WASHINGTON (July 19, 2006) – Renting can cost more than seven times annually than owning, according to a newly revised consumer education brochure from the National Association of Realtors®. The brochure, “Why rent when you can buy?” challenges certain assumptions about renting versus buying and helps Realtors® evaluate with their clients and customers whether homeownership is right for them.Is there really anywhere in the US where annual rent costs more then seven times what owning costs? Not sure how they come up with these numbers. This is pure deception. The NAR goes on to say:

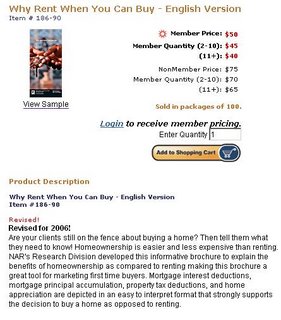

This is also misleading for many reasons. First of all, if one buys there are taxes, insurance costs, and maintenance costs that are NOT mentioned and that are NOT 'steady,' Here is the page where you can purchase the NAR Brochure:

The Federal Reserve Board estimates that homeowners have a net worth nearly 36 times more than that of renters. Over the past 10 years, the cost of rental housing in the United States has increased an average of 3 percent per year; average rents are projected to rise 4.1 percent this year alone. With a 3 percent annual increase, a current rental payment of $1,000 per month would increase every year and amount to $137,567 after 10 years, with no wealth accumulation.

In contrast, a $210,000 home purchased today with a downpayment of $10,000 and a 30-year fixed rate mortgage at 6.5 percent would cost a steady $1,100 per month and yield a net worth of $138,521 after 10 years, assuming an historic 4.5 percent annual appreciation rate.

"Are your clients still on the fence about buying a home? Then tell them what they need to know! Homeownership is easier and less expensive than renting" Pass the Kool Aid!

"Are your clients still on the fence about buying a home? Then tell them what they need to know! Homeownership is easier and less expensive than renting" Pass the Kool Aid!The National Association of Realtors (NAR) is a harmful organization that has been cheerleading the housing bubble which is a speculative episode. The housing bubble is putting millions of Americans in financial harms ways. The behavior of the NAR is absolutely despicable.

Generally speaking, I do not have a problem with this brochure, though they left out a few things:

ReplyDelete1 - Renters can take the standard deduction rather than itemize the mortgage interezt

2 - Housing Maintenance cost - I am sure that it would be easy to find average figures on the net

3 - Condo Fees (non deductable). Any place for $210k to 200k will have at least a $200 condo fee, and most do not include utilities.

4 - you can easily rent a $600k house for $2k per month - by their figures it would run about $3k per month rent

5 - Opportunity cost of the additional money that you are putting up front. Could be invested rather than just getting it back at end of year

The numbers are skewed to make buying seem more attractive, but just as any sales organization, they will create a cost benefit analysis that leaves important bebfits out on the the other side. See, that is like looking at a job offer and not paying attention to the benefits that do not show up in the payroll such as health, 401k, bonus, etc. In Econ, they teach you to look at what is seen and not seen. Don't just take their version of face value to be the law.

One critical thing they are leaving out is that the place you can buy for $1,100 per month is not going to be equivalent to the place you can rent for $1,000 (at least in major metro areas). You could have a lot less space, a much longer commute, etc. Monthly payments for purchasing in major metro areas are much higher than monthly rent payments for an equivalent property, and you are right that it is deceptive to make a comparison using non-equivalent properties.

ReplyDeleteThat was the most glaringly obvious short coming I saw in the analysis too. The basic assumption is that a place that costs $210,000 will also rent for $1,000.

ReplyDeleteAdditionally, I ran the numbers through Money Magazine's calculator and came up with something entirely different for a $200K mortgage at 6.5% interest.

(try it: http://cgi.money.cnn.com/tools/mortgagecalc/ )

Price: $210,000

Downpayment: $10,000

Interest rate: 6.5%

Yearly property tax: $2,000 (my estimate < 1%)

Payments:

P&I: $1,264.14

Tax&Ins: $166.67

PMI: $80

Total: $1510.80

If David's quotes are accurate, this is a highly deceptive brochure. And you know who will fall for it? Those that are less financially and mathematically sophisticated and trust the RE agents that advise them.

My $0.02.

English version? How do I get the Spanish version for my 11 million illegal immigrant clients?

ReplyDeleteI might add, that for anyone wanting a nice shorthand for mortgage calculations:

ReplyDelete$100,000 at 6% interest amounts to almost exactly $600 per month for principal and interest only.

That's how I knew to suspect those numbers in the NAR brochure. A $200K mortgage should be at least $1200/month for P&I only at 6%. Yet they were talking 6.5%, etc. etc...

My $0.02.

Two words...

ReplyDeleteCreative Financing

"Anonymous said...

ReplyDeleteTwo words...

Creative Financing

July 23, 2006 9:02 AM

"

With a small print at bottom that says that you will have to find GF when creative financing ends.

OT but here is seller's update from earlier thread about my offer of 230.

ReplyDelete"

Mr abcd,

I am in the real estate investor and know the real estate market exceptionally well and follow many other factors very closely that effect the market. I guarantee you real estate prices will most definitely not drop anywhere in the range of 30%-40% in the next 12, 24, 36 months. That is a completely wrong and irresponsible statement.

