post above at all?

ReplyDeleteBob

You mean your post about driving around your neighborhood? Ok, let me rephrase - if that's your proof, you've lost the argument.

ReplyDeleteno I mean the many posts by other people stating specific facts about metro pricing. You know facts... Data, posted above, not just by me. Can I make this clearer?

ReplyDeleteBob

Newsflash: One month does not make a trend. The months leading up to June do. The small decrease in inventories are nothing to get excited about. I would not even comment if they moved up bu that small amount because it would not be enough to come to a conclusion about. The fact that they remain high, and houses are sitting is the real issue. Talk about small picture people...why don't you celebrate by buying a nice 400k condo and see how well you sleep at night. You will not be able to resist getting on here and pleading your case - if it was a non issue, then you would not waste your time on here declaring a premature victory.

ReplyDeleteMore and more housingheads come on this site to refute the bubble. What does that tell you? These guys don't realize it, but their appearance on this site validates the bubble situation. Maybe they think that if they say "no bubbble" enough, like a mantra, that it will go away. If you don't think that there is a bubble, then why are you on here chasing ghosts?

ReplyDelete"Read em and weep, bubbleheads:"

ReplyDeleteMay help to tell these people the story that bought in 2004 and are listed as a loss.

www.forsakencraft.com/proof.htm

LOL at DC area inventory "trending down." After the explosion in inventory, things are down slightly from a few weeks ago. That's the reality.

ReplyDeleteLet's use housing tracker, my facorite site for housing data:

http://www.benengebreth.org/housingtracker/location/DC/Washington/

Inventory was 5,347 on 8/14/05. Up to 6,054 on 1/1/06. Up to 10,169 on 4/28/06. Peaks at 12,469 on 6/12/06, and is now down to 11,827.

This is your "trend" down? LOL. We are still more than twice as high as we were almost a year ago.

A Redskins fan

Bob is right.

ReplyDeleteRegardless of whether there are already price declines or not, the argument is no longer "Has the real estate market changed?"

Now it is "How has it changed? Why has is changed? And what does it mean?"

The fact that there is even a hint of price declines when inventory is just now reaching historical norms indicates that actual declines are on the way. (A hint of declines is the ancedotal listings that robert posted.)

Sorry, Redskins fan, it's true. Inventory is down. It's going to keep trending down. You lose.

ReplyDeleteWaaaaa! Waaaaa! We don't need facts! We're bubbleheads! We have no money and we're mad!

ReplyDeleteTwo other points:

ReplyDelete1) the emphasis on some posts above on sales prices is misplaced. Odds are right now, if you place a house for sale in the DC area, it is not selling. If most houses are not selling at their listed price, how meaningful are the few sales that actually do happen?

2) There is a townhouse for sale near me that has consistently been priced for sale above the rest of the market for at least half a year. The dude lowered the price a few times, but still kept it ahead of what other townhouses were selling for. Now, two other THs near him went up for sale at at least 100 less than what he originally wanted. His TH is no longer for sale; it's for rent. That's an inventory reduction because a crazed flipper has not yet faced reality. His property is not sold or rented. But it's no longer in inventory. If inventory started reducing because more houses are being sold, then maybe housingheads would have a point. I don't think they do.

A Redskins fan

" Sorry, Redskins fan, it's true. Inventory is down." "It's going to keep trending down"

ReplyDeleteLOL. Yes, Inventory is down a tiny bit in the last couple weeks after a massive increase over the last year.

"It's going to keep trending down"

This part remains to be seen.

A Redskins fan

Interesting point Redskin fan. From craiglist posting's it does appear there are a lot more people willing to rent because they can't sell.

ReplyDeleteSo, time will tell if inventory decreases as sales level off - it would indicate that your theory is correct.

To anon 6:58 - 7:02

ReplyDeleteI am sure that David will delete your posts soon enough but as someone who enjoys reading this blog, filling up the board with hateful, bigoted name calling cheapens the discussion and makes it less fun for everyone.

Everyone enjoys reading a zinger now and then but your attacks crossed the line.

Come on, where are all the people who were laughing yesterday at the notion of a Saudi prince spending time in DC?

ReplyDeleteDid today's CNN story about the Saudi prince selling his home in Aspen CO because he spends too much time in Washington DC put a damper on their jovial mood?