Of course nobody can predict exactly what will happen all you can do it use today's factors that effect the market to gauge what will happen tomorrow. If anyone is cautious of the real estate market it is me and there are still many places which real estate are good investments today and tomorrow. I guess if someone doesn't know about the market like myself they may be crazy enough to buy into your future predictions but I don't thik that is likely. Almost all forclosures and preforclosures do not sell as 30%-40% off market price and these are homes that people are absolutely desperate to sell as well as so are the banks . Simply put thanks but no thanks. Best of luck in your furutre business transactions.

--

Thanks!

xyz

"

The CAR and NAR should be sued as defendants in any lawsuit where the buyer has bought in this market and loses money. They can't hide behind the defense it was "just an opinion." It isn't "normal" to lose your life savings buying a home. Any description of the "landing" other than a "crash" is an outright lie. They shouldn't still be suckering people in this bubble market.

ReplyDeleteRegarding my offer of 230K.

ReplyDeleteFirst the asking price of 389K itself is not realistic. This house was around 190K 3 years back. I did not get offended by seeing asking, so the seller should not get offended by my offer. It is business transaction. Take it or leave it.

Regarding putting myself into sellers shoe's as Lance said. I am not selling so I can not do that but if I was a seller, I would certianly try to get as much as possible. And that is why I did not tell seller that his asking is unrealistic. I would have done the same thing if I was selling but it is the buyer(s) who decides what a house is worth. I have been lowballing since last 6 months and the reason I do it to do my share of work as an individual to make sellers realize that market has changed/changing. It will not happen overnight and it will take time. During last 6 months asking in the community has dropped by 10% (30K). My taget is 30 to 40% and I reduce my offers as and when interest rates go up. 30K drop (for 300K houses) for every 1% increase in interest rate.Inventory in this community has increased by 500% times in 1 year and mostly are flippers. I will be waiting (because I can afford to wait) to see how long these flippers are able to hold.

And another thing (I'm trying to let this go 'cause it's marketing hype but really...)

ReplyDeleteThey make no attempt to account for the $100 differential in price built in. If you take $100/month over 10 years at 4.5% interest you end up with $15,176.51. Not the zero net wealth they talk about. Plus, if you had the $10,000 down payment they mentioned, and put that into a 4.5% savings account, your networth is now $30,846.43 at the end of 10 years...

Sure it's less than the house because it's not leveraged but it just goes to illustrate how deceptively one sided that analysis is...

My $0.02.

My reply Reg. 230K offer

ReplyDeleteMr xyz,

Thanks for your reply. It did not work out between us this time but may be we will have some business opportunity in future.

Thanks!

abcd

waiting for godot said...

ReplyDelete"Generally speaking, I do not have a problem with this brochure, though they left out a few things:

1 - Renters can take the standard deduction rather than itemize the mortgage interezt"

Godot, your statement is misleading because when you itemize you get to take the regular deductions that make up the standard deduction PLUS you get to take a deduction for the mortgage interest and property taxes. I.e., it's not an "either/or" situation because a standard deduction is nothing more than all your others deduction other than those related to mortgage interest, property taxes, medical expenses, loss from theft, etc. So, the brochure IS correct in that respect.

WhiteTower said...

ReplyDelete""Steady" costs of homeownership -- as in how property taxes, HOA fees, and homeowner's insurance rates never increase?"

Whitetower, these fees are indeed variable, but over the total cost of ownership their increase/decrease is really insignificant. Besides triple net leases are common when renting a house (vs. an apartment) and with a triple net lease, the renter pays all these costs ... not the landlord. And even in the case of apartment renting, the renter pays his own renter's insurance (in addition to the landlord paying for dwelling insurance.)

my2cents said"

ReplyDelete"That's how I knew to suspect those numbers in the NAR brochure. A $200K mortgage should be at least $1200/month for P&I only at 6%. Yet they were talking 6.5%, etc. etc..."

Could they have been using a I/O loan?

Although I agree that US overall prices will not go down 30% in next 36 month, it simply does not matter.

ReplyDeleteIn reality, it is enough fopr prices to stay flat for seven years for real value of the house to decline 22% with inflation ratio of 3.5% per annum.

Assume additional drop of only 3% per annum, total loss of real property value is astounding 37.5% over seven years.

Meantime, rents will be increasing at inflation pace, provided economy is strong.

Look at my rent in Glendale, AZ:

Zillow Price $415,000

Rent $1395/month

GMR (Gross Rent Multiplier) 24.8

Seven Years from now

Zilow Price $335,000

Rent $1775

GMR 15.72

As you can see, even after such decline GMR is slightly above acceptable 14.

So more likely, we will be exeriencing around 40% real value decline, unless rents will go nuts and skyrocket at 7-8% per year and that is highly unlikey)

This comment has been removed by a blog administrator.

ReplyDeleteAnonymous said...

ReplyDelete"OT but here is seller's update from earlier thread about my offer of 230.

"

Mr abcd,

I am in the real estate investor and know the real estate market exceptionally well and follow many other factors very closely that effect the market. I guarantee you real estate prices will most definitely not drop anywhere in the range of 30%-40% in the next 12, 24, 36 months. That is a completely wrong and irresponsible statement.

Of course nobody can predict exactly what will happen all you can do it use today's factors that effect the market to gauge what will happen tomorrow. If anyone is cautious of the real estate market it is me and there are still many places which real estate are good investments today and tomorrow. I guess if someone doesn't know about the market like myself they may be crazy enough to buy into your future predictions but I don't thik that is likely. Almost all forclosures and preforclosures do not sell as 30%-40% off market price and these are homes that people are absolutely desperate to sell as well as so are the banks . Simply put thanks but no thanks. Best of luck in your furutre business transactions.