Prince Bandar in DC

ReplyDeletemore data on decling prices,

ReplyDeletehttp://www.arlingtonva.us/Departments/RealEstate/reassessments/scripts/saleslist.asp?Action=View&nbhd=172122&lrsn=16063&backRPC=11010076

this is the place where I live. Last summer, 2 bed/bath 986 sq ft condos were going for 435-450, this summer the most recent sale is 412K. There are now 11 units for sale in this complex, 3 units which are 986 sq ft listed between 399-410. Average rentals go for about 1500-1600/month. The two realtors I'm friends with both agree that the condo market has crapped out of late, but townhouses and single family homes are doing ok so far.

Anonymous said...

ReplyDelete“Robert, it sounds like you didn't understand the question. We're looking for evidence that the average sale price has declined in Alexandria, NW DC, Arlington, Montgomery Cty, etc. Finding examples of houses that have lowered their asking price is not evidence of that. Please please please find evidence or admit that you're wrong.”

Anonymous said...

"I love it. Bubbleheads, when asked to prove that housing prices have dropped in specific cities, point to 2 houses that have had their asking price come down."

You’re right.I missunderstood the statement.I was wrong.

According to ziprealty, the number of homes in Alexandria with price reductions: only 497

godot asked:

ReplyDelete"WHat if they double from here - is this ok for the soft landing scenario?"

godot, considering it took me 6 tries to get a house and I had 11 offers on my condo last year, I hope they MORE than double. We need that extra inventory to have a stable and balanced market. We need much more than what we have now. It had gotten soooooo out of balance by 2005!

This comment has been removed by a blog administrator.

ReplyDeleteanon said:

ReplyDelete"Anonymous said...

Robert, it sounds like you didn't understand the question. We're looking for evidence that the average sale price has declined in Alexandria, NW DC, Arlington, Montgomery Cty, etc. Finding examples of houses that have lowered their asking price is not evidence of that. Please please please find evidence or admit that you're wrong."

You're wasting your time with him. I have gone 'round and 'round with him on this issue, and he is incapable of understanding why a lowering of asking price does not nothing to indicate the trend in selling prices. He keeps on with his "places always sell for less than listed, then ... " I don't know how to explain to him that most houses I visited in 2005 were selling for at least $100K more than what they were listed at ... and then by 2006, these same (or similar houses in same neighborhoods) were listing for an additional $400K over what they'd actually sold for in 2005. So, "yes" they lowered their asking prices to something like year 2005 selling prices plus $200K ... so does that mean they've lowered their prices (since they were originally asking more) or that they've raised their asking prices since they are still somee $200K over what they sold for last year?

Robert just can't figure out why "asking price" just doesn't figure in to the calculation ... Again Darwin's theory in action ... Survival of the fitest ...

Lance,

ReplyDeleteYou keep saying Robert is missing the point. I don't think he is.

If the asking price/offer price/final sale price - whatever you want to call it, is LOWER than recent comps, then there has been a price decline.

It doesn't matter if the seller has made $300K or not because they bought in 1998. It only matters that, based on recent comps, prices are down.

In the end, this is why most people are probably okay even with massive 20-40% declines. They won't be under water because there's been such massive appreciation. Only buyers in the last 12 months risk being seriously over exposed to a collapse in price.

My $0.02.

mytwocents,

ReplyDelete"If the asking price/offer price/final sale price - whatever you want to call it, is LOWER than recent comps ... "

it's NOT, that's the problem ... and Robert has been called on the carpet by Anon for this glaring error of logic.

Robert is comparing asking prices today to asking prices 6 months ago and saying that because they are lower today, then that means that selling prices have dropped too. (He actually used words stating such in a response to me.) THAT is a glaring error in logic because the assumption is completely unfounded.

Lance said...

ReplyDelete“You're wasting your time with him. I have gone 'round and 'round with him on this issue, and he is incapable of understanding why a lowering of asking price does not nothing to indicate the trend in selling prices. He keeps on with his "places always sell for less than listed, then ... “

Lance, I don’t think we’ve “discussed” this particular issue. As a matter of fact, I think on the table we have:

-what are some specific data we can track? Lest we continue to track “insignificant data”.-

After all, according to you foreclosures, rising interest rates, ARM’s resetting and increasing inventory are all “insignificant”.

What was posted earlier:

Anonymous said...