--

Thanks!

xyz"

Sorry, but you definitely deserved what you just got from this guy.

I find it funny how bubbleheads go around accusing everybody of trying to take advantage of them ... and then what is the first thing they do the minute they think they have the opportunity to negotiate from a superior position ... ?

"

ReplyDeleteLance Said..

Sorry, but you definitely deserved what you just got from this guy.

I find it funny how bubbleheads go around accusing everybody of trying to take advantage of them ... and then what is the first thing they do the minute they think they have the opportunity negotiate with an advantage ... ?

"

People who are scared and/or nervous get offended easily. I see nothing offending in my offer or sellers reply. Although I do see a little anger and frustration in sellers email, but who cares about flippers, take it or leave it, It is business transaction.

It's amusing to see the bubbleheads question the details (sometimes in error-Waiting for Godot's tax deduction, for example) yet completely miss the overall point of the brochure: Owners save a lot of money compared to renters over a 30 year period of time. Are any of you bubbleheads questioning the tens or hundreds of thousands of dollars that would be spent on rent during 30 years time? Are any of you questioning that a 30 year mortgage would not ordinarily be paid in full at end of 30 years? Are any of you questioning that when the mortgage is paid in full in the 30 years, that the property will have appreciated in value? These are the relevent big picture lessons to be learned from this brochure.

ReplyDeleteanon said:

ReplyDelete"I am not selling so I can not do that but if I was a seller, I would certianly try to get as much as possible. And that is why I did not tell seller that his asking is unrealistic."

huh ... but by offering 40% less than asking you very much DID tell the seller you thought the asking price was unrealistic ... which is why he had good reason to take offense and you just came out looking like either (a) someone who shouldn't be looking to buy where you were looking or (b) someone looking to take advantage of others in the same fashion that bubbleheads claim real estate agents and others are tryin to take advantage of them or (c) both of the above.

"

ReplyDeleteLance said...

huh ... but by offering 40% less than asking you very much DID tell the seller you thought the asking price was unrealistic.

"

This is where the disconnect is "Sellers can list their houses for whatever absurd prices they want? And buyers should not offer what they think that value should be? It is free market and market will decide what the worth is. As I said earlier people who are afriad/nervous easily get offended.

It is simple "If I am a seller I will try to get as high as possible but If I am a buyer I will try to get it as low as possible" but in both cases market and sellers situation will decide the final price.

I have been lowballing for last six months and in earlier post I have mentioned that prices in my community has already dropped by 30K around 10% and I know it will take sometime to reach my target of 30 to 40% drop. I can afford to wait but let us see if the flippers can afford to wait as long.

First of all buying with 10% down requires PMI or the second note. That is additional cost never mentioned in that brochure.

ReplyDeleteAnon 9:52,

ReplyDeleteThe point of the brochure is to mislead the consumer on the actual cost comparison of owning versus renting. There is a strong bias towards owning.

Fair enough, they're trying to sell houses.

You can quibble over the minor details like whether utilities are included or if from a tax perspective someone takes a standard deduction - really these are trivial points.

What matters is comparing equivalent locations and dwelling size on a rent versus buy basis. When you do that fairly, and honestly look at the numbers, then a buyer stands a much better chance of having a strong, positive net worth at the end of 30 years.

My $0.02.

Anonymous said...

ReplyDelete""

Lance said...

huh ... but by offering 40% less than asking you very much DID tell the seller you thought the asking price was unrealistic.

"

This is where the disconnect is "Sellers can list their houses for whatever absurd prices they want? And buyers should not offer what they think that value should be? It is free market and market will decide what the worth is. As I said earlier people who are afriad/nervous easily get offended.

It is simple "If I am a seller I will try to get as high as possible but If I am a buyer I will try to get it as low as possible" but in both cases market and sellers situation will decide the final price.

I have been lowballing for last six months and in earlier post I have mentioned that prices in my community has already dropped by 30K around 10% and I know it will take sometime to reach my target of 30 to 40% drop. I can afford to wait but let us see if the flippers can afford to wait as long."

Of course you can offer less than what a seller is asking. One almost always should offer less than asking in order to commence negotiations. However, when one offers 40% less than what the seller is asking, it is clear to all that you are not looking to negotiate but to "make a statement". I.e., you are wasting the other person's time sending a message under the guise of good faith negotiating. In my book, that is worse then the "puffing" that the NAR does. Afterall, no one is requiring you to look at their ads or brochures or even every consider buying a house. But, your "making a statement" required that the seller waste his time sifting though your email at the very least ... and because he was polite, answering and trying to educate you. The appropriate manner to "respond" to an ad where the price is not within the possibility of being negotiated, is to not respond to it in the first place.

Interest is rent paid on money that is leased. While there are advantages to paying interest vs. traditional rent (notably tax deductability, and in the case of fixed mortages a ceiling on payments), there are also disadvantages - you don't get any services or free maintenance on the rent you pay for that money. Worse yet, nowadays people are paying more to lease the money to buy a property than they would to lease the property directly (even including the interest deduction). And perhaps most important, is that leasing a property is largely risk free. That's why it's traditionally been cheaper to buy - there's a risk premium that's been built into rents to compensate for the risks the landlord takes as the owner.

ReplyDeleteNo longer.

Scorecard:

YOU - 0

BANK - 10

Owners save a lot of money compared to renters over a 30 year period of time. Are any of you bubbleheads questioning the tens or hundreds of thousands of dollars that would be spent on rent during 30 years time?

ReplyDeleteI don't think that anyone here fundamentally disagrees with this. But the better question is, were you better off buying your house in California in 1990 or waiting until 1998? Sure, those who bought in 1990 are now doing fine (if they were able to keep their house) but in hindsight it was not a good investment at that time.

Most of us will buy real estate again in the future. (I say "again" because many of us here have owned our house in the past and have walked away with decent profits.)

Owning your own real estate is generally a sound decision as long as the fundamentals support it. Right now, renting is so much cheaper that owning does not seem fundamentally sound. Furthermore, there we are at a period where price declines are definitely possible. Lereah should wait 4 or 5 years and his brochure will again be more valid (despite a couple of lies in there).

Historically, two implicit assumptions this brochure makes are usually valid:

1. That you can get a comparable residence with the same monthly payment by renting or buying.

2. That the house will increase in value at a 4.5% pace.

#1 is clearly not valid at this point in time. Most on here believe #2 to be highly improbable due to the recent runup in prices.

That being said do want to play devil's advocate to make a couple of points:

1. From my experience the state income taxes usually add up to almost the standard deduction so the interest deduction is just gravy.

2. "Real" declines in a home value is not necessarily a bad thing for the owner. If house costs are in line with rents, you can still come out way ahead with "real" declines. Let's say a house increases in value at a 3% clip but inflation is 4%. That's "real" declines but if my rent/own payments are the same then I'm coming out ahead with increased equity.

Analysis of real declines is much more relevant for investments that don't have a cost (i.e. rent) associated with not chosing the investment.

"

ReplyDeletelance said...

I.e., you are wasting the other person's time sending a message under the guise of good faith negotiating. In my book, that is worse then the "puffing" that the NAR does. Afterall, no one is requiring you to look at their ads or brochures or even every consider buying a house.

"

If you are in business, then be prepared to waste your time in dealing with offers that does not suit you. And sure in every offer I tell them not to respond if they do not want to but all my offers are serious.

I am laughing at your statement "good faith negotiating", there is no good faith left in RE since last 3 or 4 years. It is 'Rip off buyers as much as you can by scaring them and by doing propaganda like RE never goes down", So no one should feel any sympathy/emotions while dealing with crooks/flippers. If they find GFs, good for them and if not then I am here with with my 40% off offer.

Like the RE cheerleaders and people who have vested interest in propagating their propaganda, there is another side of coin, people who are trying to share information and countering that propaganda and helping people not to become GFs and bag holders.

"If you are in business, then be prepared to waste your time in dealing with offers that does not suit you. And sure in every offer I tell them not to respond if they do not want to but all my offers are serious."

ReplyDeleteI've done a lot of business through ebay, craigslist, etc. and of course I get ridiculous low ball offers on things. The thing is it doesn't change my pricing attitude and usually does quite the opposite. I see lowball offers as a shark or other dealer trying to steal something from me, and generally proves to me that there is interest in the item. Usually those items eventually get realistic bids and sell easily. On the other hand when I get no interest on something, it tells me that either it's overpriced, there is little interest, or I'm marketing to the wrong audience.

If you want to make your point about being unhappy with home prices, don't acknowledge the sellers. All you are doing is giving them and their agents validation that there is interest in their homes and wasting everyones time.

You will never buy something like RE at 40% under CURRENT, i.e. todays, market prices. No bank, seller, or agent is that dumb. Doing that would be the equivalent of selling at 40% under a stocks price just cause you think it will tank in a couple years.

If you want to hold out a few years cause you think RE will go down 40%, than by all means rent away.

"What matters is comparing equivalent locations and dwelling size on a rent versus buy basis. When you do that fairly, and honestly look at the numbers, then a buyer stands a much better chance of having a strong, positive net worth at the end of 30 years."

ReplyDeleteWho lives in a house for 30 years? This rarely happens.

"when you itemize you get to take the regular deductions that make up the standard deduction PLUS you get to take a deduction for the mortgage interest and property taxes."

ReplyDeleteShow me your source for that...that is incorrect

This comment has been removed by a blog administrator.

ReplyDeleteDavid said...

ReplyDelete"Who lives in a house for 30 years? This rarely happens."

It doesn't have to be the same house/condo to make out like that. You lose a little on transaction costs when you move up (or down), but you still carryforward your savings for the longhaul.

forget about 30 years. Just wait and see how this pyramid scheme of selling houses to each other crashes like house of cards. There is no endless supply of GFs and in no way salary is not going to increase to compensate.

ReplyDeletewaiting for godot said...

ReplyDelete""when you itemize you get to take the regular deductions that make up the standard deduction PLUS you get to take a deduction for the mortgage interest and property taxes."

Show me your source for that...that is incorrect"

We've already been through this ... about a month ago. Go back and check your tax records for last year and check to see how much you paid in state taxes. (I don't mean how much extra you had to send in in April, but rather the total "taxes" on your state income tax return.) Like another poster said, that amount alone should be close to what your standard deduction on your federal return is. When you itemize, that is but one of many items that get "itemized" or listed. Like the other poster said, the extra deduction you get from the interest writeoff is just gravey.

"Who lives in a house for 30 years? This rarely happens."

ReplyDeleteAnother way to look at the question: "who dies?"

The answer is "everyone".

So if you are 90 years old and only 5 years into your 30 year mortgage when you die, *what f#cking differencce does it make!?* You either have life insurance that will pay off the mortgage and allow the house to stay in your family, or your will will indicated that the house should be sold off at market rate to pay off the mortgage. In the event of a sale, the surplus goes to your family, the shortfall is covered under your life insurance.