"I love it. Bubbleheads, when asked to prove that housing prices have dropped in specific cities, point to 2 houses that have had their asking price come down."

I just wanted to point out that there are more than “just two” that have lowered ASKING PRICES (not sale prices, they have not sold yet) I don’t think asking prices are an indicator. A seller can ASK for ANY price they want. However, when sellers REDUCE their asking price, it tells me that the market will no longer support just any ole number thrown out there by the seller and, not much of a bidding war going on.

“I don't know how to explain to him that most houses I visited in 2005 were selling for at least $100K more than what they were listed at ...”

So, in 2005 you saw Average Sale Price as a percentage of Average List Price over 100%. OK

“and then by 2006, these same (or similar houses in same neighborhoods) were listing for an additional $400K over what they'd actually sold for in 2005.”

So you’re seeing a $400K price increase YOY?

Tell you what. Here’s a link to the MRIS data:

http://www.mris.com/reports/stats/index.cfm

Post the numbers that show this. Hell, post any data that support any of your opinions.

Oh and:

“Robert is comparing asking prices today to asking prices 6 months ago and saying that because they are lower today, then that means that selling prices have dropped too. (He actually used words stating such in a response to me.)”

Darwin's theory in action ... Survival of the fitest ..."

And you Lance, are completely delusional. I have made no such comment.

Lance, Will Freddie Mac report higher interest rates tomorrow?

ReplyDeleteWhy don't someone email Constatine Crist or call them (it is an 800 number) to get their side of the story?

ReplyDeleteFor more information about this item, please contact Constantine Crist at 800-368-5242 x8478 or via e-mail at dcrist@nahb.com.

Lance,

ReplyDeleteSorry, but all th ejobs I had, had to be filled by working in DC. Security reasons and the customer would not allow us to go elsewhere. Bottom line, we just hired less people and could not fill the slots (nor could anyone else). The Feds got mad but when showed the data they just said,"Well it's your problem." I then asked if they would accept people fresh out of college with no experience and they said No. Standoff. I have other hiring managers in other companies say the same thing. We were in a constant fight for each others people, but couldn't use pay to outbid each other since we were all under similar constraints.

Most of the guys we were dealing with on the Fed side had been GS-XXs for decades and didn't understand why we had troubles. I even brought up Realto.com once and showed them. They just shrugged!

If you have a brilliant idea on how to attract seasoned professionals, with technical degrees, into the greater DC area at Fed contractor prices, please tell us. We will all become wealthy!

buffpilot said...

ReplyDeleteMost of the guys we were dealing with on the Fed side had been GS-XXs for decades and didn't understand why we had troubles. I even brought up Realto.com once and showed them. They just shrugged!

I love this, the RFPs state the exact requirements (including education and experience). If you can't meet the RFP at the price you bid at, don't bid at that price. Simple as that!

buffpilot,

ReplyDeleteSo, don't you think the day will have come when the GS-XXs come to the realization that they either properly fund their needs ... or they go without?

What are you suggesting as an alternative? House prices will be what they will be, and short of communist-style controls, what can the government do to really control them (and I don't mean influence them as the Fed does.)

Buff pilot

ReplyDelete"If you have a brilliant idea on how to attract seasoned professionals, with technical degrees, into the greater DC area at Fed contractor prices, please tell us. We will all become wealthy! "

DC will have all of these empty condos. Makes you go Hmmmmmmm.

"If you have a brilliant idea on how to attract seasoned professionals, with technical degrees, into the greater DC area at Fed contractor prices, please tell us. We will all become wealthy!"

ReplyDeleteWhat's the problem? According to this blog renting is a great deal in this area. Its like putting 3k in your CD every month. Why don't you just show these potential employees rental listings instead of property listings??

Lance..what about the Freddie Mac question? You never answered?

ReplyDeleteLance,

ReplyDeleteThey are going without mostly. One office was slowly getting smaller. About 1 person per year. Yet their workload kept increasing! Since the contractors only did 40 hrs/wk, the GS type only did 40, it came down to active duty types to do the work (60+ hours) to get it done.

Like I said I don't have a solution, but I can't imagine the Feds suddenly upping their pay rates by 50-100% to cover the change in cost-of-living in the DC area. My real solution would be to move the Feds and the support contractors out of the DC area in great quantities. But could you imagine how say sending the entire HUD or 50% of the Pentagon or the FBI HQ or CIA HQ would play out politically?