Those of you who are "waiting" for everything to be perfect are going to be sorely disappointed. You'll see. Just remember this post when you're on your deathbed.

lance said:

ReplyDelete"Go back and check your tax records for last year and check to see how much you paid in state taxes. (I don't mean how much extra you had to send in in April, but rather the total "taxes" on your state income tax return.) Like another poster said, that amount alone should be close to what your standard deduction on your federal return is."

wow, that's amazing lance! see, i dont have any state income tax..

dude you no longer have any credibility with me

whitetower,

ReplyDeleteInteresting appendix ... however take a close look at it. in each and every instance where there was a sustained price reduction, that area's local economy was suffering a severe economic shock. for example, i was in denver shortly after their market had tumbled, and it was because the price of oil had fallen and their economy which was then so dependent on oil exploration and drilling suffered when it was no longer economical to drill stateside. (I also saw it go back to its previous levels before I left there a year later.) Ditto for Boston and the dotcom bust and for just about every other sustained temporary drop in prices. The fundamentals (i.e., employment, etc.) are good just about everywhere in the US right now, so there is nothing to indicate that the economic troubles that caused the markets in App C to fall will be around to cause any problems today.

Some don't pay state tax...I am referring to the federal

ReplyDeleteanon said:

ReplyDelete"wow, that's amazing lance! see, i dont have any state income tax.."

then you are allowed to itemize sales taxes for your state based on a table provided by the IRS. Sorry guy, but you're the fool here since you don't have a clue how deductions work and you are proving it by what you are saying.

waiting for godot said...

ReplyDelete"Some don't pay state tax...I am referring to the federal"

Yes, and I am referring to the deduction you get to take on your federal return for state taxes you have paid (or for sales taxes you have paid if you are from a state without an income tax.)

Lance, am I reading you correctly?

ReplyDeleteYour assertion is that most people can itemize their deductions, and be greater than the standard deduction ($5,000 in '05), without home mortgage interest. So you shouldn't make the standard deduction argument in the buy versus sell discussion?

My $0.02.

RE Taxes:

ReplyDeleteWe are not speaking the same languages. What I am saying is that you have to choos the $5k standard deduction, or take itemized deductions for your mortgage interest on your federal return. Here is a paragraph from http://www.wwwebtax.com/deductions_z_other/itemized_deductions.htm

"When you complete Form 1040, Schedule A you total the tax deductible amount spent on itemized deductions and compare the total with your standard deduction. The larger of the two tax deductions, standard deduction or itemized deduction, will be the tax deduction to choose on your tax return, since it will lower the amount of federal income tax you will owe or increase the amount of tax refund you will receive. "

Whitetower said

ReplyDelete"You will never buy something like RE at 40% under CURRENT, i.e. todays, market prices."

My, my, how soon we forget housing busts:

http://www.globalinsight.com/gcpath/1Q2006report.pdf

I was referring to actually going out today (July 23rd 2006) and buying for 40% under today's FMV. All you are doing is wasting peoples time cause there 100's of investment groups that will buy distressed properties at 15-20% below market and turn them right around.

Now over a period of a few years like you see in that study there have been 10-30% declines (though it doesn't indicate if they are real or nominal). This could very well happen here or we could see rates dropped again and have 70's style inflation.

godot,

ReplyDeletethat is correct you have to choose whether you itemize your deductions or whether you take the standard deduction. You do not however lose the deductions you would otherwise get if you choose to itemize (for example: state income taxes paid) but you do get additional deductions (mortgage interest for example) that are not included in the standard deduction when the IRS makes its estimates as to what the average person incurs in deductible expenses. Another way to view what is happening is that when the IRS sets the standard deduction for the tax year, they take a look at what the average person would get if they itemized all their they don't include amounts in there for mortgage interest, property taxes, charitable contribution etc.) They do however include average amounts for state income tax (or state sales tax in non-income states) and other deductible items that all tazpayers are assumed to be entitle to. So, when you itemize, you list all these things (like the state income tax) PLUS you get to list additional ones (like the mortgage interest deduction.) So, the NAR is correct ... You are not trading in anything to get the benefit of the mortgage interest deduction (and property tax deduction), you're still getting the other deductions ... you just have to list them yourself instead of letting the IRS do the math for you when you choose to use the standard deduction. Lot's of folks make the same mistake as you in thinking one is trading set of deductions for another.

www.statesman.com/money/content/shared/money/stories/hank/05/hank0410breaks.html

"Itemizing deductions lets homeowners take advantage of several tax incentives not available to those who use the standard deduction. They include deductions for real estate taxes, state and local income taxes, charitable donations and medical expenses, to name a few."

Hopefully, this settle this matter. Now, if I could only help you see that even under these high priced market conditions, you are still paying much more in rent over the longrun than you would be now if you bought.

MyTwoCents said...

ReplyDelete"Lance, am I reading you correctly?

Your assertion is that most people can itemize their deductions, and be greater than the standard deduction ($5,000 in '05), without home mortgage interest. So you shouldn't make the standard deduction argument in the buy versus sell discussion?"

No, you're not. Read the above post please.

"Itemizing deductions lets homeowners take advantage of several tax incentives not available to those who use the standard deduction. They include deductions for real estate taxes, state and local income taxes, charitable donations and medical expenses, to name a few."

ReplyDeleteLance,

Are you reading what you are posting? "Itemizing deductions lets homeowners take advantage of several tax incentives NOT available to those who use the standard deduction" How do you interpret that to be different from what it says? Break it down. That means either or...Drop the discussion about state tax...I am not referring to that.

Someone else jump in here who knows tax laws...

News Flash. Speculators run for you life.

ReplyDeletehttp://www.thestate.com/mld/thestate/news/nation/15102639.htm

"

Columbia’s downtown housing boom started with prices skyrocketing up to $750,000 for condos. But look for most prices to settle around $200,000

"

If you itemize your deductions and it comes in lower than your standard deduction, you take the standard, otherwise you use the itemizing. This is very easy with a computer program such as Turbotax.

ReplyDeleteI think what Lance is trying to say is that most renters if they itemized would come close to the standard deduction with deductions that everyone takes such as state and local taxes, medical deduction, education, charity, etc. Personally I've rented the past few years being military, and by using turbotax, some years I came out above the standard deduction, some years under.

When comparing rent vs own you can deduct the entire mortgage and property tax deduction from your calculations since most homeowners will have itemized deductions approximately equal to the standard deduction + mortgage deduction + property taxes. Most renters will have itemized deductions approximately equal to the standard deduction.

based on this my offet of 40% seems to be too generous. I should start my offer to speculators from 70% off and then may be settle at 50 to 60% off.

ReplyDeletegodot said:

ReplyDelete"That means either or...Drop the discussion about state tax...I am not referring to that."

NO, that means "on top of". Ask a tax accountant if you are still not understanding.

"That's why it's traditionally been cheaper to buy - there's a risk premium that's been built into rents to compensate for the risks the landlord takes as the owner."

ReplyDeleteAnony, when and where is it traditionally cheaper to buy than rent, assuming you buy or rent a comperable properties? US Census and BLS statistics and every other source I've seen that renting is almost always more expensive. Buyers pay premiums, not renters. I've never heard of your rent premium theory.

anon said:

ReplyDelete"When comparing rent vs own you can deduct the entire mortgage and property tax deduction from your calculations since most homeowners will have itemized deductions approximately equal to the standard deduction + mortgage deduction + property taxes. Most renters will have itemized deductions approximately equal to the standard deduction."

Thany you! Yes, yes, yes ...

anon said:

ReplyDelete"Anony, when and where is it traditionally cheaper to buy than rent, assuming you buy or rent a comperable properties? US Census and BLS statistics and every other source I've seen that renting is almost always more expensive. Buyers pay premiums, not renters. I've never heard of your rent premium theory."

Original Anony is absolutely right. If you rent your whole life, you are paying many times more for housing then if you buy. The only time it is cheaper to rent than to buy is when you don't plan on staying in one place long (and you MUST sell the place rather than rent out afterwards) and the transaction costs of buying and selling are great enough to offset any medium term gains due to appreciation and constant mortgage costs.

Actually, the NAR just told me that housing is at least 22% overpriced.

ReplyDeleteUsing the NAR's 21 price-to-rent multiple, condos right near my apartment should be going for 22-27% less than they are, and probably much less when we count the condo fee.

Thanks, NAR, for telling me how overvalued DC housing is!

Waiting for Godot,

ReplyDeleteLance is right about the taxes. (FYI, tax law is my career too.)

Lance,

ReplyDeleteI am tire of arguing about this, because I think that this is a matter of semantics, and we are saying the same thing since all of your sources that you sent me make my point.

Let me use an example:

Standard Deduction is $5k

Let's say that the monthly interest and taxes are $800 or $9600 per year

You are saying that you can take write $9600, and exactly $5k for a total of $14,600 off, and you are done with your taxes.

I am saying that once you itemize, then you have to itemize everything that would have made up the standard deduction, and the total of these items may be more than 5k or less than 5k. If this is the way that you see it, and you are trying to say the same thing as ANON 1:51PM, then we are done with this discussion.

I am not suggesting that you would loose the ability to claim the items that make up the standard deduction, rather, the term STANDAED DEDUCTION disappears once you go itemized. ANON 5:57 either does not see the nuance, or needs to look for a new job.

I'm not sure how you get an $1100/month payment on $200000 30 yr fixed mortgage at 6.5%. By my numbers, your payment would be $1264.14. It would take a mortgage rate of 5.2% to get $1100/month. So, if you compare renting at $1000/month to owning at $1264.14/month, you get the following results:

ReplyDeleteOwning - $1264.14/month + HOA fees of $40/month + $70/month homeowner's ins. + ave. of $97/month for maintenance costs + 3% closing costs + 6.5% selling costs (at a home value of $21198.03 after 10 yrs @ 4.5%) - $102080 of home appreciation - $40447.75 of principle payed = $61507.08

Renting - $1000/month + 1 month's rent security payment + $10/month renter's insurance - $15529.69 (since you don't need a down payment, you could invest it @ 4.5%) - $59662.44 ($461.14/month difference between mortagage + HOA + insurance + maintenance costs and rent + renter's insurance invested @ 1.5% return) = $47007.87

Now, I haven't provided any tax benefit for owning, but I figure this would not account for more than $22400 of value over 10 years. However, the PMI on a for 10 years would come out to ~$10800, so you would still come out ahead renting even if you give a max tax benefit to owning and use a very low investment return on your money when renting.

$1100/month with negative amortization. Heck, we should be able to do $500 too. :)

ReplyDeleteHas anyone thought of filing a complaint to FTC, BBB, and your state AG on false and misleading advertising or deceptive trade pratices on this brochure?