Anon - I know all about RFPs etc. The Feds want an experienced professional, MS/PhD in a technical field, etc and only pay $85K-$100K. Why would these types move to DC when they can get the same pay, in just as desirable areas (Lance - I know DC is special, but so is everywhere else), with half the cost-of-living? My example I gave is anedotal I know but is what I faced year round.

Anon 7:31. They want to buy. And can do so elsewhere at a fraction of the cost of a house in DC. You can buy in Texas (or Colorado, or Ohio etc) or rent in DC. I actually tried that approach with one guy and the laughter was so hardr he fell off his chair.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeletebuffpilot said...

ReplyDelete"Anon 7:31. They want to buy. And can do so elsewhere at a fraction of the cost of a house in DC. You can buy in Texas (or Colorado, or Ohio etc) or rent in DC. I actually tried that approach with one guy and the laughter was so hardr he fell off his chair."

Like the bubbleheads, the GS-XXs you were dealing with will only be able to put their heads in the sand for so long. Eventually, they will need to realize that high home prices are here to stay in DC, and they should just learn to deal. Pay more, move, or expect less. It's not like there is some ominous force out there that sets prices. It's just all of us acting collectively in what is known as the market.

Facing reality can be hard, but in the end one is much better off.

anon,

ReplyDeleteI have no idea what Freddie Mac is doing (or what your question relates to since from what I know they guarantee loans and don't set rates ... the market/lenders do that.) I just know that from everything I see around me, there is no doubt that we'll be facing inflation ... which will translate into higher rates of course.

"Lance said...

ReplyDeleteanon,

I have no idea what Freddie Mac is doing (or what your question relates to since....."

Thats all I need to know Thanks.

"Thats all I need to know Thanks."

ReplyDeleteLOL, still thinking I am a real estate agent? and testing me? LOL, no, for the final time, I am not a real estate agent, or a lender, or anything other than a non-bitter homeowner!

Let's see how many more threads David closes today.

ReplyDeleteHere's the supposedly offensive post from the thread on the Skokie house; the part that David objected to on the previously closed thread has been deleted.

Is this post offensive? You decide.

Once again, David posts a snipet of information and readers are to infer a very broad conclusion (e.g., this house in Skokie is wildly overpriced for its market, ergo, the bubble is EVERYWHERE!).

Here's some information that would have made this more useful - recent sales prices for comparable Skokie houses, recent listing prices for comparable Skokie houses, etc. Instead, we get a photo, a pat on the back about David's brilliant forecast that a $700k listing price in Skokie, Illinois might be a wee bit wishful thinking, and a recommendation that the asking price be lowered another $50k (why 50k? Why not 25k? Or 75k? Or 100k? Maybe if we had some listing and sales comps, we would know).

All in all, it's just another weak post that looks at one house in a very random place and asks readers to infer a major assumption about the country as a whole.

Of course, I'm sure David will respond that he didn't say any of this. But that's his usual escape hatch when he posts these sorts of things and then gets called on it. He doesn't need to be explicit in these posts; based on his stated biases, it's pretty implicit what he's trying to say.

This site used to have much more fact-driven information to make its arguments. Now it's much weaker, plus the comments section is running amuck. [Allegedly offensive sentence deleted.]

Lance said...

ReplyDeleteanon,

"I have no idea what Freddie Mac is doing (or what your question relates to since from what I know they guarantee loans and don't set rates ... the market/lenders do that.) I just know that from everything I see around me, there is no doubt that we'll be facing inflation ... which will translate into higher rates of course."

"Lance said...

"Thats all I need to know Thanks."

LOL, still thinking I am a real estate agent? and testing me? LOL, no, for the final time, I am not a real estate agent, or a lender, or anything other than a non-bitter homeowner!"

I understand you have no idea with what you write. Just want you to understand that. rate is down too.

Keep up the great postings, thanks for keeping me informed.

The bubble is nothing to get excited about. Inventory is up dramatically in almost every major metropolitan area, and sales have come to a standstill in San Diego, Boston, DC and Central CA. An investor would notice this and adjust her position. Only a house salesman or someone who quit his job to flip houses would need to feel defensive about it. Go easy on the bulls, they have a rough time ahead. The real perpetrators of this bubble have already taken their chips off the table and, I suspect, are not reading this blog.

ReplyDelete