ReplyDeletegodot said:

ReplyDelete"I am not suggesting that you would loose the ability to claim the items that make up the standard deduction, rather, the term STANDAED DEDUCTION disappears once you go itemized. ANON 5:57 either does not see the nuance, or needs to look for a new job."

correct, so why did you earlier make this statement that I labelled "misleading":

Godot said (first post above):

"Generally speaking, I do not have a problem with this brochure, though they left out a few things:

1 - Renters can take the standard deduction rather than itemize the mortgage interezt"

I.e., Why is this relevent to the calculations since you just do the calcs based on the savings from mortgage interest and property taxes? I didn't say your statement was technically wrong ... just misleading because it leavs the impression that one should deduct the "lost" standard deduction from the "gained" itemized deductions related to mortgage interest and property taxes. And, as your calcs above show, you don't.

anon asked:

ReplyDelete"I'm not sure how you get an $1100/month payment on $200000 30 yr fixed mortgage at 6.5%. By my numbers, your payment would be $1264.14."

on an interest only loan, the payment would be $1083.33 . The poster was probably rounding up. For most people, an interest only loan is far beneficial to an amortizing one ... for the very reasons the renters have been putting forward. You have money left over to invest elsewhere rather than "de-leveraging" your house by putting even more money into it. It's a matter of opportunity cost. And, of course, the entire mortgage payment is tax deductible. Additionally, it makes homes more affordable for people who would otherwise have difficulty affording as much home. Since on average people stay in a particular house something like 8 years, a 10 year interest only loan (or even a balloon loan) is fine for most people.

anon said:

ReplyDelete"Now, I haven't provided any tax benefit for owning, but I figure this would not account for more than $22400 of value over 10 years."

The tax benefit would be about 35% of the payments made ... so, you are talking $1088.33 X 35% X 12months X 10 years = $45,500 ... now (using the Future Value of a Stream of Constant Payments function in Excel) assuming you were investing that $397.1667 monthly (the $1088.33 X 35%), you end up with a total of $58,877.86! or 2.6 times what you estimated ... but wait! we haven't taken the tax benefit of property taxes into account yet! But since you didn't put them into your calcs, let's just assume they are something like $2000/yr ... using my nifty Excel spreadsheet, that comes out to an additional $9,058.13 ... giving us a grand total of $67,936.00 in savings through tax reductions! One can't underestimate the incentive the govt gives for homeownership. But wait, we aren't finished. The home appreciation of $102,080 ... ? All taken tax free! ... not a penny in capital gains tax paid because it is under $250,000 for an individual or under $500,000 for a couple filing a joint return. And if they had gone over the limit .. .guess what, they win again. Uncle Sam just taxes them 15% capital gains tax on the surplus over the $250,000 (or $500,000) ... and if they have no "earned income" and are living off of stocks and bonds ... then they just pay 5% on this capital gain! Now as for the poor renter ... well he pays full tax rates on all his earnings from his CD or his stock dividends. If he happens to sell his stock at a gain, then he gets the same 15% or 5% deal as the homeowner gets on the whole shebang. Is it any wonder that owning a home is always cheaper than renting? The deck is stacked in the homeowner's favor because of the tax code. Why? 'cause homeowners make better citizens ... They have a vested interest in their homes and communities.

btw, I invested the tax savings at 5% ... and the "payment" is the deductible interest part of the mortgage payment ... i.e, the $200,000 X 6.5% /12

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteLance,

ReplyDeleteDid you read the brochure before you started commenting on it? The brochure says $210k w/10k down and a 30 YEAR FIXED LOAN. Don't make me change my name to "Lance Police" Also, it shows the payment as $1264

"The deck is stacked in the homeowner's favor because of the tax code. Why? 'cause homeowners make better citizens ... They have a vested interest in their homes and communities."

ReplyDeleteFirst, let me say that you make a good point about home appreciation being tax-free. That’s something I did not consider and I’ll have to do the math to see how much of a benefit this is. However, there are a couple of things I don’t agree with you upon.

1. I don’t think that you can take into account property tax credits as a plus for an owner since I’ve never had to pay property taxes above and beyond my rent cost. Because you pay $0 property taxes directly thru renting (although you do pay your landlord for them as part of your rent), even if you get 100% of your property taxes back as a tax credit from owning, your basically just lending the government your money for a 0% return. If anything, when comparing renting to owning, property taxes would be a benefit to the renter since the renter could be getting a return on the money the owner is getting 0% on.

2. If you are figuring an interest only loan, then you lose that $40447.75 of principle I was using before.

3. I think you’re really overestimating the amount of tax benefit you receive on your federal taxes. I’m not sure what annual salary you are using to determine getting 35% of your interest back. Maybe my understanding of the tax code is wrong, but I thought you only got taxed 35% for dollars earned above $336550/yr. Are you saying you get 35% back because your claiming interest as a deduction on earnings above this amount? Plus, assuming you do somehow get 35% of your interest money back, it would only be that amount until the tax brackets adjust up to account for inflation. So, the further into the mortgage you are, the less you’ll receive back. Also, in a somewhat minor point here, you have an error in calculation $45500/120 = $379.167/month, not $397.167. I don’t know if you can really count on investing this amount monthly since you won’t realize the gains until you file.

4. You’re assuming that you can itemize enough deductions to equal the standard deduction and then your counting interest above and beyond this amount. I know you’ve argued this point previously, but I’ve never had a year when married filing jointly that I could itemize anything near the standard deduction.

I also have some points I did not use in my calculations and really should be considered when comparing renting to owning. Mainly, inflation is going to have an effect on your HOA, insurance, and property taxes. I already used inflation in my calculations for rent, (although my renter’s insurance did not adjust) so I gave the owner an advantage over the renter on that one.

Let me say, I have nothing against owning. I agree homeowners usually make better citizens. I’m just saying that in the example listed, your better off financially renting. I’ll try to rework the numbers when I have the time using some of the points you brought up to prove this.

For anyone that's interested, I followed the link to the brochure and then looked at their sample page.

ReplyDeleteThey calculate a mortgage on a $210K home with a $10K down payment at 6.5% interest standard 30 year loan. They throw in 1.25% taxes and end up with a ~$1500/month payment.

They get the $1100 per month effective mortgage payment by backing out the tax advantage.

With this in mind, the comparison becomes a little fairer though it's not obvious that you need to be able to afford the cash flow to make a $1500 payment not an $1100 payment.

They still ignore closing costs. They also fail to account for earnings from savings on the $10K downpayment and the closing costs that mysteriously get paid. So their comparison is still rather lacking.

My $0.02.

waiting for godot said...

ReplyDelete"Lance,

Did you read the brochure before you started commenting on it? The brochure says $210k w/10k down and a 30 YEAR FIXED LOAN."

Godot, I have a 30 YEAR FIXED LOAN and it is interest only for the first 10 years. "Fixed" refers to the interest rate not adjusting. It doesn't mean it is a P&I (Principal and Interest loan.) You're showing your incompetance in regards to real estate again.

anon asked:

ReplyDelete"35% of your interest back. Maybe my understanding of the tax code is wrong, but I thought you only got taxed 35% for dollars earned above $336550/yr"

... that's federal PLUS state income tax (or sales tax credit if you live in a non-income tax state) ... frankly, I am seeing numerous other errors in your calcs ... but I really don't have the time to go through them all.

anon asked:

ReplyDelete"I don’t know if you can really count on investing this amount monthly since you won’t realize the gains until you file."

okay ... i will answer just this one other question ... you increase your withholding exemptions so that that amount doesn't get withheld from your paycheck since you would be getting it back at end of year anyways ... i will say, you are making a valiant attempt at the numbers, but honestly it's really clear to me that you have had no financial or tax training. your calcs wouldn't hold water with a professional ...

anon said:

ReplyDelete"I’ll try to rework the numbers when I have the time using some of the points you brought up to prove this."

okay ... and thanks for your nice post. it's refreshing to see a well thought out and polite response ... i still think a lot of your calcs are not handled the way a professional would handle them, but i appreciate the attempt ... and the willingness to discuss the matter.

mytwocents:

ReplyDelete"With this in mind, the comparison becomes a little fairer though it's not obvious that you need to be able to afford the cash flow to make a $1500 payment not an $1100 payment."

as I mentioned to anon above you, you just change your exemptions (W-4) form to have less taken out of your paycheck. you can go up to 10 exemptions without having to provide the IRS substantiation for the extra exemptions. There's even a table on the back that help's you determine how many exemptions to claim to account for deductibles.

Lance, I must admit, by your statements, owning would be better than renting in this example by the tune of $63.927/month. I had to use the following assumptions to derive this:

ReplyDelete1. 3%/yr inflation.

2. 4.5%/year home appreciation and return on invested income.

3. 15% tax rate on any investment return.

4. Rent and renter’s insurance and HOA fees increases follow inflation.

5. You would be able to obtain an I/O loan for $200000 which remains fixed @ 6.5% for 10 years resulting in a payment of $1083.33/m?

6. You pay .45% PMI for every dollar borrowed.

7. We use your optimistic and somewhat simplistic thumb rule of a 35% tax benefit from any dollar spend toward paying loan interest.

Calculate cost of owning as follows: $1083.33 mortgage payment adjusted for inflation averages to $939.06 over 10 yrs. 939.06 x 120 = $112687.2. PMI inflation adjusted payment averages $79.96/m for the first 4 years 79.96 x 48 = $3838.08. HOA fees $40/m x 120 = $4800. Homeowner’s insurance starts at $70/m and adjusts yearly w/ home value to average $74.87 x 120 = $8984.4. Maintenance costs average $97/m x 120 = $11640. Closing costs = $4200 (2%). Seller’s costs = $21198.03 (6.5% of home’s future value) which adjusts to $15773.33 after inflation. Property tax = $2000 first year and adjusts yearly w/ home value to average $2140.55 or $178.39/m. Home value after 10yrs = $243713.57 adj. for inflation or a $33713.57 increase. Tax gain = .35 x 1088.33 = $380.92/m invested monthly for a 1.5% return against inflation = $49283.56.

Calculate cost of renting as follows: $1000 x 120 = $120000. Renter’s insurance = $10/m x 120 = $1200. Security deposit = $1000. Down payment investment = $11364.6 after inflation and taxes. Difference between monthly costs of owning and monthly costs of renting = $399.28 for 4 years, then $319.32 after that invested monthly @ 1.5% = $45395.91.

Total inflation adjusted difference between owning and renting:

Owning = 112687.2 + 3838.08 + 4800 + 8984.4 + 11640 + 4200 + 15773.33 - 21400.55 - 33713.57 – 49283.56 = $57525.38

Renting = 120000 + 1200 + 1000 - 11364.6 – 45638.78 = $65196.62

As you’ll notice, for simplicity, I did not take taxes out of any gains from monthly investments (let’s say the investment went to a tax exempt account). Doing so would have slightly benefited the renter. Just let me add that unless you are incredibly sick, generous, or wealthy, you would never receive such a large tax benefit all 10 years of the loan. Also, I think most people would be hard pressed to receive a mortgage as exotic as this one or find a house priced at $210000 directly comparable to one that rents for $1000.